Capital Management System (PDF:118KB)

advertisement

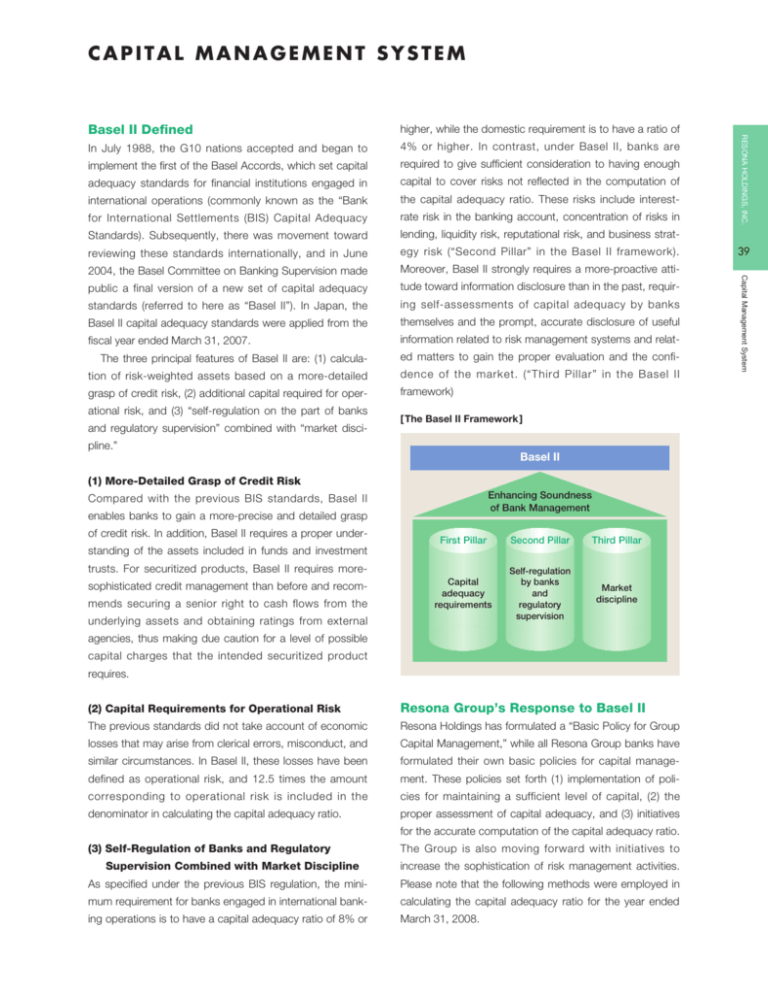

CAPITAL MANAGEMENT SYSTEM In July 1988, the G10 nations accepted and began to 4% or higher. In contrast, under Basel II, banks are implement the first of the Basel Accords, which set capital required to give sufficient consideration to having enough adequacy standards for financial institutions engaged in capital to cover risks not reflected in the computation of international operations (commonly known as the “Bank the capital adequacy ratio. These risks include interest- for International Settlements (BIS) Capital Adequacy rate risk in the banking account, concentration of risks in Standards). Subsequently, there was movement toward lending, liquidity risk, reputational risk, and business strat- reviewing these standards internationally, and in June egy risk (“Second Pillar” in the Basel II framework). 2004, the Basel Committee on Banking Supervision made Moreover, Basel II strongly requires a more-proactive atti- public a final version of a new set of capital adequacy tude toward information disclosure than in the past, requir- standards (referred to here as “Basel II”). In Japan, the ing self-assessments of capital adequacy by banks Basel II capital adequacy standards were applied from the themselves and the prompt, accurate disclosure of useful fiscal year ended March 31, 2007. information related to risk management systems and relat- The three principal features of Basel II are: (1) calcula- ed matters to gain the proper evaluation and the confi- tion of risk-weighted assets based on a more-detailed dence of the market. (“Third Pillar” in the Basel II grasp of credit risk, (2) additional capital required for oper- framework) ational risk, and (3) “self-regulation on the part of banks [ The Basel II Framework ] and regulatory supervision” combined with “market discipline.” Basel II (1) More-Detailed Grasp of Credit Risk Enhancing Soundness of Bank Management Compared with the previous BIS standards, Basel II enables banks to gain a more-precise and detailed grasp of credit risk. In addition, Basel II requires a proper under- First Pillar Second Pillar Third Pillar Capital adequacy requirements Self-regulation by banks and regulatory supervision Market discipline standing of the assets included in funds and investment trusts. For securitized products, Basel II requires moresophisticated credit management than before and recommends securing a senior right to cash flows from the underlying assets and obtaining ratings from external agencies, thus making due caution for a level of possible capital charges that the intended securitized product requires. (2) Capital Requirements for Operational Risk Resona Group’s Response to Basel II The previous standards did not take account of economic Resona Holdings has formulated a “Basic Policy for Group losses that may arise from clerical errors, misconduct, and Capital Management,” while all Resona Group banks have similar circumstances. In Basel II, these losses have been formulated their own basic policies for capital manage- defined as operational risk, and 12.5 times the amount ment. These policies set forth (1) implementation of poli- corresponding to operational risk is included in the cies for maintaining a sufficient level of capital, (2) the denominator in calculating the capital adequacy ratio. proper assessment of capital adequacy, and (3) initiatives for the accurate computation of the capital adequacy ratio. (3) Self-Regulation of Banks and Regulatory Supervision Combined with Market Discipline The Group is also moving forward with initiatives to increase the sophistication of risk management activities. As specified under the previous BIS regulation, the mini- Please note that the following methods were employed in mum requirement for banks engaged in international bank- calculating the capital adequacy ratio for the year ended ing operations is to have a capital adequacy ratio of 8% or March 31, 2008. 39 Capital Management System higher, while the domestic requirement is to have a ratio of RESONA HOLDINGS, INC. Basel II Defined RESONA HOLDINGS, INC. 40 Company Name Risk Categories Resona Holdings, Inc. Resona Bank, Ltd. Saitama Resona Bank, Ltd. Credit risk The Kinki Osaka Bank, Ltd. (Note 1) Resona Trust & Banking Co., Ltd. Methods F-IRB Approach Operational risk The Standardized Approach (Note 2) Market risk Exemption applicable under the Notification of the Consolidated Capital Adequacy Credit risk Standardized Approach Operational risk The Standardized Approach (Note 2) Market risk Exemption applicable under the Notification of the Consolidated Capital Adequacy Notes: (1) The Kinki Osaka Bank, Ltd. plans to adopt the F-IRB approach for the calculation of the amount of credit risk assets from the end of March 2010. (Stepwise application of the internal ratings approach) Notes: (2) Under the Standardized Approach, the amount equivalent to operational risk is calculated based on “gross profit” for the previous three years. This “gross profit” is defined under the Notification on Capital Adequacy and differs from “gross operating profit” that appears on Resona Group’s financial statements. Capital Management System Resona’s Capital Management System Resona Holdings and all Group banks believes that, to maintain sound and stable business operations, securing sufficient capital appropriate to risk exposure is extremely important. Accordingly, the Company manages the capital of the Resona Group to maintain the appropriate level of capital adequacy ratio. Specifically, we have developed a system in which specific departments in charge of managing the capital adequacy ratio and departments in charge of comprehensive risk management play their respective rolls and work together organically. Each department in charge implements dynamic and responsive management processes that include preparing plans for capital adequacy and risk limits, monitoring compliance with these plans, analyzing and assessing the actual results, evaluating the level of capital adequacy, and implementing policies in response when necessary. Departments in charge also make timely reports to management. [ Capital Management System ] Capital Management Board of Directors Capital adequacy ratio management (Regulatory capital) Executive Committee Comprehensive risk management (Economic capital) Finance and Accounting Division ALM Committee Risk Management Division Capital management (1) Preparation of plans Risk limits plans Discussion/reporting (2) Process management Monitoring Discussion/reporting Actual capital adequacy ratio (3) Results management Discussion/reporting Confirmation of actual risk limits (4) Adequacy evaluation Stress tests Assessment of Capital Adequacy Discussion/reporting > Assessment using a matrix of actual capital adequacy ratios and actual risk volume > Assessment using stress tests on both actual capital adequacy ratios and actual risk volume Stress tests Reviewing the original plans and process management Reviewing the original plans and process management Monitoring (5) Review of the results In the event capital is not adequate: Review risk limits, consider and implement remedial action, including asset controls, raising additional capital, etc. Discussion/reporting Methods for Assessment of Capital Adequacy Resona Holdings and Resona Group banks assess the “level of capital adequacy” from the two perspectives: 1) management of the capital adequacy ratio based on the Basel II regulations and 2) comprehensive risk management. In addition, to prepare for risks that may emerge under unforeseen conditions, we conduct stress tests to measure the impact of various scenarios, and, by taking account of the principal risks that are not included in the Basel II capital adequacy calculations (such as credit concentration risk, interest rate risk in the banking account, and other risks), we make comprehensive assessments of capital adequacy. During the fiscal year ended March 31, 2008, Resona Holdings and Resona Group banks maintained sufficient capital to maintain the sound and stable operation of their business activities.