Fair Value Accounting Policy

advertisement

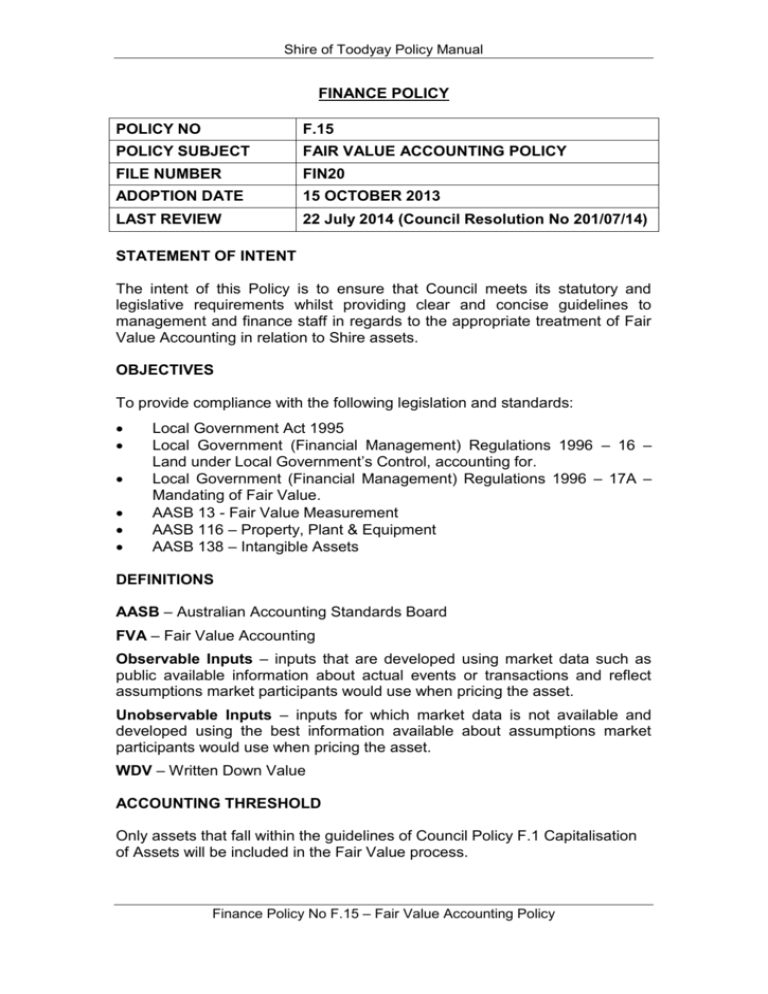

Shire of Toodyay Policy Manual FINANCE POLICY POLICY NO F.15 POLICY SUBJECT FAIR VALUE ACCOUNTING POLICY FILE NUMBER FIN20 ADOPTION DATE 15 OCTOBER 2013 LAST REVIEW 22 July 2014 (Council Resolution No 201/07/14) STATEMENT OF INTENT The intent of this Policy is to ensure that Council meets its statutory and legislative requirements whilst providing clear and concise guidelines to management and finance staff in regards to the appropriate treatment of Fair Value Accounting in relation to Shire assets. OBJECTIVES To provide compliance with the following legislation and standards: Local Government Act 1995 Local Government (Financial Management) Regulations 1996 – 16 – Land under Local Government’s Control, accounting for. Local Government (Financial Management) Regulations 1996 – 17A – Mandating of Fair Value. AASB 13 - Fair Value Measurement AASB 116 – Property, Plant & Equipment AASB 138 – Intangible Assets DEFINITIONS AASB – Australian Accounting Standards Board FVA – Fair Value Accounting Observable Inputs – inputs that are developed using market data such as public available information about actual events or transactions and reflect assumptions market participants would use when pricing the asset. Unobservable Inputs – inputs for which market data is not available and developed using the best information available about assumptions market participants would use when pricing the asset. WDV – Written Down Value ACCOUNTING THRESHOLD Only assets that fall within the guidelines of Council Policy F.1 Capitalisation of Assets will be included in the Fair Value process. Finance Policy No F.15 – Fair Value Accounting Policy Shire of Toodyay Policy Manual ACCOUNTING TREATMENT Accumulated depreciation at the date of the revaluation is treated in one of the following ways: (a) Restated proportionately with the change in the gross carrying amount of the asset so that the carrying amount of the asset after revaluation equals its revalued amount. This method is often used when an asset is revalued by means of applying an index to determine its depreciated replacement cost (Gross Method); or (b) Eliminated against the gross carrying amount of the asset (purchase cost) the net amount (WDV) restated to the revalued amount of the asset (Net Method). The amount of the adjustment arising on the restatement or elimination of accumulated depreciation forms part of the increase or decrease in carrying amount that is accounted for in accordance with the relevant AASB’s. METHODOLOGY As mandated by Local Government (Financial Management) Regulation 1996, 17A, a local government in Western Australia must show all assets in its financial report at fair value by 30 June 2015. Implementation is to be phased in over three years from 1 July 2012 and commences with plant and equipment being reported at fair value for the financial year ending 30 June 2013. The implementation of Fair Value Accounting at the Shire of Toodyay will be carried out as follows: Financial Year 2012/2013 2013/2014 2014/2015 2014/2015 Triennially – ongoing Asset Groups/Resources Plant & Equipment – predominantly in house in line with supporting documentation from external sources Land & Buildings (including specialised and nonspecialised buildings valued at component level) using industry cost guidelines – current Infrastructure – re-valued using industry unit costs – Roman Data updated June 2013 to be used as basis All other assets (including intangible, historical and cultural assets, library books, art collections etc.) All asset classes will be re-valued on a three year cycle to enable plant and equipment revaluation by 30 June 2016 and again by 30 June 2019 and so on; infrastructure by 30 June 2017 and again by 30 June 2020, and so on. Finance Policy No F.15 – Fair Value Accounting Policy Shire of Toodyay Policy Manual The Fair Valuation of Shire of Toodyay Plant and Equipment will be conducted in house using corporate knowledge backed up with supporting documentation from external sources. Each plant item is photographed and recorded individually all relevant details as per attached example. FAIR VALUE HIERARCHY (INPUTS TO VALUATION TECHNIQUES) Valuation techniques used to measure fair value shall maximise the use of relevant observable inputs and minimise the use of unobservable ones. Level 1 Inputs – quoted prices (unadjusted) in active markets for identical assets of liabilities at the measurement date. Level 2 Inputs – inputs other than quoted prices included within level one that are observable either directly or indirectly. Level 3 Inputs – inputs that are unobservable or have no ‘market’ The majority of valuation techniques will be a combination of Level 1 and 2 but Level 3 will be utilised when valuing assets such as roads or specialised buildings eg: town halls. Where a higher priced conforming offer is recommended, there should be clear and demonstrable benefits over and above the lowest total priced, conforming offer. ADOPTED 15 OCTOBER 2013 Amended Council Meeting 22 July 2014 Finance Policy No F.15 – Fair Value Accounting Policy