2013 Annual Report - Performance Sports Group

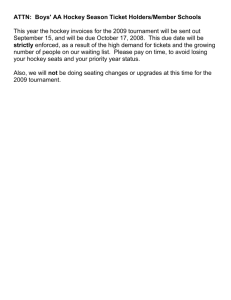

advertisement