QUEEN'S UNIVERSITY AT KINGSTON

advertisement

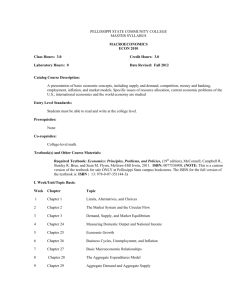

Page 1 of 21 w10-112-v1 Name: ______________________ Turn in exam question paper Student Number: _____________ QUEEN'S UNIVERSITY AT KINGSTON FACULTY OF ARTS AND SCIENCE Department of Economics ECONOMICS 112* Final Examination April 22, 2010 Instructors: Ian Cromb (Econ 112 -daytime) Time Limit: 3 Hours Permitted Calculators: Stickers: Blue and Gold Ugurhan Berkok (Econ 112X - evening) Pre-Approved: Casio 991. Instructions: Mark your selections on the multiple choice answer card in PENCIL. If you make changes, be sure to erase completely. Please record your name, student number, course and section, and the number you see on the top left hand corner of this page on the multiple choice answer card. Part A consists of multiple-choice questions surveying the course material. Parts B-F each have a series of questions related to a particular problem. Try to do these questions in order since some of the answers depend on the answers to previous questions in the series. Marking Scheme: Part A [40 marks] Parts B-F [40 marks] FORTY multiple-choice questions - 1 mark each FORTY multiple-choice questions in 5 series - 1 mark each Notes: Proctors are unable to respond to queries about the interpretation of exam questions. Do your best to answer exam questions as written. This material is copyrighted and is for the sole use of students registered in Econ 110 and writing this exam. This material shall not be distributed or disseminated. Failure to abide by these conditions is a breach of copyright and may also constitute a breach of academic integrity under the University Senate's Academic Integrity Policy Statement. Page 2 of 21 w10-112-v1 Part A [40 marks] This section consists of 40 questions that survey the course material. Each question is worth 1 mark. 1) Suppose there is a theory that several things influence the price of fish in Halifax, including weather during the fishing season. When examining the determinants of the price of fish, the weather is A) an endogenous variable, as it influences the price of fish. B) an exogenous variable, as it is determined outside the theory. C) a stock, as it influences the quantity of fish caught. D) an act of God and, therefore, has no legitimate connection with the theory. E) an endogenous variable, as it is determined within the theory. 2) The concept of scarcity in economics usually refers to a condition A) where society is not employing all of its available resources in an efficient manner. B) where people's wants can never be satisfied by the available resources. C) that afflicts only poor countries. D) where too many frivolous goods and services are produced at the expense of socially desirable goods and services. E) where production is efficient, but distribution is inefficient. 3) Assume that apples and oranges are substitute goods. Given the initial supply and demand curves for apples, a reduction in the price of oranges will tend to A) increase the price of apples. B) increase the demand for apples. C) increase the demand for oranges. D) decrease the demand for oranges. E) decrease the price of apples 4) Which of the following is a normative statement? A) The sun rises in the west and sets in the east. B) A government deficit will reduce unemployment and cause an increase in prices. C) Reducing unemployment is more important than reducing inflation. D) Queen Elizabeth II is the wealthiest woman in the world. E) An increase in the price of lumber is followed by a decrease in the construction of new houses. Page 3 of 21 w10-112-v1 FIGURE 3-3 5) Refer to Figure 3-3 which shows the supply and demand for a particular consumer good.. At a price of P1 there would be excess supply equal to A) 0 B) Q1 Q5 C) Q2 Q4 D) Q1 Q2 E) Q4 Q5 6) The "new" theories of economic growth emphasize that the pace of technological change is ________ to economic signals, and that it is ________ to the economic system. A) responsive; exogenous B) responsive; endogenous C) unresponsive; exogenous D) unresponsive; endogenous E) unresponsive; unrelated 7) Consider the following news headline: "Information technology costs for Canadian firms continue to drop." Choose the statement below that best describes the likely macroeconomic effect. A) the AD curve shifts to the right; the price level rises and real GDP rises B) the AD curve shifts to the left; the price level falls and real GDP falls C) the AS curve shifts to the left; the price level rises and real GDP falls D) the AS curve shifts to the right; the price level falls and real GDP rises E) the AD and AS curves both shift to the right; the effect on the price level is indeterminate and real GDP rises 8) An isolated, once-and-for-all rise in the price level can be caused by all of the following EXCEPT: A) the imposition of a new sales tax. B) the sudden doubling of a key raw materials price. C) a new payroll tax that raises unit wage costs. D) persistent expectations of continued inflation. E) an early frost that damages the agricultural harvest. Page 4 of 21 w10-112-v1 The labour market in the diagram below begins in equilibrium with a real wage of $10 and quantity employed of 1000. FIGURE 31-1 9) Refer to Figure 31-1. The economy begins with D0 and S0. Suppose there is a negative shock to the economy, which shifts the demand for labour curve to D1. An outcome consistent with New Keynesian theories of unemployment is: A) wages would be sticky and would adjust downward to $9, causing involuntary unemployment of 200 workers. B) the wage rate would fall to $8, employment would fall to 800, causing involuntary unemployment of 200 workers. C) wages would be sticky and would adjust downward to $9, causing involuntary unemployment of 300 workers. D) the wage rate would fall to $8, employment would fall to 800 and there would be no unemployment. E) all markets would clear, causing the demand for labour curve to shift back to D0 and the wage rate and employment levels would return to their original levels. 10) Income taxes in Canada can be considered to be automatic stabilizers because tax A) revenues increase when income increases, thereby offsetting some of the increase in aggregate demand. B) revenues decrease when income increases, thereby intensifying the increase in aggregate demand. C) structures can be changed when the Minister of Finance brings down a budget. D) revenues are changed through discretionary fiscal policy to keep the budget balanced. E) revenues are changed through discretionary fiscal policy to create surpluses in recessions. w10-112-v1 Page 5 of 21 11) Suppose economists were able to measure frictional unemployment as 3 percent, cyclical unemployment as 2 percent, and structural unemployment as 4 percent. Then we would know that the NAIRU is ________ and the actual unemployment rate is ________. A) 6 percent; 5 percent B) 5 percent; 9 percent C) 7 percent; 9 percent D) 7 percent; 7 percent E) 6 percent; 6 percent 12) Suppose the stock of government debt in Canada at the end of one fiscal year (Year 1) is $475 billion. During the following year (Year 2), government purchases were $180 billion, debt-service payments were $25 billion, and net tax revenues were $208 billion. What is the stock of debt at the end of Year 2? A) $422 billion B) $457 billion C) $472 billion D) $475 billion E) $478 billion 13) In the national income and product accounts, a reduction of inventories counts as A) consumption. B) depreciation. C) negative investment. D) positive investment. E) saving. 14) Which of the following may increase real GDP in the short run but may actually decrease the long-run growth rate of GDP? A) decrease in households' desired saving B) decrease in factor productivity C) increase in factor-utilization rates in the short run D) increase in factor supplies E) increase in the unemployment rate 15) Suppose that a price index for a certain basket of goods and services has a value of 150 in 2006 and a value of 156 in 2007. This index suggests that the cost of the market basket of goods and services A) was four percent higher in 2007 than in 2006. B) was six percent lower in 2007 than in 2006. C) was six percent higher in 2007 than in 2006. D) was 156 percent higher in 2007 than in 2006. E) was approximately the same in 2007 and 2006. Page 6 of 21 w10-112-v1 FIGURE 21-2 16) Refer to Figure 21-2. Which of the following is the correct equation for the consumption function depicted in the figure? A) C = 500 + (2/3)Yd B) C = (1/2)Yd C) C = 1000 + (2/3)Yd D) C = 500 + (1/2)Yd E) C = 2000 + (2/3)Yd 17) If 27 million people are employed and 3 million people are unemployed, what is the unemployment rate? A) 11% B) 89% C) 10% D) 90% E) indeterminable from the information provided. 18) A common assumption among macroeconomists is that when real GDP is less than potential output, factor prices adjust and the A) AS curve shifts to the left fairly rapidly. B) AS curve shifts to the right only very slowly. C) AS curve shifts to the right very rapidly. D) AD curve shifts to the left rapidly. E) none of the above -- the AS curve remains unchanged. 19) Credit cards are considered to be "money substitutes" instead of money because A) they are not acceptable to pay for purchases. B) they cannot serve as a temporary medium of exchange. C) the only function of money they can perform is to serve as a store of value. D) money must eventually be used to pay for the transaction. E) credit card accounts are not chequable. Page 7 of 21 w10-112-v1 The table below shows total output for an economy over 2 years. 2007 Good A Good B Good C Price $1.00 $2.00 $5.00 Quantity 100 units 200 units 100 units 2008 Good A Good B Good C Price $2.00 $3.00 $10.00 Quantity 120 units 200 units 98 units TABLE 20-3 20) Refer to Table 20-3. The implicit GDP deflator in 2008, when 2007 is used as the base year, was approximately A) 105. B) 160. C) 180. D) 193. E) 203. 21) One of the costs of long-run economic growth is A) declining future living standards. B) that current consumption must be sacrificed to increase investment in capital goods. C) current increases in investment may only generate greater consumption in the distant future. D) lower interest rates. E) both B and C are correct. 22) A rise in the real rate of interest ________ the opportunity cost of holding an inventory of a given size, and therefore ________ desired investment expenditure. A) increases; increases B) increases; decreases C) decreases; increases D) decreases; leaves unaffected E) decreases; decreases 23) Suppose Appliance Mart buys a used refrigerator for $100, repairs it, and resells it for $250. The result of this transaction is to A) increase the value of national product by $250. B) leave the value of national product unchanged. C) increase the value of national product by $150. D) decrease the value of national product by $100. E) insufficient information to know. 24) In an effort to maintain inflation at its targeted level the Bank of Canada designs its policies, in the short run, to A) eliminate all unemployment. B) keep real GDP close to potential output. C) minimize the growth of the money supply. D) allow the aggregate supply curve to close any output gaps. E) eliminate all negative shocks to the economy. w10-112-v1 Page 8 of 21 25) Consider the relationship between the price level, the money market, and the position of the economy's AE curve. If the price level falls exogenously, this will lead to A) an excess demand for money resulting in a rise in the rate of interest, which shifts the AE function downward and decreases the equilibrium level of income. B) an excess supply of money resulting in a fall in the rate of interest, which shifts the AE upward and increases the equilibrium level of income. C) people being able to buy more with their increased wealth, which will shift the AE function downward and decrease the equilibrium level of income. D) a movement to the right along the AE function. E) a movement to the left along the AE function. 26) Suppose aggregate output is demand-determined. If the business community decreases its planned investment expenditures by $4 billion, causing equilibrium national income to fall by $8 billion, the marginal propensity to spend must be A) 2/5. B) 1/3. C) 1/2. D) 2/3. E) 4/5. 27) The capital-service account in Canada's balance-of-payments is the section of the A) capital account which records the net change in Canadian investments abroad and the net change in foreign investments in Canada. B) capital account which represents the financial reserves held by the Bank of Canada which they can use in the foreign-exchange market. C) current account which records the interest charges and earnings of Canadian importers and exporters. D) current account which records income paid to foreign owners of assets in Canada and income received by Canadians for assets located abroad. E) current account which records the financial reserves held by the Bank of Canada which they can use in the foreign-exchange market. 28) In the basic AD/AS macro model, permanent increases in real GDP are possible only if A) potential output is increasing. B) the correct fiscal policy is implemented. C) the economy's automatic stabilizers are allowed to operate. D) the aggregate supply curve is vertical. E) aggregate demand responds positively to demand shocks. 29) The economy's aggregate supply (AS) curve is assumed to slope upward because A) inputs become more expensive at higher levels of output. B) inputs become less expensive at higher levels of output. C) firms' unit costs rise as output increases. D) firms' unit costs fall as ouptut increases. E) aggregate demand increases at higher levels of national income. 30) Suppose you come into possession of two "silver" dollars, one minted in the 1950s which contains a lot of silver, the other minted in the 1980s which contains no silver at all. The legal exchange rate between the coins is fixed at one for one. According to Gresham's law, the 1950s silver dollar: A) is considered "bad" money. B) will drive out of circulation the 1980s silver dollar. C) is more likely to be used as a medium of exchange. D) is less likely to be used as a medium of exchange. E) is less likely to be used as a store of value because it will appear old fashioned. w10-112-v1 Page 9 of 21 31) Measures of GDP may understate the economic well-being of people in developing countries if those countries tend to A) import much more than they export. B) have a high degree of foreign direct investment. C) emphasize agricultural and resource-based production. D) have very high rates of pollution. E) have a large share of nonmarket activities. 32) Doug is saving money in order to purchase a new snowboard next winter. This represents using money as A) a medium of exchange. B) a store of value. C) a unit of account. D) a medium of deferred payment. E) all of the above 33) Consider an economy that is in a long-run equilibrium with real GDP equal to potential output. Now suppose there is an increase in world demand for this country's goods. In the short run, ________. In the long run, ________. A) real GDP and the price level both fall; real GDP is below its original level with a lower price level B) real GDP and the price level both rise; real GDP is above its original level with a higher price level C) real GDP and the price level both rise; real GDP returns to its original level with a higher price level D) real GDP rises and the price level falls; real GDP returns to its original level with a lower price level E) real GDP falls and the price level rises; real GDP is below its original level with a higher price level 34) Consider a small economy where factor supply is 1000 units, the factor utilization rate is 0.9 and a simple measure of productivity (GDP per factor employed) is $80. This economy's GDP is A) $7,200 B) $72,000 C) $80,000 D) $88,888 E) $90,000 35) Consider the market for loanable funds for a closed economy in the long run. Other things being equal, a country with a high national saving rate will tend to have A) a high growth rate because aggregate expenditure will be high out of any given income. B) a high growth rate because sustained high investment is possible with high saving. C) an AS curve moving continually to the left. D) trouble achieving potential real national income in the short run. E) either a high or low growth rate depending on the investment demand schedule. 36) Consider a macro model with a constant price level and demand-determined output. A rise in the net tax rate ________ the simple multiplier and ________ equilibrium national income. A) lowers; has no effect on B) lowers; lowers C) lowers; raises D) raises; raises E) raises; has no effect on Page 10 of 21 w10-112-v1 37) On a graph that shows the derivation of the AD curve, an exogenous change in the price level causes A) a shift in the AE curve and a movement along the AD curve. B) a shift in both the AE and AD curves. C) a movement along the AE curve and a shift in the AD curve. D) a movement along the AE curve but not along the AD curve. E) a movement along both the AE and AD curves. 38) The best description of the cause-and-effect chain of an expansionary monetary policy is that it will A) lower the interest rate, raise investment spending, and increase real GDP. B) raise the interest rate, decrease investment spending, and increase real GDP. C) raise the interest rate, increase investment spending, and increase real GDP. D) lower the interest rate, increase investment spending, and reduce real GDP. E) raise the interest rate, decrease investment spending, and decrease real GDP. 39) If Robert expects interest rates to fall in the near future, he will probably be willing to A) buy bonds now, and hold less money. B) buy bonds now, but only if their price falls. C) sell bonds now, and hold less money. D) put his money in a savings account rather than buy bonds. E) maintain only the current holding of bonds. FIGURE 28-2 40) Refer to Figure 28-2. Starting at equilibrium E0, an increase in real GDP will lead to a A) shift of the Ms curve to the left and an increase in the interest rate. B) shift of the Ms curve to the right and a fall in the interest rate. C) downward movement along the MD curve and a lower interest rate. D) shift of the MD curve to the left and a fall in the interest rate. E) shift of the MD curve to the right and an increase in the interest rate. Page 11 of 21 w10-112-v1 Part B [8 marks] The following 8 questions (41-48) relate to the information given below. Try to do the questions in order since the answers for some questions depend on the answers to previous questions in the series. Each question is worth 1 mark. Assume that the production possibility boundaries (PPBs) between wheat (W) and cloth (C) for the UK and the US are as shown in diagram below. Initially, assume that there is no trade (autarky), so that both countries consume what they produce. These points are shown below: (CUK, WUK) = (1, 1) and (CUS, WUS) = (2, 3). W 9 8 PPB US 7 6 5 4 3 2 PPBUK 1 0 1 2 3 C Page 12 of 21 w10-112-v1 41) In the US the opportunity cost of cloth in terms of wheat is equal to: A) 1 B) 1/3 C) 3 D) ½ E) 2 42) If the US has an absolute advantage over the UK in the production of wheat, then it must be the case that: A) the US has a more productive labour force overall than the UK. B) there is no demand for wheat in the UK. C) the US has a larger supply of the inputs required to produce wheat than does the UK. D) the opportunity cost of wheat is lower in the US than in the UK. E) an equal quantity of resources can produce more wheat in the US than in the UK. 43) If the US has an absolute advantage in the production of wheat relative to the UK, then: A) the US also has a comparative advantage in producing wheat. B) the US also has an absolute advantage in producing cloth. C) the opportunity cost of producing wheat is higher in the US than in the UK. D) the opportunity cost of producing wheat is lower in the US than in the UK. E) the US may or may not have a comparative advantage in producing wheat. 44) Once the two countries develop trade, the emerging trade pattern will be such that: A) the UK will export both goods. B) the US will export wheat and the UK will export cloth. C) the US will export both goods. D) the US will export cloth and the UK will export wheat. E) both countries will export wheat. 45) Assuming that the post-trade price of cloth settles to the average of the two countries’ opportunity costs of cloth, the UK will produce the following quantities of (C, W): A) (1, 1) B) (0, 2) C) (1/2, 3/2) D) (2, 0) E) (3/2, 1/2) 46) Assume that, upon trade, the UK continues to consume 1 unit of cloth. It will then: A) export 1 unit of cloth and import 2 units of wheat B) export 1 unit of wheat and import 2 units of cloth C) export 2 units wheat and import 2 units of cloth D) export 1 unit of cloth and import 1 unit of wheat E) export 2 units of clothing and import 3 units of wheat 47) Based on the information from questions #45 and #46, post-trade, the US will now be able to consume the following quantities (C, W): A) (2, 3) B) (4/3, 5) C) (7/3, 3) D) (0, 9) E) (7/3, 5) 48) When we say that there are gains from trade or that trade is beneficial we mean that, in both countries: A) everyone will benefit. B) export sectors will benefit. C) import sectors will benefit. D) export sectors benefit more than import sectors lose. E) those who benefit will compensate the losers. Page 13 of 21 w10-112-v1 Part C [8 marks] The following 8 questions (49-56) relate to the information given below. Try to do the questions in order since the answers for some questions depend on the answers to previous questions in the series. Each question is worth 1 mark. The following is the balance sheet for Moneybags Bank, the only commercial bank in the country of Icecreamland. The only money in Icecreamland is in the form of deposits at Moneybags Bank. Moneybags Bank holds assets in the usual forms of loans, reserves, and government bonds, but also holds Dodgy Assets, which are assets that might lose value in a financial crisis. Assume that the bank is in equilibrium. Assets Liabilities Reserves 1000 10000 deposits Loans 8000 1000 capital Government Bonds 1000 Dodgy Assets 1000 Total 11000 11000 Total 49) The reserve ratio for Moneybags Bank is A) 1/11 B) 1/10 C) 1/8 D) 1/7 E) 2/10 50) The capital/loan ratio for Moneybags Bank is A) 1/11 B) 1/10 C) 1/8 D) 1/7 E) 2/10 51) Suppose the central bank of Icecreamland wishes to increase the size of the money supply, and does so by purchasing 1000 worth of government bonds from Moneybags Bank. Immediately after this move the reserve ratio will be: A) 1/11 B) 1/10 C) 1/8 D) 1/7 E) 2/10 52) Assuming that MoneybagsBank creates new loans in order to keep its reserve ratio at the original level, this will lead to an increase in loans of _____ and a new money supply of _____: A) 9000, 20000 B) 10000, 20000 C) 8000, 18000 D) 9000, 21000 E) 2000, 20000 w10-112-v1 Page 14 of 21 For the next four questions, suppose that the balance sheet is back to the original one, that MoneybagsBank will always try to keep its reserve ratio at the original level, and suppose it is also governed by a new regulation that requires it to have a capital/loan ratio of at least 10%. If it cannot maintain this ratio, the bank must fail and all its deposits become worthless. 53) Suppose that a financial crisis erupts in Icecreamland, and the value of the bank’s Dodgy Assets goes to zero. The bank must write down the value of its capital by the same amount. If there is no government intervention, this will lead to reserves of ____ and a money supply of ____ A) 0, 0 i.e. the bank will fail B) 1000, 10000 C) 2000, 10000 D) 1800, 10000 E) 0, 9000 54) Suppose the government responds to the crisis by buying $1000 worth of shares in the bank. Immediately after this intervention the level of reserves will be ____ and the money supply will be ____. A) 0, 0 i.e. the bank will fail B) 1000, 10000 C) 2000, 10000 D) 1800, 10000 E) 1800, 18000 55) Suppose instead that the government responds to the crisis by creating the Dodgy Asset Relief Program (DARP) and uses taxpayer money to buy up the bank’s Dodgy Assets for $800, paid with deposits at the central bank. Immediately after this intervention the level of reserves will be ____ and the money supply will be ____. A) 0, 0 i.e. the bank will fail B) 1000, 10000 C) 2000, 10000 D) 1800, 10000 E) 1800, 18000 56) Suppose the DARP policy is implemented. Sometime later, after the bank has expanded loans as much as it can, the level of reserves will be ____ and the money supply will be ____. A) 0, 0 i.e. the bank failed B) 1000, 10000 C) 2000, 10000 D) 1800, 10000 E) 1800, 18000 Page 15 of 21 w10-112-v1 Part D [8 marks] The following 8 questions (57-64) relate to the information given below. Try to do the questions in order since the answers for some questions depend on the answers to previous questions in the series. Each question is worth 1 mark. Consider the following model of an economy. Output prices, factor prices and interest rates are assumed constant. We have the following information, where YD is disposable income and Y is national income. Consumption: C = 50 + (0.8)YD Taxes (net of all transfers) T = (0.3)Y Investment: I = 100 Government Spending G = 350 Exports: X = 300 Imports: IM = (0.36)Y The space below is provided for you to keep track of your answers as you work through the series of questions. [Hint: You may want to sketch an AE diagram to help with this process.] Page 16 of 21 w10-112-v1 57) The equation for aggregate expenditures is given by: A) AE = 800 + (.8)Y B) AE = 800 + (.56)Y C) AE = 800 + (.92)Y D) AE = 800 + (.2)Y E) AE = 800 + (.36)Y 58) If AE > Y then firms have inventories that are: A) larger than the planned level, so they decrease output. B) larger than the planned level, so they increase output. C) smaller than the planned level, so they decrease output. D) smaller than the planned level, so they increase output. E) equal to the planned level. 59) The equilibrium level of national income is: A) 800 B) 1000 C) 1600 D) 1818 E) 4000 60) In equilibrium, the government: A) is running a deficit of 50. B) is running a deficit of 110. C) has a balanced budget. D) is running a surplus of 130. E) is running a surplus of 50. Suppose that, as a result of growth in the global economy, exports increase by 50 (from 300 to 350) but at the same time the government ends its stimulus program so that government spending decreases by 30 (from 350 to 320). 61) The new equilibrium level of national income is: A) 1020 B) 1025 C) 1625 D) 1100 E) 4020 62) In this model, the multiplier is equal to: A) 25.00 B) 20.00 C) 5.00 D) 1.25 E) 1.00 63) In the new equilibrium, the government: A) is running a deficit of 12.5. B) is running a deficit of 20. C) has a balanced budget. D) is running a surplus of 150. E) is running a surplus of 7.5. 64) As a result of the changes, the trade balance (net exports): A) increases by 50. B) increases by 41. C) is unchanged. D) decreases by 19. E) decreases by 50. Page 17 of 21 w10-112-v1 Part E [8 marks] The following 8 questions (65-72) relate to the information given below. Try to do the questions in order since the answers for some questions depend on the answers to previous questions in the series. Each question is worth 1 mark. The following is an aggregate supply – aggregate demand diagram for the country of Paymelater. Several years ago, Paymelater went through a financial crisis. The government responded with a variety of fiscal and monetary policies that brought the economy back to full employment (i.e. Y*). However, the past several years have seen steady high inflation rates that are now incorporated into expectations. Currently the economy has aggregate demand and aggregate supply of AD1 and AS1. Page 18 of 21 w10-112-v1 65) Initially , the real GDP and the price level of Paymelater are given by A) Y*, P1 B) Yr, P2 C) Yb, P2 D) Y*, P3 E) Yb, P4 66) Suppose, based on past experience, workers expect the next year’s price level to be P3. This expectation drives their wage demands, so that next year’s Aggregate Supply is given by AS2. The Central Bank of Paymelater accommodates with an increase in the money supply, driving aggregate demand to AD2. The next period will see: A) Increased real output with increasing inflation. B) Increased real output with steady inflation. C) Steady real output with steady inflation. D) Steady real output with reduced inflation. E) Reduced real output with reduced inflation. 67) Suppose as before that workers expect the next year’s price level to be P3. This expectation drives their wage demands, so that next year’s Aggregate Supply is given by AS2. The government faces reelection and decides it wants to reduce unemployment so as to increase its popularity among voters. If it does so, in the short run the economy will face: A) Increased real output with increasing inflation. B) Increased real output with steady inflation. C) Steady real output with steady inflation. D) Steady real output with reduced inflation. E) Reduced real output with reduced inflation. 68) Suppose worker expectations are as above and that the government wants to reduce inflation rates back to their old levels. It decides to keep Aggregate Demand at AD1. In the short term, the impact of this policy will be: A) Increased real output with increasing inflation. B) Increased real output with steady inflation. C) Steady real output with steady inflation. D) Steady real output with reduced inflation. E) Reduced real output with reduced inflation. 69) Over the longer term the effect of this policy will eventually be: A) Increased real output with increasing inflation. B) Increased real output with steady inflation. C) Steady real output with steady inflation. D) Steady real output with reduced inflation. E) Reduced real output with reduced inflation. w10-112-v1 Page 19 of 21 Below is an expectations augmented Phillips Curve diagram for the country of Paymelater. Initially, Paymelater has the Short Run Phillips Curve B, with a steady inflation rate of “c” and unemployment of U*. 70) On the Phillips Curve diagram, the long run effect of the policy outlined in question #66 above would be a move from: A) (U*, c) to (Ul, b) and then to (U*, b). B) (U*, c) to (Uh, d) and then to (U*, d). C) (U*, c) to (Uh, c) and then to (U*, d). D) (U*, c) to (U*, d) and then to(Uh, d) E) (U*, c) to (U*, c) (i.e. no change) 71) On the Phillips Curve diagram, the long run effect of the policy outlined in question #67 above would be a move from: A) (U*, c) to (Ul, b) and then to (U*, b). B) (U*, c) to (Uh, d) and then to (U*, d). C) (U*, c) to (Uh, c) and then to (U*, d). D) (U*, c) to (U*, d) and then to(Uh, d) E) (U*, c) to (U*, c) (i.e. no change) 72) On the Phillips Curve diagram, the long run effect of the policy outlined in questions #68 and #69 above would be a move from: A) (U*, c) to (Ul, b) and then to (U*, b). B) (U*, c) to (Uh, d) and then to (U*, d). C) (U*, c) to (Uh, c) and then to (U*, d). D) (U*, c) to (U*, d) and then to(Uh, d) E) (U*, c) to (U*, c) (i.e. no change) Page 20 of 21 w10-112-v1 Part F [8 marks] The following 8 questions (73-80) relate to the information given below. Try to do the questions in order since the answers for some questions depend on the answers to previous questions in the series. Each question is worth 1 mark. The diagram below represents the market for Euros exchanged for Canadian dollars. The horizontal axis measures the quantity of Euros traded for Canadian dollars ($C) and the vertical axis measures the exchange rate, the number of $C per Euro. Exchange Rate e = $C/Euro S e1 e0 D FL F0 FH Euros Traded for $C 73) The demand curve for Euros against the Canadian dollar is downward-sloping because, as the exchange rate e falls the Canadian dollar: A) appreciates so Canadians want to purchase fewer exports from Europe. B) depreciates so Europeans want to purchase fewer exports from Canada. C) appreciates so Europeans want to purchase more exports from Canada. D) depreciates so Europeans want to purchase more exports from Canada. E) appreciates so Canadians want to purchase more exports from Europe. 74) Consider the foreign exchange market above. To maintain the fixed exchange rate e1 rather than the market equilibrium e0, the central bank will have to: A) sell the quantity (FH – F0) of domestic currency. B) buy the quantity (FH – F0) of domestic currency. C) sell the quantity (FH – FL) of foreign currency. D) buy the quantity (FH – FL) of foreign currency. E) buy the quantity (F0 – FL) of foreign currency. 75) Monetary policy is more effective with flexible rather than with fixed exchange rates because it affects aggregate demand through both: A) taxes and investment expenditures. B) consumption and government expenditures. C) government and investment expenditures. D) investment expenditures and net exports. E) government expenditures and net exports. w10-112-v1 Page 21 of 21 76) If the central bank objective is short-run stabilization of output, the correct monetary policy under flexible exchange rates would be: A) expansionary if the exchange rate appreciates as a result of increasing capital inflow. B) contractionary if the exchange rate depreciates as a result of increasing exports. C) contractionary if the exchange rate appreciates as a result of increasing exports. D) contractionary if the exchange rate depreciates as a result of falling exports. E) expansionary if the exchange rate depreciates as a result of increasing capital outflow. 77) For an open economy, comparing flexible versus fixed exchange rates: A) a negative export shock sustains a larger positive AD shock under flexible exchange rates. B) a positive export shock sustains a larger negative AD shock under flexible exchange rates. C) a positive export shock sustains a larger positive AD shock under flexible exchange rates. D) a positive export shock sustains a larger positive AD shock under fixed exchange rates. E) a negative export shock sustains a larger negative AD shock under flexible exchange rates. For the following 3 questions, assume an open economy that is operating under flexible exchange rates. Furthermore, assume that any increase in government borrowing is not compensated for by increasing domestic private sector saving. 78) An increase in the government budget deficit will induce: A) sales of assets to foreigners and foreign borrowing. B) borrowing but never sales of assets. C) sales of assets but never borrowing. D) lending and purchase of foreign assets. E) sales of assets to foreigners and foreign lending. 79) From an initial macroeconomic equilibrium with the current account in balance, if the government increases its budget deficit, this will result in what is called the “twin deficits”. This means that, beyond the government budget deficit, there will exist a deficit in the: A) capital account. B) balance of payments. C) balance of trade. D) current account. E) official financing account. 80) As a result of an increase in the government deficit, future generations will be certain to be: A) better off if the deficit finances consumption of government services. B) worse off if the growth rate in national income is unchanged because of the increase in foreign debt that must be serviced in the future. C) worse off if the deficit finances infrastructure and human capital development. D) better off if the growth rate in national income is unchanged because the of decrease in foreign debt that must be serviced in the future. E) unaffected under any circumstances. Page 22 of 21 w10-112-v1 W10 – 112-v1 Answers: Part A 1) B 2) B 3) E 4) C 5) C 11) C 12) C 13) C 14) A 15) A 21) E 22) B 23) C 24) B 25) B 31) E 32) B 33) C 34) B 35) B 6) B 7) D 8) D 9) A 10) A 16) D 17) C 18) B 19) D 20) C 26) C 27) D 28) A 29) C 30) D 36) B 37) A 38) A 39) A 40) E Part E Part D Part C Part B Part F 41 42 43 44 C E E B 49 50 51 52 B C E B 57. 58. 59. 60. D D B A 65. 66. 67. 68. A C A E 73. 74. 75. 76. E D D C 45 46 47 48 D A C D 53 54 55 56 A C D D 61. 62. 63. 64. B D A B 69. 70. 71. 72. D E A B 77. 78. 79. 80. D A D B