New Jersey Complete Business Registration Package

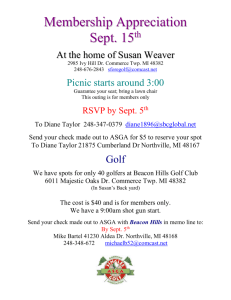

advertisement