Basic Analysis of Autarky and Free Trade Models

advertisement

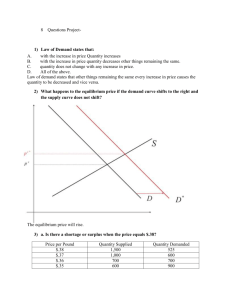

Basic Analysis of Autarky and Free Trade Models AUTARKY Autarky condition in a particular commodity market refers to a situation in which a country does not engage in any trade in that commodity with other countries. Consequently all the transactions take place within the domestic market under a closed economy. The autarky equilibrium price is determined when the total domestic supply of the commodity is equal to the total domestic demand. Autarky model for a particular commodity can be represented by the following equations. (1) Qs 0 1 P α 2 X 0 , 1 0 (2) Qd 0 1 P β 2 Z 0 , 1 0 (3) Qs Q d The equation (1) denotes that quantity supplied (Qs) is a function of its own price (P) and a vector of supply shifters (X) such as input prices and policy variable. These variables are called supply shifters because changes in any of these variables shift the supply curve up or down depending on the sign of the corresponding coefficient in the parameter vector α 2 . The elements in the parameter α 2 can be a positive or negative depending on the variable in the supply shifter vector X. The equation (2) expresses the behavioral relationship that quantity demanded (Qd) is a function of its own price and a vector of demand shifters (Z) such as income and prices of complements and substitutes. Changes in a demand shifter will shift the demand curve up or down depending on the sign of the corresponding coefficients in vector β 2 . The elements in the parameter vector β 2 can be 2 positive or negative depending on the variables in the demand shifter Z. The equation (3) entails that for this commodity market to attain equilibrium, quantity supplied must be equal to quantity demanded. The endogenous variables in this model are quantity supplied, quantity demanded, and price. The exogenous variables are supply shifters and demand shifters. A graphical representation of the autarky model in Q-P space is illustrated in Figure 2.1. Note that the supply and demand curves are drawn by assuming X and Z are zero. The supply curve in Q-P space has the required positive slope ( 1 ). The vertical intercept is negative (- 0 ) to meet the provision that quantity will be supplied only after the price reaches a certain minimum positive level. Changes in any of the supply shifters will shift the supply curve up or down depending on the sign of the corresponding coefficients in α 2 . The demand curve in Q-P space has a positive vertical intercept ( 0 ) and negative slope (- 1 ) as one would expect. Changes in any of the demand shifters will shift the demand curve up or down depending on the sign of the corresponding coefficients in β 2 . By equating the quantity supplied and quantity demanded as in (3) we can solve for equilibrium prices ( P ) (4) P 0 0 β 2 Z α 2 X 1 1 3 Note that the equilibrium price is expressed in terms of parameters and supply and demand shifters. For P to be positive, the numerator in equations (4) has to be positive, since the denominator is positive as specified in the model. The equilibrium quantity Q is obtained by substituting the equation for P either in (1) or (2) and solving the resulting expression (5) Q α 0β1 α1β 0 α1β 2 Z β1α 2 X β1 α1 Note that the equilibrium quantity is also expressed in terms of parameters and supply and demand shifters. Since the denominator is positive, for Q to be economically meaningful, the numerator also has to be positive. Refer to Figure 2.1 to understand how the determination of P and Q is illustrated graphically. A graphical representation of the autarky model in P-Q space, in accordance with the convention, is illustrated in Figure 2.2. It will be useful for later analysis to express the supply and demand equations in price dependent forms corresponding to the curves in the P-Q space as in Figure 2.2. Thus, the price dependent supply and demand equations are respectively, (6) (7) Ps Pd α 0 Qs α 2 X. α1 α1 α1 0 Q d β 2 Z 1 1 1 4 where Ps and Pd are supply and demand prices, respectively, and all other variables are as defined before. The equilibrium condition is stated as (8) Ps = Pd. The supply curve has the positive slope 1/ 1 0 , and the vertical intercept 0 / 1 is positive satisfying the provision that the price has to be sufficiently positive for any quantity supply to be forthcoming, assuming X is zero. Changes in the supply shifters (X) will shift the supply curve up or down depending on the signs of the corresponding coefficients in α 2 / 1 . The demand curve has the required negative slope 1/ 1 0 , and the vertical intercept is positive at 0 / 1 . Changes in the demand shifters will shift the demand curve up or down depending on the sign of the corresponding coefficients in 2 / 1 . The intersection of supply and demand curves, which is equivalent to setting the Qs = Qd as in (3) or Ps = Pd as in (8), determines the equilibrium price ( P ) and quantity ( Q ). The significance of the restrictions that P and Q are positive can be demonstrated using either Figure 2.1 or 2.2. For P and Q to be positive, the equilibrium point should be located above the horizontal axis, which requires that the numerators in (4) and (5) have to be positive, given that the denominators are positive. Though the materials presented in this section are elementary, they will be useful in analyzing the comparative statics of policy impacts in the later chapters. 5 IMPORT DEMAND AND EXPORT SUPPLY SCHEDULES Consider a country with supply and demand curves for a particular commodity, as depicted in P-Q space in Figure 2.3a. The autarky equilibrium price of the commodity is at P . For prices below P domestic demand will exceed domestic supply, and this country would like to import to meet all of its domestic demand. The excess or import demand (ED) of this commodity, depicted in Figure 2.3b, is the horizontal difference between domestic demand and supply curves for each price below P . The curve in Figure 2.3b measures import demand at various prices below P . The excess demand curve is negatively sloped because as the price falls farther below the P , import demand increases. At the autarky equilibrium price the import demand is zero, since the domestic supply satisfies the domestic demand exactly. To translate the excess demand into mathematical statements, consider the equations in (1) and (2) as the domestic supply and demand function of this importing country, which are rewritten here: (1) Qs 0 1P α 2 X 0 , 1 0 (2) Qd 0 1P β 2 Z 0 , 1 0 . The excess demand function is derived as (9) Qed Qd Qs 0 0 1 1 P β 2 Z α 2 X. The price dependent form of the excess demand function, corresponding to the curve in Figure 2.3b, is (10) Ped 0 0 Qed β Z α X 2 2 1 1 1 1 1 1 1 1 where Ped is the excess demand price. Thus, the intercept in Figure 2.3b is 0 0 / 1 1 , which is positive; the slope in 1/ 1 1 , which is negative. 6 Consider the exporting country with supply and demand curves for a particular commodity, as depicted in Figure 2.4a. The autarky equilibrium price of the commodity is at P . At the autarky equilibrium price, the export supply is zero since the domestic demand absorbs all the domestic supply. For prices above P the domestic supply will exceed the domestic demand. The excess or export supply (ES) for this commodity, depicted in Figure 2.4b, is the horizontal difference between the domestic supply and demand curves at each price above P . This curve captures the quantity of exports at various prices above P . The excess supply curve is positively sloped because as the price rises farther above P , this country will be able to supply more to the foreign markets. As in excess demand function, the excess supply can also be put in mathematical terms. Consider the following domestic supply (eqn. 1) and demand (eqn. 2) functions of an exporting country. (1) Qs 0 1 P α 2 X 0 , 1 0 (2) Qd 0 1 P β 2 Z 0 , 1 0 . The excess supply function is derived as 7 (11) Qes Qs Qd 0 0 1 1 P α 2 X β 2 Z. The price dependant form of the excess supply function, corresponding to Figure 2.4b, is (12) Pes 0 0 Qes α X β Z 2 2 1 1 1 1 1 1 1 1 where Pes is the excess supply price. Thus, the intercept in Figure 2.4b is 0 0 / 1 1 , which is positive implying that exports will not occur, assuming X and Z are 0, unless the price exceeds autarky equilibrium price. The slope of the excess supply cure is positive at 1/ 1 1 . It is important to note that a country can switch from an importer when world prices are below the autarky equilibrium price at some period to an exporter when world prices are above the autarky equilibrium price at other periods. This possibility is illustrated in Figure 2.5. Domestic demand and supply are plotted in Figure 2.5a; the autarky equilibrium price is at P . For prices below P , this country imports, and the corresponding import demand schedule is the A-B portion of the curve shown in the 8 positive quadrant of Figure 2.5b. For prices above P , this country exports, and the corresponding export supply schedule is the C-A portion of the curve shown in the negative quadrant of Figure 2.5b. Thus, in Figure 2.5b, imports are measured along the positive part of the x-axis and the exports are measured along the negative part of the xaxis. In mathematical terms, the import demand equation (9) can also be considered as the export supply function when Qed is negative, i.e., Qd < Qs. The case where a country switched from an exporter to an importer is illustrated in Figure 2.6. For prices above P , this country exports, and the corresponding excess supply schedule is the A-B portion of the curve shown in the positive quadrant of Figure 2.6b. For prices below P , this country imports, and the corresponding import demand schedule is the C-A portion of the curve shown in the negative quadrant of Figure 2.6b. Thus, in Figure 2.6b, exports are measured along the positive parts of the x-axis and imports are measured along the negative part of the x-axis. In mathematical terms, the export supply equation (11) can also be considered as import demand function if Qes is negative, i.e., Qs < Qd. A shortfall in domestic production can make an exporting country 9 become an importing country. Similarly, a bumper crop can switch a country from importer to exporter status. A classic example is Indian wheat trade. Between 1970 and 1991, India imported wheat in 12 years and exported in 10 years. LARGE AND SMALL COUNTRY ASSUMPTIONS In the literature, discussions about large and small countries are encountered frequently. The impacts of trade policies on large and small trading countries differ considerably. Since we analyze the large and small country cases throughout the text, it is important at this juncture to understand the differences between the large and small trading nations. First, let us examine the importing countries. LARGE AND SMALL IMPORTING COUNTRIES A large importing country imports large quantities of a particular commodity and plays a major role in the world market. Consequently, a large importing country can behave as a monopsony and alter the import price by changing its import demand. This implies that the excess supply, which originates from the exporting country, faced by this importing country is positively sloped (see Figure 2.7). Thus, the large importing country 10 can exercise its monopsony power to lower (raise) the import price by decreasing (increasing) the import demand as shown in Figure 2.7. The equation (11) can be used to represent the excess supply faced by this country. A small importing country imports only a small quantity of a particular commodity and plays an insignificant role in the world market. Consequently it can not alter the import price and behaves as a price taker. This implies that a small importing country faces a perfectly elastic excess supply curve, just like a competitive firm – being one of numerous small firms – behaves as a price taker in the input market by facing perfectly elastic input supply. Thus, changes in the import demand by the small importing country do not alter the import price as shown in Figure 2.8. Since the excess supply is perfectly elastic and import prices are constant at, say P , the excess supply can be represented as P = C, where C is a constant. LARGE AND SMALL EXPORTING COUNTRIES A large exporting country exports large quantities of a particular commodity and it plays a major role in the world market. Consequently, a large exporting country can 11 behave as a monopoly and alter the import price by changing its export supply. This implies that the import demand, which originates from the importing country, faced by this exporting country is negatively sloped (Figure 2.9). Thus, the large exporting country can exercise its monopoly power to lower (raise) the export price by increasing (decreasing) the export supply as shown in Figure 2.9. The equation (9) can be used to represent the import demand faced by this country. A small exporting country means it exports only a small quantity of a particular commodity and plays an insignificant role in the world market. Consequently it is ineffective in altering the export price and behaves as a price taker. This implies that this country faces a perfectly elastic excess demand curve, just like a competitive firm – being one of numerous small firms—behaves as a price taker in the product market by facing a perfectly elastic demand. Thus, changes in the export supply by the small exporting country do not alter the export price shown in Figure 2.10. Since the excess demand is perfectly elastic and export prices are a constant at, say P , the excess demand can be represented as P = D, where D is a constant. 12 TRADE AND WORLD PRICE DETERMINATION Trade in a particular commodity takes place between two countries because of price differences. The price difference is caused by the differences in the demand and supply conditions in each country. Thus, prices will be lower in a country where there is an excess supply relative to prices in a country where there is an excess demand. Under these conditions, the commodity will be exported by the country where the price is lower and imported by the country where price is higher. To formally examine trade between two countries, consider countries A and B, whose supply and demand functions are drawn in Figure 2.11. The autarky equilibrium price in the country A is Pa ; at any price above Pa , there will be surplus or excess supply of that commodity. Consequently, country A would like to export this commodity; the export supply (ESa) originating from this country is drawn in the middle diagram. The autarky equilibrium price in country B is Pb ; at any price below Pb , there will be shortage or excess demand for that commodity. Consequently, country B would like to import this commodity; the import demand (EDb) arising from this country is drawn in the middle diagram. It should be noted that Figure 2.11 is drawn assuming that currencies in the two countries are the same, and thus, the prices plotted along the vertical axes are in the same units. This assumption of single currency will be maintained until chapter 15 in Houck, where we discuss the effects of exchange rate changes on trade. 13 If the trade is allowed between these two countries, country A will export and country B will import until excess supply of A, ESa, equals the excess demand of B, EDb, Thus, the free trade equilibrium or world price, denoted P , is determined when excess supply and excess demand are equal. This condition also implies that at P , total world (A+B) supply equals total world (A + B) demand. This condition is shown below mathematically. Free trade converts the two separate domestic markets in A and B into a single global market. Also, free trade will equalize, assuming zero transport cost, the prices in both countries. Thus, with free trade the prevailing price in A is P , the quantity supplied and demanded at P are Qsa and Qad and the quantity of excess supply is Qaes . The price in B is also P , the quantity supplied and demanded at P are Qsb and Qdb , and b the quantity of excess demand is Qed . From the middle diagram, it should be clear that b Qaes is equal to Qed . The mathematical analysis of free trade equilibrium is carried out next. As we proceed with mathematical analysis, readers can improve their understanding by relating the equations with the graphs in Figure 2.11. Let country A’s supply and demand be (13) QSa 0a 1a P a α a2 Xa (14) Qad 0a 1a P a βa2 Za 0a , 1a 0 0a , 1a 0 and the excess supply of country A is derived as (15) Qaes QSa Qda 0a 0a 1a 1a P a α a2 Xa βa2 Za The variable definitions are as defined before, except now the superscript a refers to country A. 14 Similarly, country B’s supply and demand are (16) QSb 0b 1b P b α b2 Xb (17) Qdb 0b 1b P b βb2 Zb 0b , 1b 0 0b , 1b 0 and the excess demand of country B is derived as (18) b Qed Qdb QSb 0b 0b 1b 1b P b α b2 Xb βb2 Zb . The variable definitions are as defined before, except now the superscript b refers to country B. The free trade equilibrium is obtained by equating excess supply and excess demand, (19) b Qaes Qed and setting Pa = Pb = P . In figure 2.11, this free trade equilibrium is at point f. Note that the equality of excess supply and demand implies that (20) Qsa Qda Qdb Qsb' or (20’) Qsa Qsb Qda Qdb . Thus, free trade equilibrium is obtained by equating total world supply and total world demand. In this system of two-country free trade models, there are seven equationsa b - from eqn 13, to eqn19, and seven endogenous variables -- Qsa , Qda , Qes , Qsb , Qdb , Qed , and P. First we can solve for free trade equilibrium price P , by setting Pa = Pb = P from eqn 19. 15 (21) a0 0a 0b 0b α a2 Xa βa2 Za α b2 Xb βb2 Zb P 1a 1a 1b 1b As one would expect, P is determined by the parameters and the supply and demand shifters in both the countries. More specifically, the factors that increase the supply (demand) in both countries will depress (boost) the world price. On the other hand, the factors that decrease the supply (demand) in both countries will boost (depress) the world price. Since the denominator in eqn. (21) is positive, the numerator has to be positive for P in order to be economically meaningful. It is worth referring to figure 2.11 to know how the price determination in eqn (21) is illustrated graphically. P can be substituted for Pa in the supply and demand equations (13) and (14) to obtain the quantity supplied and demanded in country A under free trade: (22) Qsa a0 1b 1a 1b 1a 0b 0a 0b 1a α b2 Xb α a2 1a 1b 1b Xa 1a βb2 Zb a1a βa2 Za 1a 1a 1b 1b and (23) Qad a0 1a 1b 1b 1a 0a 0b 0b 1a βb2 Zb βa2 1a 1b 1b Za 1a α b2 Xb 1a α a2 Xa 1a 1a 1b 1b The quantities supplied and demanded in country A under free trade are also functions of parameters and supply and demand shifters. More specifically, the factors that increase the domestic demand in both countries and domestic supply in country A will augment the quantity supplied in A, because the demand factors boost the world price and domestic supply shifters shift the supply to the right, which causes an increase in quantity supplied in country A. On the other hand, factors that increase the supply in country B 16 depress the world price which reduces the quantity supplied in A. Factors that increase the domestic supply in both countries and domestic demand country A will expand the quantity demanded in country A, because the supply factors lower the world price and domestic demand shifters shift the demand to the right, which causes an increase in quantity demanded in country A. On the other hand, factors that increase the demand in country B boost the world price which reduces the quantity demanded in A. Similar discussions for the factors that have negative effects on demand and supply can be easily extended. For quantity supplied and demanded to be positive, the numerators in eqns. (22) and (23) should be positive. The equilibrium quantity of exports of country A under free trade can be obtained by either substituting P in the excess supply eqn. (15) or by subtracting quantity demanded (eqn. 23) from quantity supplied eqn. (22) (24) Qaes 1b 1b 0b 0b 1a 1a 1a 1a 1b 1b 1b 1b α a2 Xa 1b 1b βa2 Za 1a 1a α b2 Xb 1a 1a βb2 Zb 1a 1a 1b 1b a0 0a The exports of country A depend on the parameters and supply and demand shifters in both the countries. More specifically, the factors that increase the domestic supply in country A will increase the quantity of exports because these factors expand the supply by shifting the domestic supply curve to the right. The positive domestic demand shifters in country A will reduce the quantity of exports because these factors increase the domestic demand, by shifting the demand curve to the right, thereby crowding out the availability of the commodity for export. The positive supply shifters in country B will 17 reduce the exports of country A because more of this commodity is now available in country B as the supply shifts to the right and the excess demand shifts to the left. The factors that increase the domestic demand in country B will expand the quantity of exports of country A because more of this commodity is demanded in country B as the demand curve shifts to the right and the excess demand shifts to the right. Similar discussions for the factors that have negative effects on demand and supply can be easily extended. Refer to figure 2.11 to understand how determination of Qaes is illustrated graphically. P can be substituted for Pb in the supply and demand equations (16) and (17) to obtain the quantity supplied and demanded in country B under free trade: (25) Qsb 0b 1a 1a 1b 1b 0a 0a 0b 1b α a2 Xa α b2 1b 1a 1a Xb 1b βb2 Zb 1b βa2 Za 1a 1a 1b 1b and (26) Qdb 0b 1a 1b 1a 1b 0a 0a 0b 1b βa2 Za βb2 1b 1a 1a Zb 1b α a2 Xa 1b α b2 X b 1a 1a 1b 1b The quantity supplied and demanded in country B under free trade are functions of parameters and supply and demand shifters. More specifically, the factors that increase the domestic demand in both countries and domestic supply in country B will augment the quantity supplied in country B, because the demand factors boost the world price and domestic supply shifters shift the supply to the right, which helps to increase the quantity supplied in country B. On the other hand, factors that increase the supply in country A depress the world price which reduces the quantity supplied in B. The factors that 18 increase domestic supply in both countries and the domestic demand in country B will expand the quantity demanded in country B, because the supply factors lower the world price and domestic demand shifters shift the demand to the right, which helps to increase the quantity demanded in country B. On the other hand, factors that increase the demand in country A boost the world price which reduces the quantity demanded in B. Similar discussions for the factors that have negative effects on demand and supply can be easily extended. For quantity supplied and demanded to be positive, the numerators in ( eqns. 25 and 26) should be positive. The equilibrium quantity of imports of country B under free trade can be obtained by either substituting P in the excess demand eqn. (18) or by subtracting quantity supple (eqn. 25) from quantity demanded (eqn. 26) b Qed (27) 1b 1b 0b 0b 1a 1a 1a 1a 1b 1b 1b 1b α a2 Xa 1b 1b βa2 Za 1a 1a α b2 Xb 1a 1a βb2 Zb 1a 1a 1b 1b a0 0a The imports of country B depend on the parameters and supply and demand shifters in both the countries. More specifically, the factors that increase the domestic demand in country B will increase the quantity of imports because these factors expand the demand by shifting the domestic demand curve and also the excess demand curve to the right. The positive domestic supply shifter in country B will reduce the quantity of imports because these factors increase the domestic supply, by shifting the supply curve to the right, thereby reducing the need for imports, i.e., the excess demand shifts to the left. The positive supply shifters in country A will increase the imports by country B because more 19 of this commodity is now available in the world market as country A’s supply shifts to the right. The factors that increase the domestic demand in country A will reduce the quantity of imports by country B because more of this commodity is demanded in country A as the demand curve shifts to the right and less is available in the world market, i.e., the excess supply shifts to the left. Similar discussions for the factors that have negative effects on demand and supply can be easily extended. Refer to figure 2.11 to understand how determination of Qaes is illustrated graphically.