GOLDEN SINGAPORE GROWTH FUND

advertisement

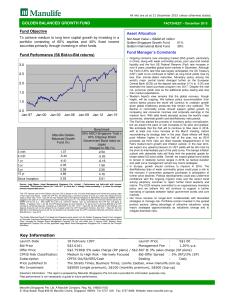

All info are as at 31 December 2015 unless otherwise stated. GOLDEN SINGAPORE GROWTH FUND (Easi-Investor) FACTSHEET – December 2015 Fund Objective Asset Allocation The Fund (feeding into Schroder Singapore Trust Class M) aims to seek long-term capital growth through investing in securities of companies quoted on the Singapore Exchange. Net Asset Value = SGD 216.85 Million Fund Performance (S$ Bid-to-Bid returns) 2.5 2.0 1.5 1.0 0.5 0.0 Sep-00 Sep-03 Sep-06 Sep-09 Manulife Golden Singapore Growth Fund (%) Sep-12 Benchmark 2.47 4.00 6 mth -10.86 -11.57 1 yr -8.59 -11.90 3 yr 1.27 0.04 5 yr 1.12 0.52 10 yr 5.32 5.24 Since Inception (5 June 2006) 5.14 4.30 88.16 3.68 0.25 7.90 Top 10 Holdings in (%) Singapore Telecommunications Limited DBS Group Holdings Oversea-Chinese Banking Corporation United Overseas Bank Limited Keppel Corporation Capitaland Limited Comfortdelgro Corporation Limited Mapletree Industrial Trust REIT UOL Group Limited Hongkong Land Holdings Limited 14.20 12.24 9.40 9.00 5.78 5.41 4.84 3.77 3.58 2.55 Sep-15 MSCI Singapore Free Index (%) 3 mth Country Allocation in (%) Singapore Hong Kong Malaysia Cash Source: Morningstar • Performance are NAV-NAV in SGD • Performance figures for 1 mth till 1 yr show the % change, those exceeding 1 yr show the average annual compounded return. Schroder Investment Management (Singapore) Ltd is the fund manager for the underlying fund of Golden Singapore Growth Fund. The Manulife Golden Singapore Growth fund started feeding into the underlying fund with effect from 14 May 2010. The CPF interest rate for the Ordinary Account (OA) is based on the 12-month fixed deposit and month-end savings rates of the major local banks. Under the CPF Act, the Board pays a minimum interest of 2.5% p.a. when this interest formula yields a lower rate. From 1 Jan 08, the new interest rate for the Special, Medisave & Retirement Accounts (SMRA) will be pegged to the yield of 10-year Singapore government bond plus 1%. For 2008 and 2009, the minimum interest rate for the SMRA will be 4% p.a. After 2009, the 2.5% p.a. minimum interest rate, as prescribed by the CPF Act, will apply to SMRA. In addition, from 1 Jan 08, the CPF Board will pay an extra interest of 1% per annum on the first $60,000 of a CPF member’s combined balances, including up to $20,000 in the OA. From 1 April 08, the first $20,000 in the Ordinary Account will not be allowed to be invested under the CPF Investment Scheme. And from 1 May 09, the first $30,000 in the Special Account will not be allowed to be invested under the CPF Investment Scheme. Fund Manager’s Comments The Singapore equity market edged up slightly in December 2015. Typical low liquidity and the long holiday period for several Asian exchanges led to quiet trading. The well-flagged decision by the US Federal Reserve to raise policy interest rates did little to change sentiment, with investors now divided as to whether more rate hikes will follow in quick succession, or whether there could be a long hiatus before the next policy move. More crucially for financial markets, the weaker Chinese yuan fuelled speculation that the currency could fall further in 2016. In terms of equity performance by sector, all sectors except Telecoms and Capital Goods registered postiive returns for the month. Real Estate Developers performed best, led by Capitaland. Transportation companies continued to edge up on low oil prices. Telcom and Capital Goods were the biggest laggards. Telcos were held back by concerns over a potential new entrant in upcoming spectrum auctions, whilst weak oil prices weighed on the oil and gas-related names. The Fund was up 0.55% in December, but underperformed the Benchmark which was up 1.36% on stronger performance from higher-beta names. Underperformance was driven mainly by the Fund’s underweight in Transportation and Consumer Discretionary sectors, coupled with an overweight in IT. Higher cash holdings which have proven defensive previously also weighed on returns. Underperformance was however mitigated by an underweight exposure to capital goods and positive stock selection among the REITs. Key Information Launch Date Bid Price Offer Price CPFIS Risk Classification Subscription Price published In Min Investment : : : : : : : 1 September 2000 Launch Price :S$1.00 S$2.0461 Management Fee :1.65% p.a. S$2.1538 @ 5% sales charge Higher Risk - Narrowly Focused CPFIS-OA/SRS/Cash Dealing :Daily The Straits Times, Business Times, Lianhe Zaobao, www.manulife.com.sg S$2000 (Annual), S$1000 (RSP Semi-Annual), S$500 (RSP Monthly), S$500 (top-up) Important Information: This report is prepared by Manulife (Singapore) Pte. Ltd. and is provided for information purposes only. Past performance is not necessarily a guide to future performance. Manulife (Singapore) Pte. Ltd. A Manulife Company. Reg. No. 198002116D 51 Bras Basah Road #09-00 Manulife Centre, Singapore 189554 Tel: 6737 1221 Fax: 6737 8488 Website: www.manulife.com.sg