Mid Michigan Community College Board of Trustees Meeting

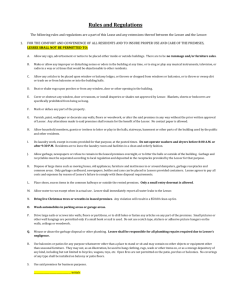

advertisement