Diving Into the ISM: What's It All Mean?

February 3, 2015

by Mike "Mish" Shedlock

of Sitka Pacific Capital

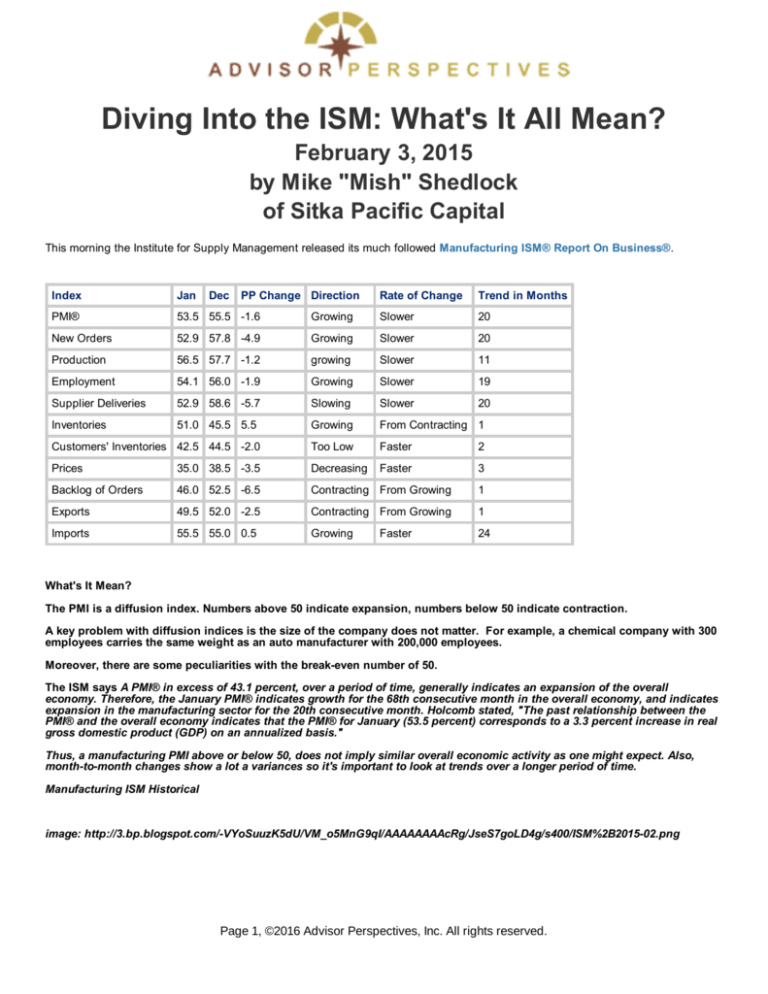

This morning the Institute for Supply Management released its much followed Manufacturing ISM® Report On Business®.

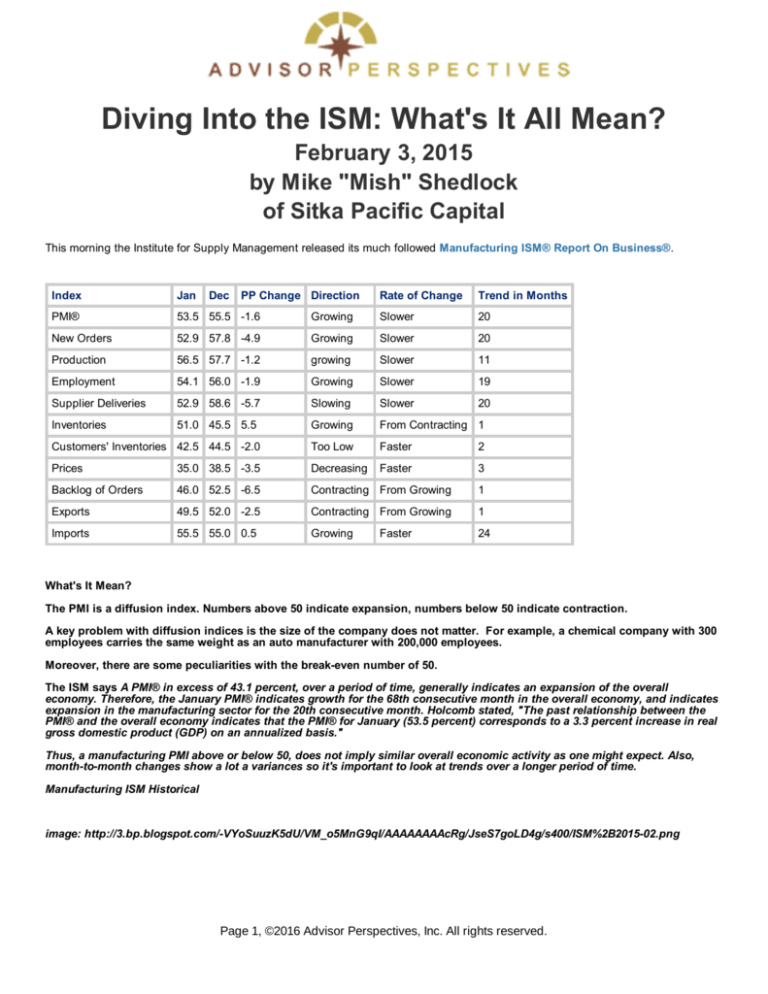

Index

Jan

Dec

PP Change Direction

Rate of Change

Trend in Months

PMI®

53.5 55.5 -1.6

Growing

Slower

20

New Orders

52.9 57.8 -4.9

Growing

Slower

20

Production

56.5 57.7 -1.2

growing

Slower

11

Employment

54.1 56.0 -1.9

Growing

Slower

19

Supplier Deliveries

52.9 58.6 -5.7

Slowing

Slower

20

Inventories

51.0 45.5 5.5

Growing

From Contracting 1

Customers' Inventories 42.5 44.5 -2.0

Too Low

Faster

2

Prices

35.0 38.5 -3.5

Decreasing

Faster

3

Backlog of Orders

46.0 52.5 -6.5

Contracting From Growing

1

Exports

49.5 52.0 -2.5

Contracting From Growing

1

Imports

55.5 55.0 0.5

Growing

24

Faster

What's It Mean?

The PMI is a diffusion index. Numbers above 50 indicate expansion, numbers below 50 indicate contraction.

A key problem with diffusion indices is the size of the company does not matter. For example, a chemical company with 300

employees carries the same weight as an auto manufacturer with 200,000 employees.

Moreover, there are some peculiarities with the break-even number of 50.

The ISM says A PMI® in excess of 43.1 percent, over a period of time, generally indicates an expansion of the overall

economy. Therefore, the January PMI® indicates growth for the 68th consecutive month in the overall economy, and indicates

expansion in the manufacturing sector for the 20th consecutive month. Holcomb stated, "The past relationship between the

PMI® and the overall economy indicates that the PMI® for January (53.5 percent) corresponds to a 3.3 percent increase in real

gross domestic product (GDP) on an annualized basis."

Thus, a manufacturing PMI above or below 50, does not imply similar overall economic activity as one might expect. Also,

month-to-month changes show a lot a variances so it's important to look at trends over a longer period of time.

Manufacturing ISM Historical

image: http://3.bp.blogspot.com/-VYoSuuzK5dU/VM_o5MnG9qI/AAAAAAAAcRg/JseS7goLD4g/s400/ISM%2B2015-02.png

Page 1, ©2016 Advisor Perspectives, Inc. All rights reserved.

The NBER (the historical arbiter of when recessions start and end) says a US recession began in November of 1973. The

Manufacturing ISM was 68.1 at the time.

The above chart also shows some recessions began with the manufacturing PMI in negative territory. In isolation, the PMI

itself does not say a lot. One needs to incorporate other data.

Manufacturing ISM Percent Change From Year Ago

image: http://3.bp.blogspot.com/-QWc4bunIGxs/VM_rK7Yu14I/AAAAAAAAcRs/4_nM1DFaKIQ/s400/ISM%2B2015-02A.png

Upturns from deeply negative tend to end recessions (purple circles), but spikes below the zero-growth tend line don't

necessarily mean anything.

There were 10 occasions since 1950 in which the year-over-year growth of manufacturing PMI sunk to -20% that were not

associated with a recession.

On the other hand, the chart shows that recessions generally start with the PMI near the zero-growth line. In those occasions

where recessions started with PMIs well above 50, the PMI quickly crashed into negative territory.

Manufacturing ISM Percent Change From Year Ago Detail

image: http://1.bp.blogspot.com/-XAbaCbGjWUw/VM_vZJm8o1I/AAAAAAAAcR8/2Hy27P_fnS0/s400/ISM%2B2015-02B.png

Page 2, ©2016 Advisor Perspectives, Inc. All rights reserved.

Far too much reliance is given to these indicators, even though flirting around the zero-line is generally not associated with

high growth.

The Manufacturing ISM is now at a spot where recessions frequently begin. Yet, far more often than not, recessions do not

begin at this spot.

Nonetheless, please note the weakening trends in the table at the top.

Exports are slowing

Imports are up

Prices falling rapidly

Backlog of orders in contraction

Growth slowing nearly everywhere

Customer inventories rising

None of those imply strong growth.

The ISM says today's report "corresponds to a 3.3 percent increase in real gross domestic product (GDP) on an annualized

basis". I will take the under for numerous reasons stated previously.

For more GDP look-ahead analysis, please see ...

January 31: Diving Into the GDP Report - Some Ominous Trends - Yellen Yap - Decoupling

or Not?

February 02: Total Construction Spending Weaker Than Expected; Residential

Construction Spending in Contraction

Page 3, ©2016 Advisor Perspectives, Inc. All rights reserved.

February 02: Four Trade War Questions; PMI Reports; Currency Manipulation Charges

Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Read more at http://globaleconomicanalysis.blogspot.com/2015/02/diving-into-ism-whats-it-allmean.html#6W52PiP70AzaSqyV.99

Page 4, ©2016 Advisor Perspectives, Inc. All rights reserved.