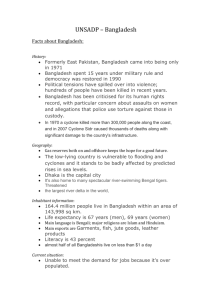

Public and Private Sector Approaches to Improving Pharmaceutical

advertisement