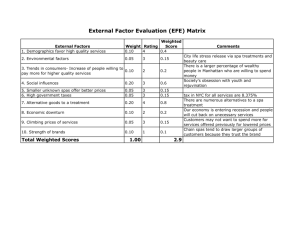

Caribbean Spa and Wellness Strategy (2014

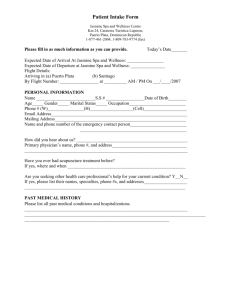

advertisement