Public Economics Syllabus

advertisement

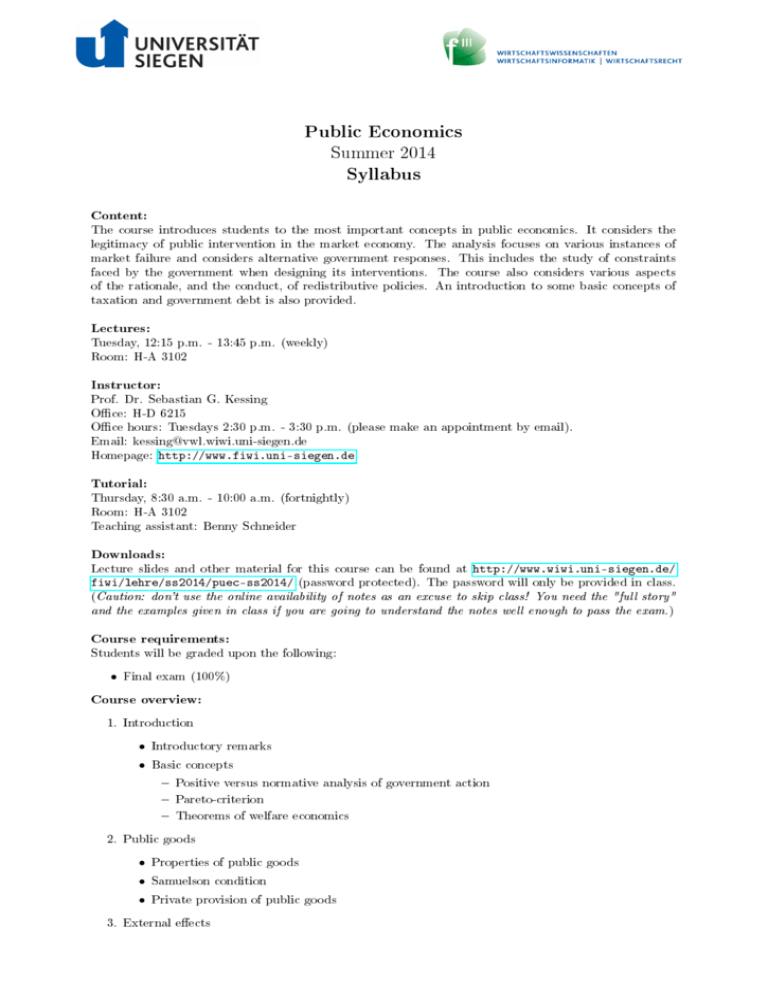

Public Economics Summer 2014 Syllabus Content: The course introduces students to the most important concepts in public economics. It considers the legitimacy of public intervention in the market economy. The analysis focuses on various instances of market failure and considers alternative government responses. This includes the study of constraints faced by the government when designing its interventions. The course also considers various aspects of the rationale, and the conduct, of redistributive policies. An introduction to some basic concepts of taxation and government debt is also provided. Lectures: Tuesday, 12:15 p.m. - 13:45 p.m. (weekly) Room: H-A 3102 Instructor: Prof. Dr. Sebastian G. Kessing Oce: H-D 6215 Oce hours: Tuesdays 2:30 p.m. - 3:30 p.m. (please make an appointment by email). Email: kessing@vwl.wiwi.uni-siegen.de Homepage: http://www.fiwi.uni-siegen.de Tutorial: Thursday, 8:30 a.m. - 10:00 a.m. (fortnightly) Room: H-A 3102 Teaching assistant: Benny Schneider Downloads: Lecture slides and other material for this course can be found at http://www.wiwi.uni-siegen.de/ fiwi/lehre/ss2014/puec-ss2014/ (password protected). The password will only be provided in class. (Caution: don't use the online availability of notes as an excuse to skip class! You need the "full story" and the examples given in class if you are going to understand the notes well enough to pass the exam.) Course requirements: Students will be graded upon the following: • Final exam (100%) Course overview: 1. Introduction • Introductory remarks • Basic concepts Positive versus normative analysis of government action Pareto-criterion Theorems of welfare economics 2. Public goods • Properties of public goods • Samuelson condition • Private provision of public goods 3. External eects • Consumption externalities • Production externalities • Rat race externalities • The commons problem • The Coase theorem 4. Redistribution • Redistribution as a public good • Redistribution as insurance • Political economy of redistribution • Cash versus in-kind transfers 5. Taxation • Tax incidence • Ad valorem & specic taxes • Tax burden and excess burden • Tax progressivity • Tax splitting • Labor income taxation 6. Government debt • Government debt as tax smoothing • Debt sustainability Readings: • If you aren't familiar with the basic concepts of public economics, you can nd instructive intro- ductions in Rosen and Gayer (2010) or Stiglitz (2000). Tresch (2002) is somewhat more advanced. • The main reference for the course is Hindriks and Myles (2006). • References for technical questions are Simon and Blume (1994) (for mathematics and optimiza- tion), Varian (2006) (for basic microeconomics) and Gravelle and Rees (2004) (for intermediate microeconomics). • Further references are given during the course. Useful books that are only available in German are: • Corneo (2009) • Wigger (2004) • Wellisch (2000a,b,c) • Gaube et al. (1996) • Rose et al. (1981) 2 References Corneo, G. G. (2009). Öentliche Finanzen: Ausgabenpolitik. Mohr Siebeck, Tübingen, 3 edition. Gaube, T., Nöhrbass, K.-H., and Schwager, R. (1996). Arbeitsbuch Finanzwissenschaft. PhysicaLehrbuch. Physica-Verl, Heidelberg. Gravelle, H. and Rees, R. (2004). Microeconomics. Prentice Hall Financial Times, Harlow and England and and New York, 3 edition. Hindriks, J. and Myles, G. D. (2006). Intermediate public economics. MIT Press, Cambridge and Mass. Rose, M., Wenzel, D., and Wiegard, W. (1981). Optimale Finanzpolitik. G. Fischer, Stuttgart. Rosen, H. S. and Gayer, T. (2010). Public nance. McGraw-Hill/Higher Education, Boston and MA, 9 edition. Simon, C. P. and Blume, L. (1994). Mathematics for economists. Norton, New York, 1 edition. Stiglitz, J. E. (2000). Economics of the public sector. W. W. Norton & Co., New York, 3 edition. Tresch, R. W. (2002). Public nance: A normative theory. Academic Press, Amsterdam and and Boston, 2 edition. Varian, H. R. (2006). Intermediate microeconomics: A modern approach. Norton, New York, 7 edition. Wellisch, D. (2000a). Finanzwissenschaft I: Rechtfertigung der Staatstätigkeit. Vahlen, München. Wellisch, D. (2000b). Finanzwissenschaft II: Theorie der Besteuerung. Vahlen, München. Wellisch, D. (2000c). Finanzwissenschaft III: Staatsverschuldung. Vahlen, München. Wigger, B. U. (2004). Grundzüge der Finanzwissenschaft. Springer-Lehrbuch. Springer, Berlin [u.a.]. 3