Solutions to Exercises in Chapter 11

1

Chapter 11 Solutions to Exercises

Solutions to Exercises in Chapter 11

11.1

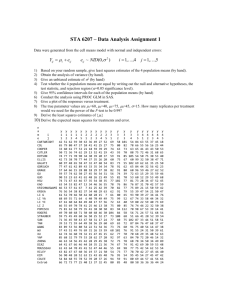

The results from the different variance specifications are presented in the following table.

Standard errors are in parentheses.

Specification for var( e t

)

σ 2 x t

σ

σ 2

σ

2

2 x x t t ln( x

2 t

)

1 2

GQ

36.753

0.13391

2.71

(20.052) (0.02879)

31.924

0.14096

2.20

(17.986) (0.02700)

21.286

(14.038)

0.15769

(0.02342)

1.46

39.550

0.12996

3.14

(21.469) (0.02997)

Each specification assumes a different degree of severity for the heteroskedasticity with

σ 2 ln( x t

) being the least severe of the specifications and

σ x t

the most severe. Interestingly, the intercept estimate declines and the slope estimate increases, the greater the assumed degree of heteroskedasticity. This outcome is consistent with a few large negative least squares residuals for large values of x . The greater the assumed degree of heteroskedasticity, the less weight is placed on these observations and the function moves away from them by decreasing the intercept and increasing the slope. Overall the estimates and their standard errors are quite sensitive to the specification, with the standard errors being smaller the greater the assumed degree of heteroskedasticity.

The critical value for the Goldfeld-Quandt test with a 10% significance level, a 2-tailed test, and (18,18) degrees of freedom is F c

= 2.22. Thus, this test suggests that the

= σ 2 = σ 2 x t

have not been adequate to eliminate

= σ 2 x t

we do not reject a null hypothesis of homoskedasticity, but the proximity of GQ = 2.20 to F c

= 2.22 does tend to

= σ x t

.

11.2

(a) Countries with high per capita income can decide whether to spend larger amounts on education than their poorer neighbours, or to spend more of their larger income on other things. They are likely to have more discretion with respect to where public monies are spent. On the other hand, countries with low per capita income may regard a particular level of education spending as essential, meaning that they have less scope for deviating

2

Chapter 11 Solutions to Exercises from a mean function. These differences can be captured by a model with heteroskedasticity.

(b) The least squares estimated function is y

!

t

= −

.

+

.

x

(0.0485) (0.00518) t

R 2

=

0 862

This function and the corresponding residuals appear in Figure 11.1. The absolute magnitude of the errors does tend to increase as x increases suggesting the existence of heteroskedasticity.

Yt 1.6

1.4

1.2

1.0

0.8

0.6

0.4

0.2

0.0

-0.2

0 y = - 0.1246 + 0.0732x

5 10 15

Figure 11.1 Estimated Function for Education Expenditure

20 Xt

(c) Since it is suspected that, if heteroskedasticity exists, the variance is related to x t

, we begin by ordering the observations according to the magnitude of x t

. Then, splitting the sample into two equal subsets of 17 observations each, and applying least squares to each subset, we obtain 2

1

= 0.0081608 and 2

2

= 0.029127 leading to a Goldfelt-Quandt statistic of

GQ

=

= 3.569

The critical value from an F -distribution with (15,15) degrees of freedom and a 5% significance level is F c

= 2.40. Since 3.569 > 2.40 we reject a null hypothesis of homoskedasticity and conclude that the error variance is directly related to per capita income x t

.

(d) Using White's formula for standard errors our estimated regression line is y

!

t

= −

.

+

.

x t

(0.0392) (0.00603)

(0.0404) (0.00621)

(SHAZAM)

(EViews)

SHAZAM and Eviews use different degrees of freedom corrections for the White standard errors.

3

Chapter 11 Solutions to Exercises

Using t c

= 2.037 as the 5% critical value for 32 degrees of freedom, the two confidence intervals for

β

2

are: least squares s.e.

White s.e. (SHAZAM) lower

0.0626

0.0609

upper

0.0837

0.0854

The confidence interval that ignores the heteroskedasticity is narrower than the one that recognizes it, suggesting that ignoring heteroskedasticity will give us misplaced confidence about likely values of

β

2

.

(e) Generalized least squares estimation under the assumption var

( ) = σ

2 x t

yields y t

= −

.

+

.

(0.0289) (0.00441) x t

The estimated response of per capita education expenditure to per capita income has declined slightly relative to the least squares estimate. The associated 95% confidence interval is (0.0603, 0.0783). This interval is narrower than both those computed from least squares estimates. The comparison with the White-calculated interval suggests that generalized least squares is more efficient; a comparison with the conventional least squares interval is not really valid because the standard errors used to compute that interval are not valid.

11.3

(a) The two estimated equations are:

GE:

West:

I

!

t

=

−

9.956 + 0.0265 V t

+ 0.1517 K t

(31.37) (0.0156) (0.0257)

I

!

t

=

−

0.509 + 0.0529 V t

+ 0.0924 K t

(8.02) (0.0157) (0.0561)

2

2

2

1

= 777.45

= 104.31

We wish to test H

0

:

σ 2

1

= σ 2

2

against the alternative H

1

:

σ 2

1

≠ σ 2

2

. The value of the

Goldfeld-Quandt statistic is

F

=

σ 2

2

2

=

1

=

With a 10% significance level, a 2-tailed test, and (17,17) degrees of freedom, the critical value for this test is F c

= 2.27. Because 7.45 > 2.27, we reject H

0

and conclude that the error variances for the two equations are not equal.

(b) Noting that

σ

1

=

.

=

.

and

2

=

.

=

.

, to obtain generalized least squares estimates we jointly estimate the following two transformed equations

I t β

1

β

V t

β

K t

+

e

1 t

4

Chapter 11 Solutions to Exercises

I t β

1

β

V t

β

K t

+

e

2 t

The first equation is that for GE and the second is for Westinghouse. The automatic commands of different software packages may yield slightly different standard errors for this problem. In the table of estimates that follows we report those from SHAZAM,

EViews and SAS. The results reported for EViews were not obtained from using the automatic command but from running ordinary least squares using the transformed variables.

Variable constant

V t

K t

(i) GLS

(SHAZAM)

Coefficients and Standard Errors

(i) GLS

(SAS and EViews)

16.747

(4.487)

0.02039

(0.00679)

0.1337

(0.0226)

16.747

(4.785)

0.02039

(0.00725)

0.1337

(0.0241)

(ii) LS with White

17.872

(4.291)

0.01519

(0.00622)

0.1436

(0.0188)

Both the estimates and their standard errors are comparable in terms of magnitudes. One would expect the GLS estimates to be more precise, and so it is surprising to see that they have larger standard errors. It is possible that the White standard errors are poor estimates of precision, given that they do not utilize all the available information.

Other slight variations in the estimation procedure and consequent results are possible. The estimates that follow are from using automatic commands in EViews. For GLS, it uses error variance estimates obtained from one pooled least squares regression instead of two separate ones. Those estimates are ˆ 2

723.44

and ˆ 2

122.98

. Also, for White standard errors, the degrees of freedom corrections used by SHAZAM and EViews are different. The standard errors given by EViews can be obtained by multiplying the SHAZAM results which appear in the above table by (

−

K ) .

Dependent Variable: I?

Method: GLS (Cross Section Weights)

Date: 05/29/00 Time: 11:51

Sample: 1 20

Included observations: 20

Number of cross-sections used: 2

Total panel (balanced) observations: 40

Variable Coefficient Std. Error t-Statistic Prob.

C

V?

K?

17.59008

0.018548

0.136650

4.891342

3.596168

0.0009

0.006852

2.706914

0.0102

0.022602

6.045815

0.0000

5

Chapter 11 Solutions to Exercises

11.4

(a) The GLS-estimated version of equation 11.7.3 is

∧

INV t

= −

.

+

.

(31.37) (32.38)

D t

+

V t

+

(0.0156) (0.0221)

V D t

+

(0.0257)

K t

−

(0.0617)

K D t

The F value for testing H

0

:

δ

1

=

δ

2

=

δ

3

= 0 comes out to be 2.69. For (3, 34) degrees of freedom the 5% critical value is F c

= 2.88. The p -value corresponding to F = 2.69 is

0.0614. Thus, when we allow for the fact that the equations have different error variances, we do not reject the null hypothesis of equal coefficients, a conclusion which is consistent with that reached in Section 9.7.

(b) (i) From the relevant computer output we have

SSE

U

= 14990 (see equation 9.7.7)

SSE

W

+ SSE

GE

= 1773 + 13217 = 14990 (see exercise 11.3(a))

(ii) Let SSE

∗

U

, SSE

∗

W

and SSE

∗

GE

be the corresponding sums of squared errors that are obtained after running least squares on the variables that have been transformed by dividing by

σ

1

(for General Electric) and

2

for Westinghouse. We know that

1

=

SSE

GE

17 and

σ

2

=

SSE

W

17

It follows that

SSE

∗

GE

=

∑

e

!

t

σ

1

2

=

1

2

1

∑

e

!

t

2 =

SSE

GE

2

1

=

17

Similarly, SSE

∗

W

= 17, and SSE

∗

U

=

SSE

∗

GE

+

SSE

∗

W

= 17 + 17 = 34.

Thus, the F statistic becomes

F

=

(

SSE

∗

R

−

SSE

∗

U

SSE

∗

)

(

T

−

K

)

J

=

(

SSE

∗

R

−

34 34

SSE

∗

R

−

(iii) From Exercise 11.3(b)(i), we have SSE

∗

R

= 42.084, and

F =

(

SSE

∗

R

−

) (

42 084

− )

= 2.69

11.5

(a) From the model C

1 t

= β

1

+ β

2

Q

1 t

+ β

3

Q

1

2 t

+ β

4

Q

1

3 t

+ e

1 t

where generalized least squares estimates of

β

1

,

β

2

,

β

3

and

β

4

are: var

( ) = σ 2 Q

1 t

, the estimated coefficient standard error

β

β

β

β

1

2

3

4

93.595

68.592

−

10.744

1.0086

23.422

17.484

3.774

0.2425

6

Chapter 11 Solutions to Exercises

(b) The calculated F value for testing the hypothesis that

β

1

=

β

4

= 0 is 108.4. The 5% critical value from the F

(2,24)

distribution is 3.40. Since the calculated F is greater than the critical F , we reject the null hypothesis that

β

1

=

β

4

= 0. The F value can be calculated from

F

=

(

SSE

R

−

SSE

U

(

SSE

U

)

24

)

2

=

(

14179

−

.

( )

)

=

(c) The average cost function is given by

C

1 t

Q

1 t

= β

1

1

Q

1 t

+ β

2

+ β

3

Q

1 t

+ β

4

Q

1

2 t

+ e t

Q

1 t

Thus, if

β

1

= β

4

=

0 , average cost is a linear function of output.

(d) The average cost function is an appropriate transformed model for estimation when heteroskedasticity is of the form var

( ) = σ 2

Q

2

1 t

.

11.6

(a) The least squares estimated equations are

1 t

= 72.774 + 83.659 Q

1 t

−

13.796 Q

1 t

2 + 1.1911 Q 3

1 t

(35.734) (23.655) (4.597) (0.272)

2

1

= 324.85

R

2

= 0.986

SSE

1

= 7796.5

C

2 t

= 51.185 + 108.29 Q

2 t

−

20.015 Q

2

2 t

+ 1.6131 Q

2

3 t

(37.597) (28.93)

2

2

= 847.66

(6.156)

R

2

= 0.959

(0.3802)

SSE

2

= 2034.4

To see whether the estimated coefficients have the expected signs consider the marginal cost function

MC

= dC

= + dQ

β

2

2

β

3

Q

+

3

β

4

Q 2

We expect MC

β

2

> 0. Also, we expect the quadratic

MC function to have a minimum, for which we require

β function is

> 0 when d MC dQ

=

Q

2

= 0; thus, we expect

β

3

+

6

β

4

Q

4

> 0. The slope of the MC

. For this slope to be negative for small Q

(decreasing MC ), and positive for large Q (increasing MC ), we require

β

3

< 0. Both our least-squares estimated equations have these expected signs. Furthermore, the standard errors of all the coefficients except the constants are quite small indicating reliable estimates. Comparing the two estimated equations, we see that the estimated coefficients and their standard errors are of similar magnitudes, but the estimated error variances are quite different.

(b) Testing H

0

:

σ 2

1

= σ 2

2

against H

1

:

σ 2

1

≠ σ 2

2

is a two-tailed test. Performing a two-tailed test at the 10% significance level is equivalent to performing a one-tailed test at the 5% significance level with the larger variance estimate being placed in the numerator of the

F statistic. Therefore,

7

Chapter 11 Solutions to Exercises

GQ

=

σ 2

2 =

2

1

=

The 5% critical value from a F

(24,24)

distribution is F c

= 1.98. Since GQ > F c

, we reject

H

0

and conclude that the data do not support the proposition that

σ 2

1

= σ 2

2

.

(c) Since the test outcome in (b) suggests

σ 2

1

≠ σ 2

2

, we use generalized least squares with the observations transformed using

1

and

2

. The estimated equation is

C t

= 67.27 + 89.92 Q t

−

15.408 Q t

2 + 1.3026 Q t

3

(25.17) (17.44)

(24.49) (16.97)

(3.509) (0.2122)

(3.415) (0.2065)

SSE = 49.241

(SHAZAM)

(SAS and EViews)

Two sets of standard errors are given, those from SHAZAM that force the transformed error variance to be unity, and those from SAS and EViews that utilize an estimate of the variance of the transformed error. With respect to the results, we note that all the signs of the estimated coefficients are as expected. The standard errors are small.

The results from using EViews automatic pool option are t

=

67.16

+

90.04

Q t

−

15.440

Q t

2 +

1.3047

Q

(24.50) (16.99) (3.420) (0.2069) t

3

(d) The F statistic for testing H

0

against H

1

is

F

=

(

SSE

R

−

SSE

U

J

SSE

U

T

−

K

)

( ) where SSE

R

= 49.241 is obtained from generalised least squares on the combined observations.

SSE

U

=

SSE

!

2

1

1 +

SSE

2

2

2

= 48

Therefore, F

=

( .

−

)

= 0.310. Since F < F c

, we fail to reject H

0

and conclude

48 48 that the data are consistent with the hypothesis that

β

1

=

γ

1

,

β

2

=

γ

2

,

β

3

=

γ

3

and

β

4

=

γ

4

.

11.7

(a) The least squares estimates of equation (11.7.5) are t

= 2.243 + 0.164 x t

+ 1.145 n t

(2.669) (0.035) (0.414)

R

2

= 0.45

These results suggest that an increase in income of $1000 will increase food expenditure by $164; an additional person in the household will increase food expenditure by $1,145.

Both the estimated slope coefficients are significantly different from zero.

8

Chapter 11 Solutions to Exercises

(b) See Figures 11.2 and 11.3. Overall, the residuals tend to increase in absolute value as x increases and as n increases. Thus, the plots suggest the existence of heteroskedasticity that is dependent on both x t

and n t

.

10

-5

-10

5

0

-15

20 40 60

X

80 100

Figure 11.2 Residuals Plotted Against Income.

10

5

0

-5

-10

-15

0 2 4

N

6 8

Figure 11.3 Residuals Plotted Against Number of Persons

(c) (i) To perform the first Goldfeld-Quandt test we order the observations according to decreasing values of x t y t

= β

1

+ β

2 x t

+ β

3 n t

+ e t

. Then, we find the least squares regression of

for both the first and second halves of the observations, to obtain estimates

σ

1

2 and 2

2

, respectively. We find that

σ

1

2 = 31.129 and 2

2

=

5.8819. Although we are not hypothesizing constant error variances within each subsample, to perform the Goldfeld-Quandt test we proceed as if H

0

and H

1

are given by H

0

:

σ 2

1

= σ 2

2

and H

1

:

σ 2

2

< σ 2

1

. The test statistic value is:

GQ

=

ˆ

ˆ

2

1

2

2

=

31.129

5.8819

=

5.2923

9

Chapter 11 Solutions to Exercises

The 5% critical value for (16, 16) degrees of freedom is F c

= 2.33. Thus, because

GQ = 5.2923 > F c

= 2.33, we reject H

0

and conclude that heteroskedasticity exists, and is dependent on x t

.

(ii) When we order the observations with respect to n t

, there is not a unique ordering because n t

takes on repeated integer values. There are 8 observations where n t

= 3.

One of these values must be included in the first 19 observations, the other 7 in the last 19 observations. There are 8 ways of doing this. The results from SAS, EViews and SHAZAM are as follows.

GQ

=

ˆ

ˆ

2

1

2

2

=

29.518

9.4177

=

3.13

GQ

=

σ 2

1

2

2

= =

.

(SHAZAM)

(SAS)

GQ

=

ˆ

1

ˆ

2

2

2

=

27.783

9.510

=

2.92

(EViews)

These values are greater than 2.33, and so we reject a null hypothesis of homoskedasticity and conclude that the error variances are dependent on n t

. These test outcomes are consistent with the evidence provided by the residual plots in part

(b).

(d) The alternative variance estimators yield the following standard errors:

Coefficients

β

2

β

3

White

0.0287

0.4360

Standard Errors

White (EViews) Least Squares

0.0299

0.4540

0.0354

0.4140

The results from White's variance estimator suggest the usual least squares results would underestimate the reliability of estimation for

β

2

and overestimate the reliability of estimation for

β

3

.

(e) To find generalized least squares estimates when

σ t

2 = σ 2 h t

= σ 2

{ x t

+

.

n t

} we begin by calculating h t

for each observation. Then we apply least squares to the transformed model.

y t h t

= β

1

1 h t

+ β

2

x t h t

+ β

3

n t h t

+

e t h t

The resulting estimates, with those from least squares, and the White standard errors are in the table below. The two estimates for

β

2

are similar, but the GLS estimate for the response of food expenditure to an additional household member is noticeably higher.

The standard errors suggest that

β

1

and

β

3

have been more precisely estimated by GLS, but not

β

2

. However, we do need to keep in mind that standard errors are square roots of estimated variances. It is possible for an improvement in precision to take place even when it is not reflected by the standard errors.

10

Chapter 11 Solutions to Exercises

Variable constant x t n t

GLS

1.682

(1.760)

0.160

(0.032)

1.364

(0.285)

LS (White)

2.243

(2.270)

0.165

(0.029)

1.145

(0.436)

11.8

From equation 8.1.4, the ratio of two independent chi-square random variables, each divided by its degrees of freedom, is an F random variable. Because V

1

and V

2

come from separate models they will be independent and

F

=

V

1

T

1

−

K

1

(

(

V

2

T

2

−

K

2

)

)

~ F (

T

1

−

1

,

2

−

K

2

)

Now, V i

(

T i

−

K i

) = !

i

2

for i = 1,2. Thus, F

=

σ σ

1

2

2

2

2

2

~ F (

T

1

−

1

,

2

−

K

2

) .

When

σ 2

1

= σ 2

2

, F

=

GQ

=

2

2

2

1

~ F (

T

1

−

1

,

2

−

K

2

) .

11.9

From the model y t

= β + β constant error variance is

2 x y t t

*

+ e t

= β

1

where x t

*

+ β + e t

*

= σ 2 x t

2 , the transformed model that gives

where y * t

= y x t

, x * t

=

1 x t

and e t

*

= e x t

.

Using least squares, we can estimate

β

1

and

ˆ

2

as

ˆ

T

∑

∑ x y * t

T ( x * t

) 2

−

−

∑ ∑

( ∑ x t

*

) y

2

* t

and

ˆ y *

ˆ

1 x *

The transformed variables give

∑ y * t

=

7

∑

( x * t

)

2 =

349 144

,

∑ x * t

=

37 12 ,

∑

. With T

=

5 the generalized least squares estimates are x y t

*

=

47 8 and

ˆ

5(47 8)

−

(37 12)(7)

5(349 144)

−

(37 12)

2

=

2.984

and

ˆ y *

ˆ

1 x *

=

(7 5)

−

2.984

(37 12)

5

= −

0.44

11

Chapter 11 Solutions to Exercises

11.10

(a) The graphs for plotting the residuals against income and age show that the absolute values of the residuals increase as income increases but they appear to be constant as age increases. This indicates that the error variance depends on income.

(b) Since the residual plot shows that the error variance may increase when income increases, and this is a reasonable outcome since greater income implies greater flexibility in travel, we set the null and alternative hypotheses as

H

0

:

1

2

2

against H

1

:

σ > σ 2

2

. The test statistic is

GQ

=

ˆ 2

1

ˆ 2

2

=

× −

4)

× −

4)

=

2.8124

The 5% critical value for (96, 96) degrees of freedom is F c

≈ and conclude that the error variance depends on income.

1.35

. Thus, we reject H

0

(c) (i) All three sets of estimates suggest that vacation miles travelled is directly related to household income and average age of all adults members but inversely related to the number of kids in the household.

(ii) The White’s standard errors are very similar in magnitude to those from the least squares standard errors. This leads to corresponding similar t -statistics. Thus, the

White’s standard errors do not change the assessment of the precision of the estimation.

(iii) The generalized least squares estimates and standard errors are also very similar in magnitude to those from least squares. The standard errors are slightly less which may suggest generalized least squares is better.

11.11

(a) The table below shows the 95% confidence intervals obtain using the critical t -statistic equal to 1.96 with the least squares standard errors and with the White’s standard errors.

After recognizing heteroskedasticity and using White’s standard errors the confidence intervals for CRIME, AGE and TAX are narrower while the confidence interval for

ROOMS is wider. None of the intervals contain zero and so all of the variables have coefficients that would be judged to be significant no matter what procedure is used.

Least squares estimates

CRIME

ROOMS

AGE

TAX

(-0.2549, -0.1119)

(5.66024, 7.1406)

(-0.0754, -0.0202)

(-0.0200, -0.0052)

Least squares estimates with

White’s standard errors

(-0.252, -0.115)

(5.0671, 7.6759)

(-0.0690, -0.0266)

(-0.0181, -0.0071)

(b) Most of the standard errors did not change dramatically when White’s procedure was used. Those which changed the most were for the variables ROOMS, TAX, and

PTRATIO. Thus, heteroskedasticity does not appear to present major problems, but it could lead to misleading information on the reliability of the estimates for ROOMS,

TAX and PTRATIO.

(c) After recognizing heteroskedasticity and using White’s standard errors the standard errors for CRIME, AGE, DIST, TAX and PTRATIO decrease while the others increase.

Therefore, using incorrect standard errors (least squares) understates the reliability of the

12

Chapter 11 Solutions to Exercises estimates for CRIME, AGE, DIST, TAX and PTRATIO and overstate the reliability of the estimates for the other variables.

11.12

(a) When observations are sorted by ROOMS the estimates ˆ 2

1

and ˆ 2

2

obtained from the first and second halves are 19.571 and 27.237, respectively. It seems likely that the error variance will be larger for large houses than for small houses and therefore we set the hypotheses as H

0

:

σ = σ 2

2

against H

1

:

σ < σ 2

2

. The Goldfeld-Quandt test value is

ˆ 2

2

ˆ

1

1.39

. Since the critical F value for degrees of freedom (244, 244) and a 0.05

level of significance is 1.23 we reject H

0

.

When observations are sorted by the variable DIST, the estimates ˆ 2

1

and ˆ 2

2

obtained from the first and second halves are 44.915 and 7.5013 respectively. It is difficult to know whether the error variance would be positively or negatively related to DIST and therefore we set the hypotheses as H

0

:

σ = σ 2

2

against H

1

:

σ ≠ σ 2

2

. The Goldfeld-

Quandt test value is ˆ 2

1

ˆ

2

5.99

. Since the critical F value for degrees of freedom

(244, 244), a 0.05 level of significance, and two tails, is 1.29, we again reject H

0

.

The conclusions from both tests suggest there is evidence of heteroskedasticity.

(b) The generalized least squares estimates are reported in the table below.

(c) The main differences between the generalized least squares estimates and the least squares estimates using White’s standard errors occur for the variables ROOMS and

DIST. There is a noticable reduction in the standard errors for these estimates as well as a marked change in the coefficients. Other variables with noticeable changes in the coefficients are ACCESS and PTRATIO.

Variable

Constant

CRIME

NITOX

ROOMS

AGE

DIST

ACCESS

TAX

PTRATIO

Estimate

33.0132

-0.2171

-19.0192

4.3322

-0.0515

-0.9525

0.3605

-0.0130

-0.9562

GLS

Standard error

4.8598

0.0377

3.8884

0.3929

0.0124

0.1560

0.0676

0.0034

0.1303

LS(with White’s se’s)

Estimate Standard error

28.4067

-0.1834

-22.8109

6.3715

-0.0478

-1.3353

0.2723

-0.0126

-1.1768

7.3800

0.0347

4.3595

0.6655

0.0108

0.1902

0.0747

0.0028

0.1236