Target Market Study Kenya Solar PV & Wind Power

advertisement

Target Market Study Kenya

Solar PV & Wind Power

German Energy Desk

Nairobi, July 2013

1

Table of Contents

Executive Summary ................................................................................................................ 3

1.

Overview of the power sector ........................................................................................ 9

1.1.

Energy mix .............................................................................................. 9

1.2.

Development of electric power supply and demand ............................... 10

1.3.

Role of renewable energies ................................................................... 11

1.4. Power tariffs .............................................................................................. 13

1.5. Power sector structure .............................................................................. 14

2.

Regulatory framework for solar PV & wind ................................................................ 15

2.1.

Feed-in Tariff-Scheme (FIT) .................................................................. 15

2.2.

Power purchase agreement ................................................................... 17

2.3.

Energy regulations ................................................................................. 17

2.4.

On-going review of the regulatory framework......................................... 18

3. Status solar PV & wind energy sector ............................................................................. 19

3.1. Status of solar PV...................................................................................... 20

3.1.1 Off-grid pico & SHS ................................................................................ 22

3.1.2 Off-grid professional ............................................................................... 25

3.1.3 Grid-connect (Small scale) ..................................................................... 26

3.1.4 Grid-Connect (Utility-scale)..................................................................... 27

3.2. Status of Wind Energy Sector.................................................................... 28

4. Market potential and planned projects .......................................................................... 31

4.1. Overall sector outlook ................................................................................... 31

4.2. Planned projects ........................................................................................... 34

4.2.1 Government projects: Institutional and SHS segment ............................. 35

4.2.2 Government projects: Hybrid mini-grids .................................................. 35

4.3. Undeveloped market opportunities................................................................ 38

4.3.1

Utility power Generation ..................................................................... 39

4.3.2

Green building sector ......................................................................... 40

4.3.3

Agriculture .......................................................................................... 42

4.3.4

Tourism .............................................................................................. 45

4.3.5

Telecom ............................................................................................. 46

4.3.6

Manufacturing Sector ......................................................................... 48

5. Engagement and positioning of German companies .................................................... 51

6. Annexes .............................................................................................................................. 58

Annex 1: List of Players ........................................................................................................ 58

Annex 2: Bibliography and Resources .............................................................................. 76

2

Executive Summary

In general, Africa countries have not, until very recently, actively pursued the

potential of small-scale distributed renewables as a core element of the central

power system expansion. Instead, renewables such as PV were, and still largely are,

considered as part of efforts to conduct off-grid rural electrification and increase

general energy access. This is still the approach that most African Governments

and international donors take.

The problem --- for German PV players --- with this is that the approach is donor aid,

charity and Government-led and that it does not necessarily build the overall

solar/PV sector. Instead it builds a sector that is set up to pursue grant-funded smallscale, off-grid projects that are unattractive for many German companies. As well,

off-grid solutions are increasingly over-the-counter and dominated by low cost

equipment from the Far East.

However, the increasing ability of PV to compete on-grid and the increasing

awareness of consumers, suppliers and policy makers of the on-grid role of PV is

changing the situation. Although major donors such as the World Bank and UN (in

Africa) still are primarily focused on use of PV in off-grid access, more players are

becoming interested in PV’s overall role in commercial applications (both off and on

grid).

Generally, Kenya’s solar and wind market is developing quite dynamically. The

regulatory framework has become more attractive over the last year: Apart from

a technology-specific Feed-in-Tariff-scheme, which has been introduced many

years ago, there are now standardized PPAs available, which reduce the

transaction costs for projects in the range of 500 kW and 10 MW. In addition, Kenya

works on regulations for the net-metering, which has been introduced in the

Energy Bill 2012. Once such regulations will be in place, experts expect the take-off

of the small & medium scale grid connect market segment. Finally, the Solar PV

regulations will be of benefit for the German companies, because the overall

requirements at quality of products and systems will be higher, which of course

favourizes German companies.

With regard to solar PV, currently the off-grid market segments are the most

important ones (around 20 MW installed capacity in total). Of most relevance for

German companies is the so-called professional off-grid market segment, in which

public facilities such as schools and health centres are electrified through solar PV

(mostly driven by the Government and NGOs) and where commercial/ industrial

clients such as hotels, lodges, camps but also telecommunication companies (base

stations) and farms invest in Solar PV for their off-grid facilities.

The grid connect solar PV market is not yet of much relevance. In the small &

medium scale grid connect segment, Solar PV has just recently become an

issue and option, especially because solar PV has been considered to be an option

primarily for the electrification of remote areas. But nowadays, more and more power

consumers are tired of the unreliable power supply from the main grid and suffer

from the high fuel/ diesel costs (around 1 USD/ litre) for the stand-by diesel

generators. Although the net-metering is not yet in place, there are some “early

movers” investing in solar PV systems (e.g. Uhuru flower farm). Dozens of projects

are under development.

With regard to the utility-scale grid connect market, most developers and experts

are of the opinion that the FIT (for power from main grid connected systems) of 12

UScents/ kWh are not enough to make investments in Solar PV systems

commercially viable. There are some project ideas around and feasibility studies

have been conducted, but no project has been realized up to now. Of more interest

3

are the isolated mini-grids: There are still few hybrid ones (just 510 kW Solar PV in

total), but 9,4 MW solar PV are planned for existing mini-grids and especially for

Greenfield mini-grids. The FIT of 20 USCent in mini-grids is more attractive.

In the wind power sector the situation is different: While the wind off-grid market

is by far lagging behind solar PV, the large-scale grid connect market is quite

important: The installed capacities of 5,1 MW are not yet much, but projects of >500

Mw are in the pipeline; 5 projects are in an advanced stage. Grid connected wind

power (utility scale) has high priority for the Government: By 2030 wind power

capacities shall amount to 3 GW. However, the bottleneck is actually the grid, which

has still a limited absorption capacity.

In isolated mini-grids wind power is supposed to play a less important role than

solar PV: 3,1 MW wind power systems are planned for the extension of the existing

mini-grids and the Greenfield projects.

Most German companies can bring in their strengths especially in those market

segments, which requires more comprehensive systems and respective system

integration knowledge and are not so much off-the-shelf products. Thus, the most

relevant segments are mainly the professional off-grid segment as well as the

small & medium grid connect segment (with project sponsors from private

sector, i.e. commercial/ industrial/ service sector):

Sub-sector

Opportunities/ indications for potential

Building sector

UN-Habitat programme on Energy Efficiency in

(Small & medium grid

Buildings/ Green Building review of building codes

connect)

IFC financing (20 Mio. USD, through Housing Finance

Kenya) to encourage eco-friendly building

Early movers, e.g. Strathmore, UNEP etc.

Flower farms

Many farms suffer from bad power and face high fuel

(Small & medium grid

costs for diesel generators

connect)

KAM RTAP programme (French credit line through 2

local banks) works on feasibility studies for 2 big flower

farms

Early mover: Uhuru invested in 75 kWp solar PV system

Other flower farms expressed high interest in solar PV

(e.g. SIAN)

General trend towards “sustainable production” in

consideration of European buyers

Tea Factories

High interest of Kenya Tea Development Agency

(Small & medium grid

(although first priority is given to small hydro); KTDA

connect)

manages 54 tea factories

Systematic approach of KTDA to reduce energy costs

Tea factories are usually “at the end of the power line”

and suffer a lot from grid failures/ outages/ bad power

quality

Tourism

Growing sector, number of tourists visiting parks and

(off-grid professional

game reserves is steadily increasing;

and small & medium High trend to ecotourism facilities

grid connect)

Quite a number of lodges and camps with olar PV

systems (e.g. Severin)

Interesting opportunity: tourism facility as “anchor

consumer” which supplies power also to community;

some tourism facilities are community-based

Telecommunication/ Around 10% (577) of the base stations are off-grid in

4

base stations

(off-grid professional)

Manufacturing

(Small & medium grid

connect)

Kenya

300 new BTS in 2013 growing sector

12% of base stations have already green power

Initiative “green power for Mobile”

Production loss due to power outage 7%, 44% of

companies have a diesel generator as stand-by

Companies which were nominated for the Energy

Management Award of KAM

Companies with comprehensive CSR programmes

The chances for German companies in the Pico & SHS segment are limited as it is

highly competitive and spoiled by bad quality products and systems. According to a

survey (75 systems were inspected), 9% of the owners said that the system was a

disaster right from the beginning and 40% were not very satisfied because the

system was not working well.

For German companies, Kenya is not a completely new market any more: For

instance, Energiebau Solarstromsysteme (e.g. solar PV roof-to p-system on UNEP

building), Donauer Solartechnik (e.g. lodge electrification with solar PV, hybrid

system for refugee camp with 15 kWp) and Juwi are already present through local

partners. By having built the first grid-connect solar PV systems (UNEP building,

SOS village), German companies are the pioneers in the emerging market segment

for small & medium grid connect systems. This can be used by other German

suppliers.

With regard to the market entry strategy, it should be developed in close

consideration of the local challenges in the respective market segments: In the pico

& SHS market segment German companies have just a chance if they address

niches, as the market is highly competitive and spoiled by (off-the shelf”) products

from the Far East. Mechanisms to ensure quality of products and systems such as

the licensing of technicians, importer, vendors and manufacturers has just been

introduced (Solar PV regulation) but they still need to be implemented (e.g. training

of technicians).

In the professional off-grid segment and especially in the emerging segment of small

& medium grid connect German companies (solar PV & wind) can be successful, if

they are willing to provide an value-added, e.g. through contributions to training of

local stakeholders and supporting the clients to get access to funds (donor funds,

credit lines, equity funds, German export credit financing, ESCO-approach etc.).

Projects on training and developing an ESCO-model can be done in cooperation with

the German implementation agencies for development cooperation (GIZ, DEG and

Sequa), e.g. within the programme develoPPP.de.

5

List of Acronyms

DFID

Department for International Development (British)

EAC

East African Community

ERC

Energy Regulatory Commission

FIT

Feed in Tariff

GDP

Gross Domestic Product

GNI

Gross National Income

GWh

Gigawatt Hours

GSMA

Global Association of Mobile Phone Operators

HFO

Heavy Fuel Oil

KenGen

Kenya Electricity Generating Company

KPLC

Kenya Power and Lighting Company

LED

Light Emitting Diode

MNOs

Mobile Network Operators

MW

Megawatt

PSMP

Power Sector Master Plan

REA

Rural Energy Agency

REMP

Rural Electrification Master Plan

REFIT

Renewable Energy Feed-In Tariff

RETAP

Renewable Energy Technical Assistance Program (Kenya Association

of Manufacturers)

SHS

Solar Home System

SPPA

Standardized Power Purchase Agreements

SREP

Scaling Renewable Energy Program

USAID

United States Agency for International Development

USD

United States Dollar

Currency

Kenya Shilling Exchange Rates June 2013

Kshs = 1 US$

Kshs = 1 €

6

List of Tables

Table 1: Major economic sectors contributors in Kenya

Table 2: Energy mix

Table 3: Levelized cost of energy (technology wise)

Table 4: Potential and targets for renewable energies

Table 5: Power tariffs

Table 6: Feed in tariffs (FIT)

Table 7: Application process for FIT

Table 8: Main market segments of the solar PV market in Kenya

Table 9: Social entrepreneur approaches to solar PV sales

Table 10: Solar PV grid connect pipeline

Table 11: Existing off-grid stations

Table 12: Approved wind power projects

Table 13: Major planned wind projects in Kenya

Table 14: Major barriers to wind project development in Kenya

Table 15: Solar PV “planned” projects

Table 16: Planned rural electrification of public institutions

Table 17: Proposed additional RE projects in existing mini-grids

Table 18: Proposed RE in the mini-grids under construction

Table 19: Greenfield projects

Table 20: Opportunities for German companies

Table 21: Tourism sector indicators

Table 22: Estimated energy requirements for BTS

Table 23: KAM Industrial Survey, 2012

Table 24: Selected “pioneer” companies in energy &CSR

Table 25: German companies with engagement in Kenya

Table 26: Sources for financing solar PV and wind projects

Table 27: Opportunities for German companies (mini-grids)

Table 28: Recommended procedure (export credit financing)

Table 29: Cover policy for Kenya

7

List of Figures

Figure 1: Primary energy consumption

Figure 2: Electric power mix

Figure 3: Landscape of Players

Figure 4: Kenya PV market set-up

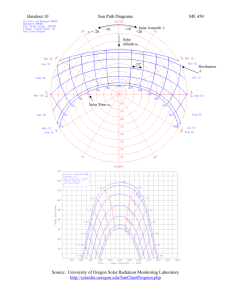

Figure 5: Modelling Kenya’s PV potential

Figure 6: Kenya’s PV costs vs grid electricity costs

Figure 7: Subscriber growth (numbers, growth rate)

Figure 8: Power outages (telecommunication base stations)

Figure 9: Off-grid deployment

List of Boxes

Box 1: Energy entrepreneur Durama Mobile Charging

Box 2: Lighting Africa

Box 3: Business model MobiSol

Box 4: Credit line of AFD for private investments in renewable energies and energy

efficiency

Box 5: Kenya Tea Development Agency (KTDA)

8

1.

Overview of the power sector

The Republic of Kenya is located in East Africa on the coast with the Indian Ocean.

With a total area of 582,646KM2, Kenya lies on the equator and is situated between

longitudes 34E to 42E and latitudes 5.5N and 5S. Somalia borders Kenya to east,

Ethiopia to the north, South Sudan to the northwest, Uganda to the west and

Tanzania to the south.

Nairobi the capital city is both a

political and commercial capital and

acts as the hub for financial

services, international companies

and donor organizations based in

the East Africa region.

The total population is over 41million

people with 32.7% found in the

urban areas and 67.3 % found in

rural areas.Kenya’s economy is the

largest in the East Africa region with

a 2012 GDP of 41.18 billion USD (an

increase of 4.6% over 2012) and is

projected to increase by 6% in 2013.

The GNI per capita as at 2011 was

$820. This is driven by a stable

macro-economic

environment,

increased domestic demand, modest

growth in credit and a liberal market

with little government influence. The

major contributors to the economy

include agriculture, tourism, industry and manufacturing sectors.

Table 1: Major economic sectors contributors in Kenya

Major Sectors in Kenya

Agriculture and Forestry

Wholesale & Retail trade

Transport & communication

Manufacturing

Financial intermediation

Construction

1.1.

% Contribution to the GDP

in 2011

24%

10%

10.6%

9.4%

6.4%

4.1%

% Growth in 2012

3.8%

6.4%

4.0%

3.1%

6.5%

4.8%

Energy mix

The overall energy supply is mainly based on the use of biomass, which has a share

of 76% at the primary energy consumption.

The current electricity generation capacities amount to 1708 MW (October 2012), of

which 48% are hydro power plants. Thermal power plays the second role (38%) and

includes emergency power plants, which are run on heavy fuel oil/ diesel. These

temporary power plants have a capacity of around 120 MW.

9

Figure 1: Primary energy

consumption, 2010

Coal

0%

Oil

17%

Figure 2: Electric Power Mix (% of

installed capacities), 2012

Hydro

1%

Geother

mal,

Solar,

Wind

6%

Biomas

s, waste

76%

Geother

Bagasse Wind

mal

0%

2%

12%

Hydro

48%

Therma

l

38%

Table 2: Energy mix

Technology

Installed capacity (in

MW)

Hydro

810

Geothermal

209

Thermal Oil

643

of which rental power

(120)

Wind

5,1

Cogeneration

26

Total

1693

Effective capacity (in

MW)

766

204

595

5,1

26

1596

Peak demand is around 1268 MW, between 18.30 and 21.30 by average.

1.2.

Development of electric power supply and demand

Kenya’s Vision 2030 plans to make the country achieve “middle-income”

status by 2030. Vision 2030 ambitiously targets a 10% growth in GDP annually in

order to meet the goal. Various projects geared at achieving vision targets have been

developed that are likely to result in significantly increased energy demand.

A detailed energy demand forecast was conducted in the context of the Least Cost

power Development Plan (2011). According to that plan, the electricity demand will

grow by 11,9% p.a (low growth scenario) up to 15,3% p.a. (high growth scenario)

until 2030.1 This means, that the current electricity production has to be increased

from 7.670 GWh to at least 77.307 GWh (low growth scenario) until 2030, in the

medium scenario to 103.518 GWh 2 . Peak loads are projected to grow to about

2,500MW by 2015 and 15,000MW by 2030. To meet this demand, the projected

installed capacity would have to increase gradually to 19,200 MW by 2030. Besides

the expansion of own capacities, Kenya will meet the increasing energy demand

1

However, according to many analysts this is too high.

2

In consideration of suppressed demand and of technical/ non-technical losses.

10

through the interconnections to the neighbouring countries. For instance, the

interconnection with Ethiopia (which is currently developing its hydropower resources

at a rapid rate) will increase the power availability in Kenya.

The drivers of the rising power demand are as follows:

Economic growth: 9% by average after 2015 (medium scenario)

Further rural electrification: total electrification rate of 88% by 2030 (medium

scenario), currently this rate is estimated to be 22%

Vision 2030 flagship projects, e.g. ICT Park with estimated energy

requirements of nearly 3000 GWh/ year, iron and steel smelting industry in

Meru with a need of 2000 GWh, second container terminal and free port in

Mombasa (750 GWh)

After reduction of the technical and non-technical losses by 4% in the period 2002 –

2010, they still amount to 16% (3,5% in the transmission grid and 12,5% in the

distribution grid).

The suppressed demand, which is reflected by power cuts and load shedding, was

estimated in 2012 to be around 80 MW or 25 GWh; by 2015 this gap shall however

be closed.

1.3.

Role of renewable energies

In consideration of the whole scope of renewable energies, they play a crucial and

even increasing role in the energy mix in Kenya. The high share of hydropower

(nearly 50% at the power mix makes the energy supply very sensitive to the water

availability in the seasons; in addition to that the price for the diesel, with which the

emergency power plants are run, for instance, during dry seasons, increased a lot

and makes the power generation more expensive3.

Thus, more a more attention is attached to renewable energies, which are to some

extent very low cost energy options. According to a detailed analysis which has been

conducted in 2011, geothermal and wind are the least cost options for energy supply

(base load):

Table 3: Levelized cost of energy (technology wise)

Technology

Load factor

LCOE (UScent/

kWh),

8% discount rate

Geothermal

93%

6,9

Wind

40%

9,2

Nuclear

85%

10,2

Low Grand Falls

60%

10,9

Hydro

GT-Natural Gas

55%

11,3

Coal

73%

12,7

High Grand Falls

60%

13,1

Hydro (e.g.

Mutonga)

LCOE (UScent/

kWh),

12% discount rate

9,2

12,26

14,5

15,1

12,0

14,9

18,1

The current diesel price is 99,16 KSH (1,14 USD); in October 2012 the price was even 106,11

KSH (1,22 USD); in September 2011 the price was 108,17 KSH (1,25 USD).

3

11

Therefore, especially geothermal resources are systematically explored: The

geothermal potential is estimated at 10 GW; by 2030 the capacities of 5,5 GW shall

be installed (current: 209 MW). Wind is considered as the second least cost option

and shall also be increased tremendously, from the current 5,1 MW to 3 GW by 2030

(2 GW by 2022).

Table 4: Potential and targets for renewable energies

Technology

Potential (in MW)

Targets (in MW),

by 2030

Hydro

1.500

Geothermal

10.000

5.500

Wind

4.400

3.000

On-Grid Solar PV

500

Current installed

capacities (MW)

209

5,1

1.3

Solar PV has been considered mainly as a reasonable and cost-effective option for

areas, which are not connected to the main grid. Currently, about 30% of the total

population has access to grid power, with rural populations well below [] access.

In the past, stand-alone systems for houses (SHS) and public facilities (schools,

health centres, administration offices etc.) have been promoted. According to the

Least Cost Power Development plan (LCPDP, 2011), LCOE from Solar PV were

assumed to be between 12,3 USCent/ kWh and 22,2 USCent, mainly depending on

the capacity factor (15-25%), based on figures from the US EIA. Recently, solar PV

is attached more importance also in the context of isolated mini-grids and, even for

feeding in the main grid, as it will be described in the next chapters. The target is to

generate power from 500 MW Solar PV capacities, by 2030, and to have installed at

least 300.000 units of SHS; by 2022 solar PV capacities shall amount to 200 MW

and at least 200.000 SHS shall be installed.

Solar ressources

Kenya receives good solar insolation all year round (coupled with moderate to high

temperatures) estimated at 4-6 kWh/m2/day.

Wind ressources

Kenya has a proven wind energy potential of as high as 346 W/m2 and speeds of

over 6m/s in parts of Marsabit, Kajiado, Laikipia, Meru, Nyandarua, Kilifi, Lamu, Isiolo

Turkana, Samburu, Uasin Gishu Narok, Kiambu Counties among others.The Ministry

of Energy developed a Wind atlas in 2008 with indicative data, based on information

from 35 meteorological stations in Kenya. This gave just an indication,as

investments in wind power plants are usually done on a basis of wind measurements

at specific sites over 2 years.

To augment the information contained in the Wind Atlas, MoE with the assistance of

Development Partners on the one hand and KenGen have installed more than 60

wind masts and data loggers in various counties to collect site specific data. For

instance, Isiolo (Mweromalia, kiremu, Matabiti area) have a monthly average speed

up to13,5 m/s (e.g. in June and July 2012).

The North West of the country (Marsabit and Turkana districts) and the edges of the

Rift Valley are the two large windiest areas (average wind speeds above 9m/s at 50

m height). The coast is also a place of interest though the wind resource is expected

to be lower (about 5-7 m/s at 50 m height). Many other local mountain spots offer

12

good wind conditions. Due to the monsoon influence, some seasonal variations on

wind resource are expected (low winds between May and August in Southern Kenya).

1.4. Power tariffs

By principle, power tariffs in Kenya are cost-reflective; they are currently adjusted

according to fuel costs, foreign exchange adjustments4 and inflation. Beyond the

basis consumption tariff and these adjustments, consumers have to pay taxes, levies

or duties which are included in the final end-user price:

-

VAT at 12% charged to the fixed charge, the demand charge, the forex

adjustment and to the fuel cost charge.

Rural Electrification Programme (REP) levy at 5% of revenue from Unit sales.

Energy Regulatory Commission (ERC) levy at 3 KES cents/kWh.

The regulation how to calculate the tariffs can be downloaded from the website of the

ERC, http://www.erc.go.ke/ctariff.pdf .

Following table gives the tariffs (in KES) from December 2011:

Table 5: Power tariffs

Tariff component

Basic consumption

tariff

Fuel cost

adjustments

Forex Foreign

exchange

adjustments

Inflation adjustment

TOTAL (without

ERC and REP levy)

TOTAL incl. VAT

ERC levy

REP levy

TOTAL

Domestic Consumers

>1500 kWh/ month

Small Commercial,

240 – 415 V

11,15

8,96

Commercial and

Industrial

>15000 kWh

5,75

7,30

7,30

7,30

1,23

1,23

1,23

0,13

19,81

0,13

17,62

0,13

14,41

22,19

0,03

0.56

22,78

19,73

0,03

0,45

20,21

16,14

0,03

0,29

16,46

Power sector regulations provide a review of electricity tariffs every three years but

there has been no review since 2008. Kenya Power was more recently pushing for a

21 per cent rise in the fixed charge and consumption tariff starting March 1 but the

Energy Regulatory Commission (ERC) delayed the plans citing need for deeper

consideration of stakeholder views.

4

A number of factors influencing the cost of power generation are affected by fluctuation in foreign

exchange rates, for example loan repayments for some electricity projects which have been financed

and need to be paid back by foreign currency. End-user electricity prices are therefore liable to an

adjustment factor for foreign exchange rate fluctuation, which reflects the exchange rate of hard

currencies against the Kenya Shilling.

13

The power firm had planned to further increase the tariffs by nine per cent in July to

cover for rising expenses. The tariffs were to rise further in July 2014 and July 2015

by four and 11 per cent respectively.

1.5. Power sector structure

Following the enactment of the Energy Act No. 12 of 2006, the energy sector was

restructured to bring on board more players in line with the new functions. That

means for instance, that the generation has been unbundled from transmission and

distribution. Following chart shows the landscape of players.

Figure 3: Landscape of players

Ministry of Energy (MOE): Responsible for policy and overall guidance of the sector

Energy Regulatory Commission (ERC): Oversees all regulatory functions including

coordination of the development of indicative energy planning, tariff setting and

oversight, monitoring and enforcement of sector regulations.

Geothermal Development Company (GDC): This Company is a Government

Special Purpose Vehicle (SPV) intended to undertake surface exploration of

geothermal fields, undertake exploratory, appraisal and production drilling, develop

and manage proven steam fields and enter into steam sales agreements with

investors in the power sector.

Rural Electrification Authority (REA) is charged with the mandate of implementing

the Rural Electrification Programme and came into operation in July 2007.

14

Kenya Electricity Generating Company (KenGen): Is the main player in electricity

generation, with a current installed capacity of 1,180.7MW (about 72%). The

company’s expansion plan aims to have an installed capacity of 1541.5MW by 2014.

Kenya Power and Lighting Company (KPLC): The single off-taker in the power

market, buying power from all power generators on the basis of negotiated Power

Purchase Agreements for onward transmission, distribution and supply to consumers

(single seller).

Independent Power Producers (IPPs): Private investors in the power sector

involved in competitively procured large scale generation and the development of

renewable energy under the Feed-in -Tariff Policy. Current players comprise

IberAfrica, Tsavo, Or-power, Rabai, Imenti, and Mumias. Collectively, they account

for about 28% of the country’s installed capacity.

Kenya Electricity Transmission Company (KETRACO): A government owned

company established to plan, design, construct, own, operate and maintain new high

voltage (132kV and above) electricity transmission infrastructure that will form the

backbone of the National Transmission Grid and regional inter-connections.

Under the New Constitution, Kenya has been divided into 47 counties, so that there

are now 2 levels of government, each with an own legislature and executive. In the

energy sector, the National Government will be responsible for energy policy

whereas the County Governments will be responsible for planning and development

within their jurisdictions. That means that the counties shall regularly update the

energy status and atlas and shall be encouraged to assess its potential for electricity

generation and to develop strategies to exploit such potential. While the main

licensing will be done by the National Government, some licensing activities will be

overtaken by the counties, e.g. licensing of

-

Small scale generation of electricity using solar and wind

Solar Water Heater and Solar PV Contractors

Solar system installation technicians

Small-scale charcoal/ biomass producers

There will be a transition period of some years to build up the necessary capacities

on level of counties and to clarify the function devolution in operation.

2. Regulatory framework for solar PV & wind

2.1. Feed-in tariff-scheme (FIT)

Feed-in tariffs for power from renewable energies were introduced in March 2008,

reviewed in January 2010 and updated again in December 2012. The RE-FITscheme allows power producers to sell electricity generated from renewable energy

to the off-taker, KPLC, at a pre-determined tariff for a given period of time. The

scheme is technology-specific. While wind energy was included right from the

beginning, solar PV was incorporated after the 1st revision of the scheme, however

just for off-grid systems.

In this context, the feed-in tariffs have been adjusted as follows:

Table 6: Feed-in-Tariffs

Technology

Plant capacity, in MW

2012

(2010 )

FIT, 2012

UScent/ kWh

FIT, 2010

UScent/ kWh

15

< 10 MW

Wind

Solar PV

Biogas

Geothermal

0,5 – 10

(0,5 –

100)

0,5 – 10

(0,5 – 10)

10

MW

10,1 - 50

10,1 – 40

(Solar grid)

0,2 – 10

(0,5 –

100)

< 10 MW

11

11

12

12 (Grid)

20 (OffGrid)

12

20 (firm

power)

10 (Non-firm)

10

MW

10

8 (Firm power)

6 (Non-firm)

35 – 70

(1 - 75)

8,8

8,5

The main principle, which underlies the calculation of the FIT, is that the tariffs reflect

the generation costs plus a reasonable investor return. Furthermore, the tariffs shall

not exceed the generation Long Run Marginal Costs (LRMC), which are 12 UScent/

KWh according to the Least Cost Power Development Plan. Only exception is the

tariff for the solar PV power, which is supposed to be fed in isolated mini-grids at a

tariff of 20 UScent/ kWh. Solar technology is intended to be used to supply mini-grids,

which are actually mainly diesel-run stations and, thus, cause high operation costs to

the operator (in most cases KPLC).

While the tariff for wind is quite attractive, the FIT for solar PV connected to the main

grid is considered to be low. However, the FIT for solar PV systems, which supply

power to mini-grids, seems to be reasonable.

The FIT for Wind and Solar PV apply for 20 years from the date of the first

commissioning. A positive feature of the updated scheme is, that the tariffs are not at

all negotiable anymore; the last versions defined a maximum tariff, which had the

implication that grid operator tried to discuss and to reduce the tariff.

Other key features of the FIT-scheme 2012 are as follows:

Off-Taker guarantees priority purchase

The costs of interconnection, including the costs of construction, upgrading of

transmission/ distribution lines, substations, and associated equipment, are to

be borne by the project developer

Off-taker shall recover from electricity consumers 70% of the FIT (85% for

solar PV connected to off-grid systems)

For power from projects up to 10 MW, a standardized PPA will be applied; for

larger systems this standardized PPA shall be used for negotiation

By latest, every three years the FIT scheme shall be reviewed; any changes

which will be made through reviews shall only apply to power systems that

are developed after the revised policy is published.

Following table shows the application process for the Feed-in Tariff:

Table 7: Application process for FIT

Milestone

Project applicant identifies and undertakes a

prefeasibility assessment

Submission of EOI & FIT application from to

the Ministry of Energy

Review of EOI: Check of suitability with

planning and grid connection; approval for 3-

Responsibility

Timeline

Applicant

Appplicant

FIT Committee

3 months

16

year exclusivity period or refusal

Project full feasibility study

Review of feasibility study; acknowledgment of

project viability within FIT regulation

Performing grid connection study

Acknowledgement of grid connection feasibility

Structuring project financing & submission of

draft standardized PPA

Conclusion of non-negotiable PPA

Close project financing

EPC contracting and construction

Connection, commissioning and permit

Applicant

FIT Committee

24 months

3 months

Applicant

FIT Committee

Applicant

Applicant/ Grid

operator

4 months

1 – 3 years

Source: Ministry of Energy, Feed-in Tariff Policy, Application and Implementation Guidelines,

December 2012

A major feature, which should be highlighted, is the grid connection study, which the

developer has to conduct. That study shall take into account the Kenya grid Code

and, for Small Scale Producers, the Guidelines for Grid Connection, issued together

with the standardized PPA in December 2012.

2.2. Power purchase agreement

For reducing the transaction costs associated with negotiating and signing a PPA, a

standardized PPA has been introduced for projects up to 10 MW. This standardized

PPA is technology-neutral.

It incorporates the following features:

There is no bidding for renewable sites and resources – a first come, first

served system applies

The plants are “embedded”, that is not dispatchable by the National Control

Centre

They are connected at distribution voltages

The PPA is offered to projects that demonstrate technical and economic

viability, meet the grid connection requirements and are able to secure all

necessary legal and regulatory approvals and financing.

To be highlighted are the take-or-pay provisions and the step-in rights, which have

been incorporated in the standardized PPA and which make the PPA finally bankable.

2.3. Energy regulations

Beyond the FIT and the standardized PPA there are 2 energy regulations which are

of relevance for the development of the solar PV market:

(1) Solar PV Regulations, 2012

The underlying purpose of the Solar PV Regulations is to improve the quality of

solar PC systems in Kenya, especially by improving and ensuring the capabilities

of the private sector actors, e.g. technicians, manufacturers, vendors.

The key features are as follows:

Persons who want to design or install a solar PV system have to licensed

17

(2)

To be licenced as a technician, a person shall be required to have minimum

qualifications and experiences

There are 3 classes for different system sizes (T1, T2, T3): T 1 refers to systems

up to 100 W, T2 to medium sized systems and T3 to advanced, grid connected

ones and hybrid ones. For instance, for T2 it is necessary to have a Certificate in

Electrical or Electronic and Intermediate Solar training.

Solar PV manufacturers (systems, components), importers, vendors and

contractors have also to be licenced by the Commission

For getting the licence a written an oral exam has to be passed. The licence is

finally given by the Energy Regulatory Commission (ERC)

The commission or its agent may carry out inspection

Manufacturers, vendors, technicians and contractors have to provide a warranty

to the customer for the components in the solar PV system and the PV

installation (10 yrs for controllers, regulators; 10 yrs for inverter, 20 yrs for panels,

1 yr for battery etc.)

Energy management regulations, 2012

Through these regulations the energy efficiency shall be enhanced in the industrial,

commercial and institutional facilities. The focus lies on energy conservation, but

renewable energy systems are usually considered as one option of energy efficiency

enhancement. Apart from that, the regulations generally contribute to the awareness

raising towards energy issues, thus, will also contribute to increase the interest in

solar PV and wind.

Key features of the regulations are as follows:

For all facilities, energy audits are mandatory, once every three years (according

to the guidelines for the energy audit report)

The audits have to be conducted by licenced energy auditors

To be licensed as an energy auditor an applicant must have a minimum of

academic and professional qualifications (as defined in the regulations)

Within 6 months after the audit, an energy investment plan for the next 3 years

has to be submitted by the facility to the Energy Regulatory Commission (ERC)

The facility has to realize at least 50% of the identified and recommended

energy conservation measures; an annual implementation report has to be

provided (acc. To guidelines for implementation report)

Commission or its agent may undertake an inspection audit

2.4. On-going review of the regulatory framework

There are actually 2 projects of the Energy Regulatory Commission (ERC) on the

further development of the regulatory framework:

(1) In the context of a project with the EU (EUEI PDF), it is intended to develop

Feasibility study templates

Grid connection study guidelines

Net-metering/ electricity banking regulations

Of much relevance for the further development of the commercial market for

Solar PV is, if course, the net metering, which has been introduced in the

Energy Bill 2012 (par. 157):

18

“A consumer who owns a renewable electrical energy generator of a capacity

not exceeding 1 MW may apply to enter into a net-metering system

agreement…with a distribution licensee or retailer…”

The net-metering allows to measure the energy flows in both directions, so that

the power which the renewable energy generator supplies to the grid is deducted

from the energy, which the distributor supplies to the generator; the owner of the

renewable energy generation plant just pays for the balance (“net”).

Solar PV installations do not make so much sense just for feeding the power in

the (main) grid, as the feed-in tariffs for main-grid connected solar PV is just 12

UScent; but in consideration of the current supply tariff from the grid, that

amounts to 20-25 UScent/ kWh, it is economically viable to offset the purchase

of electricity through power from Solar PV, which has a levelized cost of around

18-20 UScent/ kWh.

Regulations for the net-metering are actually developed on basis of 3 case

studies: While two Solar PV systems are already installed and feed in the grid

(without balancing against the supply), the systems in the SOS children Village

in Mombasa and on the roof of the UNEP Headquarter in Nairobi, one Solar PV

system is going to be installed at the Strathmore University.

(2) The International Finance Corporation (IFC) supports ERC to develop

regulations for the power wheeling: Under the Energy Act, electricity

transmission (wheeling) between a privately owned generator and an earmarked

customer is permitted. An appropriate wheeling tariff and wheeling procedures

have not been agreed, however. A Cost of Service Study will provide information

relevant to establish a wheeling tariff and suggest a methodology to define that

tariff. Focus will be on the 33-132 kV voltage levels.

3. Status solar PV & wind energy sector

Kenya has had a relatively stable off-grid PV market since the mid-1990’s, with

hands-off Government policies and continued duty and tax exemptions for PV

products. The market is extremely competitive but continues to develop a number of

interesting niches for specialized products.

Cumulative installed capacity is likely to be over 20 MW, spread between solar home

systems, NGO/professional systems and Government-procured systems. Off-grid

solar home system sales volumes have not dramatically increased since 2009

because of aggressive Government grid-based rural electrification programs.

However, demand for pumping, NGO, professional, and peri-urban systems is

increasing.

The Naivasha-based Ubbink PV module plant sold about 2 MW of locally-assembled

modules into the region over its first (2011/12). This venture, in partnership with the

local battery manufacturer (ABM) has been able to successfully reach neighbouring

markets and Kenyan consumers eager to buy local product.

Three segments of the market are poised to grow rapidly:

5

Mini-grid markets, based on >40 Government-procured systems in northern

arid regions5 and donor projects proposed by several countries.

Small-scale (<1MW) grid-connect projects in the agriculture, NGO, education

and commercial sector

See Ministry of Energy Scaling Renewable Energy Project document.

19

Commercial scale PV projects are likely to become more attractive as

electricity costs rise, South Africa’s emerging experience is better understood

and demand for daytime electricity increases.

More than 500 MW of on-grid wind projects are in the pipeline, primarily in windy

parts of the Rift Valley and the coast. The approved pipeline of project includes at

least 5 projects in advanced stages, though none has broken ground and all have

been slower than expected to come to financial close. The off-grid wind market,

though not as active as PV, is significant. More than 10 companies supply wind

generators for use in micro-grids and standalone projects, and local manufacture of

components is carried out by at least

Major PV market segments

The solar sector can be divided into 4 major segments; the two off-grid markets are

mature and currently active while the latter 2 are poised to develop in the near future.

Table 3 and Figure [] provide a basic overview of the sector.

Table 8: Main market segments of the solar PV market in Kenya

Segment

Brief description

Current status

Comments

Off-grid Pico &

SHS

Sales of relatively

standardized products

(usually below 100Wp),

“over-the-counter”,

unregulated.

Off-grid

Professional &

Project Market

Grid connect

(small & medium

scale)

Utility-scale power

generation (>100

kW)

Systems designed according

specific needs of off-grid

facilities or off-grid

electrification programs. It

can include SHS

programmes or larger

systems (solar PV and

hybrid systems).

Systems designed for the

specific needs of gridconnected facilities. It can

include power generation for

direct consumption

(embedded generation) or

grid-interactive systems (e.g.

under net-metering or energy

banking arrangements).

Power generation sold to

main utility or other

decentralized utilities using

Feed In Tariffs.

Largest portion of

market. Thousands of

outlets. Solar is a

ubiquitous product.

Competitive.

Dominated by Chinese

products. Estimated to

be over 2 MWp p.a.

Active market. Driven

by donors, NGOs or

government

procurement. Small

applications in

commercial and

industrial sector (e.g.

pumping tourism,

telecoms, etc.)

At least 10 grid connect

projects (>2 MW)

should have been

completed by end of

2014.

1 MWp of

installations in 2012.

Government

procurement and NGO

projects represent

largest portion

6

“Energy banking ”

regulations are being

actively negotiated by

the private sector and

Government bodies

3 projects of 3 MW in

RTAP pipeline

Several large scale

projects announced.

10 MW in Government

small project pipeline.

Government mini-grids

projects.

Regional aspects of

new constitution may

open up new

opportunities for

renewable generation.

3.1. Status of solar PV

In general, the “over-the-counter” nature of Kenya’s off-grid PV market has remained

the same as it was since the 1990’s except for a few important changes. First,

consumers have more choices and lower prices.

Secondly, technology

6

Kenya’s version of net metering.

20

improvements have made lower cost inverters, BOS, modules and pico-systems

available on the market. Thirdly, there have been some Government efforts to

regulate and licence the market7. Finally, there are more players operating in more

niches, including pumping, designed systems, portable systems and micro-grids, and

this is resulting in a trend towards better systems.

Since 2009, Kenya’s solar market has begun to move “on-grid”. Most PV players are

now aware of the opportunities offered in on-grid niches, and some advertise

products for on-grid applications. Policy changes to make solar systems more easily

connected to the grid are underway8.

Little formal data about sales of products exists, though current sales are well over 2

MW per annum. As shown in Figure [], there are several channels of supply:

Local manufacturer of modules (Ubbink) & batteries (2 local manufacturers),

“Formal” supply chains (importers, wholesalers, dealers with established)

suppliers, e.g. Davis & Shirtliff who are interested in long-term relationship

also with European/ German companies

“Opportunistic” supply chains (importers, wholesalers, dealers who regularly

change suppliers based on price & available product),

About 10 companies are major importers of solar PV, inverters or batteries, doing

more than $1M turnover per year. Several dozen companies are integrators or

players that specialize in various segments of the market (pumping, NGO sales,

pico-solar, mini-grids, Government projects, battery back-ups, grid-connect). There

are, hundreds of retail shops that supply PV directly to consumers throughout the

country.

A few companies with established relationships with German companies include the

following:

Chloride (Phocos charge regulators)

Davis Shirtliff (Lorenz solar pumps)

Solar Works (Energiebau)

Harmonics (Donauer)

As well, there are hundreds of solar technicians, many of which do not have formal

skills and operate with loose connections to solar distributors or retailers. However,

the training infrastructure for solar technicians and engineers develops along

with the gazetted solar PV regulations 2012. These regulations require that only

licensed technicians are allowed to design and install solar PV systems; and to be

licensed, technicians have to undertake a solar training course.

Gazetted ERC regulations require PV sellers and installers to have licenses. Enforcement of

these new regulations is difficult for Government bodies, especially since so many retailers

have solar as part of their product line.

7

8

The question is whether they will be in 1 year or 5 years.

21

Figure 4: Kenya PV market set-up

The KenyaPV Market Set-Up

Local

Manufacture

Professional

Market

Modules, Ba ery

NGO, Tourism, Telecom

Exports

Somalia

South

Sudan

Uganda

Tanzania

Rwanda

DRC

Seafreight

Tendered

Projects

Retail Overthe-counter

Government, NGO

SHS, Components

PicoSolar

Imports

Locally

Installed

Installers

In consideration of these regulations, a solar PV training curriculum has been drafted

to standardize the training programmes. Local and international institutions including

academia and regulatory institutions were involved. There are 3 classes (Class T1,

T2, T3), which entitles the holders to carry out solar PV system installation of

different sizes, e.g. T1 entitles to install systems up to 100 Wp.

Training courses are for instance offered by the Solar Energy Research Centre of the

Strathmore University, the leading private university in Kenya. It nowadays also hosts

the German Solar Academy (GSA), which was launched in context of the

construction of the UNEP 500kW project. At that time, GIZ supported the German

suppliers Energiebau Solarstromsysteme, Schott Solar and SMA to provide the

training. A total of 80 technicians have been trained through the three German Solar

Academies held in 2011 and 2012. The training is now institutionalized in Strathmore

University, which intends to build up a Competence Centre for Renewable Energy

and Energy Efficiency, with support of GIZ.

3.1.1 Off-grid pico & SHS

This well-established >1MW market operates through a number of wholesalers that

import modules and re-sell to hundreds of retailers around the country.

The target group of this market segment are mainly people in remote areas, which

are difficult to be reached. Thus, an important part of the supply chain are the socalled “energy entrepreneurs” who are trained and supported though several

donor-funded proprammes.

22

A prominent example is the programme “Developing energy enterprises in East

Africa” (2008 -2012), which was funded by the EU and the Danish Government. In

framework of this programme, over

Box 1: Energy entrepreneur Durama

1000 micro and small energy

Mobile Charging

enterprises (MSEE) have been

supported

to

develop

their

Only 30% of rural Africans are phone users,

business.

328

of

them

deliver

Solar

partly because of the problem to charge the

PV products and services, such as

phones. Very often they need to travel long

solar lighting and solar mobile

distances.

phone charging. Many of them are

The entrepreneur Athman Ndoro had

in Kenya.

already a solar mobile charging station at his

The small entrepreneurs got

home in Mlola village/ Kenya, relying on a

trainings on technologies, bookcar battery as opposed to a solar inverter.

keeping, quality assurance and

This was quite inefficient. Thanks to the

marketing. In addition, they were

DEEP programme he moved his mobile

coached by a mentor on the

charging station to a more strategic place

development of their business plan.

near to a trading Centre. Through his wife

As a crucial component of the

he got a loan (200 €) from the Kenya

programme, a Loan Guarantee

Women’s Finance Trust, which he used to

Fund was established, which

purchase a 40 W panel and solar battery of

made it possible for most of the

50 Ah. This allowed him to improve sales

entrepreneurs, who do not have

from 20 €/ month to 72€/ month. It took him

suitable surety such as a land title

just 10 month to pay back the credit.

and therefore cannot get credits, to

Source: GVEP International, developing Energy

get access to finance.

Enterprises in East Africa, booklet 2012

Despite introduction of Government regulations that require licenses for sellers and

installers, there has been little change in the nature of the over-the-counter market

since 2009.

Box 2: Lighting Africa

Lighting Africa is a joint IFC and Worldbank programme that works towards

improving access to better lighting in areas not yet connected to the electricity

grid.

Modern off-grid lighting products or systems shall replace the inefficient and

costly fuel-based lighting sources such as kerosene lamps. The products

comprise solar panels (1-5 W), rechargeable battery and a modern lantern/ lamp,

usually with a LED bulb. Very often, additional features such as a mobile phone

charging kit are integrated in the pico system.

The products, which are promoted through the programme, have to meet the

Global Lighting Minimum Quality Standards. Respective test methods and

standards have been developed, which are used actually by 4 labs worldwide,

including the Fraunhofer ISE in Freiburg.

By December 2012, 49 off-grid lighting products meet the performance targets of

Lighting Africa that means the Global Lighting minimum standard. Up to now,

almost 7 Mio. people use clean lighting access in Africa. The programme also

facilitates the access to finance: 7 Micro Finance Institutes (MFI) provide microloans for consumers to purchase quality-assured off-grid lighting products.

Source: http://www.lightingafrica.org/

23

It is mostly an over-the-counter market that operates through the major importers,

distributors, retail shops and installers. Typically, systems are purchased directly on

a do-it-yourself basis by consumers or by artisanal installers who design systems

based on consumer needs and budgets. The SHS supply chain is extremely

efficient and competitive. As it currently operates, it is of little interest to European

suppliers because it is driven by low price and uneven quality.

The Lighting Africa project has stimulated the lower end of the SHS market, and

drawn more investment --- and players --- into the market.

New marketing and business model approaches have revitalized the <100 Wp

market since 2010, especially with the stimulation from (donor-aided) social

entrepreneur pico-solar entrants. Financing, mobile money and higher technology

advancements may open up niche markets to international players by a) clustering

sales of equipment, b) enabling long-term finance of systems among groups of

customers and c) enabling direct contact between whole-sale agencies and

consumers (as happens with cellular phone companies). However, the existing overthe-counter market is in little danger of changing.

Examples of new social entrepreneur approaches which have had impact include:

Table 9: Social entrepreneur approaches to solar PV sales

Social entrepreneur

company

Business model

Financier

Lighting Africa-supported and

recognized pico-products

Barefoot,

d-Light,

SolarAid/SunnyMoney

BBox

Self-contained solar lighting kits to

remote projects and dealers

throughout region.

SolarKiosk

Berlin-based company introducing

solar-powered container-type kiosk

which sells products and services in

rural areas (e.g. charging mobile

phones, batteries, lamps; services

such as cooling, internet and

communication). Products such as

pico-systems and SHS are sold as

well.

SunKing,

IFC, various donors

Various

In 12/2012 a subsidiary was

established in Nairobi. Al least 5

Kiosks are deployed in Kenya.

MobiSol

Markets, monitors and finances

SHS through use of mobile money

platforms

(Tanzania,

Kenya,

Rwanda)

AECF

M-Kopa Solar

Franchise based on M-Pesa Model

finances solar equipment in Kenya

rural area

AECF

24

Box 3: Business model MoBiSol

19 employees, of which 4 are in the EA region, e.g. Arusha.

Product: Smart system (20 Wp – 200 Wp), linked up to mobile net (in Kenya

Safaricom and Airtel; in Tanzania Vodacom and Airtel)

Business model:

Customer pays via M-PESA a monthly fee, the system will be opened

automatically for power supply to the customer;

the systems are financed through micro-credits and can be paid back over

a period of 3 years (12 USD/ month for 20 Wp; 40 USD for largest system);

warranty is given for 3 years (for this period service for free)

Partners: The NGO SCODE (Kenya) and Kakute (Tanzania)

In a test phase (2010-2012) around 300 units were installed in Nakuru region

(Kenya) and in Aruha (Tanzania); the target for 2013 is to install 10.000

systems in Tanzania, Kenya and Ghana)

3.1.2 Off-grid professional

This developing sector includes systems designed according to specific needs of offgrid facilities or off-grid electrification programs. It includes donor-led SHS

programmes or larger systems (solar PV and hybrid systems) as well as commercial

markets that require high quality equipment (telecom, tourism, pumping, high-end

residential). Exports of equipment to other east African countries (South Sudan,

Somalia) are also important in this market.

Important segments of this market include the following:

Institutional systems

Pumping

Mini/micro grids

Specialized

Telecom

Export

AID/NGO bids

Increased demand by the aid and rural development sector, as well as from green

off-grid consumers, has stimulated this market. Mainly NGOs and Government (e.g.

through electrification of public facilities) have driven the professional off-grid market.

The private, commercial sector such as tourism facilities have a significant potential,

but up to now the tourism for instance has not yet developed projects over 30 kWp.

Institutional sub-segment

The first 5 years (2008/09 – 2012/13) of the Vision 2030’s target was to connect all

major trading centres, secondary schools, community water works, health centres

and 1 Million households. By 2012, more than 22.000 public facilities have been

electrified, either through extension of the grid or through installation of diesel

25

stations in the off-grid-areas as well as installation of Solar PVs and other renewable

energy projects. In this context, over 350 public facilities have installed solar power

for uses such as refrigeration and lighting.

An interesting aspect of this off-grid/ professional market segment is that it has many

new players. As opposed to traditional over-the-counter suppliers, these new

entrants are often nimble, able to prepare bids and proposals, technically competent,

and able to seek support from the finance and aid sector 9 . It is, for example,

common for solar companies to team up with NGOs and CBOs to develop project

proposals for specific opportunities “on offer” from donors such as the EU, UN

agencies (UNDP, UNHCR, UNEP), AECF, GVEP, EEP, international grant agencies,

etc.

As well, there are numerous alliances of importing companies and niche specialist

providers that team up to win contracts. For examples, importers like Davis Shirtliff,

CAT and Chloride Solar both tend not to go after individual solar projects; instead

they work closely with dealers/technicians to win projects, picking the right

partnership for the job.

The professional sector is likely to grow steadily, with new opportunities opening up

in tourism, aid, telecom and Government procurement.

3.1.3 Grid-connect (Small scale)

Development of small and medium sized grid-connect market is likely to be a key

growth sector for PV in East Africa as a whole and a particularly interesting one for

high-quality suppliers. There are three reasons for this:

First, the rapid expansion of the grid is a reality in Kenya 10. On the order of

80% of the population is within 10km of a grid power line in Kenya. Many

consumers would like to have a grid connection and add/keep their solar

PV system.

Secondly, grid-connected early movers in the household and commercial

segments of the economy want to go green and to invest in solar for its

predictable long term costs.

Thirdly, on-grid Kenyans already invest in battery, generator and solar backup solutions. They are used to poor service from the utility and see solar as

a potential solution to avoid the on-going frequent power cuts (that are

likely to continue in the short term).

In the absence of a clear policy framework, this market is already developing.

Recent projects (see table) have been carried out by aggressive green first movers.

The success of these projects, and the resounding support they receive from the

private sector and consumers, has forced Government to positively address a “grey

area” of policy11.

Numerous aid-based sources of support are available for start-up and small green

companies. See Solar Player Data base and Table 3.

9

10

KPLC has several hundreds of thousands of households between 2008 and 12.

11

Small scale renewables are not officially encouraged by feed in tariffs or net metering

policies yet. See ECA report.

26

Table 10: Solar PV grid connect pipeline

Project

UNEP Nairobi

SOS Children Village

Mombasa

Uhuru Flowers

Strathmore

Chloride

Size

550kW

60kW

Year Installed

2011

2011

Company

Energiebau/SolarWorks

Asantys/AfricanSolarDesigns

73 kW

500 kW

48kW

2012

2013

2013

Azimuth/SolarCentury

Energiebau/SolarWorks

Yet, the market is not off-taking: The net-metering has been introduced by law by the

end of 2012, but the implementation guidelines/ regulations are still under

preparation. At least a dozen projects are currently in development. Especially, once

the net-metering regulations will be in place, these are likely to grow into a sector that

is larger than the off-grid sector in the mid-term. Opportunities will largely be over

90% in the private sector, in the 2kW to 500kW range and without need for licenses

or formal Government approval.

3.1.4 Grid-connect (Utility-scale)

The power generation market includes systems installed as projects with power

being sold to the main utility or other decentralized utilities under a Feed-in-Tariff

regime. Already, a number of “aspirational” projects are in the Government pipeline,

but none has received a PPA. Thus far, Government policy and practice has

prioritized large (>100 MW size) geothermal, wind and coal projects over solar PV.

Large scale projects are occasionally announced by market players (ex Jinko Solar

Garissa12). Rumours are also around an upcoming project of UK-based Winch (40

MW). However, whether such projects occur has much to do with investor appetite,

improved FIT’s, available finance, overall views of the Kenya energy sector ability to

pay and ability of the power sector to absorb large-scale generation13.

In the mid-to-long term, large scale solar projects will be implemented in Kenya.

Opportunities for such projects will be limited in number and extremely competitive.

Investors will have to have strong local connections and a long-term view of these

opportunities.

Mini-grids

Besides the electrification of public facilities, the installation of isolated mini-grids is

part of the rural electrification programme. In the Rural Electrification Master Plan

(REMPP, 2009) 33 sites were identified for the installation of off-grid power stations.

By end of 2012, 12 isolated mini-grids were installed, all on basis of diesel

generators. They are operated by the national grid operator, KPLC.

7 of these off-grid stations already include RE systems, however the share of RE at

the total installed capacity is usually less than 10%.

http://www.the-star.co.ke/news/article-281/chinese-firms-build-solar-power-plantgarissa

12

If the existing wind and geothermal projects come on-line as per schedule, the ability of the

grid to absorb and pay for this power in the near term is questionable.

13

27

Table 11: Existing off-grid stations

Station

Wajir

Mandera

Marsabit

Diesel

Installed

Capacity

(kW)

1746

1600

560

Lodwar

Hola

Merti

Habaswein

Turkana

Tana River

Isiolo

Wajir

1440

800

128

360

Elwak

Baragoi

Mfangano

Moyale

Mandera

Samburu

Hombay

Marsabit

Mpeketoni

Lamu

360

128

584

Connected to

Ethiopian

National Grid,

2009

Connection

to Ethiopian

National Grid,

planned 2013

7706

Wajir

Mandera

Marsabit

County

TOTAL

RE

Capacity

No. of

Customers

Length of

MV lines

(km)

3360

3270

2194

Length

of HT

lines

(km)

186

86

123

0

300 (PV)

500

(Wind)

60 (PV)

60 (PV)

10 (PV)

30 (PV)

50 (Wind)

50 (PV)

0

0

1610

1300

287

779

35

175

6,85

105

45

42

18

150

535

199

101

25

7

42

52

4

7,3

800

25

65

510 (PV)

550

(Wind)

Source: Ministry of Energy, Scaling-Up Renewable Energy Program (SREP), Project Document for MiniGrids’ development in Kenya, Draft, April 2013

The main distribution voltage levels are 11 kV, in Wajir (Griftu), Hola, Habaswein and

Mfangano there are also 33 KV lines. With regard to the load profile, there are 2 main

peak periods usually, between 10.30 and 12.30 am and between 7.30 and 9.30 pm.

3.2. Status of wind energy sector

Potential of wind in Kenya

Kenya is one of the countries with the highest potential for wind power generation in

Africa, with the highest potential around Lake Turkana and a significant potential in

the coastal areas.

Kenya has on the order of 10-20 good sites with wind speeds of >7m/s. These sites

could have a demonstrated potential of over 1 GW of grid-connected electricity from

medium-large wind turbines. The Government is in the process of preparing a new

wind atlas14 --- however, developers generally have to measure and confirm data for

their own projects.

Large-scale projects

The large-scale wind sector has been increasingly active in the recent years. Despite

a great beginning with Ngong hills wind park 5.1 MW commissioned in 2009, the

14

A previous Wind Atlas was prepared in 2003.

28

large-scale wind sector has been unsuccessful since then trying to push for more

installed capacity. The LCPDP projects a total of 2,036 MW from wind by 2031.

As of 2011, 20 projects with a total capacity of 1008 MW had been approved for

development.

Table 12: Approved wind power projects

Name of Firm

Capacity Site

(MW)

Aeolus

Osiwo

60

60

Kinangop

Ngong

Aperture

30

Limuru

Wind Energy Ltd.

Cordisons Int. Ltd.

100

150

Malindi

Kisumu, Lamu

Tana river power

2x50

Energy Investment

2x6

Triotec int. Ltd.

Prunus

10

Isiolo &

Nyambene

Suguroi,

Mambrui

Ngong Hills

Ngong Hills

Pisu & Co

Kenergy

Ltd

KTDA

Renewables

To do feasibility study

To do feasibility study

To complete feasibility study

To finalize arrangements with KFS

To acquire land and do feasibility

study

To do detailed feasibility study

To do detailed feasibility study

20

40

Sergoit

To do feasibility study

20

750KW

Rleny Hills

Kiasemes

To do feasibility study

To do feasibility study

50

Oloitoktok

To do feasibility study

50

Corner Baridi,

Ngong

Mpeketoni

Garissa

Kinango,

Kwale

Nyambene

Hills

Tower power ltd.

Biashara

Energy

Solutions

Fahrenheit

Energy

Solutions

Facelift Energy

Ambalian

Company

Limited

Quant Energy Kenya

Ltd

GEM-CEM

Construction Limited

Electrawinds

PPA signed

Waiting for concessioning of land

from Kenya Forest services (KFS)

Finalizing agreement with

partners, ENBW

Finalizing detailed feasibility study

Import of wind masts for data

logging

To do feasibility

Between

Meru/Isiolo

Kinangop

Kapchebet

Tea Factory

Olchoro

Onyore

Hindi

Ngong Hills

Ngong Hills

Olsuswa farm

Laikipia

Corner Baridi

Isiolo &

Malindi

Kanget Meru

Triotec Int.

Blue Sea

Windgen power

Sustainable Energy

Sustainable Energy

Olsuswa Energy

Kenelec Supplies

Ol-Danyat Energy

Tata power

Status

55

100

100

10

100

90

100

100

30

To do detailed feasibility study

To do detailed feasibility study

To do detailed feasibility study

To do feasibility study

To do feasibility study

To do feasibility study

To do feasibility study

To do feasibility study

To do feasibility study

Source: List of ERC/ MoE (April 2013)

29

Table 13 below summarizes the 5 major projects that the most advance in

development. In total, these projects represent over 550 MW. According to current

plans (and predicted completion dates) these projects would supply well over 20% of

the capacity of the Kenya grid upon completion.

Table 13: Major planned wind projects in Kenya

Project /

Capacity

Players

Area

[MW]

location

Turkana Wind

Park

300

Kipeto Energy

Wind Park /

Kajiado area

100

Kinangop

Wind Park

60.8

Ngong Wind

Park

Expansion /

Ngong hills

13

Baharini

Electra Wind

Farm • Lamu

coast

90

Aldwich International – Original

developer

AfDB – Lender

Lake Turkana Wind Project (LTWP)

Vestas – Turbine supplier

Isolux Corsan S.A. – Transmission

line contractor

CFD – 100% ownership

GE - Founder of the project

Local partner – CraftSkills

Aeolus Kenya

General Electric – Supplier

Iberdrola - EPC contractor

OPEC – American bank lender

Iberdrola - EPC Contractor

Gamesa - Supplier

Prunos and GE - Investors/Owners

Electra Winds Kenya Limited

IFC investment

Status

The project is about to

achieve financial close

around June 2013, but is

temporarily on hold due

to World Bank concerns

over grid absorption

capacity and cost

recovery.

Close to financial

closure, afterwards 18