Tax Market Report & Salary Survey 2014

advertisement

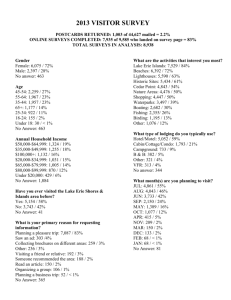

Tax Market Report & Salary Survey 2014 – 2015 Company Overview Established in 2003, Bluefin Resources has from the very beginning operated with the aim of servicing our chosen market sectors, in a way far superior to that of a traditional recruitment firm. Bluefin Resources employs over 40 staff across locations in Sydney and Melbourne focusing on specialist market areas including; Tax, Risk Compliance & Audit, Data Analytics, Wealth Management & Insurance, Technology, Sales and Project Services. Bluefin Resources is an Australian specialist recruitment firm, providing talent to the Australian market for over 11 years. Our consultants are specialists within their fields, with in-depth knowledge and experience in their niche markets. Bluefin Resources is a panel supplier to many Australian leading organisations, and we also support many unique and interesting SMEs. Lauren Maunsell, Account Manager – Taxation Tel: +61 (2) 9270 2650 Email: lauren@bluefinresources.com.au Tax Specialisation In 2014, Lauren Maunsell joined Bluefin Resources to provide dedicated coverage of the Tax market across the firm’s key areas of focus. The client areas include: Banking and Financial Services, Private Practice, Energy & Resources, Infrastructure and a select group of ASX listed commerce organisations. Working closely with other members of the team, including the key areas of specialist finance Risk, Compliance and Audit, Lauren brings over 8 years specialist experience recruiting Tax professionals within these disciplines, 6 years of which are in Australia and 2 years in London completing searches for many of the global corporates and well known Australian brands. Market Trends – Industry Sectors Legal & Private Practice This has been the busiest area by far this year with 3 of the Big 4 recruiting heavily including specific recruitment drives for multiple hires within the transactional and M&A tax space, the Financial Services and Wealth space and one firm in particular predominantly replacing a large number of corporate tax professionals that moved into in-house roles in 2013 and 2014. We have seen a number of tax professionals move between the Big 4 on inflated salaries as well as from the law firms to the Big 4 in order to advance their career and experience direct access to the clients - something which is rarely available to them in a legal environment. It is still very much recognised within the industry that the law firms are losing some work to the Big 4 who are able to offer a "one stop shop" tax solution to their clients at a reduced price which is only becoming more prevalent with the investment from the Big 4 in their tax, legal and controversy teams. Throughout the first 6 months of 2014 the reports from both the Big 4 firms and the law firms alike was that transactions have picked up, people are busier and there is generally more faith returning to the market. This has translated to an increase of tax roles being signed off within industry clients but also to the accounting firms going above and beyond to hold on to their staff when faced with a resignation. This year has seen more successful counter-offers than ever before with promises being made to staff that we suspect will remain largely unfulfilled even as we move into 2015. Industry, Infrastructure & Property Whilst the property sector has remained relatively stable this year, there have been a number of interesting new roles signed off within the infrastructure space which have been largely filled by professionals coming out of the Big 4 accounting firms. The roles have not only been within corporate tax but also more specialised areas including employment and expatriate tax divisions. This calendar year has seen some interesting trends with senior tax professionals moving from Financial Services into fantastic roles within Commerce & Industry. These include; Douglas Smith from Lloyds International who has recently joined Maersk Line as the Head of Tax in a Lauren Maunsell, Account Manager – Taxation Tel: +61 (2) 9270 2650 Email: lauren@bluefinresources.com.au newly created role and Basil Salvaris (Ex ANZ and Credit Suisse) is now the Head of Tax Compliance and Strategy at News Corp Australia. Historically it has been quite difficult to move from a long term tax career in Financial Services into Commerce particularly at a senior level, but some of these moves indicate that more emphasis is being put on proven technical and people management ability and indeed cultural fit as opposed to specific industry experience. We believe that both Doug and Basil will make fantastic additions to their respective new employers. Banking & Financial Services The main area of activity and growth this year across the Banking and Finance sector has been within the wealth management arms' of organisations such as; HSBC, Westpac, ANZ and NAB who have been hiring professionals with specific tax skills across the areas of Superannuation, Life Insurance and Funds Management. A high number of successful hires has come from the investment and Insurance Tax teams within the Big 4 accounting firms. One of these successful hires was Jessika Heynen who joined ANZ Wealth as a Tax Manager from KPMG Sydney. Looking forward to 2015, we predict that there will still be vacancies across the Wealth Management sector. We also expect to see an increase of potential roles within indirect tax due to changes to the GST reform in Australia. Both the domestic and international banks are likely to add bench strength in their Transfer Pricing Tax teams due to continued pressure from the ATO. We expect there to be some redundancies within the international banks however with continued pressure to streamline and reduce headcount within Australian subsidiary tax functions. One organisation worth mentioning is UBS who as of this year, no longer have a tax team in Australia. Energy & Resources We believe that Energy & Resources will be an area to watch in 2015. We have already seen some interesting and high profile roles filled towards the back end of 2014 including the appointment of the new Tax Manager at Horizon Oil – Luke Domrow from PricewaterhouseCoopers, Aoife Dean's move from BHP Billiton to Orica as Tax Manager Global Strategy & Compliance, EMEA/Asia, the appointment of Tom DeGeorgio from the Houston Office of BHP Billiton to take over from Chen Leong as the VP Tax – Asia Pacific and Anne Maree Wolff's promotion to the Head of Tax Australia position at Rio Tinto post Ross Lion's move to London to take on the Global Head role. BHP Billiton Melbourne are still very much in the process of hiring and onboarding 10 new members of the Group Tax Team and the new Global Head of Tax to replace Tony Merlo's internal move is yet to be announced. With the oil price dropping there has been a slight hesitation from various organisations but there are still plans for many to move some senior staff internally or overseas thus creating positions across Sydney, Melbourne and Brisbane. Lauren Maunsell, Account Manager – Taxation Tel: +61 (2) 9270 2650 Email: lauren@bluefinresources.com.au Candidate Trends What have we seen in 2014? This year has been a year of restored faith into the Australian Tax market in both professional services as well as in-house. We have seen more roles signed off in industry for candidates to consider but also a huge number of successful counter offers from the Big 4 accounting firms desperate to hold on to their high performers. It will be interesting to see how this unfolds in 2015 when even more in-house roles become available and the Big 4 perhaps being unable to commit to previous promises made in order to keep their staff. Salaries in the Australian market remain fairly unchanged in industry as is the case also "officially" within the Big 4 accounting firms (we have seen some candidates paid above their grade in order to entice them to move to a competitor). The Law firms as always pay way above market at the more senior level which is actually a good move on their part as it does keep their higher performers from leaving and joining the Big 4 as it would just not be viable for most to take such a significant pay cut. All of the major banks have gender diversity targets and as a result women in leadership has been a major focus over the last 12 months. This has also been a strong focus for some of the Big 4 accounting firms but less so within commerce and industry who tend to have a more even split traditionally. Candidates considering their options in 2015 The information we have so far is that specialist skill sets will be in demand next year particularly within the first 6 months. Those skills sets are Transfer Pricing and GST due to several legislative changes that have already happened or are expected to happen in July next year. If you are currently in Private Practice and considering a move in-house, now would be a good time to start looking at options. We are also interested in hearing from candidates with the more traditional corporate tax skill sets for various roles that we are aware of for the first few months of 2015 including both advisory and international roles as well as the more compliance and reporting focused positions within large Australian organisations. The general feeling moving into 2015 is that the market has recovered, and we are expecting to have a busy year with various moves already being reported, with exciting new roles and projects in the pipeline. The Numbers Lauren Maunsell, Account Manager – Taxation Tel: +61 (2) 9270 2650 Email: lauren@bluefinresources.com.au * Attached in Appendix Figures based on candidate data gained through the Bluefin interview process. Questions Lauren Maunsell Account Manager – Taxation lauren@bluefinresources.com.au 02 9270 2650 | 0405 619 413 See my profile on Bluefin Resources If you have any questions in relation to this market update or would like more detail on any of the above, please feel free contact Lauren Maunsell – Account Manager, Taxation on: +61 (0) 2 9270 2650. Lauren Maunsell, Account Manager – Taxation Tel: +61 (2) 9270 2650 Email: lauren@bluefinresources.com.au Appendix – Salary Survey *all salaries quoted do not include bonuses. Big 4 Tax Consultant (approx. graduate – 2 years) Senior Consultant (approx. 2.5-4 years) Manager (approx. 4-6 years) Senior Manager (approx.. 6-8 years) Director (approx. 8+ years) Partner (Salaried) Partner (Equity) Direct Taxes (Corporate Tax/M&A) 55,000 - 72,000 73,000 - 95,000 100,000 - 135,000 135,000 - 180,000 181,000 - 280,000 281,000 - 400,000 Indirect Taxes (GST/Stamp Duty 55,000 - 72,000 73,000 - 95,000 100,000 - 135,000 135,000 - 180,000 181,000 - 280,000 281,000 - 400,000 Direct Tax (Corporate/Funds) 55,000 - 72,000 73,000 - 95,000 100,000 - 135,000 135,000 - 180,000 181,000 - 280,000 281,000 - 400,000 Transfer Pricing 55,000 - 72,000 73,000 - 95,000 100,000 - 135,000 135,000 - 180,000 181,000 - 280,000 281,000 - 400,000 450,000 + (have seen up to 1.5 million for practice leaders 450,000 + (have seen up to 1.5 million for practice leaders 450,000 + (have seen up to 1.5 million for practice leaders 450,000 + (have seen up to 1.5 million for practice leaders Top Tier Law Firms Paralegal (Tend to be on rotation in all areas) Associate/Consultant Senior Associate Salaried Partner/Special Council Equity Partner Direct Taxes (Corporate Tax/M&A) 65,000- 90,000 90,000- 130,000 135,000- 280,000 300,000- 550,000 550,000 + (depending on firmhave seen up to 3 mil) Direct Tax (Corporate/Funds) 65,000- 90,000 90,000- 130,000 135,000- 280,000 300,000- 550,000 550,000 + " Indirect Tax - GST 65,000- 90,000 90,000- 130,000 135,000- 250,000 300,000- 500,000 500,000 + " Indirect Tax Stamp Duty 65,000- 90,000 90,000- 130,000 135,000- 280,000 300,000- 550,000 550,000 + " Transfer Pricing 65,000- 90,000 90,000- 130,000 135,000- 250,000 300,000- 500,000 500,000 + " Banking/Financial Services 1-3 years 4-6 years 7-10 years 10+ years Lauren Maunsell, Account Manager – Taxation Tel: +61 (2) 9270 2650 Email: lauren@bluefinresources.com.au Global Head of Tax N/A N/A N/A 400,000 + discretionary bonus Regional Head of Tax N/A N/A 200,000 - 300,000 250,000 - 350,000 Senior Tax Manager/2IC N/A N/A 160,000 - 220,000 180,000 - 300,000 Tax Manager N/A 110,000 - 140,000 140,000 - 160,000 140,000 - 165,000 Tax Accountant/Advisor 60,000 - 85,000 85,000 - 110,000 100,000 - 130,000 100,000 - 140,000 Energy & Resources 1-3 years 4-6 years 7-10 years 10+ years Global Head of Tax N/A N/A N/A 500,000- 750,000 + Regional Head of Tax N/A N/A 200,000- 300,000 200,000- 350,000 + Senior Tax Manager/2IC N/A N/A 170,000- 250,000 200,000- 350,000 + Tax Manager N/A 115,000- 150,000 150,000- 220,000 160,000- 220,000 Senior Tax Accountant/Advisor 70,000- 100,000 105,000- 130,000 135,000- 200,000 140,000- 200,000 Tax Accountant/Advisor 65,000- 90,000 95,000- 120,000 100,000- 150,000 100,000- 150,000 Commerce, Infrastructure & Property (ASX Listed) 1-3 years 4-6 years 7-10 years 10+ years Global Head of Tax N/A N/A N/A 350,000 + (Discretionary bonus depending on company) Lauren Maunsell, Account Manager – Taxation Tel: +61 (2) 9270 2650 Email: lauren@bluefinresources.com.au Regional Head of Tax N/A N/A 180,000 - 250,000 200,000 - 400,000 Senior Tax Manager/2IC N/A N/A 150,000 - 250,000 200,000 - 300,000 Tax Manager N/A 110,000 - 150,000 150,000 - 180,000 170,000 - 200,000 Senior Tax Accountant/Advisor N/A 90,000 - 125,000 120,000 - 150,000 140,000 - 170,000 Tax Accountant/Advisor 55,000 - 85,000 85,000 - 110,000 100,000 - 130,000 120,000 - 140,000 Lauren Maunsell, Account Manager – Taxation Tel: +61 (2) 9270 2650 Email: lauren@bluefinresources.com.au