Corporate Strategy

advertisement

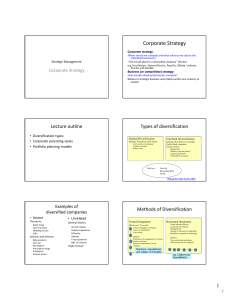

MBA STRATMAN Corporate Strategy Dr. Vesselin Blagoev Lecture outline • Diversification types • Corporate parenting styles • Portfolio planning models Corporate Strategy Corporate strategy: Where should we compete and what value do we add to the individual businesses? “The overall plan for a diversified company” (Porter) e.g. Ford Motors, General Electric, PepsiCo, Gillette, Unilever, Proctor and Gamble. Business (or competitive) strategy: How should individual businesses compete? Relates to strategic business units (SBUs) within one industry or market Types of diversification Related Diversification Unrelated Diversification Businesses within the same industry. Strategic fit between value chains Can be skills or technology Combine activities Reduce costs Strategic fit is absent or secondary Undervalued companies Criteria such as: Bottom line? Stability, long term future? Capital requirement? Vulnerable to recession? Motives: Growth Spreading Risk Profit 'Making the right moves' (Associated British Foods) Types of diversification Mintzberg believes all diversification are unrelated because no matter what is common between businesses, there are always more things that aren’t common than are common. Aim is reduce costs by combining some activities but can be too expensive. Combining is complex and may end up satisfying no one. Unrelated diversification - finance driven approach. Known as conglomerates approach Examples of diversified companies • Related • Unrelated Thorntons General Electric Retail shops Café Thorntons Wedding service Gifts Johnson and Johnson Baby products First-aid Neutrogena Prescription drugs Prosthetics Contact lenses Aircraft engines Hotpoint appliances GE Equity Lighting X-ray equipment NBC TV network Virgin Group Travel Music, Mobile phones Methods of Diversification Vertical Integration (Backward / Forward) Control of Supplies or Markets Access to Information Cost saving ISSUES: Problems in the management of diverse business activities Increase of dependency on one ‘industry’ Thorntons: manufacturer and retailer of chocolate Horizontal Integration Under utilized resources Escape present business Spreading risk Synergy in resources & capabilities Building on expertise or technology ISSUES: Close and distant relatedness What exactly are the synergies? e.g. Cadbury buy Green&Blacks Corporate Parenting Styles PORTFOLIO MANAGER SYNERGY MANAGER PARENTAL DEVELOPER RESTRUCTURER Conditions for adding value (Goold and Campbell, 1994) • Room for improvement of SBU? • Can parent add anything that SBU can’t do better on its own? • Does parent understand Critical Success Factors? Parenting Matrix assessing fit High Fit between: SBU Critical Success Factors, and Parent’s skills, resources, characteristics Low Goold, Campbell & Alexander(1995) Ballast SBUs Alien SBUs Heartland SBUs Value trap SBUs Low Fit between: High SBU parenting opportunities, and Parent’s skills, resources, characteristics How do corporate parents destroy value? • Add an extra layer of bureaucracy that delays decision-making • Encourage ‘careerism’ in managers • Increase mistrust managers • Advise incorrect methods because don’t understand the industry • Force all businesses to follow the same strategic planning methods • Force synergy between businesses that doesn’t add any benefit Portfolio planning models Purpose • Evaluate business unit performance • Assess balance of the corporate portfolio • Formulate business unit objectives Models • GE/McKinsey matrix • BCG Growth-Share matrix (Boston Box) Popular in 1970s but not now GE/McKinsey matrix Business unit position Industry Attractiveness Strong Medium High Medium Low (Henry, 2008, p.243; Blagoev, 2003) Weak BCG Matrix (Boston Box) Annual real rate of market growth (%) HIGH LOW Earnings: high stable, growing Earnings: low, unstable, growing Cash flow: neutral Cash flow: negative Strategy: invest for growth Strategy: analyze to determine whether business can be grown into a star, or will degenerate into a dog Earnings: high stable Cash flow: high stable Strategy: milk HIGH Earnings: low, unstable Cash flow: neutral or negative Strategy: divest Relative market share LOW ? Portfolio planning models critique • These models were popular in the 1970s/1980s but are now seen as oversimplifications • Assume no linkages between businesses Conclusion • Corporate parenting decisions are made at the highest level often involving 1000s of employees and billions of Euro. • Perhaps there is no ‘formula’ for making the right decision because there are so many variables and a great deal of uncertainty. • Businesses that are up for sale tend to be overvalued – therefore difficult to recover the cost of purchase References • Collis, D. and Montgomery C. (1998) .‘Creating Corporate Advantage’, Harvard Business Review, MayJune 1998, pp71-83. • Grant, R (2005). Contemporary Strategy Analysis, Blackwell , 4th ed, or newer. • Goold, Campbell & Alexander (1995) .‘The quest for corporate parenting advantage’, Harvard Business Review, March-April 1995, pp120-132. • Henry, A. (2008) Understanding Strategic Management, OUP. • Johnson, Scholes and Whittington (2008). Exploring Corporate Strategy (8th edition) – (note 6th and 7th edition also useful) FTPH.