Banks

Switzerland

Zuercher Kantonalbank

Full Rating Report

Key Rating Drivers

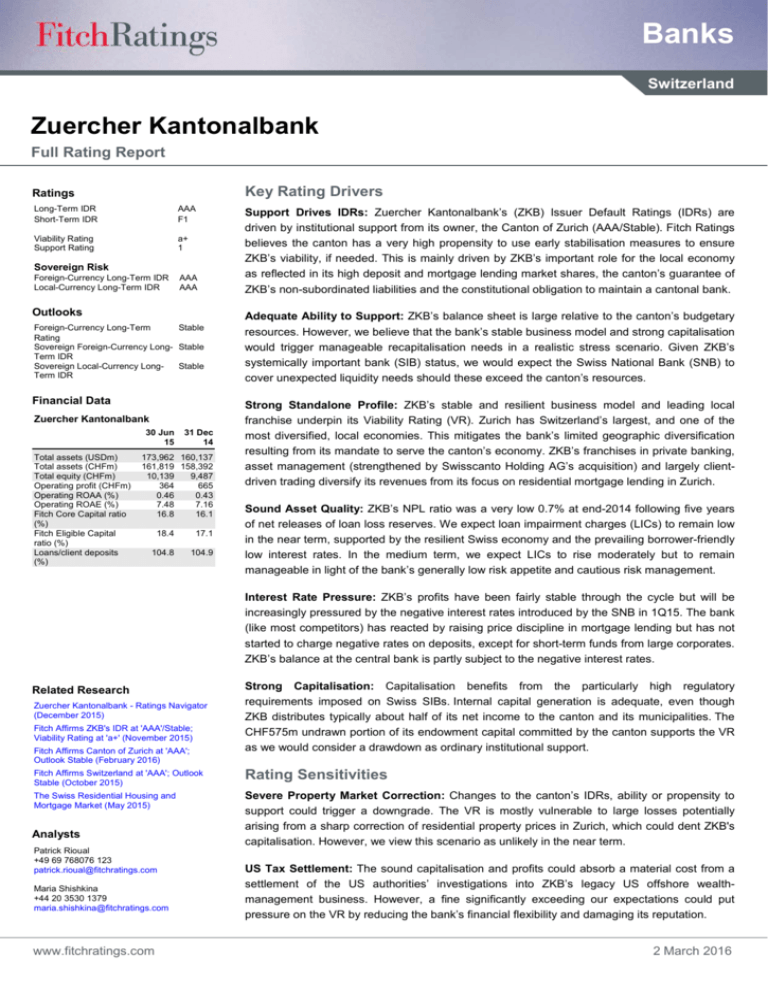

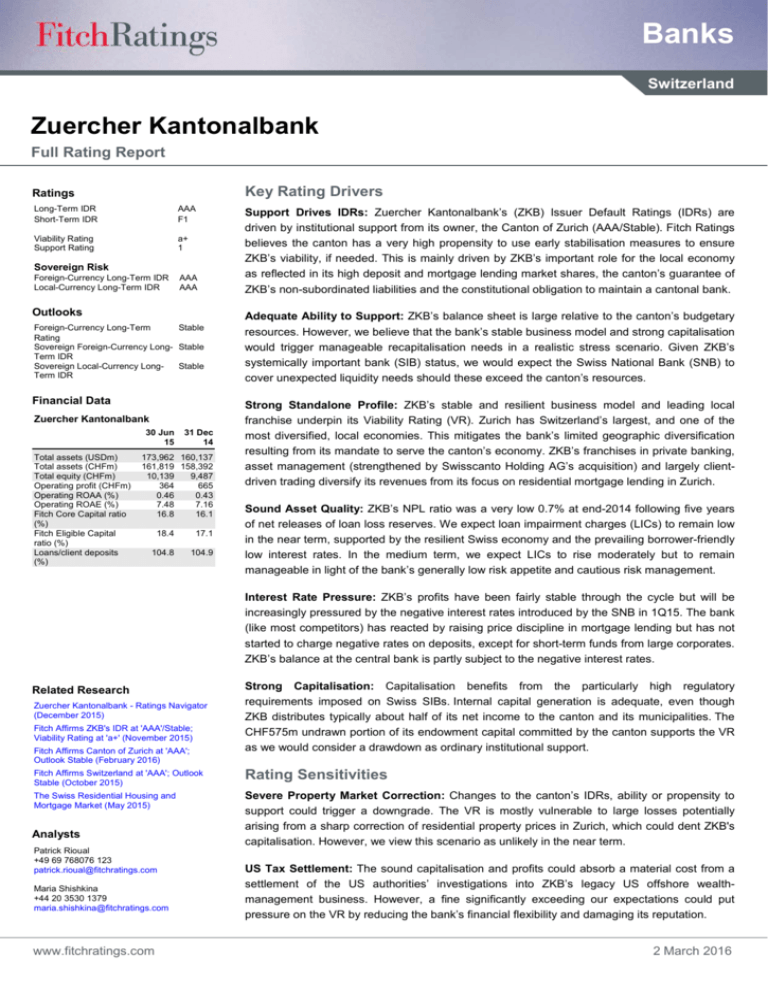

Ratings

Long-Term IDR

Short-Term IDR

AAA

F1

Viability Rating

Support Rating

a+

1

Sovereign Risk

Foreign-Currency Long-Term IDR

Local-Currency Long-Term IDR

AAA

AAA

Outlooks

Foreign-Currency Long-Term

Stable

Rating

Sovereign Foreign-Currency Long- Stable

Term IDR

Sovereign Local-Currency LongStable

Term IDR

Financial Data

Zuercher Kantonalbank

30 Jun

15

Total assets (USDm)

Total assets (CHFm)

Total equity (CHFm)

Operating profit (CHFm)

Operating ROAA (%)

Operating ROAE (%)

Fitch Core Capital ratio

(%)

Fitch Eligible Capital

ratio (%)

Loans/client deposits

(%)

31 Dec

14

173,962 160,137

161,819 158,392

10,139

9,487

364

665

0.46

0.43

7.48

7.16

16.8

16.1

18.4

17.1

104.8

104.9

Support Drives IDRs: Zuercher Kantonalbank’s (ZKB) Issuer Default Ratings (IDRs) are

driven by institutional support from its owner, the Canton of Zurich (AAA/Stable). Fitch Ratings

believes the canton has a very high propensity to use early stabilisation measures to ensure

ZKB’s viability, if needed. This is mainly driven by ZKB’s important role for the local economy

as reflected in its high deposit and mortgage lending market shares, the canton’s guarantee of

ZKB’s non-subordinated liabilities and the constitutional obligation to maintain a cantonal bank.

Adequate Ability to Support: ZKB’s balance sheet is large relative to the canton’s budgetary

resources. However, we believe that the bank’s stable business model and strong capitalisation

would trigger manageable recapitalisation needs in a realistic stress scenario. Given ZKB’s

systemically important bank (SIB) status, we would expect the Swiss National Bank (SNB) to

cover unexpected liquidity needs should these exceed the canton’s resources.

Strong Standalone Profile: ZKB’s stable and resilient business model and leading local

franchise underpin its Viability Rating (VR). Zurich has Switzerland’s largest, and one of the

most diversified, local economies. This mitigates the bank’s limited geographic diversification

resulting from its mandate to serve the canton’s economy. ZKB’s franchises in private banking,

asset management (strengthened by Swisscanto Holding AG’s acquisition) and largely clientdriven trading diversify its revenues from its focus on residential mortgage lending in Zurich.

Sound Asset Quality: ZKB’s NPL ratio was a very low 0.7% at end-2014 following five years

of net releases of loan loss reserves. We expect loan impairment charges (LICs) to remain low

in the near term, supported by the resilient Swiss economy and the prevailing borrower-friendly

low interest rates. In the medium term, we expect LICs to rise moderately but to remain

manageable in light of the bank’s generally low risk appetite and cautious risk management.

Interest Rate Pressure: ZKB’s profits have been fairly stable through the cycle but will be

increasingly pressured by the negative interest rates introduced by the SNB in 1Q15. The bank

(like most competitors) has reacted by raising price discipline in mortgage lending but has not

started to charge negative rates on deposits, except for short-term funds from large corporates.

ZKB’s balance at the central bank is partly subject to the negative interest rates.

Related Research

Zuercher Kantonalbank - Ratings Navigator

(December 2015)

Fitch Affirms ZKB's IDR at 'AAA'/Stable;

Viability Rating at 'a+' (November 2015)

Fitch Affirms Canton of Zurich at 'AAA';

Outlook Stable (February 2016)

Strong Capitalisation: Capitalisation benefits from the particularly high regulatory

requirements imposed on Swiss SIBs. Internal capital generation is adequate, even though

ZKB distributes typically about half of its net income to the canton and its municipalities. The

CHF575m undrawn portion of its endowment capital committed by the canton supports the VR

as we would consider a drawdown as ordinary institutional support.

Fitch Affirms Switzerland at 'AAA'; Outlook

Stable (October 2015)

Rating Sensitivities

The Swiss Residential Housing and

Mortgage Market (May 2015)

Severe Property Market Correction: Changes to the canton’s IDRs, ability or propensity to

support could trigger a downgrade. The VR is mostly vulnerable to large losses potentially

arising from a sharp correction of residential property prices in Zurich, which could dent ZKB's

capitalisation. However, we view this scenario as unlikely in the near term.

Analysts

Patrick Rioual

+49 69 768076 123

patrick.rioual@fitchratings.com

Maria Shishkina

+44 20 3530 1379

maria.shishkina@fitchratings.com

www.fitchratings.com

US Tax Settlement: The sound capitalisation and profits could absorb a material cost from a

settlement of the US authorities’ investigations into ZKB’s legacy US offshore wealthmanagement business. However, a fine significantly exceeding our expectations could put

pressure on the VR by reducing the bank’s financial flexibility and damaging its reputation.

2 March 2016

Banks

Operating Environment

Figure 1

Swiss Banks' Deposit Rates

Sight deposits

Savings deposits

12-month time deposits >CHF0.1m

(%)

0.20

0.15

0.10

0.05

0.00

-0.05

-0.10

-0.15

Jul 15

May 15

Jan 15

Mar 15

Nov 14

Jul 14

Sep 14

May 14

Mar 14

Jan 14

SNB rate cut

Source: SNB

Figure 2

Swiss Banks' Mortgage Rates

10-Year Fixed

(%)

3.0

SNB rate cut

Concentration on the Small but Wealthy and Diversified Zurich Region

ZKB is predominantly active in the Canton of Zurich, Switzerland's largest region, which

accounts for over a fifth of the country’s GDP and a fifth of the total population (about 1.5m).

The region is wealthy and economically diversified, creating a stable and resilient environment

that adequately mitigates ZKB’s modest geographic diversification. Fitch expects solid GDP

growth for Switzerland of 1.6% in 2016 and 1.8% in 2017 despite the Swiss franc’s strength,

but rising household debt/GDP exposes retail clients to potential economic downturns.

Market Discipline Mitigates Pressure from Negative Interest Rates

The SNB’s unexpected removal of the Swiss franc’s ceiling against the euro in January 2015

triggered a sharp appreciation of the franc despite the simultaneous cut of short-term rates into

negative territory. Most Swiss banks, including ZKB, have not passed on negative rates to retail

depositors. Instead, they have mitigated the resulting margin pressure by maintaining solid

market discipline, raising fees and margins on mortgage lending. Trading income has also

benefited from rising market volatility following the SNB’s move. However, this may be

insufficient in the long term. Moreover, a significant share of the bank’s large cash balance at

the SNB is subject to negative interest rates, which further depresses profitability.

2.5

2.0

Company Profile

1.5

Largest Cantonal Bank and One of Five Swiss SIBs

1.0

ZKB, by far the largest of Switzerland’s 24 cantonal banks, is a public-law institution owned by

the Canton of Zurich. Its stable business model is primarily underpinned by solid market shares

in retail deposit and mortgage lending in the Zurich region of 28% and 35%, respectively. It is

also Switzerland’s third-largest bank by assets (the fourth largest if the unconsolidated

cooperative Raiffeisen banks are considered as a single group). The SNB categorises ZKB as

one of Switzerland’s five SIBs – alongside Credit Suisse Group AG (A/Stable), UBS Group AG

(A/Positive), PostFinance AG and Raiffeisen – due to its sizeable retail franchise. This status

imposes particularly stringent regulatory capital and liquidity requirements.

0.5

Jul 15

May 15

Mar 15

Jan 15

Nov 14

Sep 14

Jul 14

May 14

Jan 14

Mar 14

0.0

Source: SNB

Figure 3

Loans by Borrower Types

CHF89bn at end-1H15

Retail/small SMEs

Swisscanto Acquisition Improves Business Diversification

Corporates

Public sector

(CHFbn)

80

The acquisition of Swisscanto, completed in 1Q15, has further diversified ZKB’s business

scope beyond its core regional retail banking franchise. Following the acquisition, ZKB became

Switzerland’s third-largest investment fund provider and fourth-largest asset manager.

60

Small Private Banking Franchise

40

ZKB began to develop its domestic and international private banking franchise a decade ago.

Its core European markets are Germany, the UK, Italy, Spain, Austria and the Czech Republic,

with its core emerging markets being the United Arab Emirates and Hong Kong. The bank

monitors the tax compliance of its international private banking clients, which accounted for

only 5% of the unit’s CHF64bn assets under management at end-2014.

20

0

Other

loans

Source: ZKB

Mortgages

Figure 4

Assets Under Management

(End of period in

CHFbn)

1H15a 2014 2013

Managed by ZKB

73

34

31

Managed mandate

56

31

28

Other client assets

133 134 134

Total client assets

262 199 192

O/w double-counted

35

20

18

Net new money

2.5 -2.3 -0.2

a

Including Swisscanto

Source: ZKB

Related Criteria

Management and Strategy

Public Service Mandate Defines Strategy

ZKB’s public mandate set out in a dedicated cantonal law, the ZKB Law, governs its focus on

the Zurich region. The law prescribes the sustainable provision of comprehensive banking

services to local households and SMEs, and the support of the canton’s economic and social

development by fostering home ownership and construction of affordable housing.

Beyond Zurich, ZKB lends mostly to Swiss SMEs and export-focused companies. International

expansion is likely to remain modest due to the US tax investigations and the uncertainty in the

eurozone. We expect private banking and asset management to grow most given ZKB’s high

local market shares in retail and corporate banking and constraints imposed by the ZKB Law.

Global Bank Rating Criteria (March 2015)

Zuercher Kantonalbank

March 2016

2

Banks

We view management’s experience and execution record as solid. This is evidenced by the

bank’s fairly stable performance, notably during the financial crisis. Corporate governance is

effective, with neutral rating implications.

Risk Appetite

Robust Risk Controls and Prudent Risk Appetite

Credit risk is by far ZKB’s major source of risk, accounting for 59% of its capital at risk (CaR) at

end-2015. Market and operational risks accounted for 28% and 13%, respectively. ZKB has

tightened its conservative underwriting standards in recent years amid concerns over inflating

residential property valuations in Switzerland, and in Zurich in particular. The bank switched to

a more conservative loan-to-value (LTV) calculation by adjusting market values of properties

for depreciation and increasing market standards.

Risk limits are conservative and the ZKB Law limits risk appetite. Risk-management controls

and parameters are robust and subject to regular reassessment. Management is assisted in

the implementation and monitoring of risk policies by a committee chaired by the chief risk

officer (CRO), who reports directly and regularly to the supervisory board. The CRO produces

quarterly reports covering significant risk areas. ZKB also carries out periodic stress testing and

scenario analyses. Capital allocation is calculated using a CaR model.

Below-Average Mortgage Lending Growth

We view ZKB’s asset growth (5.5% a year since the start of the financial crisis) and new business

volumes as sustainable relative to its steady internal capital generation. Mortgage loans, which

make up the bulk of ZKB’s credit exposures, have grown at below-market rates since 2011.

Management expects total assets to continue growing below market rates in the coming years.

Litigation Cost from US Tax Investigation Manageable in Our Base Case

Figure 5

Below-Average Growth

Swiss domestic mortgage loans

Stock - Swiss banksᵃ (LHS)

Stock - ZKB (LHS)

Growth yoy - Swiss banksᵃ (RHS)

Growth yoy - ZKB (RHS)

(CHFbn)

1,200

900

(%)

6

Rising Interest-Rate Risk in the Banking Book

4

ZKB controls its interest-rate risk in all currencies by using value-at-risk (VaR; 99% confidence

interval, 20-day holding period) and CaR approaches and sensitivity analyses. Fitch considers

that ZKB’s exposure to interest-rate risk in the banking book, which is almost entirely driven by

Swiss franc-denominated assets and liabilities, has increased. At end-9M15, a one basis-point

parallel shift in the yield curve would have resulted in a CHF7.6m change in the value of equity,

which implies a sensitivity of about 7% of Fitch Core Capital (FCC) for a 100bp shift.

600

300

0

2011 2012 2013 2014 1H15

a Domestic lending only

Source: Fitch, ZKB, SNB

ZKB’s main source of operational and reputational risk is the US Department of Justice’s

investigation since 2011 into Swiss banks’ (including ZKB) alleged assistance to US citizens’

tax evasion. ZKB’s provision appears conservative relative to other banks’ known settlements

but the final cost is impossible to predict. ZKB’s solid profits and capital could absorb a sizeable

fine, although pressure could arise on the VR if the cost significantly exceeds our base case as

this could erode ZKB’s financial flexibility and damage its reputation. The bank has verified the

tax compliance of its international private banking clients. The regulatory pressure to do so for

the domestic client base is also gradually building up.

2

0

Moderate Traded Market Risk

Market risk arises from the trading book (CHF10bn at end-1H15), which mainly consists of

bonds, precious metals (also linked to ZKB’s issuance of structured products, warrants and

ETFs) and equity-linked securities. Management has adopted a more cautious approach to

traded market risk following trading losses during the financial crisis. Since 2007, it has

reduced equity trading and largely focused on client-driven activities and products, mostly

foreign exchange (mainly francs to euros), interest-rate swaps, and franc and euro bonds.

ZKB controls market risk in its trading book by setting daily VaR limits (99% confidence interval,

10-day holding period, 365-day observation period) and running sensitivity and CaR analyses.

Trading VaR utilisation including diversification effects was a low CHF14m at end-1H15. ZKB

Zuercher Kantonalbank

March 2016

3

Banks

did not breach its VaR limit in January 2015 despite the market volatility driven by the SNB’s

removal of the franc’s ceiling against the euro, which however caused backtesting exceptions.

Figure 6

Asset-Quality Metrics

(%)

2014 2013 2012

Loan growth

7

2

7

NPL ratio

0.7

0.9

1.1

NPL coverage

50

50

58

Unreserved NPLs/

3

4

4

FCC

LICs/gross loans

-0.03 -0.07 -0.03

Source: ZKB, Fitch

Figure 7

Loan Impairment

Development 2007-2014

Impaired loans (LHS)

Impaired/gross loans (RHS)

(CHFbn)

(%)

1.8

1.5

1.2

0.9

0.6

0.3

0.0

2014

2013

2012

2011

2010

2009

2008

2007

1.2

1.0

0.8

0.6

0.4

0.2

0.0

2013 was restated to CHF674m following

the change from customer to product view

Source: ZKB; Fitch

ZKB also calculates a stressed VaR weekly to determine its capital-adequacy requirements.

At end-1H15, the total stressed VaR in the trading and banking books (defined as the sum of

modelled total risk and the risk premium for trading products not fully modelled) was a low

CHF38m (CHF36m at end-2014). Open currency positions are kept limited.

Asset Quality

Strong Metrics but Unsustainably Low Impairment Charges

Impaired loans have declined since 2011 to a low 0.7% of gross loans and 6.4% of FCC at

end-2014, triggering a net release of loan loss reserves during the period. Specific loan loss

provisions of CHF302m covered 50% of impaired loans, which we view as adequate in light of

the high degree of collateralisation and despite the collateral values’ significant downside.

At end-2014, 79% of total assets and 96% of client loans were domestic, mostly in the Zurich

area. Mortgage loans are mostly to households and small SMEs, and generally granular as a

result. The robust economic forecast for 2016-2017 limits short-term risk despite headwinds

given the strong franc. However, the current extremely low risk costs are, in our opinion,

unsustainable over the longer term.

Residential Property Valuation Risk

Loan quality benefits from ZKB’s focus on the strong Zurich area, strict underwriting standards,

periodic collateral revaluation and quarterly loan-impairment tests with special attention to

commercial loans. The non-payment risk associated with interest rate fluctuations is mitigated

by the bank’s high share of fixed-rate mortgages (three-quarters of all mortgages at end-1H15).

We believe loan quality would be resilient to moderate declines in residential property values

but is likely to suffer significantly from a severe price correction. The SNB considers that the

residential property market’s imbalances did not increase in 2015 but remain high. Pressure is

most likely to arise from excess demand from institutional investors and households searching

for higher-yielding investments.

Figure 8

ZWEXa 1980-3Q15

Index (1Q80 = 100)

300

250

200

150

a

3Q15

2010

2005

2000

1995

1990

1985

1980

100

ZWEX (Zurich residential propety index)

calculated by ZKB using observed Canton of

Zurich real estate transaction values

Source: ZKB

This is exacerbated by the fact that, thus far, macro-prudential stabilisation measures have

predominantly addressed the owner-occupied segment. These measures include the revision

of self-regulation rules for mortgage lending, increase of risk weights for high LTV mortgages

and the activation (in 2013) and a subsequent increase (in 2014) of the countercyclical capital

buffer. A high share of ZKB’s residential mortgage portfolio relates to buy-to-let properties,

reflecting the relatively low owner-occupancy in the Swiss property market.

Earnings and Profitability

Negative Interest Rates Put Rising Pressure on Earnings

Low and falling interest rates have burdened ZKB’s profits moderately in the past seven years.

Its net interest margin (net interest income (NII) over average earning assets) has declined

steadily from a modest 1.36% in 2008 to a weak 0.89% in 1H15. Despite the SNB’s rate cut in

1Q15, ZKB kept its deposit rates positive, except for large short-term corporate deposits.

As long as the domestic banking sector considers negative rates on retail deposits

unacceptable, the scope for downward repricing will be very limited, making the banks’ NII

increasingly vulnerable to further rate cuts by the SNB or the European Central Bank.

This will continue to burden ZKB’s NII, whose vulnerability is exacerbated by its large central

bank deposits. This was partly mitigated in 1H15 by ZKB’s increased margins on mortgage

loans, in line with competitors. Higher fee income also helped to diversify revenues, driven by

increased client activity and Swisscanto’s acquisition, although full synergies are unlikely to be

realised before next year.

Zuercher Kantonalbank

March 2016

4

Banks

Moreover, ZKB is addressing challenges from regulatory tightening in the asset-management

sector, particularly the phasing-out of retrocessions. These fees are generally received by

banks for distributing third-party products to clients; sometimes from client funds and are based

on arrangements that the regulators often consider as opaque. We expect the new regime to

have a manageable impact as ZKB is responding by adjusting its remuneration structure.

Interest Income Is the Main, but Not Dominant, Source of Revenues

Figure 9

Operating Revenue

Interest income from retail and corporate banking generates half of ZKB’s total revenues. Asset

management and wholesale banking also generate significant fee and trading income.

Other operating income

Net fee income

Net trading income

Net interest income

100%

80%

60%

40%

20%

0%

2011 2012 2013 2014 1H15

Trading income fluctuates between CHF250m and CHF400m a year, representing 15% to 20%

of total operating income. ZKB trades securities, currencies, precious metals and commodities

on behalf of clients. It is also an established market maker and a sizeable issuer of structured

products and warrants in the Swiss market. Almost half of trading income in 1H15 (CHF213m,

or 20% of total operating income) came from foreign exchange and precious metals, a third

came from bonds, interest rate and credit derivatives and the rest being derived from equity

and structured products.

Source: ZKB, Fitch

Moderate but Fairly Stable Profits Despite Regulatory and Investment Costs

Figure 10

The operating ROAE (7% to 10% since 2008) is adequate in light of its fairly low volatility even

amid adverse markets and the bank’s large equity base. The Swisscanto acquisition is

triggering staff and integration cost and linear goodwill impairment under Swiss GAAP while the

social mandate attached to the cantonal bank status limits the flexibility to cut staff.

Profit Distribution

2009-2014

Retained earnings

Endowment capital costs

Distribution to municipalities

Distribution to Canton

Retained earnings/annual profit (RHS)

(%)

(CHFm)

1,000

60

50

40

30

20

10

0

500

0

2009 2010 2011 2012 2013 2014

Source: ZKB, parent company view

ZKB, which started to remunerate (CHF21m a year) the canton’s guarantee in 2015, is exempt

from corporate tax but typically distributes about half of its profits to public authorities, of which

two thirds goes to the canton and one third to the municipalities. Its focus on the mature Zurich

region and the ZKB Law restraining risk-taking should moderately constrain revenue growth.

Profitability remained resilient in 2015 despite the challenging operating environment. NII was

broadly unchanged, but the integration of Swisscanto (included in ZKB’s accounts from 2Q15)

increased net fees and commissions while higher market volatility and client activities improved

the trading result. This more than offset the higher operating costs from the acquisition,

allowing for an increase in net income by 12% to CHF722m yoy.

Capitalisation and Leverage

Strong Capitalisation Benefits from High Regulatory Requirements

Figure 11

Capitalisation

(%)

FCC ratio

FEC ratio

Tangible

equity/tangible

assets

Tier 1 ratio

CET1 ratio

Internal capital

generation

Basel leverage

ratio

1H15 2014 2013 2012

16.8 16.1 15.9 15.1

18.4 17.1 16.9 16.1

6.2 6.0 6.2 5.8

17.1 15.6 16.2 15.2

16.1 14.6

7.8 3.9 4.5 2.5

6.0

Source: ZKB, Fitch

5.8 5.73 n.a.

Capitalisation is strong by international comparison. As an SIB, ZKB must maintain a minimum

total capital ratio of 14.7%, including a 0.7% countercyclical buffer and 13% Tier 1 capital.

Its 17.9% total capital ratio at end-2015 exceeds this requirement by a solid margin. The

CHF575m undrawn endowment capital could add almost 100bp to the ratio, offering additional

protection against a deteriorating property market or unexpectedly large US settlement costs.

Capital is of good quality, predominantly consisting of endowment capital and retained earnings

complemented with Basel III-compliant high- and low-trigger convertible capital. The hightrigger instrument is a CHF590m perpetual Tier 1 bond issued in 2012 to which we assign

100% equity credit in our Fitch Eligible Capital (FEC). We assign 50% equity credit to the two

low-trigger bonds (CHF185m and EUR500m) issued in 2015. This explains the difference to

FCC, which excludes hybrid instruments.

Comfortably Fulfils Proposed New Pillar II Capital Requirements

In 4Q15, the Swiss Federal Council proposed to amend the Capital Adequacy Ordinance to

bolster the SIBs’ resilience. Under the new too-big-to-fail proposals, total capital and leverage

requirements would comprise going-concern and gone-concern capital. ZKB expects its goneconcern capital requirement to be set in 2017 once its contingency plan is finalised (see below).

Zuercher Kantonalbank

March 2016

5

Banks

The going-concern capital requirement proposed for ZKB is a minimum Tier 1 ratio of 12.86%,

to be phased in from mid-2016 to end-2019. Up to 4.3% (currently 3%) can consist of additional

Tier 1 (AT1) capital with a high conversion trigger at 7% CET1 ratio. The proposed goingconcern leverage ratio requirement is 4.5% (up from 3.53%), which ZKB comfortably fulfilled

with its 7% at end-2015.

The gone-concern capital would cover the total loss-absorbing capacity requirements in

accordance with the Financial Stability Board’s standards. The amount to be covered could be

substantial, as suggested by the high gone-concern capital requirements of 14.3% proposed

for UBS Group and Credit Suisse Group. It is still unclear which instruments ZKB would use.

Swisscanto’s integration primarily affects ZKB’s regulatory capital ratios by moderately increasing

operational risk, which the bank calculates using the basic indicator approach. The deduction of

Swisscanto’s goodwill reduces ZKB’s total capital ratio by less than 30bp.

Internal Capital Generation Adequate but Limited by Dividend Payments

ZKB is not legally obliged to pay dividends, but we understand that the canton and its

municipalities budget stable payouts. In our view, this constrains ZKB’s financial flexibility.

From 2009 to 2013, it distributed CHF220m to the canton and CHF110m to the municipalities

annually. In 2014, this was cut to CHF164m and CHF82m, respectively, to accommodate

ZKB’s lower profits but remained in line with the long-term 45% payout ratio. In 2015 as profits

recovered, ZKB distributions increased to CHF200m and CHF100m, respectively. In addition,

the remuneration of the endowment capital of CHF2.4bn amounted to CHF26m.

Funding and Liquidity

Sound Liquidity and Funding Profile Benefits from Canton’s Guarantee

A large and mostly granular deposit base (despite some concentrated corporate deposits)

underpins ZKB’s funding. Client funds, which are roughly equally split between deposits and

bonds, accounted for 66% of non-equity funding and fully covered client loans at end-1H15.

The large high-quality liquid assets (monthly average of CHF35bn in 3Q15) predominantly

consist of cash at the SNB. This is needed to fulfil the 100% liquidity coverage ratio (LCR)

requirement, which came into force for Swiss SIBs on 01.01.2015. ZKB’s LCR stood at 128%

(monthly average) in 4Q15. It does not disclose its Net Stable Funding Ratio but reports it

monthly to the regulator.

Good Access to Interbank und Capital Market Funding

ZKB has been consistently perceived as a safe haven during market volatility. This enables it to

attract unsecured funds from commercial and central banks with rising maturities, a material

share of which is dollar-denominated. As a result, interbank liabilities were a high CHF34bn or

22% of non-equity funding at end-1H15 (CHF16bn net of interbank exposures, which are

predominantly to highly rated international banks on a secured basis).

Capital-market instruments are relatively well diversified by currency (francs and euros) and

investors’ geography (mostly Switzerland and the EU). Wholesale maturities in 2016 and 2017

will be close to the CHF3bn redeemed in 2015. This is comfortable in light of ZKB’s good

market access underpinned by its strong standalone profile and its owner’s guarantee. Its funding

profile also benefits from high-quality and granular assets backing its covered bonds.

Support

Canton’s Strong Incentive to Support

Several factors drive the canton’s high propensity to ensure ZKB’s viability as a going concern

rather than winding it down, in our view: the canton’s guarantee of ZKB’s non-subordinated

liabilities and its constitutional requirement to maintain a cantonal bank; the bank’s important

role for the regional economy, including leading retail deposit market shares; and negative

repercussions of a default on the canton’s reputation and on the Swiss financial markets.

Zuercher Kantonalbank

March 2016

6

Banks

Canton’s Adequate Ability to Support

ZKB’s strong standalone profile makes a severe stress triggering large and sudden needs for

capital or liquidity support unlikely. Given its residential mortgage lending focus, we would

expect any recapitalisation needs to arise gradually from asset-quality erosion rather than large

unexpected single losses. The high SIB buffers would trigger early stabilisation measures well

before the point of non-viability, mitigating the need for capital injections. This should allow the

canton to provide timely and sufficient recapitalisation.

We believe that the canton could also provide substantial liquidity support in a fairly timely

manner. However, in case of large unexpected liquidity outflows, ZKB may rely on liquidity

injections by the SNB, which should be forthcoming given ZKB’s SIB status and the absence of

regulatory constraints on central bank support.

Contingent Capital from the Canton Is a Key Element of Resolution Planning

As an SIB, ZKB must prepare a contingency plan that requires approval from the FINMA, the

Swiss financial market supervisor, and the canton in its capacity as sole potential contributor of

capital support. We expect that the plan may require the canton to commit a large volume of

contingent capital relative to its own resources. However, we do not expect this to jeopardise

the canton’s (and hence ZKB’s) IDRs or trigger a reassessment of our support assumptions

underpinning ZKB’s IDRs.

Zuercher Kantonalbank

March 2016

7

Banks

Peer Analysis

We compare ZKB’s metrics to those of European universal banks with VRs of or close to ‘a+’.

Figure 12

Peer Table

Long-Term Issuer Default Rating

Outlook

Viability Rating

Income statement (CHFm)

Net interest income (NII)

Net fees and commissions

Total non-interest operating income

Total non-interest expenses

Pre-impairment operating profit

LICs

Operating profit

Pre-tax profit

Net income

Balance sheet (CHFbn)

Gross loans

Reserves for impaired loans

Impaired loans

Loans and advances to banks

Total securities

Total earning assets

Total assets

Total customer deposits

Total long term funding

Total funding

Total equity

Fitch Core Capital

Asset quality (%)

Growth of gross loans

Growth of total assets

Impaired loans/gross loans

NPL coverage ratio

Unreserved impaired loans/FCC

Impaired loan reserves/gross loans

RWA/total assets

LICs/av gross loans

Earnings & profitability (%)

NII/earning assets

Non-interest income/ gross revenues

Cost income ratio

Pre-impairment operating RoE

Pre-impairment operating RoA

LICs/ pre-impairment operating profit

Operating RoE

Operating RoA

Operating RoRWA

Net RoE

Net RoRWA

Capitalisation & leverage (%)

Tangible common equity/tangible assets

Tier 1 ratio

Total capital ratio

Core Tier 1 ratio

Equity/total assets

FCC/RWA

Internal capital generation

Funding & liquidity (%)

Loans/deposits

Interbank assets/interbank liabilities

Client deposits/total funding

Zuercher

Kantonalbank

AAA

Stable

a+

Jun 15 Dec 14

CM11-CIC

Danske Bank AS

A+

A

Stable

Stable

a+

a+

Jun 15 Dec 14 Jun 15 Dec 14

Swedbank AB

A+

Positive

a+

Jun 15 Dec 14

ABN AMRO Bank

N.V.

A

Stable

a

Jun 15 Dec 14

549

318

539

731

370

6

364

400

393

1,070

531

844

1,294

641

-24

665

647

647

2,734

1,643

4,138

4,280

2,665

419

2,240

2,206

1,387

6,828

3,423

7,549

9,061

5,401

1,100

4,354

4,335

2,900

2,375

755

995

1,695

1,719

20

1,699

1,699

1,314

5,592

1,586

1,871

4,122

3,359

610

2,748

1,266

621

1,363

631

719

928

1,211

8

1,203

1,199

903

3,001

1,432

1,886

2,283

2,729

61

2,675

2,688

2,105

3,181

964

1,276

2,566

1,904

299

1,605

1,605

1,191

7,232

2,031

2,380

6,365

3,308

1,406

1,902

1,856

1,362

88.8

n.a.

n.a.

16.2

14.1

119.1

161.8

84.7

13.6

132.4

10.1

10.0

86.7

0.3

0.6

16.3

27.1

129.8

158.4

82.6

11.6

146.9

9.5

9.5

314.5

8.7

13.9

50.6

171.9

530.7

583.6

252.4

59.6

434.7

37.4

32.3

355.1

10.2

15.7

41.7

85.4

582.2

652.9

278.6

69.6

486.1

41.9

27.4

232.6

5.1

9.3

17.5

162.2

458.0

481.6

117.1

144.7

396.3

20.7

16.5

264.1

6.6

11.6

10.3

220.5

545.7

557.9

124.1

163.9

462.1

23.8

19.0

154.0

0.3

0.6

9.1

46.5

226.8

259.7

89.4

80.7

219.8

12.9

11.3

172.0

0.4

0.8

12.3

49.9

252.1

271.2

84.5

69.8

231.3

15.0

13.2

282.5

4.9

7.5

16.0

109.7

403.4

427.4

239.7

72.3

402.7

16.5

16.3

320.2

5.7

9.1

18.0

114.6

447.1

464.6

259.4

82.3

437.2

17.9

17.0

2.4

2.2

n.a.

n.a.

n.a.

n.a.

36.8

0.0

7.3

5.8

0.7

49.9

3.2

0.4

37.1

0.0

2.2

3.1

4.4

62.9

15.9

2.8

0.0

0.3

4.0

6.6

4.4

64.8

20.2

2.9

33.4

0.3

2.0

0.0

4.0

54.7

25.4

2.2

25.9

0.0

0.5

7.0

4.4

56.9

26.5

2.5

25.1

0.2

1.3

8.4

0.4

55.3

2.5

0.2

17.7

0.0

10.2

16.3

0.5

52.0

2.9

0.2

19.5

0.0

1.8

6.2

2.7

65.0

16.1

1.7

28.0

0.2

1.8

4.0

2.9

62.6

20.1

1.8

28.3

0.4

0.9

49.5

67.2

7.6

0.5

1.6

7.5

0.5

1.2

8.1

1.3

0.9

44.1

67.6

6.9

0.4

-3.7

7.2

0.4

1.1

7.0

1.1

1.1

60.2

62.3

14.6

0.9

15.9

12.3

0.8

n.a.

7.6

n.a.

1.2

52.5

63.0

13.4

0.9

19.4

10.8

0.7

2.0

7.2

1.3

1.0

29.5

50.3

16.8

0.7

1.2

16.6

0.7

2.8

12.9

2.1

1.1

25.1

55.2

14.0

0.6

18.2

11.5

0.5

2.0

2.6

0.4

1.2

34.5

44.6

19.2

1.0

0.6

19.0

1.0

5.3

14.3

4.0

1.3

38.6

46.7

19.4

1.1

2.0

19.1

1.1

5.1

15.0

4.0

1.6

28.6

57.6

24.0

0.9

15.7

20.2

0.8

2.7

15.0

2.0

1.7

24.8

66.2

19.4

0.7

42.5

11.1

0.4

1.4

8.0

1.0

6.2

17.1

18.2

16.1

6.3

16.8

7.8

6.0

15.6

16.6

14.6

6.0

16.1

3.9

5.6

n.a.

n.a.

14.6

6.4

n.a.

7.5

5.6

14.4

17.5

14.4

6.4

12.6

6.4

4.0

16.5

18.7

14.3

4.3

13.3

12.8

4.0

16.7

19.3

15.1

4.3

13.6

-1.2

4.4

25.0

28.2

22.4

5.0

24.6

14.1

4.9

22.4

25.5

21.2

5.5

24.9

3.3

3.8

14.6

18.3

14.2

3.9

13.6

11.0

3.7

14.6

19.7

14.1

3.9

12.9

4.9

105

48

64

105

48

63

125

280

59

127

182

59

199

109

33

213

50

31

172

57

42

204

58

38

118

86

64

123

95

65

Source: Fitch

Zuercher Kantonalbank

March 2016

8

Banks

Zuercher Kantonalbank

Income Statement

1. Interest Income on Loans

2. Other Interest Income

3. Dividend Income

4. Gross Interest and Dividend Income

5. Interest Expense on Customer Deposits

6. Other Interest Expense

7. Total Interest Expense

8. Net Interest Income

9. Net Gains (Losses) on Trading and Derivatives

10. Net Gains (Losses) on Other Securities

11. Net Gains (Losses) on Assets at FV through Income Statement

12. Net Insurance Income

13. Net Fees and Commissions

14. Other Operating Income

15. Total Non-Interest Operating Income

16. Personnel Expenses

17. Other Operating Expenses

18. Total Non-Interest Expenses

19. Equity-accounted Profit/ Loss - Operating

20. Pre-Impairment Operating Profit

21. Loan Impairment Charge

22. Securities and Other Credit Impairment Charges

23. Operating Profit

24. Equity-accounted Profit/ Loss - Non-operating

25. Non-recurring Income

26. Non-recurring Expense

27. Change in Fair Value of Own Debt

28. Other Non-operating Income and Expenses

29. Pre-tax Profit

30. Tax expense

31. Profit/Loss from Discontinued Operations

32. Net Income

33. Change in Value of AFS Investments

34. Revaluation of Fixed Assets

35. Currency Translation Differences

36. Remaining OCI Gains/(losses)

37. Fitch Comprehensive Income

38. Memo: Profit Allocation to Non-controlling Interests

39. Memo: Net Income after Allocation to Non-controlling Interests

40. Memo: Common Dividends Relating to the Period

41. Memo: Preferred Dividends Related to the Period

Exchange rate

Zuercher Kantonalbank

March 2016

30 Jun 2015

6 Months - Interim

CHFm

Unaudited

31 Dec 2014

Year End

CHFm

Unqualified

31 Dec 2013

Year End

CHFm

Unqualified

31 Dec 2012

Year End

CHFm

Unqualified

678.0

33.0

0.0

711.0

0.0

162.0

162.0

549.0

213.0

3.0

0.0

0.0

318.0

5.0

539.0

470.0

261.0

731.0

13.0

370.0

6.0

0.0

364.0

0.0

36.0

0.0

0.0

0.0

400.0

7.0

0.0

393.0

0.0

0.0

0.0

0.0

393.0

0.0

393.0

0.0

0.0

1,448.0

73.0

n.a.

1,521.0

n.a.

451.0

451.0

1,070.0

287.0

3.0

n.a.

n.a.

531.0

23.0

844.0

816.0

478.0

1,294.0

21.0

641.0

(24.0)

n.a.

665.0

n.a.

42.0

60.0

n.a.

n.a.

647.0

n.a.

n.a.

647.0

n.a.

n.a.

n.a.

n.a.

647.0

n.a.

647.0

280.0

n.a.

1,490.0

72.0

n.a.

1,562.0

n.a.

445.0

445.0

1,117.0

340.0

56.0

n.a.

n.a.

551.0

27.0

974.0

851.0

477.0

1,328.0

26.0

789.0

(53.0)

n.a.

842.0

n.a.

218.0

263.0

n.a.

n.a.

797.0

0.0

n.a.

797.0

n.a.

n.a.

n.a.

n.a.

797.0

n.a.

797.0

369.0

n.a.

1,628.0

94.0

n.a.

1,722.0

n.a.

568.0

568.0

1,154.0

379.0

14.0

n.a.

n.a.

536.0

25.0

954.0

1,020.0

496.0

1,516.0

15.0

607.0

(25.0)

n.a.

632.0

n.a.

33.0

71.0

n.a.

n.a.

594.0

0.0

n.a.

594.0

n.a.

n.a.

n.a.

n.a.

594.0

n.a.

594.0

374.0

n.a.

USD1 = CHF0.930

USD1 = CHF0.9891 USD1 = CHF0.89150SD1 = CHF0.91660

9

Banks

Zuercher Kantonalbank

Balance Sheet

30 Jun 2015

6 Months - Interim

CHFm

31 Dec 2014

Year End

CHFm

31 Dec 2013

Year End

CHFm

31 Dec 2012

Year End

CHFm

72,370.0

0.0

0.0

0.0

16,459.0

0.0

88,829.0

88,829.0

0.0

0.0

59,042.0

12,347.0

n.a.

n.a.

15,321.0

302.0

86,408.0

86,710.0

605.0

n.a.

57,650.0

12,008.0

n.a.

n.a.

11,124.0

360.0

80,422.0

80,782.0

727.0

n.a.

55,800.0

11,570.0

n.a.

n.a.

11,674.0

492.0

78,552.0

79,044.0

844.0

n.a.

16,162.0

0.0

10,058.0

0.0

0.0

0.0

148.0

3,933.0

14,139.0

0.0

0.0

0.0

0.0

0.0

119,130.0

16,302.0

n.a.

11,394.0

11,501.0

n.a.

n.a.

163.0

4,027.0

27,085.0

n.a.

n.a.

n.a.

n.a.

n.a.

129,795.0

14,612.0

n.a.

13,284.0

6,511.0

n.a.

n.a.

161.0

3,768.0

23,724.0

n.a.

n.a.

n.a.

n.a.

n.a.

118,758.0

17,185.0

n.a.

14,532.0

8,619.0

n.a.

n.a.

203.0

3,659.0

27,013.0

n.a.

n.a.

n.a.

n.a.

n.a.

122,750.0

29,185.0

0.0

0.0

755.0

173.0

1.0

0.0

0.0

0.0

12,575.0

161,819.0

27,069.0

n.a.

n.a.

723.0

n.a.

1.0

n.a.

n.a.

n.a.

804.0

158,392.0

29,553.0

n.a.

n.a.

698.0

3.0

2.0

n.a.

0.0

n.a.

693.0

149,707.0

26,093.0

n.a.

n.a.

670.0

6.0

3.0

n.a.

0.0

n.a.

1,172.0

150,694.0

38,703.0

46,031.0

0.0

84,734.0

33,812.0

0.0

312.0

118,858.0

13,558.0

0.0

n.a.

0.0

13,558.0

0.0

0.0

132,416.0

37,021.0

45,624.0

n.a.

82,645.0

33,870.0

n.a.

3,005.0

119,520.0

11,569.0

n.a.

n.a.

n.a.

11,569.0

15,823.0

n.a.

146,912.0

37,101.0

43,992.0

n.a.

81,093.0

31,788.0

n.a.

2,031.0

114,912.0

12,156.0

n.a.

n.a.

n.a.

12,156.0

11,423.0

n.a.

138,491.0

36,450.0

44,455.0

n.a.

80,905.0

31,813.0

n.a.

1,061.0

113,779.0

11,631.0

n.a.

n.a.

n.a.

11,631.0

14,474.0

n.a.

139,884.0

0.0

0.0

702.0

0.0

0.0

544.0

0.0

0.0

16,727.0

150,389.0

n.a.

n.a.

321.0

400.0

n.a.

265.0

n.a.

n.a.

419.0

148,317.0

n.a.

n.a.

379.0

309.0

n.a.

284.0

n.a.

n.a.

447.0

139,910.0

0.0

n.a.

517.0

100.0

0.0

294.0

n.a.

n.a.

525.0

141,320.0

1,291.0

0.0

588.0

n.a.

589.0

n.a.

590.0

n.a.

10,139.0

0.0

0.0

0.0

0.0

10,139.0

161,819.0

9,974.0

10,912.5

9,487.0

n.a.

n.a.

n.a.

n.a.

9,487.0

158,392.0

9,486.0

10,074.0

9,208.0

n.a.

n.a.

n.a.

n.a.

9,208.0

149,707.0

9,203.0

9,792.0

8,784.0

n.a.

n.a.

n.a.

n.a.

8,784.0

150,694.0

8,775.0

9,365.0

Assets

A. Loans

1. Residential Mortgage Loans

2. Other Mortgage Loans

3. Other Consumer/ Retail Loans

4. Corporate & Commercial Loans

5. Other Loans

6. Less: Reserves for Impaired Loans

7. Net Loans

8. Gross Loans

9. Memo: Impaired Loans included above

10. Memo: Loans at Fair Value included above

B. Other Earning Assets

1. Loans and Advances to Banks

2. Reverse Repos and Cash Collateral

3. Trading Securities and at FV through Income

4. Derivatives

5. Available for Sale Securities

6. Held to Maturity Securities

7. Equity Investments in Associates

8. Other Securities

9. Total Securities

10. Memo: Government Securities included Above

11. Memo: Total Securities Pledged

12. Investments in Property

13. Insurance Assets

14. Other Earning Assets

15. Total Earning Assets

C. Non-Earning Assets

1. Cash and Due From Banks

2. Memo: Mandatory Reserves included above

3. Foreclosed Real Estate

4. Fixed Assets

5. Goodwill

6. Other Intangibles

7. Current Tax Assets

8. Deferred Tax Assets

9. Discontinued Operations

10. Other Assets

11. Total Assets

Liabilities and Equity

D. Interest-Bearing Liabilities

1. Customer Deposits - Current

2. Customer Deposits - Savings

3. Customer Deposits - Term

4. Total Customer Deposits

5. Deposits from Banks

6. Repos and Cash Collateral

7. Commercial Paper and Short-term Borrowings

8. Total Money Market and Short-term Funding

9. Senior Unsecured Debt (original maturity > 1 year)

10. Subordinated Borrowing

11. Covered Bonds

12. Other Long-term Funding

13. Total LT Funding (original maturity > 1 year)

14. Derivatives

15. Trading Liabilities

16. Total Funding

E. Non-Interest Bearing Liabilities

1. Fair Value Portion of Debt

2. Credit impairment reserves

3. Reserves for Pensions and Other

4. Current Tax Liabilities

5. Deferred Tax Liabilities

6. Other Deferred Liabilities

7. Discontinued Operations

8. Insurance Liabilities

9. Other Liabilities

10. Total Liabilities

F. Hybrid Capital

1. Pref. Shares and Hybrid Capital accounted for as Debt

2. Pref. Shares and Hybrid Capital accounted for as Equity

G. Equity

1. Common Equity

2. Non-controlling Interest

3. Securities Revaluation Reserves

4. Foreign Exchange Revaluation Reserves

5. Fixed Asset Revaluations and Other Accumulated OCI

6. Total Equity

7. Total Liabilities and Equity

8. Memo: Fitch Core Capital

9. Memo: Fitch Eligible Capital

Exchange rate

Zuercher Kantonalbank

March 2016

USD1 = CHF0.930

SD1 = CHF0.989

SD1 = CHF0.891

SD1 = CHF0.91660

10

Banks

Zuercher Kantonalbank

Summary Analytics

30 Jun 2015

6 Months - Interim

A. Interest Ratios

1. Interest Income on Loans/ Average Gross Loans

2. Interest Expense on Customer Deposits/ Average Customer Deposits

3. Interest Income/ Average Earning Assets

4. Interest Expense/ Average Interest-bearing Liabilities

5. Net Interest Income/ Average Earning Assets

6. Net Int. Inc Less Loan Impairment Charges/ Av. Earning Assets

7. Net Interest Inc Less Preferred Stock Dividend/ Average Earning Asset

B. Other Operating Profitability Ratios

1. Non-Interest Income/ Gross Revenues

2. Non-Interest Expense/ Gross Revenues

3. Non-Interest Expense/ Average Assets

4. Pre-impairment Op. Profit/ Average Equity

5. Pre-impairment Op. Profit/ Average Total Assets

6. Loans and securities impairment charges/ Pre-impairment Op. Profit

7. Operating Profit/ Average Equity

8. Operating Profit/ Average Total Assets

9. Operating Profit / Risk Weighted Assets

C. Other Profitability Ratios

1. Net Income/ Average Total Equity

2. Net Income/ Average Total Assets

3. Fitch Comprehensive Income/ Average Total Equity

4. Fitch Comprehensive Income/ Average Total Assets

5. Taxes/ Pre-tax Profit

6. Net Income/ Risk Weighted Assets

D. Capitalization

1. Fitch Core Capital/ Risk Weighted Assets

2. Fitch Eligible Capital/ Risk Weighted Assets

3. Tangible Common Equity/ Tangible Assets

4. Tier 1 Regulatory Capital Ratio

5. Total Regulatory Capital Ratio

6. Core Tier 1 Regulatory Capital Ratio

7. Equity/ Total Assets

8. Cash Dividends Paid & Declared/ Net Income

9. Internal Capital Generation

E. Loan Quality

1. Growth of Total Assets

2. Growth of Gross Loans

3. Impaired Loans/ Gross Loans

4. Reserves for Impaired Loans/ Gross Loans

5. Reserves for Impaired Loans/ Impaired Loans

6. Impaired loans less Reserves for Impaired Loans/ Fitch Core Capital

7. Impaired Loans less Reserves for Impaired Loans/ Equity

8. Loan Impairment Charges/ Average Gross Loans

9. Net Charge-offs/ Average Gross Loans

10. Impaired Loans + Foreclosed Assets/ Gross Loans + Foreclosed Ass

F. Funding and Liquidity

1. Loans/ Customer Deposits

2. Interbank Assets/ Interbank Liabilities

3. Customer Deposits/ Total Funding (excluding derivatives)

4. Liquidity Coverage Ratio

5. Net Stable Funding Ratio

Zuercher Kantonalbank

March 2016

31 Dec 2014

Year End

31 Dec 2013

Year End

31 Dec 2012

Year End

1.54

n.a.

1.15

0.23

0.89

0.88

0.89

1.73

n.a.

1.23

0.32

0.86

0.88

0.86

1.87

n.a.

1.30

0.32

0.93

0.97

0.93

2.14

n.a.

1.44

0.45

0.96

0.98

0.96

49.54

67.19

0.92

7.60

0.47

1.62

7.48

0.46

1.23

44.10

67.61

0.84

6.90

0.42

(3.74)

7.16

0.43

1.13

46.58

63.51

0.88

8.83

0.53

(6.72)

9.43

0.56

1.45

45.26

71.92

1.06

7.06

0.42

(4.12)

7.35

0.44

1.09

8.08

0.49

8.08

0.49

1.75

1.33

6.96

0.42

6.96

0.42

n.a.

1.10

8.92

0.53

8.92

0.53

0.00

1.37

6.91

0.41

6.91

0.41

0.00

1.02

16.77

18.35

6.16

17.10

18.20

16.10

6.27

n.a.

7.82

16.13

17.13

5.99

15.60

16.60

14.60

5.99

43.28

3.87

15.86

16.88

6.15

16.20

16.20

15.20

6.15

46.30

4.65

15.11

16.12

5.82

15.20

15.20

n.a.

5.83

62.96

2.50

2.16

2.44

n.a.

n.a.

n.a.

n.a.

n.a.

0.01

n.a.

n.a.

5.80

7.34

0.70

0.35

49.92

3.19

3.19

(0.03)

n.a.

0.70

(0.65)

2.20

0.90

0.45

49.52

3.99

3.99

(0.07)

n.a.

0.90

12.46

6.19

1.07

0.62

58.29

4.01

4.01

(0.03)

n.a.

1.07

104.83

47.80

63.99

124.00

n.a.

104.92

48.13

63.04

n.a.

n.a.

99.62

45.97

63.82

n.a.

n.a.

97.70

54.02

64.51

n.a.

n.a.

11

Banks

Zuercher Kantonalbank

Reference Data

30 Jun 2015

6 Months - Interim

CHFm

31 Dec 2014

Year End

CHFm

31 Dec 2013

Year End

CHFm

31 Dec 2012

Year End

CHFm

0.0

0.0

0.0

0.0

7,128.0

3,524.0

262,074.0

n.a.

n.a.

3,323.0

n.a.

7,432.0

563.0

199,095.0

n.a.

n.a.

4,116.0

n.a.

6,869.0

648.0

192,070.0

n.a.

n.a.

3,827.0

n.a.

7,632.0

724.0

175,762.0

87,769.5

124,462.5

160,105.5

0.0

139,664.0

9,813.0

9,813.0

83,689.5

83,542.3

121,417.0

154,307.7

n.a.

138,836.7

9,290.3

9,290.3

81,882.7

79,873.0

118,089.0

150,073.0

n.a.

134,831.0

8,932.0

8,932.0

80,465.3

76,238.7

119,967.7

143,383.6

n.a.

127,328.7

8,595.0

8,595.0

74,746.7

0.0

0.0

0.0

0.0

22,115.0

11,902.0

32,411.0

19,980.0

18,186.0

9,037.0

34,992.0

18,207.0

17,799.0

10,333.0

35,074.0

15,346.0

0.0

0.0

0.0

0.0

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

0.0

0.0

0.0

0.0

9,098.0

4,240.0

2,659.0

305.0

9,090.0

3,407.0

1,813.0

302.0

9,604.0

5,649.0

1,676.0

256.0

0.0

0.0

0.0

0.0

80,047.0

879.0

951.0

768.0

81,669.0

757.0

957.0

710.0

78,312.0

906.0

911.0

776.0

0.0

0.0

0.0

0.0

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

0.0

0.0

0.0

0.0

27,574.0

3,035.0

2,661.0

600.0

26,719.0

1,774.0

2,450.0

845.0

26,522.0

1,988.0

2,096.0

1,207.0

0.0

0.0

0.0

0.0

n.a.

0.0

0.0

0.0

0.0

0.0

n.a.

0.0

224.0

2,781.0

4,839.0

6,730.0

14,574.0

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

639.0

1,981.0

6,384.0

5,772.0

14,776.0

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

821.0

830.0

5,899.0

5,732.0

13,282.0

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

D. Risk Weighted Assets

1. Risk Weighted Assets

2. Fitch Adjustments to Risk Weighted Assets

3. Fitch Adjusted Risk Weighted Assets

59,481.0

0.0

59,481.0

58,816.0

n.a.

58,816.0

58,020.0

n.a.

58,020.0

58,085.0

n.a.

58,085.0

E. Equity Reconciliation

1. Equity

2. Add: Pref. Shares and Hybrid Capital accounted for as Equity

3. Add: Other Adjustments

10,139.0

n.a.

0.0

9,487.0

n.a.

n.a.

9,208.0

n.a.

n.a.

8,784.0

n.a.

n.a.

10,139.0

9,487.0

9,208.0

8,784.0

10,139.0

0.0

0.0

173.0

1.0

(9.0)

0.0

0.0

9,974.0

938.5

0.0

10,912.5

9,487.0

0.0

0.0

0.0

1.0

0.0

0.0

0.0

9,486.0

588.0

0.0

10,074.0

9,208.0

0.0

0.0

3.0

2.0

0.0

0.0

0.0

9,203.0

589.0

0.0

9,792.0

8,784.0

0.0

0.0

6.0

3.0

0.0

0.0

0.0

8,775.0

590.0

0.0

9,365.0

A. Off-Balance Sheet Items

1. Managed Securitized Assets Reported Off-Balance Sheet

2. Other off-balance sheet exposure to securitizations

3. Guarantees

4. Acceptances and documentary credits reported off-balance sheet

5. Committed Credit Lines

6. Other Contingent Liabilities

7. Total Assets under Management

B. Average Balance Sheet

Average Loans

Average Earning Assets

Average Assets

Average Managed Securitized Assets (OBS)

Average Interest-Bearing Liabilities

Average Common equity

Average Equity

Average Customer Deposits

C. Maturities

Asset Maturities:

Loans & Advances < 3 months

Loans & Advances 3 - 12 Months

Loans and Advances 1 - 5 Years

Loans & Advances > 5 years

Debt

Debt

Debt

Debt

Securities

Securities

Securities

Securities

Loans

Loans

Loans

Loans

&

&

&

&

< 3 Months

3 - 12 Months

1 - 5 Years

> 5 Years

Advances

Advances

Advances

Advances

to Banks

to Banks

to Banks

to Banks

< 3 Months

3 - 12 Months

1 - 5 Years

> 5 Years

Liability Maturities:

Retail Deposits < 3 months

Retail Deposits 3 - 12 Months

Retail Deposits 1 - 5 Years

Retail Deposits > 5 Years

Other Deposits

Other Deposits

Other Deposits

Other Deposits

Deposits

Deposits

Deposits

Deposits

from

from

from

from

< 3 Months

3 - 12 Months

1 - 5 Years

> 5 Years

Banks

Banks

Banks

Banks

< 3 Months

3 - 12 Months

1 - 5 Years

> 5 Years

Senior Debt Maturing < 3 months

Senior Debt Maturing 3-12 Months

Senior Debt Maturing 1- 5 Years

Senior Debt Maturing > 5 Years

Total Senior Debt on Balance Sheet

Fair Value Portion of Senior Debt

Subordinated Debt Maturing < 3 months

Subordinated Debt Maturing 3-12 Months

Subordinated Debt Maturing 1- 5 Year

Subordinated Debt Maturing > 5 Years

Total Subordinated Debt on Balance Sheet

Fair Value Portion of Subordinated Debt

4. Published Equity

F. Fitch Eligible Capital Reconciliation

1. Total Equity as reported (including non-controlling interests)

2. Fair value effect incl in own debt/borrowings at fv on the B/S- CC only

3. Non-loss-absorbing non-controlling interests

4. Goodwill

5. Other intangibles

6. Deferred tax assets deduction

7. Net asset value of insurance subsidiaries

8. First loss tranches of off-balance sheet securitizations

9. Fitch Core Capital

10. Eligible weighted Hybrid capital

11. Government held Hybrid Capital

12. Fitch Eligible Capital

Exchange Rate

Zuercher Kantonalbank

March 2016

USD1 = CHF0.930

SD1 = CHF0.989

SD1 = CHF0.891

SD1 = CHF0.91660

12

Banks

The ratings above were solicited by, or on behalf of, the issuer, and therefore,

Fitch has been compensated for the provision of the ratings.

ALL FITCH CREDIT RATINGS ARE SUBJECT TO CERTAIN LIMITATIONS AND DISCLAIMERS.

PLEASE READ THESE LIMITATIONS AND DISCLAIMERS BY FOLLOWING THIS LINK:

HTTPS://FITCHRATINGS.COM/UNDERSTANDINGCREDITRATINGS.

IN

ADDITION,

RATING

DEFINITIONS AND THE TERMS OF USE OF SUCH RATINGS ARE AVAILABLE ON THE AGENCY'S

PUBLIC WEB SITE AT WWW.FITCHRATINGS.COM. PUBLISHED RATINGS, CRITERIA, AND

METHODOLOGIES ARE AVAILABLE FROM THIS SITE AT ALL TIMES. FITCH'S CODE OF

CONDUCT, CONFIDENTIALITY, CONFLICTS OF INTEREST, AFFILIATE FIREWALL, COMPLIANCE,

AND OTHER RELEVANT POLICIES AND PROCEDURES ARE ALSO AVAILABLE FROM THE CODE

OF CONDUCT SECTION OF THIS SITE. FITCH MAY HAVE PROVIDED ANOTHER PERMISSIBLE

SERVICE TO THE RATED ENTITY OR ITS RELATED THIRD PARTIES. DETAILS OF THIS SERVICE

FOR RATINGS FOR WHICH THE LEAD ANALYST IS BASED IN AN EU-REGISTERED ENTITY CAN

BE FOUND ON THE ENTITY SUMMARY PAGE FOR THIS ISSUER ON THE FITCH WEBSITE.

Copyright © 2016

by Fitch Ratings, Inc., Fitch Ratings Ltd. and its subsidiaries.

33 Whitehall Street, NY, NY 10004.

Telephone: 1-800-753-4824, (212) 908-0500. Fax: (212) 480-4435. Reproduction or retransmission in whole or in part is prohibited except

by permission. All rights reserved. In issuing and maintaining its ratings and in making other reports (including forecast information), Fitch

relies on factual information it receives from issuers and underwriters and from other sources Fitch believes to be credible. Fitch conducts a

reasonable investigation of the factual information relied upon by it in accordance with its ratings methodology, and obtains reasonable

verification of that information from independent sources, to the extent such sources are available for a given security or in a given

jurisdiction. The manner of Fitch’s factual investigation and the scope of the third-party verification it obtains will vary depending on the

nature of the rated security and its issuer, the requirements and practices in the jurisdiction in which the rated security is offered and sold

and/or the issuer is located, the availability and nature of relevant public information, access to the management of the issuer and its

advisers, the availability of pre-existing third-party verifications such as audit reports, agreed-upon procedures letters, appraisals, actuarial

reports, engineering reports, legal opinions and other reports provided by third parties, the availability of independent and competent thirdparty verification sources with respect to the particular security or in the particular jurisdiction of the issuer, and a variety of other factors.

Users of Fitch’s ratings and reports should understand that neither an enhanced factual investigation nor any third-party verification can

ensure that all of the information Fitch relies on in connection with a rating or a report will be accurate and complete. Ultimately, the issuer

and its advisers are responsible for the accuracy of the information they provide to Fitch and to the market in offering documents and other

reports. In issuing its ratings and its reports, Fitch must rely on the work of experts, including independent auditors with respect to financial

statements and attorneys with respect to legal and tax matters. Further, ratings and forecasts of financial and other information are

inherently forward-looking and embody assumptions and predictions about future events that by their nature cannot be verified as facts.

As a result, despite any verification of current facts, ratings and forecasts can be affected by future events or conditions that were not

anticipated at the time a rating or forecast was issued or affirmed.

The information in this report is provided “as is” without any representation or warranty of any kind, and Fitch does not represent or warrant

that the report or any of its contents will meet any of the requirements of a recipient of the report. A Fitch rating is an opinion as to the

creditworthiness of a security. This opinion and reports made by Fitch are based on established criteria and methodologies that Fitch is

continuously evaluating and updating. Therefore, ratings and reports are the collective work product of Fitch and no individual, or group of

individuals, is solely responsible for a rating or a report. The rating does not address the risk of loss due to risks other than credit risk,

unless such risk is specifically mentioned. Fitch is not engaged in the offer or sale of any security. All Fitch reports have shared authorship.

Individuals identified in a Fitch report were involved in, but are not solely responsible for, the opinions stated therein. The individuals are

named for contact purposes only. A report providing a Fitch rating is neither a prospectus nor a substitute for the information assembled,

verified and presented to investors by the issuer and its agents in connection with the sale of the securities. Ratings may be changed or

withdrawn at any time for any reason in the sole discretion of Fitch. Fitch does not provide investment advice of any sort. Ratings are not a

recommendation to buy, sell, or hold any security. Ratings do not comment on the adequacy of market price, the suitability of any security

for a particular investor, or the tax-exempt nature or taxability of payments made in respect to any security. Fitch receives fees from issuers,

insurers, guarantors, other obligors, and underwriters for rating securities. Such fees generally vary from US$1,000 to US$750,000 (or the

applicable currency equivalent) per issue. In certain cases, Fitch will rate all or a number of issues issued by a particular issuer, or insured

or guaranteed by a particular insurer or guarantor, for a single annual fee. Such fees are expected to vary from US$10,000 to

US$1,500,000 (or the applicable currency equivalent). The assignment, publication, or dissemination of a rating by Fitch shall not constitute

a consent by Fitch to use its name as an expert in connection with any registration statement filed under the United States securities laws,

the Financial Services and Markets Act of 2000 of the United Kingdom, or the securities laws of any particular jurisdiction. Due to the

relative efficiency of electronic publishing and distribution, Fitch research may be available to electronic subscribers up to three days earlier

than to print subscribers.

For Australia, New Zealand, Taiwan and South Korea only: Fitch Australia Pty Ltd holds an Australian financial services license (AFS license

no. 337123) which authorizes it to provide credit ratings to wholesale clients only. Credit ratings information published by Fitch is not

intended to be used by persons who are retail clients within the meaning of the Corporations Act 2001.

Zuercher Kantonalbank

March 2016

13