Partnership Agreement

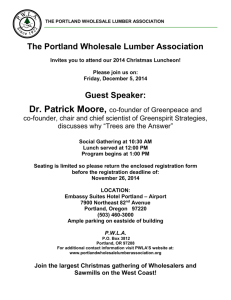

advertisement