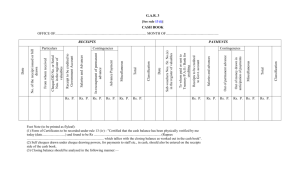

Cheques & Cheque Clearing The Facts

advertisement