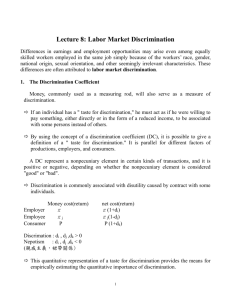

Penyelarasan Gaji Minimum_2

advertisement

SUMBER:

JURNAL

&

MAJALAH

I

SUMBER MANUSIA

I

Bpah Minimum Waiar

Dilaksanakan di Malavsiail

Oleh OR MUSTAFA QAKIAN

(Kolej Yayasan pelaJilranCMruAruRruA,I_ _

K

ONGHES Kesatuan Sckcrja r.oIalaysia

(MTlJC) dan Kongrcs Kesatuan Pckcrja dalarn Pcrkhidrn;Hi\ll Awam

(CUEPACSj tclah mcncfldangkan supaya

kcrajaan mcnimbang sClllula pcnggcnaan upah minilllum scbanyak RM I ,200

kcpada pMil pckcrja llnlUk meningk,llbtl kcbajikan lllcrcka.Gcsaan ini

dilakukan rncmandangkan ~HlJC berlanggungjawab lIlcndesak kcrajaan

utltuk rncnghargai surnhangan bcsar

pihak pckcrja yung rncnjadi pcnggcrak

kcpada pcmbangunan ekonomi ncgara.

$clama inL hubungan pekcrja-llliljikan-kcraj<lilll lllcrupakan satu pertali;1Il

eral all\ara liga pillak yang sarna-sarna

bcrganding balm Iltlluk mcmastikan produktiviti jlckcrja. up3h buruh yang kompelitif dan pengguna<ln sumbcr rnanusia

dcngan cara yang cfisicll terus dilakubn

supaya kos pcngc1uar3n tidak mcningkat.

Pcrdana Mcntcri. [)atuk Scri Dr.

Mahalhir Mohamad Illenekankan bah3wa kerjas.ulla eral di anlara liga pihak

ini lIlarnpu mcnangkis sebarang kegiman

penyelcwcngan olch pcngusaha dan

pcnglibalan pclabur asing yang tamak

akibm kesan globalisasi dunkl. Jus!Cru.

pckerja perlu lcrus bcrganding bahu

unluk memaslikan bahawa sebarang lintlakan yang dial1lbiJ perlu mengarnbilkir,t

pihak lain.

Kcs pcrhubullgan perusahaan di

Malaysia lllcnunjukkan k;ldar yang meIlllHtskan apabila bilang,1ll pertikaian

pCrllsahaan lclah mcnurull sebanyak

0.114 bagi seliap \,000 pckerja pada

tahun 1984 kepada 0.052 pada lalulIl

1998. Kchilangan hari bckerja kcrana lin<.htkiln pcrusah'lan khususnya discbabkan mogok berkurangan dari 19.800

hari pada wtUlll 19BO kcpada 2.685 hari

pad3 lahUll 1998.

Kerajaan juga tclah mcngarnbil lindakan t1nlllk mClllulihkan kebajikan

pckcrja tcrutama scktor awam dalarn

l3elanj3wan 2000 rnclalui kcnaikan

imbuhan peru mahan. pcrnbcri<ln bOllus

scbanyak seblilan gaji dan kcnaikan 10

pcratus gaji bcrkllatkuasa pada I Janu<tri

2000.

Tindakan ini disokong olch kenyataan 1\lcntcri Sumbcr r-,·Ianusia. [)al\lk

Dr. Fong Chan Onn bahawa. "/\pa jua

upah yang ada di Malaysia hams rnclllberikan pcngiktirafan kepada pckcrja

bahawa mereka merllpakan kllmplll3n

pcnting scbagai pcnyumbang ckonorni

M3Iaysia".

Sclalll:l ini sistem inselllif lIcgara

rncrupakan SiStClll upah yang bolch

mcngambilkira keb3jikan dan kcperlu31l

pekcrja di samping rnclllclihara kc·

pentillgan pih3k lll:ljik:lI1. Sistern up3h

(G3fis Panduan Pernbaharu3n G3ji

tJcrasaskan Prodllktiviti) yang digu!>al

oleh Kcmcnlerian Surnber ~1:lIl11Si3

(1996) mCllg;unbilkim kcpcnlingan pih'lk

pckcrja dan majik311.

Di l\'lalaysia. k:tkit:lngan kerajaall

merniliki pckerjaan tctap yang dib<ly:tr

upah tTlcngikut gaji bulanan. Mercka

Illcndapat gaji tidak rncngira cllti S3kit

atau bckcrja. g3ji y3rlg st3tik rncngikllt

kellaikan tahllll3n. mend3pal pclbagai

kCl1ludahan. dibay3r el3un tencnlll, pinjat1l3l\ perul1l3h3l\ dan kcndcm,1Il deng3n bd3r faedah ernp31 pcr31lls. caru-

man Kumplllan Wang Simp,man I'ckerja

(K\VSf'1. skim f'erlubuhan Kehajikan

Sosial (Perkesol. insurans berkelolllpok,

pemberian bonu::. st'liap l<lhun dan

beb'Hl kerj,j yang rdatir rendah.

Pihak swasta juga memberikan gaji

yang fleksibcl mcngikut produktiviti dan

prcstasi scmasa organisasi, kl'lHlikan

pangkat yang pantas, faedah s<lmpingan

dan penman kesatu<ln sekerja yang tillggi

Llntuk membela kebajikan para pekcrja.

Keadaan ini menunjukkan bahawa pihak

majikan mengrl<1rgai sum bangall jlckcrjfl

sebagai ,>jen pl'tlggcrak kcmajwll1 ckonorni ncgara.

Indeks LJaya Pcrsaingan Sedlillia ;WOU

yang dikeluarkan oleh Perbadallilll

Produktiviti Kegara (NPC) menyebtll ba·

hawa Malaysia berada di lempal Kt' 2!i

disebabkan produktiviti peker·

j<l di Malaysia hanya rnem:apai

tahap lim,l peralils. Tahap produkti\'ilj yang rendah dan

kenaikall gaji yang mcndadak

akan

rncrnlmrukkan

lagi

kcadaan yang scdia ada.

Pandangan Dr. Fan Chan

Onn menunjukkan bahawa

pembangunan s\lmber 1ll,lllll'

sia di Mal(lysia sangat baik berdasarkan Indeks Persckitaran

Kerja yang lIleningkat daripada

106.0 mata kcpada 118.9 mata

dalam tcmpoh 18 tahun lalu.

!\amun, berdasarkan maklumat semasa dahlm Utusan

\1alaysia, membayangkall lerdap<ll anggaran hampir 19.000

orang lulusan Inslitut Pcngajian Tinggi

Awam dan Swasta yang mcnganggur.

Kcadaan ini agak mcmbimhangkan kerana ekonomi Malaysia kini scmakin berusaha untuk beralih daripada p-ekonollli

kepada k-ekonomi.

Berhubung dengan isu gaji minimuTll

yang utarakan oleh MTUC dan CtJEPACS

scbanyak H:Yll,ZOO, lllcnurut

Dr.

Mahathir, kerajaan tidak dapat lllcnetapkan gaji minimum tersebut kerana akan

mengakibatkan kenaikan gaji ke panls

yang terlalu tinggi. Kenaikan gilji ini akan

menyebabkan kerajaan dan pihak swasla

menanggung beban d<ln menyebllbkan

berlaku jarak gaji yang bcsar alltara

pckcrja atasan dcngan pckrrja snkongan.

Keadaan ini sccara tidak langsung

alan meningkatkan kos buruh, mengurangkan daya saingan industri dan mengurangkan pelaburan langsung asing

(FOIl. Kerajaan hanya akan berst'mju

dengan penelapan gaji minimum st'banyak RMI,200 sekiranya wlljud dalam

!ll'llingkat;ln produktiviti pekerja dun

rnajikan. pcningkatan nilai tambah

antam scklor dan kos kehidupan yang

rasiona1.

Memang diakui bahawa par,ls g<lji

minimum d,tlam lingkllngan Hr.,1400

~t'blilan b'lgi st'setf'llgah sektar sl'bagaimana yang wujud hari ini, agak rendab. Plmyelarasan lTlungkin diperlukan

pad<l masa ini. Tctapi. jib peningbmn

gaji mcncapai 20U pemtus sehingga

11\11 ,ZOO sebulan, mungkin membeban·

kall pihak majikan. Sebarang kenaikan

perlulah dilengkapi dengan kewajarilll

yang rasiunal bagi mengelakkan st'gala

y,lng dirancang lidak mernbcrikan kesan

11l'g,lIifkepada ekonomi ncgara.

Kesal\lan sekerja harus sepakat dan

mengambilkira jangkaan produktivill

hllj<lh lwliau, upah minuman akan

Illeninl:(kalkan kos sara hidllP, kos pl"

ngeluarall, pcrbczaan Kadar upah dall

llf(H"\uklil'ili, pcnganggurall meningkal,

kebajikan pckcrja diabaikan, mern·

behankan kedudukan kew<lngan ncgara,

Il1cngurangkan persaingan ckonomi

ncgara, 111l'ningkalk<tn pinjaman kewangan negara, inflasi nwningkat. kcsatuan

sekerja lebih lwrkuasa daripada majikan,

kllnlllg l_lt'laburan langsung asing (FOil.

Slrllktllr llpah ncgara yang relatif tinggi

hl'rlJilnding ncgara maju dan kesej<lhlemall rakyat tcrbantul.

Saya bcrpendapal. upah minimUlTl ini

mampu meningkatkan stllllbangan scktor pertama Ipert<lnian, prrhlllanan, perlombongan d,Hl kuari) vang memiliki

nil'li tumb'lh yang linggi kcpada sLlmbangan ekonomi herbanding seklOr kcdua (pcrindustrian dan

pcmhinaan]

dan

kel iga

(pcrkhidmatanl. Hal ini disebabkan sebahagi,U1 hesar rakyat Malaysia (40 peratus) tcrlibat dalam seklor pcrtama yang

memiliki struktur upah yang

tidak mencntu. Mereka sangal

bcrgantung kcpada keadaan

rnusim dan cuaca untuk rnernpcrolch pendapatan dan masih

I11cnyumbang sebanyak 4:; peratus kepada ekonami ncgara.

Dengan pelaksanaan upah

minimum ini mampu menjana

pertlllllbuhan dan sumbangan

sektor pertama, meningkatkan

prnggunaan

buruh

yang

('knomik, ITlcningkarkan produktiviti

Kt'rja, mcngatasi kadar pengangguran

slruktuml ncgara. meningkatkan pelahuran swasta dalam sektor pertama,

rneningkalkan eksport negara dan sctcrusnya memberikan kelehihan kcpada

seklOr pertama sebagai pcnyumbang

eksporll1egara pada masa hadapan.

Ptmgalaman Malaysia daJam nwngharungi krisis ekonomi telah menjadikan

rakyal Malaysia lebih prihalin dan memahami akan cabaran terhadap ekonomi

tlcgal'a, Pckcrja-majikan-kerajaan pcrlu

mcncari pendekatan dan formula baru

untuk mencapai kejayaan ekonomi yang

lebih l11elllberangsangkan dan menya·

kinkan.

Upah minimum ini jika dilihat

IT1l'ngikUl slllllbangan sektor ekonumi

rnampu mcnjana sumbangan sektor perlama untllk mcnjadi ejen penggerak

kcpada perlumbuhan ekonomi negara

untuk menangani kesan globalisasi

ckonomi dunia.

Pihak swasta juga memberikan

gaji yangfleksibel mengikut

produktiviti dan prestasi semasa

organisasi, kenaikan pangkat

yang pantas,faedah sampingan

dan peranan kesatuan sekerja

tinggi untuk membela kebajikan

para pekerja.

yang tinggi yang boleh disumbangkan

olch setiap pekerja. Bagi seklOr kerajaan,

cara yang paling mudah unluk melipal'

gandakan jumlah hasil adalah dengan

menaikkaTl Kadar cukai. 11al ini kerana,

keO<likan Kadar cukai boleh digunakan

untuk membayar gaji pckcrja. Cukai

ll1crupakan hasil utama kerajaan dan jiku

gaga!' proses peminjaman dipt'rlukan

dan hal ini akan menjejaskan kedudukan

kewangan negara.

Manakala bagi pihak swasla, kenaikan gaji minimum ini akall mcnycbabkan kenaikan kas pengeluaran dan

selerusnya menychabkan pihak majikan

lTlclakukan pcmbuangan pekerja (downsizing). Hal ini akan meTlyebabkan Kadar

pcngangguran dalam negara meningka\

dan setemsnya menjejaskan kt'bajikan

rakyal.

Sungguhpun begitu. saya menyokong

pendapal Prof. Dr. Mahani (BI-1,20001

yang menyebut ten lang kesan ncgalif

pelaksanaan upah minimum ini. Alllara

IWIU\ f:lW~O\lI'JtUI1000'

39

SUMBER:

INTERNET

A Minimum Wage for Malaysia

Is Malaysian Government Aiming to Suppress Wages?

Jul 24, 2007 John Walsh

Labour activists are campaigning for a national minimum wage in Malaysia where salaries are

far out of touch with cost of living. Here are the issues.

From time to time the Malaysian government is overcome with resentment towards the many

thousands of migrant workers, mostly Indonesians, in their presence and resolves to expel them

all, one way or another. A few weeks later, as the middle classes call out for affordable domestic

help and the construction sites across the country are disturbed only by the occasional passing

of tumbleweed, the policy is quietly reversed and the migrants return. Malaysia, in common with

just about every other developed or developing country of the world, cannot survive without

migrant workers. And if some of those workers are illegal or unregistered, then that probably

benefits the economy even more. The presence of migrant workers, especially those willing to

accept just about any wages no matter how low because of fear of attracting the attention of the

authorities, keeps wages for the whole country suppressed. This benefits some and hurts others;

it is reasonable to assume that the former are happy with the situation while the latter would like

to change it.

So it is with Malaysia where wage rates have become almost completely decoupled from the

cost of living. A recent salary increase for civil servants only just managed to bring them up

above the designated poverty line. The going rate for work in most of the country ranges

between 300-450 ringgits monthly while the cost of living rarely dips below 800 ringgits no

matter where in this highly diverse country one might look. Now trade unionists are becoming

unexpectedly and almost unprecedentedly bold in asking for a set minimum wage which would

enable workers to live free from the fear of poverty. Government minister Fong Chan Onn, who

represents human resources in the country, has argued that introducing a minimum wage at the

suggested rate of 900 ringgits per month would be disastrous because it would mean that

migrant workers would receive the same rate and this would lead to job losses, inflation and the

disappearance of investment overseas. The minister has rather revealed the government’s

thinking on this issue, which is to support the low-wage economy for the benefit of business

owners. This is not something that the government has freely acknowledged before.

KENYATAAN MEDIA MENGENAI HARI TERBUKA GAJI MINIMUM

Kementerian Sumber Manusia sedang mengadakan Makmal Gaji Minimum pada 7 hingga 14

Februari 2011 di Pusat Konvensyen Antarabangsa (PICC) Putrajaya. Bersempena dengan

makmal tersebut, Kementerian Sumber Manusia akan mengadakan Hari Terbuka Gaji Minimum

untuk mendapatkan maklum balas daripada orang awam seperti ketetapan berikut:

Program : Hari Terbuka Gaji Minimum

Tarikh : 12 Februari 2011 (Sabtu)

Masa : 2.00 petang – 4.30 petang

Tempat : Tingkat 18, Wisma PERKESO, Jalan Tun Razak Kuala Lumpur

Penyertaan dibuka kepada semua orang awam terutama pekerja di sektor swasta, majikan,

Pertubuhan Bukan Kerajaan (NGO) dan juga individu yang berkepentingan.

Objektif Program:

1. Merasionalisasikan pelaksanaan gaji minimum di Malaysia;

2. Platform kepada orang awam untuk memberikan pandangan dan cadangan bagi

pelaksanaan gaji minimum; dan

3. Memberi makluman berkaitan amalan terbaik pelaksanaan gaji minimum di negara lain.

Atur Cara Program

2.00 petang: Ketibaan tetamu jemputan dan orang awam

2.30 petang: Taklimat mengenai gaji minimum oleh wakil Bank Dunia

4.00 petang: Sesi soal jawab

4.30 petang: Majlis berakhir

KEMUDAHAN TEMPAT LETAK KERETA SECARA PERCUMA DISEDIAKAN DAN ORANG

AWAM DIJEMPUT HADIR.

Pengumuman

Kementerian Sumber Manusia dengan kerjasama Bank Dunia akan menganjurkan

Makmal Gaji Minimum pada 7-14 Februari 2011 bertempat di Pusat Konvensyen

Antarabangsa Putrajaya (PICC).

Kata-kata aluan Y.B Menteri

Tuan/ puan yang dihormati,

Salam 1Malaysia

Selaras dengan konsep “1Malaysia: Rakyat Didahulukan, Pencapaian Diutamakan”, Kerajaan

melalui Kementerian Sumber Manusia sedang mengkaji kemungkinan pelaksanaan gaji

minimum kebangsaan untuk pekerja sektor swasta di Malaysia. Kajian ini juga selaras dengan

hala tuju Kerajaan untuk merealisasikan Model Ekonomi Baru (MEB) yang berteraskan ekonomi

berpendapatan tinggi dan usaha mempertingkatkan taraf hidup isirumah berpendapatan rendah.

Tidak dinafikan, masih terdapat segelintir rakyat yang hidup di bawah paras Pendapatan Garis

Kemiskinan (PLI), malahan ramai pekerja yang menerima upah kurang daripada RM750

sebulan. Sebagai contoh, analisis gaji yang ditawarkan oleh majikan dalam program Fast Track

KSM bagi bulan Oktober - Disember 2009, menunjukkan gaji purata pekerja tempatan seperti

dalam jadual berikut: Jadual 1 : FastTrack: Gaji dan Elaun Purata Pekerja Tempatan mengikut

Sub-Industri Sektor Pembuatan

Berdasarkan kiraan gaji purata bagi lima sub-sektor berkenaan iaitu Elektrik & Elektronik,

Perabot, Plastik, Sarung Tangan Getah dan Tekstil, gaji pokok purata adalah RM626.76

sebulan manakala gaji kasar purata termasuk elaun-elaun tetap adalah RM762.20 sebulan.

Peningkatan kos sara hidup terutamanya harga barang keperluan harian yang semakin

meningkat, golongan berpendapatan rendah ini menghadapi kesulitan untuk memenuhi

keperluan hidup mereka terutamanya di kawasan bandar. Cadangan penetapan gaji minimum

kebangsaan sekurang-kurangnya akan dapat mengurangkan permasalahan ini.

Namun demikian, sesetengah pihak berpendapat penetapan gaji minimum kebangsaan akan

membawa kepada implikasi negatif kerana ia boleh menjejaskan kuasa pasaran (distort market

forces). Pelaksanaan gaji minimum juga boleh menyebabkan ‘kehilangan’ beberapa kategori

pekerjaan di peringkat rendah yang masih ada permintaan terutamanya untuk golongan yang

mudah terjejas (vulnerable groups) khususnya mereka yang bekerja di luar bandar dan secara

tidak langsung akan meningkatkan kadar pengangguran negara.

Sehubungan itu, Kementerian Sumber Manusia amat mengalu-alukan sebarang pandangan,

pendapat, idea, cadangan dan komen yang boleh disalurkan melalui blog ini atau menerusi email: gaji-minimum@mohr.gov.my bagi membantu Kerajaan dalam menggubal dasar dan

strategi mengenai gaji minimum.

Untuk mendapatkan maklumat lanjut berhubung dengan pelaksanaan gaji minimum, sila layari

pautan gaji minimum yang disediakan.

Kerjasama tuan/ puan amat saya hargai dan didahului dengan berbanyak-banyak ucapan

terima kasih.

Datuk Dr. S. Subramaniam

Menteri Sumber Manusia

Tuesday, March 23, 2010

Pandangan MEF Mengenai Gaji Minimum

Pembangunan Ekonomi Yang Tidak Seragam

Dalam membincangkan keberkesanan pelaksanaan Gaji Minimum di Malaysia, keadaan

struktur ekonomi semasa negara perlu diambil kira. Perkembangan pesat yang berlaku

sekarang sememangnya dihargai dengan kewujudan sektor yang besar di kawasan luar bandar.

Di kawasan luar bandar, perusahaan yang dijalankan adalah perniagaan yang sangat kecil

seperti kedai runcit, warung, perkhidmatan bengkel motor dan kiosh-kiosh petrol. Data

menunjukkan bahawa sebanyak 99 peratus syarikat di Malaysia adalah dalam terdiri daripada

Industri Kecil dan Sederhana (IKS). Sekiranya penetapan gaji minimum dilaksanakan maka ini

hanya akan menyebabkan banyak syarikat IKS terpaksa ditutup dan mengakibatkan kesukaran

kepada penduduk sekitarnya. Kerajaan seharusnya membantu membangunkan syarikatsyarikat kecil ini dan tidak membebankan mereka dengan penetapan Gaji Minimum

kebangsaan. Selain itu, ini akan meningkatkan kadar penggangguran kerana syarikat-syarikat

kecil tidak dapat meneruskan operasi mereka kerana kos buruh yang semakin meningkat.

Sistem Sedia Ada Memadai

Buat masa ini, secara prinsipya upah ditentukan berdasarkan kepada kuasa pasaran dan bagi

pekerja yang mempunyai kesatuan, mereka akan berunding dengan majikan dalam

menentukan kadar upah yang dipersetujui oleh pihak pekerja dan majikan. Kaedah penetapan

upah ini membolehkan terdapat perbezaan upah berdasarkan kepada perbezaan bentuk

perniagaan yang dijalankan oleh syarikat, saiz syarikat, lokasi perniagaan di mana terdapatnya

perbezaan dalan kos dalam menjalankan perniagaan. Kaedah ini adalah jauh lebih baik

daripada penetapan kadar gaji minimum. Undang-undang perburuhan juga memberikan ruang

yang mencukupi kepada pekerja dan majikan untuk berunding dalam menentukan kadar gaji

yang sesuai untuk mereka. Undang-undang memperuntukan bahawa Perjanjian Kolektif akan

dijadikan kontrak dalam pekerjaan yang akan digunapakai kepada semua pekerja dan

membatalkan kontrak-kontrak yang lain. Perjanjian Kolektif ini tidak akan dipindah atau

dibatalkan tanpa adanya persetujuan di antara pekerja dan majikan.

Dalam konteks Malaysia, keharmonian industri adalah matlamat yang harus dikekalkan. Sistem

perhubungan industri yang wujud sekarang membenarkan majikan dan pekerja menyelesaikan

sebarang masalah yang wujud secara bersama. Sekiranya persepakatan gagal dicapai maka

khidmat perundingan akan digunakan. Apabila persepakatan gagal juga dicapai maka

Mahkamah Perusahaan akan mendengar perkara tersebut dan memberikan arahan yang akan

mengikat kedua-dua pihak apa yang lebih penting ialah mengelakkan tindakan perindustrian.

Sistem yang ada sekarang adalah memadai dan sekiranya penetapan gaji minimum

kebangsaan dilaksanakan, ia akan menyebabkan sistem tidak fleksibel dan akan mengganggu

hubungan di antara majikan dan pekerja.

Mereka yang mengusulkan penetapan gaji minimum kebangsaan berbuat demikian

berdasarkan pendapat yang salah di mana pekerja akan menikmati gaji yang setimpal;

mengelakkan eksploitasi; mengurangkan kemiskinan; dan memastikan upah yang dibayar

adalah sesuai dengan kerja yang dijalankan. Seharusnya kita tidak menyatakan bahawa objektif

ini hanya boleh dicapai jika sekiranya perkembangan ekonomi memberangsangkan. Ekonomi

yang sentiasa berkembang maju akan turut meningkatkan penerimaan kadar upah kerana

peningkatan kemakmuran negara akan meningkatkan upah. Penetapan gaji minimum tidak

menjamin kepada perkembangan ekonomi negara.

Gaji Minimum Akan Menjejaskan Daya Saing

Perniagaan yang dijalankan berkait rapat dengan senario persaingan dan kos untuk

menjalankan perniagaan adalah fakor penting dalam menjalankan sesuatu urusniaga.

Kesannya bukan sahaja ingin mengekalkan penglibatan berterusan para pelabur asing bahkan

juga keupayaan Kerajaan untuk menarik para pelabur asing yang baru. Hal ini terbukti

sekiranya kos buruh meningkat melebihi paras yang difikirkan berpatutan oleh majikan, ini akan

menyebabkan sesetengah majikan bersedia untuk menutup operasi mereka dan berpindah ke

negara lain yang menawarkan kos buruh yang lebih munasabah. Terdapat banyak syarikat

yang terpaksa menutup operasi mereka semasa krisis ekonomi yang berlaku baru-baru ini.

Meskipun terdapat tanda-tanda pemulihan ekonomi, namum pertumbuhannya tidak menyeluruh

dan prestasi syarikat dan sektor adalah tidak sekata.

MEF berpendapat bahawa dalam menggubal dasar yang tepat berkaitan dengan penetapan

upah, adalah penting untuk menanamkan kepercayaan di kalangan pelabur asing dalam

ekonomi; membantu syarikat mendapatkan kembali kos daya saing; membuka peluang

pekerjaan dan mengurangkan kadar pengangguran. Penetapan Gaji Minimum Kebangsaan

jelas menunjukkan bahawa ianya adalah satu langkah yang kurang sesuai. Apa yang Kerajaan,

Majikan dan Kesatuan sekerja perlu lakukan adalah mempromosikan dan mempraktikkan

sistem upah berdasarkan kepada prestasi.

MEF menyokong pendirian Kerajaan bahawa Malaysia buat masa ini masih belum bersedia

untuk melaksanakan dasar gaji minimum, ini kerana sekiranya dasar ini dilaksanakan dikhuatiri

akan menyebabkan para pelabur asing meninggalkan negara ini seterusnya akan menghalang

minat para pelabur asing yang baru untuk melabur di dalam negara.

Aspek Statistik dalam penentuan gaji minimum

Sistem Gaji minimum walaubagaimana pun bentuknya, tidak akan berjaya berfungsi kecuali

bepandukan statistik yang tepat, boleh dipercayai dan terkini berdasarkan data-data seperti

pendapatan, upah, harga dan ciri-ciri penerima upah (jantina, pekerjaan, tahap kemahiran dan

sebagainya). Ia memerlukan sistem sokongan statistik perburuhan berdasarkan kepada

program kajian establishment yang dilakukan secara berkala, kajian guna tenaga isi rumah

yang kerap, kajian perdapatan dan perbelanjaan isi rumah dan pengumpulan statistik yang

berterusan daripada sistem pentadbiran. Melaksankan penetapan gaji minimum bukanlah suatu

perkara yang mudah. Menurut Konvensyen ILO 131 dan Cadangan 135 mengenai gaji

minimum yang merujuk khas kepada negara-negara membangun telah menyatakan bahawa

kreteria-kriteria penetapan gaji minimum adalah seperti berikut; keperluan asas pekerja dan isi

rumahnya, upah umum dalam negara, kos sara hidup, faedah keselamatan sosial, standard

hidup yang relatif dengan kumpulan sosial yang lain; dan faktor ekonomi, termasuklah

keperluan perkembangan ekonomi, tahap produktiviti, keinginan untuk mencapai dan

mengekalkan tahap tenaga kerja yang tinggi. Adalah sukar bagi Malaysia untuk menentukan

gaji minimum yang “tepat” dengan menganbil kira kewajaran yang sepatutnya diberikan untuk

setiap faktor-faktor tersebut.

Pandangan Kesatuan Pekerja

Merapatkan jurang antara kaya dan miskin serta mengurangkan kemiskinan

Beberapa negara di sekitar Malaysia telah melaksanakan peraturan gaji minimum kebangsaan

seperti Thailand dan Filipina. Walau bagaimana pun, tiada bukti kukuh untuk mengatakan

bahawa nasib pekerja-pekerja di sana lebih baik berbanding pekerja di Malaysia berikutan

penetapan gaji minimum. Sebaliknya, pendapatan pekerja di Malaysia semenjak kemerdekaan

secara konsisten telah meningkat dalam semua sektor tanpa penetapan gaji minimum

kebangsaan.

Konsep gaji minimum sering disamaertikan dengan konsep minimum living wage untuk

membolehkan pekerja memenuhi keperluan asas mereka. Apabila kita bercakap mengenai

keperluan asas, kita merujuk kepada golongan miskin, mereka yang berada di bawah

pendapatan garis kemiskinan seperti yang dinyatakan oleh Kerajaan. Istilah ‘gaji’ bermaksud

kewujudan kontrak pekerjaan antara majikan dan pekerja. Walau bagaimana pun, mereka yang

berada di bawah pendapatan garis kemiskinan selalunya tiada pekerjaan bergaji, contohnya

penduduk miskin di kawasan luar bandar.

Sekalipun peraturan gaji minimum dilaksanakan, ia tidak dapat membantu mereka yang miskin

untuk keluar dari kepompong kemiskinan memandangkan mereka bukan pekerja yang bergaji.

Jika demikian, apa perlunya gaji minimum? Pihak MTUC semestinya berpandangan bahawa ia

akan meningkatkan kadar gaji terendah, namun demikian, ia seharusnya bergantung kepada

tahap yang ditentukan sebagai gaji minimum. Perkara ini adalah sangat penting untuk

dipertimbangkan. Indonesia dan Thailand contohnya menetapkan kadar gaji minimum yang

terlalu rendah sehingga ianya tidak menggambarkan “minimum try me wage”, yang mungkin

bertujuan untuk memastikan ramai majikan mematuhinya.

Namun demikian, terdapat keburukan di sebalik kepatuhan majikan yang tinggi terhadap kadar

gaji minimum yang ditetapkan. Sesetengah majikan mungkin mampu membayar gaji yang lebih

tinggi tetapi memilih untuk tidak berbuat demikian terutamanya semasa kadar pengangguran

tinggi seperti yang sedang berlaku di Indonesia. Pandangan bahawa gaji minimum akan

meningkatkan kadar gaji terendah – adakalanya melindungi golongan yang mudah terjejas –

adalah tidak kena pada tempatnya dan tidak dapat dibuktikan.

Satu laporan Suruhanjaya Diraja di United Kingdom pada tahun 1968 menyimpulkan bahawa

perlindungan dari segi undang-undang tidak meningkatkan gaji golongan pekerja yang bergaji

rendah berbanding dengan pekerja lain. Sekalipun gaji minimum dapat meningkatkan kadar gaji

– bertentangan dengan hasil penemuan laporan – dalam situasi kurang guna tenaga penuh, ia

hanya akan menyebabkan peningkatan kadar pengangguran.

Benarkah gaji di sektor perladangan rendah?

Di bawah Perjanjian Gaji Penoreh Getah MAPA/NUPW, kenaikan gaji antara 9% dan 13% telah

diberikan dan komponen-komponen berikut dibayar kepada penoreh getah berdasarkan

prestasi mereka:

a) Komponen bulanan sebanyak RM95.00 sekiranya menoreh sekurang-kurangnya 26 tugas

sebulan

b) Komponen harian sebanyak RM13.50 satu tugas

c) Insentif sekiranya lateks melebihi 11 kg, kadar terkini adalah 73 sen per kg

d) Insentif getah sekerap basah sebanyak 20 sen per kg

e) bonus harian berdasarkan harga getah, kadar terkini RM17.60 sehari

f) Jaring keselamatan sebanyak RM350 sebulan tidak termasuk bonus harga dan insentif out

turn

Penoreh getah mampu memperoleh pendapatan serendah RM800 sebulan dan boleh

mencecah RM1,500 sebulan. Sistem gaji flexi ini adalah standing dengan sistem-sistem yang

digunakai di negara lain. Di samping itu, majikan juga menyediakan kemudahan-kemudahan

percuma seperti tempat tinggal, bekalan air dan elektrik, rawatan perubatan, asuhan kanakkanak dan tanah untuk diusahakan yang dianggarkan bernilai antara RM 350 dan RM450

sebulan. Sehubungan itu, tuduhan yang kononnya pekerja ini dibayar gaji rendah adalah tidak

berasas.

Penutup

Cadangan pelaksanaan gaji minimum kebangsaan di Malaysia adalah tidak produktif. Sistem

upah sedia ada berfungsi dengan baik dalam konteks pembangunan Negara kita. Badan-badan

yang mengawal selia pertikaian mengenai gaji telah menjalankan tugas dengan lancar dan

berkesan, manakala hubungan industri yang harmoni dapat dikekalkan sepanjang tahun.

Langkah ke hadapan yang lebih positif dalam perundingan gaji harus berpandukan kepada

mengaitkan upah dengan produktiviti. MEF sejak sekian lama menyokong sistem upah

berdasarkan produktiviti yang mengambil kira prestasi syarikat dan individu. Berdasarkan hujahhujah di atas, penetapan gaji minimum kebangsaan adalah tidak mempunyai justifikasi dan

tidak berasas.

Posted by Admin MOHR at 1:16 PM 28 comments

Labels: Gaji dan Upah

Pandangan MTUC Mengenai Gaji Minimum

Isu mengenai gaji minimum untuk pekerja di Malaysia bukanlah suatu perkara baru. MTUC

sejak bertahun-tahun telah menyuarakannya. Ianya agak rancak diperkatakan sejak beberapa

tahun kebelakangan ini. Tampaknya perjuangan untuk mendapatkan gaji minimum masih belum

membuahkan kejayaan. Tidak dapat dinafikan bahwa hal yang berkaitan dengan gaji atau

pendapatan ada kaitannya dengan perkara kemiskinan. Masih kedapatan di Malaysia bahwa

pekerja-pekerja menerima gaji pokok (basic wages) dibawah paras kemiskinan.

Kos hidup di Malaysia saban hari terus meningkat sedangkan pendapatan pekerja tidak dapat

mengimbangi perbelanjaan yang kena ditanggung. Kita tidak dapat membayangkan

bagaimanakah keadaan kehidupan pekerja nanti setelah subsidi beberapa barangan dan

perkhidmatan ditarik balik. Tanpa gaji atau pendapatan yang munasabah sudah tentulah

kehidupan mereka yang berpendapatan rendah akan menjadi bertambah teruk berbanding

dengan keadaan sebelum ini. Jelasnya, gaji mereka tetap sama namun kuasa beli yang ada

semakin merosot.

Para majikan pula, atas kehendak mereka sendiri, tidak akan menaikkan upah atau gaji

pekerja-pekerja yang bergelut untuk meneruskan kehidupan dalam keadaan yang ada sekarang

untuk menyara diri dan tanggungannya. Oleh hal yang demikian campur tangan pemerintah

dalam memperkenalkan undang-undang bagi gaji minimum adalah sangat diperlukan.Objektif

dan hasrat pemerintah Malaysia untuk mencapai Model Ekonomi Berpendapatan Tinggi agak

sukar dicapai tanpa adanya gaji minimum yang munasabah.

Banyak orang yang berkata, termasuk Menteri Sumber Manusia, bahwa pekerja tempatan tidak

mahu bekerja dengan syarikat-syarikat swasta akibat dari gaji yang ditawarkan adalah agak

rendah. Tambang untuk pergi ke tempat kerja dan balik telah meningkat. Begitu juga dengan

kos makan minum turut meningkat. Akibat dari sistem pengangkutan awam yang tidak effisien

maka ianya memaksa para pekerja menggunakan kenderaan mereka sendiri yang tentunya

akan meningkatkan kos hidup.

Dalam abad ini sepatutnya kita tidak lagi mendengar atau melihat berita bahwa pekerja masih

ditindas dan diainayai. Akan tetapi penindasan ke atas pekerja masih berlaku. Majikan masih

membayar gaji yang rendah yang tidak selaras dengan kos hidup terutama sekali bagi mereka

yang berada di Lembah Kelang. Hujah yang menyatakan bahwa: 'biarlah kuasa pasar (market

forces) menentukan paras gaji' tidak hanya membuatkan para pekerja terus ditindas malah

ianya akan memburukkan lagi taraf kehidupan mereka.

MTUC masih berpendirian bahwa pekerja di Malaysia hendaklah dibayar gaji pada paras

RM1,200 (termasuk Elaun Kos Hidup/COLA RM300) seperti mana yang telah dikemukakan

kepada pemerintah sebelum ini. Masanya sudah sampai bagi sebuah negara seperti Malaysia

yang bakal menjadi sebuah negara 'maju' tidak berapa lama lagi memperkenalkan undangundang gaji minimum. Banyak negara di dunia ini telahpun menetapkan gaji minimum sejak

lama dulu termasuk negara-negara jiran kita di rantau ini. Barang diingat bahwa gaji minimum

tidak bermakna bahwa gaji tersebut akan beku pada paras tersebut. Dalam kata mudah gaji

minimum bukanlah akan menjadi maksimum!

Posted by Admin MOHR at 10:18 AM 17 comments

Labels: Gaji dan Upah

Tuesday, February 9, 2010

Gaji Minimum

Gaji minimum mengikut definisi International Labour Organization (ILO) ialah upah minimum

yang patut dibayar kepada pekerja untuk kerja atau perkhidmatan yang dilakukan dalam

tempoh tertentu, sama ada dikira berdasarkan masa atau output, yang tidak boleh dikurangkan

sama ada oleh individu atau menerusi perjanjian kolektif, dijamin oleh undang-undang dan

ditetapkan bertujuan untuk menampung keperluan minimum kehidupan pekerja dan

keluarganya berasaskan keadaan sosio-ekonomi sesebuah negara.

Gaji minimum kebangsaan adalah ditetapkan oleh Kerajaan atau pihak tripartite (wakil kerajaan,

wakil majikan dan wakil pekerja). Ia merupakan model yang paling banyak digunakan di seluruh

dunia dan terbahagi kepada 2 kategori iaitu satu kadar seragam gaji minimum kebangsaan

untuk seluruh negara, atau kadar gaji minimum berbeza mengikut sektor / wilayah.

Posted by Admin MOHR at 11:23 AM 85 comments

Labels: Gaji dan Upah

Isu Tuntutan Pelaksanaan Dasar Gaji@Upah Minima dan Konsep dalam

Pembangunan

Kongres Kesatuan Sekerja Malaysia (MTUC) berpendirian yang dasar upah

minima prlu dilaksanakan di malaysia. Hujah yang menyokong pendirian (MTUC).

Sebagai penggubal dasar pertimbangkan hujah ini dengan hujah dari pihak

majikan.

Isu tuntutan gaji minima merupakan isu sejagat yang diperjuangkan oleh

golongan pekerja di serata dunia. Definisi upah minimum adalah penghasilan upah

yang diperoleh dari upah pokok yang bersifat tetap dengan jumlah hari kerja normal. Isu

ini bukanlah perkara baru khususnya dalam senario perhubungan perusahaan di

Malaysia.

Sejak negara mencapai kemerdekaan para pekerja merupakan tenaga

penggerak kepada pelbagai kegiatan ekonomi dan telah memainkan peranan yang

penting kepada pembangunan negara. Sumbangan pekerja kepada perkembangan

ekonomi negara dan kemajuan pembangunan adalah tidak dinafikan dan kerajaan

sentiasa memberikan pengiktirafan kepada sumbangan mereka melalui dasar-dasar

kerajaan yang telah dan sedang dilaksanakan. Dalam konteks ini, isu gaji minimum

telah menarik perhatian banyak pihak di negara ini khususnya pihak Kongres

Kesatuan Sekerja Malaysia (MTUC) yang telah menggesa pihak kerajaan agar

memperkenalkan skim gaji permulaan untuk para pekerja sektor swasta. Pendebatan

tentang gaji minimum adalah merupakan satu isu negara dan perkara ini harus dikaji

secara mendalam untuk kepentingan para pekerja, syarikat dan pertumbuhan ekonomi

Negara.

Dalam hal ini, tidak terdapat undang-undang upah minimum kebangsaan yang

dikenakan kepada sektor perkilangan mahupun perladangan di Malaysia. Upah asas

berbeza mengikut lokasi dan sektor perindustrian, manakala faedah tambahan, yang

boleh merangkumi bonus, pakaian seragam percuma, pengangkutan percuma atau di

beri subsidi, insentif prestasi dan faedah-faedah lain, berbeza dari syarikat ke syarikat

lain. Manakalag gaji dan faedah-faedah sampingan yang ditawarkan kepada pihak

pengurusan dan eksekutif juga berbeza mengikut industri dan dasar penggajian syarikat.

Kebanyakan syarikat memberi rawatan perubatan percuma, perlindungan kemalangan

diri dan insurans hayat, pengangkutan percuma atau diberi subsidi, bonus tahunan,

faedah persaraan dan caruman tertingkat kepada Kumpulan Wang Simpanan Pekerja.

Kongres

Kesatuan Sekerja Malaysia (MTUC) mengenal pasti beberapa sektor

pekerjaan dalam sektor pembuatan dan perladangan yang tidak memenuhi peraturan

gaji minimum mengikut pasaran. Melalui pendirian MTUC, Pengerusi Kongres Kesatuan

Sekerja Malaysia (MTUC) Pulau Pinang, Abdul Razak Abdul Hamid iaitu menyelesaikan

masalah gaji minimum RM900 dan elaun pekerja (cola) dinaikkan ke RM300. MTUC

telah mengadakan perbincangan untuk menaikan gaji masa kini yang dianggap di

bawah paras kemiskinan kerana ramai pekerja sektor perkilangan khususnya masih

menikmati gaji yang amat rendah berbanding pengumuman kerajaan bagi sektor awam

Negara. MTUC juga mendesak pihak kerajaan untuk melaksanakan undang-undang

upah minima supaya pekerja yang tertindas dijamin pendapatan bulanan yang lebih

terjamin dan munasabah. Namun, semua masalah ini diabaikan oleh pihak kerajaan.

Selain itu, Sistem Upah Berkait Produktiviti (SUBP) juga dipesoalkan kerana ada

sesetengah syarikat yang tidak melaksanakan sistem ini. Sistem ini merupakan satu

sistem perubahan upah yang berkait dengan kemahiran dan dihubungkan dengan

produktiviti output. Oleh itu, setiap peningkatan upah melalui kemahiran harus disertai

dengan peningkatan produktiviti output yang tinggi. Dengan ini, daya saing syarikat

dapat diperkukuhkan dan pekerja mendapat jaminan pekerjaan dan upah minimum yang

setimpal dengan kemahiran mereka. Namun tahap pelaksanaan Sistem ini dalam

syarikat-syarikat swasta di Malaysia tidak begitu menggalakkan.

Sebagai Pengubal Dasar yang juga merupakan pihak kerajan dan pemerintah,

adalah sukar bagi pengubal dasar untuk melaksanakan upah minimum kerana kadar

gaji sektor swasta di negara ini ditentukan mengikut kuasa pasaran. Penetapan ini

dibuat berdasarkan kepada permintaan dan penawaran. Ini bagi memastikan negara

sentiasa kompetitif dalam persaingan ekonomi diperingkat global. Melalui Institute for

Management Development (IMD) World Competitiveness Yearbook pada tahun 2007

melaporkan bahawa kedudukan Malaysia adalah di tempat ke-23 daripada 55 buah

negara dari aspek daya saing. Berdasarkan kepada laporan tersebut, kedudukan ini

perlu diperbaiki dan peningkatan kos tanpa peningkatan produktiviti perlu dielakkan.

Antara cara yang digunakan oleh kerajaan dalam penetapan gaji adalah melalui kuasa

pasaran, Perjanjian Kolektif dan Majlis Penetapan Gaji (MPG). Majlis Penetapan Gaji

ditubuhkan di bawah Akta Majlis Penetapan Gaji 1947 bagi golongan pekerja yang

mudah terjejas iaitu yang bekerja di sektor di mana tiada satu mekanisma yang

berkesan dalam menetapkan gaji dan syarat pekerjaan. Sehingga kini, kerajaan telah

menubuhkan 11 MPG yang akan menetapkan gaji minima dan syarat-syarat pekerjaan

bagi golongan pekerja dalam sektor-sektor yang ditentukan. Kerajaan akan sentiasa

mengkaji dan menentukan gaji minima mengikut sektor pekerjaan pembuatan dan

perladangan, sekiranya terdapat keperluan untuk penubuhan tersebut. Kerajaan

berpendapat bahawa penetapan gaji minima kebangsaan (National MinimumWage)

untuk semua sektor pekerjaan adalah kurang wajar pada masa ini kerana peningkatan

kos dalam menjalankan perniagaan di Malaysia akan menjejaskan daya saing negara

dalam menarik pelaburan asing ke Malaysia dan mengekalkan pelabur-pelabur

sedia ada. Selaras dengan hasrat agenda pembangunan negara, kerajaan sedang

mempromosikan sistem upah yang dikaitkan dengan produktiviti (Productivity Linked

Wages System- PLWS). Dasar ini bertujuan menjamin daya saing negara di samping

menyumbang kepada peningkatan kualiti hidup pekerja.

Dalam hal ini, isu berkenaan Upah Minima amatlah penting untuk difahami oleh

massyarakat terutamanya sumber tenaga manusia di Malaysia yang merupakan

pemangkin kepada pertumbuhan ekonomi Negara. Pada pendapat saya, Dasar Upah

Minima harus dilaksanakan di Malaysia dan juga di Negara-negara lain berdasarkan

keadaan ekonomi, politik , sosial, pasaran dunia, kuasa beli, infrastruktur, pendidikan,

dan sumber bahan mentah (input) di Malaysia pada masa kini mahupun Negara lain.

Jika dilihat dari segi pertumbuhan ekonomi, eksport Malaysia dijangka akan terus kukuh

dalam tempoh Rancangan Malaysia Kesembilan (RMK-9) berdasarkan unjuran

pertumbuhan ekonomi dunia yang dijangka berkembang pada kadar 4.3 peratus

setahun dalam tempoh tahun 2006-2010. Eksport barangan perkilangan dijangka

berkembang pada kadar purata 9.3 peratus setahun dalam tempoh RMK-9 dengan

perolehan eksport meningkat daripada RM429.9 bilion pada tahun 2005 kepada

RM670.8 bilion pada tahun 2010. Eksport utama barangan perkilangan termasuk

barangan elektrik dan elektronik, kimia dan keluaran kimia, keluaran petroleum,

makanan, tekstil, pakaian dan kasut, keluaran kayu, keluaran logam serta kelengkapan

pengangkutan.

Pertumbuhan

eksport

barangan

perkilangan

menggambarkan

pengembangan berterusan permintaan daripada pasaran tradisional, baru dan bukan

tradisional seperti China, India dan Eropah Timur.

Selain itu, eksport sektor

pertanian pula dijangka berkembang pada purata 8 peratus setahun hasil pertumbuhan

positif nilai eksport getah, minyak sawit, koko dan keluaran perhutanan serta keluaran

makanan.

Manakala itu, masalah lambakan pekerja asing juga menyebabkan kadar

kenaikan gaji pekerja berpendapatan rendah pada kadar perlahan yang sebahagian

besarnya disebabkan oleh lambakan pekerja asing di Malaysia. Berdasarkan Kumpulan

Pemerhati Makro, Universiti Utara Malaysia (UUM), Prof. Madya Dr. Asan Ali Golam

Hassan, sejak akhir 1980-an terutamanya dalam tempoh 1990-1995 struktur ekonomi

Malaysia berubah kepada perindustrian dan telah tumbuh dengan pesat sekitar 8.4

peratus setahun. Ia lebih tinggi daripada sasaran Rangka Rancangan Jangka Panjang

Kedua (1991-2000) iaitu sebanyak 7 peratus setahun dan guna tenaga dalam sektor

perindustrian meningkat dengan mendadak daripada 542,817 orang pada tahun 1980

kepada 2.6 juta pada 2000. Dalam masa yang sama sektor pertanian menjadi semakin

kurang menarik kepada pekerja tempatan dan sebahagian besar mereka berpindah

kepada sektor perindustrian dan perkhidmatan. Guna tenaga meningkat sekitar 3.4

peratus manakala tenaga buruh tempatan hanya meningkat sebanyak 2.9 peratus

mengakibatkan berlaku kekurangan dalam penawaran buruh ketika itu. Untuk mengatasi

masalah tersebut, kerajaan membuka ruang kepada kemasukan pekerja asing. Pada

tahun 1995, pekerja asing meliputi 35 peratus daripada tenaga pekerja di Malaysia.

Dalam tempoh Rancangan Malaysia Ketujuh (1995-2000) penduduk Malaysia

meningkat pada kadar 2.3 peratus setahun manakala penduduk asing (bukan

warganegara) pula meningkat pada kadar 4.3 peratus setahun. Pada 2005, penduduk

asing meliputi 7.6 peratus daripada jumlah penduduk yang berada ketika umur bekerja

di Malaysia, tidak termasuk penduduk asing tanpa izin.

Kemasukan pekerja asing yang terdiri daripada pekerja tidak mahir terutamanya

dalam sektor pertanian dan perindustrian memperlahankan upah dalam sektor tersebut

daripada meningkat. Keadaan ini, menyebabkan upah pekerja tidak mahir dalam

kalangan penduduk tempatan meningkat pada kadar yang jauh lebih rendah daripada

kadar peningkatan pendapatan per kapita negara, dan seterusnya meluaskan jurang

perbezaan pendapatan dalam ekonomi. Kemasukan mereka secara beramai-ramai akan

merendahkan secara relatif upah pekerja tidak mahir sementara upah pekerja mahir dan

pulangan pemilik modal terus meningkat. Akibatnya, jurang perbezaan pendapatan

dalam masyarakat akan melebar dan pergantungan yang tinggi kepada pekerja asing

bukan sahaja menyebabkan faktor upah pekerja tidak mahir menjadi tegar (rigid) dan

peningkatan aliran keluar ringgit Malaysia malah lambakan pekerja asing juga akan

terus menambahkan bilangan isi rumah miskin di bandar. Misalnya, menurut Rancangan

Malaysia Ketujuh, 1996-2000, kira-kira 12 peratus (atau 11,300 isi rumah) daripada

jumlah isi rumah miskin di kawasan bandar di negara ini adalah terdiri daripada

warganegara asing. Malah, sebahagian yang agak besar daripada penempatan

setinggan di kawasan bandar, khususnya di Kuala Lumpur, telah menjadi tumpuan

penempatan penduduk asing.

Untuk mengurangkan kesan lambakan pekerja asing yang menyebabkan upah

pekerja tidak mahir menjadi tegar kerajaan mungkin boleh memikirkan peraturan

berkaitan dengan tingkat gaji minimum dan nisbah (ratio) pekerja asing. Tingkat gaji

minimum bagi pekerja tempatan seharusnya lebih tinggi dari tingkat gaji minimum

pekerja asing bagi pasaran pekerjaan untuk pekerja tidak mahir dan separa mahir. Ini

bagi membolehkan buruh tempatan mendapat kos sara hidup mencukupi dengan

peningkatan harga barangan minyak dan krisis makanan dunia yang berlaku pada masa

sekarang.

Konsep Produktiviti, Pindahan Teknologi, Pelaburan Langsung Asing dan

Pertumbuhan

dan

Pembangunan

Ekonomi.

1. Produktiviti

Produktiviti merupakan suatu isu yang semakin diberi perhatian, pelbagai faktor

digunakan bagi mendapatkan pengukuran tahap produktiviti yang sesuai digunakan di

bahagian pengeluaran. Konsep Produktuviti ialah nilai atau kuantiti output yang dapat

dihasilkan oleh satu unit input. Output adalah keluaran atau perkhidmatan yang

dihasilkan oleh sesebuah organisasi yang mengeluarkan Keluaran dan Perkhidmatan.

Manakala, input merupakan sumber-sumber yang digunakan

untuk menghasilkan

output. Input merangkumi Tenaga Manusia, Teknologi, Kelengkapan, Modal dan Sistem

Pengurusan. Terdapat banyak faktor yang mempengaruhi Produktiviti antaranya adalah

tenaga manusia, modal, input, teknologi, persekitaran pekerjaan, pengurusan, struktur

organisasi, system dan prosedur. Melalui tenaga manusia iaitu buruh untuk

meningkatkan produktiviti dengan melatih kakitangan dalam bidang-bidang berkaitan,

memotivasikan kakitangan supaya menghasilkan kerja dengan cemerlang dengan

pemberian bonus,kenaikan pangkat dan gaji, menggalakan penglibatan kakitangan

dalam penentuan matlamat organisasi dan dalam penyelesaian masalah produktiviti dan

mewujudkan komunikasi yang berkesan dalam jabatan atau pejabat.

Dengan adanya modal, syarikat dapat menyelenggara kelengkapan modal mengikut

jadual, menentukan kelengkapan modal berada dalam persekitaran operasi yang baik,

dan merancang penggunaan kelengkapan supaya semuanya dapat digunakan dengan

optimum. Dengan adanya input pula, syarikat boleh menjalankan pemeriksaan kualiti

pada bahan-bahan input yang diperolehi daripada pembekal, memberi pendidikan kualiti

kepada pembekal dan mengamalkan sistem inventori yang baik untuk mengelakkan

pemegangan

stok

yang

berlebihan

bagi

bahan-bahan.

Selain

itu,

teknologi

membolehkan produktiviti pengeluaran output secara cekap dan berkesan, pengeluaran

secara besar-besaran (mass production), berlaku pengkhususan kerja yang mana

membolehkan pekerja menjadi mahir dalam bidang tertentu dan pengeluaran semakin

meningkat.

2. Pindahan Teknologi

Pemindahan teknologi adalah selaras dengan dasar kerajaan supaya syarikatsyarikat di Malaysia mengenalpasti mana-mana teknologi yang sesuai dan terkini yang

boleh dipindahkan ke negara ini supaya dapat menyumbang kepada peningkatan

keupayaan industri, terutamanya dengan pembelian keupayaan sedia ada dalam

syarikat-syarikat tempatan. Pemindahan teknologi mesti ditambah dengan keupayaan

tenaga manusia dalam syarikat-syarikat tempatan dan inisiatif tempatan untuk

memahirkan dan mengoperasikan teknologi yang diperolehi itu serta menggalakkan

inovasi dalaman dalam syarikat. Pindahan teknologi tidak sepatutnya dianggap sebagai

penerima teknologi asing secara langsung dan terus bergantung kepada pihak luar

untuk meningkatkan keupayaan teknologi itu. Pihak syarikat dan kerajaan perlu ada

rancangan dan program komprehensif untuk memanfaatkan pindahan teknologi

tersebut. Dengan mengadakan latihan-latihan bersesuaian kepada sumber manusia

atau buruh tempatan serta menyediakan kemudahan-kemudahan untuk jurutera dan

para juruteknik tempatan untuk mempelajari apa skill yang diperlukan dari pindahan

teknologi tersebut. Lebih-lebih lagi pindahan teknologi bukan semata-semata bererti

pembelian loji, mesin dan jentera tetapi melibatkan kepakaran, pengetahuan serta

kemahiran-kemahiran yang berkaitan secara langsung dengan loji dan peralatan yang

dibeli itu. Pindahan teknologi mesti melibatkan program penerapan (absorption)

pengetahuan dan kemahiran yang secara terus akan meningkatkan keupayaan tenaga

manusia dalam syarikat-syarikat yang menerima pindahan teknologi.

3. Pelaburan Langsung Asing

Pelaburan langsung asing (PLA) memberi kesan ke atas pembangunan ekonomi

menjadi tumpuan syarikat luar negara untuk melabur ke pasaran malaysia. PLA

dipercayai mendatangkan kesan positif kepada negara penerima atau negara

tuanrumah dalam bentuk sumber modal, kemahiran pengurusan, teknologi dan

ekonomi.

Walau

bagaimanapun,

ada

juga

pendapat

yang

mengatakan

PLA

mendatangkan kesan yang tidak diingini kepada imbangan pembayaran. PLA

meningkatkan jumlah pekerjaan, menyediakan akses kepada pasaran eksport dan

aktiviti penyelidikan dan pembangunan. Walau bagaimanapun, ada kalanya ia

menyebabkan defisit dalam imbangan pembayaran negara. Keputusan yang diperolehi

menyatakan bahawa, jika negara ingin mengekalkan pertumbuhan ekonomi, lebih

banyak tumpuan perlu diberikan kepada sektor eksport, meningkatkan produktiviti buruh

dan menggerakkan tabungan domestik, berbanding dengan terlalu bergantung kepada

modal asing. Daripada keputusan yang diperolehi, diharap ia dapat dijadikan panduan

kepada pembuat-pembuat polisi bagi merancang dan memastikan PLA yang memasuki

Malaysia dapat dioptimakan faedahnya bagi kepentingan negara.

Sebagai contoh berdasarkan sumber Kementerian Perdagangan Industri dan

Antarabangsa, pada tahun 2007, jumlah pelaburan langsung asing yang diterima oleh

Malaysia dari segi projek perkilangan yang diluluskan adalah sebanyak US$9.7 bilion,

iaitu yang ketiga tertinggi di kalangan sepuluh negara ASEAN selepas Indonesia dengan

US$20 bilion dan Viet Nam sebanyak US$10.4 bilion. Pelaburan langsung asing utama

ke kedua-dua negara ini adalah tertumpu kepada industri petroleum dan kimia,

berbanding Malaysia yang menerima pelaburan langsung asing paling besar dalam

industri elektrik dan elektronik. Negara-negara destinasi utama pelaburan langsung

asing ASEAN yang lain seperti Singapura , Thailand dan Filipina masing-masing

mencatatkan US$9.5 bilion, US$9.0 bilion dan US$2.0 bilion. Sektor-sektor industri yang

digalakkan di Malaysia adalah sektor yang memberi nilai tambah tinggi, berteknologi

tinggi dan berintensifkan modal.

4. Pertumbuhan Ekonomi dan Pembangunan

Pertumbuhan dan pembangunan ekonomi adalah dua konsep yang tidak dapat

dipisahkan. Pembangunan bermatlamat menentukan usaha pembangunan yang

berterusan dan tidak memusnah dan memupuskan sumber asli. Manakala teori dan

model pertumbuhan yang dihasilkan dijadikan panduan dan penggubalan dasar negara.

Konsep pembangunan dikupas dalam teori pertumbuhan dan pembangunan dan cuba

menganalisa

secara

kritikal

dengan

melihttp://tomorrowiscertain.blogspot.com/2011/02/isu-tuntutan-pelaksanaan-dasargajiupah.htmlhat kesesuaiannya dalam konteks negara. Walaupun tidak semua teori

atau model dapat digunakan, perbincangan mengenai peranan faktor pengeluaran

termasuk buruh, tanah, modal, pengusaha, teknologi dan pengurusan boleh

menjelaskan sebab-sebab berlakunya ketiadaan pembangunan dalam sebuah negara.

Pada peringkat awal, pendapatan per kapita menjadi pengukur utama bagi

pembangunan.

Walau bagaimanapun, melalui perubahan masa, aspek pembangunan manusia,

kesihatan, pendidikan dan pembangunan lestari semakin ditekankan. Pembangunan

lestari (sustainable development) melihat kepada aspek kebajikan generasi akan datang

melalui kehendak masa kini. Ini, diandaikan bahawa konsep pembangunan dan

pertumbuhan tidak ditafsirkan dari perspektif ekonomi semata-mata, malah merangkumi

pelbagai disiplin seperti pendidikan, perindustrian dan perkhidmatan.

Thanks to Cik Zainab Wahidin

Posted by Sky Juice at 1:51 AM

http://tomorrowiscertain.blogspot.com/2011/02/isu-tuntutan-pelaksanaan-dasargajiupah.html

Sumber-sumber lain

http://www.mtuc.org.my/memobmcola18jun07.pdf

Perlaksanaan Gaji Minimum Di Malaysia: Suatu Pandangan

Oleh: Rafzan Ramli

Sejak kebelakangan ini, kita sering terdengar dan terbaca didalam media cetak dan

elektronik mengenai tuntutan agar seseorang pekerja menerima gaji minimum. Badanbadan yang berkaitan seperti Kongress Kesatuan Sekerja Malaysia (MTUC), Kongres

Kesatuan Pekerja-Pekerja Dalam Perkhidmatan Awam (CUEPACS) dan beberapa

Pertubuhan Bukan Kerajaan (NGO) dengan lantang menyuarakan tuntutan agar dasar

gaji minimum dilaksanakan. Tuntutan ini dirasakan semakin releven apabila Perdana

Menteri merealisasikan tuntutan CUEPACS dengan mengeluarkan kenyataannya dalam

perhimpunan hari pekerja kakitangan awam di Putrajaya pada 21 May 2007 mengenai

kenaikan gaji pokok dan elaun bulanan kakitangan awam sebanyak 7.5% hingga 35%

yang akan berkuatkuasa pada 1 Julai 2007. Harus difahami bahawa pengumuman

kenaikan gaji dan elaun kakitangan awam yang dikeluarkan oleh Perdana Menteri ini

bukanlah satu gagasan atau dasar gaji minimum yang diperjuangkan oleh MTUC atau

badan-badan organisasi yang lain.

Mengikut takrifan polisi gaji minimum yang dikeluarkan oleh “International Labour

Organization” atau ILO, gaji minimum adalah satu amaun minimum yang ideal, yang

harus dibayar oleh majikan kepada pekerjanya bersesuaian dengan keperluan minimum

harian seseorang pekerja dan keluarganya. Kadar gaji minimum juga haruslah selari

dengan keadaan ekonomi dan sosial semasa sesebuah negara. Bayaran yang dibuat

adalah mengikut kadar kiraan bulanan, harian atau jam. Kira-kira lebih 90% negara di

seluruh dunia mengamalkan dasar gaji minimum yang bersesuaian dengan sistem

ekonomi negara masing-masing. Ada diantaranya telah menguatkuasakan dasar gaji

minimum seawal tahun 1900-an. Negara Australia umpamanya telah menguatkuasakan

dasar gaji minimum seawal 1904, manakala negara Amerika Syarikat pula telah

mempunyai dasar gaji minimum pada tahun 1938. Dasar gaji minimum ini bukan sahaja

diterimapakai di negara-negara maju, malahan ia turut dilaksanakan di negara-negara

dunia ketiga seperti Korea Selatan dan Sri Lanka.

Terdapat pelbagai kebaikan sekiranya dasar gaji minimum yang ideal dan manusiawi

dapat dikuatkuasakan. Jika diukur daripada takrifan polisi gaji minimum yang

dikeluarkan oleh ILO, ia sangat jelas menunjukkan bahawa dasar gaji minimum dapat

digunakan sebagai kunci bagi menangani masalah kemiskinan serta dapat

meningkatkan pendapatan bagi pekerja yang bergaji rendah. Ini secara tidak langsung

dapat meningkatkan kualiti hidup seseorang pekerja dan keluarganya.

Dasar ini bukan sahaja memberi kebaikan kepada pekerja semata-mata, malahan ia

juga memberi kesan positif kepada pembangunan ekonomi sesebuah negara. Ini adalah

kerana dasar gaji minimum boleh meningkatkan kuasa beli dan kadar belanjawan

pekerja. Sebagai contoh, pekerja yang berpendapatan rendah sebelum ini, dapat

memperuntukkan gajinya untuk berbelanja dan bercuti bersama keluarga. Selain itu,

kebergantungan pekerja terhadap kerajaan juga akan berkurangan bilamana dengan

pendapatan yang sesuai dengan keadaan semasa ekomoni serta sosial negara, maka

pekerja dapat mengatasi beban kewangan yang ditanggung serta tidak bergantung

kepada dasar kebajikan kerajaan semata-mata. Kesannya, pihak kerajaan mempunyai

peruntukan dana yang lebih untuk disalurkan kepada sektor yang lebih mendesak serta

memerlukan.

Dari perspektif hak asasi manusia pula, Perkara 23 Perisyitiharan Hak Asasi Manusia

Sejagat 1948 (UDHR) menyatakan, setiap orang tanpa sebarang pembezaan, adalah

berhak kepada penggajian yang sama bagi kerja yang sama. Semua orang juga berhak

kepada saraan yang adil dan berfaedah yang dapat memastikan diri dan keluarganya

mendapat suatu kehidupan yang wajar dan manusiawi. Justeru, dalam konteks pekerja

asing umpamanya, pelaksanaan gaji minimum dapat mengelakkan eksploitasi majikan

yang memberikan kadar upah yang amat rendah kepada pekerja asing seperti yang

berlaku pada masa ini. Secara tidak langsung, gaji yang adil dan saksama juga

menjamin seseorang pekerja itu dapat memenuhi tuntutan keperluan asasnya yang lain

seperti hak terhadap tempat kediaman yang wajar, hak untuk berehat dan berekreasi

serta hak kepada kemudahan kesihatan dan jaminan sekuriti sosial, ini semua

merupakan hak asasi setiap individu yang harus dijamin serta dilindungi oleh sesebuah

negara.

Sungguhpun dasar gaji minimum ini dikatakan banyak membawa kesan positif, terdapat

juga beberapa pihak yang membantah perlaksanaan dasar ini. Persekutuan Majikan

Malaysia (MEF) umpamanya, berpendirian bahawa penetapan gaji para pekerja di

sektor swasta berkait rapat dengan prestasi syarikat. Pastinya, bagi sesebuah syarikat

korporat, produktiviti serta keuntungan syarikat merupakan aspek utama yang

mempengaruhi kadar penetapan gaji kakitangan mereka. Sungguhpun demikian,

adakah wajar sekiranya atas dasar produktiviti dan prestasi, maka pengawal

keselamatan umpamanya diberi ganjaran gaji serendah RM400 disesetengah syarikat

swasta? Bagaimanakah 10.3 juta rakyat malaysia yang bekerja di sektor swasta

berupaya menampung kehidupan mereka sedangkan mereka ini tidak diberikan kadar

pendapatan yang manusiawi dan wajar? Bukankah ini akan hanya membunuh

produktiviti para pekerja serta menurunkan minat pekerja untuk menyertai sektor swasta

di negara ini. Sepertimana kenyataan Timbalan Menteri Kementerian Sumber Manusia,

Datuk Abdul Rahman Bakar baru-baru ini di dalam media, para majikan perlulah sensitif

kepada para pekerjanya terutama sekali dengan mereka yang terlibat dengan pekerjaan

yang berbahaya, kotor dan sukar.

Perjuangan bagi merealisasikan dasar gaji minimum di negara ini adalah satu

perjuangan yang besar dan panjang. Ia tidaklah hanya melibatkan pihak yang memberi

dan merima gaji semata-mata. Ia melibatkan pelbagai pihak.Pihak yang

bertanggungjawab seperti MTUC yang mewakili kelompok besar kelas pekerja haruslah

memainkan peranan yang aktif dalam memperjuangkan kempen-kempen gaji minimum.

Bagi memperjuangkan satu amaun gaji minimum yang ideal, MTUC sebagai contoh,

haruslah melihat dan mempertimbangkan dasar ini dari pelbagai sudut. Kajian yang

terperinci mestilah dilakukan sebelum mengadakan sebarang tuntutan. Hasil dari

perbincangan saya bersama wakil UNISON, Dave Watson, di Scotland beberapa bulan

yang lalu, beliau memberitahu bahawa perjuangan bagi merealisasikan tuntutan dasar

gaji minimum di United Kingdom ini telah mengambil masa selama lebih sepuluh tahun.

Ini termasuklah usaha meningkatkan kefahaman pimpinan kesatuan sekerja serta akar

umbi mengenai kepentingan serta cabaran-cabaran dalam melaksanakan dasar gaji

minimum. Kempen mengenai kepentingan dasar gaji minimum mestilah dilakukan

secara konsisten dan haruslah tersebar kesemua lapisan masyarakat. Beliau juga

menegaskan bahawa kajian-kajian yang terperinci haruslah dilakukan dengan

melibatkan pelbagai pihak. The Scottish Low Pay Unit (SLPU), sebuah organisasi

independen, merupakan antara penggerak utama usaha melobi pelaksanaan gaji

minimum di sana bilamana organisasi ini telah melahirkan kajian-kajian penting yang

mengaitkan isu gaji pekerja yang rendah dengan kadar kemiskinan di Scotland, lantas

mengukuhkan lagi gerakan memperjuangkan dasar gaji minimum di Scotland.

. . . Perundingan serta perbincangan yang serius bersama pakar-pakar ekonomi dan

golongan intelektual serta akademik haruslah dilakukan bagi memutuskan satu

anggaran siling pendapatan yang ideal bagi seseorang pekerja. Tidak hanya dengan

meletakkan suatu kadar secara sembrono, perbincangan ini mestilah turut meliputi

aspek-aspek yang lebih luas seperti kos sara hidup mengikut kedudukan demografi,

pecahan guna tenaga mengikut kemahiran, umur dan faktor-faktor lain yang relevan.Ini

adalah supaya sebarang syor mengenai dasar gaji minimum dapat diperkukuhkan agar

berupaya meyakinkan pihak kerajaan bahawa dasar ini sememangnya wajar dan

diperlukan di Malaysia. Perundingan dan perbincangan bersama pihak kerajaan

mestilah dilakukan dengan aktif dan berterusan.

Dasar gaji minimum tidak dapat lari dari aspek perundangan. Matlamat pelaksanaan

dasar gaji minimum ini mestilah direalisasikan melalui penguatkuasaan undang-undang

oleh kerajaan. Peruntukan mengenai pembayaran gaji yang terkandung di dalam Akta

Pekerja 1955 haruslah dikaji serta dipinda. Dasar gaji minimum ini pula mestilah digubal

menjadi satu akta Parlimen. Adalah diharapkan agar kesatuan sekerja dapat berbincang

bersama badan undang-undang seperti Majlis Peguam ke arah melahirkan dasar gaji

minimum yang berkesan dari sudut perundangan. Dalam hal ini, inisiatif yang diambil

oleh gerakan wanita merangka rang undang-undang alternatif bagi menangani

gangguan seksual sebagai salah satu strategi untuk melobi penggubalan undangundang gangguan seksual, bolehlah dicontohi oleh golongan pekerja dalam meneruskan

usaha menggesa kerajaan melaksanakan dasar gaji minimum.

Agenda dasar gaji minimum mestilah disebar secara aktif di segenap lapisan pekerja.

Setiap hasil perbincangan yang dipersetujui mestilah disebarluas melalui penulisan di

media. MTUC dan badan-badan lain harus bijak mendapatkan ruang di dalam media

cetak dan elektronik bagi menyebarkan agenda dasar gaji minimum ini. Kesatuan

sekerja yang bernaung di bawah MTUC pula haruslah menyebarkan kepada semua

pekerja mengenai dasar gaji minimum dengan menggunakan bahasa yang mudah

difahami. Bagi pekerja yang tidak mempunyai kesatuan pula, mereka ini tidak harus

dipinggirkan dan menjadi tugas MTUC untuk menyebarkannya kepada golongan ini. Ini

adalah bagi memastikan agar perjuangan menuntut dasar gaji minimum di Malaysia

tidak hanya dipelopori oleh pimpinan atasan kesatuan sekerja semata-mata bahkan

perjuangan ini haruslah menyeluruh dan melibatkan semua lapisan pekerja.

Kesimpulannya, adalah menjadi satu anugerah yang tidak ternilai untuk para pekerja di

negara ini jika dasar gaji minimum dapat dikuatkuasakan oleh kerajaan. Namun begitu,

bagi memastikan dasar ini tidak menjadi edisi “tangkap muat” terbaru kerajaan,

penguatkuasaan gaji minimum haruslah berteraskan dasar yang melindungi hak pekerja

dengan mekanisme penguatkuasaan yang adil dan telus. Pelaksanaan dasar gaji

minimum di Malaysia mampu mencatat satu sejarah penting dalam gerakan pekerja

seterusnya menjadi nadi penting kepada perjuangan pekerja yang seterusnya.

Rafzan Ramli adalah salah seorang bekas aktivis Mahasiswa yang masih lagi

dibicarakan dalam kes ISA 7.

http://aminiskandar.wordpress.com/2007/06/18/perlaksanaan-gaji-minimum-di-malaysiasuatu-pandangan/

Perspektif KPRU: Kewajaran Pelaksanaan Gaji Minimum

October 9, 2010 by kpru2010 Leave a Comment

Dewan Rakyat akan bersidang semula pada 11 Oktober 2010. Menjelang persidangan Parlimen

kali ini, kita sering terbaca paparan-paparan berita yang mengatakan bahawa kerajaan akan

mengemukakan dasar berhubung gaji minimum. Apabila ditinjau kembali sejarah, tuntutan gaji

minimum oleh golongan pekerja bukanlah sesuatu yang baru, cuma tindakan berlainan diambil

oleh pemerintah berdasarkan pertimbangan politik dan keperluan semasa.

Kali terakhir gesaan sebegitu dibuat secara besar-besaran adalah pada 18 Jun 2007. Ketika itu,

Kongress Kesatuan Sekerja Malaysia (MTUC) menghantar satu memorandum kepada Perdana

Menteri Tun Abdullah Ahmad Badawi untuk menuntut gaji minimum RM900 dan Elaun Kos

Hidup RM300.

Sebelum itu, pada 21 September 2006, Jaringan Rakyat Bertindak (JERIT), sebuah pertubuhan

bukan kerajaan, juga menganjurkan satu piket yang melibatkan lebih 1,500 pekerja kilang dari

seluruh Malaysia. Mereka hadir ke Parlimen untuk menghantar lebih 50,000 kad tuntutan yang

menuntut Perdana Menteri supaya menggubal Akta Gaji Minimum serta undang-undang yang

menjamin hak pekerja. Kedua-dua desakan langsung tidak dihiraukan oleh kerajaan, malah

ramai penuntut gaji minimum tersebut diserbu dan direman oleh polis.

Anehnya, pendirian kerajaan berubah secara drastik pasca 8 Mac 2008. Daripada pengabaian

terhadap tuntutan gaji minimum,, kerajaan kini bertukar menjadi ”rakan seperjuangan” para

pekerja dan tidak bersabar-sabar memperkenalkan dasar gaji minimum. Pemuda UMNO/BN

juga sibuk merancang forum awam bersama MTUC bagi ”memperjuangkan” pelaksanaan gaji

minimum, seakan-akan terlupa pihak mana terlibat dengan penyekatan pertumbuhan gaji dan

penambahbaikan kebajikan pekerja selama empat dekad![1]

Perkembangan baru-baru ini jelas menunjukkan bahawa perubahan sikap pemerintah tidak

berlaku secara tiba-tiba. Perubahan ini merupakan produk PRU-12 dan hasil perjuangan

pelbagai pihak termasuk kesatuan sekerja, pertubuhan bukan kerajaan, pihak pembangkang

dan lain-lain. Tanpa peniupan angin perubahan yang kencang sehingga mengubah landskap

politik Malaysia, segala perkembangan sebegini mustahil berlaku.

Pasca 8 Mac, Kita bukan sahaja menyaksikan pembentangan Manisfesto Pakatan Rakyat yang

dicorakkan oleh wacana gaji minimum, tetapi juga pelaksanaan dasar berkaitan oleh Kerajaan

Selangor. Kini giliran Kerajaan Persekutuan untuk melaksanakan dasar tersebut.

Bagi sesetengah pihak yang masih mempunyai keraguan terhadap pelaksanaan gaji minimum,

mungkin analisis kepada persoalan berikut dapat menyakinkan anda: Adakah pelaksanaan gaji

minimum membawa faedah kepada pihak pekerja, perniagaan dan pertumbuhan ekonomi

negara? Mengapakah gaji minimum harus dilaksanakan di Malaysia?

Sebab utama pelaksanaan gaji minimum adalah pendapatan pekerja di Malaysia masih rendah

dan sudah lama berada pada tahap hampir beku (stagnation). Mengikut Laporan Model

Ekonomi Baru, sebanyak 40% isi rumah di Malaysia yang berpendapatan kurang daripada

RM1,500 sebulan.[2] Selain itu, kira-kira 442,000 orang atau 34% daripada 1.3 juta pekerja

tempatan memperoleh pendapatan bulanan di bawah Pendapatan Garis Kemiskinan (PGK)

iaitu RM720 sebulan.[3] Tambahan lagi, Malaysia telah mengalami stagnasi produktiviti di mana

mengikut kajian Bank Dunia, pertumbuhan gaji sebenar di Malaysia hanya mencatatkan

pertumbuhan 2.6% dari tahun 1994 hingga 2007. [4]

Malaysia juga mengalami cabaran dari segi jurang pendapatan yang semakin luas. Pendapatan

isi rumah 40% terendah hanya mencapai 1/7 daripada 20% isi rumah tertinggi, dan lebih kurang

4 juta warga Malaysia hidup di bawah purata tahap KNK iaitu AS$7,600 setiap tahun atau

RM2,200 setiap bulan.[5] Oleh yang demikian, pelaksanaan gaji minimum adalah kritikal untuk

mengurangkan jurang pendapatan golongan berlainan dalam strata masyarakat tanpa mengira

kaum, di samping mengimbangi gaji sebenar (real wage) yang tidak mencatatkan peningkatan

signifikan dalam tempoh 10 tahun yang lalu.

Dengan kata lain, penetapan gaji minimum bukan sahaja dapat dilihat sebagai salah satu

langkah memantapkan jaringan perlindungan sosial untuk golongan miskin (majoriti golongan

pekerja), malah juga dapat membantu meningkatkan produktiviti melalui pengenalan faktor

tolakan (push factor), iaitu dengan menetapkan gaji minimum dan memaksa majikan mencari

jalan penyelesaian untuk meningkatkan produktiviti mereka. Sesungguhnya, pelaksanaan gaji

minimum adalah selari dengan hasrat rakyat untuk mencapai negara berpendapatan tinggi.

Adakah gaji minimum akan menjejaskan pertumbuhan ekonomi negara? Pada tahun 2006,

International Labour Organisation (ILO) mengeluarkan satu kertas kerja mengenai dasar gaji

minimum.[6] Kertas kerja tersebut menyebut bahawa kebanyakan kajian tidak menunjukkan

impak negatif terhadap peluang pekerjaan selepas pengenalan gaji minimum (walaupun

sebahagian kecil menunjukkan begitu), malah terdapat kajian yang menunjukkan kesan

positif. [7]

Menyentuh dakwaan bahawa gaji minimum akan memberi impak negatif kepada Perusahaan

Kecil dan Sederhana (PKS), Fiscal Policy Institute di Amerika Syarikat telah menjalankan satu

kajian pada tahun 2006 untuk membandingkan kesan gaji minimum terhadap pertumbuhan

PKS dan juga tahap gaji antara negeri-negeri di Amerika Syarikat.[8] Hasil kajian sepanjang

tempoh tahun 1998 hingga 2003 menunjukkan prestasi negeri dengan pelaksanaan gaji

minimum yang lebih tinggi adalah lebih baik: [9]

•

•

•

Pertumbuhan bilangan perniagaan kecil (kurang daripada 50 pekerja) adalah lebih tinggi

(5.4% berbanding dengan 4.2% bagi negeri dengan gaji minimum lebih rendah);

Pertumbuhan peluang pekerjaan dalam sektor perniagaan kecil adalah lebih tinggi

(6.7% berbanding dengan 5.3% bagi negeri dengan gaji minimum lebih rendah);

Pertumbuhan jumlah gaji tahunan juga lebih tinggi (24.5% berbanding dengan 21.2%

bagi negeri dengan gaji minimum lebih rendah).

Terbukti daripada kajian tersebut bahawa selepas pengenalan gaji minimum, kebanyakan

majikan tidak memberhentikan pekerja, sebaliknya melambatkan kadar penambahan sumber

tenaga kerja, mengurangkan masa kerja, meningkatkan harga, dan juga mencari penyelesaian

lain supaya pekerja mereka menjadi lebih produktif. Tren sebegini juga dikenalpasti oleh Low

Pay Commission di British pada tahun 2005 selepas pengenalan gaji minimum sejak tahun

1999.[10]

Sebenarnya, pengenalan gaji minimum selain dapat membantu golongan pekerja yang miskin,

golongan pekerja wanita juga banyak mendapat manfaat daripadanya. Statistik menunjukkan

2/3 daripada penerima gaji minimum di British merupakan golongan wanita.

Memang benar bahawa kebanyakan negara maju telah memperkenalkan dasar gaji minimum.

Bersandarkan statistik perbandingan pada peringkat antarabangsa, daripada 197 buah negara,

hanya 28 buah negara yang tidak melaksanakan gaji minimum. Walau bagaimanapun, gaji

minimum tidak harus dihadkan sebagai satu-satu kriteria untuk meningkatkan taraf kehidupan

para pekerja. Sebagai contoh, walaupun kebanyakan kerajaan Scandinavia seperti Norway,

Denmark dan Finland tidak menetapkan gaji minimum, tetapi majoriti pekerja mereka dilindungi

oleh perjanjian ataupun rundingan kolektif antara majikan dengan pekerja dalam pelbagai

sektor.[11] [12] Rundingan kolektif tersebut adalah begitu komprehensif di Norway sehingga gaji

minimumnya adalah dua kali ganda lebih tinggi daripada British pada tahun 2008. [13]

Oleh yang demikian, selain daripada memberi tumpuan kepada pelaksanaan gaji minimum,

dasar lain juga harus dipertimbangkan dalam memperkukuh hak dan kebajikan pekerja supaya

taraf kehidupan pekerja dan mutu kerja dapat dipertingkatkan secara keseluruhannya. Sebagai

titik tolak baru pasca 8 Mac, cadangan berikut wajar diberikan pertimbangan oleh pemerintah

sebagai ”pakej gaji minimum”:

•

•

•

•

Hak pekerja untuk membentuk kesatuan sekerja mengikut kesesuaian dan pilihan

pekerja sendiri dan memastikan mereka diberi hak dan perlindungan selaras dengan

piawaian antarabangsa;

Penubuhan Dana Penamatan Kerja;

Pengenalan sistem pencen untuk setiap pekerja sektor swasta;

Pengenalan usia tamat tempoh perkhidmatan 60 tahun bagi kedua-dua sektor awam

dan swasta.

Salary and wages in Malaysia

By Ghani, Rohayu Abd.

Publication: Journal of Comparative International Management

Date: Saturday, December 1 2001

Intelligence Trends Study

Global Market Intelligence Trends 2015 - Download free white paper!

www.globalintelligence.com

This paper discusses the compensation practices in Malaysia against the backdrop of the legal

framework for wage and salary deterination. It also examines the Malaysian labour market

situation and trends in salary and wage administration together with the role of unions in

compensation determination.

INTRODUCTION

Malaysia is a country of more than 20 million located at the southernmost tip of mainland Asia.

Besides being a leading exporter of commodities such as natural rubber, tin, palm oil, timber,

petroleum, and natural gas, Malaysia is also one of the world's leading exporters of electronic

semiconductors, room air-conditioners, and audiovisual equipment. Prior to July 1997, Asia was

seen as a region exemplifying success in economic growth and development. Between 1991 to

1996, the Malaysian economy grew at an average rate of more than 8%. However, Malaysia

could not shield itself from being negatively impacted by the 1997 Asian Financial Crisis where

the nation suffered a 7.5% contraction in its Gross Domestic Product (GDP) in 1998.

In 2000, Malaysia had a workforce (defined as persons between 15-64 years old) of slightly

above 9 million. About 60% of the workforce were below 35 years of age. Union members

accounted for about 8.15% of the labour force. Unemployment was reported at 3% of the labor

force, and foreign workers accounted for one out of every seven jobs (Malaysia 1996-1998,

1996).

This scenario shapes the Malaysian labour market condition. Until 1997, the salary and wage

rate in the country had experienced a significant growth. This was a result of the rapid economic

growth and near perfect employment. This paper will discuss the salary and wage practice in

Malaysia. It will begin by describing the legal framework for wage and salary determination. It

1 will then describe the Malaysian labour market and trends in salary and wage administration in

the country. An examination of the role of unions is also included.

LEGAL PROVISIONS ON WAGE AND SALARY DETERMINATION

The legal framework for salary and wage payment in Malaysia is governed by the Employment

Act 1955. The Act defines wages as basic pay and all other cash payments made to employees

for their contract of service. The following payments, however, are not included as part of wages:

* The value of any house accommodation, the supply of any food, fuel, light or water, and

medical attendance.

* Contributions paid by employers on their own account to any fund or scheme established for

employees' benefit or welfare including pension fund, provident fund, superannuation scheme,

retrenchment scheme, termination scheme, layoff scheme, retirement scheme, and thrift

scheme.

* Traveling allowance or the value of any traveling concession.

* Any sum payable to employees to defray special expenses entailed on them by the nature of

their employment.

Under the Act, payment of wages must be made no later than the 7th day after the last day of a

wage period. A wage period must not exceed one month, and unless this period is specified in a

contract of service, it is deemed to be one month. That is, employees are paid at least once a

month. Employers, however, may pay wages at shorter intervals, say once a week or once

every two weeks.

The Act specifies that when an employer terminates an employee without notice, the wages

owing to the employee must be paid no later than the day the service is terminated. If it is the

employee who terminates the service without notice, payment must be made within 3 days from

the day of such termination. If termination is with notice by either the employer or employee,

wages must be paid by the end of the notice period.

The Employment Act does not govern every aspect of wages. For example, wage rates or levels

are not regulated by the Act but are determined through negotiations between an employer and

an employee or, in the case of unionized companies, between the representatives of the

company and the trade union. However, wage determination for some employees, such as hotel

2 and restaurant workers, are subject to the minimum wage requirements of the Wage Councils

Ordinance 1947.

Malaysia's Industrial Court and Industrial Arbitration Tribunal, in some of their judgments, have

indicated some factors that should be considered in determining wage rates and wage levels. In

one Industrial Court case, the Court determined that in fixing wage levels, employers should (a)

compare their wage levels with that of similar or related industries; (b) consider whether their

wage levels are fair, giving due consideration to the cost of living; and (c) take into account their

financial capacity to meet such wage levels. In another case, the Industrial Arbitration Tribunal

stated that due consideration should be given to the following factors in determining wage and

salary levels and increases: (a) the cost of living, (b) the wages and salaries paid by comparable

establishments in the same region, (c) any inconsistencies in the wage and salary structure of