Sponsored by SiriusXM Radio Inc.

advertisement

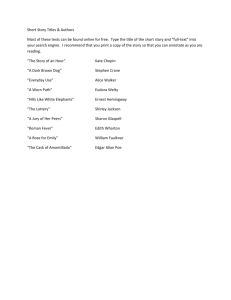

PREDICTING CUSTOMER ACQUISITION & RETENTION Sponsored by SiriusXM Radio Inc. WCAI Research Opportunity 10 February 2012 http://wcai.wharton.upenn.edu @WhartonCAI WHARTON CUSTOMER ANALYTICS INITIATIVE PAGE 1 INTRODUCTIONS David Frear Executive Vice President and CFO Joe Zarella Elea McDonnell Feit Research Director, WCAI Eric T. Bradlow Group Vice President & Chief Service Officer K.P. Chao Professor Professor of Marketing, Statistics, and Education Vice-Dean and Director, Wharton Doctoral Programs Evelyn Sasmor Co-Director, WCAI Vice President, Process & Information Management Peter S. Fader Frances and Pei-Yuan Chia Professor Professor of Marketing Co-Director, WCAI Charles Pensig Assistant Research Director, WCAI WHARTON CUSTOMER ANALYTICS INITIATIVE PAGE 2 WHY SHOULD I SUBMIT A PROPOSAL? • Access to unique data • Simple, efficient proposal process • Assistance with data cleaning and preparation • Teleconference Q&A sessions with the corporate partners • Invitation to a private symposium to share your research findings with the corporate partner • Promotion of your research paper through the WCAI SSRN Research Paper Series WHARTON CUSTOMER ANALYTICS INITIATIVE PAGE 3 S IRIUS XM WHARTON CUSTOMER ANALYTICS INITIATIVE PAGE 4 ABOUT S I R I U S XM Sirius XM Radio is America’s satellite radio company. SiriusXM broadcasts more than 135 satellite radio channels of commercial-free music, and premier sports, live news, talk, comedy, entertainment, traffic and weather to more than 21 million subscribers. SiriusXM offers an array of content from the biggest names in entertainment, as well as from professional sports leagues, major colleges, and national news and talk providers. SiriusXM programming is available on more than 800 devices, including aftermarket and factory-installed radios in cars, trucks, boats, and aircraft, and consumer electronics products for homes and offices. SiriusXM programming is also available online at siriusxm.com, and through the SiriusXM Internet Radio App for Apple, BlackBerry, and Android-powered smartphones and mobile devices. SiriusXM has arrangements with every major automaker and its radio products are available for sale at shop.siriusxm.com as well as retail locations nationwide. WHARTON CUSTOMER ANALYTICS INITIATIVE PAGE 5 ABOUT S I R I U S XM MARKE TI NG AND ANALYTI C S Mission • Maximize subscribers and revenue Organizational Goals • • • • • • Overcome people’s unwillingness to pay for radio - communicate why it’s worth it Improve the customer experience Increase conversions from trial subscriptions to self-pay subscriptions Reduce subscriber churn Improve revenue per customer and reduce marketing costs Communicate with the customers in a way that creates and sustains a relationship that shows that we know the customer throughout the customer’s lifecycle with us o Present the right offer to the right customers at the right time – with “offer” being more than just price variation o Know our customers – get a 360-degree view of the customer’s relationship with us o Gather and utilize enhanced customer knowledge to anticipate points of transition and maintain customer history WHARTON CUSTOMER ANALYTICS INITIATIVE PAGE 6 SIRIUSXM SUBSCRIPTION PROCESS: CONVERSION This is a hypothetical user’s path through subscription. All events are tracked by SiriusXM. • When a customer buys a car he either a) already has an active radio in the car and the sale info is sent to SiriusXM by the car manufacturer, b) calls in to start the trial, or c) the car dealer activates the trial for the customer. Whichever of a, b, or c occurs first marks the beginning of the conversion stream • At the end of the stream of events below, if the customer converts, he enters an automatically renewing paid-for subscription plan POST-ACTIVATION PRE–DEACTIVATION ENGAGEMENT END OF TRIAL RADIO DEACTIVATES WELCOME E-mail WELCOME KIT “Remit” WELCOME & Engagement Emails CONVERSION 1&2 OTM* Approx 35 & 46 days after trial starts. E-NEWSLETTERS CONVERSION CONVERSION DM E-MAIL 1 CONVERSION DM ^ “Remit” CONVERSION E-MAIL 2 CONVERSION DM + WHARTON CUSTOMER ANALYTICS INITIATIVE CONVERSION CONVERSION E-MAIL 3 OTM** PAGE 7 S I R I U S X M S U B S C R I P T I O N P R O C E S S : P O S T- D E A C T I VATI O N • If the customer does not convert after the trial period ends, the radio is deactivated and a post-deactivation campaign commences • If the customer converts during the post-deactivation campaign, he would enter an automatically renewing paid-for subscription plan just as if he had converted during the trial period • If the customer does not convert during this campaign he becomes part of a general marketing campaign for reactivations POST–DEACTIVATION END OF TRIAL RADIO DEACTIVATED WINBACK E-MAIL 1 WINBACK OTM 1^ WINBACK DM WINBACK E-MAIL 2 WINBACK DM WINBACK E-MAIL 3 WINBACK DM WINBACK DM* & OTM** WHARTON CUSTOMER ANALYTICS INITIATIVE WINBACK OTM 2 WINBACK DM WINBACK E-MAIL 4 PAGE 8 S I R I U S XM SUBSCRIPTION PROCESS: WIN BACK • Finally, if a paying subscriber deactivates his paid-for subscription service he becomes part of a win back campaign WHARTON CUSTOMER ANALYTICS INITIATIVE PAGE 9 IMPORTAN T TERMS • Churn is the event when a revenue-generating subscriber who pays out-of-pocket (versus revenue-generating trial subscriptions sponsored by a car manufacturer) decides to terminate service for a specific device. The reported average SiriusXM self-pay monthly churn rate for 2010 was 1.9%. • Conversion (or Trial Conversion) is the event when a subscriber who is not paying for a subscription out of his own pocket (either provided free by SiriusXM or paid for by a car manufacturer) decides to become a paying subscriber and purchases a subscription after his trial period ends. The reported SiriusXM conversion rate for 2010 was 46.2%. WHARTON CUSTOMER ANALYTICS INITIATIVE PAGE 10 DATA WHARTON CUSTOMER ANALYTICS INITIATIVE PAGE 11 NOTE ON THE SAMPLE DATA You can look at patterns within a group of like customers; however, the overall patterns in these data (e.g., churn or conversion rates) should not be taken as representative of the full SiriusXM customer base. Records were selected to provide good data for relevant scenarios, not to mimic the distributions across the full customer base. WHARTON CUSTOMER ANALYTICS INITIATIVE PAGE 12 DATA : 360 DEGREE VIEW OF CUSTOMER The data consist of information on 300,000 customers who first activated a trial or paid subscription in September or October of 2009. Their histories run through the the end of 2011, providing a full 27 months of history. For each customer we have: • Devices: what type of device(s) the customer owns, where they were purchased, and how they were activated/deactivated • Vehicles: type of car (aliased), time and location of purchase • Subscription histories: price paid and duration of services, types of services (e.g. radio-only, internet radio, weather service) • Outbound marketing: direct marketing efforts made to customers and how they responded (if relevant) • Customer service records: use of online self help tool, calls to call center, including free-text notes taken by call center agents • Billing records: when bills were sent and paid, and whether customers went into collections for late payments WHARTON CUSTOMER ANALYTICS INITIATIVE PAGE 13 DATA : 360 DEGREE VIEW OF CUSTOMER • About 12% of households in this sample had more than one active device in January 2011 WHARTON CUSTOMER ANALYTICS INITIATIVE PAGE 14 P O TE N TI A L RE S E A R C H Q UE S TI O N S : CH U R N • Using data on subscriber interactions including the free text in call center notes and email response notes, can we identify users that are likely to deactivate soon or who are most likely to convert to a paying customer? • What are the key customer events, such as calls into the call center, falling into collections, a certain time in the customer life cycle, the content or reasons for the calls, use or non-use of self-care site, etc. that cause or precede deactivation? • What actions on the part of SiriusXM forestall deactivation? • How does going into collections (late payment) affect churn? WHARTON CUSTOMER ANALYTICS INITIATIVE PAGE 15 DATA : CHUR N • Subscribers choose from a variety of terms lengths with different pricing. The top 5 most-popular plans are: Plan Type Cost Annual $142.45 Monthly $12.95 Two Year $271.95 Quarterly $38.85 Semi Annual $77.70 * Note: these are 2011 prices which are slightly lower than 2012 prices published on the SiriusXM Website WHARTON CUSTOMER ANALYTICS INITIATIVE PAGE 16 DATA : CHUR N • Because subscriptions are for a fixed amount of time (3, 6, 12 months, etc.) churning happens most around these “round numbers”. • However, if the subscriber sells the car, they may deactivate subscriptions “offcycle” WHARTON CUSTOMER ANALYTICS INITIATIVE PAGE 17 P O TE N TI A L RE S E A R C H Q UE S TI O N S : CONV E R S I O N • Can user behavior be used to predict which trial-subscription customers will convert and target trial-subscribers who will be positively influenced by additional direct marketing such as outbound calls? Are there identifiable segments that should be marketed to differently? • Can the optimal plan and pricing to convert a trial user be determined in real time? • How do the attributes of a trial promotion affect conversion? Do features such as length of trial and service bundling have an impact? WHARTON CUSTOMER ANALYTICS INITIATIVE PAGE 18 DATA : CONVER SION • The trial period offered to users varies across users, depending on arrangements between the car manufacturer and SiriusXM. Most trials are 3, 6 or 12 months in duration. WHARTON CUSTOMER ANALYTICS INITIATIVE PAGE 19 DATA : CONVER SION • As an example, within a particular group, customers who began trials in H2’10 are contacted mainly by direct mail during the conversion stream. • Note that e-mail addresses often are not provided by the OEMs; SiriusXM collects them once the customer contacts SiriusXM or through other appends. • After conversion, subscribers in this cohort are contacted primarily by email WHARTON CUSTOMER ANALYTICS INITIATIVE PAGE 20 DATA : CONVER SION • SiriusXM seeks to better understand the relationship between the number of marketing touches a customer receives and her likelihood to convert. • Simply looking at the relationship between marketing touches as conversion suggests that marketing touches do not improve conversion, however, this ignores the fact that those subscribers most impressed tend to convert sooner and so receive fewer communications. WHARTON CUSTOMER ANALYTICS INITIATIVE PAGE 21 DATA : TRIAL CONVER SION • One potential explanatory variable for trial conversion is the car make. Low % High % • For the H2’10 cohort there appears to be substantial differences in conversion rates between makes WHARTON CUSTOMER ANALYTICS INITIATIVE PAGE 22 P O TE N TI A L RE S E A R C H Q UE S TI O N S : COMPE TI TI O N • How does the availability of terrestrial radio (which varies across geography) affect subscription activation and deactivation, e.g. users who like opera, but have no access to terrestrial radio stations that play opera may have lower propensity to unsubscribe than users who have good terrestrial options? WHARTON CUSTOMER ANALYTICS INITIATIVE PAGE 23 DATA : COMPETITI V E OFFERI NGS • How do competitive terrestrial (AM/FM) radio offerings affect subscriber churn? • WCAI will provide a list of a radio stations per zip code with the data set • The graph below shows cumulative churn over 2 years for the September 2009 cohort More Terrestrial Radio Less Terrestrial Radio WHARTON CUSTOMER ANALYTICS INITIATIVE PAGE 24 P O TE N TI A L RE S E A R C H Q UE S TI O N S • Using listening data (available for internet users only), can we identify patterns in listenership that precede subscription or deactivation? Can this rich information about the internet users be used to predict subscription deactivations among the non-internet users (some principled assumptions will be required)? WHARTON CUSTOMER ANALYTICS INITIATIVE PAGE 25 DATA : INTERN ET RADIO SiriusXM has provided “listening logs” for a sample of its internet radio users • Internet radio subscribers are currently a small portion SiriusXM’s total user base • Listening logs record which channels a user listened to, on what device (PC, smartphone, tablet, other music player) and for how long he listened to each channel. WHARTON CUSTOMER ANALYTICS INITIATIVE PAGE 26 DATA : INTERN ET RADIO • Because of the time period that was selected for this sample of data, the data show the majority of devices that use SiriusXM Internet Radio are PCs, followed by iPhones (~13%). The actual usage on smart phones (iPhone and Android) and tablets has grown rapidly. WHARTON CUSTOMER ANALYTICS INITIATIVE PAGE 27 DATA : INTERN ET RADIO • A “session” is a continuous period of listening to one internet radio channel (e.g. 90s Rock or Mozart) WHARTON CUSTOMER ANALYTICS INITIATIVE PAGE 28 Q&A WHARTON CUSTOMER ANALYTICS INITIATIVE PAGE 29 Q& A : PROPOSA L PROCESS • Review the WCAI FAQ on Research Opportunities: http://www.wharton.upenn.edu/wcai/dump/FAQ.cfm • Contact wcai-research@wharton.upenn.edu, if you have questions about the data • Submit a brief proposal to wcai-research@wharton.upenn.edu by Friday, 2/24/2012. Proposals should be less than 2,000 words and should include: o Research team, affiliations and e-mail addresses • Please designate a corresponding author o Objectives & contribution to the academic literature o Proposed methods o Rough timeline o Potential for managerial insights & impact for ARC and other non-profits o PDF format preferred o Please put “RO: SiriusXM Proposal” in the subject line • Proposals will be evaluated by Elea Feit (WCAI), Pete Fader (WCAI), Eric Bradlow (WCAI), Kartik Hosanagar (Wharton), Foster Provost (NYU), Evelyn Sasmor (SiriusXM), and Brian Wood (SiriusXM) WHARTON CUSTOMER ANALYTICS INITIATIVE PAGE 30 Q &A: O THE R O P P O RT U N I TI E S FOR RES E A R C H E R S If you registered for this webinar, you will receive regular announcements about: • Research Opportunities like this one o MARS International: April 2012 o NC Soft: June 2012 • Grant/funding opportunities • WCAI Conferences o Marketing on the Move: Understanding the Impact of Mobile on Consumer Behavior, Feb 27-28 at The Wharton School (co-sponsored with MSI) http://www.wharton.upenn.edu/wcai/MobileConference2012.cfm • Announcements are also available at http://wcai.wharton.upenn.edu Visit SSRN Research Paper series: http://www.ssrn.com/link/Wharton-CustAnalytics-Initiative-RES.html WHARTON CUSTOMER ANALYTICS INITIATIVE PAGE 31