The United Kingdom A Diverse Foodservice Sector

advertisement

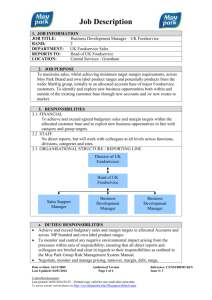

International Markets Bureau MARKET ANALYSIS REPORT | MAY 2011 Source: Shutterstock Source: Shutterstock The United Kingdom A Diverse Foodservice Sector The United Kingdom A Diverse Foodservice Sector EXECUTIVE SUMMARY The British foodservice market is among the most modern and concentrated in Europe. However, since 2008, the United Kingdom (U.K.) has changed from a booming economy to an economy in crisis, which has impacted the consumer foodservice market. In this fast-changing environment, up-to-date market and consumer data is more critical than ever. A Shift in the British Foodservice Sector The consumer foodservice sector continued to be affected by the economy in 2010. Falls in disposable income and rising unemployment resulted in a tough trading environment since 2009, leading to limited growth in foodservice value sales and a decline in outlet numbers, as operators struggled to keep up with the increasing costs of ingredients and rent. As a means to remain in business, foodservice operators sought opportunities to attract cash-strapped consumers with promotional vouchers and discounts. Pizza Express, Zizzi and Bella Italia were among those that offered „buy one, get one free‟ meals, among other offers, as operators competed with ready-meal deals offered by supermarket chains, which would allow consumers to spend less by staying in. INSIDE THIS ISSUE Executive Summary 2 The State of the Market 3-5 Major Trends in the Foodservice Sector 6-7 Foodservice Sector Performance by Channel 8-18 Market Entry Strategies 18-19 Conclusion 19 Bibliography 20 Annex: Company Profiles 20 Due to the number of outlets present in the market, cafés/bar operators, better known as “pubs” in the U.K., have maintained a strong presence, despite the economic downturn. Meanwhile, both chained and independent operators struggled due to declines of over 2% in 2009 (Euromonitor). Losses stemmed from rising rent and utility costs, alongside a decline in consumers dining out. Like most markets, chained 100% home delivery/takeaway flourished in this difficult economic environment, alongside smaller niche, less-developed subsectors and affordable options such as chained Middle Eastern fast food and chained specialist coffee shops. Market Outlook Private consumption has held up reasonably well since mid-2009, but the outlook for foodservice operators and consumers appears increasingly grim. With the struggling private sector and public sector cuts, the unemployment rate is set to continue rising into 2011. As a result, with the economy still uncertain, smaller/independent operators are likely to be driven out of the market. Meanwhile, highend restaurants have also taken a hit, leaving mid-level restaurants to benefit. Since the British are accustomed to eating out, often due to a large number of single occupant households, they are likely to consume more ready-meals instead, and are expected to continue eating out less often. Source: Shutterstock PAGE 2 THE STATE OF THE MARKET The U.K.‟s Hotel, Restaurant and Institutions Sector (HRI) is ranked the fourth largest consumer market in the country, after food retail, motoring, and clothing and footwear. Nonetheless, recent economic turmoil caused a decrease in consumer demand for foodservices as food prices increased in 2008. The U.K.‟s economic health continues to be uncertain, leading foodservices to remain unsteady. Although improvements in overall spending can be expected ahead, British consumers will still be watching how they spend their money, and therefore the total number of HRI outlets is still likely to fall. Effects of the Recession on Consumer Expenditures in Foodservices The U.K.‟s fast food industry benefited from the recession, having grown by over 2% in value terms in 2009 (Euromonitor). Consumers with less disposable income have turned away from more conventional restaurants and have moved towards fast food eateries or takeaway instead. Source: Planet Retail Quick-service restaurants are likely to continue to do well with consumers spending less. With the British increasingly seeking convenience, fast food outlets with drive-thrus saw an increase in trade over the recessionary period. In addition, new enclosed shopping malls throughout the U.K. led consumers to increasingly spend their time in malls, during which time they likely spent money on food and drink. However, the success of fast food operators will not last forever, as consumers slowly begin to return to pre-recessionary habits. Some players plan to remain competitive by broadening their consumer base through the health and wellness, sustainability, and fair trade trends. In addition, grocery retailers such as Marks & Spencer began offering meal deals to consumers, such as “Dine In for £10”, which in turn affected the restaurant business. These meal deals combined with the numerous cookery shows and food-related advertisements, continued to tempt consumers to stay home more often for a low-cost dining experience. The economy continues to struggle in the U.K., as the unemployment rate continues to rise. In March 2010, the unemployment total was at its highest level since December 2004 (Euromonitor). Consumer sentiment is unlikely to improve following the October 2010 announcement of the coalition government‟s comprehensive spending review, and as a result of concerns over a renewed slump in the U.K. housing market. The fiscal tightening program has set out projections showing an estimated 490,000 public-sector job losses, resulting in increased fear over job security across many areas of the economy, which are likely to weigh on spending plans for some time (Viewswire – The Economist). Following an estimated rise of 1% in 2010, the Economist Intelligence Unit expects private consumption growth to slow to a mere 0.2% in 2011, as the official measure of unemployment starts to trend higher. A fragile economic recovery has forecasters seeing a 1.7% expansion of the country‟s real gross domestic product (GDP) in 2010, slowing to 1.3% in 2011 (Viewswire – The Economist). PAGE 3 Facts and Figures Since 2007, the foodservice sector has suffered a decrease in sales, with a slight increase in 2010 as the economic downturn eased in the U.K. The figures shown in Chart 2 on the following page, illustrate the amount of total spending that was dedicated to food in the U.K. This was a higher proportion in 2010 than in the previous years. This small increase is a result of consumers increasingly opting for convenience when purchasing food and beverages. Foodservice operators did not all benefit from this increase, with full-service restaurants still feeling the pressure of cash-strapped consumers. Chart 1: Size of the Foodservice Market in the U.K. $180 $160 $140 $120 $100 $80 $60 $40 $20 $2006 2007 2008 2009 2010 Foodservice total spend (Billion USD) Source: Planet Retail, HoReCa Market – United Kingdom, July 2010 Chart 2: Proportion of Total Expenditures on Foodservice 2,500,000.00 165,999.96 2,000,000.00 158,982.68 Total expeditures USD$Mn 144,231.95 129,917.95 137,766.84 1,500,000.00 Foodservice total Spent Total Spending 1,000,000.00 500,000.00 0.00 2006 2007 2008 2009 2010 Year Source: Planet Retail, HoReCa Market – United Kingdom, July 2010 PAGE 4 Table 1: Top 20 Foodservice Operators by Banner Sales in the U.K. (2010) Banner sales (USD$) Foodservice Market Share % Rank Company 1 Punch Taverns 6,978,913,976 5.90 2 McDonald's 4,050,457,700 3.53 3 Mitchells & Butlers 3,371,663,330 2.82 4 Whitbread 1,956,680,525 1.56 5 JD Wetherspoon 1,876,114,754 1.56 6 Yum! Brands 1,758,311,443 1.50 7 Greggs 1,207,363,084 1.03 8 Subway 1,143,753,869 0.97 9 Domino's Pizza 788,949,600 0.67 10 Starbucks 751,635,400 0.59 11 Gondola Group 741,076,348 0.63 12 Burger King 642,682,949 0.55 13 Restaurant Group 629,320,302 0.53 14 Carlson 172,347,097 0.15 15 Papa John's 86,159,447 0.07 16 Dunkin' Brands 36,422,379 0.03 17 HMV 18,660,198 0.01 18 Church's Chicken 11,730,000 0.01 19 Grupo Zena 8,454,658 0.01 20 Lincolnshire Co-operative 4,853,517 0.00 Source: Planet Retail, HoReCa Market – United Kingdom, July 2010 Table 2: Top 20 Foodservice Operators by Number of Outlets in the U.K. Rank Company Number of Outlets, 2010 1 Punch Taverns 6,770 2 Subway 2,010 3 Mitchells & Butlers 1,567 4 Greggs 1,448 5 Yum! Brands 1,420 6 Whitbread 1,418 7 McDonald's 1,210 8 JD Wetherspoon 771 9 Gondola Group 682 10 Domino's Pizza 634 11 Starbucks 630 12 Burger King 505 13 Restaurant Group 318 14 Nando's 284 15 Dunkin' Brands 167 16 Papa John's 122 17 Carlson 50 18 Quiznos 13 19 Church's Chicken 11 20 Grupo Zena 8 Source: Shutterstock Source: Planet Retail, HoReCa Market – United Kingdom, July 2010 PAGE 5 MAJOR TRENDS IN THE FOODSERVICE SECTOR The Rise of Discount Vouchers As a result of heightened competition in the consumer foodservice sector, promotional vouchers and discounts flooded the market in 2009. Operators opted to compete with meal deals that supermarket chains were offering, which were encouraging consumers to spend less by staying in. A price comparison website, www.moneysupermarket.com, indicated that more than a quarter of British consumers will only go to restaurants if they have a discount voucher. The site states the most popular vouchers are Pizza Express, Zizzi, Strada, Haha Bar & Grill and Bella Italia. According to research conducted by HitWise Intelligence, the „Pizza Express voucher‟ was the most popular branded voucher search, with the only other company to have a branded voucher in the top 10 apart from restaurants being Tesco. This tool proved necessary in 2009 as consumers chose to forgo eating out as frequently as a result of the recession. The slow recovery of the economy will bring a new change to foodservice operators, as they will have to be more innovative in their value offerings and wean consumers off discount vouchers. Restaurants that used promotions to attract consumers in 2009 might be faced with the same challenge. Niche Subsectors Gain Popularity Consumer foodservice outlets are expected to continue struggling over the next two years. However smaller niche, less-developed subsectors and affordable options such as chained Middle Eastern fast food and chained 100% home delivery/takeaway, as well as chained specialist coffee shops will continue to thrive in value terms (Euromonitor 2010) The British have developed a strong appreciation for ethnic foods, which is largely driven by the high numbers of non-British citizens making the U.K. their home, as well as international travel. In the last couple of years, Japanese food has seen a big increase in popularity, due somewhat to its healthy image. Many British consumers are also known to cook non-British food at home on a regular basis. Health and Wellness Is Still On the Radar The health and wellness trend has grown strong in the U.K., leading Brits to spend more money on food and beverages in health centers. The British government has put increased efforts into encouraging consumers to eat “healthy” through governmental campaigns and other means; one of the reasons is that the U.K.‟s obesity rates are now the highest in Western Europe. As a result, consumers are increasingly demanding healthier products, to which the industry as a whole has had to respond. Sector operators such as Pizza Express introduced a range of “Leggera pizzas”, a lighter pizza in which the dough in the centre is removed, leaving a hole that is filled with fresh salad. Each pizza is designed to be approximately 500 calories and is low in saturated fat. Meanwhile, in November 2009, other fast food players such as Burger King, KFC, McDonald’s, Subway and Wimpy, committed to offering healthier choices to consumers by complying with the Food Standards Agency (FSA) guidelines to reduce salt, saturated fat and energy intakes, as well as informing consumers further of healthier options. Other chains, such as Pizza Express, Pizza Hut, Café Rouge and Domino’s Pizza, along with Tragus Group restaurants, have signed up to „hide‟ vegetables in children‟s dishes, in an attempt to encourage healthier eating. Despite efforts to promote health in the U.K., figures suggest that the recession-hit British have put their health on the back-burner, turning to fast food. The Health Food Manufacturers‟ Association (HFMA) recently conducted a survey suggesting that approximately 36 million people, two thirds of the British population, opted for TV dinners and fast food take-aways in 2009. Similarly, a study conducted by the FSA found that, on average, only 14% of the British population ate the recommended five portions of fruit and vegetables every day. These research results are further supported by sales figures achieved by fast food brands McDonald’s and KFC, whose value sales increased in 2009. Still, efforts towards the moderation of salt and fat intake on behalf of the FSA, the government, as well as manufacturers and foodservice operators will lead consumers to become increasingly aware of high-fat and highsalt foods over the medium term. Euromonitor predicts that consumers may return to pre-recessionary spending habits as healthier foods are deemed more affordable in a less economically panicked society. PAGE 6 Consumer Consciousness Hits the Foodservice Sector Ethics continue to make their mark in the U.K., with foodservices increasingly adopting the trend. According to Euromonitor, the U.K.‟s Sustainable Restaurant Association (SRA), launched in March 2010, plans to accredit its member restaurants with gold, silver and bronze awards based upon their ethical practices. These ratings are then displayed on online booking services, such as www.toptable.com, to inform consumers of the restaurant‟s status. The SRA also exists as a means to help restaurants become more sustainable in the way they source their ingredients, engage with the community and affect the environment. The SRA is expected to play a large part in shaping the future of consumer foodservice over the medium term. Other foodservice operators, such as the U.K.‟s first fully vegetarian restaurant chain, Otarian, have engaged in sustainable eating with the carbon footprints of each dish communicated on the menu. The chain owner posits that vegetarians have a lighter ecological footprint, in terms of reduced water impacts and lower carbon emissions than meat eaters. Otarian also believes that consumers will save up to 3 kg of carbon when purchasing a „Carbon Saving Combo Meal‟, which includes dishes such as Tandoori Mushrooms or a Paneer Wrap. Consumerism has gained speed in the U.K. and may continue at this speed as ethical eating becomes more accessible through consumer foodservices. Still, if ethical and fair-trade foods are unable to keep costs down, consumers may not be as keen to pay a premium to be kinder to the environment. Source: Shutterstock Globalization is Out - Localization is In The trend for buying seasonal, local produce is increasingly popular with British consumers, many of whom chose fruits and vegetables grown conventionally in the U.K. over imported organic produce. In response, Compass Group Plc, a major U.K. foodservice player that services around 7,000 sites, announced in October 2009 that it would source its apples and pears exclusively from the U.K. in the months of October and November. In addition, the company has created a Truly Local sourcing initiative to emphasize their support for the local movement - one of the criteria for fruit and vegetables to qualify is that they must be grown within a 50-mile radius of the client site. Concept Foodservices and Entertainment Consumer standards have risen in the U.K. in the past decade, especially in regards to the customer experience. Consumers are increasingly enjoying added benefits and functions from their purchases. As a result, new foodservice concepts have emerged, with restaurants offering added value in the form of entertainment or a different dining experience. Some examples are Dans le Noir?, French for „in the dark‟, which serves multi-course meals in a dark room with diners unable to see a thing. Dans le Noir? opened in Paris in 2004, followed by franchise openings in London, Barcelona and New York (Euromonitor). Another themed restaurant in the U.K. is Circus, launched in 2010, which provides diners with an in-house interactive show after their meal, comprised of burlesque, drag and aerialist performances. YO! Sushi is another 2010 outlet aiming to create more of an ambience in its new London site. Inspired by trends from Tokyo, YO! Sushi features interiors with a red and black colour scheme and a heaven and hell theme. Meanwhile, other players, such as Starbucks, Burger King, and McDonald’s, are also looking to create more of an atmosphere to keep customers coming back and to encourage new visitors, as consumers continue to expect more from the money they spend. Chained and Independent Operators Struggle Together Both chained and independent operators struggled in terms of outlet numbers in 2009, both experiencing declines of over 2% during the year. Rising rent and utility costs, alongside a decline in consumers dining out, affected both chained and independent operators, with chained 100% home delivery/takeaway being one of the few subsectors to flourish in a difficult economic environment. PAGE 7 FOODSERVICE SECTOR PERFORMANCE BY CHANNEL The British foodservice market is complex and can be considered more intricate than the grocery retail market. According to the United States Department of Agriculture (USDA), the U.K.‟s foodservice sector is divided into two distinct sectors: profit outlets and cost outlets. When profit acts as the main motivator, pricing becomes flexible; these are typically outlets working within the hospitality industry such as restaurants, fast food, pubs, hotels, and leisure venues. Alternatively, the cost sector includes caterers that provide food out of necessity, with pricing being controlled, if not fixed. Examples of this sector include schools, hospitals, prisons, and specialist care homes. The following section describes the performance of foodservice outlets in the U.K. by channel. Full Service Restaurants Major Trends Full-service restaurants are the most common type of foodservice – independent players continue to dominate the sector, with approximately 90% of restaurants being accounted for by independent operators in terms of outlet numbers, down from 91% in 2004 (Euromonitor). A shift towards chained restaurants has been reported in the U.K., as these outlets are larger, more centrally located and able to generate higher revenues. This shift is likely to accelerate over the medium term, as economic instability may continue to affect independent operators. The full-service restaurant sector has battled strongly against the recession with continual marketing and promotional deals. Research by Hitwise Intelligence suggests that U.K. Internet searches for restaurant vouchers, specially pizza, have increased by more than 226% over the past 12 months. Restaurant vouchers dominate the list of top 10 voucher-related searches (Euromonitor). Specialist discount voucher sites such as www.myvouchercodes.co.uk and www.voucherseeker.co.uk have contributed to the trend. Although the price of a three-course meal increased in 2009, the flurry of discounts and meal deals kept main course prices fairly stable or even lower than in previous years. In an attempt to offset such discounting, some operators increased their prices of starters and desserts. London has seen the development of numerous upscale restaurants, some of which evolved around famous chefs such as Jamie Oliver and Gordon Ramsay. Apart from the U.K.‟s classics, recent newcomers include The Ivy, Chez Bruce and Hakasan. In addition to the U.K.‟s numerous independent luxury restaurants are some notable fast casual chains, such as Nando's, La Tasca and Pizza Express, as well as some American influenced concepts such as Tootsies, TGI Fridays and Hard Rock Cafe. More recently there has been an increase in the presence of ethnic chains, especially Asian inspired ones, as they gain popularity with consumers. Typically, full-service outlets in the U.K. offer traditional British, Indian and Chinese cuisine with the latter two having become a strong part of British culture. The U.K. reported having almost 17,000 Indian and Chinese restaurants, a sector that has attracted government funding in an attempt to improve staff training and upgrade the quality of food offered (Planet Retail). The popularity of Indian and Chinese food is now being followed by tastes from Mexico, Thailand, the Caribbean, Indonesia and Malaysia. Some notable chains are Masala World (Indian), Oriental Restaurant Group (Thai), Wagamama (Japan), and Yo! Sushi (Japan). Also, Latin American full-service restaurants are experiencing growth with Giraffe, Las Iguanas and Chiquito being among those that increased in outlet numbers in 2009, as British taste palates continue to expand. Other popular segments are the fish and chips section or burger section. While fish and chip operators are decreasing in outlet numbers, a number of upmarket niche operators offering "gourmet burgers" have been emerging, including Tootsies, Hamburger Union, Fine Burger Company and Real Burger World. Changes in foodservice trends have forced operators to modify their operations. For example, to respond to health and nutrition trends, Pizza Express, Pizza Hut, The Restaurant Group and Tragus, among others, have agreed to commit to providing a range of healthier options to their customers. These foodservice operators have partnered with the FSA to help with measuring salt reduction projects, reviewing children‟s menus and increasing the range of healthier options. Another example is the increase of full service restaurants that are eat-in outlets. Additionally, the number of takeaway outlets has increased as many restaurants introduce „take-away‟ sections to cater to all customers. PAGE 8 Popular Players in the British Marketplace The Restaurant Group plc (one of the largest independent restaurant and pub restaurant groups in the country, encompassing Chiquito, Frankie & Bennies, Garfunkel’s, Home Country, TRG Concessions, and Brunning & Price) Gondola Holdings plc (the leading U.K. casual dining group operating Pizza Express, ASK, Zizzi, BYRON and Kettners, together with a number of smaller brands.) Clapham House Group (The Real Greek, Gourmet Burger Kitchen) The Giraffe Restaurant Group Boparan Ventures (Harry Ramsdens fish and chips chain as well as the Fishworks seafood restaurants) Tragus (Café Couge, Bella Italia, Strada, and Brasseries) Wagamama Busaba Eathai Mitchells and Butler Whitbread Restaurants Future Prospects British market operators are mostly concerned with what will be the next big trend in the U.K. Organic and localization trends are increasingly important, but the media may overstate their impact. With the E.U. population expanding, examining the next wave of immigration may be useful. Perhaps food from Eastern Europe or Asia may begin to influence the U.K., particularly where operators can promote a healthy or functional aspect to the menu. Finally, operators should be worried about the ongoing economic concerns that are expected to limit growth in the U.K., as promotions and discounting continue to entice consumers to eat out, yet not increase spending. Another growing trend is that of restaurant chain brands being sold not only in restaurants, but also at grocery chains. For example, Wagamama has developed four sauces which are sold in Wagamama restaurants as well as approximately 400 Sainsbury's stores. In a highly fragile environment, growth through expansion can be risky and expensive, and expanding into new sales channels represents an attractive alternative to the traditional growth model of opening new restaurants. The growth of new sales channels also represents an opportunity for manufacturers as restaurant chains seek companies to produce the food ranges in their name. Furthermore, the British tourism agency VisitBritain predicts tourist spending is set to double by 2020, while Deloitte and Oxford Economics have forecasted a 4.4% increase in tourism expenditure in the next 10 years. With London hosting the Olympic and Paralympic Games in 2012, full-service restaurants, and the foodservice industry as a whole, is set to be revitalised. Fast Food Restaurants Major Trends Similar to the full-service restaurant industry, the U.K.‟s fast food industry is dominated by independent players operating sandwich shops, fish and chips or fried chicken outlets and various take away formats; however, recent years have seen the share of chained outlets increase steadily. The modern fast food sector is among the most developed in Europe and is dominated by a small number of larger corporations such as McDonald’s. Competition among major players remains fierce, with each attempting to respond to the trend towards healthier eating options. Competition is also no longer restricted to a battle between the traditional fast food chains as coffee shops, doughnut chains, casual dining, pub-restaurants, supermarkets, convenience stores and petrol forecourt stores all try to feed the demand. Fast food restaurants have been on the rise since 2007 and have been facilitated by a number of factors, including: the rapid expansion of certain players; the introduction of healthier menu options and healthier food preparation in response to criticisms about the unhealthy nature of products; and the revamping of fast food restaurants such as McDonald’s. Across chains, menu changes and new product launches focusing both on healthier and more upscale dishes have been observed. Meanwhile, companies are also increasingly investing in advertising and marketing campaigns, as well as providing nutritional information about the food served at their respective chains. The recession was the key driver in a return to strong sales growth as consumers migrated back to fast food at the expense of full-service restaurants and pubs. Fast food operators were quick to capitalize on the value proposition by promoting family meals and meal deals, as well as straight price cuts on some of their products. Take away was another area worth noting as British families increasingly chose to dine at home. PAGE 9 Some of the larger fast food operators have continued to strongly support other menu items outside their traditional businesses of burgers, sandwiches, chips and chicken. McDonald’s, for example, has established its coffee offering in the U.K., despite strong competition from specialist coffee shops Starbucks and Costa Coffee. Meanwhile, breakfast trade continues to be viewed as an untapped revenue source. Source: Planet Retail Recent regulations banning fast food operators from advertising to children on British television have encouraged players to adapt their marketing strategies to fit the more limited environment. Healthier menus have been the major trend in recent years and fast food operators have been competing with each other to advertise this shift to foods with lower fat and salt content. Prêt a Manger, EAT and Greggs have linked up with the FSA‟s voluntary healthy eating campaign. Prêt a Manger pledged to apply new calorie labelling on its sandwiches and reduce the level of salt. Greggs pledged to remove all hydrogenated fats and artificial colours and flavours from its pies by summer 2010. These recent initiatives follow earlier moves by KFC, Burger King, McDonald’s and Subway to conform to the FSA‟s voluntary standards. Similar to cafés, quick service restaurants, also known as fast casual dining, offer a quick meal on the go, but lack the social element of a café. Fast casual dining represents a growing segment of the fast food sector, showing the fastest growth in recent years. This growth has been driven by the segment‟s healthy perception among British consumers, as well as the expansion of players such as Nando’s, Prêt a Manger and EAT, which all saw doubledigit store growth in 2009. Bakery retailers and sandwich specialists are both quite popular in the U.K. Mixed bakery retailers offering a range of sandwiches and baked goods dominated the sector, aided by Greggs, which significantly increased its offering as part of recession-busting meal deals. Sweet bakery goods specialists, although still a fraction of bakery products fast food, have seen solid growth underpinned by the expansion of Krispy Kreme, which is now sufficiently established in the U.K. Meanwhile, sandwich specialists, led by Prêt a Manger, Subway and EAT, lost share in 2009 with sweet bakery goods specialists increasing their share of the market. Since the 1990‟s, sandwiches had been a major growth sector, with the working population opting for shop-bought sandwiches as opposed to homemade ones. Although the total number of sandwiches sold has decreased in recent years, value sales have remained sustainable due to a variety of price-points. Major players in the sandwich shop sector are Gregg’s network of sandwich shops, Subway, Upper Crust, O’Brien’s, Benugo, and Benjy’s. Another important channel to consider in the sandwich market is that of petrol forecourt operators. Chicken fast food operators maintained their presence in the U.K. with players such as Nando’s, KFC, Dixie’s, and Chicken Cottage, continuing to prove themselves attractive to many middle-income families forced to trade down from full-service restaurants. Some players demonstrated a healthier offering (Nando’s) or halal-natured menu (Chicken Cottage), while others offered an attractive value deal (KFC). KFC remains the market leader within the fried chicken segment; other players include Favourite Fried Chicken, Chick King and Southern Fried Chicken. Fish and chips shops are another known segment in the British market and remain a great British tradition as well as an important area of the fast food industry. This segment has, however, decreased in size since the 1970s due to the availability of other fast foods, the perception that fish and chips are unhealthy, and the expanding range and quality of frozen fish and chip products available in supermarkets. Ice cream outlets are another form of fast food. Today, ice cream chains are more likely to be international chains located in shopping centres and cinemas. Some of the U.K.‟s biggest players are Baskin-Robbins (Dunkin’ Brands), Häagen-Dazs, Ben & Jerry’s, and the specialist chocolate retailer Thornton’s. In terms of the food versus drink distinction, the latter has gained share. The growth of drinks in this sector can be explained by the rising quality of hot drinks in fast food outlets such as McDonald’s, Greggs and Prêt a Manger. Many fast food brands are experiencing greater coffee sales, benefiting as consumers shift away from more expensive coffee shops such as Starbucks.. Source: Planet Retail PAGE 10 Popular Players in the Market McDonald‟s Greggs Plc Baker‟s Oven Doctor‟s Associates Inc. (Subway) YUM Brands (KFC) Burger King Prêt a Manger Nando‟s Group Holdings Ltd. EAT Fast Food Systems (Southern Fried Chicken) Wimpy‟s Urban Dining (Tootsies) Compass Group (Upper Crust) Source: Shutterstock Future Prospects With fast food increasing in popularity, expansion is set to be a key trend in the medium term. Players such as KFC, Greggs, Nando’s, Prêt a Manger, EAT and smaller brands such as Leon, Paul and Wasabi all have ambitious plans to expand over the coming years. Furthermore, many of these brands already have the funding in place to do so. The U.K.‟s fragile economy is less of a threat to chained fast food operators than it is to independent players, who may continue to struggle in the medium term. The fast food sector‟s biggest threat is the take-away outlets which continue to grow at a rapid rate and which have established a solid business competing on value and increased convenience through such innovations as text ordering. Other competitors are cafés/bars, which offer a range of food and drink as well as longer kitchen hours as they attempt to compensate for lost alcohol sales with increased food sales. Forecasts for the fast food sector are expected to be flat in value terms up to 2014. The better sales performance of bigger chained brands will counterbalance the long-term sales and outlet decline of independent fast food operators, which will be squeezed out further by economic uncertainty. Moreover, according to Euromonitor, fast casual dining is predicted to be the fastest-growing fast food category. The upcoming 2012 Olympic Games as well as the predicted increase in tourism will have a positive impact on the British foodservice sector with some focus on fast food. With McDonald’s as a principal sponsor of the Olympics, they are expected to reap much of the benefits, however, there will be spin-off benefits for other fast food operators and the challenge ahead will be how best to capitalize on the worldwide event. Further price competition from the likes of take-away and cafés/bars operators, as well as the rising cost of raw materials and static rent prices, will continue to affect independent operators in the medium term. These increased costs will be extremely difficult to pass on to consumers, as competition on price becomes the norm. Cafés and Bars Major Trends The cafés/bars sector in the U.K. is one of the largest consumer foodservice sectors and the most highly concentrated. Chained outlets continue to dominate the cafés/bars sector, accounting for 74% of value sales and a 59% share of outlet numbers in 2009 (Euromonitor).The majority of cafés/ bars are eat-in venues achieving almost 93% of sales, however, this has been slowly declining and is expected to continue to do so over the medium term (Euromonitor). The British population enjoys eating in pubs and cafés/ bars, and very rarely will they visit a pub for an on-the-go reason. Meanwhile, the food/drink sales split in the U.K.‟s cafés/bars sector was 54% to 46% in favour of food in 2009, a result of growing food sales in pubs and chained specialist coffee shops. Juice bars have increased the share of take-away for this segment to over 7% in 2009. PAGE 11 Pubs and Bars As part of the cafés/bars sector, pubs had always been a popular outlet in the U.K. However, as a result of an unsteady economy, pubs continue to close at a steady rate, as reported by the British Beer & Pub Association (BBPA). The BBPA also indicated that pubs with a shared focus between food and drink faired better than those classified as “drink led”. According to Planet Retail, there are currently 60,000 pub enterprises trading in the U.K., with more than three-quarters of them serving food. The majority of these rely on snack food, while some larger players have considerably expanded their food offering. Many pubs have gone from pre-cooked and frozen foods to more cosmopolitan and even ethnic food, thereby appealing to a larger market segment. Meanwhile, beverage consumption has also changed with a shift from beer to wine. Some of the larger operators, such as Mitchells and Butlers Plc, Greene King Plc, and JD Wetherspoon, have continued to generate profit as a result; pubs have become a cheap and informal foodservice destination for family dining. Low prices and price promotions are some of the main differences between restaurants and pubs. Other prominent pub operators in terms of the number of leased and tenanted properties are Punch Taverns, Enterprise Inn, Admiral King, Wolverhampton & Dudley Breweries and Greene King. One of the sector‟s main concerns over the short term is the government‟s goal to reduce binge drinking in the U.K. Some direct outcomes that may affect pubs are a potential increase in the cost of alcohol and stricter rules, which will affect the segment‟s growth in the long term. Specialist Coffee Shops As a general observation, the specialist coffee shop channel has grown exponentially. Specialists continue to launch company-owned and franchised chains, as well as many established retail and non retail businesses. Coffee shops in the U.K currently total 8,000, and are led by three major players: Starbucks, Costa Coffee (Whitbread) and Caffè Nero. Other companies to bear in mind are Coffee Nation, AMT Espresso, and Puccino’s. Competition is further heated by concession-based operations such as Caffè Ritazza and food-led operators such as Prêt A Manger and McCafé or EAT. Other indirect competitors include in-store restaurants and cafés, such as Marks & Spencer's Café Revive, and pub operator JD Wetherspoon, which attempted to enter the coffee segment by offering affordable cappuccinos and early morning openings. In addition, juice/smoothie bars such as Boost and Revive juice bars, are increasing in presence nationwide, presenting themselves as a healthier alternative to coffee. However, unfavourable weather in the U.K. and cash-strapped consumers continue to constrain the potential of this segment. In a nation of avid tea drinkers, specialist coffee shops have grown in popularity and continue to experience growth. The coffee shop sector consists of outlets that serve hot and cold beverages, but no alcohol. They also serve snack foods such as cakes, sandwiches, soups and salads, although serving food is not their primary business domain. These players have expanded their range of food offerings in an attempt to compete with other foodservice operators, as well as to diversify their offering, allowing them to appeal to a larger consumer segment. Euromonitor has observed a great emphasis on increasing the selection of fresh pastries and baked goods, as well as coffee accessories and related products, on behalf of operators in this sector. Another key trend is the attention specialist coffee shops allocate to offering consumers a healthier proposition. According to Euromonitor, seven British foodservice operators have made public commitments to improve their food offering, including chained specialist coffee shop operators Starbucks, Costa Coffee, Caffé Nero and BB’s Coffee & Muffins. Popular Players in the Market Scottish & Newcastle JD Wetherspoon Plc Punch Tavern Group Ltd. Enterprise Inns Plc Greene King Admiral Taverns Whitbread Plc (Costa Coffee) Starbucks Town & City Pub Company Yates‟s Hogshead Litten Tree Regent Inns (Walkabout, Jongleurs, etc.) Coffee Republic Arab Investments Ltd. BB‟s Coffee & Muffins Puccino‟s Ca‟ppucino Café Nero Millies PAGE 12 Future Prospects The combination of the U.K.‟s economic instability and the government‟s goal to reduce binge drinking will continue to play a role in the cafés/bars sector, however, growth in the specialist coffee shop sector is expected in the medium term. Trading is forecasted to remain difficult for pubs and bars; budget announcements of increased alcohol tax will continue to affect trading at more “drink led” operators. In addition, according to Euromonitor, the national chain Cadbury has entered the specialist cafés and bars sector, with Kraft Foods throwing its support behind it. The cafés were launched in the fall of 2010, offer afternoon teas along with a chocolate service, and could open as many as 60 locations nationwide over the next three to five years. Home Delivery and Takeaway Services Major Trends In contrast to other sectors within the foodservice industry, home delivery and takeaway services (HDTS) performed well both during and post recession, and saw outlets expand. The sector benefited from consumers trading down during the recession, and meanwhile, continued to grow due to the channel‟s convenience factor and level of expansion throughout the U.K. Despite extensive expansion by large pizza chains such as Domino’s Pizza, the HDTS sector is predominantly a sector run by independents. The vast majority of independents in the U.K. are family run businesses, often by immigrants and ethnic minorities. They are less interested in attaching their operations to corporations and franchises that would limit and set guidelines to their buisnesses. According to Euromonitor, the unorthodox hours and paucity of good locations are proving to be obstacles to penetration by chained operators, thereby allowing smaller, more flexible and often family-run outlets to dominate. Players in the independent field include Indian restaurants and fish and chip shops with a high proportion of Chinese and Middle Eastern operators also doing significant trade. Although the tendency exists for independent HDTS operators to offer multiple cuisines, particularly in smaller towns and in rural areas, it is not uncommon to find fish and chips offered in Chinese and Indian takeaways or vice versa. Most new developments were independent and Asian, most commonly Thai or Vietnamese. Other new offers, such as Korean and Indonesian food, are limited to larger cities within the U.K. The shift towards these new alternatives has led some Chinese takeaway outlets to resort to rebranding themselves as Thai takeaways. In the case of Thai outlets, profits are also higher than at other takeaways simply because consumers are prepared to pay higher prices for products they perceive to be healthier. Popular Chained Players in the Market Domino‟s Pizza Pizza Hut Pizza Go Go Hot Stuff Pizza Pizza Express Source: Planet Retail Source: Planet Retail Source: Planet Retail PAGE 13 Future Prospects British consumers have acted as homebodies in the last two years, hosting various home entertainment events such as the Six Nations rugby, the Ashes cricket and most importantly, the football World Cup in South Africa, all of which have contributed positively to the HDTS sector. In the medium term, HDTS operators will continue to see growth, though at a slower pace. The slowdown in both outlet and value growth owes more to the growing maturity of the market rather than any fundamental decline. Both chained and independent HDTS operators are forecast to show positive growth over the next five years with chains growing significantly faster due to players such as Domino’s Pizza and their expansion plans. One of the main threats to the sector is a lack of internal investment by smaller operators, which have become complacent, and the ongoing improvement in terms of quality and choice of ready meals and even hot food from supermarkets/hypermarkets. According to Euromonitor, consumer trust of supermarkets/hypermarkets is high, and their offers are typically cheaper, healthier and clearly labelled. The one core difference is in the delivery of the goods, which will always help preserve a degree of growth in the sector. Another potential threat could also arise if HDTS operators fail to keep pace with technological advances, such as mobile and Internet ordering, as the U.K. becomes increasingly web-focused. Street Stalls and Kiosks Major Trends The street stalls and kiosks sector is dominated by independent players in the U.K. These have been increasingly challenged in the last decade by the growth of other consumer foodservice formats, such as specialist coffee shops, which can often offer similar products, such as coffee, sandwiches, paninis and cookies. In addition, these players are often present in the same retail space where street stalls/kiosks can be found, such as train stations. An improved product offering has been a dominant trend in the sector in recent years, with some categories being characterized as premium. Prior to the recession there was an increase in consumer demand for premium-priced coffees and teas, as well as other drinks, such as fresh juice, all of which contributed to price increases. Post-recession, the shift to premium products saw a sharp correction and a new trend towards value for money emerged. Although street stalls and kiosks have been able to adapt to the shifting trends due to their smaller operating footprint, the trend towards value had a significant and negative impact on sales in the sector. Popular Players in the Market Compass Group Plc (over 50% market share) West Cornwall Pasty Co. Upper Crust SSP Group Ltd.‟s (Camden Food Co.) Millie‟s Cookies AMT Espresso Ltd. Future Prospects The economic volatility in the U.K. continues to affect the sector in both outlet and value terms, especially for independent, non-established brands. This slowdown is also a result of saturation in the market, with most prime sites being occupied, while new ones are being reserved by chained operators before plans of future locations are even announced. These trends will help drive an ongoing shift towards chained operators within this sector, to the detriment of independent players. Other threats to the sector in the coming months are rises in rental spaces. Moreover, there is also expected to be a lack of suitable sites. Although spaces will free up due to smaller independent operators exiting the sector, sites that offer meaningful traffic will become more expensive, as operators will seek to avoid the low turnover of many independent street stall/kiosk sites. Source: Planet Retail PAGE 14 Retail, Entertainment, and Hotel/Accommodations and Resort Catering Retail Cafés and restaurants operating in chain stores were a secondary feature of U.K. shops until the 1990s. Retail catering has grown in popularity in the last decade as grocers seek to increase their one-stop-shopping appeal. Operators such as M&S, Tesco and Asda all offer either chained foodservice concepts, or develop their own in store catering concepts. Moreover, retail giants IKEA and Borders are both non-food retailers which have also opted to offer a similar service. Entertainment The entertainment sector includes various venues such as theatres, cinemas, sports venues and bingo halls. Other visitor attractions or consumer destinations are museums, zoos, theme parks, as well as health clubs and fitness centers, sports and social clubs. Health clubs are one area where consumers are spending more money on food and drink as the importance of health is increasingly significant. Key players include Living Well Fitness and David Lloyd. Although foodservice is not considered the core business of entertainment venues, the latter have increasingly developed their food and drink offerings as a means to increase revenue. Bingo halls have become an important channel for foodservices, typically running one or more bars and a fast food concept, while some even have full-service restaurants. There are nearly 700 licensed bingo clubs operating in the U.K., according to the Bingo Association. Some of the leading bingo operators in the U.K. are Gala Bingo, Mecca Bingo and Carton Bingo. Theatres have also generated significant foodservice sales alongside their main activities. The vast majority of cinemas are already active in selling products such as popcorn, hot dogs, nachos, soft drinks, sweets, crisps and branded ice creams, with an increasing number introducing features such as licensed bars. Still, although the British are increasingly vacationing within the U.K., visits to these establishments have not contributed to additional spending on food. British consumers prefer to take their own snacks to cinemas rather than buying food there. A key player in this sector is Odeon cinemas. Another popular venue in the U.K. is the bowling centre. According to the Tenpin Bowling Proprietors Association (TPBA), there are around 320 bowling centres in the U.K. Most of them feature a licensed bar, a snack bar and/or café/restaurant, and are popular locations for children‟s parties and family weekend trips. While some centres feature third-party concepts such as McDonald’s, most are owned concepts that offer „American diner‟ style restaurants. Hotels/Accommodation and Resorts The majority of hotels trading in the U.K. are small independent businesses, mostly run by families; however, this is slowly changing as a number of larger chained operators have entered the market. Hotels generally have several foodservice components within their hotel locations, for example, a restaurant, a bar, room service, and associated leisure locations such as museums, cinemas, theatres, theme parks and sports auditoriums. Each of these foodservice components can be counted as one outlet. Source: Planet Retail A decline in public spending and the general public‟s price consciousness owing to the credit crunch, has seen demand increase for budget accommodations. Many budget hotels feature narrow foodservice offerings, often limited to vending machines if anything at all. Many travel budget hotels are located adjacent to pubs or restaurants. The significant rise in the budget sector is due to the popularity among business travellers and the competitiveness of prices in comparison to more upmarket hotels. Since the recession hit, people increasingly choose to vacation in the U.K. as a result of the weaker pound, thus allowing leisure outlets and hotels/accomodation and resorts to see increasing success. In addition, the weakness of the pound has led the U.K. to experience an increase in foreign visitors. As previously mentioned, tourist spending is set to double by 2020, and is expected to increase by 4.4% in the next 10 years. With London hosting the Olympic and Paralympic Games in 2012, the hotels/accomodation and resorts industry as a whole, is set to experience noticeable growth. Key players include: Hilton Hotels Corporation, Holiday Inn, Marriott, Intercontinental Hotels Group, Whitebread, The Savoy Group and Accor. PAGE 15 Contract Catering Growth has been slow in the contract catering sector, making it difficult to predict its future. One of the major trends has been the move towards healthier dishes and light “grab „n' go” meals. Commercial formats such as kiosks, are also on the rise due to shorter lunch breaks in the U.K. Meanwhile, reductions in catering subsidies to clients and an under-investment in catering in both educational and healthcare facilities, are other issues currently being addressed by catering companies. These challenges have led to a trend towards fixed-price or guaranteed-cost contracts. The sector‟s leading companies are Compass, Sodexho and Aramark. Compass U.K. & Ireland serves clients in business and industry, education, healthcare, defence, remote sites and offshore sectors, and is also active in vending. Meanwhile, Sodexho provides food and support services to clients in the business and industry, education, healthcare, remote sites, corrections and defence sectors. The company further offers service vouchers and cards, as well as river and harbour cruises. The American company Aramark, the third-largest operator, operates in the business and industry, healthcare and seniors, defence, education, offshore and remote sites, and corrections sectors. However, Aramark also provides foodservice solutions to commercial clients including hotels, commercial restaurants, sport stadiums and arenas, theatres and entertainment venues through its Parallel division. Another notable player is Elior, which strengthened its position within the business and industry segment with new contracts and contract renewals. Other smaller players include Initial Catering Services, the catering division of the Rentokil Initial Group; Castle View, Halliday Catering, Charlton House, Baxter Storey, Catering Alliance, Harrison Catering Services (mainly active in education catering) and Redcliffe Catering. Business and Industry/Workplace Foodservices The U.K.‟s business and industry/workplace foodservice sector includes trolley services as well as areas where full meals are sold such as self-run or contracted canteens, National Government canteens, and off-shore catering. The sector has decreased in size in recent years due to shrinking demand and tighter subsidies for employee meals. Catering operators are facing increased challenges in expanding their returning clients; major companies are working towards identifying innovative ways to retain clientele such as operating a variety of branded outlets. Compass, one of the U.K.‟s larger players, operates branded outlets such as Café Ritazza and Upper Crust, in most sectors in which they do business. Another trend in workplace catering is the preparation of single serving meals for employees to collect on their way home to be heated up or cooked later, catering to the increasingly busy lifestyles of British residents. Education Schools in the U.K. receive grants from the government to partly cover catering services. This includes all food and drinks served in schools at all levels from nurseries to universities. In the last couple of years, guidelines have been changed so that the meals served are healthy and nutritional. The leading contract school caterers are Compass's Scolarest Division, Initial Catering Services and Sodexho. Healthcare Healthcare centres in the U.K. are, by law, obliged to hire the catering company that submits the lowest bid. Meals in the health care sector include those served to patients, staff and visitors of hospitals, nursing homes and care homes. As with the educational sector, nutritional needs are under scrutiny in this area. Commercial caterers have come a long way in hospital catering due to larger, more viable contract deals, though less so in private healthcare. Similar to other sectors within contract catering, branded outlets are becoming more present, particularly for staff and visitor catering facilities, which are starting to resemble mini shopping malls, with a selection of food and other retail services available. Vending is also used, mainly to cater to night staff when kitchens are closed. Another interesting dimension of the healthcare sector is “Meals on Wheels” – this concept entails delivering and serving lukewarm food in the middle of the afternoon to pensioners. With the boom in seniors‟ residences this has proved to be an interesting growth area, though prospects are now less certain as a result of the U.K.‟s volatile financial sector, as the elderly may have less disposable income to afford nursing homes. Meals served to the elderly living in their own homes have, consequently, proven to be popular alternatives. The service has been revitalised with the introduction of regeneration vans. Under this system, the food can be cooked or reheated while the van is on the road, so the food is delivered piping hot, which is said to also improve nutritional value. The over 65 age group enjoy the less cosmopolitan food offered, such as sliced roasted meat, and steak and kidney pie. PAGE 16 The Defence Segment The vast majority of the defence catering market is still managed by the Ministry of Defence catering group, which is part of its defence logistics organization. Like much of contract catering, defence contracts no longer solely focus on food and commonly encompass areas such as waste management, bakery productions, cleaning and laundry management. Despite being a relatively mature market, interest in this sector is high, as the Ministry of Defence decided to overhaul its internal defence infrastructure. The idea is to end up with a smaller number of larger contracts. Defence caterers include mainly large players, such as Sodexho (Defence Services), Compass Group (ESS Defence), and Aramark (combined Services Division). Prisons Catering for prisoners has a number of attractive features. Demand is predictable and regular, and the quality does not have to be higher than adequate. However, the sector is not one in which governments wish to spend large amounts of money. Prison farms and gardens supply varying amounts of food, especially vegetables, pork, bacon, eggs, and milk. The main purchases are dried or tinned foods. Airline Catering The U.K.‟s in-flight catering has benefited from the importance of London‟s Heathrow airport; nonetheless, the trend towards no-frills airlines has encouraged airlines to cut down on free hot meals in the last decade, offering instead, discretionary snacks or sandwiches available for an extra charge. The market leader for in-flight catering in the U.K. is Alpha Flight Services, part of the Alpha Retail Group, and has locations in airports across the country. Gate Gourmet is another strong catering company, currently supplying in-flight meals for British Airways. Meanwhile, LSD Sky Chefs, part of Lufthansa, is another internationally-known caterer, currently supplying British airlines. Concession Catering Roadside In the last decade, roadside catering has grown through petrol stations in the form of store foodservice solutions such as cafés, coffee machines, hot food facilities and co-branded outlets with fast food operators. This particular market is split by three main companies: Moto, Welcome Break and RoadChef. Brands operated at Moto’s include some of Compass' own brands such as Harry Ramsden’s, Upper Crust, Caffé Ritazza, as well as Fresh Express, Marks & Spencer‟s Simply Food, (a convenience store concept offering hot and cold 'to go' sandwiches and snacks), as well as franchised brand Burger King. Welcome Break operates main street brands such as Starbucks, KFC and Burger King as well as the company‟s own brands, Red Hen, and Coffee Primo, and a convenience store format. The company also has hotels at motorway service stations including Days Inn and its own chain Welcome Break; these locations have a self-service restaurant and a retail shop, most featuring a Costa Coffee and a Wimpy hamburger restaurant. Airport Outlets Airports have seen numerous multi-brand food courts open up in the last decade. This channel has helped big contract caterers, with their portfolio of brands, to gain a foothold. Also part of the Airport foodservice sector are full-service restaurants, with the likes of Chez Gerard, TGI Friday's, Garfunkel’s, Giraffe, Est Est Est and Pizza Express, which are all either available or opening in airport sites. Other players are coffee shops, with representation from leading players such as Caffè Nero, Starbucks and Costa Coffee in most major airports. Select Service Partner (SSP), is the major supplier of airport catering in the U.K., and is present at most major airports in the country, operating a selection of franchised units and proprietary foodservice concepts. The Restaurant Group is another foodservice player at U.K. airports, operating franchised and owned outlets at some airports across the U.K. It is noteworthy to mention that airport dining experienced high growth since security levels increased in the U.K. Travelers have a meal at the airport and buy drink products and snacks after crossing security in order to take the items on the plane with them. PAGE 17 Rail SSP U.K. Rail is the country‟s major provider of railway catering. Burger King, Upper Crust, Caffe Ritazza, Threshers, Millies Cookies and Whistlestop are some of the familiar names that make up the company's portfolio of over 20 brands. As part of SSP's exclusive franchise arrangement with Marks & Spencer, it operates Simply Food stores in stations across the U.K. Ferries Eurotunnel and Eurostar have negatively affected ferry foodservice operations between the U.K. and mainland Europe, due to their higher convenience and efficiency in terms of links and length of trips. Major ferry operators provide a wide variety of catering facilities such as bars, coffee shops, restaurants, fast food, self service cafeterias and kids‟ food/leisure services. The leading providers of ferry services between the U.K. and France are P&O Ferries, SeaFrance, Brittany Ferries, Hoverspeed Limited, Stena Line, Norfolkline, Fjord Line, DFDS Seaways and Condor Ferries. Vending One of the leading vending companies in the U.K. is Compass’ Selecta, with an important presence in the subway system with both beverage and snack machines. Another important player is Coffee Point Group – the company provides clients an extensive range of vending machines including snack and food machines as well as beverage and coffee machines. MARKET ENTRY STRATEGIES The following diagram, provided by the USDA, shows the most common routes to market in the British foodservice sector. Although there are a variety of routes, the most common way for Canadian products is through an importer, due to their knowledge of the market, well-developed contacts and distribution systems. Chart 3: Most Common Routes to Market in the U.K. Foodservice Market Exporter Imported/Contracted Distributor (16%) Delivered Wholesaler (53%) Cash and Carry (13%) Retail (18%) Foodservice Operator Source: USDA, HRI Food Service Annual Report – United Kingdom, August 2010 According to the data provided in Chart 3, over half of all food and drink sold to foodservice operators is through delivered wholesale. While larger operators will purchase from wholesalers, smaller outlets generally buy from either cash and carries or retail stores. Due to the large number of companies operating within the foodservice sector, intermediaries skilled in fulfilling small orders efficiently, play a pivotal role in the distribution of products. PAGE 18 The foodservice sector cannot be looked at as a single market. The role of each channel varies from sector to sector. Wholesalers, for example, distribute a lot more frozen foods than ambient products and the retail sector has the most chilled short-life products. Meanwhile, cash and carries mostly supply chilled long-life products. Advantages and Challenges to Canadian Products in the British Hotel, Restaurants and Institutions Sector Advantages Challenges According to the USDA, there are a relatively small number of specialist foodservice importers, capable and interested in importing from the U.S. – this also applies to Canada. With the exchange rate still being comparatively low against the dollar of two years ago – price competitiveness will be fierce. Canada has a good brand image in the U.K. There are trict E.U. import regulations and labelling/ ingredient requirements. The country is English-speaking and is therefore a natural gateway into the rest of Europe for Canadian exporters. U.K. importers don‟t pay duty on E.U. origin goods. The importers of Canadian origin products generally pay 0-25 percent import duty, depending on the product. CONCLUSION Food consumption in the U.K. is being shaped by a number of factors. Changing demographics have influenced tastes, with a whole new ethnic food sector emerging around the large numbers of immigrants from Central and Eastern Europe. More significantly, the uncertain prognosis for the U.K.‟s economy is causing value for money to remain at the forefront of consumers‟ minds. Foodservice will continue to face tough competition from retailers, which have strongly promoted a number of deals that are clearly presented as an alternative to eating out. Ready meals are set to grow as a result of these meal deals offered by retailers. The U.K.‟s fast food sector continues to be the most challenged within the foodservice industry as a result of growing concerns over obesity rates in the U.K., especially among children. Across chains, but most visibly in the burger segment, companies are diversifying their menus to offer healthier and more upscale products. Pubs are expected to suffer as new regulations to avoid binge drinking come into effect. Meanwhile, in the catering sector, companies are diversifying their offering and providing customers with healthier and more convenient, “grab „n' go” meals. Trends toward standardization through branding and the development of chains have emerged in the U.K.‟s catering sector. Growth prospects are mostly expected to be seen in the lower- to middle-market sectors, as well as in niche outlets such as coffee and juice bars. The home delivery and take-away service sector is also expected to remain the industry‟s best performing sector in growth terms. The U.K. is one of the most sophisticated markets in the world. Canadian products face fierce competition in the British market, with European companies incurring relatively low transportation costs, fast delivery times, and duty-free access. Despite the disadvantages faced by Canadian suppliers and manufacturers with regards to market access, there are several opportunities to pursue in this competitive and challenging environment. Working through importers or contracted distributors is the most common approach, and may be the best option for Canadian exporters to get acquainted with the British marketplace. It is, however, essential that Canadian suppliers and manufacturers do a great deal of research and prepare themselves prior to entering the British market. Overall, the British foodservice sector is very large and diversified. The most successful strategy will be to keep up with ongoing trends in the industry, and for manufacturers and suppliers to match their network strategies with the evolving future requirements of the foodservice sector in the U.K. PAGE 19 BIBLIOGRAPHY Datamonitor, Country Overview – United Kingdom, July 2010 Economist, The. United Kingdom, October 2010, (ViewsWire Euromonitor, 100% Home Delivery – United Kingdom, August 2010 Euromonitor, Cafes and Bars – United Kingdom, August 2010 Euromonitor, Consumer Foodservices, August 2010 Euromonitor, Consumer Foodservice by Location, August 2010 Euromonitor, Consumer Foodservice – United Kingdom, August 2010 Euromonitor, Fast Food – United Kingdom, August 2010 Euromonitor, Full Service Restaurants – United Kingdom, August 2010 Euromonitor, Self-Service Cafeterias – United Kingdom, August 2010 Euromonitor, Street Stalls and Kiosks – United Kingdom, August 2010 Planet Retail, HoReCa Market – United Kingdom, July 2010 United States Department of Agriculture (USDA), HRI Food Service Annual Report – United Kingdom, August 2010 ANNEX: COMPANY PROFILES According to the USDA, the following companies are some of the biggest players in the U.K. foodservice industry: 1. Aramark Ltd. Millbank Tower, 21-24 Millbank London, SW1P 4QP Tel: +44 (0) 20 7963 0000 Fax: +44 (0) 20 7963 0500 Website: www.aramark.co.uk 2. Brakes Enterprise House, Eureka Business Park Ashford, Kent, TN25 4AG Tel: +44 (0) 1233 206 000 Website: www.brake.co.uk 3. Compass Group plc Rivermead, Oxford Road, Denham Uxbridge, Middlesex, UB9 4BF Tel: +44 (0) 189 555 4554 Website: www.compass-group.co.uk 4. 3663 First for Foodservice Buckingham Court, Kingsmead Business Park London Road, High Wycombe, Bucks, HP11 1JU Tel: +44 (0) 870 3663 000 Website: www.3663.co.uk 5. Mitchells & Butlers plc 27 Fleet Street Birmingham, B3 1JP Tel: +44 (0)870 609 3000 Fax: +44 (0)121 233 2246 Website: www.mbplc.com 6. Sodexho UK Ltd Capital House, 2nd Floor 25 Chapel Street London, NW1 5DH Tel:+ 44 (0) 20 7535 7400 Fax:+ 44 (0) 20 7535 7401 Website: www.sodexho.co.uk 7. Whitbread Group plc Whitbread Court Houghton Hall Business Park Porz Avenue, Dunstable, LU5 5XE Tel: +44 (0) 1582 424200 Website: www.whitbread.co.uk PAGE 20 The Government of Canada has prepared this report based on primary and secondary sources of information. Although every effort has been made to ensure that the information is accurate, Agriculture and Agri-Food Canada assumes no liability for any actions taken based on the information contained herein. The United Kingdom: A Diverse Foodservice Sector © Her Majesty the Queen in Right of Canada, 2011 ISSN 1920-6593 Market Analysis Report AAFC No. 11459E Photo Credits All Photographs reproduced in this publication are used by permission of the rights holders. All images, unless otherwise noted, are copyright Her Majesty the Queen in Right of Canada. For additional copies of this publication or to request an alternate format, please contact: Agriculture and Agri-Food Canada 1341 Baseline Road, Tower 5, 4th floor Ottawa, ON Canada K1A 0C5 E-mail: infoservice@agr.gc.ca Aussi disponible en français sous le titre : Le Royaume-Uni : Un secteur diversifié des services alimentaires