Accounting for Tax Accounting for Tax Equalization Costs

advertisement

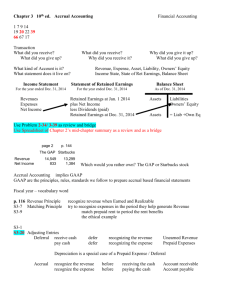

Accounting for Tax Equalization Costs March 29, 2012 Webinar Format: Webinar Format: • We will proceed with the webinar in its entirety, before p y, responding to any questions • Questions should be submitted via the link in the Microsoft Li M ti Live Meeting under Q&A d Q&A • Trouble logging in or dialing in: cdaas@gtn.com Webinar Format: Webinar Format: Your Presenters Your Presenters Mary Lou Stockton Mary Lou is the Managing Director of the Philadelphia office. She has over 15 years experience providing expatriate tax services with Ernst & Young in Philadelphia. Her clients have included a large pharmaceutical manufacturer a large global pharmaceutical manufacturer, a large global software consulting company, and many smaller companies that were just starting up their overseas activities. She has also worked in the corporate tax environment, having been Director of Tax with a national US retailer. Mary Lou received her undergraduate degree from Bryn Mawr College, and her Masters of Science in Business Administration from Temple University. Your Presenters Your Presenters Brett Sipes Brett is a Director in the Global Tax Network (“GTN”) office in Minneapolis, MN and has over 14 years of combined experience at GTN, in the Global Mobility practice at Ernst & Young, and the International Executive Services practice at KPMG Brett overseas Executive Services practice at KPMG. Brett overseas the delivery of GTN’s compliance and advisory services to his clients, and specializes in managing complex and unique assignments. In addition to his client duties, Brett also has a lead role in GTN’s strategic technology initiatives. Brett received his undergraduate degree in accounting from Northwestern College in St. Paul, MN. Disclaimer Circular 230: To ensure compliance with the requirements imposed by the IRS, we inform you that any tax advice contained in our communication (including any attachments) was not h d i i di i i (i l di h ) intended or written to be used, and cannot be used, for the purpose of (i) avoiding any tax penalty or (ii) promoting, marketing or recommending to another party any transaction or matter addressed herein. Our advice in our communication is limited to the conclusions specifically set forth herein and is based on the completeness and accuracy of the facts and assumptions as stated. Our advice may consider tax authorities that are subject to change, retroactively and/or prospectively. Such changes could affect the validity of our advice. Our advice will not be updated for subsequent h ld ff t th lidit f d i O d i ill t b d t df b t changes or modifications to applicable law and regulations, or to the judicial and administrative interpretations thereof. Agenda A. B. C. D. What is tax equalization? q Why does a tax equalization policy create accounting issues? Other potential accrual issues for assignments Comparison of the 3 common methods of accounting for tax equalization costs. E Analysis of the “full accrual” method of accounting for tax E. Analysis of the “full accrual” method of accounting for tax equalization costs. What is Tax Equalization? What is Tax Equalization? • Company policy to minimize tax impact to an assignee related p yp y p g to going on an assignment. • Results in company paying individual tax liabilities on behalf of an assignee. Why Does Tax Equalization Create Accounting Issues?? • Timing of tax payments can vary and can often occur long g p y y g after assignment is completed. • If tax accruals are not implemented, there can be unpleasant b d ti budgeting surprises when tax payments are paid long after i h t t id l ft the assignment is over. Other Issues Not Covered Other Issues Not Covered • Accrual for: • • • • • Base salary and normal compensation components Assignment allowances Deferred compensation (i e bonus) Deferred compensation (i.e., bonus). Equity awards Tax equalization costs on equity awards • Compensation Reporting Comparison of the 3 Common Methods of Accounting for Tax Equalization Costs i f li i Method Description Cash method. Tax payments are recorded as an expense when paid. Partial accrual method. Hypothetical tax and/or tax payments withholding is recorded in a reserve account. Full accrual method. Expense accruals are made based on the tax cost projection and all tax payments are reconciled through the tax accrual account. Example • The Widget Company sends Gary Smith on a one year g p y y y assignment from the US to Belgium. • Gary remains on U.S. payroll and is tax equalized. • Widget Co withholds hypothetical tax during assignment period. • Widget Co pays Belgium tax liability on behalf of assignee. Widget Co pays Belgium tax liability on behalf of assignee • Tax liability is paid two years after the assignment (i.e., in 2014) Basic Fact Pattern – Projected Costs Basic Fact Pattern Projected Costs Projection At Outset of Assignment Amount Projected Actual Belgium Taxes to be funded by Widget Co: funded by Widget $100,000 Projected Hypothetical Tax Liability to be funded by Gary: (40,000) P j t d N t T C t t Wid t C Projected Net Tax Cost to Widget Co: $60 000 $60,000 Basic Fact Pattern – Final Actual Costs Basic Fact Pattern Final Actual Costs Final Actual Costs Hypothetical Withholding Amount Year Paid ($40,000) 2012 Actual Tax Payment 110,000 2014 Final Actual Net Tax Costs: $70,000 Sample Journal Entries: Cash Method Sample Journal Entries: Cash Method Year: Description Account 2012 Hypo Tax Withholding Collected Cash Dr. 40,000 Salary Expense Salary Expense 2014 Cr. 40 000 40,000 Belgian Tax Payment Salary Expense Cash 110,000 110,000 Sample Journal Entries: Partial Accruall Year: Description i i Account 2012 Hypo Tax Withholding Collected Cash Dr. 40,000 Expatriate Tax Accrual (Liability) 2014 C Cr. 40,000 Belgian Tax Payment Expatriate Tax Accrual (Liability) Expatriate Tax Accrual (Liability) 40 000 40,000 Salary Expense 70,000 Cash 110,000 Sample Journal Entries: Full Accrual Sample Journal Entries: Full Accrual Year: Description Account 2012 Hypo Tax Withholding Collected Cash Dr. 40,000 Expatriate Tax Accrual (Liability) 2012 40,000 Record Accrual for Projection Salary Expense 60,000 Expatriate Tax Accrual (Liability) 2014 Cr. 60,000 Belgian Tax Payment Expatriate Tax Accrual (Liability) Salary Expense Cash 100,000 10,000 110,000 Summary Comparison of Accounting Methods h d Net Amount of Tax Costs to the P&L Recorded by Year Accounting Method Cash Method: Partial Accrual Method: Full Accrual Method: 2012 2013 2014 Total (40,000) 0 110,000 70,000 0 0 70,000 70,000 60,000 0 10,000 70,000 Analysis of Full Accrual Method for Accounting for Tax Equalization Costs f l Advantages • Can help to reduce “surprise” expenses for tax payments th t that are made after d ft assignment is completed. • Can minimize need to project when tax payments will occur, h t t ill unless there is a need to analyze cash‐flow issues. – . Disadvantages • Can result in additional time to prepare the calculations and reconcile accounts. d il t • Can result in additional administrative work to track all tax payments. ll t t Implementing Full Accrual Method: Tax Calculations/Analysis Required l l / l d 1. Cost projection at beginning of assignment 2. Estimated tax calculation at end of each tax year/calendar year 3. Reconciliation of amounts in tax accrual at end of each tax year/calendar year year/calendar year. 4. Reconciliation of amounts in tax accrual after annual returns/tax equalization completed. 5. Updating tax cost projection each year throughout assignment. Implementing Full Accrual Method: Challenges for Tracking Tax Payments h ll f k • Gross‐ups on assignment allowances can easily be buried • Host country tax payments often recorded as an adjustment to wages, not as an actual payment of cash. Consider intra‐company chargeback issues chargeback issues. • Depending on policy of company, payments to company may not be recorded as reduction to wages, so tying accrual to timing of compensation adjustments may not work. ti dj t t t k Implementing Full Accrual Method: Tracking Tax Payments k Host C H Country Taxes Hypo Tax Withholding Taxes paid By 3rd Party Gross-ups Tax Accrual Account Tax Equalizations Est. Tax Payments Refunds signed To Company Employer Social Taxes Tax Accrual (Balance Sheet Liability) Account – Typical Impact l Debit to the Accrual Account Home or Host tax Payment paid by company (or third party) Credit to the Accrual Account Initial Tax Cost based on projection Estimated tax payments made by the Hypothetical tax withholding company Employer social taxes Home or host tax refunds signed over to company by employee Tax equalization payment made by company to employee Tax equalization payment made by employee to company Tax grossups funded by the company Productivity Tip Productivity Tip The Process Should be Unique to Your Organization • Agree on the terminology • Start the process when it makes sense – ideally at the beginning of the assignment • Identify the owner of the process up‐front Id tif th f th f t • Remember it takes time to get everyone on board – HR, Tax, Finance. • Continual refinement and process i improvement t Terminology • These are terms of art These are terms of art ‐ agree on what they mean! agree on what they mean! Hypo tax Grossup Tax Equalization q Tax Accrual TEQ True Up Stay at home Tax Home Tax Theoretical Tax Foreign Host Tax Foreign Host Tax Tax Reimbursement Tax Cost Next Steps 1. Determine what process my company is using. 2. If full accrual, work with tax service provider to confirm process working appropriately. ki i t l 3. If not using full accrual, then: a. b. Get approval from appropriate levels at company to move to full pp pp p p y accrual process. Work with tax service provider on transition plan. Can be very challenging to correct for current assignees, so consider changing on g g g , g g go‐forward basis. Resources • Today’s presentation/slides will be posted on our website. • GTN’s December Newsletter on Topic here: http://www.gtn.com/newsletter_2011_12.php • GTN’s “Tax Accrual Process Guide” with case study, journal entries, sample T-Accounts, and other helpful information available upon request. • Contact Mary Lou or Brett, or your GTN contact, for additional assistance. Thank You! Questions? Polling Question Polling Question Your company accounts for the international tax costs of the p y assignment: A. On the cash method. Tax payments are recorded as an expense when paid. paid B. On the partial accrual method. Hypothetical tax withholding is recorded in a reserve account. Tax payments are recorded when paid. C On the full accrual method. Expense accruals are made based on the tax C. On the full accrual method Expense accruals are made based on the tax cost projection and all tax payments are reconciled through the tax accrual account D Unsure or some combination of the above. D. Unsure or some combination of the above Contact Details Mary Lou Stockton Managing Director Global Tax Network PA, LLC Global Tax Network PA, LLC 45 Darby Road, Suite E4 Paoli, PA 19301 Phone: (484) 885‐2419 Email: mstockton@GTN.com Web: www.GTN.com Brett Sipes Director , Global Tax Network MN, LLC 750 Boone Ave. N., Suite 102 Minneapolis, MN 55427 Phone: (763) 390‐4919 Email:l bsipes@GTN.com b Web: www.GTN.com 30