The neuropathic pain market

N E W S & A N A LY S I S

FROM THE ANALYST’S COUCH

The neuropathic pain market

Sarah Nightingale

Munro sofa by Donna Wilson, courtesy of www.scp.co.uk

Neuropathic pain is a chronic pain condition caused by a primary lesion or dysfunction in the nervous system. It can be a consequence of many different insults, such as trauma, neuronal injury or infection. The most commonly studied neuropathic pain subtypes include diabetic neuropathic pain

(DNP), postherpetic neuralgia (PHN) and

HIV-related neuropathic pain. Collectively, these three conditions were estimated to affect over 6 million people across the seven major pharmaceutical markets (the United

States, Japan, France, Germany, Italy, Spain and the United Kingdom) in 2010 (REF. 1) .

However, the total affected population is considerably larger owing to the number of additional neuropathic pain conditions, such as neuropathic lower back pain, cancer-related neuropathic pain, complex regional pain syndrome and postoperative neuropathic pain.

Current therapeutic options

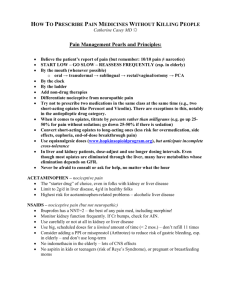

Owing to the limited understanding of the precise aetiology of many neuropathic pain conditions, current pharmacological treatments encompass an array of drug classes including anticonvulsants, antidepressants, narcotic analgesics and topical anaesthetics.

However, with just seven drugs approved for neuropathic pain conditions across the seven major markets (late 2011), and because of the limited efficacy of these drugs, off-label prescribing is widespread.

The current standard treatment is the anticonvulsant pregabalin (Lyrica; Pfizer).

It alters neuronal activity through modulation of the calcium channels and agonism of the

GABA (γ-aminobutyric acid) α2δ subunit.

This dual mechanism of action leads to efficacy in many neuropathic pain conditions.

Lyrica has the broadest neuropathic pain label of all marketed agents but its analgesic efficacy profile leaves much room for improvement; it is associated with several central nervous system (CNS)-related side effects including sedation and dizziness.

Another leading product is the anti - depressant duloxetine (Cymbalta; Eli Lilly).

It is a serotonin and noradrenaline reuptake inhibitor indicated for the treatment of DNP.

However, Cymbalta is expected to face fierce competition from generic duloxetine in the

European and US markets following its patent expiry in December 2012 and June 2013, respectively.

In recent years there has been a shift towards the use of transdermal therapies for the management of neuropathic pain. Since the 1990s, Lidoderm (5% lidocaine patch;

Endo/Grünenthal/Teikoku) has dominated the topical neuropathic pain market. In 2010

4.0

3.5

3.0

2.5

2.0

1.5

1.0

0.5

ARC-4558

Ralfinamide

AVP-923

AmiKet

Eladur

Horizant

Nucynta ER

Other*

Generic

Qutenza

Gralise

Lidoderm

Cymbalta

Lyrica

0.0

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

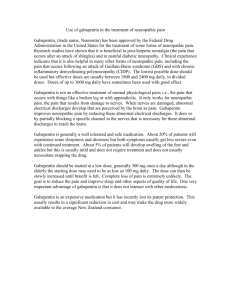

Figure 1 | Shifting composition for the neuropathic pain market. Data are for the seven major markets (the United States, Japan, France, Germany, Italy, Spain and the United Kingdom).

The neuropathic pain market is expected to grow from US$2.4 billion in 2010 to reach $3.6 billion by 2020. Nucynta ER is forecast to be the market leader by 2020, achieving neuropathic pain-specific sales of $1.2 billion in 2020. Marketed drugs will continue to lose market share to generics, and the current pipeline is set to account for 59.1% of market share by 2020. *‘Other’ corresponds to other marketed drugs and drugs that are prescribed off-label in this market.

however, Qutenza (8% capsaicin patch;

NeurogesX/Astellas Pharma) entered the US and European markets for the treatment of

PHN. Qutenza offers an application frequency of once every 3 months, which is a substantial improvement on Lidoderm’s once-daily dosing frequency. However, Qutenza’s painful and cumbersome application process is expected to limit future uptake.

The newest compounds to enter the neuropathic pain market are Gralise

(extended release gabapentin; Depomed) and

Nucynta ER (extended release tapentadol;

Johnson & Johnson). Gralise is a once-daily formulation of the anticonvulsant gabapentin and was approved for the management of

PHN in January 2011, making it the first oral treatment to obtain approval from the US

Food and Drug Administration (FDA) for neuropathic pain in over 6 years. Despite its improved dosing regime, Gralise offers limited clinical differentiation from other established treatment options and this is likely to hinder the product’s success. By contrast, Nucynta

ER, which obtained FDA approval for the treatment of chronic pain in August 2011, is likely to achieve blockbuster sales in the neuropathic pain market. It possesses a dual mode of action — agonism of the μ-opioid receptor and inhibition of noradrenaline reuptake — and has demonstrated efficacy in both neuropathic and nociceptive pain conditions. As a result, it is expected to be prescribed for conditions involving both pain types, such as chronic lower back pain. Its opioid-sparing effects and reduced potential for abuse will be key clinical advantages for

Nucynta ER in neuropathic pain conditions requiring long-term management.

Unmet needs

In the absence of disease-modifying or curative agents for the management of neuropathic pain, improved analgesic efficacy remains a primary unmet need. It is estimated that only one in four patients with neuropathic pain experiences over 50% pain relief. The pharmaceutical industry has so far struggled to improve on current therapeutic options, owing to the complexity of identifying the most appropriate targets to investigate.

Currently available drugs also produce several significant side effects such as ▶

NATURE REVIEWS | DRUG DISCOVERY VOLUME 11 | FEBRUARY 2012 | 101

© 2012 Macmillan Publishers Limited. All rights reserved

N E W S & A N A LY S I S

NEUROPATHIC PAIN | MARKET INDICATORS

▶ drowsiness, dizziness and somnolence, which negatively affect patients’ quality of life.

Furthermore, there is also increasing pressure on cost-effectiveness. Drug developers not only have to demonstrate efficacy to physicians but are also facing the increasing challenge of demonstrating a cost–benefit to regulatory bodies and insurers.

Key drugs in development

The neuropathic pain pipeline is one of the most extensive in the CNS arena, with

79 candidates known to be under clinical investigation in 2011 (REF. 2) . A summary of key late-stage compounds can be found in TABLE 1 .

The pipeline contains an array of novel candidates and agents offering improved dosing convenience. The most advanced pipeline candidate is Horizant (gabapentin enacarbil; XenoPort/GlaxoSmithKline), which offers once- or twice-daily dosing and is currently pending approval in the United

States for the treatment of PHN. However, it will face competition from other branded and generic gabapentin compounds in the marketplace, in particular from the once-daily extended release gabapentin, Gralise. Other compounds aiming to reduce the dosing frequency include: the controlled release pregabalin, which is in Phase III development for the once-daily treatment of neuropathic pain conditions; and Eladur (bupivacaine patch; Durect/King/Pfizer), which is in

Phase II development for the treatment of

PHN and requires one patch application every 3 days. Although Eladur improves on Lidoderm’s once-daily application, it falls short of Qutenza’s 3-monthly dosing frequency. However, the absence of severe application-site side effects such as those associated with Qutenza will be a clinical advantage for Eladur.

AmiKet (ketamine and amitriptyline;

EpiCept) and ARC-4558 (clonidine; Arcion) are two topical ointment formulations that are set to offer a more versatile application method than the patch formulation. This is of particular importance for the management of peripheral neuropathic pain types that are often localized to the hands and feet, where patch application can be challenging. Although AmiKet is expected to become the first of the topical ointments in the pipeline to enter the market, both agents will offer novel mechanisms of action in the neuropathic pain market. Drugs with novel mechanisms of action represent useful additions to the neuropathic pain market given the high percentage of patients who do not respond to current therapy options. Other novel candidates under clinical investigation include the cough suppressant dextromethorphan (AVP-923; IriSys/Avanir) and the selective sodium channel blocker ralfinamide (Newron).

Market outlook

In addition to the expansion of existing brands into new geographical regions, the uptake of new neuropathic pain products is expected to offset generic erosion, expanding the seven major market neuropathic pain sales from US$2.4 billion in 2010 to peak sales of $3.6 billion by 2020. Seven pipeline candidates are expected to enter the neuropathic pain market across the seven major markets by 2020 (FIG. 1) . Over this forecast period, sales of currently marketed products are projected to decrease threefold as leading brands such as Cymbalta and Lyrica experience generic erosion.

Nevertheless, the anticipated uptake of

Nucynta ER in the neuropathic lower back pain market is expected to drive market growth as there are currently no treatments indicated for this prevalent condition.

Sarah Nightingale is an associate analyst at Datamonitor, 119 Farringdon Road,

London EC1R 3DA, UK. e‑mail: snightingale@datamonitor.com

doi:10.1038/nrd3624

1. Datamonitor. Epidemiology: Peripheral Neuropathic pain — A common co-morbidity for HIV, diabetes, and herpes zoster. HC00221–001 (October 2011)

2. Datamonitor. R&D Trends: Neuropathic pain —

Extensive and diverse pipeline driven by high unmet need. HC00064–006 (July 2011).

Competing interests statement

The author declares no competing financial interests.

Table 1 | Neuropathic pain compounds either recently approved or in late-stage development

Drug

Nucynta ER

(extended release tapentadol)

Mode of action

Opioid receptor agonist, noradrenaline reuptake inhibitor

Gralise (extended release gabapentin)

Horizant (gabapentin enacarbil)

AVP-923

(dextromethorphan and quinidine)

Lyrica (controlled release pregabalin)

GABA modulator

GABA modulator, voltage-gated calcium channel modulator

NMDA receptor antagonist, sigma-1 agonist

GABA α 2 δ subunit agonist, calcium channel modulator

ARC-4558 (clonidine) α -adrenergic receptor agonist

AmiKet (amitriptyline and ketamine)

TCA, NMDA receptor antagonist

Ralfinamide

(NW-1029)

Selective sodium channel blocker, calcium channel inhibitor,

NMDA receptor antagonist

Formulation Indication

Oral

Oral

Oral

Oral

Oral

Topical gel

Oral

DNP, PHN

PHN

PHN

DNP

NP

DNP

Topical cream DNP, PHN, chemotherapy- induced NP

NP

Company

(partner)

Grunenthal

(Johnson &

Johnson/Janssen)

Depomed

XenoPort

(GlaxoSmithKline)

IriSys (Avanir)

Pfizer

Arcion

EpiCept

Newron

Phase (region)

Approved (United

States); launched

(Europe)

Approved (United

States)

Pending approval

(United States)

III (United States)

III (United States)

IIb (United States)

IIb (United States,

India)

II

Eladur (bupivacaine) Sodium channel blocker Transdermal patch

PHN, chronic lower back pain

Durect (King/

Pfizer)

II

DNP, diabetic neuropathic pain; GABA, γ -aminobutyric acid; NMDA, N -methyl-d-aspartate; NP, neuropathic pain; PHN, postherpetic neuralgia; TCA, tricyclic antidepressant.

102 | FEBRUARY 2012 | VOLUME 11 www.nature.com/reviews/drugdisc

© 2012 Macmillan Publishers Limited. All rights reserved