Target Market Analysis

advertisement

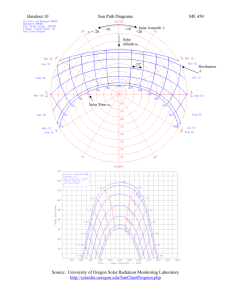

Project Development Programme East Africa Target Market Analysis Kenya’s Solar Energy Market www.renewables-made-in-germany.com www.german-renewable-energy.com www.german-renewable-energy.com Target Market Analysis Kenya’s Solar Energy Market Authors Integrated Energy Solutions (IES): Mark Hankins Anjali Saini Paul Kirai November 2009 Editor Gesellschaft für technische Zusammenarbeit (GTZ) GmbH On behalf of German Federal Ministry Of Economics and Technology (BMWi) Contact Deutsche Gesellschaft für technische Zusammenarbeit (GTZ) GmbH Potsdamer Platz 10, 10785 Berlin, Germany Regine Dietz Daniel Busche Tel: +49 (0)30 408 190 253 Fax: +49 (0)30 408 190 22 253 Email: pep-ostafrika@gtz.de Web: www.gtz.de/projektentwicklungsprogramm Web: www.exportinitiative.bmwi.de This Target Market Analysis is part of the Project Development Programme (PDP) East Africa. PDP East Africa is implemented by the Deutsche Gesellschaft für Technische Zusammenarbeit (GTZ) on behalf of the German Federal Ministry of Economics and Technology (BMWi) under the Export Initiative Renewable Energies. More information about the PDP and about renewable energy markets in East Africa: www.gtz.de/projektentwicklungsprogramm This publication, including all its parts, is protected by copyright. Any use that is not expressly permitted under copyright legislation requires the prior consent of the GTZ. All content was created with the utmost care and in good faith. The GTZ assumes no responsibility for the accuracy, timeliness, completeness or quality of the information provided. The GTZ cannot be liable for any material or immaterial damage caused directly or indirectly by the use or disuse of publication’s information, unless intentional or gross negligent fault can be proven. Target Market Analysis: Kenya’s Solar Energy Market IV Contents 1 STATUS QUO OF THE SOLAR ENERGY SECTOR .................................................... 1 1.1 BRIEF SOLAR SECTOR OVERVIEW ............................................................................ 1 1.2 MAJOR MARKET SEGMENTS ..................................................................................... 1 1.2.1 Solar PV............................................................................................................. 1 1.2.2 Solar Water Heating (SWH) ............................................................................... 4 1.3 LOCAL CAPACITIES ................................................................................................... 5 1.3.1 Solar PV Human Capacity.................................................................................. 5 1.3.2 Solar Water Heating Capacity ............................................................................ 6 2 2. MARKET POTENTIALS ............................................................................................ 6 2.1 OVERALL SECTOR OUTLOOK ..................................................................................... 6 2.1.1 2.1.1 PV ............................................................................................................. 6 2.1.2 SWH .................................................................................................................. 9 2.2 UNDEVELOPED MARKET OPPORTUNITIES ..................................................................10 2.2.1 Solar Hybrid PV & Tourism ...............................................................................10 2.2.2 Solar PV Hybrid Systems & Telecommunications .............................................11 2.2.3 Solar PV Hybrid Systems & Village Mini-grids ...................................................12 2.2.4 Solar PV Grid Connect ......................................................................................13 3 SOLAR-SPECIFIC REGULATION AND FRAMEWORK ..............................................13 3.1 POLICIES AND REGULATIONS ...................................................................................13 3.1.1 Government Institutions for Solar Energy in Kenya ...........................................14 3.1.2 Off-grid Solar PV ...............................................................................................15 3.1.3 Solar PV grid connect .......................................................................................16 3.1.4 Solar water heaters ...........................................................................................16 3.2 APPLICABLE PUBLIC SECTOR SUPPORT AND OTHER SOURCES ....................................17 4 BUSINESS PARTNERS AND COMPETITORS ...........................................................18 4.1 OVERVIEW OF KEY SOLAR MARKET PLAYERS ............................................................18 4.2 OVERVIEW MAJOR AND/OR MOST EMBLEMATIC SOLAR PROJECTS .....................................22 Target Market Analysis: Kenya’s Solar Energy Market V List of Tables Table 1: Main market segments of the solar PV market in Kenya ...................................................2 Table 2:Sales of solar water heaters and market structure in Kenya ..............................................4 Table 3: Comparative Electricity Cost and Availability .....................................................................6 Table 4: Modelling Kenya’s PV Potential .........................................................................................7 Table 5: Market Opportunities in Solar Hybrid PV & Tourism ........................................................10 Table 6: Market Opportunities in Solar PV Hybrid Systems & Telecommunications .....................11 Table 7: Market Opportunities in Solar PV Hybrid Systems & Village Mini-grids...........................12 Table 8: Market Opportunities in Solar PV Grid Connect ...............................................................13 Table 9: Importing Companies in Kenya ........................................................................................18 Table 10: Consultants, NGOs and Government Projects ..............................................................20 Table 11: Government and Public Sector Projects ........................................................................21 Currency Kenya Shilling (KES) Exchange Rates June 2009 78.8 KES = 1 USD 108.8 KES = 1 EUR Target Market Analysis: Kenya’s Solar Energy Market List of Acronyms a-Si amorphous silicon BOS Balance of Systems (non PV components of systems) BBS Battery Based Systems ERC Electricity Regulatory Commission GEF Global Environment Facility HH Household ICT Information Communication Technology IFC/PVMTI International Finance Corporation PV Market Transformation Initiative Project KBS Kenya Bureau of Statistics KES Kenya Shilling KPLC Kenya Power and Lighting Co kWp Peak kilowatt MWp Peak megawatt (solar PV unit) NGO Non-Government Organisation SHS Solar home system PPA Power Purchase Agreement PV Photovoltaic REA Rural Electrification Agency SWH Solar Water Heater UNDP UN Development Program x-Si Crystalline silicon VI Target Market Analysis: Kenya’s Solar Energy Market VII Summary Kenya boasts a solar market that is one of the most mature and well-established in Africa. At over 1.2 MW in sales per year, the PV market offers opportunities in solar home systems, institutional systems and Government procurement. Growth has been constant at over 10 % per year over the past ten years, and the potential off-grid market is estimated to be over 40 MW. Emerging opportunities in off-grid PV include the telecom industry and the tourism sector. The anticipation is for policy to be introduced soon by the Government (through the Ministry of Energy) and Energy Regulatory Commission to enable net metering of on-grid PV. High electricity prices, combined with new policy and legislation are believed to boost the emerging solar water heater industry. Rural electrification programs continue and will increasingly include solar electric power through the Rural Electrification Authority. The MoE provides little current policy incentives and targets or allocations for solar energy, however, electricity shortages, fuel prices and consumer demand is focusing attention on this matter. In June 2009, the Task Force on Accelerated Green Energy Development was created by Prime Minister Odinga, from which the first report is timetabled for December 2009. The Green Energy Fund has recently been announced as not supporting solar power as a means of meeting its target of 2000MW from clean energy. In combination with any new policy and financing mechanisms to assist solar power, improvement will be needed of standards, their enforcement and a better procurement and specification process. There are no formal solar energy training programs within Kenya, instead skills are taught through project-specific training and within solar companies. These include established importers, sales agents and niche players offering pure solar products or integrated with other renewable and battery/pump products. Target Market Analysis: Kenya’s Solar Energy Market 1/24 1 Status Quo of the Solar Energy Sector 1.1 Brief Solar Sector Overview Kenya is endowed with ample solar energy resources, with annual averages well over 5 kWh/m2/day available throughout the country. In the north of the country and along the Lake Victoria basin, solar energy resources are generally higher and more consistent. In the populated areas near Nairobi, Mt Kenya and the Aberdares, solar irradiation is considerably reduced during the cloudy season between May and August (<3.5 kWh/m2/day). Total installed capacity of solar electricity is likely to be over 8-10 megawatts based on 15 years of sales over 500 kWp/year. In 2008, key players estimate that the total market was in the region of 12 1.3 MWp. Annual solar water heater sales are of the order of 5000 x 2 m units. By African standards, Kenya’s market is well-developed, though largely based on over-the-counter sales of PV components and solar heating systems (SHS). Niches for institutional systems, battery back-ups, pumping, tourism and telecom have developed rapidly and are helping to drive the sophistication of the market forward. The solar water heater sector may grow faster than the PV sector in the near future because of rising prices for electricity and petroleum fuels as well as policy changes. There are 15-20 major suppliers of solar equipment in Kenya and three manufacturers of SLI-type lead acid batteries. In general there is a good availability of PV modules, batteries, inverters, charge regulators and appliances. The value chain has reached into rural areas where there is a relatively strong foundation of experienced (if uncertified) basic level installers. The quality of the equipment remains an issue because the low end of the market is extremely cost conscious and competitive. 1.2 1.2.1 Major Market Segments Solar Photovoltaic (PV) Kenya has one of the most dynamic commercial PV markets in Africa with a non-subsidized demand of 1-1.3 MWp per year that has been growing at an annual rate of 15% since the mid 90’s. Fuelled by consumer demand from a relatively prosperous non-electrified rural population, support from NGO/missions, and growing Government interest, a strong consumer chain has developed that is effective in supplying and installing solar home systems and institutional systems throughout the populated areas of the country. The capacity of the market to install and sell is mostly limited to systems below 1.5 kW in the categories outlined. Demand for small 12 Wp a-Si modules, which comprised the largest portion of module sales between 1998-2003, have reduced considerably and have been replaced by small x-Si modules from the Far East. Table 1 below breaks down the main 1 market segments of the existing Kenya solar PV markets : 1 Estimate from survey of 5 major suppliers. Detailed survey was not possible within time constraints. Target Market Analysis: Kenya’s Solar Energy Market 2/24 Table 1: Main market segments of the solar PV market in Kenya Solar PV Technology Off-grid HH electrification & small scale commercial Off-grid community systems (including institutional and pumping systems) Telecom Tourism Estimated installed capacity >6-8 MWp Estimated capacity installed/ year (2008) >700 kW Estimated financial 2 volume (€/Year/2008) >€5M Degree of Competition >1.5 MWp >250 kW >€2.5M Extremely competitive. Many players Dominated by wholesaler/agent partnerships >100 kWp >50 kWp 100 kWp N/A N/A N/A Emergent – few players Emergent Off-grid household and small scale business electrification Off-grid household electrification in Kenya began in the late 1980’s following the coverage of the most densely populated rural areas (especially the Mt Kenya region) with television signals. During the “boom period” of coffee and tea in the early to mid 1990’s, small-scale farmers who could not access the electric grid began to buy 12-volt televisions, radios and lighting systems, and this fuelled strong demand for solar electric systems. Today this portion of the market is highly competitive and mature, though it does suffer from sub-standard quality issues in installation and components. The successful development of the household and small commercial system markets is attributable to the following factors: 1) Relatively high incomes among farmers (coffee, tea, horticulture), rural teachers, civil servants and businesses with a strong demand for consumer electronics (TV’s, radios, cell phones) 2) Availability of PV modules (in sizes ranging from 12 to 150 Wp) and Balance of Systems 3 (BOS) . Trade in 12-14 Wp a-Si modules took up over a third of the module demand between 1998 and 2003 but has since waned with the availability of competitively priced small crystalline modules. 3) Active entrepreneur class with strong connections between Nairobi and rural areas 4) Local battery manufacturing (there are 3 battery manufacturers in Nairobi) and large-scale use of SLI-batteries for rural electrification Rural demand for solar PV systems follows household demand for lead acid batteries, which has penetrated 15-20 % of the rural and peripheral urban market. Thousands of town-based small-scale grid based entrepreneurs in rural towns charge batteries for the rural population (at €0.30-0.60/charge) in a business worth tens of millions of dollars per year. The battery manufacturers in Nairobi all offer unconditional 1 year warranties on their modified SLI batteries, meaning that the purchase of such batteries provides reasonable access to 100-200 Wh of DC electricity per day over a full year. Demand for PV systems is largely “component”-based, meaning that sellers tend to sell system pieces rather than whole systems. Few rural people can afford to purchase a full system all at once. Surveys of PV system owners show that many leave out charge regulators while under-sizing modules for systems. 2 3 Total system volume including PV and BOS Fluorescent light bulbs and units were locally assembled until about 2000 when competition from the far east forced local assemblers out of business Target Market Analysis: Kenya’s Solar Energy Market 3/24 A significant percentage of small PV systems are used for small-scale commercial uses. These include cell phone charging, barber shop, lighting of bars and kiosks and powering of music systems to attract customers or for rural functions (church services, weddings, discos, etc.). Off-Grid Community/Institutional Systems Kenya has many active NGOs and missions that provide services in the remote off-grid parts of the country (Turkana, Marsabit, etc). These groups set up infrastructure that provides a demand for PV power systems for the following uses: Catholic church orders set up missions in remote areas that provide church, school, health and water facilities that often utilize solar PV for their electricity demands. NGO office power, laboratory and clinic equipment, school lighting and community water pumping. Exports to Sudan and Somalia. Many of the off-grid PV systems for Somalia and Sudan are sourced from Kenya and small Kenyan companies are used to provide installation services. Since 2005, the Government Rural Electrification Program has installed PV systems in over 150 schools in remote off-grid parts of the country. The total capacity of installations between 2005 and 2009 is approximately 450 kW, with work completed by two companies (procurements totalled over Kshs 338M). The Government procurement program is said to be extended and may offer additional opportunities for interested companies. The Government policy set solar PV targets for sparsely populated, remote areas in the north and eastern regions of the country. A recent Rural Electrification Master Plan study identified ample opportunities in solar-assisted mini-grids, and the Government may support this type of procurements in the future. Tourism and Telecom Off-grid tourism and telecom is an emerging market field (see Section 2). The sectors have been slow in making use of solar PV systems because of The low traditional prices for fuel Historically off-grid tourism facilities power their entire site with diesel generators The lack of easy finance for solar energy systems A lack of sophisticated and tailored solutions from PV equipment suppliers A lack of technical capacity in the sector to supply quality services. Predominant operator models Kenya’s PV market is mature with a distribution network that essentially is supported by the retail network that supplies televisions and electronic goods. Linkages between international sellers, local wholesalers and retailers and installers are firmly established, and many larger importers provide support to their retailers, however there remains some inconsistency in models imported. The key players are: 5-8 established importers represent international PV companies and sell their products to their selected distributors around the country. For example, a local battery company that manufactures and supplies most of the batteries used in household systems. A number of opportunistic importers import PV modules as and when they can afford from changing suppliers and distribute them to retailers of electric goods. Hundreds of sales agent companies (often one or two personnel) represent major solar companies and sell to geographic and niche markets that they develop on behalf of the wholesaler. Many of these sales agents are ex-employees of the larger PV companies Target Market Analysis: Kenya’s Solar Energy Market 4/24 High-end niche companies operate in NGO, UN and increasingly tourism and telecommunication markets. Some of these players specialize in installing systems for NGO clients in remote parts of Sudan, Northern Kenya or Somalia. Others work for telecommunication companies. Technicians play a less prominent but key role in the market, as they rely on suppliers and retailers to offer them jobs. Some skilled technicians operate as re-sellers and as sales agents in developed niches. In Kenya there is a strong distinction between importers and retailers. Retailers include shops (which range from hardware dealers to electronics goods shops to supermarkets), franchised agents and skilled designer/installers, all of which operate in niche markets. Few players survive 100% on sales of solar electric systems as the business, especially for solar water heating systems, fluctuates seasonally. 1.2.2 Solar Water Heating (SWH) Solar water heaters have a well-established market in Kenya and have been sold in the country for 2 twenty years. In 2008, between 8,000 and 10,000 m were installed. With constantly increasing electricity prices and planned changes in Government policy, the market for solar water heaters is likely to significantly increase in the next 5 years. Estimates vary widely on the existing installed capacity of solar water heaters, as many of the units installed in the 1990’s are no longer working. Table 2 outlines the sales of solar water heater and the market structure: Table 2: Sales of solar water heaters and market structure in Kenya Solar Water Heater Technology Estimated installed 2 capacity (M ) Urban Households Tourism and Institution N/A Estimated installed/year (2008) 2 (M ) 4000-5000 4000-5000 Estimated financial 4 volume (€/Year/2008) €4.5M €4.5M Technologies used for solar water heaters include direct and indirect flat plate units, as well as vacuum tube collectors. Although local manufacturing and assembly of flat plate thermosyphon-type 5 collectors was common in the 1990’s, virtually all collectors are imported today . The main exporting nations of units to Kenya are Greece, Australia, Turkey, Israel, and China. A few companies manufacture their own water tanks. Since Kenya’s electricity prices doubled during 2008 (due to a shortage of hydro power and spiking fuel bills for diesel turbines) solar water heaters have become much more attractive to consumers and demand has increased remarkably. However, it is difficult to predict how fast demand will grow because a) prices of electricity are extremely variable, b) the prevailing recession has hit the Kenya middle class and tourism market hard and c) Government programs are hard to predict in the current climate. 4 5 Total system volume including PV and BOS Quality of locally manufactured solar water heaters is extremely variable and back up service is also poor. Local units cannot compete on a price basis with internationally manufactured units. Target Market Analysis: Kenya’s Solar Energy Market 5/24 Predominant operator models In the past, a significant portion of solar water heaters were locally manufactured and this resulted in mixed quality and a poor reputation for the technology. Today, 4-6 companies import SWH in container loads and distribute them to customers. There are two predominant operator models: Wholesalers import SWH and provide them to individual agents (quite commonly plumbers or contractors) Wholesalers deal directly with clients for projects (housing estates, hotels and lodges). 1.3 1.3.1 Local capacities Solar PV Human Capacity Outside of the solar companies themselves, Kenya has no organised solar energy training programs for artisans or engineers. It does have some University-level courses in alternative energy, but these are fairly basic and do not prepare “solar engineers” per se. There have been a number of courses offered as part of international agency funded projects (such as 6 IFC PVMTI ) and donor/NGO-supported initiatives. An example of the latter is from the 1990s when several NGOs offered regular training courses for PV artisans. Courses similar to these, primarily targeted at the SHS market, have been offered around the country. Thus, there is a base of capacity in Kenya for the installation of SHS, institutional systems, inverter-battery back-up and pumping systems even though most installers do not have formal training. There is a lack of capacity for design and installation of large complex systems in the industry as a whole. Thus, when it comes to design and specification of systems above 1 kWp there is a lack of significant engineering capacity at all levels. This lack of capacity has limited the PV industry to the supply of small systems and prevented “upward” expansion of the market to more complex systems. In general, large companies do not handle installation of small systems. They hand these over to agents or specialist installers (who often market systems on their behalf) or systems are simply selfinstalled (>30%). When there is a need to install or design large systems (i.e. >2kW) companies often call upon the international supply companies to bring in expertise. For the size of the market, there is a sufficient pool (>50) of experienced solar technicians in Kenya who can handle the installation of pumps, institutional systems, inverter back-ups and other “medium” sized systems. General solar technicians that serve the smaller SHS market usually do not have formal PV training or accreditation --- most training is on-the-job or under the supervision of experienced solar installers. A 2003 study of 300 solar technicians that had installed more than 5 systems found that less than 5% had received any formal solar PV training at all. Many sales engineers offering systems to consumers do not have sufficient training in design of systems --- their poor engineering of systems contributes to the view that solar PV is a “second class” technology. Through the IFC PVMTI project, and other similar efforts, training programs have been developed, but these courses are short term, irregular, and they do not have recognized accreditation. Several 6 International Finance Corporation’s PV Market Transformation Initiative Project: 1998 – 2007, a GEF project of $5 million that targeted the development of the PV market through loans to consumers and PV companies. The Kenya portion of the project has widely been regarded as unsuccessful. Target Market Analysis: Kenya’s Solar Energy Market 6/24 consulting firms and polytechnics have basic capacity to train technicians, but there is a need to build 7 this . Training courses for solar technicians in the absence of practical installation activity often do not result in significant improvement of skills levels because 1) technicians rapidly loose the skills imparted and 2) there is no means for technicians to be practically evaluated after finishing courses. 1.3.2 Solar Water Heating Capacity The human capacity for solar water heating is largely a similar situation to PV. However, because of the smaller market activity in solar water heaters, the pool of available plumber/technicians is smaller. As well, problems with water quality and supply compound installation issues and increase the complexity of solar water installation. Virtually all installations of solar water heating are single-unit thermo-siphon type. Only a handful of institutional large-scale solar water heater systems with centralized storage, pumped circulation and thermostat regulation have been completed. Most training for SWH installations is done in-house at companies. Similarly to PV companies, SWH companies suffer from a fairly rapid turnover of staff and a migration of staff into the independent market, resulting in a relatively low capacity of some companies to deliver consistent quality. 2 Market potentials 2.1 2.1.1 Overall sector outlook Photovoltaic (PV) PV market potentials are largely based on the cost and availability of electricity. In Kenya, this can be divided broadly into on-grid areas and off-grid areas. The table below summarizes the cost and availability of electricity in on and off-grid areas and among several economic sectors: Table 3: Comparative Electricity Cost and Availability Sector Grid-Proximate Middle Class Consumer Electricity Costs 8 KPLC rates US$0.15-0.25/kWh Grid-Proximate Low Income Consumer KPLC rates US$0.10-0.25/kWh Recharged Battery: >$0.50/kWh Dry Cell: >$10.00/kWh Kerosene: ±0.25/lighting point hr KPLC rates US$0.15-0.25/kWh Grid Proximate Commercial Off-grid Middle Class 7 8 Generator: >US$0.30/kWh Recharged Battery: >$0.50/kWh Dry Cell: >$10.00/kWh Kerosene: ±0.25/lighting point hr Electricity Availability Most middle-income urban consumers are grid connected. They often buy back-up battery-inverter systems or generators to overcome frequent electricity shortages Less than 50% of low income urban HH are connected to the grid. They use car batteries, dry cells and kerosene for HH lighting and electricity. Most urban businesses are grid connected. They often buy back-up battery-inverter systems or generators to overcome frequent electricity shortages Less than 1% of rural HH are connected to the grid. They use generators car batteries, dry cells and kerosene for HH lighting and electricity. Use of electricity & fuels varies greatly with income. ESD/CAMCO, Electricity prices are approximate and based on figures from Kenya Power and Lighting Co. Figures fluctuate greatly, in line with changes in international fuel prices. Electricity bills are composed of connection charges, kWh charges, variable fuel cost charges and other levies. Power rates can be downloaded at < http://www.kplc.co.ke>. Target Market Analysis: Kenya’s Solar Energy Market Off-Grid Low Income Off-Grid Commercial Recharged Battery: >$0.50/kWh Dry Cell: >$10.00/kWh Kerosene: ±0.25/lighting point hr Generator: >US$0.30/kWh. Costs are often much greater in remote areas. 7/24 Off-grid rural poor use car batteries, dry cells and kerosene for HH lighting and electricity. Use of electricity & fuels varies greatly with income. Off-grid businesses utilise generators for many activities. The flexibility of generators is seen as an advantage over PV in many locations. Market Potentials The market potential for PV is excellent in Kenya for a number of reasons that echo across East Africa: 1. PV sales have been growing at a sustained rate of over 10% per year for the last 10 years. Although the 2008 political disturbances and economic downturn have slowed investment and buying power somewhat, the general trend for the solar market is still positive. 2. Off-grid, the costs of running generators increased rapidly in 2008. Geographically speaking, 70% of the country is far from the grid, and this means that commercial, NGO and households that had previously relied on generator power are reconsidering use of generators and switching to hybrid solar. 3. On-grid, it is just a matter of time before the Government and regulator will accept net-metering of PV. Electricity demand in Kenya is outstripping supply, and there are many up-market grid-based customers that already have inverter-battery systems to weather power failures. Many of these 9 customers would be willing to install PV if net-metering was in place . 4. Planned Government and World Bank-coordinated rural electrification programs will increasingly include solar electric power, particularly through the newly-established Rural Electrification Agency. The table below presents an indicative matrix of the potential for PV systems in Kenya. These categories are discussed in greater detail in the following sections. Table 4: Modelling Kenya’s PV Potential PV Category Basic Potential Market Size Existing Penetration Solar home systems Off-grid Schools Clinics NGO power Isolated grids and rural mini-grids (RE) Small-scale commercials Telecom Tourism >30 MW >2 MW N/A N/A >3 MW 0.5 MW >3 MW >2.5 MW 6-8 MW >500 kWp N/A >1.5 MW 0 N/A <150kWp Negligible, NA Obstacles / constraints Obstacles and constraints in “developed” markets are discussed in this section. Unique problems with undeveloped market portions are discussed in Section 2.2. 9 Informal survey work with major PV companies and customers has established that there are scores of potential grid connect PV systems in existence and, most probably, hundreds of installations (ranging from 1-100 kWp) that would occur given a legal approval of the practice. See Section 3 for more information. Target Market Analysis: Kenya’s Solar Energy Market 8/24 Commercial Small System SHS Market Limited short term consumer spending power since a large portion of this demand is over-thecounter and based on consumer desire to power televisions, music systems, cell phones and lights. Expenditures typically range between $50 and $200. Many consumers buy solar equipment to match existing BBS and do not plan or prepare for SHS. Despite many efforts to finance PV, there are only a handful of successful PV finance programs. Quality is a major issue within the SHS market. There are problems with equipment standards 10 and installation practice . Companies that seek to participate in the market will be forced to deal with both of these issues. SHS competes unfairly with grid electrification. The Government electrification strategy views solar PV as a second-class technology to be used in remote areas only and does not have a policy for “grid-proximity” PV systems even though most of Kenya’s estimated 300,000 SHS are within 2-5 km of the grid. In the Government’s view, all these customers will receive grid connection. Given that there are over 4 million un-electrified rural households, and historically the Government has not been able to connect more than 30-40,000 rural households per 11 year , conservative attempts to roll out electricity would take well over 50 years. Despite this, the Government promises of grid power to rural groups impacts the consumers’ demand for SHS solutions. The cost of reaching and servicing large numbers of small off-grid systems is high. Intense competition often forces down the quality in this market. Larger System Market In Kenya, this market is driven by personal contacts that sometimes carry more weight than the quality of products. There is sometimes a lack of transparency in the selection process for tenders (especially in Government procurements). Installers often do not have enough skills to meet international standards. Drawings and electrical diagrams are often missing. Providers of electrical spares often do not have the equipment needed for professional systems. Often buyers do not have clarity of what they want and consumers of large systems often have unrealistic expectations. System failure in the off-grid market is often the result of poorly operated, maintained and managed systems. 10 The Kenya Bureau of Standards and participating PV companies recognizes east African standards. However, the lack of consumer awareness, proper incentives or enforcement practice means that the standards are largely meaningless. Since virtually all SHS installations are private sector and consumer driven, there is not an incentive to encourage consumers to follow standards. 11 The REA, with World Bank support, plans to greatly expand this! See Annual Report KPLC, 2007/08 available at http://www.kplc.co.ke. Target Market Analysis: Kenya’s Solar Energy Market 9/24 Recommendations for German RE enterprises Commercial SHS Market Clustering of large numbers of systems may provide an interesting approach to reaching a large number of customers. This may be done by contacting associations of cash crop or salaried workers (i.e. tea, coffee, civil service and teachers) and offering them wholesale prices on systems with warranties. Partner with suppliers who have a reach into the market When targeting the SHS market, have as flexible as possible a product offering and let local dealers assemble components. Remember that entertainment and communication (i.e. TV, music and cell phones) are more expensive and important than lighting services to most rural people Offer packages that can build on batteries since many customers already have a battery. Work with Government to install demo-projects in grid-proximate areas. Participate in dialogue with consumer groups, Government policy agencies, the World Bank, Rural Electrification Agencies, and PV companies to expand the roll of PV in rural electrification. Larger System Market The larger system market is quite distinct from small system market and requires a different market approach. To enter this market, contacts with donors, aid organizations, missions and Government procurement agencies are useful. Ensure that systems are appropriately designed and installed well. It may be useful to approach this market through groups that have not traditionally been connected to the PV market but have good contacts in the desired markets (i.e. providers of pumping technology, contractors, engineering groups, etc.). Use Kenya as a staging point for the installation of large systems in neighbouring countries (especially Sudan, Somalia, Uganda, Rwanda, Burundi, etc). 2.1.2 Solar Water Heating (SWH) As mentioned previously, the outlook for growth in the solar water heater sector is excellent, both in terms of the household and commercial units. Conservatively assuming that 10% of the approximately 1,000,000 domestic and small commercial KPLC consumers have geysers, there is a potential market for 100,000 solar water heaters in the country among small consumers. As well, there is a large potential market both on and off-grid in the hotel industry (±6000 SWH, assuming one geyser per two beds). Current Government electricity policy discussions view solar water heaters as a positive method of reducing peak load. It is expected that policy initiatives supporting solar water heaters will be put in place in the medium term (see Section 3). Target Market Analysis: Kenya’s Solar Energy Market 2.2 10/24 Undeveloped market opportunities All areas of opportunity are outlined and summarised in the following tables. 2.2.1 Solar Hybrid PV & Tourism In 2007, Kenya had about 840,000 international visitors to parks and game reserves (and almost 700,000 local visitors). There are several hundred licensed tourism accommodation facilities in the country, 200-300 of which are off-grid. The most likely segments of interest to German renewable energy companies are the hotel and lodge groups servicing the mainstream package tourism market and the high end small scale exclusive camps (there are 40 of these). Tourism globally has experienced a downturn since the second half of 2008 and current indicators suggest that challenging conditions will continue into 2010. The economic downturn has translated to tourism companies postponing planned capital investments in projects. Conversely, the downturn is a key driver in companies seeking to reduce their energy costs, which typically are amongst the highest operating costs of a lodge or hotel. Virtually all off-grid tourism sites in Kenya rely on generators for electrical requirements (lighting, 12 pumping, refrigeration, communication, etc) . Rising prices for fuel, theft, and a “greening” of expectations among tourists is driving off-grid facilities to reduce dependence on generator power. Some tented camps have installed hybrid solar PV systems, and other lodges are installing inverterbattery back-up systems so that they run equipment when generators are off. Tourism companies are generally aware of solar energy and interested in pursuing it as en energy solution (especially for water heating), but specific awareness of the right technology and their appropriateness to particular applications is low. Tourism companies use the top 3 suppliers (Davis Shirtliff; Chloride Exide; Wilken) based upon relationships built over the last decade or so. They are extremely risk averse in investment strategies with new technologies and this approach has been greatly exacerbated by high numbers of unreliable and questionable companies that approach them. Table 5: Market Opportunities in Solar Hybrid PV & Tourism Applied technology Size of Opportunity Competitiveness Solar PV stand alone power for small tented camps Hybrid solar generator systems for mid-sized camps and lodges Solar water heaters for all camps and lodges Solar electric fencing, telecommunications, solar pathway lighting Solar PV stand alone & hybrid solar generator systems for camps and lodges >2.5 MW Solar water heaters for camps and lodges Primary competition is against generator sets that entail a lower investment cost despite higher operation costs (±USD 0.35/kWh from operation & fuel costs). Higher end of the market targeting higher paying customer (small and medium sized tented camps and lodges) likely to be more discerning in their choice of technologies, favouring quality and reliability. Planning 12 Solar water heating will have to compete with cheaper technologies from elsewhere in Europe, N. Africa and China. 1 + year time horizon 1-2 + year time horizon, but projects must compete with other unrelated (i.e. non energy) investment projects Some sites even cook and heat water with generator electricity Target Market Analysis: Kenya’s Solar Energy Market Constraints Recommendations for German companies 2.2.2 11/24 Financing of solar water heaters --- and especially solar PV – presents difficulties because of high capital costs. Weak design and installation capacity of local systems integrators. Previous poor experiences with solar technologies. Poor maintenance and back-up capabilities Much of existing market will require retrofit, so installation best considered during planned hotel rehabs/refurbishment projects. Rapid uptake for good quality solar PV and hybrid systems is possible once a “bold mover” can demonstrate proof of concept – this is demonstrated by previous experience with battery-back up systems (see Serena example below) Financing solutions will be a key determinant, especially in high capital cost solar PV. Work with trade finance organisations, export credit schemes etc to address risk factors & offer finance solutions Penetrate the existing market by work with larger tourism groups that have international partners and/or presence Market for new hotels and lodges will require marketing and engagement with design teams (project managers, architects, consulting engineers) – currently more inclined towards traditional forms of supplying energy Professional systems integration, solutions offering strong technical back up & support Complete PV system solutions / PV hybrid solutions Centralised SWH systems either providing complete supply or as pre-heat to boilers Solar PV Hybrid Systems & Telecommunications The ICT sector, especially mobile telephony, has seen phenomenal growth in Kenya since 2002. Subscriber growth in the period June 2007 to June 2008 alone grew by 39%, an outlook that is set to continue over the next three to five years, even with the current economic downturn. Kenya currently has four mobile phone providers and there are approximately 8,000 base transmission stations (BTS) in the country. Half of these are owned by the largest operator, Safaricom. Approximately 25% of all base stations (2000) are off-grid and out of these only about 50 are powered using wind/diesel or solar/diesel hybrids and 150 utilise inverter-battery back up systems. There is ample opportunity to work with local companies to build up solar hybrid powered power sources, as they have lower costs and are more reliable (see Section 2.1 for conventional off-grid 13 costs of power) . Table 6: Market Opportunities in Solar PV Hybrid Systems & Telecommunications Opportunities Applied technology Size of Opportunity Competitiveness 13 Base stations Wireless communication / internet HF / VHF Consumer / cell phone charging Solar / Wind and diesel hybrid systems Battery back up systems for BTS powered by diesel gensets Small PV systems for VSAT, phone charging and other applications 3 MWp (assuming 50% penetration of off-grid market and 2.5 kWp system on each base station, 500 kWp additional opportunities) Telecommunications companies operate as large multinationals so much of the procurement and ordering decisions are made off-shore. Renewable energy systems, base station electronics and other technology are competitively sourced with competition from China and other countries. Employees of telecom often steal fuel and tourism companies operating generators. Target Market Analysis: Kenya’s Solar Energy Market Planning Constraints Recommendations for German companies 2.2.3 12/24 1-2 year (or longer) planning periods are common for telecom base station investments High upfront costs of solar powered systems Fighting oil cartels within telecom companies/local Government that resist switches to RE/solar Overcoming poor previous experiences with solar Matching solar equipment to telecomm equipment is often difficult as telecomm companies change equipment frequently Approach telecomm companies at high levels where decisions are made It may be useful to bring finance with technology packages Do research on the type of equipment the prospective client it using Be prepared to offer demonstration equipment to prospective customers Be aware of the linkages between the various regional telecomm companies as it may help build business networks Study other opportunities in the telecommunications sector (i.e. VSAT power, mobile phone charging, internet cafes) as companies may be interested in a wide range of applications Solar PV Hybrid Systems & Village Mini-grids The Kenya Government, through the Rural Electrification Agency and the Ministry of Energy, has set about embarking on an aggressive Rural Electrification program that is likely use solar PV in mini-grids and off-grid hybrid diesel generation. Although funding is not identified, there is a strong possibility for support from the Kenya Government and the World Bank. A recent study, carried out for the Ministry of Energy by Decon (a German consulting company), analysed the development of remote off-grid sites and recommended approaches for meeting their electricity needs. Currently, the primary approach is remote generator sets feeding power into minigrids and isolated solar PV systems for institutions. Over US$100M in opportunities for renewable projects is outlined in the 2008 Rural Electrification Master Plan. See Section 3 for more information on this study. Table 7: Market Opportunities in Solar PV Hybrid Systems & Village Mini-grids Opportunities Applied technology Size of Opportunity Competitiveness Constraints Recommendations for German companies Village mini-grids Large hybrid generation Solar / Wind and diesel hybrid systems Isolated grid connected solar power generation stations This is a new field that will require considerable development and possibly co-financing by international agencies. Since this is a largely unexplored field, there is little competition or commercial activity. High upfront costs of solar powered systems Lack of experience in designing, financing, planning and installing PV mini-grids Oil cartels that seek to continue trade in diesel and do not want to see reduced fuel use Scepticism on the part of Government agencies on solar electricity value in this type of project. Advocate for PV in mini-grids and provide examples and technical expertise to help planners Seek to work with the Kenyan Government, and multi-lateral and bilateral agencies to build experience in developing projects Identify opportunities for public-private partnership in implementation of PV minigrids. If this is an area of interest, be prepared to explore piloting arrangements Target Market Analysis: Kenya’s Solar Energy Market 2.2.4 13/24 Solar PV Grid Connect It is predicted that consumer demand for grid-connect PV (in response to the need for demand-based solutions for load shedding), and development of grid-connect policy by other African states (including South Africa) will eventually lead the Kenyan Government to enact grid connect policies and it may 14 happen faster than previously expected . Companies are exploring a variety of approaches for grid-connect PV ranging from large scale power plants to individual house systems. For example, a large Indian-US PV generation group has met with the Kenyan Prime Minister and discussed the potential of large grid connect projects (>50 MW). At the same time, local Kenyan PV companies are quietly lobbying the Government to develop legal and regulatory structures for grid connect PV for existing customers. As well, several property developers are interested in including grid-interactive solar PV systems in housing developments (one of these could potentially be over 500 kWp of PV). All of these players see demand for grid connect PV now and are positioning them to take advantage of this as a significant business opportunity. Table 8: Market Opportunities in Solar PV Grid Connect Opportunities Size of Opportunity Applied technology Competitiveness Constraints Recommendations for German companies Household Commercial BIPV Solar Power Plants Too early in pre-development stages to quantify. Solar electric systems with inverter and battery back-up technologies Larger power plant types of systems For the commercial and middle class electricity customers, PV is rapidly approaching grid parity in Kenya. Electricity costs already approach US$0.20-0.25 and spike with fuel cost increases. Further, thousands of small businesses utilise battery back-ups and generators to ensure power availability when the grid fails (a daily occurrence in many locations). High upfront costs of solar powered systems Lack of experience in designing, planning and installing systems Lack of Government legislation and regulations for grid connect Lack of awareness of grid connect/grid interactive potential Make sure local partners have technical expertise on grid technology Assist local partners to lobby for proper policy Keep track of legislative developments Package market development with battery back-up products (which are in high demand) 3 Solar-specific regulation and framework 3.1 Policies and regulations With the exception of the removal of duties and VAT for solar energy equipment and the use of solar PV in remote electrification activities, the Kenya Government has not developed a policy support regime for solar energy which has specific targets or allocations. Although Government documents mention solar energy in a “positive light” there have been few incentives, and no specific targets or legislation designed to increase the uptake of solar energy. However, Government policy is beginning to put in place some legislation that will help the solar market develop in response to electricity shortages, fuel price rises and consumer demand. This 14 South Africa, Namibia and Rwanda already have pilot grid connect systems. South Africa is currently developing grid connect legislation will be carried out. Target Market Analysis: Kenya’s Solar Energy Market 14/24 15 includes feed-in tariffs for other renewables than solar PV , and the wider use of solar energy in rural electrification. 3.1.1 Government Institutions for Solar Energy in Kenya Ministry of Energy (MoE) The Ministry of Energy is the policy-setting body of the Government on all energy matters. It is responsible for implementing the Energy Act 2006, which sets out the National Policies and Strategies for short to long-term energy development. The broad objective of the 2006 Energy Policy is to ensure the provision of adequate, quality, cost-effective, affordable supply of energy while ascertaining environmental conservation. The MoE is responsible for the development and provision of costeffective, affordable and adequate quality energy services on a sustainable basis in the short to longterm and has developed the current Feed-In Tariffs for wind, hydro, co-generation and geothermal power. To manage and regulate its power sector effectively, the Kenyan Government has established two bodies to regulate energy related issues (ERC) and to promote and implement the rural electrification of rural, non-grid-connected areas (REA). Energy Regulatory Commission (ERC) The Electricity Regulatory Board (ERB) was established under the Electric Power Act, 1997. On the coming into effect of the Energy Act, 2006, ERB was re-organised as Energy Regulatory Commission (ERC), a single sector regulatory agency with responsibility for economic and technical regulation of both power, renewable energy and downstream petroleum sub-sectors, including tariff setting and review, licensing, enforcement, dispute settlement and approval of power purchase and network service contracts. Negotiation of power contracts with IPPs falls under the responsibility of the ERC. ERC is appointing a senior management position that will be dealing with renewable energy sources. Rural Electrification Authority (REA) The Rural Electrification Authority (REA), established in 1973 by the Government of Kenya, manages the Rural Electrification Programme Fund, hereby supporting the electrification of rural areas and other areas considered economically unviable for electricity by the licensees. In their Strategic Plan 2008 – 2012, which is based on Vision 2030 and Sessional Paper No. 4 of 2004 of Energy, REA is setting the target to raise access level to electric energy in urban areas from 63% in 2008 to 100% in 2012, and Proportion of Rural Population with Electricity from 10% (2008) through 22% (2012) and 65% (2022) to 100% in 2030. To achieve these targets, REA has defined strategic objectives that contain, among others, the promotion of development and use of renewable energies, with an estimated budget of more than 1.1 billion Kshs (US$ 14M) between 2008 and 2012. This is primarily targeted for off-grid PV and wind systems. 15 Feed-in tariff schedules and programs have been developed for wind, mini & micro hydro and biomass cogeneration. There is no PV feed-in policy or regulation. Target Market Analysis: Kenya’s Solar Energy Market 3.1.2 15/24 Off-grid Solar PV Taxation and Duties In the late 1990’s, duties were removed from solar products (including modules, solar batteries, regulators and inverters). PV modules were exempted from Value Added Tax during the 1990’s, and this exemption has continued in recent budgets. Standards and Quality The Kenya Bureau of Standards has developed minimum standards and installation guidelines for solar PV equipment and solar installations (these are largely adapted from international standards and have been incorporated into East African standards). Systems installed for Government projects are required to follow these. As well, equipment Imported into the country must, in theory, meet these 16 standards . However, KBS is not legally able to enforce its standards, and it has little recourse with companies that bring in equipment that does not meet international standards, so there have been problems with quality control of modules and components in the market. In practice, local importers often work together to prevent offending agents from importing sub-standard equipment. Private installations largely occur outside of any code or standards and there is no standard procedure for inspection of PV systems. An increase in awareness of standards might change the market status and perception of PV as a “cheap” technology. However, any such approach would have to be lighthanded and based on pro-consumer approaches, as the Government does not have the capacity to regulate the market and there is risk of “rent-seeking” behaviour if legislation enabled policing of substandard installations without equivalent incentives for consumers to improve their systems. Rural Electrification As mentioned in Section 2, rural electrification planning activities of REA recognize a role for and provide a planning budget for solar PV in off-grid electrification in off-grid electrification strategies for a) mini-grids and b) stand alone institutions (clinics, administration posts and schools)(see section 3.2 for details). The role of implementing off-grid solar PV systems, which has traditionally been handled by the Ministry of Energy, is likely to be transferred to the REA. Note that Government policy does not specify a role of solar PV for Solar Home Systems in “preelectrification” of areas proximate to the grid (where >300 kWp/year demand for SHS is located). Unlike Tanzania or Uganda, Kenya does not provide incentives or subsidies for household solar PV systems. This is seen as a serious flaw in policy for several reasons. It limits PV implementation to public sector procurement in remote areas where there is little commercial interest (when most PV business in Kenya is currently in the private sector in high potential cash crop area). It does not provide a role for PV in the support of grid electrification in high potential areas. Given that there are 4 million un-electrified off-grid rural households, mostly located in high potential farming areas, and grid-based rural electrification is only completing (at most) 100,000 connections per year, there is a large suppressed demand for electricity. It limits participation in the rural electrification PV sector to the several selected companies that win Government tenders. This means the scores of other companies are unable to participate in the market. 16 See <eac-quality.net/fileadmin/.../Draft_EAS_for_16TH_EASTSC.pdf> for description of standards for PV components. These standards will be adopted throughout East Africa and will supersede Kenya and Uganda country standards. Target Market Analysis: Kenya’s Solar Energy Market 3.1.3 16/24 Solar PV grid connect The Ministry of Energy has formulated, published and is now implementing a feed-in tariffs policy for wind, small hydro and biomass resource generated electricity (these projects must meet a minimum size to qualify for funding). This policy is aimed at attracting private sector investments in electricity generation from Renewable Energy Sources as a means of diversifying national power sources, enhancing national energy security, creating employment and income generation. The tariffs which are for power grid interconnections shall apply for fifteen (15) years. The feed-in tariffs do not allow small power systems to feed power into to the grid. Policy makers have yet to consider inclusion of PV grid connection clauses and solar projects (large and small) are yet to be considered for feed-in. PV was most probably not included in these feed-in tariffs because it is viewed by the Ministry to be too expensive, poorly matched to demand and too small in size. Small scale solar PV does not meet expressed policy goals of rapidly scaling up power availability with low cost electricity. Recommendations for German RE enterprises on how best to proceed in light of the above present themselves in the following ways. Rapid changes in solar feed-in tariffs are occurring in various parts of Africa (South Africa, Namibia, Uganda). It is useful for companies to establish relationships with the Government and private sector to lobby for positive grid-connected regulations. Some companies may want to demonstrate the value of grid connect (and net-metering) by conducting “pilot” demonstration projects. If support was properly couched, the Kenyan Government would likely be supportive of “business initiatives” and it is likely that there will be a number of companies and customers who would like to execute grid connect solar projects. 3.1.4 Solar Water Heaters (SWH) The Government views solar water heaters as a practical demand-side method to reduce consumer electricity demand in urban areas. Standards, Quality and Legislation Standards have been developed for solar water heaters and are available from KBS. As with PV standards, there is a lack of enforcement because KBS does not have the capacity to play this role. Legislation has been drafted that will require all newly-built homes and commercial institutions to install solar water heaters that meet Government standards. This legislation has not yet been gazetted, but it is expected that this will become law in the next several years. Lawmakers realise that the private sector does not have the capacity to rapidly scale up solar water heater installations, so implementation of the policy has not yet occurred, and there is likely to be a period of time over which enforcement of the new policy will be effected. Target Market Analysis: Kenya’s Solar Energy Market 3.2 17/24 Applicable public sector support and other sources The Kenya Government does not yet directly allocate support for solar energy, except remote institutional systems for the Rural Electrification Program described below. Task Force on Accelerated Green Energy Development In June 2009, Prime Minister Odinga appointed the Task Force in light of the worsening situation for energy supply and costs to industries and households, with the intention of launching a Green Energy Development Campaign in June 2011. The campaign is due to offer attractive financing, strong fiscal incentive and/or equity investment to eligible private sector organisations to facilitate the conversion from conventional energy sources to alternatives including solar and replace existing power generation facilities with “less costly and carbon free technology by large energy users”. The objectives of the Task Force are to review and identify eligible projects, policy and means to allow projects are completed in shortest timeframes as possible, provide financing sources and modalities including PPP arrangements and provide encouragement for the sale of green energy generated carbon credits. Members of the Task Force Steering Committee include the Ministers for Energy, Industrialisation, Environment and Agriculture, the Chair of the Kenya Private Sector Alliance and the Chair of the Association for Large Power Consumers. The Prime Minister’s Office, in close collaboration with the Ministry of Energy, announced a “Green Energy Fund” during the time of this market study. It was announced that the Green Energy Fund, which targets the development of 2000 MW of clean energy, would support wind, hydro, geothermal and “clean coal”. Solar energy was not specifically mentioned. Currently, the Fund developers are consulting with members of the energy sector to identify potential projects. The first quarterly report from the Task Force is timetabled for release in December 2009. Rural Electrification Procurements Currently, the Government is completing installation of stand-alone PV systems in a number of clinics and schools. As mentioned previously, these activities, worth about US$ 1M/year since 2004, have been tendered to two companies through the Ministry of Energy. Under the 2008 Rural Electrification Master Plan report recommendations, solar electricity public sector support fall in remote power supply through a) stand-alone power supply for clinics, schools and Government posts and b) power supply for mini-grids as follows: The retrofit of existing diesel engine based decentralised power stations into hybrid schemes (wind-diesel or PV-diesel or producer gas/biogas-diesel) for an improved economic efficiency (USD 50 million); Pre-electrifying 4,000 isolated loads in remote hamlets will be pre-electrified with stand-alone PV systems Note that the 2008 Rural Electrification Master Plan document has yet to be implemented. The MoE and REA are currently developing strategies to implement the plan (with the World Bank and others). Interested parties should consult the Ministry of Energy and Rural Electrification Agency. Target Market Analysis: Kenya’s Solar Energy Market 4 4.1 18/24 Business partners and competitors Overview of key solar market players Table 9: Importing Companies in Kenya Importing Company Company Description & Distributors Company Strategy Major Product Solar/PV Business Sector Equipment Sources Contact Person Address Further Contact Details Chloride Exide Kenyan Company with subsidiaries in Tanzania & Uganda. Owned by battery manufacturer (Associated Battery Manufacturers). Largest player in PV market. Likely to open PV factory with German company. 35% of business is PV, core business is lead acid batteries. Sell PV in order to push their batteries. Have 10 outlets/depots and >250 dealers all over the country. Sell both retail and wholesale and offer both installation and after sales services through their depots. Sell power protection and solar-related products. 50% of business is PV. Have 4 branches and 15 dealers. Do both wholesale and retail through their branches. All PV components, batteries. Inverter battery back-ups, refrigerators, pumps. Solar water heaters. Wind generators. Wholesaler and large project implementer. Institutional market and small commercial system market. Local batteries from ABM. Supplies Suntec and BP modules, various BOS from Germany, China, US. Megasun SWH. Guy Jack, MD P.O. Box 14242, Industrial Area, Nairobi Kenya guy@chlorideexide. com Wholesaler. Operates through agents in Kenya, Tanzania, and Uganda. Sollatek BOS, modules from US. Chris Soper Kenyan-owned PV and remote power company. Solar company established in 1989. Was market leader 2000-2005. Have several branches. Sell system packages and components from Nairobi office. Use media to sell product. 100% PV and backup power systems. All PV components, batteries. Inverter battery back-ups, pumps. Solar water heaters. Wind generators. Institutional, telecomm. E-solar brand. Recent company changes have affected partnerships. Ngong Rd, Nairobi Kenya Kenyan-owned family business. Several shops in Nairobi. Oldest PV seller in country (since 1985). Appliance and solar PV company. Sell over the counter and packed systems mostly to the SHS market. Have agents they distribute through. All PV components, batteries. Inverter battery back-ups, pumps. Institutional market and small commercial system market. Modules: Kyocera. Regulators: Steca. Various BOS P.O Box 45525, Nairobi Kenya Sollatek Kenital Telesales Kenyan-Owned Franchise of Sollatek UK. Franchise in Tanzania, agents in Uganda and region. Modules, lamps, charge controllers. Tel: +254 (0)20 532211/48/49 www.cekl.com PO Box 34246 Sollatek Building Mombasa/Malin di Rd. chris.soper@sollate k.co.ke Tel: +254 (41) 5486250/1/2/3 www.sollatek.co.ke solar@kenital.com Tel: 254 20 2715960 www.kenital.com telesales@wananchi .com Tel: (020) 213143 Target Market Analysis: Kenya’s Solar Energy Market Davis & Shirtlif 19/24 Pumping/swimming pool service company expanded into solar in 2005. Established >20 years. Rapidly growing. Operate in Kenya, Tanzania, Uganda, Rwanda, Ethiopia and Zambia. 10% of their business is PV. Focus on NGO, pumping and wholesale to distributor. Operate through a number of small-scale agents that provide customer service. 2nd largest PV player in Kenya. All PV components. Inverter battery back-ups, pumps. Solar water heaters. Wholesalers. NGO Market, institutional market, SHS. Sangyug Ent. Long established solar wholesaler. Family business. Modules, lamps, BOS. Some SWH. Wholesaler Modules from India & China, Tripplite inverters, CC- India. Sundaya CFLs Win Afrique. Specialist systems integrator company focused on large projects and telecom sector. 25% of their business is PV, have no depots but over 100 dealers most of who are hire purchase companies countrywide. Do not sell retail and do not offer installation services. >$1.2M/2008 Actively seeking to install back-up and hybrid solutions for Safaricom and other players. Installed $1M worth of PV in 2008 Wind & solar hybrid systems. Niche market in supply of large systems for communication sector N/A Digitel Supplies Edwards SWH systems to corporate (hotel) clients. Solar water heaters. Institutional, tourism Australian SWH Supplies Solahart (Australia). Works in commercial hotel market and HH market. Solar water heaters, some PV Institutional, tourism Australian SWH Premier Telecomm firm established by exWilken MD. >10 years in business. Telecomm firm that does some SWH and PV business. Established > 20 years PV wholesaler Asachi PV wholesaler Bhatt Electrical s PV wholesaler Wilken Supplies Yingli PV modules (was Shell/Solarworld distributor). Batteries-Incoe (indonesia), CC, DC lightsSundaya, Norman Chege, Manager, Solar Dept. Industrial Area, Nairobi Kenya solar@dayliff.com norman@dayliff.com Work: 254 20 558335 Mobile: 0722 781081 www.dayliff.com Mr. Mulki Cell:+254 720 650065 Target Market Analysis: Kenya’s Solar Energy Market 20/24 Table 10: Consultants, NGOs and Government Projects Name Role in Sector Activities Procurements (Types of equipment/services) Volume kWp or $$$ Integrated Energy Solutions Consultant Project development, off-grid system design, energy audits, market study Specifying off-grid PV systems CAMCO Consultant Integral Consulting & Advisory Services Ltd Consultant Solarnet Contact Address Email Telephone N/A Anjali Saini P O Box 41411 anjali.saini@ escoafrica.c om 254 20 7125694 Training, project support, carbon trading (have conducted numerous PV trainings in Kenya and region and managed UNEP regional PV project) Project management (Managed $5M PVMTI project on behalf of IFC-GEF) N/A Stephen Mutimba PO Box 76406, Nairobi Kenya smutimba@ camcoglobal .com Work: 3871027 /3877942/ 3875902 N/A Ashington Ngigi 3rd Floor, Occidental Plaza, Muthithi Rd, Westlands, P.O. BOX 11463, 00100GPO ashington@i ntegraladvisory.co m 254 (20) 3754853 / 6 Advocate NGO Advocacy. Produces Solarnet magazine on quarterly basis. Organizes "Solar days". N/A Andrew Kilonzo andrew.kilon zo@gmail.c om +254 725509064 Kenya Renewable Energy Association RE Association Organizes trainings, conducts industry outreach N/A Charles Muchunki, Chair P.O. Box 42040 nthigaen@y ahoo.com +254 724 279972, 723 885135, 735 527041 Solar Aid NGO Involved in rural PV projects John Keane, Head of Programmes Nairobi office john@solaraid.org +254 717446158 Procures PV systems for rural HH and institutions $100's of k Plans in Immediate Future Assembling small PV kits for rural people, installing systems in schools Website www.camco. com www.solarne t-ea.org www.solaraid.org Target Market Analysis: Kenya’s Solar Energy Market 21/24 Table 11: Government and Public Sector Projects Name Role in Sector Activities Procurements (Types of equipment/services) Volume kWp or $$$ Plans in Immediate Future Contact Address Email Telephone Website Rural Electrificatio n Authority Government rural energy agency Future procurer of off-grid institutional RE ststems To be decided Government energy ministry Procurer of energy PV systems Has procured >8M$ of PV equipment over 5 years MoE PV system procurements to be handled by REA See above James Murithi, Ministry of Energy Managing rural electrification projects. On & off-grid. Relatively new agency with little solar experience. Energy policy Eng. Isaac Kiva. Director RE Dept. 22-24 Floor Nyayo Hse, Off Uhuru Highway, P.O Box 30334 dre@energy min.go.ke, ps@energy min.go.ke +254-20330048, +254-20250680 www.energy .go.ke Energy Regulatory Commission Government energy regulator Energy regulations, pricing None None Interested in PV grid tied work Frederick Nyang 1st Floor Integrity Centre Valley Rd. PO Box 42681, Nairobi Kenya frederick.nya ng@erc.go.k e 254-0202717627/31/ 75 www.erc.go. ke 0725 607728 Target Market Analysis: Kenya’s Solar Energy Market 22/24 4.2 Overview major and/or most emblematic solar projects Ministry of Energy/Rural Electrification Authority Institutional Electrification The Ministry of Energy has made at least 6 separate procurements over the past 6 years for PV 17 equipment in remote off-grid areas, totaling about $8M . The contracts are for rural schools, clinics and institutions. All but one of the contracts was awarded to one company (the latest contract was awarded to two smaller players that are not seen as major players). Several local PV companies interviewed are not interested in participating in these tenders because of what they view as an irregular procurement and specification process. There are likely to be future procurements of large institutional systems through the Rural Electrification Authority. The 2008 Rural Electrification Master Plan estimated a need for $50M in stand-alone and mini-grid power systems, much of which will be PV and/or retrofitting of dieselpowered mini-grids with hybrid renewable energy systems. The World Bank is currently working with the REA and MoE to develop a large (>$100M) rural electrification initiative that is likely to include a PV component. Solar Aid Solar Aid is involved in projects to electrify rural households and institutions. They have opened a small factory that assembles low cost small 5-20Wp solar electric systems. They are also involved in electrification of rural schools on a semi-commercial basis. 17 The MoE did not disclose exact figures. This publication is available free of charge as part of the public relations work of the Federal Ministry of Economics and Technology, and may not be sold. It may not be used by political parties or campaigners or electoral assistants during an election for the purposes of campaigning. In particular, it is forbidden to distribute this publication at campaign events or at information stands run by political parties or to insert, overprint, or affix partisan information or advertising. It is also forbidden to pass it on to third parties for the purposes of electoral campaigning. lrrespective of when, in what way, and in what quantity this publication reached the recipient, it may not be used even when an election is not approaching in a way that might be understood as suggesting a bias in the federal government in favour of individual political groupings.