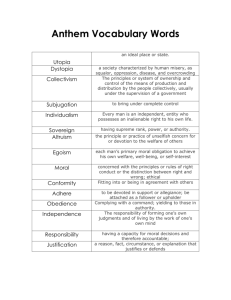

Moral Hazard In The Insurance Industry

advertisement