Sources of Revenue and Government Performance

advertisement

Sources of Revenue and Government Performance:

Theory and Evidence from Colombia

Luis R. Martı́nez*

December 2014

Abstract

Increases in local governments’ revenue have little (if any) impact on public good provision

or development indicators in low-income countries. However, since local governments obtain

most of their revenue from external sources (intra-government transfers, natural resource rents)

it is not clear whether the documented low return is specific to these types of revenue or if it

reflects an intrinsic inability to transform revenue into goods and services. A political agency

model with career concerns predicts that increases in taxation should have a greater impact

on public good provision than increases in external revenue through their opposite effects

on citizens’ willingness or ability to hold the government accountable. I use panel data from

Colombian municipalities for the period 2005-2011 to test the model’s main prediction by

comparing the impact on local public good provision of increases in property tax revenue to

that of increases in oil and coal royalties. I exploit quasi-exogenous variation in the international

prices of oil and coal and in the timing of cadastral updates for this purpose. I find that a $1

increase in tax revenue has an impact on educational enrollment at least twice as large as a $4

increase in oil/coal royalties. Neither type of revenue seems to improve infant mortality, even

though royalties must be spent on education and health.

JEL Classification: H71, H75, P16

*

l.r.martinez@lse.ac.uk. Department of Economics and STICERD, London School of Economics (Houghton Street, WCA2 2AE, London). I would like to thank Gerard Padró i Miquel for his support and advice

throughout this project. I am also grateful to Tim Besley, Miguel Espinosa, Greg Fischer, Lucie Gadenne,

Maitreesh Ghatak, Anders Jensen, Gilat Levy, Munir Squires and to seminar participants at LSE (workin-progress: public, development, STICERD) and EDEPO for comments and suggestions. I thank Mario

Martinez at Instituto Geográfico Agustı́n Codazzi for answering all my questions on cadastral updating and

I also thank Adriana Camacho, Oskar Nupia, Mónica Pachón, Fabio Sánchez, Rafael Santos and Ana Marı́a

Tribı́n for generously sharing data with me. All remaining errors are mine.

1.

Introduction

The number of low-income countries devolving expenditure responsibilities to local go-

vernments has increased in recent years (Gadenne and Singhal, 2014), but it is not clear

that these local governments do a better job at providing basic public goods and services

(Faguet, 2014). Lack of resources could be part of the problem but increases in local governments’ revenue have been shown to have little impact, if any, on public good provision or

development indicators, with increases in corruption often being reported instead.1

However, local governments in developing countries are heavily dependent on revenue

from external sources, like intra-government transfers or natural resource rents, rather than

on internally-raised tax revenue (Gadenne and Singhal, 2014) and it is on these external

sources of revenue that the existing literature has focused for the most part.2 This fact

can change our interpretation of the literature’s findings if we share the widely-held belief

that external revenue undermines government accountability and is relatively ineffective.3 It

could be the case that local governments fail to provide more public goods when they receive

additional revenue because of the particular type of revenue they collect.

But it could also be that these local governments are intrinsically unable (due, for instance, to low technical capacity or weak political institutions) to transform revenue into

goods and services, no matter what the source is. That is, for example, what a recent report on resource-rich municipalities in Colombia concludes (DNP, 2012). More generally,

cross-country evidence suggests that natural resource rents are not always a ‘curse’ for the

1

See Fisman and Gatti (2002); Reinikka and Svensson (2004); Vicente (2010); Caselli and Michaels

(2013); Brollo et al. (2013); Gadenne (2014); Olsson and Valsecchi (2014).

2

These local governments resemble the “rentier states” of the middle east, as characterized by Mahdavy

(1970) and Beblawi (1990), in their high dependence on external rents.

3

A large literature has documented how early European states in need of revenue were forced to implement

policies favoured by tax-payers in return for their contribution (North and Weingast, 1989). Besley and

Persson (2011) provide a theoretical account of how external revenue provides low incentives to improve the

ability to tax, which has a detrimental effect on growth. Ross (2001, 2004) provides evidence in support of a

“rentier effect”, according to which the availability of external revenue leads to a political equilibrium with

low taxation and low accountability. Bauer (1972) argues that one of the reasons for the ineffectiveness of

development assistance is precisely because it allows governments to loosen the fiscal contract with voters.

A similar point has been made in the context of the natural resource curse (See Frankel (2012) or van der

Ploeg (2011) for reviews).

1

countries that receive them (Mehlum et al., 2006b), while theoretical work on this topic

has highlighted how the problem may not lie in external revenue but in the institutional

characteristics of recipients (Robinson et al., 2006, 2014; Mehlum et al., 2006a).

This paper aims to shed light on the relation between the sources of government revenue

and public good provision. First, I develop a political agency model with career concerns

to illustrate how the return on government revenue may depend on the source. The model

formalizes the idea that tax revenue may have an opposite effect to external revenue on voters’

willingness to hold the government accountable or on their ability to do so, as suggested by

Paler (2013). The main prediction of the model is that an increase in tax revenue has a larger

impact on public good provision than an increase in external revenue of the same magnitude.

I test this prediction by comparing the effects of plausibly exogenous increases in property

tax revenue and natural resource royalties (from the extraction of oil and coal) on education

and health provision by Colombian municipal governments between 2005 and 2011.

Colombia is an ideal setting where to study this topic for at least three reasons. First,

municipal governments are responsible for the provision of local public goods and they have

access to several sources of revenue, both internal and external.4 This includes various local

taxes, transfers from the central government and natural resource royalties.

Second, while municipalities can spend property tax revenue at their discretion, revenue

from natural resource royalties can only be spent on projects that contribute to meeting

targets for a set of specific development indicators. I use two of these indicators, the basic

education enrolment rate and the infant mortality rate, as my main outcomes of interest.

Not only are these indicators a good gauge for local public good provision in the areas of

education and health, but due to the constraint mentioned above they are the best place

to look for an effect of additional royalties. The fact that tax revenue can be spent on

other things may bias the comparison in favour of royalties, but this bias works against the

4

Colombia is divided into 32 departments, each of which is itself divided into municipalities, in a somewhat

similar fashion to US states and counties. In total, there are 1100 municipalities in the country plus 20 nonmunicipalized territories in sparsely populated regions.

2

hypothesis I am testing.

Finally, Colombia is also a good setting for this study because high-quality data on the

relevant variables is available at the municipality-year level. The panel structure of the data

allows me to control for permanent differences between municipalities and for departmentspecific time effects affecting the outcomes of interest by including municipality fixed effects

and department-year fixed effects in all estimations.

An important challenge that this type of empirical exercise faces is having access to

plausibly exogenous sources of variation in both tax revenue and external revenue. I exploit

fluctuations in the international prices of oil and coal as a source of variation in the amount

of natural resource royalties received by municipalities where these resources are exploited.

The identifying assumption here is that fluctuations in the international prices of oil and

coal are exogenous to local conditions in producing municipalities in Colombia. Even though

the exclusion restriction is probably violated, as I find evidence consistent with price shocks

having a positive income effect besides the fiscal one of interest, this will likely bias estimates

of the impact of royalties upwards and should also work against the hypothesis being tested.

I exploit the timing of cadastral updates as a source of variation in property tax revenue.

The cadastre is a record of the characteristics of the properties in a municipality, including

their value. This cadastral valuation is the base of the property tax that is collected by the

municipality. Cadastres are updated periodically by the national geography institute (IGAC),

which is run by the central government. Since municipalities have to agree to the update, and

they often partly finance it, the timing of updates could be endogenous. More specifically, I

have to deal with the possibility of joint determination (an unobserved variable affects both

the probability of updating and the outcomes of interest) and of reverse causality (updates

are triggered by good projects in the areas of education or health that require funding).

I argue that the timing of cadastral updates is as good as random, conditional on municipality and department-year fixed effects, by showing that there is no significant correlation

between the timing of cadastral updates and changes in a wide range of observable time-

3

varying municipal characteristics. These include all other sources of revenue, local political

conditions, indicators of civil conflict and central-government policies. I argue that it is unlikely that a change in relevant unobservable characteristics would not be reflected in a change

in one of these observables.

I provide additional evidence supporting that the timing of the updates may be plausibly

exogenous. First, for a more recent period (2012-2013) I match municipalities that updated

during a given year to a ‘wish list’ drafted by IGAC at the start of that year. This exercise

reveals that updating is largely determined by the supply of updates by IGAC, whose objective is to maximize the percentage of properties up-to-date in the country. Second, I show

that during the sample period there was a positive shock to the supply of updates by IGAC,

which resulted in a large and plausibly exogenous increase in the number of municipalities

that updated. This was due to the central government’s demand that IGAC reach 100 % of

cadastres up to date and the availability of an IDB loan that fully funded updates for 15 %

of municipalities.

The results indicate that cadastral updating leads to an increase in property tax revenue

that is only a fraction of the impact of an oil/coal price shock on royalties. But while the

extra tax revenue leads to a small but significant increase in educational enrolment, the extra

royalties have barely any effect. A conservative estimate suggests that a $1 increase in tax

revenue has an effect on educational enrolment at least two times as large on educational

enrolment as a $4 increase in royalties. Extra tax revenue also seems to contribute to a

reduction in infant mortality but the impact is very small and statistically insignificant.

These results are unchanged if I only look at municipalities that receive oil or coal royalties, which alleviates concerns about the variation in the sources of revenue affecting different

sets of municipalities. It also provides further evidence against selection bias as it is very

unlikely that resource-rich municipalities select into updating to raise additional revenue for

education or health. Results are also unchanged if I look at a long time window to account

for a potential lag in the effect of large projects funded with royalties.

4

This paper contributes to a small literature focusing on the effects of different sources of

revenue on government performance. An early example was Zhuravskaya (2000), who showed

that public good provision is better in Russian cities where increases in tax revenue are not

offset by a reduction in transfers from the regional government. A more recent contribution by

Gadenne (2014) finds that the quantity and quality of educational infrastructure in Brazilian

municipalities is positively affected by local tax revenue while additional intra-government

transfers have no effect. The lab experiments in Paler (2013) and Martin (2014) provide

additional evidence on the different effects of internal and external revenue on government

accountability.

The rest of this paper is organized as follows. Section 2 summarizes the theoretical model

and presents the main hypothesis to be tested in the empirical exercise. Section 3 provides

background information on sources of revenue and expenditure responsibilities of municipal

governments in Colombia. I discuss the empirical strategy and the data used in section 4.

Section 5 presents the results and section 6 concludes.

2.

Theory: taxation and accountability

In this section I develop a political agency model with career concerns to show how

taxation may differ from external revenue in the way it shapes the incentives of public

officials. The model formalizes what are perhaps the two most important mechanisms that

previous literature has suggested may drive the heterogeneous impact of internal and external

revenue on government performance. As suggested in Paler (2013), taxation may increase

citizens’ willingness to hold the government accountable but it may also better enable them

to do so.

The model illustrates how these mechanisms operate in a context of imperfect monitoring, where voters can’t perfectly assess the quality of the incumbent based on public good

provision because they only get a noisy signal on the amount of government revenue. This

5

affects the incentives that the incumbent has to put in extra effort, which is unobservable to

voters, in order to appear more competent to them. Formally, the model takes a standard

political agency model with career concerns (Persson and Tabellini, 2000; Brollo et al., 2013)

and adds to it the element of imperfect monitoring, along the lines of Holmström (1999).5

I allow taxation to increase citizens’ ability to hold the government accountable by considering the possibility that the noise in voters’ signal on revenue is decreasing in the share

of taxes in total revenue. I then consider an alternative set-up where voters can improve the

precision of their revenue signal at a cost. Under the assumption that the marginal utility of

public goods is decreasing in private consumption, an increase in taxation increases voters’

willingness to hold the government accountable because it increases their willingness to pay

for more precise revenue information. Both mechanisms suggest that an increase in tax revenue should have a greater impact on public good provision than an increase in external

revenue of the same magnitude.

In what follows I will first present the basic set-up of the model and then look at the two

alternative mechanisms in turn. I close this section by discussing the empirical relevance of

these mechanisms and where the model fits relative to the existing literature. I leave formal

derivations and proofs for a theoretical appendix.

2.1.

Set-up of the model

This is a two-period model in which a citizen/voter obtains utility from private consumption of her disposable income and also from consumption of a public good that is provided

by the politician in power each period (henceforth referred to as the mayor). At the end of

the first period an election between the incumbent and a random opponent takes place. The

incumbent as well as his opponent are drawn from a pool of potential politicians, each endowed with some level of ability θi > 0. The ability of all politicians is unknown to everyone

but there is a common prior that is normally distributed with mean m and precision h.

5

Alesina and Tabellini (2007) analyze the career concerns model with imperfect monitoring with regards

to a very different question.

6

The citizen receives a constant income yt = y each period. She pays a tax on a fraction

of her income, determined by η ∈ (0, 1), with exogenous rate τ ∈ (0, 1). The citizen’s private

consumption is equal to her disposable income: ct = (1 − τ η)yt . Her utility function is

Ut = U (ct , gt ), where gt is the amount of the public good that is supplied that period. U (·)

is increasing in both its arguments.

Government revenue (Rt ) is equal to tax revenue (amounting to τ ηyt ) plus revenue from

an external source (Tt ) such as royalties from the extraction of natural resources or transfers

from another level of government. I assume that operational expenditures eat up a constant

share 1 − µ of revenue, so the amount of revenue available for public good provision is µRt ,

µ ∈ (0, 1).

The amount of public good provided by a mayor with ability level θ is given by the

function

gt = θ + µRt + et

(1)

where Rt = τ ηyt + Tt and et ≥ 0 is the amount of effort put in by the mayor, which is

unobservable to the citizen.6 The cost of effort borne by the mayor is given by the increasing

and strictly convex function γC(e), γ > 0. The mayor also gets a benefit E > 0 from being in

power each period, which includes financial rewards and “ego rents”. Total per-period utility

for the mayor is then E − γC(e).

At the end of the first period the citizen observes the amount of public good provided.

She also receives a noisy signal (R̃t ) on the total amount of revenue (Rt ). Based on this

information and a conjecture on effort she updates her beliefs on the incumbent’s ability.

She then votes for the candidate of her liking.

Before making additional assumptions about the link between the sources of revenue and

the noisy signal that the citizen receives, I summarize the timing of the game (I will drop

the time subscripts for everything that is not changing over time):

6

See Dewatripont et al. (1999) for a discussion of more general versions of this type of model.

7

1. The incumbent (with ability θ unknown to all) gets revenue R = T + τ ηy and picks e1 .

2. A quantity of public goods g1 is provided according to equation 1.

3. The citizen observes g1 and receives the noisy signal R̃. She uses this information to

update her beliefs on the incumbent’s ability.

4. The citizen chooses between the incumbent and a random opponent with the same

prior ability (m).

5. The winner of the election chooses e2 and this determines g2 .

2.2.

Taxes as a source of information on public revenue

I will start by assuming that the share of exogenous revenue in total revenue amplifies

the noise in the citizen’s perception of total revenue:

R

Assumption 1. R̃t = Rt − R

t where t ∼ N [0, 1/h ] and t =

Hence, the precision of R

t is

T +τ ηy

T

T

T +τ ηy

12

t

h . Through this assumption I introduce the idea

that citizens are better informed about changes in tax revenue than about changes in external

revenue.

The functional form of the production function for public goods implies that additional revenue from any source always has a positive direct effect on public good provision

(mechanical revenue effect), but the total effect depends also on the indirect effect through

incumbent effort. Under assumption 1, an increase in revenue affects the incumbent’s effort

choice because it changes the precision of the revenue signal the citizen gets. As tax revenue

increases, the signal becomes more precise and the citizen becomes more attentive to the

amount of public goods provided in her assessment of the incumbent’s quality. This in turn

makes it optimal for the incumbent to increase effort in order to influence the election in his

favour. By the same logic, an increase in exogenous revenue makes the revenue signal noisier

8

and the citizen less responsive, so the incumbent reduces effort.7 The following proposition

formalizes this result.

Proposition 1. Under assumption 1, equilibrium first-period effort of the incumbent is increasing (decreasing) in tax revenue (external revenue). Hence, public good provision in the

first period increases by more (less) than the mechanical revenue effect when there is an

increase in tax revenue (external revenue).

2.3.

Taxes as an incentive for information acquisition on public

revenue

I now substitute Assumption 1 with the following three assumptions:

Assumption 2. R̃t = Rt − t , where t ∼ N [0, 1/h ]

Assumption 3. Ut = U (ct + αgt ) where U (·) is a strictly concave function and α ∈ (0, 1/µ)

Assumption 4. At the start of the game, the citizen can choose how much effort (m1 ≥ 0) to

spend on the improvement of the revenue signal. Effort increases the precision of the revenue

signal according to the linear function h = λm1 , λ > 0, but it has a cost given by the strictly

convex function K(m1 )

Just like before, the citizen is more responsive to public good provision in her assessment

of the incumbent’s quality the better she is informed about revenue. In turn, the incumbent

puts in more effort as the citizen becomes more responsive. Under the new assumptions,

what sets this mechanism in motion is information acquisition by the citizen, which depends

on the marginal utility of public goods. When tax revenue increases, private consumption

mechanically decreases. Although public good provision also increases due to the mechanical

revenue effect, Assumption 3 ensures that the marginal utility of the public good goes up

7

The model can easily be rewritten in terms of incumbent rents rather than effort, as discussed in Alesina

and Tabellini (2007). In that case, additional revenue has an additional effect on rent extraction because

it increases the value of staying in power. This mechanism is at play in the model of the resource curse in

Robinson et al. (2006, 2014).

9

nevertheless, which increases the benefit the citizen gets from additional incumbent effort.

External revenue, on the other hand, has a negative effect on the marginal utility of the

public good due to the positive mechanical revenue effect and the fact that it does not

affect the citizen’s disposable income. Hence, extra taxation provides an incentive for more

information acquisition while the opposite holds true for external revenue. The following

proposition formalizes this result:

Proposition 2. Under Assumptions 2-4, optimal citizen effort and equilibrium first-period

effort of the incumbent are increasing (decreasing) in tax revenue (external revenue). Hence,

public good provision in the first period increases by more (less) than the mechanical revenue

effect when there is an increase in tax revenue (external revenue).

2.4.

Discussion

The theoretical discussion above allows us to better understand the type of environment

in which the source of revenue may matter for government performance. The model shows

that misinformation on local public finance on the part of voters is sufficient and may be

necessary for internal and external revenue to have opposite effects on public good provision.

In a world where revenue is perfectly observed, as in Persson and Tabellini (2000) or Brollo

et al. (2013), incumbent effort is not differentially affected by each source of revenue.

The model also defies the common-sense notion that taxation improves accountability

simply because voters dislike the loss in private consumption that results from taxation.

This asymmetric effect of internal and external revenue on disposable income does not by

itself translate into differential government performance because taxes are a sunk cost at the

time of voting. Voters cannot credibly commit to punish an incumbent who wastes their tax

money if they have reasons to believe that he is of higher ability than his opponent in the

election. The fact that both Martin (2014) and Paler (2013) report that participants in lab

experiments were more willing to punish the government when it was handling tax money

may thus be a consequence of the one-shot nature of the games being played.

10

In the empirical exercise that follows I will test the main prediction of the model (captured

in Propositions 1 and 2), but I will not be able to establish the relative importance of the

two mechanisms discussed. However, I can provide anecdotal evidence on the realisticness of

the underlying assumptions and I can also look to the previous literature to get a sense of

their relevance.

Assumption 1 seems like a reasonable assumption to make given that tax revenue is

coming out of voters’ pockets. This should provide contributors with relatively costless information about changes in tax revenue, while learning about changes in external revenue is

costly. The word ‘changes’ is crucial in this context: voters in resource-rich areas may know

about the abundance of natural resource rents (level), but still they must pay close attention

to fluctuations in prices and output to be well informed about the change in these rents.8

Gadenne (2014) provides a model of moral hazard based on a similar assumption: the amount

of external revenue is only known by the incumbent and this allows him to appropriate a

larger share of revenue when external revenue is high.

Evidence from previous research seems to support the idea that voters are better informed

about changes in tax revenue than about changes in external revenue. For example, Gadenne

(2014) finds that local tax revenue has a larger effect on educational infrastructure than intragovernment transfers only in Brazilian municipalities that don’t have a radio station. This

finding suggests that media presence closes the gap in voters’ awareness about changes in

external revenue relative to changes in tax revenue. A related example is provided by Reinikka

and Svensson (2004), who report that only 13 cents of every $1 from an educational grant

program in Uganda reached the primary schools that were the intended recipient, with the

rest being embezzled by local politicians. The fact that an information campaign started

by the central government in response to this finding led to large increases in the amount

of grants reaching the schools indicates that lack of information about the grants was what

8

Of course, paying one’s own taxes may not be very informative about total tax revenue in a world with

significant heterogeneity in tax liabilities, but this is something the model abstracts from.

11

allowed funds to be diverted (Reinikka and Svensson, 2005).9

However, there is also evidence supporting the idea that taxation increases voters’ willingness to hold the government accountable. Both Paler (2013) and Martin (2014) find

that participants in lab experiments are more willing to engage in costly punishment of a

misbehaving government when the source of revenue is taxation than when it is external.

The experimental setting allows these authors to ensure that information is constant across

treatments, thereby shutting down the mechanism discussed above. Martin (2014) argues

that this finding is consistent with a model of loss-aversion where citizens’ reference point

is given by their pre-tax endowment. In this model taxation drives citizens into the realm

of losses and makes them more willing to engage in costly punishment unless they are compensated through increased public good provision. While punishment is assumed to provide

citizens with an “expressive benefit” in this framework , in the model presented above the

benefit that voters get from not re-electing the incumbent is endogenously determined by the

information available to them. Still, loss aversion may help to explain why taxation increases

the marginal utility of public goods (Assumption 3).

3.

Background

Following decentralization reform in the early 1990s, Colombian departments and muni-

cipalities became responsible for the provision of public services in the areas of education,

health, drinking water and sanitation. The central government provides funding for related expenditures through a system of earmarked and formula-determined transfers called

“Sistema General de Participaciones” (SGP). These transfers account on average for 63 %

of a municipality’s total revenue but they are not fungible with other sources of revenue

9

Several papers provide more general evidence on the importance of information provision for government

accountability: Ferraz and Finan (2008) find that audit reports published before elections allow voters to

punish corrupt politicians. Björkman and Svensson (2009) report that the provision of information to local

communities on the quality of health services leads to improved health outcomes through better monitoring.

Paler (2013) shows that once participants in a lab experiment are provided with information on government

expenditures, they are equally willing to monitor the government no matter what the source of revenue is.

12

and must be kept in separate accounts. Municipalities have more discretion over education

policies than over the ones related to health.10

Taxes are the second most important source of municipal revenue after transfers and

contribute on average with 44 % of current receipts and 13 % of total revenue. The main local

taxes (and their average shares of tax revenue) are the property tax (34 %), the business tax

(17 %) and the petrol surcharge (22 %).11 The property tax is the most important source

of tax revenue for slightly more than one half of municipalities, but its relative importance

decreases with population size.12 Property tax revenue can be spent at the discretion of

the municipal government, except for a fixed share that must be transferred to the relevant

regional environmental agency.13

The property tax is levied on the cadastral value of all real estate in the municipality. The

cadastre or land registry is the official record of the physical and economic characteristics of

all properties in a municipality. The three largest cities (Bogotá, Medellı́n and Cali) as well

as the department of Antioquia have their own cadastral agencies. All others (86 % of municipalities) are under the authority of the National Geography Institute (Instituto Geográfico

Agustı́n Codazzi - IGAC), an agency run by the central government. Through periodic updates of the cadastres under its control, IGAC includes new properties and updates the records

(including the value) of existing ones.

The third most important source of local revenue are royalties from the extraction of

10

Municipalities ‘certified’ by the Ministries of Education or Health directly manage the shares of transfers

assigned to these areas. Otherwise, transfers are managed by the government of the department where the

municipality is located. Any municipality, certified or not, can provide additional funding for the provision

of education and can also invest in infrastructure, quality improvements or school equipment. On the other

hand, municipalities not certified by the Ministry of Health are banned from providing health services, while

certified ones must do so through highly-regulated firms called “Empresas Sociales del Estado” (ESE). All

municipalities are responsible for providing health insurance to the population classified as poor by the

national government’s proxy-means-testing targeting system (SISBEN).

11

Other taxes include those for car registration and the display of billboards and banners. Departments

have authority over the alcohol and cigarettes taxes. They also set their own, albeit smaller, petrol surcharge.

12

Glaeser (2013) reports that local public finances in the US are not very different, with intra-government

transfers and property taxes being the most important sources of revenue for all but the largest cities.

However, Gadenne and Singhal (2014) show that local governments are much more dependant on intragovernment transfers in developing countries than in developed ones.

13

There are 34 such agencies in the country. Some cover a handful of municipalities while others cover

multiple departments. The percentage transferred must be between 15 % and 25 % of property tax revenue.

13

natural resources. Royalties are paid by firms to the central government according to a set

of fixed formulae of the form

royalty = output * world price (USD) * exchange rate (COP/USD) * royalty rate

The vast majority of this revenue is then transfered to producing municipalities and departments, as well as port municipalities, according to predetermined shares. The main source

of royalties is the extraction of oil and coal, which accounts for 93 % of all royalties paid

between 2005 and 2011.14 Oil and coal royalties benefit around 20 % of municipalities (see

Figure 1), for which they represent on average 19 % of total revenue. By law, at least 75 % of

royalties must be spent on education, health, drinking water and sanitation until a specific

set of indicators (listed in Table 1) meet certain target rates.15 The system was reformed

in 2012, with the share of royalties going to producing regions significantly reduced in an

attempt to make the distribution of royalties more equitable.

4.

Empirical Strategy

The main objective of the empirical exercise is to test the hypothesis, summarized in

Propositions 1 and 2, that an increase in tax revenue has a larger effect on public good

provision than an increase in external revenue of the same magnitude. I carry out this

comparison between sources of revenue using data for Colombian municipalities between

2005 and 2011. I compare the effect on local public good provision of increases in property

tax revenue vis-à-vis increases in royalties from the extraction of oil and coal.

As discussed in the previous section, Colombian law stipulates that royalties must be

spent on projects that help to bring indicators in the areas of education and health closer to

14

Royalties are also paid for the extraction of precious metals, gemstones, iron, copper, nickel and salt.

The guidance from the central government in DNP (2007) suggests that in order to reduce infant

mortality municipalities can carry out vaccination campaigns (vaccines are provided at zero cost by the

central government) or set up emergency health posts for common infant diseases. Regarding education,

royalties can be used to finance the provision of education if SGP transfers are shown to be insufficient.

Otherwise, royalties can be spent on education infrastructure, school equipment or transportation. In the

case of water supply and sewage, royalties can be invested in the necessary infrastructure.

15

14

some predetermined target rates. I focus on two of these indicators as the main outcomes of

interest for the empirical exercise: the net enrollment rate in basic education and the infant

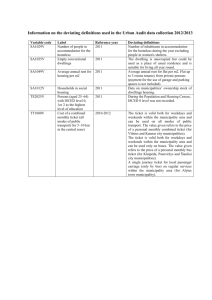

mortality rate. Table 1 shows that less than one quarter of the municipalities with positive

oil or coal royalties in 2004 had reached the target goal for these two indicators in 2005,

which makes these variables a good place to look for an effect of royalties.

The availability of yearly observations for each municipality allows me to include municipality and time fixed effects in all regressions. Still, the variation over time in a particular

source of revenue for a given municipality may be correlated with other time-varying municipal characteristics affecting the outcomes of interest, which could lead to biased estimates

of the effects we are interested in measuring. Hence, plausibly exogenous variation in both

sources of revenue must be found in order to claim that the estimates capture causal effects.

I mentioned above that the geographical institute IGAC carries out regular updates

of the cadastres under its supervision. I use the timing of these updates as a source of

variation in property tax revenue. I argue below that these updates are driven for the most

part by the ‘supply’ of such services on the part of IGAC and that they are plausibly

uncorrelated with variation in municipal characteristics, conditional on municipality and time

fixed effects. I provide evidence in support of this claim by showing that the timing of updates

is uncorrelated with a set of relevant and observable economic and political characteristics,

which are also likely to reflect variation in the main unobservables of concern.

I exploit fluctuations in the international prices of oil and coal interacted with a measure

of local resource abundance as a source of variation in royalties. The argument is that

variation in the world prices of commodities affects Colombian municipalities differentially

depending on resource abundance but is plausibly exogenous to local conditions in Colombian

municipalities.

I will next introduce the data employed in the empirical exercise. Afterwards, I will

discuss the identification strategy just outlined and I will provide evidence in support of it.

15

4.1.

Data

The empirical exercise described above requires three main pieces of data. First, I need

data on the different sources of revenue of municipal governments. Second, I require the

indicators that will be the main outcomes of interest. Finally, I must also have information

on the sources of variation of both internal and external revenue. This means having data

on cadastral updates in the case of property taxes, and on the world prices of oil and coal,

as well as on local resource abundance, in the case of royalties.

Data on municipal public finance comes from the yearly balance sheets reported by each

municipality to the Office of the Comptroller General for the purpose of fiscal control. These

balance sheets have disaggregated information on revenue, including taxes (each one separately), transfers and royalties. I express all money values in thousands of 2004 Colombian

Pesos per capita (unless otherwise stated) using the Consumer Price Index and population

estimates from the National Statistical Agency (DANE).

The net enrollment rate in basic education and the infant mortality rate are provided at

the municipality-year level by the Ministry of Education and DANE, respectively.16 These

two indicators are the main outcomes of interest in the empirical exercise. Lack of data before

2005 for either indicator forces me to start the analysis in this year. Although Colombian

law also allows royalties to be spent on projects that increase the percentage of population

with access to drinking water or sanitation, lack of panel data at the municipal level prevents

me from including the corresponding indicators in the analysis. The other potential use of

royalties is in the provision of subsidized health insurance to the poor.17 During the sample

period the central government set out to achieve full coverage in this area and, as Table 1

shows, this policy was very successful: 94 % of the municipalities with oil or coal had reached

the target by 2011 (the percentage is almost identical for the full sample). Thus, it is not

16

Basic education in Colombia includes one year of pre-school, five years of primary and four years of

secondary. The net enrollment rate is calculated by dividing the number of children enrolled with ages

between five and fourteen by the total number of children in this age group.

17

Poor is defined as falling into categories 1 and 2 of the central government’s proxy means testing system,

SISBEN.

16

surprising that increases in either source of revenue don’t seem to have any effect on this

indicator (results are not reported but are available upon request).

Regarding cadastral updating, IGAC has yearly data on the number of properties, the

cadastral value and the year of the last cadastral update for each municipality under its

supervision. The three largest cities in the country (Bogotá, Medellı́n and Cali) as well as

the department of Antioquia have their own cadastral agencies and are excluded from the

analysis. All cadastral information provided by IGAC is disaggregated for each municipality

between the urban and rural areas. I focus on urban cadastral updates since urban areas

contain most of the properties and value. Also, urban updates are more frequent and less

likely to be endogenous, since security concerns related to the internal armed conflict have

often prevented IGAC agents from carrying out rural updates (IGAC, 2012).

As indicators of oil and coal abundance I use the amount of royalties specific to each of

these resources that each municipality received in 2004, according to the National Hydrocarbons Agency (Agencia Nacional de Hidrocarburos - ANH) and the Mining and Energy

Planning Unit (Unidad de Planeacion Minero-Energética - UPME), respectively. I pick this

year because it is the earliest one for which information on resource-specific royalties is publicly available at the municipality level. I then interact the respective measure with the

average yearly price of bituminous coal (from UPME) and the average petroleum spot price

(from the IMF/IFS) to predict variation in royalties over time.

The final panel includes 961 municipalities (out of a total of 1123) between 2005 and 2011.

Table 2 shows summary statistics for the variables discussed above and for some additional

ones employed in the paper.

4.2.

Identification Strategy

The first part of this paper’s identification strategy exploits cadastral updates as a source

of plausibly exogenous variation in property tax revenue. To estimate the reduced-form impact of cadastral updating on the outcomes of interest I use the following flexible specification

17

that allows for time-varying effects in a window around the update year:

yi,j,t = αi + δj,t +

4+

X

βk · D(update(t − k))i,t + i,j,t

(2)

k=−2

where αi is a municipality fixed effect and δj,t is a department-year fixed effect. These account

for all permanent differences between municipalities and for common factors affecting equally

all municipalities from the same department in the same year. D(update(t−k))i,t is a dummy

equal to one if an update took place k years ago. The error term i,j,t is clustered two-way

by municipality and department-year following the methodology in Cameron et al. (2011).

The parameters of interest, βk , flexibly capture the behavior of the dependent variable

both before and after a cadastral update, allowing me to alleviate concerns about potential

pre-trends. These coefficients will provide unbiased estimates of the causal effect of having a

cadastral update k years ago only under the assumption of strict exogeneity of the timing of

the update. They will also be valid instruments for property tax revenue under the additional

exclusion restriction that updating only affects the outcomes of interest through its effect on

tax revenue.

Since cadastral updating is not randomly assigned, joint determination and reverse causality are two major concerns that may compromise the identification strategy. Joint determination occurs if there is variation over time in some unobservable characteristic that not only

makes cadastral updating more likely but also affects the outcomes of interest. For example,

an economic boom may increase parents’ willingness to send their children to school, thereby

improving enrollment rates, while at the same time making local governments more willing

to update the cadastre in an attempt to benefit from the resulting rise in property prices.

Reverse causality has to do with the possibility that improving social indicators affect the

probability of a cadastral update. In the present context, this could happen for instance

if municipalities update in order to raise extra funding when there is a good investment

opportunity in the areas of education or health.

We must better understand the update decision in order to assess the magnitude of the

18

threat that these concerns pose to the identification strategy. Colombian law stipulates that

cadastres should be updated every five years, but this condition is rarely satisfied. Panel A

in Table 2 shows that on average municipalities that updated between 2005 and 2011 did

so 10.3 years after the previous one. Hence, the cadastral updates that we observe are the

equilibrium outcome of the interaction between the supply of updates, provided by IGAC,

and the demand for updates by the municipalities.

The first step of the update process takes place at the start of the calendar year, when

IGAC drafts a list of municipalities that it considers to be suitable for updating.18 Municipalities are included in this list based mostly on the number of years since the previous update,

as IGAC’s institutional objective is to keep the cadastres under its control as updated as

possible. IGAC does not receive any financial reward from cadastral updates. Nevertheless,

other considerations such as the availability of up-to-date cartography and the reports by

the regional offices on the feasibility of potential updates are also taken into account.

The next step involves IGAC contacting the municipal authorities (mainly the mayor’s

office) to seek their approval for the update. Although de jure IGAC has the sole authority

to carry out cadastral updates, de facto it turns out to be almost impossible to do an update

without the support of the local authorities. Additionally, only a small amount of resources is

assigned to IGAC by the central government for cadastral updating, so in most cases IGAC

also asks municipalities to provide at least partial funding for the update.19

The final list of municipalities whose cadastres are updated in a given year is the result

of this bargaining process between IGAC and the municipalities. However, looking at the

preliminary lists drafted by IGAC for the years 2012 and 2013 (after the sample period), I

find that 80 % of the municipalities that effectively updated were in IGAC’s preliminary list,

while 68 % of the municipalities in the list actually updated. This suggests that although

there is room at the margin for selection into and out of updating by municipalities, most

18

Following an update, the revised cadastre comes into effect on January 1st of the following year. Hence

updates must always be carried out within a calendar year.

19

Other sources of funding are the departmental governments and the regional environmental agencies.

19

updates come from the preliminary list drafted by IGAC at the start of the year.

The supply of updates by IGAC may have been particularly important during the sample

period for two extra reasons. First, Alvaro Uribe set for IGAC a target rate of 100 % urban

cadastres up-to-date as part of the official government goals for his first term as president

between 2002 and 2006 (Law 812/2003). Second, IGAC had access to an IDB loan with

which it fully funded urban updates for 145 municipalities (15 % of the sample total) around

the same time (IGAC, 2006). In consequence, there was a significant increase in the number

of municipalities that had a cadastral update in the period 2004-2007, as can be seen in

Figure 3.

Overall, 68 % of municipalities update between 2005 and 2011. These are evenly distributed throughout the country, as shown in Figure 2. Among the non-updaters, 38 % had

updated in 2003 or 2004, which suggests that the ability of municipalities to affect the timing

of cadastral updates is limited. I can’t fully exploit this large number of updates since the

inclusion of all of them in the estimations could introduce significant composition effects, as

I do not observe the same time-window around the update for all update cohorts. In order to

have at least two years of data before an update and at least three years after it I restrict the

main analysis to the update cohorts of 2007, 2008 and 2009.20 The number of municipalities

for which I observe an update drops to 32 % as a result, but I show that the results are very

similar if I include the 2006 cohort (thereby observing updates for 47 % of municipalities),

although this leaves me with only one year of pre-update data.

To further assuage endogeneity concerns, I investigate whether the timing of a cadastral

update is correlated with changes in some important observable economic and political characteristics. For this purpose I estimate equation 2 using these characteristics as dependent

variables.

The first four columns in Table 3 look at sequentially larger aggregates of other sources

20

I drop the years 2005 (and 2006) for the 2008 (2009) cohorts and I code as zero the update dummies for

all other cohorts. Coding updates outside the period 2007-2009 as zeros could potentially bias the estimates

downward, which would work against my hypothesis, but the results are qualitatively similar if I drop these

other update cohorts instead.

20

of revenue different from property taxes. The results suggest that there is no statistically

significant difference in any other source of revenue before or after a cadastral update, which

implies that there is no evidence of revenue offsets leading to or being caused by cadastral

updates.21 These results help to alleviate other concerns as well. Insofar as the business tax

revenue serves as a coarse proxy for municipal GDP (Sánchez and Núñez, 2000), the results in

column 1 indicate that there is no significant change in economic activity around the time of

a cadastral update. Additionally, these results make it less likely that municipalities update

the cadastre to raise revenue for profitable social projects as they show that municipalities

do not raise extra revenue in any other way around this time.

I investigate the possibility of changes in policies by the central government that could

be correlated with the timing of updates in columns 5 and 6 of Table 3. During the Uribe

administration (2002-2010), the president visited a different municipality every week with

some senior members of his staff. During these visits, local residents voiced their problems

and the president agreed to different policies concerning the municipality. One potential

concern is that a cadastral update and other policies affecting educational enrollment or

infant mortality are part of what the president agrees to when he visits a municipality.22

However, the estimates in column 5 show that there is no statistically significant evidence of

any correlation between the timing of updates and Uribe visits. Moreover, column 6 shows

that the number of new families enrolled in the conditional cash transfer program called

“Familias en Acción”, which was expanded dramatically during the Uribe administration

(Nupia, 2011), is also uncorrelated with the timing of updates.

The final two columns explore possible links between changes in violence and the timing

of cadastral updating. This is a source of concern because the presence of illegal armed

actors has often prevented IGAC from carrying out (mostly rural) updates in areas of high

conflict intensity (IGAC, 2012), and because violence could potentially affect the outcomes

of interest. Column 7 shows estimates of equation 2 using the murder rate as dependent

21

22

I do not find any significant effect either if I look at each source of revenue separately.

See Tribı́n (2014) for more information on the political economy of these promises.

21

variable, while in column 8 I use a dummy equal to one if any of the conflict indicators from

the CEDE dataset are positive.23 Again, the results suggest that the timing of cadastral

updates is uncorrelated with variation in violence.

To study the possibility that local political characteristics affect the timing of cadastral

updates I use electoral results from the local elections of 2003 and 2007, as well as the

presidential elections from 2002 and 2006, to construct a series of indicators on political

competition and alignment between branches of the local government, as well as between

levels of government.24 Summary statistics for these variables are provided in Panel E of

Table 2. I then run the following specification at the municipality-term level:

D(update)i,t = αi + δj,t + agei,t + D(age ≤ 3)i,t + Xi,t ξ + i,j,t

(3)

where the dependent variable D(update)i,t is a dummy equal to one if an update took place

in municipality i during local political term t. αi is a municipality fixed effect, δj,t is a

department-term fixed effect and Xi,t is a vector of political characteristics. The variable

agei,t corresponds to the age of the cadastre inherited from the previous administration,

while D(age ≤ 3)i,t is a dummy equal to one when at the start of the administration the

last cadastral update took place less than three years ago. This accounts for the fact that no

municipality updates the cadastre within three years of the previous update. I standardize

all explanatory variables, except dummies, for comparability. The error term i,j,t is clustered

two-way by municipality and department-year (Cameron et al., 2011).

Results are presented in Table 4. The first three columns show that, in the absence of

municipality fixed effects, there is a positive and statistically significant correlation between

the probability of a cadastral update and local political competition, measured by the number

of candidates in mayoral and council elections. There is a similarly positive and significant

23

Results are unaffected if I use an indicator of conflict intensity instead or if I look at presence of different

illegal armed actors separately.

24

All municipalities have simultaneous elections for mayor, city council, governor and departmental assembly every four years. Presidential and congress elections also take place every four years, but with a one

year lead relative to the those of sub-national governments.

22

correlation between the probability of updating and the vote share of the winning candidate

in elections for president and department governor. However, columns 4-7 show that once

I control for fixed differences between municipalities by including municipality fixed effects,

political characteristics have no statistically significant effect on the probability of a cadastral

update, conditional on the number of years since the last cadastral update. A one standard

deviation increase in the age of the inherited cadastre is associated with a 34 percentage point

increase in the probability of updating, which is one order of magnitude greater than the

point estimates for all political characteristics. This provides further evidence that IGAC’s

interest in reducing the age of the cadastres in the country is the main determinant of

cadastral updating. The results are unaffected if I replace the term fixed effect with a more

stringent department-term fixed effect, as can be seen in the last three columns of the table.

The second part of the identification strategy exploits plausibly exogenous variation in

the world prices of oil and coal and the heterogeneous distribution of these resources across

municipalities. This type of difference-in-differences methodology has been widely used in

recent studies on Colombia.25 The identifying assumption in this case is, first, that the world

prices of coal and oil are exogenous to local conditions in Colombian municipalities and,

second, that any effect of being differentially endowed with coal or oil is absorbed by the

municipality fixed effects. I estimate the following equation:

yi,j,t = αi + δj,t +

X

0

X

γm pricert+m · royaltiesri,2004 + i,j,t

(4)

r∈{oil,coal} m=−2

where αi and δj,t are again municipality and department-year fixed effects, respectively.

pricert+m is an index (2004=1) of the price of resource r, m years ago. I include the contemporary price of both resources as well as the values for up to two previous years to account for

the possibility of a lagged impact. The error term i,j,t is clustered two-way by municipality

and department-year (Cameron et al., 2011). As a measure of oil (coal) abundance I use the

amount of oil (coal) royalties received by the municipality in 2004 (royaltiesri,2004 ). Ideally, one

25

See Dube and Vargas (2013); Carreri and Dube (2014); Santos (2014); Idrobo et al. (2014)

23

would want to use some ex-ante geological measure of resource abundance to avoid concerns

about the endogeneity of previous royalties. However, as long as any characteristics specific

to municipalities with positive oil or coal royalties in 2004 are roughly constant during the

following seven years they should be picked up by the municipality fixed effect. Additionally,

the fact that new resource deposits are regularly found makes the case for the exogeneity of

geological indicators less clear. I standardize both the resource price indices and the 2004

royalty indicators to facilitate interpretation.

It is plausible that the world price of oil is not endogenously determined by local conditions in Colombian producing municipalities, as Colombia is a relatively small exporter of

oil. According to the US Energy Information Administration, Colombia is the 18th largest

exporter of oil with less than 1 % of world exports. The exogeneity assumption is slightly

less obvious in the case of coal, since Colombia is ranked sixth and its share of world exports

is approximately 6 %. However, Figure 4 shows that the variation in fuel prices can be accounted for to a large extent by the state of the world economy. Prices were on the rise in

the early years of the sample period, fell as a result of the global financial crisis around 2009

but then recovered in the final years of the sample.

The exclusion restriction in this case is that changes in the price of resources affect the

outcomes of interest in the municipalities where resources are extracted only through their

effect on royalties. This may be an unrealistic assumption to make as resource booms could

potentially affect municipalities where resources are extracted through other channels besides

the fiscal effect of royalties (Dube and Vargas, 2013; Caselli and Michaels, 2013; Asher and

Novosad, 2014).

To get a sense of the relative importance of some of these channels, in Table 5 I present

estimates of equation 4 using as dependent variables indicators for some of the most relevant

ones. In general, the results are somewhat heterogeneous across resources. This may have to

do with differing characteristics of oil and coal extraction in Colombia: oil extraction is more

capital intense, employs less local labour, has fewer linkages to other local industries and is

24

relatively more important for the local economy.

The first four columns look at other sources of revenue. The results in column 1 show that

oil price shocks are accompanied by reductions in property tax revenue. This contradicts the

prediction from the “fly-paper effect” (Hines and Thaler, 1995), but is consistent with “rentier

effect” theories, which suggest that governments respond to external revenue increases with

tax decreases to reduce accountability (Ross, 2001; McGuirk, 2013). Column 2 provides

evidence of a positive impact of coal price increases on the local economy of producing

municipalities, as the coefficients are positive and significant when the dependent variable is

business tax revenue. Additionally, increases in the prices of both resources seem to lead to

increases in “other revenue” (column 4), while only oil price increases are associated with

statistically significant increases in co-financing from the central government (column 3).

The increase in the “other revenue” category is not surprising since this category includes

the fees paid to municipalities that have oil pipes running through them, which includes

producing ones.

The last three columns of Table 5 investigate the possibility that commodity price shocks

lead to increased immigration or to more violence. If anything, the results in column 5 suggest

that the net effect on the municipality’s population is negative and quite small. This could

be the result of higher immigration combined with even higher mortality, but the results

in columns 6 and 7 provide only weak evidence suggesting that increased violence could be

the underlying cause. The estimates indicate that the murder rate falls contemporaneously

with both oil and coal price shocks, with the reduction reverting one year later in the case of

coal. Column 7 shows that coal price shocks seem to lead to a lagged and small increase in

conflict incidence, but there is no evidence of conflict incidence increasing as a result of oil

price shocks. These findings go against those in Dube and Vargas (2013), but this may be

due to the different time period being analyzed: while Dube and Vargas (2013) focus on the

1990s and early 2000s, when the guerrilla and paramilitary groups were on the rise, in the

years I study in this paper the demobilization of paramilitary groups had almost concluded

25

and the guerrillas were on the retreat.

In sum, the results in Table 5 suggest that commodity price shocks may have a positive

impact on the local economy besides the positive fiscal effect. This positive impact, evidenced

by the increase in business tax revenue, is reinforced by the fact that there does not seem

to be any significant change in migration, while the evidence on violence and conflict is

mixed. Acemoglu et al. (2013) provide additional evidence in support of the positive income

effect of oil price shocks and on the positive income elasticity of health expenditures. Under

these assumptions, my estimates using commodity price shocks as a source of variation will

most likely overestimate the effect of royalties on the social indicators of interest, working

against the hypothesis being tested.26 In the next section I further assuage concerns related

to the exclusion restriction by showing that the net fiscal impact is positive, large and almost

exclusively driven by the increase in royalties. I also show that the main results remain very

stable after adding the dependent variables of Table 5 as controls.

5.

Results

Table 6 shows estimates of equation 2. The dependent variable is specified in the header

of each column. Columns 1 and 2 show that, as expected, after a cadastral update both

cadastral values and property tax revenue shoot up dramatically. The point estimates in

column 1 show that the year the update comes into effect cadastral values rise by more than

5 million Colombian pesos (COP) per property, which is more than 50 % of the sample mean.

Similarly, the estimates in column 2 suggest that one year after the update comes into effect

property tax revenue is almost 4,400 COP per person higher, which is approximately 20 % of

the sample mean property tax take of around 21,000 COP per capita. This revenue increase

is followed by an increase in expenditure (mostly investment), as shown in columns 3 and 4.

Column 5 shows estimates of the effect of cadastral updating on the basic education

26

See Miller and Urdinola (2010) for evidence on the procyclicality of the infant mortality rate in Colombia,

based on coffee price shocks.

26

enrolment rate. I find a positive and significant effect that rises over time: contemporaneously

with the update the enrolment rate is 0.7 % higher, but two years later the magnitude of

the increase rises to 2 %. Although this increase corresponds to only 2 % of the sample mean

(88 %), it may still be economically significant as it is likely that these are students with a

high marginal cost of enrolment (under the plausible assumption of convex marginal cost).

Column 7 shows that the magnitude of the estimates drops when the 2006 update cohort

is included, although the coefficients are still statistically significant at conventional levels.

Including this cohort increases the number of municipalities for which an update is observed

from 32 % to 47 %, but for these additional updates it is not possible to estimate any impact

two years before the update, which could lead to a composition effect in the coefficient for

“update (t+2)”.

The results in column 8 show that if I restrict the sample to only include the municipalities with positive oil or coal royalties in 2004 the coefficients not only remain statistically

significant but their magnitude actually increases, relative to column 5. This finding assuages

concerns related to a potential lack of common support between municipalities with cadastral update and those endowed with oil or coal. It also provides evidence against selection

into updating to finance projects in education, as these resource-rich municipalities are less

likely to be strapped for cash.

Finally, column 6 shows estimates of equation 2 using the infant mortality rate as dependent variable. Although the point estimates are consistent with a decrease in the infant

mortality rate following a cadastral update, the magnitude of the estimated effect is quite

low (at the most a 0.4 % reduction after three years) and the coefficients are not statistically

different from zero.

I now turn to the effect of royalties on these same indicators. The first two columns

in Table 7 show estimates of equation 4 using royalties and total revenue, respectively, as

dependent variables. A comparison of the coefficients with those in Table 5 confirm that the

revenue increase resulting from commodity price increases is almost exclusively driven by

27

royalties. For example, a municipality with oil royalties one standard deviation above the

mean in 2004 experiences an increase of 29,400 Colombian pesos per capita in total revenue

when the price of oil is one standard deviation above its mean between 2005 and 2011. 95 %

of this increase (27,800 COP per capita) comes from extra royalties (83 % in the case of

coal). These results also suggest that commodity price shocks (particularly in the case of oil)

have a larger impact on local government revenue than cadastral updating. If we add across

rows in column 2 of Table 6 we can see that on average updating leads to about half as much

revenue (≈ 15,000 COP per capita), spread over four years, as a one standard deviation

increase in the price of oil. In the case of coal, the overall fiscal impact seems to be roughly

of the same magnitude.

The results in columns 3 and 4 then show that the additional revenue is spent almost

exclusively on investment with a one year lag. Although the point estimates seem to suggest

that the revenue elasticity of expenditure is larger in the case of coal, t-tests fail to reject (at

the 5 % level) the null that the lagged effect on expenditure is equal to the contemporaneous

effect on total revenue, as well as the null that the effect on expenditure is equal across

resources.

The results in column 5 of Table 7 do not provide evidence in support of a positive effect

of oil price shocks on the basic education enrolment rate. However, the estimates indicate

that a one standard deviation increase in the price of coal leads to a statistically significant

increase of 0.2 % in this indicator in municipalities with coal royalties one standard deviation

above the 2004 average. Not only is this effect of a smaller magnitude than the one from

additional property tax revenue documented in Table 6, but it also seems to last much less,

as the lagged coefficients are not statistically different from zero. This could be telling us

that the regression is picking up the effect of a temporary increase in income rather than one

from additional public spending, especially if we recall that it was also for coal that I found

a statistically significant effect of price shocks on business tax revenue in Table 5. However,

the coefficients are almost identical after I include controls, including business tax revenue,

28

in column 6.

Moving on to the infant mortality rate, the results in column 7 of Table 6 suggest that this

indicator is not affected by the increase in royalties resulting from commodity price shocks.

If anything, the estimates point towards infant mortality increasing, but the coefficients are

statistically and economically insignificant. Again, the results are very robust to the inclusion

of controls in column 8.

Overall, the results in this section suggest that an increase in the revenue of local governments in Colombia has a positive effect on the provision of education (as measured by the

enrolment rate) when it comes from taxes but not when it comes from oil or coal royalties,

even if the revenue increase is much larger in the latter case than in the former. The results

in Table 8 further illustrate this finding. They also address the posibility that royalties are

invested in projects with more long-term benefits.

Columns 1 and 2 show results based on a modified version of equation 2, in which I add

the dummies for the years following an update into a single post-update dummy and I also

include the interaction between this dummy and one for the 190 resource-rich municipalities

(positive oil or coal royalties in 2004). According to the estimates in column 1, a cadastral

update leads to an increase of about 3,800 COP per capita in the following years. This

increase seems to be a bit smaller in resource-rich municipalities but the difference is not

statistically significant. Column 2 indicates that the extra tax revenue leads to a 1.3 %

increase in educational enrolment, with no significant difference between municipalities with

oil or coal and those without.

The results in the remaining columns are based on a modified version of equation 4,

where I interact the indicator for resource abundance (resource-specific royalties in 2004)

with a full set of year dummies (omitting 2005). The results in columns 3 and 5 highlight

the difference in magnitude between the changes in the two sources of revenue analyzed.

Oil-rich municipalities always received at least as much royalties as in 2005 throughout the

sample period, but they received more than 65,000 COP per capita in extra royalties per

29

year between 2006 and 2008. In the case of coal-rich municipalities, there is some evidence of

a decrease in coal royalties during the early years of the sample, relative again to 2005, but

this is compensated by a royalty increase of 60,000 COP per capita in 2009. In general, the

variation in royalties matches the fluctuation in prices shown in Figure 4 for both resources.

Columns 4 and 6 confirm the very low return of royalties in terms of educational enrolment. Despite the large royalty inflows just discussed, the estimates show that the education

enrolment rate in 2011 is only 0.3 % higher than in 2005 in municipalities one standard deviation above the average in the 2004 oil royalty distribution. This difference is not statistically

significant. Things look only a bit better in the case of coal, where the enrolment rate is 0.6 %

greater in 2011 than in 2005. The specification employed allows us to see that the effect of

the positive shock of 2009 seems to last until the end of the sample period in 2011.

Finally, column 7 shows that the results are unaffected if I include all the explanatory

variables in the same regression. Assuming that the revenue increase from cadastral updating

lasts four years (adding up to approx. 15,000 COP per capita), I conclude that a $1 increase

in property tax revenue has an effect at least twice as large as a $4 increase in royalties.

6.

Conclusion

This paper tries to establish whether the source of revenue matters for government per-

formance. A political agency model with career concerns suggests that this may indeed be

the case: when revenue comes from the citizens’ pockets, they may be both more able or

more willing to monitor the functioning of government.

An empirical exercise based on panel data from Colombian municipalities between 2005

and 2011 provides evidence in support of the main prediction of this model: increases in

tax revenue have a positive effect on educational enrolment, while extra royalties from the

extraction of oil or coal have a much smaller effect, if any.

The findings of this paper have implications for important policy debates regarding de-

30

centralization, the natural resource curse and foreign aid. In particular, they provide quantitative evidence in support of the widely-held belief that external revenue has a very low

impact on public good provision. Future research must try to better understand the mechanism driving the documented difference between sources of revenue. The experimental work

in Paler (2013) and Martin (2014) constitutes early steps in this direction. One particular

topic of interest would be the study of different taxes with the objective of establishing which

characteristics (e.g. salience) are particularly important.

References

Acemoglu, Daron, Amy Finkelstein, and Matthew J. Notowidigdo (2013), “Income and

health spending: Evidence from oil price shocks.” The Review of Economics and Statistics,

95 (4), 1079–1095.

Alesina, Alberto and Guido Tabellini (2007), “Bureaucrats or politicians? part I: A single

policy task.” American Economic Review, 97 (1), 169–179.

Asher, Samuel and Paul Novosad (2014), “Digging for development: Mining booms and local

economic development in India.” Working Paper.

Bauer, Peter (1972), Dissent on development. Harvard University Press, Cambridge (Mass.).

Beblawi, Hazem (1990), “The rentier state in the arab world.” In The Arab State (Giacomo

Luciani, ed.), University of California Press, Berkeley.

Besley, Timothy and Torsten Persson (2011), Pillars of Prosperity: The Political Economics

of Development Clusters. Princeton University Press, Princeton, New Jersey.

Björkman, Martina and Jakob Svensson (2009), “Power to the people: Evidence from a

randomized field experiment on community-based monitoring in Uganda.” The Quarterly

Journal of Economics, 124 (2), 735–769.

31

Brollo, Fernanda, Tommaso Nannicini, Roberto Perotti, and Guido Tabellini (2013), “The

political resource curse.” American Economic Review, 103 (5), 1759–1796.