mPAY Gateway : API Guide and Reference version 1.0.7.1

mPAY Gateway

API Guide and Reference

Version 1.0.7.1

@2015 Advance mPAY Co., Ltd. ALL RIGHTS RESERVED

Page 1

mPAY Gateway : API Guide and Reference version 1.0.7.1

Revision Control

Version

1.0.1.0

1.0.2.0

1.0.3.0

Date

11/05/2015

11/08/2015

17/08/2015

Modifier

Dejsak T.

Tharanart S.

Patti U.

1.0.4.0

1.0.5.0

28/08/2015

08/09/2015

Tharanart S.

Tharanart S.

Description of Content

Initial Draft

Change Parameter

- Remove parameter amount from “RequestOrderTepsApi”

- Update parameter orderID to 30 Character

- Update sequence diagram of chapter 4

Add New Command: DownloadRptTeps

- Modify Command : RequestOrderTepsApi

o Add input parameter (smsFlag,smsMobile)

- Add output parameter of “Payment result for respUrl”

(Table 5.3)

1.0.6.0

1.0.7.0

14/09/2015

01/10/2015

Thongjit Y.

Patti U.

- Add New Command: ResendSmsUrl

- Add Report Templates (chapter7)

Add Response Code Description

- Update Payment Flow (chapter 4)

- Add detail column ref1 – ref6 in payment report

@2015 Advance mPAY Co., Ltd. ALL RIGHTS RESERVED

Page 2

mPAY Gateway : API Guide and Reference version 1.0.7.1

Index

Table of Contents

Chapter 0 – ขันตอนการเปิ

้

ดบริการ ....................................................................................................................................... 4

Chapter 1 – Introduction to mPAY Gateway ...................................................................................................................... 5

Chapter 2 - Recommended Minimum Configuration ......................................................................................................... 7

Chapter 3 – Activating Your mPAY Gateway Account ...................................................................................................... 8

Chapter 4 – mPAY Gateway Transaction Flow .................................................................................................................. 9

Chapter 5 – Submitting Transaction to mPAY Gateway .................................................................................................. 13

Chapter 6 – Inquiry Order Status from mPAY Gateway................................................................................................... 18

Chapter 7 – Standard HTTP header................................................................................................................................. 20

Chapter 8 – Download Merchant Reports ....................................................................................................................... 21

Chapter 9 – Resend SMS EndPoint URL ......................................................................................................................... 21

Chapter 10 – Generic Action Response / Response Code Description ......................................................................... 29

@2015 Advance mPAY Co., Ltd. ALL RIGHTS RESERVED

Page 3

mPAY Gateway : API Guide and Reference version 1.0.7.1

Chapter 0 – ขนตอนการเปิ

ั้

ดบริการ

1. ทางร ้านค ้าจะต ้องทาการสมัครบริการ mPAY Gateway ให ้เรียบร ้อยก่อน

กรณีนต

ิ บ

ิ ค

ุ คล ติดต่อสมัครบริการได ้ที่ Merchant Contact Center 02-271-9181 กด 2

(เวลา 08:30-21:00 น. ทุกวัน)

กรณีบค

ุ คลธรรมดา สมัครได ้ด ้วยตัวเอง ผ่าน www.ais.co.th/mpaygateway

2. ร ้านค ้าส่งเอกสารประกอบการสมัครมาที่ บริษัท แอดวานซ์ เอ็มเปย์ จากัด

3. ทางทีมงาน mPAY Gateway จะจัดส่งข ้อมูลสาหรับ Call API เพือ

่ ทดสอบระบบให ้กับร ้านค ้าทาง E-mail ทีร่ ะบุตอน

สมัคร (ภายใน 7 วันทาการหลังจากทีท

่ างทีมงานได ้รับเอกสารตามข ้อ 2 )

ข ้อมูลทีจ

่ ะจัดส่งให ้มี 3 ค่า

3.1 Merchant ID

3.2 SID

3.3 Secret Key

4. หลังจากนัน

้ ทางร ้านค ้าสามารถเริม

่ พัฒนาระบบ พร ้อมทาการทดสอบเข ้ามาได ้เลย

่ มต่อระบบกับ mPAY Gateway สามารถติดต่อได ้ที่

กรณีพบปั ญหาหรือมีข ้อสงสัยในการพัฒนาเชือ

E-mail : dp-pts@ais.co.th หรือ โทร 02-029-4391

@2015 Advance mPAY Co., Ltd. ALL RIGHTS RESERVED

Page 4

mPAY Gateway : API Guide and Reference version 1.0.7.1

Chapter 1 – Introduction to mPAY Gateway

mPAY Gateway is an easy to plug-in total payment solution for E-Commerce business with capabilities

Easily to plug with API

Initially support the currency of Thai Baht only

Offer both online channel and offline payment channel

Allow merchant to choose type of payment fee, it can be absorb by merchant or pass on to customer at

agreeable rate.

Flexibility to set the validity for the payment for any purchase items.

Real-time proceed transaction with result notification to merchant

Cash settlement on next working day

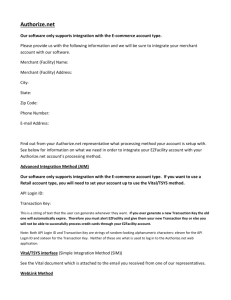

Figure 1.1 Overview of E-commerce transaction flow

1.

2.

3.

4.

5.

6.

At Merchant website, customer clicks “Buy” to purchase merchandise.

Merchant’s Server sends transaction request to mPAY Gateway.

mPAY Gateway processes payment and return result back to Merchant’ Server.

Merchant website displays the result to the customer.

Merchant delivers goods to customer.

mPAY then, settles the money to merchant on next working day.

Payment Method

With mPAY Gateway Solution, we allow customers to choose their preferred payment method which allow by

the merchant from the following 3 methods:

Online Channel

1.

mPAY wallet – the e-wallet of mPAY

Offline Channel - By choosing to pay via either mPAY STATION or Bank Transfer channel, the system will generate the

10 digits payment code for customers to pay later. However, when they make payment, the transaction will be proceed

in real-time and system will sent out the notification to merchant immediately.

2.

mPAY STATION – this is our agent with almost 5,000 locations nationwide. It comprises of:-

@2015 Advance mPAY Co., Ltd. ALL RIGHTS RESERVED

Page 5

mPAY Gateway : API Guide and Reference version 1.0.7.1

AIS Shop

Telewiz

Big C

Family Mart

Tops Supermarket

mPAY STATION

3.

Bank Transfer – just choose to re-charge the money into those 10 digits payment code from 8 leading banks’

ATM with almost 9,000 locations nationwide i.e.

Bangkok Bank

BBL

Kasikorn Bank

KBANK

Siam Commercial Bank

SCB

Krung Thai Bank

KTB

Bank of Ayudhaya

BAY

Thai Military Bank

TMB

CIMB Thai Bank

CIMB THAI

United Overseas Bank

UOB

Payment Fee

Our system allow merchant to choose type of payment fee, it can be absorb by merchant or pass on to

customer at agreeable rate. Merchant Fee – Payment fee will be charged to merchant in term of Merchant

Discount Rate (MDR)

Customer Fee – payment fee will be charged to customer. Merchant passes only the net amount of

goods/services (after any discount to mPAY Gateway, then mPAY Gateway will show product amount

customer fee separately together with total paid amount.

Reconciliation & Settlement Process

Payment transactions will be proceed in real-time and system will send payment result to merchant instantly.

Settlement report will be summarized in daily basis, the cut off time of daily transactions is mid-night. Merchant can

access mPAY Merchant Self Service System download settlement text file for reconciliation. Cash settlement will be

transferred to merchant’s bank account on next working day. For instance:-

Transaction Date

Cash Settlement Date

Monday

Tuesday

Wednesday

Thursday

Friday

Saturday

Sunday

Tuesday

Wednesday

Thursday

Friday

Monday

Remark

1.

The net settle amount will the amount after deducting the MDR. Merchant can deduct With Holding Tax of

MDR amount, and have to issue With Holding Tax document based on Thai Tax Regulation. Detail

operation will be provided later.

2.

Settlement files for Friday, Saturday and Sunday will be combined into a single cash transfer transaction.

3.

During national holiday, the settlement file(s) will be combined into the next cash transfer.

@2015 Advance mPAY Co., Ltd. ALL RIGHTS RESERVED

Page 6

mPAY Gateway : API Guide and Reference version 1.0.7.1

Chapter 2 - Recommended Minimum Configuration

Merchant’s Server Minimum Configuration

Merchant’s Server connects with mPAY Gateway by using HTML language. mPAY Gateway can support many

types of merchant server, for example, UNIX, Windows, Linux, etc.

For submit request to mPAY Gateway, merchant must use SSL System, 256 Bits from trusted certification CA.

(e.g. Verisign, Entrust).

Merchant needs to have the basic knowledge of HTML 1.1 syntax and languages especially:

• How to write HTML FORM POST

• How to receive HTML FORM POST

@2015 Advance mPAY Co., Ltd. ALL RIGHTS RESERVED

Page 7

mPAY Gateway : API Guide and Reference version 1.0.7.1

Chapter 3 – Activating Your mPAY Gateway Account

1.

2.

3.

4.

5.

6.

7.

8.

Merchant goes to mPAY Gateway Site URL https://xxxxxxxxxxxx to register

o Fill in merchant information

o Attached all the required documents as stated on WEB mPAY Gateway

Merchant downloads the mPAY Gateway - API Guide and Reference for further develop

mPAY will verify the documents and approve. Merchant Id (max. 15 digits) will be sent to merchant’s e-mail within 5

working days.

Merchant have to go to Merchant setting in mPAY’s payment gateway page to get “sid” and “SecretKet” for use in

API integration, and also set the rest of merchant’s parameter.

After developed, merchant can do the integrate test and make payment to

https://saichon-beauty.ais.co.th:8002/AISMPAYPartnerInterface/InterfaceService?

(The tested mobile number will be provided in the WEB mPAY Gateway [Developer corner])

Merchant submits test result to mPAY Admin for Data & Log checking which shown the mPAY Transaction Id to

mPAY Gateway

Upon checking, mPAY will On Production and inform back the status to Merchant via e-mail

Then, Merchant can change the URL to be the On Production one

https://partnerservices.mpay.co.th/AISMPAYPartnerInterface/InterfaceService? and go live.

@2015 Advance mPAY Co., Ltd. ALL RIGHTS RESERVED

Page 8

mPAY Gateway : API Guide and Reference version 1.0.7.1

Chapter 4 – mPAY Gateway Transaction Flow

Payment transaction will be stared when customer select to make the payment via mPAY Gateway. The

transaction will be re-directed to mPAY Gateway, customer can choose his/her preferred payment method which allow

by merchant. Upon getting the payment from customer from either online channel or offline channel, mPAY Gateway

will send back the result notification to merchant.

Figure 4.1 Sequence Diagram of mPAY Wallet transaction flow

@2015 Advance mPAY Co., Ltd. ALL RIGHTS RESERVED

Page 9

mPAY Gateway : API Guide and Reference version 1.0.7.1

Figure 4.2 Sequence Diagram of Credit Card transaction flow

Figure 4.3 Sequence Diagram of Offline transaction flow

@2015 Advance mPAY Co., Ltd. ALL RIGHTS RESERVED

Page 10

mPAY Gateway : API Guide and Reference version 1.0.7.1

1. Customer make a shopping & finalized shopping cart at Merchant’s Website

2. Merchant generates own unique order id and calls mPAY Gateway to start payment with passing order information

such as unique order id, order amount, etc. (see table 5.1)

3. mPAY Gateway verifies all input data, then initialize session and returns unique session id (called saleId) and Payment

URL of end-point mPAY Gateway Page back to Merchant's System (see table 5.1)

4. Merchant opens mPAY Gateway Page, re-direct customer to mPAY PaymentURL that returned in step 3.

5. mPAY Gateway displays Order Info page, then customer can confirm to pay.

6. mPAY Gateway displays list of payment methods page, then customer can select their preferred payment method

(which allow by merchant)

7. Customer makes the payment with payment method that they had selected. Payment transaction will be proceed

instantly if customer selects online payment. If customer selects offline channel merchant will get payment code with

expire date/time, then mPAY Gateway will notify payment status with payment transaction ID when customer make

payment at mPAY any offline channels.

8. mPAY Gateway returns payment result to Merchant's Specified respURL (HTTP Post). (see table 5.3)

9. mPAY Gateway opens Merchant's Specified RedirectURL Page with passing HTTP Post data. (see table 5.2)

10. (Optional) If Merchant's Server doesn't receive a response from mPAY Gateway, Merchant's Server can query order

status by using "SaleId". (see table 6.1)

11. Merchant's Server displays payment result page to customer.

12. Customer inputs mPAY’s mobile number.

13. mPAY notifies pending transaction to customer’s mobile number.

14. Customer clicks notify then login to mPAY app to make a payment.

15. mPAY app displays payment success/fail page.

@2015 Advance mPAY Co., Ltd. ALL RIGHTS RESERVED

Page 11

mPAY Gateway : API Guide and Reference version 1.0.7.1

16. mPAY generates payment REF Code

17. Customer goes to mPAY’s offline channel, such as AIS shop, Telewiz, Big C, FamilyMart, TOP, ETC.

18. Offline channel queries REF Code.

19. mPAY returns order information to offline channel.

20. Offline channel confirms payment.

21. mPAY return payment success to offline channel.

22. Offline channel print receipt to customer. (TAX invoice must issue from merchant)

Notice : mPAY Gateway time out is 30 seconds (For request API).

@2015 Advance mPAY Co., Ltd. ALL RIGHTS RESERVED

Page 12

mPAY Gateway : API Guide and Reference version 1.0.7.1

Chapter 5 – Submitting Transaction to mPAY Gateway

Step 1: Customer check out at Merchant’s website

Customer goes to merchant’s website for choosing goods or services, then confirm to buy by click button

‘Payment’ or ‘Confirm’ etc. at merchant’s website

Step 2: Merchant send request to mPAY Gateway

After Customer checked out from the merchant’s website, merchant has to produce the order information such

as unique order id, order amount, payment method (option) etc. and pack all into payment request command (detail in

Table 5.1) and send it to mPAY Gateway and then waiting for response from mPAY Gateway. There are 2 important

fields in the output response data set

(i) ‘saleId’ used as reference for further steps

(ii) ‘endPointUrl’ parameter used for merchant’s website to redirect to mPAY Gateway.

Important !! mPAY Gateway supports only Customer/customer input and API parameter values in regular ASCII (English

language) characters. The mPay Gateway does not support extended ASCII characters or any other character sets other

than regular ASCII at this time.

Table 5.1 : Request Payment to mPAY Gateway parameter

Input

No

Variable

Data Type

Max

Mandator

Length

y

1

projectCode

Character

10

Y

Description

2

3

command

sid

Character

Character

50

36

Y

Y

4

redirectUrl

Character

255

N

5

merchantId

Numeric

20

Y

6

orderId

Character

30

Y

7

currency

Character

3

Y

8

purchaseAmt

Numeric

12

Y

10

paymentMethod

Character

5

N

11

productDesc

Character

50

N

Name of project, use

default is ‘TEPS’

'RequestOrderTepsApi'

Merchant security control

(specific to a merchant)

URL, where customer will

be re-directed to

merchant’s Website and

mPAY returns variables to

when customer clicks ‘Go

Back to Merchant’s

Website’

(Success page) or

‘Continue’ (Error page)

Merchant No. (Assigned by

mPAY)

Purchase Order Id. Use

unique number within x

month. (Generate by

merchant)

Payment currency

e.g. THB, USD

Amount of purchased

order (Original product

amount) and last 2 digits

are decimal.

Method of payment

Values as belows:

- '1' = mPAY

- '4' = Credit Card

- '5' = Offline

Product Description

12

13

14

15

ref1

ref2

ref3

ref4

Character

Character

Character

Character

50

50

50

50

N

N

N

N

Free

Free

Free

Free

form

form

form

form

text

text

text

text

@2015 Advance mPAY Co., Ltd. ALL RIGHTS RESERVED

Page 13

Remark

http://www……………

or

https://www……………

12345678

1111111111

Reference : ISO4217

No decimal (multiple of

100) e.g. key in

178125 = 1781.25

If merchant is not

specific payment

method, mPAY will

show all accepted

Payment Method.

Electric Fan – Toshiba

Model XYZ103

mPAY Gateway : API Guide and Reference version 1.0.7.1

16

17

ref5

integrityStr

Character

Character

50

128

N

Y

Free form text

Application Authentication

SHA256

(sid+merchantId+orderId+

amount+SecretKey)

18

smsFlag

Character

1

N

19

smsMobile

Character

11

N

Y= send sms to buyer

N= don’t send sms to

buyer

(default value is “N”)

Buyer’s mobile number

Or the recipient that the

message will be sent to.

Format : 66xxxxxxxxx

(international format)

Output

No

Variable

Data Type

1

status

Character

Max

Length

1

Mandator

y

Y

Description

2

respCode

Character

10

Y

Processing Status

S = success , F = fail

Detail of processing status

0000 = success code

Other = error code

3

respDesc

respDesc

100

Y

Error Description

4

saleId

Numeric

27

Y

5

endPointUrl

Character

255

Y

6

7

8

detail1

detail2

detail3

Character

Character

Character

50

50

50

N

N

N

mPAY Payment request

reference ID

Redirect URL for End Point

Page

other information (if need)

other information (if need)

other information (if need)

Remark

S or F

If status = ‘S’

and respCode = 0000

means API execution

successfully

CHKPI – Session Lost

12345678900000

Step 3: Merchant brings customer to mPAY Gateway payment page

Merchant’s site brings their customers to make payment at mPAY Gateway site by redirect or browsing to mPAY

Gateway regarding of URL in the field "endPointUrl".

Step 4: Customer makes payment at mPAY Gateway

There are 3 steps for customer to make payment via mPAY Gateway

(i) Select Payment Method, mPAY provides 2 types of payment

Online channel

@2015 Advance mPAY Co., Ltd. ALL RIGHTS RESERVED

Page 14

mPAY Gateway : API Guide and Reference version 1.0.7.1

o Allow payment method by mPAY Wallet

o Notify Payment return Success or Fail to Merchant instantly

Offline channel

o mPAY Gateway allows merchant to self-configure the validity of the payment code (maximum

7 days). If customer selects offline channel mPAY will notify the status ‘Wait for paid’ to

merchant instantly.

o When customer goes to pay at mPAY STATION’s Counter or Bank’s ATM, mPAY Gateway will

online notify to Merchant at Merchant’s respURL with payment result ‘Success’ (In case that

customer does not make any payment until the payment code is expired, mPAY will then

notify ‘Payment timeout’ to Merchant)

(ii) Make payment following by the chosen payment method

(iii) Display Payment result page differently between online and offline.

Step 4: Go back to Merchant’s website after payment process is end

After customer clicks “Back to Merchant” button, mPAY Gateway will Notify by using Silent Post to the

specified respUrl, and mPAY Gateway will bring customer back to Merchant’s website by redirect to the specified

redirectURL with passing Post Data as Table 5.2

Table 5.2 : Payment result for HTTP post parameter

No

Variable

Data Type

Max

Mandat

Length

ory

1

status

Character

1

Y

2

respCode

Character

10

Y

3

4

5

respDesc

tranId

saleId

respDesc

Character

Numeric

100

30

27

Y

Y

Y

6

orderId

Character

30

Y

7

currency

Character

3

Y

8

exchangeRate

Numeric

12

Y

9

purchaseAmt

Numeric

12

Y

10

amount

Numeric

12

Y

11

incCustomerFee

Numeric

12

N

Description

Processing Status

S = success , F = fail

Detail of processing status

0000 = success code

Other = error code

Error Description

mPAY Transaction Id

mPAY Payment request

reference ID (Generate by

mPAY Gateway)

Purchase Order Id. Use

unique number within x

month. (Generate by

merchant)

Payment currency

e.g. THB

Rate for convert two

currencies is the rate at

which one currency will be

exchanged for another.

This case for convert

purchaseAmt to amount.

(last 5 digits are decimal)

Amount of purchased

order (Product amount)

and last 2 digits are

decimal.

Amount of purchased

order (Product amount)

that convert to ''Thai

Baht' and last 2 digits are

decimal.

Customer Fees are

included in ‘amount’

(currency = THB) last 2

digits are decimal.

Remark

S or F

If status = ‘S’

and respCode = 0000

means API execution

successfully

CHKPI – Session Lost

111222333

12345678900000

1111111111

Reference : ISO4217

For example, 3213830

= 32.13830

No decimal (multiple

of

100) e.g. key in

178125 = 1781.25

No decimal (multiple

of

100) e.g. key in

178125 = 1781.25

Do not include comma

separator and decimal

(multiple of 100). For

example, use 178125

not 1,781.25

e.g.

amount = 100 THB

incCustomerFee = 10 THB

excCustomerFee = 0 THB

customer pay = 100 THB

12

excCustomerFee

Numeric

12

N

Customer Fees are not

@2015 Advance mPAY Co., Ltd. ALL RIGHTS RESERVED

Page 15

Do not include comma

mPAY Gateway : API Guide and Reference version 1.0.7.1

included in ‘amount’

(currency = THB) last 2

digits are decimal.

e.g.

separator and decimal

(multiple of 100). For

example, use 178125

not 1,781.25

amount = 100 THB

incCustomerFee = 0 THB

excCustomerFee = 10 THB

customer pay = 110 THB

13

paymentStatus

Character

20

Y

Payment/Order Status

14

paymentCode

Character

10

N

15

orderExpireDate

Character

20

N

Reference for payment via

offline payment method

Expire date of

paymentCode

e.g. OPEN, ATTEMPT,

PENDING, SUCCESS,

FAIL

Format :

YYYYMMDDHH24MISS

Time Zone : (UTC+07:00)

Bangkok, Hanoi, Jakarta

e.g. 20151012130000

Table 5.3 : Payment result for respUrl (Silent Post) parameter

The Silent Post ensures that the transaction data is passed back to your website when a transaction is

completed. The Silent Post feature uses the HTML Post method to return data to your server for both approved and

declined transactions. This occurs even if a customer closes the browser before returning to your site, or if the mPAYhosted payment confirmation page is disabled. Silent Post data will be sent to your server at the same time as when a

payment confirmation page is displayed or as soon as a transaction is declined.

No

Variable

Data Type

1

status

Character

Max

Length

1

Mandat

ory

Y

2

respCode

Character

10

Y

3

4

5

respDesc

tranId

saleId

respDesc

Character

Numeric

100

30

27

Y

Y

Y

6

orderId

Character

30

Y

7

currency

Character

3

Y

8

exchangeRate

Numeric

12

Y

9

purchaseAmt

Numeric

12

Y

10

amount

Numeric

12

Y

Description

Processing Status

S = success , F = fail

Detail of processing status

0000 = success code

Other = error code

Error Description

mPAY Transaction Id

mPAY Payment request

reference ID

Purchase Order Id. Use

unique number within x

month. (Generate by

merchant)

Payment currency

e.g. THB

Rate for convert two

currencies is the rate at

which one currency will be

exchanged for another.

This case for convert

purchaseAmt to amount.

(last 5 digits are decimal)

Amount of purchased

order (Product amount)

and last 2 digits are

decimal.

Amount of purchased

order (Product amount)

that convert to ''Thai

@2015 Advance mPAY Co., Ltd. ALL RIGHTS RESERVED

Page 16

Remark

S or F

If status = ‘S’

and respCode = 0000

means API execution

successfully

CHKPI – Session Lost

111222333

12345678900000

1111111111

Reference : ISO4217

For example, 3213830

= 32.13830

No decimal (multiple

of

100) e.g. key in

178125 = 1781.25

No decimal (multiple

of

100) e.g. key in

mPAY Gateway : API Guide and Reference version 1.0.7.1

Baht' and last 2 digits are

11

incCustomerFee

Numeric

12

N

decimal.

Customer Fees are

included in ‘amount’

(currency = THB) last 2

digits are decimal.

e.g.

178125 = 1781.25

Do not include comma

separator and decimal

(multiple of 100). For

example, use 178125

not 1,781.25

amount = 100 THB

incCustomerFee = 10 THB

excCustomerFee = 0 THB

customer pay = 100 THB

12

excCustomerFee

Numeric

12

N

Customer Fees are not

included in ‘amount’

(currency = THB) last 2

digits are decimal.

e.g.

Do not include comma

separator and decimal

(multiple of 100). For

example, use 178125

not 1,781.25

amount = 100 THB

incCustomerFee = 0 THB

excCustomerFee = 10 THB

customer pay = 110 THB

13

paymentStatus

Character

20

Y

Payment/Order Status

14

paymentCode

Character

10

N

15

orderExpireDate

Character

20

N

Reference for payment via

offline payment method

Expire date of

paymentCode

e.g. OPEN, ATTEMPT,

PENDING, SUCCESS,

FAIL

Format :

YYYYMMDDHH24MISS

Time Zone : (UTC+07:00)

Bangkok, Hanoi, Jakarta

e.g. 20151012130000

16

17

18

19

20

21

custEmail

shipName

shipAddress

shipProvince

shipZip

shipCountry

Character

Character

Character

Character

Character

Character

50

100

255

20

10

3

N

N

N

N

N

N

22

23

24

remark1

remark2

integrityStr

Character

Character

Character

255

255

128

N

N

Y

Refer to:

http://en.wikipedia.org/wi

ki/ISO_3166-1_numeric.

Application Authentication

SHA256

(saleId+orderId+amount+

SecretKey[response])

25

customerId

Numeric

20

N

mPAY customer ID

(show when buyer is

mPAY’s customer)

12345678900000

Step 5: Merchant’s complete sales transaction with customer (redirect to merchant page)

Merchant captures payment result from mPAY Gateway. If payment is success, merchant has to display Success

transaction wording to customer and continues with goods or services delivery process.

@2015 Advance mPAY Co., Ltd. ALL RIGHTS RESERVED

Page 17

mPAY Gateway : API Guide and Reference version 1.0.7.1

Chapter 6 – Inquiry Order Status from mPAY Gateway

The mPAY Payment Service is capable of sending an order notification when a payment reaches one of the following

statuses:

OPEN

ATTEMPT

PENDING

SUCCESS

FAIL

Other payment statuses are not reported through order notifications. To check any possible status for a payment you

can consult its payment details in the Merchant Interface or send an information request in the API as below. (Inquiry

between created order date and after order expiration date 3 days)

Table 6.1 : Inquiry order status parameter

Input

No

Variable

1

2

3

4

projectCode

command

merchantId

orderId

Data

Type

Character

Character

Numeric

Character

5

purchaseAmt

Numeric

12

Y

Numeric

Character

Character

Character

Character

Character

27

50

50

50

50

50

Y

N

N

N

N

N

Max

Length

1

Mandatory

6

saleId

7

ref1

8

ref2

9

ref3

10

ref4

11

ref5

Output

No

Variable

Max

Length

10

50

20

30

Mandatory

Y

Y

Y

Y

Description

Name of project, use default is ‘TEPS’

‘InquiryApi’

Merchant No. (Assigned by mPAY)

Purchase Order Id. Use unique number

within x month. (Generate by merchant)

Amount of purchased order (Product

amount) and last 2 digits are decimal.

mPAY Payment request reference ID

1

status

Data

Type

Character

2

respCode

Character

10

Y

Processing Status

S = success , F = fail

Detail of processing status

0000 = success code

Other = error code

3

respDesc

respDesc

100

Y

Error Description

4

5

6

tranId

saleId

orderId

Character

Numeric

Character

30

27

30

Y

Y

Y

7

currency

Character

3

Y

8

exchangeRate

Numeric

12

Y

9

purchaseAmt

Numeric

12

Y

mPAY Transaction Id

mPAY Payment request reference ID

Purchase Order Id. Use unique number

within x month. (Generate by merchant)

Payment currency

e.g. THB

Rate for convert two currencies is the rate

at which one currency will be exchanged for

another. This case for convert purchaseAmt

to amount. (last 5 digits are decimal)

Amount of purchased order (Product

amount) and last 2 digits are decimal.

Y

Description

@2015 Advance mPAY Co., Ltd. ALL RIGHTS RESERVED

Page 18

Remark

12345678

1111111111

No decimal

(multiple of

100) e.g. key in

178125 =

1781.25

12345678900000

Remark

S or F

If status = ‘S’

and respCode =

0000

means API

execution

successfully

CHKPI – Session

Lost

111222333

12345678900000

1111111111

Reference :

ISO4217

For example,

3213830 =

32.13830

No decimal

(multiple of

100) e.g. key in

178125 =

1781.25

mPAY Gateway : API Guide and Reference version 1.0.7.1

10

amount

Numeric

12

Y

Amount of purchased order (Product

amount) that convert to ''Thai Baht' and

last 2 digits are decimal.

11

incCustomerFee

Numeric

12

N

Customer Fees are included in ‘amount’

(currency = THB) last 2 digits are decimal.

e.g.

amount = 100 THB

incCustomerFee = 10 THB

excCustomerFee = 0 THB

customer pay = 100 THB

12

excCustomerFee

Numeric

12

N

Customer Fees are not included in

‘amount’

(currency = THB) last 2 digits are decimal.

e.g.

amount = 100 THB

incCustomerFee = 0 THB

excCustomerFee = 10 THB

customer pay = 110 THB

13

paymentStatus

Character

20

Y

Payment/Order Status

14

paymentCode

Character

10

N

15

orderExpireDate

Character

20

N

Reference for payment via offline payment

method

Expire date of paymentCode

Format :

YYYYMMDDHH24MISS

Time Zone : (UTC+07:00) Bangkok, Hanoi,

Jakarta

e.g. 20151012130000

16

17

18

19

20

21

custEmail

shipName

shipAddress

shipProvince

shipZip

shipCountry

Character

Character

Character

Character

Character

Character

50

100

255

20

10

3

N

N

N

N

N

N

22

23

24

remark1

remark2

integrityStr

Character

Character

Character

255

255

128

N

N

Y

Refer to:

http://en.wikipedia.org/wiki/ISO_31661_numeric

Application Authentication SHA256

(saleId+orderId+amount+ SecretKey[response])

@2015 Advance mPAY Co., Ltd. ALL RIGHTS RESERVED

Page 19

No decimal

(multiple of

100) e.g. key in

178125 =

1781.25

Do not include

comma

separator and

decimal (multiple

of 100). For

example, use

178125 not

1,781.25

Do not include

comma

separator and

decimal (multiple

of 100). For

example, use

178125 not

1,781.25

e.g. OPEN,

ATTEMPT,

PENDING,

SUCCESS, FAIL

mPAY Gateway : API Guide and Reference version 1.0.7.1

Chapter 7 – Standard HTTP header

Header Name

Connection

Content-Length

Content-Type

Host

Description

State of the connection. The server returns the value close to close the connection after the

response is sent.

(Required)Size of message body.

(Required)Provide one of the following values:

- text/name value, transaction request body is in name-value pair format.

- text/xml

(Required)

@2015 Advance mPAY Co., Ltd. ALL RIGHTS RESERVED

Page 20

mPAY Gateway : API Guide and Reference version 1.0.7.1

Chapter 8 – Download Merchant Reports

This API

for download all merchant

Payment Report

Cancel Report

Refund Report

Settlement Report

reports from mPAY Gateway. That contain 4 types of report such as

-- > Showing the transactions report.

-- > Showing the transactions that has been refunded in the same payment day.

-- > Showing the transactions that has been refunded on the next payment day.

-- > Showing information about revenue and payments related to refund

information on the account.

Generally, mPAY Gateway first settles your account 1 day after your payment transaction completes. Your account is

settled daily business days.

The merchant reports are generated regularly, and you can download them from API only. The Reports are Pipedelimited text files(CSV file). These can be difficult to read in a text editor, such as Notepad or Text Edit, but you can

easily open them in most spreadsheet applications (such as Microsoft Excel) or database software, to review and

manage the information.

Note : The reports are available only for the past 6 months.

How to Downloading and Reading the Merchant Reports

1. Request API as the table 7.1

2. Decode only the string output parameter name is "reportFile" to ByteArrayOutputStream

3. Convert ByteArrayOutputStream (from No.2) to CSV file with java.io.ByteArrayOutputStream

Table 7.1 : Download Merchant Report parameter

Input

No

Variable

1

2

3

projectCode

command

sid

Data

Type

Character

Character

Character

Max

Length

10

50

36

Mandatory

4

5

merchantId

reportType

Numeric

Numeric

20

2

Y

Y

6

reportDate

Character

10

N

Y

Y

Y

Description

Name of project, use default is ‘TEPS’

‘DownloadRptTeps’

Merchant security control (specific to a

merchant)

Merchant No. (Assigned by mPAY)

‘1’ = Payment Report

‘2’ = Cancel Report

‘3’ = Refund Report

‘4’ = Settlement Report

Format : YYYYMMDD

Remark

12345678

1

Note : If you are not sent this parameter,

you'll get the report of yesterday

Output

No

Variable

1

status

Data

Type

Character

Max

Length

1

Mandatory

2

respCode

Character

10

Y

Processing Status

S = success , F = fail

Detail of processing status

0000 = success code

Other = error code

3

respDesc

respDesc

100

Y

Error Description

4

reportFile

String

(231)-1

Y

Binary data

Y

Description

@2015 Advance mPAY Co., Ltd. ALL RIGHTS RESERVED

Page 21

Remark

S or F

If status = ‘S’

and respCode =

0000

means API

execution

successfully

CHKPI – Session

Lost

VFlQRXxVlNR…

mPAY Gateway : API Guide and Reference version 1.0.7.1

For example:

Request

http://saichonbeauty.ais.co.th:8001/AISMPAYPartnerInterface/InterfaceService?projectCode=TEPS&command=DownloadRptTeps

&sid=mGIx4cOZKgE=&integrityStr=7af2beadbcff9c0a3ffd5a594b1a8bc42d6f1c6f37bded5a92627bbba9ee8ce8&mer

chantId=6342&reportType=1&reportDate=20150816

Response

<?xml version="1.0" encoding="UTF-8"?>

-<response>

<status>S</status>

<respCode>0000</respCode>

<respDesc>Success</respDesc>

<reportFile>VFlQRXxTRVFVRU5DRXxUUkFOU0FDVElPTl9JRHxQQVlNRU5UX0RBVEVUSU1FfFNFTExFUl9PUk

RFUl9JRHxUT1RBTF9BTU9VTlR8UEFZTUVOVF9NRVRIT0R8T1JERVJfREFURQpIfDF8VEVTVFRFUFM2MzQyfD

E2LzA4LzIwMTV8MTkvMDgvMjAxNXx8CkR8MnwxMTExMjcyNTU0fDE2LzA4LzIwMTUgMTA6MTk6NTJ8RjQyM

DAyfDUyLjF8bVBBWSBXYWxsZXR8MTcvMDgvMjAxNQpUfDN8VGVzdFRlcHM2MzQyfDE2LzA4LzIwMTV8MXw

1Mi4xfHwK</reportFile>

</response>

Opening the Merchant Reports in Microsoft Excel

1. Download a report as described earlier.

2. Open Microsoft Excel.

3. In Microsoft Excel, click File > Open.

4. Locate and open your report. Because your report is in pipe-delimited(|) text format, you might need to look for

all file types and not just Microsoft Excel worksheets.

5. When you find the file, select it, and click Open. Microsoft Excel should start the Text Import Wizard. This tool

allows you to specify how Microsoft Excel formats the file data.

6. In the Original Data Type section, select Delimited, and then click Next.

7. In the Delimiters section, make sure that PIPE(|) is the only box selected, and then click Next. This tells

Microsoft Excel to begin a new column whenever it comes across a tab in the report file.

8. In the Data Preview section, use the scroll bars to locate the order-item-id column and then click the

General heading.

9. In the Column Data Format section, select the Text option. This prevents Microsoft Excel from converting

the values to an exponential format. (For example, it prevents Microsoft Excel from converting

66522216496654 to 6.65222E+13.) Apply the same format to any other columns.

10. Click Finish. The report opens in Microsoft Excel.

@2015 Advance mPAY Co., Ltd. ALL RIGHTS RESERVED

Page 22

mPAY Gateway : API Guide and Reference version 1.0.7.1

Report Template

Report Type : Payment Report

Report Name : YYYYMMDD_PAYM_<MERCHANTNAME>.csv

1. Header

No.

Colume Name

Description

1

Type

Header

2

Sequence

First Sequence No.

3

Merchant Name

Merchant Name (Always show in upper case)

4

Payment Date

Format : DD/MM/YYYY (Transaction Date)

5

Process Run Date

Format : DD/MM/YYYY (Normally = Payment Date + 1)

2. Detail

No.

Description

Remark

1

Type

"D" = Detail

2

Sequence

Running Sequence No.

3

Transaction Id

mPAY Transaction Id

4

Payment Datetime

Format : DD/MM/YYYY HH24:MI:SS (Transaction Date,Time)

5

Order Id

Order Id From Merchant

6

Total Amount

Total Payment Amount (Include fee, Show 2 decimals)

7

Payment Method

Payment Method Description

8

Order Date

Format : DD/MM/YYYY

9

ref1

Merchant’s ref1

10 ref2

Merchant’s ref2

11 ref3

Merchant’s ref3

12 ref4

Merchant’s ref4

13 ref5

Merchant’s ref5

3. Total

No.

Description

Remark

1

Type

“T” = Total

2

Sequence

Last Sequence No. (Row id)

3

Merchant Name

Merchant Name (Always show in upper case)

4

Payment Date

Format : DD/MM/YYYY (Transaction Date)

5

Total Transaction

Count Transaction of Details

6

Total Payment Amount

Sum Amount of Details (Show 2 decimals)

Examples

“H”

"1"

KANOM PINKLAO

17/07/2015

18/07/2015

Remark

"D"

2

11123123404

17/07/2015 08:01:10

1111111

1,000.00

mPAY Wallet

16/07/2015

Remark

“T”

Last Sequence No.

KANOM PINKLAO

17/07/2015

1

1,000.00

@2015 Advance mPAY Co., Ltd. ALL RIGHTS RESERVED

Page 23

mPAY Gateway : API Guide and Reference version 1.0.7.1

Report Type : Cancel Report

Report Name : YYYYMMDD_CANC_<MERCHANTNAME>.csv

1. Header

No.

Colume Name

Description

1

Type

Header

2

Sequence

First Sequence No.

3

Merchant Name

Merchant Name (Always show in upper case)

4

Cancel Date

Format : DD/MM/YYYY (Refund Date)

5

Process Run Date

Format : DD/MM/YYYY (Normally = Cancel Date + 1)

6

7

8

2. Detail

No.

Description

Remark

1

Type

"D" = Detail

2

Sequence

Running Sequence No.

3

Transaction Id

mPAY Transaction Id

4

Cancel Datetime

Format : DD/MM/YYYY HH24:MI:SS (Refund Date,Time)

5

Order Id

Order Id From Merchant

6

Total Amount

Total Payment Amount (Include fee, Show 2 decimals)

7

Payment Method

Payment Method Description

8

Payment Datetime

Format : DD/MM/YYYY HH24:MI:SS (Transaction Date,Time)

3. Total

No.

Description

Remark

1

Type

“T” = Total

2

Sequence

Last Sequence No. (Row id)

3

Merchant Name

Merchant Name (Always show in upper case)

4

Cancel Date

Format : DD/MM/YYYY (Refund Date)

5

Total Cancel Transaction

Count Cancel Transaction of Details

6

Total Cancel Amount

Sum Cancel Amount of Details (Show 2 decimals)

7

8

Examples

“H”

"1"

KANOM PINKLAO

17/07/2015

18/07/2015

Remark

"D"

2

11123123404

17/07/2015 08:01:10

1111111

1,000.00

mPAY Wallet

17/07/2015 18:01:10

Remark

“T”

Last Sequence No.

KANOM PINKLAO

17/07/2015

1

1,000.00

@2015 Advance mPAY Co., Ltd. ALL RIGHTS RESERVED

Page 24

mPAY Gateway : API Guide and Reference version 1.0.7.1

Report Type : Refund Report

Report Name : YYYYMMDD_REFN_<MERCHANTNAME>.csv

1. Header

No.

Colume Name

Description

1

Type

Header

2

Sequence

First Sequence No.

3

Merchant Name

Merchant Name (Always show in upper case)

4

Refund Date

Format : DD/MM/YYYY (Refund Date)

5

Process Run Date

Format : DD/MM/YYYY (Normally = Refund Date + 1)

6

7

8

9

2. Detail

No.

Description

Remark

1

Type

"D" = Detail

2

Sequence

Running Sequence No.

3

Transaction Id

mPAY Transaction Id

4

Refund Datetime

Format : DD/MM/YYYY HH24:MI:SS (Refund Date,Time)

5

Order Id

Order Id From Merchant

6

Total Amount

Total Payment Amount (Include fee, Show 2 decimals)

7

Payment Method

Payment Method Description

8

Payment Datetime

Format : DD/MM/YYYY HH24:MI:SS (Transaction Date,Time)

9

Settlement Batch Date

Format : DD/MM/YYYY (Normally = Payment Date + 1)

3. Total

No.

Description

Remark

1

Type

“T” = Total

2

Sequence

Last Sequence No. (Row id)

3

Merchant Name

Merchant Name (Always show in upper case)

4

Refund Date

Format : DD/MM/YYYY (Refund Date)

5

Total Refund Transaction

Count Refund Transaction of Details

6

Total Refund Amount

Sum Refund Amount of Details (Show 2 decimals)

7

8

9

Examples

“H”

"1"

KANOM PINKLAO

18/07/2015

19/07/2015

Remark

"D"

2

11123123404

18/07/2015 08:01:10

1111111

1,000.00

mPAY Wallet

17/07/2015 18:01:10

18/07/2015

Remark

“T”

Last Sequence No.

KANOM PINKLAO

18/07/2015

1

1,000.00

@2015 Advance mPAY Co., Ltd. ALL RIGHTS RESERVED

Page 25

mPAY Gateway : API Guide and Reference version 1.0.7.1

Report Type : Settlement Report

Report Name : YYYYMMDD_SETM_<MERCHANTNAME>.csv

1. Header

No.

Colume Name

Description

1

Type

Header

2

Sequence

First Sequence No.

3

Merchant Name

Merchant Name (Always show in upper case)

4

Settlement Date

Format : DD/MM/YYYY (Settle Date)

5

Process Run Date

Format : DD/MM/YYYY (Normally = Transaction date + 1)

8

2. Detail

No.

Description

Remark

1

Type

"D" = Detail

2

Sequence

Running Sequence No.

3

Batch Id

Settle Batch Id

4

Batch Date

Format : DD/MM/YYYY (Batch Date)

5

Payment Date

Format : DD/MM/YYYY (Payment Date)

6

Sales Transaction

Number of Sales & Dispute Clear Transaction

7

Sales Amount

Amount of Sales & Dispute Clear Transaction

8

Fee

Payment Fee

9

VAT

VAT of Fee

10 Refund Transaction

Number of Refund/Adjust Transaction

11 Refund Amount

Amount of Refund/Adjust Transaction

12 Net Amount

Net Amount that will transfer to merchant

3. Total

No.

Description

Remark

1

Type

“T” = Total

2

Sequence

Last Sequence No. (Row id)

3

Merchant Name

Merchant Name (Always show in upper case)

4

Settlement Date

Format : DD/MM/YYYY (settle Date)

5

Total Settlement Batch

Number of Settle Batch

6

Total Settlement Amount

Sum of Net Amount (Show 2 decimals)

7

8

Examples

“H”

"1"

KANOM PINKLAO

17/07/2015

18/07/2015

Remark

"D"

2

11123123404

17/07/2015

16/07/2015

20

1,000.00

100.00

10.0

1

50.00

850.00

Remark

“T”

Last Sequence No.

KANOM PINKLAO

17/07/2015

1

850.00

@2015 Advance mPAY Co., Ltd. ALL RIGHTS RESERVED

Page 26

mPAY Gateway : API Guide and Reference version 1.0.7.1

Examples of data file (Delimeter = '|')

FILE_NAME = 20150818_PAYM_TESTTEPS6342.csv

TYPE|SEQUENCE|TRANSACTION_ID|PAYMENT_DATETIME|SELLER_ORDER_ID|TOTAL_AMOUNT|PAYMENT_METHOD|ORDER_DATE

H|1|TESTTEPS6342|18/08/2015|19/08/2015||

D|2|1111272821|18/08/2015 16:00:53|1000010|1052.1|mPAY Wallet|18/08/2015

D|3|1111272769|18/08/2015 11:52:59|100001|1044.1|mPAY Wallet|18/08/2015

D|4|1111272767|18/08/2015 11:51:06|100000|1043.1|mPAY Wallet|18/08/2015

D|5|REC000003|18/08/2015 12:36:49|A39005|101.1|mPAY Wallet|18/08/2015

T|6|TestTeps6342|18/08/2015|4|3240.4||

@2015 Advance mPAY Co., Ltd. ALL RIGHTS RESERVED

Page 27

mPAY Gateway : API Guide and Reference version 1.0.7.1

Chapter 9 – Resend SMS EndPoint URL

This command can be used to resend text messages to the buyer’s mobile number as requested from Command

“RequestOrderTepsApi” in the first time only. It uses a same message which links to the original endpoint URL, and that

order has not yet been paid and expired. SMS will be sent out immediately and delivered within a few seconds.

Table 8.1 : Resend SMS EndPoint URL parameter

Input

No

Variable

1

2

3

3

projectCode

command

merchantId

sid

Data

Type

Character

Character

Numeric

Character

Max

Length

10

50

20

36

Mandatory

4

orderId

Character

30

Y

5

saleId

Numeric

27

Y

Y

Y

Y

Y

Description

Name of project, use default is ‘TEPS’

‘ResendSmsEndpoint’

Merchant No. (Assigned by mPAY)

Merchant security control (specific to a

merchant)

Purchase Order Id. Use unique number

within x month. (Generate by merchant)

mPAY Payment request reference ID

Remark

12345678

1111111111

1234

(Receive from Command: 'RequestOrderTepsApi')

Output

No

Variable

1

status

Data

Type

Character

Max

Length

1

Mandatory

2

respCode

Character

10

Y

Processing Status

S = success , F = fail

Detail of processing status

0000 = success code

Other = error code

3

respDesc

respDesc

100

Y

Error Description

Y

Description

@2015 Advance mPAY Co., Ltd. ALL RIGHTS RESERVED

Page 28

Remark

S or F

If status = ‘S’

and respCode =

0000

means API

execution

successfully

CHKPI – Session

Lost

mPAY Gateway : API Guide and Reference version 1.0.7.1

Chapter 10 – Generic Action Response / Response Code Description

Error Code

Message to Customer

0000

Action successfully, completed

1767

standard Success format

Sorry, Service is temporary unavailable.

Please try again later.

Sorry, Service is temporary unavailable.

Please try again later.

Sorry, Service is temporary unavailable.

Please try again later.

Sorry, Service is temporary unavailable.

Please try again later.

Sorry, Service is temporary unavailable.

Please try again later.

Your mPAY Wallet balance is not sufficient,

please cash-in before proccessing

transaction.

Sorry, Service is temporary unavailable.

Please try again later.

Your transaction has timed out, please retry

again.

Sorry, Service is temporary unavailable.

Please try again later.

Invalid amount , please recheck and try

again.

Your balance is not sufficient, please cash-in

before proccessing transaction.

Sorry, Service is temporary unavailable.

Please try again later.

Sorry, Service is temporary unavailable.

Please try again later.

Sorry, Service is temporary unavailable.

Please contact [Merchant call center]

PIN code is temporary locked, please contact

AIS CALL CENTER 1175

PIN code is incorrect, please try again.

Sorry, Service is temporary unavailable.

Please try again later.

Sorry, Service is temporary unavailable.

Please try again later.

Invalid amount , please recheck and try

again.

Invalid amount , please recheck and try

again.

Sorry, Service is temporary unavailable.

Please contact [Merchant call center]

Your balance is not sufficient, please cash-in

before proccessing transaction.

Sorry, Service is temporary unavailable.

Please try again later.

Sorry, Service is temporary unavailable.

Please contact [Merchant call center]

This order has already paid.

1771

This order has already expired.

This order id already expired.

0001

0002

0003

0004

1007

1037

1038

1044

1112

1125

1141

1142

1143

1217

1278

1309

1427

1552

1581

1582

1619

1706

1713

1766

Error Cause

Database Error

Data not found

Bu error other

Update not Success

CustomerId is null

You have no money to pay ,please contact AIS CALL

CENTER 1175

Transaction Not Found

Session Lost

Get mCash Balance Error

Your amount is incorrect, please try again.

Your mCASH is not sufficient, please refill your mCASH

before making transaction.

No Selected PI

Duplicate Transactioin

No Posting Text

Pin code or Password is temporary locked, please contact

AIS CALL CENTER 1175

Pin code is incorrect, please try again

The service in temporary unavailable , please try again later.

Voucher not found

Amount Under Service Mininum

Amount Over Service Maxinum

Check Sum Incorrect

Your balance is not sufficient, please check available balance

or deposit to Beat S/A before making transaction.

Sorry, Service is unavailable. Please try again later.

There are incomplete required fields.

This order id has already been paid.

@2015 Advance mPAY Co., Ltd. ALL RIGHTS RESERVED

Page 29

mPAY Gateway : API Guide and Reference version 1.0.7.1

1772

1773

1774

1775

1790

6001

6008

6009

6036

6201

6204

6234

Sorry, Service is temporary unavailable.

Please contact [Merchant call center]

Sorry, Service is temporary unavailable.

Please contact [Merchant call center]

Sorry, Service is temporary unavailable.

Please contact [Merchant call center]

Sorry, Service is temporary unavailable.

Please contact [Merchant call center]

Sorry, Service is temporary unavailable.

Please contact [Merchant call center]

Sorry, Service is temporary unavailable.

Please try again later.

Sorry, Service is temporary unavailable.

Please contact [Merchant call center]

Sorry, Service is temporary unavailable.

Please contact [Merchant call center]

Sorry, Service is temporary unavailable.

Please contact [Merchant call center]

You are not mPAY member, please register

to mPAY before processing transaction

(register via mPAY App; free download at

google play or App store)

Sorry, Service is temporary unavailable.

Please try again later.

Sorry, Service is temporary unavailable.

Please contact [Merchant call center]

This order id is not expired, can't create a new one.

Missing or incorrect sid

Incorrect purchaseAmt or Amount

Incorrect Currency

Merchant url response does not exists

Please correct the mobile number.

Please Input TranId

Please Input Amount

Please Input ProductAmt

Please make a registration before using mPAY.

The service is temporary unavailble,please try again later

PostingTxt is null

@2015 Advance mPAY Co., Ltd. ALL RIGHTS RESERVED

Page 30

mPAY Gateway : API Guide and Reference version 1.0.7.1

@2015 Advance mPAY Co., Ltd. ALL RIGHTS RESERVED

Page 31