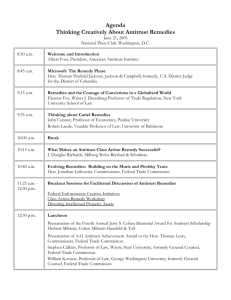

antitrust and intellectual property: from separate spheres to unified

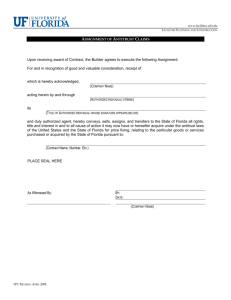

advertisement