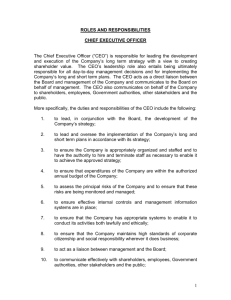

Why Do Some CEOs Work for a One Dollar Salary

advertisement