UOBM Annual Report 2012

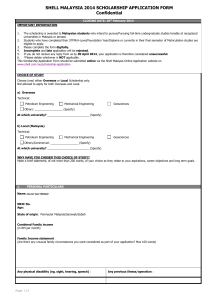

advertisement