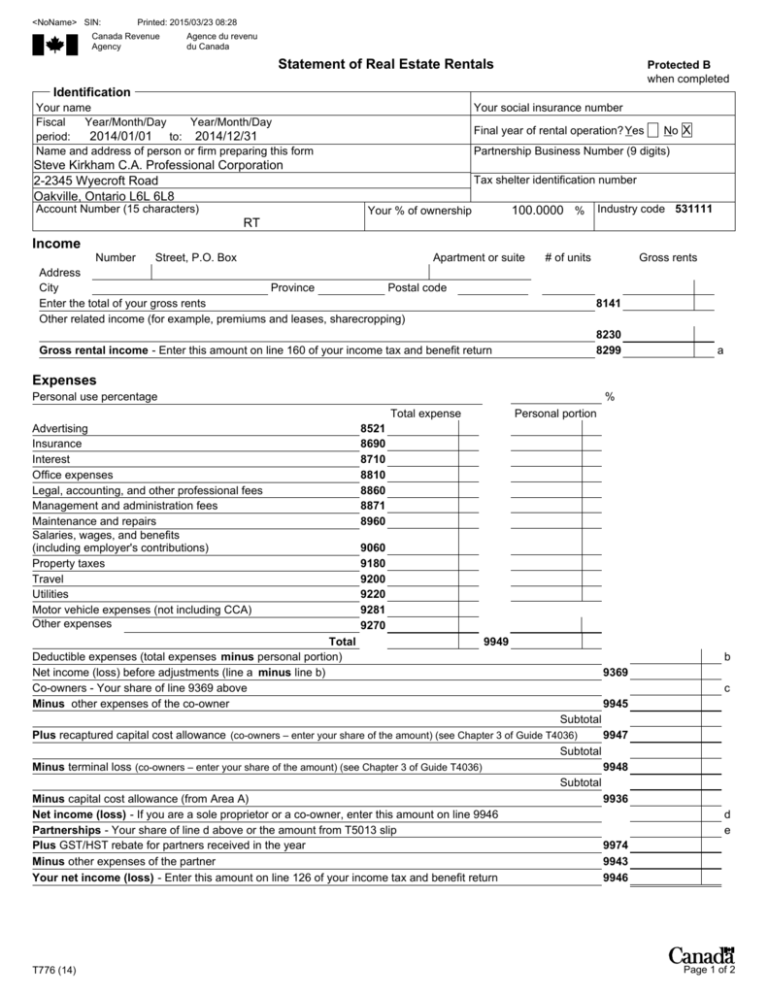

Statement of Real Estate Rentals Income Expenses

advertisement

<NoName> SIN: Printed: 2015/03/23 08:28 Canada Revenue Agency Agence du revenu du Canada Statement of Real Estate Rentals Protected B when completed Identification Your social insurance number ___ ___ ___ Your name Fiscal Year/Month/Day Year/Month/Day period: 2014/01/01 to: 2014/12/31 Name and address of person or firm preparing this form Final year of rental operation? Yes Partnership Business Number (9 digits) Steve Kirkham C.A. Professional Corporation 2-2345 Wyecroft Road Oakville, Ontario L6L 6L8 Account Number (15 characters) No X _________ Tax shelter identification number ________ 100.0000 % Industry code 531111 Your % of ownership _____ ____ RT ____ Income Number Street, P.O. Box Apartment or suite Address City Province Postal code ___ ___ Enter the total of your gross rents Other related income (for example, premiums and leases, sharecropping) Gross rental income - Enter this amount on line 160 of your income tax and benefit return # of units Gross rents 8141 8230 8299 a Expenses Personal use percentage % Total expense Advertising Insurance Interest Office expenses Legal, accounting, and other professional fees Management and administration fees Maintenance and repairs Salaries, wages, and benefits (including employer's contributions) Property taxes Travel Utilities Motor vehicle expenses (not including CCA) Other expenses Total Deductible expenses (total expenses minus personal portion) Net income (loss) before adjustments (line a minus line b) Co-owners - Your share of line 9369 above Minus other expenses of the co-owner Personal portion 8521 8690 8710 8810 8860 8871 8960 9060 9180 9200 9220 9281 9270 9949 b 9369 c 9945 Subtotal Plus recaptured capital cost allowance (co-owners – enter your share of the amount) (see Chapter 3 of Guide T4036) 9947 Subtotal Minus terminal loss (co-owners – enter your share of the amount) (see Chapter 3 of Guide T4036) 9948 Subtotal Minus capital cost allowance (from Area A) 9936 Net income (loss) - If you are a sole proprietor or a co-owner, enter this amount on line 9946 Partnerships - Your share of line d above or the amount from T5013 slip Plus GST/HST rebate for partners received in the year 9974 Minus other expenses of the partner 9943 Your net income (loss) - Enter this amount on line 126 of your income tax and benefit return 9946 T776 (14) d e Page 1 of 2 <NoName> SIN: Printed: 2015/03/23 08:28 Protected B when completed Details of other co-owners and partners Co-owner or partner's first name Last name Address: Co-owner or partner's first name Last name Address: Co-owner or partner's first name Last name Address: Co-owner or partner's first name Last name Address: Co-owner or partner's first name Address: T776 (14) Last name Percentage of ownership Share of net income (loss) Percentage of ownership Share of net income (loss) Percentage of ownership Share of net income (loss) Percentage of ownership Share of net income (loss) Percentage of ownership Share of net income (loss) % % % % % See the privacy notice on your return. Page 2 of 2