Classification of environmental accounting systems

advertisement

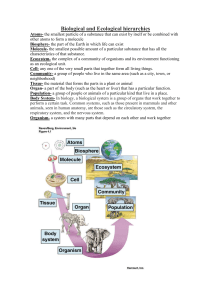

A classification of environmental accounting systems By J.Richard (2008) ,text published in « Encyclopédie de la comptabilité -2009 » 1 Foreword • Accounting :one of the main instruments of regulation in the capitalist world (visible hand) • Most businesses try to maintain their financial capital with the help of accounting (concept of depreciation); some without any law • Without accounting no more dividends ,no more taxes, may be no more markets! • Capitalist accounting has changed a lot (phases) • Financial accounting: the result of a long and tumultuous process • Romans :fructus (Hicks); 1200-1300 middle age florantins:capital and balance sheet;1800-1850:comprehension of the concept of systematic depreciation;1900- 1945:general appliance of the concept of depreciation;2000 :no more depreciation? (see fair value and goodwill) 2 Foreword (end) • • • • • • • Curiously today (2000-2010) the question of E accounting for economy and businesses is marginal in the debate about the creation of a new economic system in line with sustainable development See books of ecological economics: E policy instruments are limited to command and control instruments,tradable permits and taxation See financial and management accounting books (generally almost nothing on the subject See books of modern finance (BM for ex): nothing See Grenelle de l’environnement :absence of discussion Only some theoretical discussions of a new GDP at a very high level Why? Absence of proposals?or other factors 3 Introduction • • • Environmental accounting is recent but not totally new The very first works appear in the beginning of the seventies 1971:in the field of national accounting the AmericanNordhaus and Tobin publish « Is growth obsolete? » • 1972:in the field of business accounting the Swiss Müller-Wenck publishes « Ökologische Buchhaltung eine Einführung » (ecological accounting an introduction) • Europe is in advance in the field of business accounting (see notably Schaltegger , Bebbington and Gray; in France Christophe) • Very few works but very rich ones and different ones with a difficult problem of classification 4 Introduction (following) • We would like to propose a classification • This classification is based on 7 main criteria allowing to determinate the nature of an environmental accounting system • The criteria are the following ones: • • • • • • • 1 the direction of the relationship with the environment 2 the dimension of the environment 3 the way of conservation of the capital 4 the spatial dimension of the information 5 the degree of detail of the information 6 the type of valuation of the data 7 the concept of result (income) 5 The proposed classification S ig le s (a n g la is ) F ig u r e 1 C la s s ific a tio n o f e n v ir o n m e n ta l a c c o u n tin g V ie w IE EI STRO NG M odel W EAK W EAK D im e n s io n M ACRO EI M IC R O W EAK M IC R O M IC R O EDPA EDPA W EAK M IC R O W EAK M IC R O P r ic e s S Y S T E M O F V A L U E S RC … … . H B S O (G ) M P … … G PI (G AV … … … B S O (G ) SEEA ) G (A ) EDPA (T ) TPA B S O (G ) V Va lael ue ur sr sE EC C ) E c o p o in ts ........... E n e rg ie s (G ) A Analytical (accounting) AV Actuarial value BMW Brunschweig Müller-Wenk EC Ecological EDPA Environmentally Differentiated Private Accounting EI External Internal (view) EMAS Eco Management Audit Scheme G General (accounting) GPI Genuine Progress Indicator GRI Global Reporting Initiative H Hueting IE Internal-External (view) LCA Life cycle Analysis MP Market Price NRE New Regulation for Economy P Pillet RC Restoration cost T Tax (accounting) TPA Traditional Private Accounting SEEA System of Environmental and Economic Accounting W Wackernagel BM W P S u rfa c e s W Q u a n titie s … .… … W LC A G RI EM AS NRE 6 1-The direction of the relationship with the environment • Every accounting system is determined by the point of view of a dominating actor who imposes his own view ; this rule also applies to E.accounting • In line with Schaltegger and alii (1996) we will distinguish two very different views: – The external-internal view (or outside-in view) – The internal -external view (or inside-out view) 7 11- The external-internal view (outside-in view) • According to this view the accounting system (inside) is concerned by the environment (outside) only and if only specific external rules to the organisation oblige it to take account of the impacts on the Environment • In a sense the problem is more to know the impacts of the Environment on the firm that the reverse • This type of E accounting is in line with traditional financial accounting • One could wonder if it is worth while , in the frame of this view, to speak of an environmental accounting? 8 The external-internal view (following) • The response is the following one :we will speak of an environmental accounting only if the received « impacts » from the environment are isolated and specifically showed inside the accounts • Schaltegger and alii speak of an « environmentally differenciated accounting » • As far as, in this type of E.accounting, only the financial private capital is concerned we will speak of a « private (or financial) environmentally differenciated accounting » 9 12-The internal –external view (inside-out) • According to this view the organisation (inside) seeks to know all its impacts and its consequences on the environment (outside) • If using the language of ecological economists the goal is to internalize in accounting all the « externalities » so that to know the total damage caused to the E • Normally, according to this view, it is no more possible to take only account of the financial capital; the environmental capital must also be conserved which means an extension of the Hicksian rule of conservation of capital • We will name this very different E.accounting « ecological and human environmental accounting » 10 2- The dimension of the environment • It is traditional to oppose two conceptions of the environment • According to a restrictive conception the environment is limited to the natural environment • In that case E accounting is (only) an ecological or green accounting • According to an extensive view the environment also comprises the humans contributing to the organisation • In that case E accounting is an « ecological and human environmental accounting » • In the following developments we will focus on this enlarged conception wich is more adaptated to the three pillars view 11 3- The way of conservation of the capital • According to the private environmentally differenciated E accounting the question is simple: the only one capital to be conserved is the financial capital • In the context of the ecological and human accounting the problem is much more complicated because there are three types of capital to be maintained • Daly(1973) has showed that there exists two models of the conservation of the natural capital (reasoning which can be extended to the human capital): the « weak » and the « strong » models 12 31- The weak model of conservation of the E capital • According to this model a compensation between financial capital, ecological capital and human capital is admitted • So the concervation of the capital is a global one • So the priority of financial capital could be conserved • NB generally when it is spoken of a « three pillars » view of SD this conception is implicitely (sometimes but rarely explicitely) admitted 13 32- The strong model of conservation of the capital • According to this view each type of capital must be separately conserved: no compensation is admitted • Daly has demonstrated the necessity of a strong approach to permit the development of humanity on a sane basis • Daly has also shown that the realisation of a strong approach implies the calculation and the respect of naturel standards (limits) not to be tresspassed • These limits may be exprsessed in terms of stocks and /or flows 14 4-The spatial dimension of the information • It is traditional in the field of accounting to distinguish national macro-accounting systems from business micro-accounting systems • It is relatively rare that a relationship between them is made ,as well in the fields of research as in the fields of practice and education • There are however some exceptions especially in countries where a tradition of governance with the help of planification is observed (see for example the case of the French traditional business accounting system since 1980). 15 The spatial dimension of E accounting (following) • This kind of separation also exists in the field of E accounting • For example there are many various proposals of macro E.accounting systems that are frequently ignored in the field of micro E. accounting (and reciprocally) • This kind of separation is not justified and will be rejected here for three main reasons: • The environmental problem is a global one where micro and macro questions are intricated • With the development of the social responsability of businesses the spatial dimension of business accounting is enlarged (see for example the development of LCA thereafter) • Many ideas of macro-economist are very interesting for conception of new types of business accounting (see after for example the Hueting’s proposals) 16 5- The degree of detail of the information • It is traditional in the field of private financial business accounting to distinguish two main types of accounting • General (or « financial ») accounting which gives information on the global result • Analytical (or « management » accounting) which gives information on partial results (products,investment projects..) • This kind of separation is largely connected with socio-political problems notably the problem of business secrets and the problem of valuation • This kind of separation is also prevalent in the field of E accounting; hence the distinction of: • General environmental accounting systems • Analytical environmental accounting systems • Schaltegger and alii also distinguish a third « tax E accounting but it seems to us that this is a question of valuation which is to be discussed separately 17 6- The type of valuation of the data • Already in the field of traditional accounting there is a fierceful social-political debate on the choice of a valuation concept (unit) in order to determinate the business income there are mainly: • The partisans of market prices • The partisans of (historical) costs • The partisans of discounted values • The same debate exists in the field of Environmental accounting • But it is even more acute because some specialiste even refuse any recourse to market based prices , costs or values • We can in this respect distinguish three main types of Environmental accounting systems: 18 The three main types of valuation units in environmental accounting • Some accountants try to determinate global results (E.impacts) with the help of units derived from the observation of markets ; they differ because they can use various units: • Some propose market prices (MP) • Other propose restoration costs (RC) connected with standards allowing for the restoration of the E.functions • Other propose hedonic prices (HP) • Other propose values in use derived from actuarial values (AV) • Other accountants also try to determinate global results but without any recourse to market data (wich are deemed to be dangerous or meaningless for SD ): • Some propose eco-points it means special units taking account of the degree of toxicity of environmental impacts • Other propose units of surface • Other propose units of energy 19 The three main types of valuation units for E accounting (end) • A third group of specialists renounces to calculate a global result with the recourse to valuation units and limit the function of E accounting systems to the delivery of quantitative data ex :number of tons of emitted CO2 NB in that case there could be a debate about the question if this type of information is constituting a real accounting system 20 7- The concept of income • • • • • • Accounting is a subjective social institution It is « subjective » in the sense that the subject who detains the power defines the concepts of expenses and revenues so as to determinate his own income (bottom line of the P$L statement) Up to now the income of most of accounting systems has been defined in correlation with the sole interests of financial capitalists (private or governmental ones) But the evolution towards an Ecological and human E accounting corresponding to a strong view could be associated with a redefinition of the concept of residual income It is notably symptomatic that some examples of such types of E accounting are accompanied with a proposal to take a kind of « green added value » as a basis of a new concept of result for the sake of stakeholders Obviously this type of evolution would imply a very massive revolution of thoughts detrimental to the power of traditional financial capitalists 21 Examples • It is now possible to apply these criteria of classification and to propose a classification of some major contributions for building new systems of E accounting • See the following annex which distinguishes (in a simplified manner) – – – – a « Dutch » school of accounting A « Swiss » school of accounting An « American » school of accounting A « statistical » (not strictly an accounting?) approach 22 1 The Dutch school • Hueting ‘s proposal (national accounts) • BSO’s proposal (business accounts) • These proposal are – Inside-out oriented – Defending a strong approach of conservation of natural capital (with some question about BSO) – Calculating a global monetary result – On the basis of restoration costs 23 Hueting’s proposal • • • • • • Hueting wants to correct the GDP to take account of the losses of the natural capital (externalities) He does not believe in the practical possibility to value the nature on the basis of prices, even shadow prices or contingent prices He focuses on restoration costs (see the influence of Limperg ?) He proposes to establish a set of national standards to be respected to conserve the natural capital and to calculate the restoration costs to get these standards These restoration costs will be passed as expenses into the national accounts to lower the GDP This could be interpreted as a return to a kind of historical cost accounting which is contrary to the actual trend towards market value accounting systems 24 Hueting’s demand curve 25 The BSO case • • • • • BSO was a Dutch computer software company (purchased by Atos –Origin) In 1990 BSO published an Environnemental report containing « green » accounts that became very famous The idea was to take the added value as a basis and to correct it by deducting the externalities (« cost of residual effects ») These costs are ,practically, obtained by « establishing the marginal cost of environmental protection which corresponds to « optimum » environmental health ».. « in accordance with current social standards »; they will use reports of economic institutes So BSO seems to be a replica of the Hueting’s proposal at the micro level ,but there are some elements that are not so clear in comparison with the Hueting’s model 26 Some uncertainties by BSO • What is the purpose of these reports (management,information, public relations?) • Is the sum corresponding to the externalities to be reserved (no distribution of dividends)? • Why deduct externalities from added value (not from profit) • What is concretely « optimum environmentaly health »? • They say that « the price society considers reasonable to mitigate the ecological effects is substantially higher tha the price we are paying at present » and that « what is considered reasonable is not enough to reduce pollution up to the point where the planet could absorb the remainder » • Finally they take account of the standards of the Dutch NEPP but they double them • So what ?Is this standard in line with the conservation of natural capital? • With the benefit of doubt we have classified BSO as internal-external and strong approach 27 2 The Swiss school • • • • • • • • Muller-Wencks’ proposal Wackernagel’s proposal Pillet’s proposal All these authors basically refuse the use of prices because prices have nothing to do with the measure of the degradation of the natural capital NB they do not mention the Hueting’s proposal They will use special ecological units to measure this degradation All these proposal are inside-out (use of natural capital is taken all but partially in consideration) All these proposals are defending a strong view (existence of standards related to the limit of natural capital) 28 The Müller – Wenck’s proposal (Die ökologische Buchhaltung) • • • • • • All agressions against nature ‘emissions, consumption of NRR..) are valued on the basis of eco-points Eco-points are measures of the degree of dangerousness (toxicity) of pollutions and degree of rarety (NRR) Eco-points ,as units of value,are obtained by comparing some level of pollution (consomption of NRR) with limits of pollution (reserves of NRR); the nearer of pollution limits the higher the value of ecopoints; when nearing the limits the value is « boosted (warning) » global eco-points (qtxunits) are obtained for each element of pollution (consumption) and added to get a global result; Normally each limit is impassable MW applies this accounting system to enterprises and associations notably in Germany and Switzerland . 29 The Wackernagel’s conception (ecological footprint) • All human material consumptions (net of exports) of a country are expressed in global hectares of land necessary to produce them – NB to make this calculation it is taken account of the productivity of management in different zones and of the relative quality of soil • All emissions of greenhouse gases (not captured) and all production of nuclear energy is expressed in global hectares of land covered by forests • These 2 consumptions of « real » global hectares are compared with the disponible global hectares in the country – NB disponible hectares of forest are set apart to know the forest deficit) • If real hectares> disponible hectares (ecological deficit) : – Either importations of biocapacity – Or liquidation of natural capital (overshoot) 30 The Pillet’s proposals (based on Odum’s proposals) • All material consumption (net of exports) of a country is expressed in solar energy needed for obtening it • This quantity is compared with the disponible solar energy disponible in the country • If there is a deficit: – Imports from abroad – No sustainability 31 3 The « American » school (main stream) • Like the preceeding schools this school tries to get a global result (« true » accounting system) • This school tries to use prices to value the externalities and to correct the traditional accounts on that basis (inside-out view) • This school is not trying to relie the data with limits (standards) expressing a sustainable use of the natural (human) capital • In that sense it belongs to the weak view • Some examples: GPI,SEEA 32 The GPI (Guenuine Progress Indicator) by Cobb,Halstead,Rowe • Correction of the GDP • To take account of social problems • Cost of commutation • Cost of lost of leisure • Cost of crime …. • To take account of waste of natural resources • Then a global income is calculated (implied emphasis on compensation due to the absence of Environmental standards) • Various units of valuation -prices paid for damages -restoration costs 33 The SEEA (UN,Worldbank,EU,OECD) • Correction of GDP • Only for waste of natural capital • Priority of valuation given to market prices then values in use,then (at default) costs • An exemple: NRR are valued on the basis of the discounted economic rent (difference between the market prices and normal expenses) 34 4 The « statistical » trend ( cf balance and score-cards) • • • • Inside –out view but No use of common units Hence no global results Mainly weak approach but sometimes strong approach if use of Env limits 35 Some examples of a « statistical » approach with a weak view • • • • • GRI EMAS Law NRE Most carbon balances Most LCA 36 An example of a statistical approach with a strong view • Lamberton case (Australian farm) • Two sets of physical environmental standards • One set : internal management targets • One other set :environmental targets (measured by E experts) 37 Conclusion • A high diversity of experiences of environmental accounting for business • A big choice of possibilities for the accounting system of to-morrow • Concrete experiences exist for « true »E accounts • But these experiences are ignored • Generally what is considered as E accounting is under the umbrella of a statistical approach (see GRI-EMAS) • No desire to correct the financial accounting system and to find new figures of income ( strict separation of financial and green accounts reduced to quantities) • So the distribution of dividends is a blind one : risk of distribution of fictitious dividends 38 Conclusion (end) • What could explain the reluctance of today’s firms to engage in a reconstruction od accounting to take account of natural and human capital • Clearly ,under the pressure of short sighted shareholders and managers there is no desire to see accounts impacted by the necessary losses and depreciations to take account of the degradation of the human and natural capitals (see the GPI figures) • We need a big change of business governance to change this situation • Sarkozy’s three tier proposal applied to power? 39 Exit (and hope) • The flexibility of accounting is extraordinary • There has already been a lot of revolutions in the field of accounting • But the main revolution is for to morrow: introduce the human and the natural capital on the liabilities’side of the balance sheets • After that the financial capital will be reduced to a second role 40