Cash and Accrual Basis Accounting

advertisement

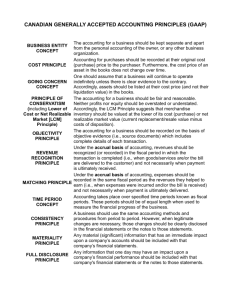

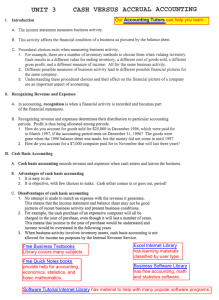

Earn 2 CE credits This course was written for dentists, dental hygienists, and assistants. (Keeping Two Sets of Books Could be a Good Thing) A Peer-Reviewed Publication Written by Richard C. Capasso, CPA, PFS, CFP Abstract Understanding the method of accounting when looking at financial statements is important to determine the profitability of a company. There are many different methods of accounting, but the two most common are the Cash Basis Method and the Accrual Basis Method. This course will give you a general understanding of both the Cash Basis Method and Accrual Basis Method of accounting, and when to use one method over another and why. Educational Objectives At the conclusion of this educational activity participants will be able to: 1.Describe the Cash Basis Method of Accounting. 2.Describe the Accrual Basis Method of Accounting. 3.Identify Cash Basis and Accrual Basis financial statements. 4.Determine when to use these two different methods of accounting for practice management. © Terry Mapstone | Dreamstime.com Cash and Accrual Basis Accounting Author Profile Richard C. Capasso, CPA, PFS, CFP is Vice-President and shareholder of Clairmont, Paciello and Co, PC, a regional certified public accounting firm, CPC Financial Planning and Tanglewood Financial Services which are based in King of Prussia, PA. Mr. Capasso is a member of numerous boards of directors, is the recipient of numerous awards and has been recognized for his contributions to the business, civic and cultural betterment of the greater Philadelphia region. Author Disclosure Richard C. Capasso, CPA, PFS, CFP has no commercial ties with the sponsors or the providers of the unrestricted educational grant for this course. Go Green, Go Online to take your course Publication date: Oct. 2014 Expiration date: Sept. 2017 Supplement to PennWell Publications This course is approved for AGD credits only it is not approved for ADA credits PennWell designates this activity for 2 continuing educational credits. Dental Board of California: Provider 4527, course registration number CA# 02-4527-14083 “This course meets the Dental Board of California’s requirements for 2 units of continuing education.” The PennWell Corporation is designated as an Approved PACE Program Provider by the Academy of General Dentistry. The formal continuing dental education programs of this program provider are accepted by the AGD for Fellowship, Mastership and membership maintenance credit. Approval does not imply acceptance by a state or provincial board of dentistry or AGD endorsement. The current term of approval extends from (11/1/2011) to (10/31/2015) Provider ID# 320452. This educational activity was developed by PennWell’s Dental Group with no commercial support. This course was written for dentists, dental hygienists and assistants, from novice to skilled. Educational Methods: This course is a self-instructional journal and web activity. Provider Disclosure: PennWell does not have a leadership position or a commercial interest in any products or services discussed or shared in this educational activity nor with the commercial supporter. No manufacturer or third party has had any input into the development of course content. Requirements for Successful Completion: To obtain 2 CE credits for this educational activity you must pay the required fee, review the material, complete the course evaluation and obtain a score of at least 70%. CE Planner Disclosure: Heather Hodges, CE Coordinator does not have a leadership or commercial interest with products or services discussed in this educational activity. Heather can be reached at hhodges@pennwell.com Educational Disclaimer: Completing a single continuing education course does not provide enough information to result in the participant being an expert in the field related to the course topic. It is a combination of many educational courses and clinical experience that allows the participant to develop skills and expertise. Image Authenticity Statement: The images in this educational activity have not been altered. Scientific Integrity Statement: Information shared in this CE course is developed from clinical research and represents the most current information available from evidence based dentistry. Known Benefits and Limitations of the Data: The information presented in this educational activity is derived from the data and information contained in reference section. The research data is extensive and provides direct benefit to the patient and improvements in oral health. Registration: The cost of this CE course is $49.00 for 2 CE credits. Cancellation/Refund Policy: Any participant who is not 100% satisfied with this course can request a full refund by contacting PennWell in writing. Educational Objectives At the conclusion of this educational activity participants will be able to: 1. Describe the Cash Basis Method of Accounting. 2. Describe the Accrual Basis Method of Accounting. 3. Identify Cash Basis and Accrual Basis financial statements. 4. Determine when to use these two different methods of accounting for practice management. Abstract Understanding the method of accounting when looking at financial statements is important to determine the profitability of a company. There are many different methods of accounting, but the two most common are the Cash Basis Method and the Accrual Basis Method. This course will give you a general understanding of both the Cash Basis Method and Accrual Basis Method of accounting, and when to use one method over another and why. Revenue and Expense Recognition The major difference between the Cash Basis Method and the Accrual Basis Method is when revenues and expenses are recognized. Cash Basis Method When using the Cash Basis Method, revenue is recognized when received and expenses are recognized when paid. Accrual Basis Method When using the Accrual Basis Method, revenue is recognized when earned and expenses are recognized when incurred. Another way at looking at the difference in methods is the timing difference of revenue and expense recognition. Example 1: A dentist performs a procedure on a patient and bills the patient $250.00 on March 21, 2014. The patient receives a bill on March 27, 2014 and pays it on April 15, 2014 at her next visit. Under the Cash Basis Method the revenue of $250.00 was recognized when it was received on April 15, 2014. Under the Accrual Basis Method the revenue of $250.00 was recognized when the revenue was earned on the date of the procedure, March 21, 2014. Example 2: The fee for the lab work for this patient was $125.00. The lab billed the dentist on March 24, 2014 and the dental practice paid the bill on April 5, 2014. Under the Cash Basis Method the expense of $125.00 was recorded on April 5, 2014, when it was paid. Under the Accrual Basis Method the expense of $125.00 was recorded on March 24, 2014, when the expense was incurred. In both examples the revenue and expenses were recognized, but the timing of the recognition was different. The Cash Basis Method focuses on cash flow; the actual money coming in and out of your business. The Accrual Basis Method is geared towards matching revenues and expenses to the time period they are earned and incurred respectively. The proper matching of revenue and expenses give the business owner a truer picture of the profitability of his or her business. It is important to know your cash flow, but it is more important to know if you are profitable in your business. The Accrual Basis Method of accounting is the generally accepted method of accounting or G.A.A.P. When to use the Cash Basis Method If you are starting up your practice you may elect to use the Cash Basis Method of accounting for tax purposes. The election for using Cash Basis Method will have you pay tax on monies you received and expenses you have paid. This is a simpler method to use for taxes and again you only pay on what went in and out of your practice during the year. But be aware if a patient pays a down payment for a procedure in December but the work is performed in January; the Cash Basis Method would recognize the income in December when received, not in January when earned. When it is best to use the Accrual Basis Method From a practice management standpoint the Accrual Basis Method gives you a true picture of the financial operations. By matching revenues and expenses during the period they took place, the reader of the financial statements can have a better understanding of how the business is doing. With the Accrual Basis Method you will not only know your cash position, but you will know other important information such as accounts receivable, prepaid expense and unearned revenue to name a few. The basic financial analysis of the balance sheet and income statement is an important tool for practice management. Keeping two sets of books The I.R.S. allows for practices to keep their company books on the Accrual Basis Method while filing their tax return on the Cash Basis Method. When you first start filing your tax returns you must choose one method or the other. Once that choice is made of which method you are filing your return, you must continue the same method. You can change methods, but only with approval of the IRS by filing a Federal Form 3115, Application of Change in Account Methods. Although keeping two sets of books may appear to be double work, most software allows you to have both the Cash Basis and Accrual Basis Methods in your financial reporting. These types of options in software give you the best of both 2www.ineedce.com worlds. You will have the simplicity and potential benefit of the Cash Basis Method while having a true picture of the practice’s financial position. Example 3: Using several transactions you should see the benefit of both methods as they relate to taxes and the financial statement. In the first year of operation, Great Smiles produced $300,000 in total patient invoices for services performed in 2013. $250,000 was deposited in 2013 and $10,000 of that deposit represented down payments on future dental procedures. In addition, the practice received $200,000 in vendor invoices for 2013 expenses. $190,000 was paid in 2013 of which $8,000 represented prepayment of 2014 malpractice insurance. You have elected the Cash Basis Method for tax reporting and Accrual Basis Method for financial statement purposes. For this example, equipment purchases did not take place in 2013. The results would be as follows: (Figure 1) The Accrual Basis Method has $40,000 more income compared to the Cash Basis Method. The reasons are the proper matching of revenues and expenses. Accounts Receivable of $60,000 was a result of $300,000 invoiced for 2013 services, but only $240,000 was collected for those services. The additional $10,000 in cash deposited was for the down payment of services to be performed in 2014. The unearned revenue of $10,000 is actually a liability of the practice until the service is performed in 2014. Accounts Payable of $18,000 was a result of $200,000 of vendor invoices and expense occurring in 2013, but only $182,000 was paid. The additional $8,000 in cash payments was for a 2014 malpractice premium. The $8,000 is a current asset until properly matched with the 2014 expense. As was stated earlier, these differences are timing differences and temporarily delay the payment of tax due to the different reporting basis. Other considerations for taxes are depreciation expenses. The tax code allows for accelerated depreciation methods such as MACRS (Modified Accelerated Cost Recovery System), Bonus Depreciation and Section 179. These methods expense capital purchases or assets with more than one year of useful life, generally at a higher rate in the early years. These methods are not Generally Accepted Accounting Principles (G.A.A.P.). For the Accrual basics to be in compliance with G.A.A.P., you must use straight line method of depreciation. Depreciation is uniform during the useful life of the asset. When looking at Cash Basis statements and Cash Basis tax returns, the reader of the financial data could misunderstand the true profitability of the company. Many readers of financial statements look directly at the net income of a company and how much cash is in the bank. You should not solely focus on the net income, especially with a Cash Basis statement. The true profitability of the practice may not be represented. www.ineedce.com Figure 1. The Cash Basis Method Tax Return Great Smiles Balance Sheet 12/31/13 ASSETS Cash $ 60,000 Total Assets $ 60,000 Owner’s Equity $ 60,000 Great Smiles Income Statement 12/31/13 Patient Fees $ 250,000 Lab fees and Overhead Expenses $ 190,000 Net Income $ 60,000 The Accrual Basis Method Financial Statements Great Smiles Balance Sheet 12/31/13 ASSETS Cash Accounts Receivable 60,000 Prepaid Expenses 8,000 Total Assets Accounts Payable $ 60,000 $ 128,000 LIABILITIES Unearned Revenue $ 18,000 10,000 Total Liabilities $ 28,000 Owner’s Equity $ 100,000 Total Liability and Owner’s Equity $ 128,000 Great Smiles Income Statement 12/31/13 Patient Fees $ 300,000 Lab Fees and Overhead Expenses $ 200,000 Net Income $ 100,000 3 Having accounts receivable, accounts payable and other Accrual Basis accounts will show a truer picture of profitability. When looking at whether to merge, buy or sell a practice, it is good to see three years of tax returns. It is equally important to see the books and records of the practice on the Accrual Basis for the same three-year period. By looking at both, you can get a true sense of profitability, cash flow, financial obligations and tax obligations of the practice. Do not be fooled by what your gross income is or how much cash you have in your practice bank account. You need to understand how profitable your practice is and how much of the cash in the bank is truly the practice’s and not an unpaid debt. There are too many times a vendor is not paid but the practice has the cash in the bank. This is why the Accrual Basis should always be considered a preferred method to determine profitability. Keeping two sets of books is a good thing; you have the potential tax benefits of using the Cash Basis and the benefit of knowing the true profitability of the practice. There are more fine points of the Cash Basis Method of reporting and the Accrual Basis Method of reporting. The objec- tive of a basic understanding of both methods, how to identify them and when to use them have been presented. The Cash Basis Method and Accrual Basis Method of accounting are both valuation methods for a practice. You should consult your accountant for more detail on how these methods can work for you in both taxes and practice management. Author Profile Richard C. Capasso, CPA, PFS, CFP is Vice-President and shareholder of Clairmont, Paciello and Co, PC, a regional certified public accounting firm, CPC Financial Planning and Tanglewood Financial Services which are based in King of Prussia, PA. Mr. Capasso is a member of numerous boards of directors, is the recipient of numerous awards and has been recognized for his contributions to the business, civic and cultural betterment of the greater Philadelphia region. Author Disclosure Richard C. Capasso, CPA, PFS, CFP has no commercial ties with the sponsors or the providers of the unrestricted educational grant for this course. Notes 4www.ineedce.com Online Completion Use this page to review the questions and answers. Return to www.ineedce.com and sign in. If you have not previously purchased the program select it from the “Online Courses” listing and complete the online purchase. Once purchased the exam will be added to your Archives page where a Take Exam link will be provided. Click on the “Take Exam” link, complete all the program questions and submit your answers. An immediate grade report will be provided and upon receiving a passing grade your “Verification Form” will be provided immediately for viewing and/or printing. Verification Forms can be viewed and/or printed anytime in the future by returning to the site, sign in and return to your Archives Page. Questions 1.Prepaid Expenses would be found on a(n): a. Accrual Basis Method Income Statement b. Cash Basis Method Income Statement c. Accrual Basis Method Balance Sheet d. Cash Basis Method Balance Sheet 2.Accrual Basis Method uses the: a. Matching Principle b. Consistency Principle c. Timing Principle d. Balanced Principle a. Accrual Basis Method b. Depreciation Basis Method c. Cash Basis Method d. Financial Statement Method 9.A difference in the Cash Basis Method and Accrual Basis Method is: a. Revenue and expense allocation b. Revenue and expense proration c. Revenue and expense apportion d. Revenue and expense recognition 3.The difference between Cash Basis Method and Accrual Basis Method is an example of: 10. A small business tax return could be prepared using: 4.The Accrual Basis Method is prepared according to: 11. Which of the following do most small businesses use when preparing year end taxes? a. Statement Difference b. Timing Difference c. IRS Difference d. Efficiency Difference a. IRS Regulations b. Financial Accounting Standards c. Generally Accepted Auditing Standards d. Generally Accepted Accounting Principles 5.Expenses recognized when paid is an example of: a. Accrual Basis Method b. Depreciation Basis Method c. Cash Basis Method d. Financial Basis Method 6.The IRS allows a company to maintain their records on: a. Accrual Basis Method b. Cash Basis Method c. Both a and b d. None of the above 7.The Asset Category of Cash can be found on: a. Cash Basis Method of Accounting b. Accrual Basis Method of Accounting c. Both a and b d. None of the above 8.Expenses recognized when incurred is an example of: www.ineedce.com a. Cash Basis Method b. Accrual Basis Method c. Both a and b d. None of the above a. Deferred Basis Method b. Accrual Basis Method c. Financial Basis Method d. Cash Basis Method 12. Revenue when received is an example of the: a. Accrual Basis Method b. Depreciation Basis Method c. Cash Basis Method d. Financial Basis Method 13. A practice can petition the IRS to change an accounting period by filing form: a.1040 b.1120S c.1065 d.3115 14. Accelerated depreciation would be found on a: a. Cash Basis Tax Return b. G.A.A.P. Financial Statement c. Statement of Cash Flow d. Financial Footnotes 15. A payment of $5,000 is made on 12/28/12 for 2013 malpractice expenses. On the Accrual Basis, how much of the expense would be recognized in 2012? a.$5,000 b.$2,500 c.$0 d.$1,000 16. Accounts Receivable on an Accrual Basis Balance Sheet represents: a. Total Sales b. Net Sales c. Outstanding patient invoices not yet paid d. Total invoices 17. Revenue recognition when earned is an example of: a. Cash Basis Method b. Depreciation Method c. Financial Statement Method d. Accrual Basis Method 18. Accounts payable on an Accrual Basis Balance Sheet represents: a. Total Expenses b. Total Cost c. Total Invoices d. Outstanding vendor invoices not yet paid 19. Lab Fees Expenses can be found on: a. Accrual Basis Income Statement b. Cash Basis Income Statement c. Both a and b d. None of the above 20. The truest view of a practice’s profitability would be found in: a. Accrual Basis Income Statement b. Cash Basis Income Statement c. Both a and b d. None of the above 5 ANSWER SHEET Cash and Accrual Basis Accounting (Keeping Two Sets of Books Could be a Good Thing) Name: Title: Specialty: Address:E-mail: City: State:ZIP:Country: Telephone: Home ( ) Office ( Lic. Renewal Date: ) AGD Member ID: Requirements for successful completion of the course and to obtain dental continuing education credits: 1) Read the entire course. 2) Complete all information above. 3) Complete answer sheets in either pen or pencil. 4) Mark only one answer for each question. 5) A score of 70% on this test will earn you 2 CE credits. 6) Complete the Course Evaluation below. 7) Make check payable to PennWell Corp. For Questions Call 216.398.7822 If not taking online, mail completed answer sheet to Academy of Dental Therapeutics and Stomatology, Educational Objectives A Division of PennWell Corp. 1. Describe the Cash Basis Method of Accounting. P.O. Box 116, Chesterland, OH 44026 or fax to: (440) 845-3447 2. Describe the Accrual Basis Method of Accounting. 3. Identify Cash Basis and Accrual Basis financial statements. For immediate results, go to www.ineedce.com to take tests online. Answer sheets can be faxed with credit card payment to (440) 845-3447, (216) 398-7922, or (216) 255-6619. 4. Determine when to use these two different methods of accounting for practice management. Course Evaluation 1. Were the individual course objectives met? Objective #1: Yes No Objective #2: Yes No Objective #3: Yes No Objective #4: Yes No P ayment of $49.00 is enclosed. (Checks and credit cards are accepted.) If paying by credit card, please complete the following: MC Visa AmEx Discover Please evaluate this course by responding to the following statements, using a scale of Excellent = 5 to Poor = 0. 2. To what extent were the course objectives accomplished overall? 5 4 3 2 1 0 3. Please rate your personal mastery of the course objectives. 5 4 3 2 1 0 4. How would you rate the objectives and educational methods? 5 4 3 2 1 0 5. How do you rate the author’s grasp of the topic? 5 4 3 2 1 0 6. Please rate the instructor’s effectiveness. 5 4 3 2 1 0 7. Was the overall administration of the course effective? 5 4 3 2 1 0 8. Please rate the usefulness and clinical applicability of this course. 5 4 3 2 1 0 9. Please rate the usefulness of the supplemental webliography. 4 3 2 1 0 5 10. Do you feel that the references were adequate? Yes No 11. Would you participate in a similar program on a different topic? Yes No Acct. Number: ______________________________ Exp. Date: _____________________ Charges on your statement will show up as PennWell 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 12. If any of the continuing education questions were unclear or ambiguous, please list them. ________________________________________________________________ 13. Was there any subject matter you found confusing? Please describe. _________________________________________________________________ 14. How long did it take you to complete this course? _________________________________________________________________ 15. What additional continuing dental education topics would you like to see? _________________________________________________________________ AGD Code 552 PLEASE PHOTOCOPY ANSWER SHEET FOR ADDITIONAL PARTICIPANTS. COURSE EVALUATION and PARTICIPANT FEEDBACK We encourage participant feedback pertaining to all courses. Please be sure to complete the survey included with the course. Please e-mail all questions to: hhodges@pennwell.com. INSTRUCTIONS All questions should have only one answer. Grading of this examination is done manually. Participants will receive confirmation of passing by receipt of a verification form. Verification of Participation forms will be mailed within two weeks after taking an examination. COURSE CREDITS/COST All participants scoring at least 70% on the examination will receive a verification form verifying 2 CE credits. The formal continuing education program of this sponsor is accepted by the AGD for Fellowship/ Mastership credit. Please contact PennWell for current term of acceptance. Participants are urged to contact their state dental boards for continuing education requirements. PennWell is a California Provider. The California Provider number is 4527. The cost for courses ranges from $20.00 to $110.00. Provider Information PennWell is an ADA CERP Recognized Provider. ADA CERP is a service of the American Dental association to assist dental professionals in identifying quality providers of continuing dental education. ADA CERP does not approve or endorse individual courses or instructors, not does it imply acceptance of credit hours by boards of dentistry. Concerns or complaints about a CE Provider may be directed to the provider or to ADA CERP ar www.ada. org/cotocerp/ The PennWell Corporation is designated as an Approved PACE Program Provider by the Academy of General Dentistry. The formal continuing dental education programs of this program provider are accepted by the AGD for Fellowship, Mastership and membership maintenance credit. Approval does not imply acceptance by a state or provincial board of dentistry or AGD endorsement. The current term of approval extends from (11/1/2011) to (10/31/2015) Provider ID# 320452 RECORD KEEPING PennWell maintains records of your successful completion of any exam for a minimum of six years. Please contact our offices for a copy of your continuing education credits report. This report, which will list all credits earned to date, will be generated and mailed to you within five business days of receipt. Completing a single continuing education course does not provide enough information to give the participant the feeling that s/he is an expert in the field related to the course topic. It is a combination of many educational courses and clinical experience that allows the participant to develop skills and expertise. CANCELLATION/REFUND POLICY Any participant who is not 100% satisfied with this course can request a full refund by contacting PennWell in writing. Image Authenticity The images provided and included in this course have not been altered. © 2014 by the Academy of Dental Therapeutics and Stomatology, a division of PennWell CASHACC1014DE Customer Service 216.398.7822