The 1986 Tax Reform: Lessons for 2011

advertisement

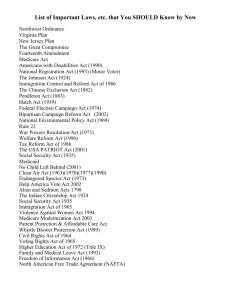

The 1986 Tax Reform: Lessons for 2011 Garett Jones George Mason University and The Mercatus Center Overview The Prospects Before Us The World Before 1986 What Happened in ’86 What Really Happened in ’86: A Public Choice Perspective Chairman Rangel’s Bill and 2011 How to tax the rich The Prospects Before Us 2011: When all of EGTRRA expires Why 2011: End of 2001 Budget window. Past and Future of taxes and spending: (As Percent of GDP. Source: Congressional Budget Office) What Expires in 2011? “New” 10% bracket for low-earners 35% Top rate: Back to Clinton’s 39.6% ½ of $1000 per child tax credit Limits on deductions and exemptions Tax breaks for married-filing-jointly Capital Gains and Dividend tax cuts Revenue Gained: about 1.5% of GDP The Olden Days before ‘86 Top Marginal Tax Rate: 50% Average tax rate on richest 1%: 19% But it took a lot of work to get it that low! At 50% rate, every deductible cut taxes by 50 cents: Net cost of $1 church donation: 50 cents! Net cost of $100 country club dues: $50! Net cost of $1000 business-education cruise: $500! • Result: Living your life around the Tax Code… Then what happened? Senator Bill Bradley (D-NJ) (NY Knicks) and President Ronald Reagan (R): “You came to [tax reform, Bradley told Reagan] because you were an actor who paid at the 90 per cent rate. I came to this because I was a depreciable asset.' Source: Birnbaum and Murray, Showdown at Gucci Gulch Reform: Low Rates, Broad Base Birnbaum and Murray’s classic book, Showdown at Gucci Gulch, in just one slide 1. 2. 3. 4. 5. Reagan punted tax reform past 1984 election Treasury accidentally took the issue seriously W&M Chairman Rostenkowski (D-IL) got religion Finance Chairman Packwood (R-OR) fought for union-favored tax breaks At halftime: Sorta-low rates, kinda-broad base. Politically– Politically–why make lobbyists mad for such a small victory? 6. Then, the famous “Two Pitcher Lunch” at Irish Times. Just Packwood and Diefenderfer, his top tax aide. A 25% top rate? “Why not?” The net result Top personal rate: from 50% down to 28% Millions taken off tax rolls Elimination of many, many tax incentives/loopholes Stronger AMT More taxes on corporations, less on individuals Capital gains tax raised from 20% to 28% (stopped the incentive to turn wages into capital gains) % of tax paid by top 1%: From 19% to 20% Sources: CBO, “Historical Effective Federal Tax Rates,” Rates,” and Auerbach and Slemrod, Slemrod, “Economic Effects of Tax Reform Act of 1986.” 1986.” The Economic Result Affluent married women worked more Lower marginal rates More efficiency on labor side Higher capital taxation (cap gains and depreciation) Less efficiency on capital side Maybe a wash? No academic consensus “The Impossible Became Inevitable” (WaPo headline). But how? A powerful focal point: A president people trusted not to raise taxes (“tax reform” was usually code for “tax hike)–and who would give anything–anything–for low rates Divide and conquer the lobbyists: Darman, Reagan Treasury Aide: Powerful tax lobbyists were too divided against each other….“Brought down by the narrowness of their vision…” The power to shame fellow members: Once the issue was framed as “the general interest v. the special interests,” the game was over. But how does framing work? One for the other rhetoricians, sociologists, and cognitive scientists…. But really, how? A public choice perspective James Buchanan, “Tax Reform as Political Choice (Nobel 1986, George Mason University) Short version: By 1980’s, the tax code was Swiss cheese–no more tax breaks left to sell to lobbyists. That meant it was time to take the tax breaks back and start selling them again…. It’s good to be in a line of work where you can sell your product to the same customers again and again…. Two big tax changes ahead 1. W&M Chairman Rangel’s bill: Redistributes tax burden among individuals Redistributes tax burden among corporations Top corporate rate: from 35% to 30.5% Top individual rate: Back to Clinton’ Clinton’s: 39.6% Corporate Rate: From 2nd highest in rich world to 4th (Source: Tax Foundation) 2. 2011: Will Congress let everyone’s taxes go up? 1.5% of GDP: 1/3 of military, 1/3 of Social Security, ½ of Medicare Chairman Rangel’s Bill Ends Individual Alternative Minimum Tax forever– a big tax cut for high earners: $800B/10 years $425 bigger standard deduction for everyone: $48B/10 years Pay-fors: Back to Clinton’s top rate: $831B/10 years, Turning cap gains into wages: $26B/10 years. Corporate side: Drop rate to 30.5% by: Eliminating special tax break for domestic manufacturers Changing inventory and international tax rules. So what is the best way to tax the rich? Joseph Stiglitz (Nobel 2001, Clinton CEA Chair)–pure theory: “[E]fficient taxation requires that the marginal tax rate on the most able individual should be negative.” (Source: Stiglitz (1987) “Pareto Efficient Taxation and the New New Welfare Economics” Economics”) Only true if skilled workers help unskilled workers do their job Key story: The skilled help the unskilled earn more 2011: 1986 All over again?