Promoting the Promise Manufactured Homes

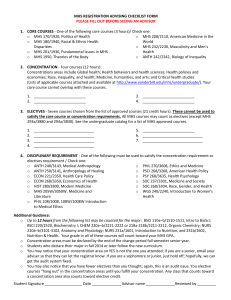

advertisement