Stretch Goals and Distribution of Performance John Sterman, MIT

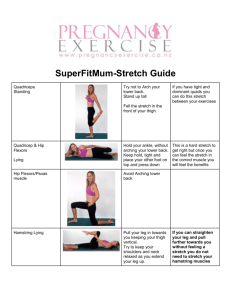

advertisement