2009 Chapter 10 - C Corporation Issues

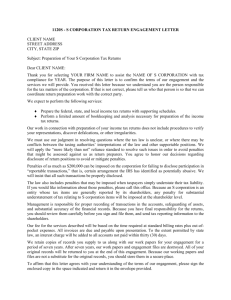

advertisement