The AGR Graduate

Recruitment Survey 2013

Winter Review

Produced for AGR by

The AGR Graduate

Recruitment Survey 2013

Winter Review

Graduate Recruitment Survey 2013 Winter Review

Association of Graduate Recruiters

The Innovation Centre

Warwick Technology Park

Gallows Hill

Warwick CV34 6UW

Survey produced for AGR by

CFE

Phoenix Yard

Upper Brown Street

Leicester LE1 5TE

For more information please contact Lindsey Bowes on 0116 229 3300 or lindsey.bowes@cfe.org.uk

Website: www.cfe.org.uk

All information contained in this report is believed to be correct and unbiased, but the publisher does not accept

responsibility for any loss arising from decisions made upon this information.

© CFE and the Association of Graduate Recruiters

All rights reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted in

any form or by any means, electronic, mechanical, photocopying or otherwise, without prior permission of the

publisher.

Graduate Recruitment Survey 2013 Winter Review

Contents

Foreword ................................................................................................................................... 2

Executive summary .................................................................................................................... 3

Introduction .............................................................................................................................. 6

Graduate vacancies.................................................................................................................. 14

Graduate vacancies in 2011-2012 and 2012-2013 ....................................................................................................... 14

Expected changes in vacancies by sector ..................................................................................................................... 20

Vacancies in 2011-2012 by business sector .................................................................................................................. 22

Vacancies in 2011-2012 by region ................................................................................................................................ 23

Vacancies in 2011-2012 by career area ........................................................................................................................ 24

Achievement of 2011-2012 recruitment targets .......................................................................................................... 25

Challenges anticipated in filling vacancies in 2012-2013 ............................................................................................. 26

Graduate salaries ..................................................................................................................... 31

Graduate salaries in 2011-2012 and 2012-2013........................................................................................................... 31

Expected changes in salaries by business sector .......................................................................................................... 33

Graduate salaries in 2011-2012 by business sector ..................................................................................................... 36

Graduate salaries in 2011-2012 by region .................................................................................................................... 37

Graduate salaries in 2011-2012 by career area ............................................................................................................ 37

Education premiums for graduates in 2012-2013 ........................................................................................................ 39

Graduate recruitment marketing ............................................................................................. 43

Total marketing spend in 2011-2012 and 2012-2013................................................................................................... 43

Graduate recruitment marketing activities in 2012-2013 ............................................................................................ 45

Mean spend on key activities in 2011-2012 and 2012-2013 ........................................................................................ 46

Marketing spend per vacancy ....................................................................................................................................... 47

Targeting universities in 2011-2012 and 2012-2013 .................................................................................................... 48

Hot topics in graduate recruitment .......................................................................................... 51

Higher Education Achievement Report ........................................................................................................................ 51

1

Graduate Recruitment Survey 2013 Winter Review

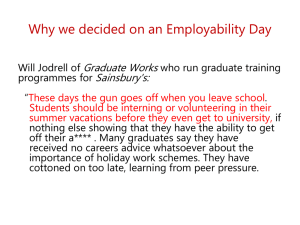

Foreword

I always look forward to discovering which direction the graduate market is taking when the AGR graduate

recruitment survey is published. This winter my interest was heightened by operating against a backcloth of

considerable changes in higher education with a growing emphasis on employability and employment

prospects (not the same thing in my view).

In this report you will find out what actually happened to vacancies in 2012 and predictions for 2013. I am

struck by how much variation there is sector by sector. How well is your sector faring?

For the first time we explore dropout rates and again you can benchmark your track record against the

market as a whole and your sector. There was good news on the salaries front for those graduates lucky

enough to land a graduate job in 2012 but how will 2013 starting salaries compare?

The Winter Review traditionally explores marketing activities and spend. I suspect in the current climate

where many AGR members are having to manage more with less there will be added interest in comparing

your marketing spend with your competitors. I was fascinated by the chart showing the degree of targeting

that takes place in graduate attraction especially as Government has been critical of the selective practices

of some employers. Which leads nicely to the Hot Topics section of the report which sets out to identify

awareness and use of the Higher Education Achievement Report.

All this and more can be found in the report which comes to you free of charge if you are an AGR member.

Non-members can purchase the report for £300.

Enjoy reading the report and put it to good use!

Carl Gilleard

Chief Executive

AGR

2

Graduate Recruitment Survey 2013 Winter Review

Executive summary

Graduate vacancies

Overall, graduate vacancies decreased during the 2011-2012 recruitment season by 8.2%. However, there is

positive news for the 2012-2013 recruitment season; employers are predicting an 8.8% rise in the number

of vacancies which is set to rise from 19,350 to 21,061 next year.

Across the majority of sectors there is a predicted increase in the number of vacancies expected for 20122013 when compared to the number of vacancies in 2011-2012. The construction company or consultancy

sector is predicting the largest increase in vacancies at 77.8%, followed by the transport or logistics

company sector at 41.4%, and the energy, water or utility company sector at 29.6%.

The highest proportion of graduate vacancies continues to be found in the accountancy or professional

services firm sector. A total of 18.0% of all vacancies were in this sector this year. In second place is the

public sector with 13.8% of all graduate vacancies followed by the retail, and banking and financial services

sectors in joint third place at 9.9%.

Nearly one-third of AGR members had not met their recruitment targets for 2011-2012. In 2012-2013

candidate drop-out is regarded to be the biggest challenge that AGR employers are likely face. The reason

for this shortfall was further explored through the survey; of the total number of graduates who were

offered a job across all AGR employers, 87.1% went on to start at the company. Of the graduates who

accepted a position, overall 95.5% went on to start at the company.

Graduate starting salaries

As predicted in the Winter 2012 Review, there has been a 4.0% increase in graduate starting salaries

following three years of salary stagnation; the median graduate starting salary in 2011-2012 was £26,000. A

further increase is expected in the 2012-2013 recruitment season, when graduate starting salaries are

predicted to rise by 1.9% to £26,500.

The highest increase in graduate starting salaries is likely to be found in the public sector with a rise of 7.5%

predicted for this recruitment season. This is followed by the accountancy or professional services firm

sector with a predicted increase of 5.8% and the construction company or consultancy sector at 4.3%. The

sectors with the highest median graduate starting salaries remain the same as in previous years with the

investment bank or fund managers sector taking the top spot at £38,250 followed in second place by law

firms at £37,000.

3

Graduate Recruitment Survey 2013 Winter Review

Over three-quarters of AGR members did not pay any wage premiums to graduates with specific

qualifications or work experience in 2011-2012. However, a high proportion of AGR employers do offer

financial incentives to graduate recruits. A relocation allowance was most commonly used by 27.7% of AGR

members, closely followed by a signing on bonus (27.2%).

Graduate recruitment marketing

The mean marketing spend for 2011-2012 by AGR employers was £88,750. This is predicted to decrease

slightly in 2012-2013 to £87,000. There is also a small corresponding decrease expected in the mean

marketing spend per vacancy from £2,009 in 2011-2012 to £1,922 in 2012-2013.

Online promotion continues to be the most popular marketing activity with 96.3% of AGR employers

engaging in this, followed by on-campus activities (87.8%). The majority of AGR employers continue to

target UK universities for campus events or local advertising with nearly nine out of ten (89.3%) reporting

they targeted universities in 2011-2012.

Hot topics in graduate recruitment

Degree classification is used as a screening tool by a high proportion of AGR employers (82.1%) when

recruiting graduates. The majority (81.3%) use the 2:1 as a cut off for most of their positions, 15.0% use a

2:2 and a small minority (3.8%) state that it varies according to the role.

Following a successful trial 2008, the Higher Education Achievement Report (HEAR) is currently being rolled

out by a range of universities. The six page electronic document is designed to complement the degree

classification system, providing information about a student’s academic achievements, any additional

awards or university prizes gained, and any other recognised activities undertaken (such as volunteering,

student union roles or national sports representation). AGR members were asked if they had heard of the

HEAR; just under half reported that they had. Just over half of those who had heard of the HEAR (57.5%)

did not plan to use it, 19.5% stated that they would use it as a recruitment tool and 17.2% as a

development tool.

Of those AGR members who had heard of the HEAR but did not plan to use it, almost half reported that this

was because they were happy with the recruitment tools they already had (46.9%). Just over a fifth (22.4%)

stated they did not intend to use it because it was new and untried whilst 16.3% thought it contained too

much information.

4

Graduate Recruitment Survey 2013 Winter Review

Introduction

5

Graduate Recruitment Survey 2013 Winter Review

Introduction

Welcome to the AGR Graduate Recruitment Survey 2013 – Winter Review.

The AGR Graduate Recruitment Survey is the definitive study of AGR employer members and their

recruitment practices, providing up-to-the-minute insights into conditions and trends in the graduate

recruitment market. It provides regular benchmarking of key market indicators including vacancy and salary

levels.

As the leading survey of graduate recruitment practices, spanning the longest continuous series of

recruitment seasons, the survey is the primary source of information on graduate recruitment levels,

methods and practices amongst AGR members. This means that it is an invaluable tool for assessing,

organising and optimising graduate recruitment and development activities.

The Graduate Recruitment Survey is conducted twice a year. Undertaken on behalf of AGR by CFE, the

Winter Review explores AGR employers in relation to:

Graduate vacancy and starting salary levels for the 2011-2012 recruitment season by business

sector, region and career area

Predicted vacancy and salary levels for the 2012-2013 recruitment season

Graduate recruitment and marketing practices

Recruiters’ understanding of the Higher Education Achievement Report

The findings of the survey are presented in four chapters structured to reflect the areas outlined above.

Chapter 1 focuses on vacancy levels while Chapter 2 looks at graduate starting salaries. AGR employers’

spend on activities to attract graduate talent are explored in Chapter 3 and Chapter 4 examines the Higher

Education Achievement Report. In addition to the main survey findings, the Winter 2013 Review features

comparative data from national data sources to position AGR members and their recruitment practices in

the broader political and economic context.

6

Graduate Recruitment Survey 2013 Winter Review

Method

Data was collected via an online survey hosted on the CFE website for a four-week period in November

2012. An electronic invitation containing a link to the survey and a personal password was sent to all AGR

employer members. A series of semi-structured telephone interviews were also undertaken with

respondents to explore further themes emerging from the survey data.

The survey

The online survey included different types of questions to capture a variety of quantitative and qualitative

information. Some key questions were mandatory to ensure that all respondents’ views were captured.

AGR employers were routed through the survey on the basis of their responses to questions to ensure they

only responded to those relevant to their recruitment practices.

The analysis

The results were analysed using statistical software. The Review reports a variety of statistics including

frequencies, means and medians1. The number of organisations that responded to each question is

presented for each chart or table as the base. Bases vary throughout the report to reflect that not all

participants responded to the same questions due to the routing applied. Where bases are too low to

ensure the reliability of findings or maintain the anonymity of respondents, figures are not reported.

References to data for the 2011-2012 recruitment season relate to the actual year-end figures captured in

November 2012. By contrast, information for the 2012-2013 recruitment season represents AGR members’

predictions or expectations for the current recruitment season and should therefore be seen as a forecast;

the Summer 2013 Review will provide an update on these predictions in May. It is also important to

understand that the graduate recruitment practices of AGR members vary widely from sector to sector.

Law firms provide a case in point – recruitment lead times of two years are standard as graduates are often

sponsored to complete post-graduate law courses prior to the commencement of their Training Contract.

The vacancy levels reported for the 2011-2012 recruitment season therefore relate to vacancies for which

law firms have recruited, although graduates will not typically commence employment until 2014.

1

A frequency reports the proportion of respondents giving a specific answer. A mean (average) is calculated by adding

together all of the results and then dividing the total by the number of responses. A median is the number we obtain

by placing all of the responses to a given question in order of their value and selecting the middle value. Where there

is no single middle value the two middle values are added together and divided by two.

7

Graduate Recruitment Survey 2013 Winter Review

Profile of respondents

A total of 197 AGR members took part in the survey representing a response rate of 63.5%. Collectively,

these are estimated to have offered a total of 19,350 vacancies during the 2011-2012 recruitment season.

A high proportion of employers (60.9%) have just one graduate intake per year. Just over one-quarter

(25.4%) recruit more than one intake of graduates per year with one in ten (10.2%) using a rolling

programme of recruitment (Figure I).

Ad hoc

Other

recruitment 1.5%

2.0%

Rolling programme

of recruitment

10.2%

More than one

intake of graduates

per year

25.4%

One intake of

graduates per

year

60.9%

Figure I:

Recruitment methods of respondents – Base = 197

A wide variety of employers responded to the AGR survey, thereby reflecting the AGR membership base

and ensuring the findings are representative (Figure II). Law firms provided the largest proportion of

responses to the survey (17.8%), followed by engineering or industrial companies (11.2%) and the public

sector (8.1%).

The full list of responding organisations is provided on pages 10-12.

8

Graduate Recruitment Survey 2013 Winter Review

Law firm

17.8%

Engineering or industrial company

11.2%

Public sector

8.1%

Retail

7.6%

Consulting or business services firm

7.1%

Banking or financial services

7.1%

Investment bank or fund managers

5.6%

Energy, water or utility company

5.6%

Accountancy or professional services firm

5.1%

Construction company or consultancy

4.6%

IT/Telecommunications

4.6%

FMCG company

4.1%

Transport or logistics company

Chemical or pharmaceutical company

3.0%

1.5%

Oil company

1.0%

Insurance company

1.0%

Motor manufacturer

1.0%

Manufacturing

1.0%

Hospitality and leisure

1.0%

Other

2.0%

Figure II:

Sector of respondents – Base = 197

9

Graduate Recruitment Survey 2013 Winter Review

The following AGR members took part in the survey

3M

A

Accenture

Accenture (UK) Ltd (formerly Accenture

Technology Solutions)

Addleshaw Goddard

AECOM

AkzoNobel

Allen & Overy LLP

American Express

Amey

Anglian Water

Aon

Arcadia Group

Arriva

Asda

Ashurst

AstraZeneca

Atkins

Aviva Plc

AXA UK

B

B&M

B&Q plc

Babcock International Group, Nuclear Business

Unit

BAE Systems

BAE Systems Detica

Baillie Gifford

Balfour Beatty

BAM Nuttall Ltd

Bank of America Merrill Lynch

Bank of England

Barclays

Bentley Motors Limited

BG Group

Bircham Dyson Bell

BlackRock

Bloomberg

BNP Paribas

BNP Paribas Real Estate

10

Bond Pearce LLP

Boots

BP

Brewin Dolphin

Bristows

British Airways

British Sugar

BT

Burges Salmon LLP

C

Cancer Research UK

Centrica

CFE (Research and Consulting) Ltd

Civil Service Fast Stream

Clifford Chance

Co-operative

Commerzbank

CSC

Cummins

D

Danone Ltd

Dechert LLP

Deloitte

DENSO

DHL

Dixon Wilson

DLA Piper

Doosan Power Systems Ltd

DTZ

dunnhumby Limited

DWF LLP

Dyson

E

E.ON UK

EC Harris LLP

ECA International

Enterprise Rent-A-Car

Environment Agency

European Personnel Selection Office (EU Careers)

Explore Learning

Graduate Recruitment Survey 2013 Winter Review

F

L

FDM Group

Field Fisher Waterhouse

Filtrona plc

Freshfields Bruckhaus Deringer LLP

FSA

Fujitsu

L'Oreal

Lloyd's Register

Lloyds Banking Group

Lockheed Martin UK

Logica

G

Gazprom Marketing & Trading

GKN plc

GL Noble Denton

GlaxoSmithKline

Grant Thornton UK LLP

H

Hampshire Constabulary

Hitachi Data Systems

HJ Heinz

HM Revenue and Customs

Hogan Lovells International LLP

Home Retail Group

HP

Hymans Robertson Services Limited

I

IBM UK Limited

ICAP

IMI plc

International Financial Data Services

IPG Mediabrands

Irwin Mitchell

J

Jaguar Land Rover

John Lewis

Johnson Matthey plc

K

Kent County Council

Kirkland & Ellis International LLP

KPMG

M

Mace Limited

Macfarlanes LLP

Macquarie Group

Majestic Wine

Marks & Spencer

Mars UK

Mayer Brown

Mazars LLP

MBDA

Mercer

Merlin Entertainments Group

Metaswitch Networks

Mills & Reeve LLP

Mitchells & Butlers

Mitsubishi UFJ Securities International

Moore Stephens LLP

Morgan Crucible

Morgan Stanley

Mott MacDonald

N

Nabarro LLP

National Leadership and Innovation Agency for

Healthcare (NHS Wales)

National Offender Management Service

Nestlé

Network Rail

NHS Leadership Academy

Nomura International

NSG/Pilkington Group

nucleargraduates

O

Ocado

Osborne Clarke

11

Graduate Recruitment Survey 2013 Winter Review

P

T

PA Consulting Group

Pinsent Masons LLP

Procter & Gamble

PwC

Taylor Wessing

Teach First

Technip UK Ltd

Tesco

Thales

Thames Water Utilities Limited

The National Audit Office

TLT

Towers Watson

Transport for London

TRW

Tube Lines

Q

Qinetiq

R

Rabobank International

Reed Smith

RM Education

Rolls-Royce

Royal Bank of Scotland Group

Royal Borough of Kingston upon Thames

Royal Mail

RPC

RSM Tenon

S

Sainsbury's

Sanctuary Housing Association

Santander UK

Scottish Power

Scottish Prison Service

Scottish Water

Severn Trent Water

Shearman & Sterling

Shoosmiths

Siemens

SIG plc

Simmons & Simmons

SJ Berwin

SNR Denton

SSE

Standard Bank Plc

Standard Chartered

Standard Life

Stephenson Harwood LLP

SunGard Financial Systems

12

U

UBS

UK Power Networks

Unilever

Unipart Group

United Biscuits

W

Waitrose

Wates

Watson, Farley & Williams LLP

Weil, Gotshal & Manges

Whitbread

Graduate Recruitment Survey 2013 Winter Review

Chapter 1

Graduate vacancies

13

Graduate Recruitment Survey 2013 Winter Review

Graduate vacancies

This chapter examines actual year-end vacancy levels for the 2011-2012 recruitment season and presents

AGR members’ predictions or expectations for the current recruitment season (2012-2013). Vacancy levels

are explored at the sectoral, regional and career area level.

Graduate vacancies in 2011-2012 and 2012-2013

When comparing the total number of vacancies that are estimated to have been offered in 2011-2012 with

the total number reported in the 2010-2011 recruitment season, there was an 8.2% decrease in vacancies

amongst those AGR employers who responded to both surveys (Figure 1.1). In total, AGR members are

estimated to have offered 19,350 vacancies in 2011-2012. Although there was a decrease in vacancies last

year, there is positive news for the current recruitment season; the number of vacancies is predicted

increase to 21,061 vacancies for 2012-2013, a rise of 8.8%.

2000

14.7%

2001

14.6%

2002

-6.5%

2003

-3.4%

2004

15.5%

2005

5.1%

2006

5.1%

2007

12.7%

2008

2009

0.6%

-8.9%

2010

8.9%

2011

2012

2013 (predicted)

1.7%

-8.2%

8.8%

Figure 1.1:

Graduate vacancy changes at AGR employers 2000 to 2013 (predicted) – Percentage increase or decrease on

previous year (varying bases)

Although there has been an overall drop in the total number of vacancies offered by the AGR employers

who responded to the survey, the mean number of vacancies per employer has remained relatively stable

since 2008-2009, fluctuating by less than 2 vacancies per employer on average over the four year period

(Figure 1.2). The mean number of vacancies per employer has decreased by 1.4 between 2011 and 2012.

Recruiters are, however, predicting a substantial increase in the mean number of vacancies per employer

for the first time since 2008-2009 from 98 in 2011-2012 to a predicted 109 in 2012-2013.

14

Graduate Recruitment Survey 2013 Winter Review

2009

98.7

2010

99.4

2011

99.6

2012

2013 (predicted)

98.2

108.6

Figure 1.2:

Mean number of vacancies per AGR employer 2009 to 2013 (predicted) – Varying bases

In-depth interviews with AGR members suggested that the overall decline in graduate vacancies between

2010-2011 and 2011-2012 was attributable to a lack of business confidence arising from the weak

economic climate.

When exploring the predicted increase in vacancies for 2012-2013, AGR members highlighted that signs of

improved market conditions and business confidence were the primary reasons, with firms implementing

growth strategies to expand their business. As stated by one employer from the transport sector:

“Personally, I think there are some green shoots of recovery. I think we are starting to see a little bit more

confidence, certainly in the recruitment market. We are seeing a lot of growth now in mainland Europe

operations. In fact, we have a strategy to double in size over five years, which is a really aggressive

growth strategy.”

An employer from the accountancy and professional service sector suggested that the increase in vacancies

was as a result of firms not being able to meet recruitment targets from the previous season and hence the

need to subsequently increase this year’s target to offset the shortfall. Meanwhile, an employer from the

energy sector felt that the rising demand for certain skills from businesses, such as those found in STEM

(Science, Technology, Engineering and Maths) disciplines, was another factor behind the predicted

increase: “There’s really a shortage of talent in the sector, plus a large volume of the current workforce is

approaching retirement therefore businesses need to meet that shortfall over the next five to ten years.”

15

Graduate Recruitment Survey 2013 Winter Review

Figure 1.3 shows that for a high proportion of AGR members, the number of graduates they plan to recruit

in 2012-2013 remains relatively unchanged from the actual numbers reported in 2011-2012. The category

with the biggest predicted change is 1-25 graduates, with a predicted decrease of 3.1 percentage points

from 39.1% to 36.0%. There is also a predicted decrease in the proportion of employers who plan to recruit

between 51-75 graduates, dropping from 10.7% to 8.1%. There are predicted increases in the categories

26-50 and 76-100 rising from 18.3% to 20.8% and 6.1% to 7.6% respectively.

No new vacancies

2.0%

2.5%

36.0%

1-25

39.1%

20.8%

18.3%

26-50

8.1%

51-75

10.7%

7.6%

6.1%

76-100

13.7%

12.7%

101-250

5.6%

7.6%

251-500

501-750

More than 750

Don't know

2.5%

1.5%

2.0%

1.5%

1.5%

0.0%

2012-2013 (predicted)

2011-2012

Figure 1.3:

Number of graduate vacancies offered by AGR employers in 2011-2012 and 2012-2013 (predicted) – 2011-2012 Base

= 197; 2012-2013 Base = 197

Comparative data: Increasing vacancy levels

The Office for National Statistics estimates that there were 489,000 job vacancies in the UK

during September to November 2012. Compared to the same period in 2011, when the total

number stood at 459,000 vacancies, ONS predicts a 6.5% increase in vacancies. This mirrors

AGR employers’ predicted increase in vacancies for the 2012-2013 recruitment season,

suggesting this is indicative of wider trends.

16

Graduate Recruitment Survey 2013 Winter Review

Those AGR employers who predicted an increase in their graduate vacancies were asked to indicate how

important several factors were in their predictions on a scale from one to six, where one was ‘not

important at all’ and six was ‘very important’. Figure 1.4 shows that an increased strategic focus on

graduate recruitment is the most important reason why employers plan to recruit more graduates, with a

mean score of 4.44. Actual growth in business was rated the second most important factor at 4.14, closely

followed by an anticipated growth in business at 4.07. A further reason for the predicted increase

highlighted by a minority of employers through the survey was succession planning for the years ahead. As

an employer in the engineering or industrial company sector observed, succession planning is important

“to ensure we have the talent in the business both in the short and long term.”

Increased strategic focus on graduate recruitment

4.44

Actual growth in business

4.14

Anticipated growth in business

Higher recent turnover of staff

Increase in the number of applicants

4.07

2.37

2.05

Figure 1.4:

Importance of reasons for expected increase in vacancies during 2012-2013; mean ratings on a scale from 1 (not

important at all) to 6 (very important) – Base =67 (this question is answered only by those who reported an increase in

vacancies)

Those employers who predicted a decrease in vacancy levels for 2012-2013 were also asked to state how

important several factors were in their predictions to recruit fewer graduates. This was again on a scale

from one to six, where one was ‘not important at all’ and six was ‘very important’. The most important

reason reported was as a direct result of the current economic climate with a mean of 3.97, followed by an

indirect result of the current economic climate at 3.46 (Figure 1.5). Through the survey, AGR employers

were asked to report any other reasons to explain the predicted decrease in vacancies. A minority reported

that the decrease was due to an increase in school leaver programmes and apprenticeships as illustrated by

one employer in the legal firm sector: “The business model of most law firms is having to change and this

means fewer positions for trainee solicitors and newly qualified lawyers but an increase in opportunities

for other support roles, including school leavers.” Changes in organisational structure were also reported

by a minority of AGR members as a reason for the decrease in vacancies.

17

Graduate Recruitment Survey 2013 Winter Review

Direct result of the current economic climate

3.97

Indirect result of the current economic climate

(cautionary measure)

3.46

Improved retention rates

Lower strategic focus on graduate recruitment

2.81

2.16

Figure 1.5:

Importance of reasons for expected decrease in vacancies during 2012-2013; mean ratings on a scale from 1 (not

important at all) to 6 (very important) – Base = 34 (this question is answered only by those who reported a decrease in

vacancies)

The impact that school leaver and apprenticeship programmes were having on employers’ graduate

vacancies was further explored during the in-depth interviews. The majority of employers consulted

reported that they already had an established apprenticeship and/or school leaver programme. However,

the majority commented that these programmes were for different job roles within the business rather

than as a substitute for their existing graduate vacancies. This would not therefore affect the number of

graduates they were recruiting. As stated by an employer from the transport sector: “It doesn’t have an

impact on our graduate numbers. They try to achieve two very different aims. The graduate programme

for us has a very clear aim in that we want the graduate programme to produce the future leaders and

managers of the business. The apprenticeship programme is typically longer term and comes very much

with a lower level. The aim is much more engineering focused, whilst the graduate programme is more

operational management focused. There are two very different approaches there.”

Employers offered several reasons for introducing alternative talent programmes to their business. Many

reported that increased competition from other employers seeking to recruit talented school leavers as a

reason for implementing these schemes. A further reason was that increased tuition fees could be

deterring individuals from going into Higher Education and therefore not joining graduate programmes. As

indicated by one employer from the banking sector: “We’re doing this because the shift in political

landscape is going to cause a lot of individuals to decide not to go to university and will impact where the

talent goes in the marketplace. Most big employers are waking up to this and have developed their own

apprenticeship programmes. The programme is on the same level as graduate programme with the same

priorities for the business and professional studies, but we do see it as a separate pipeline for the future.”

One employer in the construction sector suggested that their senior management team was interested in

diversifying the type of individuals they recruited into the business, meanwhile an employer from the retail

sector saw these programmes as an opportunity to provide both work opportunities to school leavers, and

to develop the technical competence of staff from an earlier age: “We recognised that we have a

responsibility to provide work experience opportunities and give exposure and build skills early on for the

business. Retail is about technical skills which take time, and it is valuable to getting the right skills in.”

18

Graduate Recruitment Survey 2013 Winter Review

A minority of employers, whose school leaver programmes were in their infancy, were unsure as to

whether apprenticeship programmes would impact on their graduate vacancy numbers. As outlined by an

employer from the retail sector: “We are just beginning to understand how the programmes are working

so we still need to work out how many we plan to retain and what level they will move into. The schemes

are run within the business discretely but may become more linked in the future. It does not affect the

numbers, but it will take a few years to recognise the impact.”

An employer from the accountancy sector who was considering launching a school leaver programme

stated that, if implemented, this would reduce the overall number of graduates recruited onto their

existing programme.

Policy insight

The government continues to place a significant focus on the role and growth of

Apprenticeships. The Richard Review of Apprenticeships was submitted to government in

November 2012 and the government will formally respond in spring 2013. Ten key

recommendations were made in the report including redefining and better articulation of

Apprenticeships, greater focus on outcomes and quality, and creating the right incentives

for Apprenticeship training.

19

Graduate Recruitment Survey 2013 Winter Review

Expected changes in vacancies by sector

Table 1.6 presents the expected percentage change in vacancies from 2011-2012 to 2012-2013 by sector2.

Table 1.6: Expected percentage change in vacancies from 20112012 to 2012-2013 by sector

Construction company or consultancy

77.8%

Transport or logistics company

41.4%

Energy, water or utility company

29.6%

Consulting or business services firm

28.6%

IT/Telecommunications company

26.6%

Engineering or industrial company

18.2%

Retail

14.9%

Investment bank or fund managers

7.5%

FMCG company

4.4%

Public sector

1.3%

Accountancy or professional services firm

-2.4%

Law firm

-2.7%

Banking or financial services

-27.9%

Overall, the majority of sectors are predicting an increase in the number of vacancies for 2012-2013

compared to the number of vacancies they had in 2011-2012. The construction company or consultancy

sector is planning the largest increase in vacancies at 77.8%; this follows the 29.4% increase predicted for

the previous recruitment season in the Winter 2012 Review. The sector with the second largest predicted

increase in vacancies is the transport or logistics company sector at 41.4%; this follows a predicted

decrease of 4.9% in the Winter 2012 Review for the previous recruitment season. The third biggest increase

for 2012-2013 is in the energy, water or utility company sector at 29.6% followed by consulting or business

services firms at 28.6%.

An employer from the construction sector revealed that their business was growing and had advertised the

largest number of vacancies ever, with plans for further increases next year. This employer also recognised

that current cohorts of graduates were performing well, resulting in an appetite from the business to

recruit more. An employer from the transport sector highlighted that their business was going through a

period of expansion, suggesting that increasing fuel prices may have helped to stimulate an increase in the

use of public transport.

2

The following sectors are not reported in our analysis as the small number of respondents within the sector may

jeopardise their anonymity: oil company, chemical or pharmaceutical company, insurance company and motor

manufacturers.

20

Graduate Recruitment Survey 2013 Winter Review

Likewise in the energy sector it was reported that the demand for non-carbon energy (i.e. nuclear and

renewable energy) had resulted in a large rise in the number of graduates required to meet the demands of

the sector. The employer also explained that recruitment levels had been static for a number of years,

however this change in demand had led to an increase in graduate recruitment: “You can’t just recruit

qualified engineers, you have to grow your own and apprentices, grads in particular. I keep hearing we

can get more work if only we get more people to drive it. More people, more skilled people, means more

business.”

The largest predicted decrease in vacancies is in the banking or financial services sector at 27.9%; this

follows a small predicted increase of 0.4% in the previous Winter 2012 Review. Small predicted decreases

are also expected in the law firm sector (2.7%) and the accountancy or professional services firm sector

(2.4%). The reason for the decreases in vacancies for the law sector was outlined by one depth interviewee

who identified a decline in work, especially that which can be undertaken at the trainee level. Another

employer from the law sector suggested that firms in that sector were being more cautious as law firm fees

were being reduced.

Policy insight

The UCAS end of cycle report for 2012 showed a drop of 6.6% in applications across the UK

following the first year of tuition fees of up to £9,000 per year for full-time home & EU

undergraduate students. There were 53,900 fewer students starting in 2012 compared to

2011. There were 51,000 fewer acceptances In English universities which accounts for a

drop of 13%. However the proportion of disadvantaged 18 year olds progressing to higher

education in 2012 actually increased across the UK, although entry rates in advantaged

areas remain 4 times greater than those in disadvantaged areas.

Amongst 18 year old UK students, women are now one third more likely to progress to

higher education compared to their male counterparts. Although there was a fall in entry

rates for both men and women in 2012, the fall amongst male students was four times

greater than that of female students.

21

Graduate Recruitment Survey 2013 Winter Review

Vacancies in 2011-2012 by business sector

Table 1.7 presents the proportion of total graduate vacancies by sector.3 The accountancy or professional

services firm sector continues to have the highest proportion of graduate vacancies at 18.0%. This has,

however, dropped by 3.4 percentage points from the proportion reported in the Winter 2012 Review

(21.4%) and currently stands at a level similar to that found in the Winter 2011 Review (18.4%). In second

place is the public sector with 13.8% of all graduate vacancies. This sector has seen an increase from 9.6%

in the Winter 2012 Review and from 7.9% in the Winter 2011 Review. The retail, and banking and financial

services sectors are in joint third place at 9.9%. Although only making up 4.2% of all vacancies, the

construction company or consultancy sector has more than doubled the proportion of vacancies they hold

from 1.9% in the Winter 2012 Review to 4.2%.

Table 1.7: Vacancies at AGR employers by sector in 2011-2012

% of 19,350 vacancies

3

Accountancy or professional services firm

18.0%

Public sector

13.8%

Retail

9.9%

Banking or financial services

9.9%

Engineering or industrial company

8.2%

Consulting or business services firm

8.2%

Investment bank or fund managers

7.9%

Law firm

5.9%

IT/Telecommunications company

5.5%

Construction company or consultancy

4.2%

FMCG company

1.6%

Transport or logistics company

1.5%

Energy, water or utility company

1.3%

Other

1.4%

The following sectors are not reported in our analysis as the small number of respondents may jeopardise their

anonymity: oil company, chemical or pharmaceutical company, insurance company and motor manufacturers.

22

Graduate Recruitment Survey 2013 Winter Review

Vacancies in 2011-2012 by region

London continues to have the highest proportion of graduate vacancies at 42.4% followed by the South

East at 10.1% (Table 1.8). The North West has moved up from third to fourth place, increasing its share of

total graduate vacancies from 5.9% to 6.5% and overtaking the West Midlands which has dropped from

6.6% to 6.0%.

Table 1.8: Vacancies at AGR employers by region in 2011-2012

% of 19,218 vacancies

London

42.4%

South East

10.1%

North West

6.5%

West Midlands

6.0%

South West

5.0%

Scotland

4.8%

East Midlands

4.5%

Yorkshire and Humberside

4.1%

North East

2.7%

East of England

1.8%

Wales

1.3%

Northern Ireland

1.1%

Europe

4.0%

Asia

2.3%

Rest OW

2.3%

USA

1.2%

*The base appears as 19,218 instead of 19,350 because some responding

organisations failed to provide information about the regions where they recruit.

Please note recruiters may be offering vacancies in more than one region

simultaneously.

23

Graduate Recruitment Survey 2013 Winter Review

Vacancies in 2011-2012 by career area

Table 1.9 shows the proportion of graduate vacancies by career area4. Accountancy continues to occupy

the top spot with the highest proportion of vacancies at 16.1%, however this proportion has reduced in size

when compared to the Winter 2012 Review where it stood at 19.3%. Consulting has moved up from third

place in the Winter 2012 Review (10.5%) to second place at 11.7%, followed by IT at 10.1%. General

management has also moved up a place this year from fifth to fourth with an increase of 1.4 percentage

points compared with the Winter 2012 Review, whilst legal work has dropped from 8.5% to 6.2%.

Table 1.9: Vacancies at AGR employers by career area in 20112012

% of 18,758 vacancies

Accountancy

16.1%

Consulting

11.7%

IT

10.1%

General management

9.5%

Legal work

6.2%

Investment banking

6.0%

Retail management

4.1%

Sales/customer management/business development

3.9%

Financial management

2.8%

Marketing

2.6%

Mechanical engineering

2.5%

Human resources

2.1%

Electrical/electronic engineering

2.0%

Civil engineering

1.6%

Purchasing

1.4%

Manufacturing engineering

1.4%

Research and development

1.2%

Actuarial work

1.2%

Science

1.0%

Logistics

1.0%

Other

5.1%

*The vacancies base appears as 18,758 instead of 19,350 because some responding

organisations failed to provide information about the career areas in which they

recruit. Recruiters may be offering vacancies in more than one career area

simultaneously.

4

The following career areas are not reported in our analysis as the small number of respondents within the career

area may jeopardise their anonymity: health and education.

24

Graduate Recruitment Survey 2013 Winter Review

Achievement of 2011-2012 recruitment targets

AGR employers were asked to state whether or not they had achieved their recruitment targets for 20112012. Just over two-thirds of employers (68.2%) reported that they had achieved their recruitment targets

for 2011-2012, however this means that nearly one-third (30.7%) had not (Figure 1.10). The transport or

logistics company sector reported the highest shortfall with 66.7% of recruiters reporting that they had not

met their recruitment targets, followed by IT/telecommunications (44.4%), retail (40.0%) and consulting or

business services firms (35.7%).

Don't know

1.0%

No

30.7%

Yes

68.2%

Figure 1.10:

Whether graduate vacancies were filled in 2011-2012 recruitment season – Base = 192

Those AGR members who had not met their recruitment targets were asked what proportion of their

graduate vacancies they had not filled. Just over two-fifths reported not filling between 1% and 5% of their

vacancies. One-quarter reported not filling between 6 to 10% of their vacancies and just over one-quarter

reported not filling between 11 to 25% of their vacancies. On a positive note, and unlike in the Winter 2012

Review, none of the AGR members who responded to the Winter 2013 Review reported that they had not

filled over 50% of their vacancies.

42.1%

24.6%

26.3%

7.0%

1 to 5% of vacancies

6 to 10% of

vacancies

11 to 25% of

vacancies

26 to 50% of

vacancies

Figure 1.11:

Extent of shortfall of graduate recruits in 2011-2012 – Base = 57 (this question is answered only by those who

reported not meeting their recruitment targets)

25

Graduate Recruitment Survey 2013 Winter Review

Challenges anticipated in filling vacancies in 2012-2013

AGR employers were asked to rate the likelihood of them facing a variety of challenges in relation to

meeting their recruitment targets for 2012-2013 on a scale from one to six, where one was ‘not at all likely’

and six was ‘very likely’. Candidate drop-out continues to be the most likely challenge, rated the highest on

average by AGR employers at 3.80, followed by graduates’ perceptions of the industry at 3.62. The

likelihood that employers will face late changes in the business’ requirements has increased from 3.19 in

the Winter 2012 Review to 3.50 (Figure 1.12).

Those organisations who did not fill all of their graduate vacancies in 2011-2012 rated some of the

challenges more highly than those who had met their targets. Candidate drop-out due to graduates

applying to a large number of organisations is more likely to be a challenge for those who had not met their

targets (4.24), compared to those who did (3.54). They also rated the likelihood of a shortage of applicants

in specific geographical areas higher at 3.72 (compared to 2.83) along with not having enough applicants

with the right skills (3.86 compared to 3.10).

Candidate drop-out because graduates are applying to a

large number of organisations

3.80

Graduates’ perceptions of the industry sector

3.62

Late changes in the business’ requirements

3.50

Not enough applicants with the right skills

3.35

Shortage of applicants in specific geographical areas

3.13

Limited resources to market graduate vacancies properly

3.11

Not enough applicants with the right qualifications

2.87

Offering a competitive starting salary

2.80

Candidate drop-out because selection and assessment

process is too slow

Offering a competitive graduate training and development

programme

2.74

2.25

Figure 1.12:

Likelihood to face various challenges in meeting 2012-2013 recruitment targets; mean ratings on a scale from 1 (not

likely at all) to 6 (very likely) – Base = 186

26

Graduate Recruitment Survey 2013 Winter Review

As highlighted above, candidate drop-out is the biggest challenge affecting recruiters. In order to enable us

to explore drop out further, survey respondents were asked to state how many graduates they had made

job offers to, how many offers had been accepted and the number of graduates that started at their

organisation for the first time this year. Of those graduates who were offered a job, 87.1% overall went on

to start at the company, however, analysis by sector shows that the ratio of offers to starts ranges from

45.5% to 100% at individual organisations. Of all the graduates who accepted a position, 95.5% went on to

start at the company; once again the proportion ranged from 55.6% to 100% at individual organisations.

When examining this data by AGR member, the findings show that all of the graduates who accept a job

start at the company in 60.8% of cases; a further 23.1% of employers report that between 90-99% of

graduates who accept an offer start at the company.

Figure 1.13 shows the proportion of graduates who are offered a job that start by sector. The investment

bank or fund managers sector has the highest proportion of starts at 92.7%, followed by the engineering or

industrial company sector (90.6%) and accountancy or professional services firms (89.4%). Law firms have

the lowest start rate with only 76.1% of graduates starting who were offered a position.

All

87.1%

Investment bank or fund managers

92.7%

Engineering or industrial company

90.6%

Accountancy or professional services firm

89.4%

Construction company or consultancy

89.1%

Banking or financial services

88.1%

Retail

87.9%

Consulting or business services firm

85.5%

FMCG company

85.2%

Public sector

82.4%

Energy, water or utility company

82.2%

Law firm

Other

76.1%

90.1%

Figure 1.13:

Proportion of graduates who are offered a job and start by sector; – Base = 132

Figure 1.14 goes on to explore the proportion of starts by those who accept a job, again by sector. The

accountancy or professional services firm sector reported that 100% of graduates who accepted an offer

started their job; this is closely followed by the construction company or consultancy sector (99.2%) and

investment bank or fund managers (98.8%). Again law firms are near the bottom at 89.1%, however the

lowest proportion this time can be found in the public sector at 83.4%.

27

Graduate Recruitment Survey 2013 Winter Review

All

95.5%

Accountancy or professional services firm

100.0%

Construction company or consultancy

99.2%

Investment bank or fund managers

98.8%

Banking or financial services

98.4%

Engineering or industrial company

96.9%

Retail

96.1%

FMCG company

95.1%

Energy, water or utility company

92.7%

Consulting or business services firm

89.6%

Law firm

89.1%

Public sector

83.4%

Other

100.0%

Figure 1.14:

Proportion of graduates who accept a job and start by sector; – Base = 131

Consultations with AGR members investigated why candidates drop out at key stages in the recruitment

process. Members suggest that graduates are submitting a higher volume of applications to graduate

recruiters to ensure they get offered a role because of increased competition for jobs. One employer from

the transport sector noted there had been an increase in the number of applications per advertised

vacancy over the past three years: “We are seeing some vacancies this year which have over 400

applications per vacancy. It’s the law of averages. Students know they are in a competitive environment

and will therefore make more applications and will follow through with more recruitment processes until

the very end. The lucky ones will choose the one that’s best for them.”

The majority of members suggested that both starting salaries and the perception of working for a better

company (suggesting in the main a bigger company that has better brand recognition) were often the

reasons why graduates decided not to accept an offer, or failed to start a post after accepting an offer. As

highlighted by an employer from the engineering sector: “We get high numbers of drop out, the issue is

that they perceive other companies as better than ours as our company is not a well know name.”

Similarly, one employer from the energy sector indicated that they were losing engineering graduates to

larger, higher paying recruiters from outside the sector: “we found that non-engineering type sectors are

targeting engineers with higher salaries to attract them. Larger companies have large quotas to fill.”

Conversely, other factors raised by a minority of AGR members included a perception that some graduates

preferred to work for smaller employers to increase their exposure to a wider breath of work opportunities

within a business. In addition, it was suggested that working for a smaller recruiter would equate to

additional mentoring time from colleagues as opposed to being one individual amongst a large volume of

graduates.

28

Graduate Recruitment Survey 2013 Winter Review

One employer from the accountancy and professional services sector indicated that there was a growing

trend amongst graduates of accepting offers but consequently turning these down once they had received

a better offer. As highlighted by an employer from the accountancy and professional services sector: “We

are finding that graduates are making multiple applications. They will accept the first offer but may then

receive an offer from a bigger rival. In previous years they would be open and honest about where they

were applying but now they wait for other offers before making a decision. If the first offer is not with the

firm they are after they tend to sit on other offers that they will pursue and then decline others they have

already accepted.” The consequences for recruiters were that vacancies were left unfilled because they

were not able to recruit a replacement to the position in the time available. However, one employer from

the retail sector stated they drew upon a bank of graduates (coined their ‘talent bank’) to fill these

positions.

One employer from the engineering sector suggested that the timing of the offer to graduates determined

the level of drop-out, revealing the earlier the offer is made, the higher the likelihood they would drop out.

This view was shared by an employer from the public sector who felt that they had high drop-out as a result

of their recruitment processes being longer than other recruiters.

AGR members were asked about the approaches they adopted to counteract drop-out of this nature. The

majority of employers reported that regular communication with graduates throughout the recruitment

process was essential. One employer from the accountancy and professional services sector talked about

their “keep warm strategy” which involved inviting recruits to work functions, linking them to university

ambassadors and maintaining telephone communication with them at regular intervals. One employer

from the banking sector also highlighted the importance of maintaining communication with their interns

as potential future employees for the business: “with our programme we get a lot of interns, so we work

hard to ensure they don’t forget about us.”

Another employer from the transport sector described their approach to tackling drop-out: “The points put

in place in the recruitment process to reduce drop-out are those that hopefully inspire people to think this

is the right job for them or not. At every point in the recruitment process; the application form, the

telephone interview, the assessment centre, we will make them do tasks and answer questions that are

around things that are specific to the job and that give them a real insight into what the job is like and it

gives them and us a clear indication of how they behave to see whether they are a right fit for the

company.”

29

Graduate Recruitment Survey 2013 Winter Review

Chapter 2

Graduate salaries

30

Graduate Recruitment Survey 2013 Winter Review

Graduate salaries

This chapter focuses on graduate starting salary levels at AGR employers in 2011-2012 by business sector,

region and career area and explores members’ expectations for salary levels in 2012-2013. It also provides

information in relation to the provision of educational premiums and financial incentives.

Graduate salaries in 2011-2012 and 2012-2013

As predicted in the Winter 2012 Review, there has been a 4.0% increase in graduate starting salaries

following three years of stagnation. The views of recruiters were summed up by an employer from the

transport sector: “Of all the economic variables you can look at, salary has been the one to rise slowest

versus prices of fuel, prices of houses for example. We have managed to keep the salary static at a

competitive rate for quite a while now. I think most companies are looking at their overall salary levels

and thinking ‘it’s time to raise the graduate salary now.’”

The median graduate starting salary has increased from £25,000 in the 2010-2011 recruitment season to

£26,000 in the 2011-2012. There is a further predicted increase for the 2012-2013 recruitment season

when graduate starting salaries are set to increase by 1.9% to £26,500 (Figure 2.1).

2000

5.7%

2001

2.7%

2002

2.6%

2003

4.1%

2004

3.4%

2005

7.1%

2006

2.0%

2007

2.4%

2008

1.8%

2009

0.0%

2010

0.0%

2011

0.0%

2012

2013 (predicted)

4.0%

1.9%

Figure 2.1:

Changes in median graduate starting salaries at AGR employers from 2000 to 2013 (predicted) – Percentage increase

or decrease on previous year (varying bases)

31

Graduate Recruitment Survey 2013 Winter Review

During in-depth interviews with AGR members, a number of reasons were given to explain the rise in

graduate starting salaries. Overall, most AGR employers believed that salaries had increased because firms

wanted to improve their competitive advantage. Nearly half of those interviewed stated that they thought

employers had increased their graduate starting salaries partially as a result of other firms, particularly their

competitors, increasing theirs. According to the interviewees, organisations are seeking to keep pace with

their competitors in terms of average graduate starting salary levels: “The longer we wait to put our

salaries up, the further behind we’ll drop in terms of being below that average and the further we’ll move

away from the average. So there comes a critical point, where we have to kind of say ‘Well, we really

need to move now with the market.’” They are also looking to ensure they attract the top talent to their

business, as an employer from the retail sector explained: “we’ve not moved on graduate starting salaries

but one of our competitors has in order to attract the real top talent. Companies are looking to pick up

the cream of top level graduates.”

One employer from the law sector suggested that firms were increasing salary levels to retain graduates on

their existing programmes, as a consequence, others were raising their starting salaries to match these

increases. In addition, employers in the energy and transport sector suggested that salary increases could

be the result of companies taking account of the inflation that occurred during the preceding period of

salary stagnation. However, a minority of employers highlighted that the economic climate was still

preventing them from increasing their salaries. .

Comparative data: decrease in salary levels

According to the Labour Force Survey, for the period July to September 2012, the median

salary for adults with a degree or equivalent level qualification was £30,004. This has

decreased from £30,524 for the same quarter in the previous year. This indicates that the

predicted increase observed amongst AGR employers is not representative of the wider

market. The salaries reported in the Labour Force Survey are for individuals who are at any

point in their career showing that AGR employers remain competitive.

Figure 2.2 shows overall that the proportion of employers offering salaries in the specified categories is

predicted to remain relatively consistent. However, as salaries are predicted to rise in 2012-2013, it is

perhaps not surprising that the proportion of employers offering salaries in the lower categories is

decreasing. The largest predicted change is amongst the proportion of employers who pay between

£22,001 and £24,000, with a decrease of 3.8 percentage points from 17.3% to 13.5%. There is also a

predicted decrease from 24.6% to 22.4% in the proportion of employers expecting to pay £24,001-£26,000

and from 5.8% to 4.2% in the category £19,001-£22,000. There has, however, been an increase in the

proportion who predict they will pay £26,001-£31,000 from 24.1% to 27.6%; alongside this 5.7% of

employers are still unsure what their starting salary will be in 2012-2013.

32

Graduate Recruitment Survey 2013 Winter Review

14.1%

£36,001 or more

13.6%

9.4%

£31,001-£36,000

9.9%

27.6%

£26,001-£31,000

24.1%

22.4%

£24,001-£26,000

24.6%

14.1%

£22,001-£24,000

17.3%

4.2%

£19,001-£22,000

£19,000 or less

Don’t know

5.8%

2.6%

3.1%

2012-2013 (predicted)

5.7%

2011-2012

1.6%

Figure 2.2:

Graduate starting salaries at AGR employers in 2011-2012 and 2012-2013 (predicted) – 2011-2012 Base = 191; 20122013 Base = 192

Expected changes in salaries by business sector

Table 2.3 shows the predicted change in salaries between 2011-2012 and 2012-2013 by sector5. The

highest increase in graduate starting salaries can be found in the public sector; after the stagnation

predicted in the Winter 2012 Review, an increase of 7.5% is predicted for this recruitment season. The

accountancy or professional services firm sector is in second place with a predicted increase of 5.8%. The

construction company or consultancy sector predicts an increase of 4.3% following a predicted decrease of

1.1% in the Winter 2012 Review.

5

The following sectors are not reported in our analysis as the small number of respondents within the sector may

jeopardise their anonymity: oil company, chemical or pharmaceutical company, insurance company and motor

manufacturers.

33

Graduate Recruitment Survey 2013 Winter Review

Table 2.3: Expected salary change from 2011-2012 to 2012-2013

by sector

Public sector

7.5%

Accountancy or professional services firm

5.8%

Construction company or consultancy

4.3%

Retail

4.2%

Investment bank or fund managers

No change

Law firm

No change

Consulting or business services firm

No change

Banking or financial services

No change

FMCG company

No change

Energy, water or utility company

No change

Transport or logistics company

No change

IT/Telecommunications company

-0.9%

Engineering or industrial company

-1.0%

An employer from the public sector indicated that other organisations may be increasing their graduate

starting salaries in order to ensure they were aligned to the sector average: “In comparison to others, we

are higher than a lot of other graduate schemes, so other organisations in the sector might be aligning

their salaries to the average.”

In sectors where there was no reported salary increases, employers suggested that it was not necessary for

companies to increase graduate salaries as they are satisfied with the volume and quality of applications

they receive. As reported by an employer in the transport sector: “We are attracting good graduates and

we think the market is still pretty buoyant. So, as long as we get the good people in, we won’t just raise

salaries to match the market necessarily, but we will be conscious of the average and making sure we

don’t fall behind too much”. One company in the banking sector also felt that the firm was offering a

sufficiently high salary to remain competitive: “We got to a level where we felt we couldn’t go higher.

We’ve not needed to raise our salary levels. We are comfortable with the levels that we are attracting.

And the business is happy with the talent that we are recruiting.”

Others highlighted the issues faced by employers when setting salary levels and considering raising the

level for future cohorts. They highlighted that an increase in salary level would need to take into account

the salary of those who are already in post. An employer in the transport sector summed up the challenge:

“When companies are planning salary changes, there is a whole activity of making sure that the current

graduate cohort understands why they are not getting a rise, but other people are. If we run a

programme that is eighteen months long and that at the end of the programme, they will move on to

substantive roles, so they should be getting significant pay rises then anyway, but you know, you have to

look at it as an organisation and think, ‘Does this pay rise for the future graduates starting in 2014 affect

34

Graduate Recruitment Survey 2013 Winter Review

those who started in 2013?’ The answer is probably yes, so it’s not a light decision to make, because it

has a big impact on your business.” This view was echoed by an employer from the engineering sector who

commented: “One big problem with changing starting salaries is you’ve got to look at the existing

graduates you’ve recruited over the last 2-3 years so it does not create a problem for existing staff. For

any salary rises you have to think what the market rate is and then over the years edge your salaries up

rather than step change.”

Only two sectors are predicting a small decrease in their graduate starting salaries at 1.0% for engineering

or industrial companies and 0.9% for the IT/Telecommunication companies sector. In-depth interviews

suggested that general market conditions were the causal factor, with companies reporting that they are

increasingly having to deliver against tighter budgets.

In-depth interviews also explored whether employers endeavour to match salary levels to their respective

sector average. Members provided mixed responses to this but the majority suggested that they did not.

Employers instead indicated a preference for benchmarking their salary levels against organisations of a

similar size, or brand recognition as the sector average could be skewed by larger firms. As suggested by an

employer from the law sector: “It all depends on the size of the law firm. We would look at a

benchmarking tool looking at firms of a similar size as we can’t compete with bigger law firms because

their charge out rates are a lot higher”.

Employers were also asked to what extent they competed for the best graduates on the basis of salary.

Overall, our consultations revealed that while salaries are regarded as an important component of the

overall offer to graduates, other elements such as the training on offer, work opportunities, career

progression and organisational culture were equally significant. As one employer in the transport sector

explained: “I don’t think salary is the biggest factor that plays into it and I look at the biggest salaries in

the market and actually our graduates are looking at those salaries and going, ‘why are they paying so

much? What’s the deal there?’... Our single biggest unique selling point is the career advancement in our

organisation. That’s the pull for us. It’s the big sell. We also have the distinct advantage of offering

regional programmes. A lot of the programmes are London based. I think offering a job that is regional

and local is quite appealing to people.”

Policy insight

Drops in university applications for 2012 by subject area varied quite significantly. Subjects

such as physical science (-0.6%), engineering (-1.3%) and mathematics and computer science

(-2.8%) fell by comparatively small amounts when contrasted with more significant falls in

non-European languages (-21.5%), architecture (-16.3%) and creative arts and design (16.3%).

35

Graduate Recruitment Survey 2013 Winter Review

Graduate salaries in 2011-2012 by business sector

Table 2.4 shows the median graduate starting salary by sector6. The sectors with the highest median

graduate starting salaries remain the same as in previous years with the investment bank or fund managers

sector taking the top spot at £38,250 followed in second place by law firms at £37,000. Third place

continues to be banking or financial services (£28,750) followed by IT/Telecommunications companies at

£28,500. FMCG companies have seen a big increase in salaries from 2010-2011 with a starting salary

increasing to £28,250 in 2012-2013 from £25,750 reported in the Winter 2012 Review. Consulting or

business services firms have also seen an increase from £23,000 in the Winter 2012 Review to £26,500 this

year.

Table 2.4: Median graduate starting salaries at AGR employers

by sector in 2011-2012

6

Investment bank or fund managers

£38,250

Law firm

£37,000

Banking or financial services

£28,750

IT/Telecommunications company

£28,500

FMCG company

£28,250

Consulting or business services firm

£26,500

Accountancy or professional services firm

£25,750

Engineering or industrial company

£25,250

Energy, water or utility company

£25,000

Transport or logistics company

£25,000

Retail

£24,000

Public sector

£23,250

Construction company or consultancy

£23,000

Other

£23,000

The following sectors are not reported in our analysis as the small number of respondents within the sector may

jeopardise their anonymity: oil company, chemical or pharmaceutical company, insurance company and motor

manufacturers.

36

Graduate Recruitment Survey 2013 Winter Review

Graduate salaries in 2011-2012 by region

Graduate vacancies in London (including regional weighting) continue to attract the highest starting salaries

in the UK at £28,500. This has increased from £27,250 reported in the Winter 2012 Review and is in line

with the prediction made in the Summer 2012 Review (Table 2.5). Salaries in the South East have remained

static at £25,000. Scotland has seen graduate salaries increase by £1,250 since the Winter 2012 Review

when they stood at £23,500; this brings them in line with the starting salaries paid to graduates across

other regions in England.

Table 2.5: Median graduate starting salaries at AGR employers

by region in 2011-2012

London

£28,500

South East

£25,000

Scotland

£24,750

North West

£24,500

Yorkshire and Humberside

£24,500

Wales

£24,250

South West

£24,000

East of England

£24,000

East Midlands

£24,000

West Midlands

£24,000

North East

£24,000

Northern Ireland

£23,000

USA

£33,500

Rest of World

£33,500

Europe

£28,500

Asia

£28,000

37

Graduate Recruitment Survey 2013 Winter Review

Graduate salaries in 2011-2012 by career area

Table 2.6 shows the median graduate starting salary by career area7. Investment banking continues to

occupy the top spot with the highest median starting salary of £38,250. This has, however, dropped from

the £39,000 reported in the Winter 2012 Review. Legal work remains in second place and the median salary

has increased since the Winter 2012 Review from £35,500 to £37,000 – back to the level reported in the

Winter 2011 Review. Salaries in consulting continue to rise, increasing from £26,500 in the Winter 2011

Review, to £27,750 in the Winter 2012 Review and again to £28,500 in the Winter 2013 Review.

Table 2.6: Median graduate starting salaries at AGR employers

by career area in 2011-2012

7

Investment banking

£38,250

Legal work

£37,000

Consulting

£28,500

Actuarial

£28,500

Manufacturing engineering

£26,500

IT

£26,000

Sales/customer management/business development

£25,500

Human Resources

£25,500

Logistics

£25,500

Financial management

£25,250

Marketing

£25,250

Research and development

£25,250

Accountancy

£25,000

General management

£25,000

Electrical/electronic engineering

£25,000

Mechanical engineering

£25,000

Purchasing

£25,000

Science

£24,750

Civil engineering

£24,500

Retail management

£23,000

Other

£25,000

The following career areas are not reported in our analysis as the small number of respondents within the career

area may jeopardise their anonymity: health and education.

38

Graduate Recruitment Survey 2013 Winter Review

Education premiums for graduates in 2012-2013

AGR employers were asked if they paid premiums to graduates with specific qualifications or work

experience (Figure 2.7). Over three-quarters (76.6%) stated that they did not pay any premiums, similar to

the 77.7% reported in the Winter 2012 Review. There has been a small increase in the proportion of AGR

members who pay a premium to those with a PhD which has risen three percentage points since the