Federal Regulation of the Prepaid Card Industry

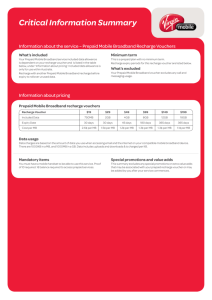

advertisement