Complete Annual Report

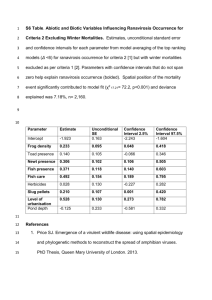

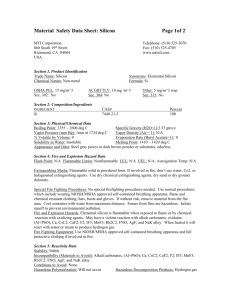

advertisement