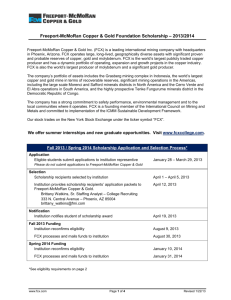

Freeport-McMoRan

advertisement

@K#hss

KEL345

DAVID STOWELL

Freeport-McMoRan:

Financingan Acquisition

A November 19, 2006, press release announcedFreeport-McMoRanCopper & Gold's

(NYSE: FCX) acquisitionof PhelpsDodge,creatingthe world's largestpublicly tradedcopper

company.FCX chief executiveofficer Richard Adkerson said, "This acquisitionis financially

compellingfor FCX shareholders,

who will benefit from significantcashflow accretion,lower

cost of capital,and improvedgeographicand assetdiversification.The new FCX will continueto

invest in future growth opportunitieswith high rates of return and will aggressivelyseek to

reducedebt incurred in the acquisitionusing the substantialfree cashflow generatedfrom the

combined business."rThe press releasewent on to note that "FCX has received financing

commitmentsfrom JPMorganand Merrill Lynch." This was the culminationof weeksof work

"inside the wall" at the two investmentbanks.However,the public announcement

was only the

beginning of a new streamof work that would take place "outside the wall" in the salesand

tradingdivisionsat thesefirms.

MetalsHeatingUp

At the time of the announcedmerger,FCX describeditself as a companythat 'oexploresfor,

develops,mines, and processesore containingcopper,gold, and silver in Indonesia,and smelts

in Spainand Indonesia."2

PhelpsDodgewas describedas"one of

andrefinescopperconcentrates

the world's leading producersof copper and molybdenum and is the largest producer of

molybdenum-basedchemicals and continuous-castcopper rod."3 The merger of these two

companiestook placeafter an unprecedented

run in the valueofcopper, basedin part on the rapid

growth in demandfrom China (seeExhibit 1), resulting in the world's largestpublicly traded

coppefcompany.

Thesetwo mergercandidatescametogetheronly after a tumultuousseriesof eventsin the

mergersand acquisitions(M&A) landscapewithin the mining industry.Just months earlier, in

June2006,PhelpsDodgeannounceda three-waymergerbetweenitself andtwo Canadianmining

companies,Inco and Falconbridge,for $56 billion.o At the time, this would have createdthe

'

FCX company press release,November 19,2006.

2Ibid.

t

a

Ibid.

Phelps Dodge company press release, June 26,2006.

@2007 by the Kellogg School of Management,Northwestem University. This case was preparedby Peter Rossmann'08 and

ProfessorDavid Stowell. Casesare developedsolely as the basisfor classdiscussion.Casesarenot intendedto serveas endorsements,

sourcesof primary data, or illustrationsof effective or ineffectivemanagement.To order copiesor requestpermissionto reproduce

materials,call 800-545-7685(or 617-783-7600outsidethe United Statesor Canada)or e-mail custserv@hbsp.harvard.edu.

No part of

this publicationmay be reproduced,storedin a retrieval system,usedin a spreadsheet,

or transmittedin any form or by any meanselectronic,mechanical,photocopying,recording,or otherwise-without the permissionofthe Ke'lloggSchoolof Management.

KEL345

FREEPORT-MCMORAN

world's largest nickel producer and largest publicly traded copper producer. J. Steven Whisler,

CEO of Phelps Dodge, made the following proclamation at the time of the announcedmerger:

This transactionrepresentsa unihqueopportunityin a rapidly consolidatingindustryto

createa global leaderbasedin North America-home of the world's deepestand most

liquid capital markets.Thecombinedcompanyhas one of the industrlt'smostexciting

portfolios ofdevelopment

projects,and thescaleand management

expertiseto pursue

their development

successfully.Thecreationofthis new companygivesus thescaleand

diversificationto managecyclicality,stabilizeearnings,and inuease shareholder

rehrns. At thesametime,we are committedto maintainingan investment-grade

credit

rating throughoutthe businesscycle.s

The Phelps Dodge announcement came months into Falconbridge's implementation of a

'opoison pill" defense in an ongoing attempt to protect itself from a takeover by Swiss mining

giant Xstrata, which had accumulated more than2} percent of Falconbridge's stock.o

Eventually, the attempted combination between Phelps Dodge, Inco, and Falconbridge fell

apart after Xstrata upped its bid for Falconbridge"Tcausing Falconbridge's board of directors to

accept this higher bid and reject Phelps Dodge and Inco.8

As the events with Xstrata unfolded, Companhia Vale do Rio Doce (CVRD), a Brazilian

mining company, made an unsolicited all-cash offer for Inco of C$86 per share; Phelps Dodge, on

the other hand, had made a partial-equity bid of C$86.89. In spite of the lower price, analysts

prophetically suggested that investors would favor the all-cash bid of CVRD at the time.e By

early September Phelps Dodge and Inco had decided to go their separateways, and CVRD soon

claimed victory in acquiring Inco.'o Having been left at the altar now twice, analysts predicted

that Phelps Dodge "could soon find itself hansformed from a bidder to a target in the deal-making

that has engulfed the global mining industry."rr

Whisler attempted to reassure his investor base when his company announced that it was

terminating its combination agreementwith Inco:

Weare very conJidentabout theprospectsof PhelpsDodge.Themarketfundamentalsfor

copperand molybdenumare excellent,and at cutent prices we are generating

signi/icantamountsofcash. Throughoutthepast severalmonths,management

and the

board havefocusedon ourfundamentalresponsibilitiesto build long-termvaluefor all

our shareholderswhile managingour balancesheetprudentlyand maintaining

investment-grade

uedit in this cyclical industry.Whilewe regret theproposedthree-way

combinationcould not be completedon acceptableterms,thefuture of PhelpsDodge

remainsvery bright.12

s Ibid.

6 "FalconbridgeProtectsAgainst 'CreepingTakeover' Xstmt4"

by

Metat Bulletin, September23, 2005.

T"Falconbridge

Gets$52.5O-Per-Share

Offer fiom X strala,"Stoclwatch, May 17, 2006.

8 "FalconbridgeYields to Xstrata,"

SteelBusinessBriefing, August1l, 2006.

e "In the Battle to Control Inco, CVRD Looks Readyto Rumble,"lnerrcan Metql Market,August 11, 2006.

r0"PhelpsLeavesCVRD as SoleBidder for Inco," Financial ?"rnes,

September6, 2006,

rrlbid.

t2PhelpsDodge companypressrelease,September5,2006

KELLOGG SCHooL oF MANAGEMENT

Fnnrronr-McMoRAN

KEL345

EnterFreeport-McMoRan

On November 19, 2006, FCX and Phelps Dodge signed a definitive merger agreement in

which the acquirer, FCX, would purchase the larger Phelps Dodge for $25.9 billion in cash and

stock. The joint press releaseannounced the following transaction details:

FCX will acquireall of the outstandingcommonsharesof PhelpsDodgefor a

combinationof cashand commonsharesof FCXfor a total considerationof $126.46per

PhelpsDodgeshare,basedon the closingprice ofFCX stockon November17,2006.

EachPhelpsDodgeshareholderwould receive$88.00per sharein cashplus 0.67

commonsharesof FCX. Thisrepresentsa premium of 33percentto PhelpsDodge's

closingprice on November17, 2006,and 29 percentto its one-monthaverageprice at

that date.

Thecashportion of $ I 8 billion representsapproximately70percentof the total

consideration.In addition,FCX would delivera total of 137million sharesto Phelps

Dodgeshareholders,resultingin PhelpsDodgeshareholdersowningapproximately38

percentof the combinedcompatryon afully dilutedbasis.

Theboardsof directorsof FCX and PhelpsDodgehaveeachunanimouslyapprovedthe

that their shareholdersapprovethe

termsofthe agreementand haverecommended

transaction.Thetransactionis subjectto the approvctlof theshareholdersof FCX and

PhelpsDodge,receipt ofregulatory approvalsand customaryclosingconditions.The

transactionis expectedto closeat the end ofthefirst quarter of2007.

FCX hasreceivedJinancingcommitments

from JPMorganand Merrill Lynch tofund the

transaction.

After giving effectto the transaction,estimated

to

complete

the

required

cash

proforma total debtat December31,2006,wouldbe approximately

$17.6billion, or

approximately$ I5 bitlion net of cash.13

The initial reaction to the merger announcement among Wall Street analysts was mixed (see

Exhibit 2 and Exhibit 3 for stock price performance):

In our view this transactionmakessensefor both companies. . . Freeportis basicallya

singlemine company,with its only significantassetlocatedin Indonesia(assethasa long

life, but limitedgrowth opportunities).PhelpsDodgehasa geographicallydiverse

operatingbaseand also hasa growthprofile, targetingincreasedoutputof 20 percentby

2009 but a relativelyshort reservelife. Hencefor Freeport,this dealspreadsthe

company'soperatingrisk and givesthe companya growthprofile. In our view this deal

also highlightsthe scarcityofcopper reservesglobally, with onelargeproducer

acquiringanother,insteadof building large-scalecoppermines.ta

Thereare severalpositivessurroundingthis transaction:(I) an improvedcostposition

(vs.PD standalone);(2) long reservelife; (3) ctmorediversifiedgeographicfootprint;

13FCX companypressrelease,November19, 2006

rr Credit SuisseEquity Research,November20, 2006.

KELLoGG SCHooL OF MANAGEMENT

KEL345

F'REEPORT-McMoRAN

(4) an attractivegrowthproJile; and (5) enhancedmanagement

depth.I(e do not seeany

anti-trustissuessuwoundingthis transaction.For PD shareholdersspecifically-the 33

percentpremium to Friday's closeand departureof CEO StevenWhislerfromthe

combinedentity is the antidotewe believetheywerelookingfor-post thefailed threeway mergerattemptfor two nickelproducersearlier in theyear. For FCX-we are

surprised-we believedFCXwas more of a seller thana buyerof assets.ts

Iile assign a onelhird likelihood that Freeport acquires Phelps Dodge as announced.

Two-thirds likelihood that Freeport collects the $750 million breakupfee. The deal

oppears very accretive to FCX and likely to attract higher bidder.l6

As the companiesinitially projectedin their joint pressrelease,the shareholders

ultimately

terms.l7Of course,one of the

approvedthe mergeron March 14,2007,underthe announced

worst kept secretson Wall Streetwas that the smallerFCX still had a tremendousamountof

work to do in financing the acquisitionof PhelpsDodge. FCX announcedon March 15 the

pricing of a total of $17.5billion in debtfinancingfor the PhelpsDodgeacquisition,including$6

billion in seniorfixed ratenotesand $10 billion in seniorfloatingratenotes.In addition,a $1.5

billion senior securedrevolving credit facility was provided, which was to be undrawn at

closing.rsJPMorganand Merrill Lynch jointly underwrotethe note offeringsand led the credit

facility. Finally, on March 19, in conjunctionwith the closing of the PhelpsDodge acquisition,

FCX announceda public offering of commonstock and convertiblepreferredstock.The initial

pressreleaseindicatedan offering of "approximately35 million sharesof commonstock" and l0

Total proceeds

million sharesof mandatoryconvertiblepreferredstockat $100.00per share.re

from thesetwo equity-relatedtransactionswere expectedto be approximately$5 billion. The

marketreceivedthesefinancingspositively,markingup FCX nearly3 percenton a day when the

S&P 500 increasedjust over I percent. At least one Wall Street analyst portrayed the

announcement

asan expectedpositive:

Management clearly communicated its intention to do an equity transaction. Likewise,

the size of the transaction is consistent with our expectcttions.While diluting existing

shareholders is not a positive, we believe this equity deal is a prudent transaction in

terms of reducing some of the/inancial risk. We estimate the combination of the equity

transaction andfree cashflow at current copper prices has the potential to reduce FCX's

debt burden by S5 billion, or 3l percent ofthe S16 billion in debt taken onfrom this

transaction, with the magnitude of debt reduction to translate into higher multiples over

time.2o

FCX's two equity-relatedtransactions(commonstock and mandatoryconvertiblepreferred)

were led by JPMorganand Merrill Lynch asjoint book-runners.The two firms equally shared

feesand leaguetable credit for thesetransactions.Eachquarter,leaguetablesrankingthe major

investmentbanks by underwritingproceedsfrom various categories(debt, equity, convertible

15Bear SteamsEquity Research,November20, 2006

16PrudentialEquity Research,November21, 2006.

r7FCX pressrelease,

March 14,2007.

18FCX pressrelease,

March 15,2007.

reFCX pressrelease,

March 19,2007.

20Credit SuisseEquity Research,March I 9, 2007.

KELLocc ScHooL oF MANAGEMENT

KEL345

Fnnrponr-McMoRAN

bonds,etc.) are released.At the end of the first quarterof 2007(1Q07),JPMorganrankedfirst in

U.S. convertibles,with a 23.9 percentmarket share and nearly $6 billion in proceedsfrom

convertibleissuance.Menill Lynch rankedthird in U.S. convertiblesat the end of 1Q07 with

nearly $4 billion, a 15.8 percent market share. For cofllmon stock underwriting at 1Q07,

JPMorganwas first at just over $5.1 billion in underwritingproceeds,with a 16.2percentmarket

share;Merrill Lynch wassecondat over $4.3billion, with a 13.7percentmarketshare.2l

Role of the InvestmentBanks

Throughoutthe flurry of activity centeredaroundFCX, from merger advisoryto debt and

equity underwriting,therewas a consistenttheme:JPMorganand Merrill Lynch were involvedat

nearlyeverystepof the way. Typically, whena companyneedsadvisoryor financialassistance,

it

holds a "bake-off' betweeninvestmentbanks,wherefirms areinvited to presenttheir credentials,

preliminaryvaluation,and view of investordemand.Companieswill choosean investmentbank

(or banks)for a variety of reasons,but over time, they usually focuson existingrelationships,in

additionto factorssuchas executioncapability,independentresearchfunction,and leaguetable

rankings.In the caseof FCX, it had well-established

ties to both JPMorganand Merrill Lynch,

and placedits trust in them for both M&A advisoryandunderwritingresponsibilities.

Investment banks typically talk about two sides of a "Chinese wall" of information.

Coverage,M&A, and capital markets teams within the investment banking function are

responsiblefor all of the due diligenceand valuationwork. As a result,they are consideredto be

insidersworking on the "private side" of the wall (or inside the wall) becauseof the sensitive

informationthat they receive.Generally,an investmentbank's salesand tradinggroup sits on the

"public side" of this wall, working with investorsand havingaccessonly to informationthat has

beenmadepublicly available.Whena companyissuesa pressreleasedescribinga mergerand/or

financingit is generallythe first time that an individualin salesandtradingwill hearof it.

Inside the Wall

Prior to the public announcements

of the transactionssurroundingthe merger,the investment

banking coverageteamsat JPMorganand Merrill Lynch were actively coordinatingthe entire

process,from the acquisitionto all aspectsof the capitalraising.The metalsand mining industry

coverageteam at each bank was primarily responsiblefor knowing FCX's generalneedsand

priorities. From there, each bank's M&A group was responsiblefor advisingthe companyon

mergervaluation,mix of cashand stock,timing, and likely shareholderreaction.The leveraged

financegroup at eachbank was responsiblefor the analysisbehindmakingthe bridge frnancing

commitmenton behalfof the investmentbankto the company.This was particularlyimportantto

enableFCX to show committedfinancingto PhelpsDodge.The equity capitalmarketsgroupsat

JPMorganand Menill Lynch were responsiblefor all aspectsof the equity offering: advisingthe

company regarding the optimal structure, size, pricing and timing of the financing (the

"origination" function), as well as working with colleaguesin their firm's institutional equity

salesareato determinepotentialinvestorinterest(the"placemenf'function).

2r ThomsonEquity Capital MarketsReview,First

KELLOGG SCHOoL oF MANAGEMENT

Quarter2007

FREDPORT-McMoRAN

KEL345

The investmentbanksand FCX neededto determinea permanentfinancingstructurebased

on expectedcredit ratings.Essentially,FCX's managementfirst had to decideon the optimal

capital structure and acceptableequity dilution levels before selecting the best financing

alternatives.Ratingsadvisoryprofessionalswho were part of the debt capital marketsgroup at

JPMorganadvisedthe companyon the credit ratingsprocessand the expectedratingsoutcomes

based on the selectedcapital structure.All of the information about financing terms and

conditions,aswell aspricing, wasfed backto eachbank'sM&A team,which assessed

the impact

to eamingsper share(EPS),expectedvaluation,andlikely investorreaction.

There are severalforms of risk that investmentbanksmust considerwhen advisingclients

and executingtransactions.Capital rlsk is the financialrisk associatedwith a bank's financing

commitmentin relationto an acquisition.If the bank commitsto providinga loan, it undertakes

considerablerisk. Large banksmitigatethis risk by syndicatingup to 90 percentof theseloansto

a wider group of banksand money managers.However,banksare forcedto keep the debt that

they are unableto syndicateto others.During the first half of 2007,bankshad committedmore

than $350 billion in loan commitmentsto facilitateacquisitionsof companiesby private equity

firms. Becauseof severedislocationin the mortgage-backed

securitiesmarket starting in mid2007, theseloans becamevery difficult to syndicate,leaving huge unanticipatedrisk positions

that resultedin billions of dollars in reportedlosses(see Exhibit 4). Reputotionrisk is less

tangible, but no less important. This is the risk that comes from associatingthe investment

bankingfirm with the companyfor which it is raising capital.Seriousproblemsexperiencedby

the companymay havea residualeffecton the investmentbank'sreputation.

Outsidethe Wall

Freeportannouncedits acquisitionof PhelpsDodge in a formal pressreleasethat "hit the

tape"(publishedon thenewswire services)on November19,2006.

After the PhelpsDodgeacquisitionhad beensigned,the investmentbanks'focussoonshifted

to syndicating out the bridge loan in order to raise the capital necessaryto complete the

transaction.Included in this processwas negotiatingwith credit rating agenciesto securethe

highestpossibleratingson the upcomingbond offerings.On February28, 2007,S&P upgraded

its debt rating on FCX's existing2014 seniordebtfrom B+ to BB+. It followedthis with another

upgradeto BBB- on April 4. Justtwo monthsafter this, on June7, it upgradedFCX's debtrating

onceagainto BBB. Similarly,Moody's had placedthe companyon positivewatchon November

20, 2006.It followed this up with an upgradefrom B 1 to Ba2 on February26, 2007,and then to

Baa3 on March 27. The credit upgradesresultedfrom both the more-than-$5billion in equity

capital raisedthroughthe commonstock and convertibleoffering and the significantincreasein

cashflow that resultedfrom the merger(seeExhibit 5).22

After the completionof all debt-relatedtransactions,FCX and PhelpsDodge finalized the

acquisition.Once this was complete,it openedthe door to the equity and equityJinkedcapital

raising.

--

IJlOOmDerg.

KELLoGGScHooL oF MANAGEMENT

KEL345

F,REI,PORT-MCMoRAN

Placing the Equity and Convertible Offerings

Institutional salespeopleat investment banks are responsiblefor bringing investment

opportunitiesto the analystsand portfolio managersof large assetmanagerssuch as mutual

funds,hedgefunds,pensionfunds,and someinsurancecompanies.Their investmentideascome

from a variety of sources,including researchdone by the firm's equity researchanalysts.The

institutionalassetmanagersdo not pay investmentbanksfor their investmentideas;rather,they

pay commissionson the largetradesthat they execute.This processis part art andpart science.

Traditionally, institutionalmanagersconducta periodic vote to rank eachinvestmentbank and

attemptto allocatecommissionsfor the next periodaccordingly.

Shortly after FCX's intentionto issueequity and convertiblesecuritieswas announced,the

JPMorganinstitutionalsalesforce hearda "teach-in" by the frrm's metalsand mining industry

analyst.Becauseof JPMorgan'sinvolvementas advisor to Freeporton the acquisition,their

equity researchanalystwas restrictedfrom providing an investmentopinion on sharesof FCX.

However,he was allowed to provide the institutionalsalesforce an overview of the equity and

had.

convertibleofferingsandtheir uses,as well as answerany relatedquestionsthat salespeople

team

After this presentation,

the salesforce had the opportunityto hearfrom FCX's management

regardingboth the rationalefor the PhelpsDodgeacquisitionas well as the methodof frnancing

chosen.Altogether,this sessionprovidedthe salesteam with enoughinformationto be able to

discussthe offeringsin detailwith their institutionalassetmanagerclients.

The managementteam at FCX also participatedin an investor "roadshow": a series of

meetingswith institutional investorsto discussthe company'scurrent frnancial position and

businessactivities.For IPOs,roadshowstypically last one or two weeks,providingthe company

a forum to tell its story to new investors.For secondaryofferings(follow-on capitalraisingsfrom

an existing public company)and convertibles,roadshowsare consideredoptional,dependingon

how well the companyis known. In this case,FCX had done a'onon-deal"roadshowafter the

educatinginvestorson the transaction,and so only a limited roadshow

acquisitionannouncement,

was scheduledfor the equityandconvertiblefinancings.

The combinedequity and convertibleroadshowbeganon Tuesday,March 20, one day after

from both JPMorgan

regardingclosing of the acquisition.Salespeople

the public announcement

andMerrill Lynch lined up a seriesof meetingsin multiple citiesover a three-dayperiodandthen

joined a member of the investmentbanking team and several members of the company's

managementteam on the roadshow.Becauseof the high demandfor meetingsand the limited

time frame, salesforce managementhad to work with the capital marketssyndicateteam to

decidewhich investorsto see.The decisionto meet with investorsdependedon severalfactors,

suchas the size of the investor,quality of relationshipwith the company,and level of previous

interestin it. Currentshareownershipwas alsoan importantconsideration.

During this time, salespeoplehad a seriesof conversationswith their institutional investor

clients about the stock and convertible issuesand provided feedbackto the capital markets

syndicateteam,who kept track of investorconcernsand overall sentimentaboutthe issue.The

syndicateteam communicatedany recurringissuesthat cameup during the feedbackprocessto

companymanagement.This feedbackloop was particularly important for the price discovery

process,as the syndicateteamwas responsiblefor establishinga price for the offering. The price

discoveryprocessis relativelytransparentbecausethe stockis alreadytradedin the openmarket.

However,the key questionthat remainsis how much of a discount(if any) will be appliedto the

"last sale,"or closingprice of the stockon the day of pricing. Someinvestorsput in limit orders,

KELLOGGSCHooL oF MANAGEMENT

F.REEPoRT-MCMoRAN

KEL345

which dictate the highest price they would be willing to pay, while others are content with market

orders, which indicate a willingness to pay the market-clearing price for the offering. This affects

the final pricing decision because investment banks, as well as companies, are reluctant to shut

out large and important investors who have submitted limit orders, even though market orders are

always preferable.

For the convertible offering, price discovery focuses on the coupon and conversion premium

relative to the underlying common stock. Similar to the common stock transaction, the equity

capital markets syndicate maintains a book of investor demand and makes a pricing

recommendation to the company that is designed to allow the security to trade up modestly.

Demand for the convertible comprises approximately half convertible arbitrage hedge funds and

half traditional mutual funds or dedicated convertible funds. In smaller transactions and for

convertibles that do not have a mandatory conversion feature, allocations tend to be skewed

toward convertible arbitrage funds. Convertible arbitrage funds attempt to purchase the

convertible instrument while short-selling shares of the common stock in a manner to take

advantage of inherent arbitrage opportunities. While companies might have concems about a

large pool of investors shorting their common stock, convertible arbitrage funds provide several

advantages: (1) the incremental demand from convertible arbitrage funds allows companies to

achieve better pricing in their convertible offerings (cheaper financing); and (2) the demand also

ensures more trading liquidity in the convertible security, adding to the attractiveness for

traditional long-only investors.

MandatoryConvertiblePreferredShares

FCX's convertibleinstrumentwasdesignedto be convertedmandatorilyinto a predetermined

number of the company'scommonsharesin three years.As a result, rating agenciesassigned

"equity content"of up to 90 percentto this convertibletransaction(seeExhibit 6 and Exhibit 7).

For a more traditional optionally convertingconvertible,rating agenciesusually athibute no

equity contentand,in fact, assumethe convertibleis more like a bond unlessand until it converts

in the future into commonshares(which will happenonly if the investordeterminesthat the value

of the commonsharesthe convertiblecan convertinto exceedsthe cashredemptionvalue of the

original security).The use of a mandatoryconvertiblestructureby FCX facilitatedthe rapid

credit rating upgradespreviouslydiscussed.The issuanceof commonstock in conjunctionwith

the convertibleenabledconvertiblearbitragehedgefund investorsto moreeasilyborrow andthen

short sell FCX common shares,which facilitated strongerdemandfor and resultedin better

pricingof the convertible.

FCXPost-Allocation

Sharesof FCX closedon Thursday,March22,2007,at $61.91.On March23,Ihe company

priced47.15million sharesof stockat $61.25per share(proceeds

of approximately

$2.9billion),

along with 28.75million sharesof 63/npercentmandatoryconvertibleprefenedstock at $100.00

per share(proceedsof approximately$2.9 billion). Net proceedsto FCX, after underwriting

discountand expenses,totaled $5.6 billion.'3 By the end of trading on March 23, FCX shares

2r FCX pressrelease,

March28,2007

KELLoGG ScHooL oF MANAGEMENT

KEL345

Fnnnronr-McM0RAN

closedup 39 centsfrom the prior closeto $62.30,a nearly 2 percentgain from the transaction

price (seeExhibit 8). By most accounts,this was a successfuloffering for both the companyand

investors.FCX was interestedin the quality of the investorbase.Generally,if a companyhasan

opportunityto allocatenewly issuedsharesto investorsit believeswill be long-termholders,it is

willing to makesomeconcessionon price,which wasthe casewith the FCX offering.

The convertibleendedthe trading day at 101.5,having beenofferedto investorsat 100 (the

"par" price). As was the casewith the equity offering, FCX had an interest in making surethat it

did not leavesignificantmoney on the table for the convertibletransaction.At the sametime, it

wanted to ensure that both offerings----commonshares and convertible-were placed with

appropriateinvestorswho werewilling to take long-termpositions(seeExhibit 9 and Exhibit 10

price action).

for post-transaction

NORTHWESTERN

UNIVERSITY

KELLoGG SCHOOL OF MANAGEMENT

KEL345

FREEPORT-MCMORAN

Exhibit1: CopperSpotPricevs. FCXStock,September,2}0l-December,

2006

400

350

300

250

+CopperSpot

200

+FCX

Price

Price

150

100

50

0

5 5 ; E $ E E 3 8 S8 S 3 8 8 9 33 3 3 3 3 3 3 3 3 3 33 3 3 33 3 3 33 3 33 3 3 3 3 8 3 33 3 83 3 3 33 8 8 33 8 88 8 I

gtEp

=E#tE5$E

!$eFg€=$,ffi

s3tE5$EFg:

sg5=FsEtE

s+g:iss3'g

EEE$s

sg-Ei3a"E

prices

Source.'NYMEX

COMEXdata;FCXhistorical

Exhibit2: PhelpsDodgeStockPerformance,

January3, 2006-March

19,2007

@ U SI

Acquired

EquityGP

GP- LineChan

upp.t flffilililtr

MovAvgsfff

LrrwerffifirytrMov.Avs

m

Ranse[@-@@

-=l

Period

Page1/9

currencyiltr|

30

t0

10

00

0

0

Hustrqlrq

.Idpdn

81

3

bl

? 9///

3201

8900

rflzll

))ll

Singspore

3u4B 4300

65 621e 1000

r J .s . 1 2 1 2 3 1 8 2 0 0 0

Cop'Jright 20OZ Bloomberg Findnce L.F.

G597-5O6-0 19-Hov-?007 08,37'?9

SourcejBloomberg

t0

KELLocc ScHool or MATAGEMENT

KEL345

Fnn['Ponr-MCMoRAN

Exhibit3: FCXStockPerformance,

January3, 2006-March19,2007

-2

.67

g

N 3s N 97,ii/9i,43? 1gxl

f f i us T 9 7 -2 7

A t 8 : 4 0 V o l 7 8 7 . 9 8 60 u 9 7 . 5 T H i 9 7 . 5 N L o 9 7 . 3 3i l P r e v L 0 0 . 0 4

GP - LineChaft

liirle-'l

-----***-lMov.Avgs

Ranse@-ffiupper

-*l

Period

Jqpqn 8l

3 3201 89OO

Lnwer

Singqpore

Source;Bloomberg

KELLoGG ScHooL oF MANAGEMENT

---l

65 6212 l0OO

fff

Mov Avg lE

Page1/B

Currency

iltr|

FREDPORT-MCMoRAN

KEL345

Exhibit4: Bankson a BridgeToo Far?As RiskRisesin LBOs,lnvestorsStartto

Balk;WarningfromOverseas

B Y R O B I N S I D E L ,V A L E R I EB A U E R L E I NA N D C A R R I C KM O L L E N K A M P

The nation'slargestfinancialinstitutionshave spentthe pastyear relying on robustcapitalmarketsto offset woes

in their retail-bankingoperations.Now, that big revenuestreammay be startingto dry up.

A suddenretrenchmentin debt marketsis likely to nip at profits at the big banks that have been financing the

leveraged-buyout

boom aroundthe globe.The latestdealbonanza,in which private-equityfirms buy public companies

and load them up with debt,has createdseveralnew financingtechniquesthat mint money for the banks,but can also

leavethem holding more risk.

For J.P. Morgan Chase& Co., Citigroup Inc. and Bank of America Corp., the biggestplayersin the leveragedloan business,a slowdown in deal financingscomes as they grapple with diffrcult issues.Among them: a tric$

interest-rateenvironmentthat makesit lesslucrativeto makeloans,a slowdownin mortgageandhome-equitylending,

and fierce competitionto acquiredeposits,even as banks are still strugglingto assessthe fallout from the turmoil in

subprimehousing.

Banks won't "lose money,but what will happenis that they won't make asmuch and earningsmay decline,"said

GaneshRathnam,a bankinganalystat MorningstarInc. in Chicago.

As they haveracedto financeleveragedbuyouts,the bankshave alsosteadilytakenon more risk. Although much

ofit is typically parceledout to investors,the bankscan be left holding the bag, as happenedwhen investorsbalkedat

the U.S.Foodservice

deal.

In the U.S., so-calledcovenant-litedealsaccountedfor about26% offirst-quarter dealsversus4.602in European

leveraged-loanissues.The pacebeganto sharplyincreasein Europein March, accordingto Bank ofAmerica research.

The "covJite" deals-- where a bank'scovenantprotectionsare weakened-- havebeena result ofthe cheapfinancing,

allowing borrowers to reduce financial covenantsthat typically require bonowers to meet fmancial hurdles on a

quarterlybasis,the reportnotedearlierthis week.

In particular,regulatorsare expressingconcernabout"equity bridge loans"in which private-equityfirms asktheir

banks to provide stop-gapfinancing for some deals.The loans,which carry high interestrates,last from tfuee to 24

monthsand arerepaidoncethe saleofbelow-investment-grade,

orjunk, bondshas occurred.

So far this year, bankshaveprovided $33.38billion in bridge loansto leveraged-buyout

deals,more than double

last year's $12.87 billion, accordingto ReutersLoan Pricing/DealScan.The volume is the highest since the LBO

heyday20 yearsago,when$48.14billion in bridgeloanswasissuedin 1988.

Of the banks,Citigroup,DeutscheBank AG and J.P.Morgan have arrangedthe most bridge loans for leveragedbuyout dealsthis year.

Regulatorsexpectto take anotherlook at guidancethey issuedin 2001 on leveragedlendingto seeifit still fits. At

the time, bankskept most leveragedloans on their balancesheets,and regulatorsthus expectedthem to considerthe

borrower's ability to repay principal, not just interest. Banks now typically distribute their loans to institutional

investors,so regulatorssay they may needto considerdifferentcriteria.It may be lessimportantfor a bank to consider

the borrower'sability to amortizea loan, and more importantto weigh the "reputationalrisk" that a loan it sold to

investorsgoesbad, or "pipelinerisk" -- when adversefinancingconditionsforce it to keep a loan on its balancesheet

ratherthan distributingit.

A report this month by the Bank for InternationalSettlementssaid, "The fact that banks are now increasingly

providing bridge equity, along with bridge loans, to support the still growing number of corporatemergers and

acquisitionsis not a good sign." It went on to say: "A closelyrelatedconcernis the possibility that bankshave,either

intentionallyor inadvertently,retaineda significantdegreeofcredit risk on their books."

Source:

WallStreet

Journal,

June28,2007

12

KELLOGGScHooL oF MANAGEMENT

KEL345

FRf,EPORT-MCMORAN

Exhibit5: BondRatingsby Dateand RatingAgency

November

20, 2006

February26,2007

February28,2OO7

March27,2OO7

Aptil4,2007

June7,2OO7

RatingAgency

Moody's

Moody's

S&P

Moody's

S&P

S&P

Upgrade

Positiveoutlook

81 to Ba2

B+ to BB+

Ba2to Baa3

BB+to BBBBBB-to BBB

Source.'Bloomberg

Preferred

Exhibit6: Selections

fromSECFilingfor Convertible

Offering,3/23

T H EO F F E R I N G

Issuer

Freeport-McMoRan

Copper& Gold Inc.

Securitiesoffered

25,000,000sharesof 6sloolo

mandatoryconvertible

preferredstock(28,750,000

sharesifthe underwriters

exercisetheir overallotmentoption in full), which we

refer to in this prospectussupplementasthe "mandatory

convertibleprefenedstock."

Initial offering price

$100.00per shareofmandatoryconvertiblepreferred

stock.

Option to purchaseadditionalsharesof

mandatoryconvertiblepreferredstock

To the extentthe underwriterssell morethan

25,000,000

sharesof our mandatoryconvertible

prefenedstock,the underwritershavethe optionto

purchase

up to 3,750,000additionalsharesofour

mandatoryconvertiblepreferredstockfrom us at the

initial offering price, lessunderwritingdiscountsand

commissions,

within 30 daysfrom the dateof this

prospectus

supplement.

Dividends

per shareon the liquidationpreferencethereofof

6t/oYo

$100.00for eachshareofour mandatoryconvertible

prefemedstockper year.Dividendswill accrueand

cumulatefrom the dateof issuanceand,to the extent

that we arelegallypermittedto pay dividendsand our

boardof directors,or an authorizedcommitteeof our

boardof directors,declaresa dividendpayable,we will

pay dividendsin cashor, subjectto certainlimitations,

in commonstockon eachdividendpaymentdate.The

expecteddividendpayableon the first dividendpayment

dateis $2.30625per share,andon eachsubsequent

dividendpaymentdateis expected

to be $1.6875per

share.See"Descriptionof mandatoryconvertible

prefenedstock-Dividends."

KELLoGG SCHOOL OF MANAGEMENT

13

FRDEPORT-MCMoRAN

KEL345

Exhibit 6 (continued)

Dividend paymentdates

February1, May l, Augustl, andNovember1 of each

yearprior to the mandatoryconversiondate(asdefined

below),and on the mandatoryconversiondate,

commencingon August 1, 2007.

Redemption

Our mandatoryconvertibleprefenedstockis not

redeemable.

Mandatoryconversiondate

M a y1 , 2 0 1 0 .

Mandatoryconversion

On the mandatoryconversiondate,eachshareofour

mandatoryconvertiblepreferredstockwill

automaticallyconvertinto sharesof our commonstock,

basedon the conversionrateas describedbelow.

Holdersof mandatoryconvertiblepreferredstockon the

mandatoryconversiondatewill havethe right to receive

the dividenddueon suchdate(includingany acuued,

cumulated,andunpaiddividendson the mandatory

convertiblepreferredstockas ofthe mandatory

conversiondate),whetheror not declared(otherthan

previouslydeclareddividendson the mandatory

convertiblepreferredstockpayableto holdersof record

asof a prior date),to the extentwe arelegally permitted

to pay suchdividendsat suchtime.

Conversionrate

The conversionrate for eachshareof our mandatory

convertibleprefered stockwill not be more than 1.6327

sharesof commonstockandnot lessthan 1.3605shares

of commonstock,dependingon the applicablemarket

valueof our commonstock,asdescribed

below.

The "applicablemarketvalue" of our commonstockis

the averageofthe daily closingpriceper shareofour

commonstockon eachof the 20 consecutivetrading

daysendingon the third tradingday immediately

precedingthe mandatoryconversiondate.

The following table illustratesthe conversionrateper

shareof our mandatoryconvertiblepreferredstock

subjectto certainanti-dilutionadjustmentsdescribed

under"Descriptionof mandatoryconvertiblepreferred

"

stock-Anti-dilution adjustments.

Applicable

MarketValue

Lessthanor equalto $61.25

Between$61.25and$73.50

Rate

Conversion

1.6327

dividedby the

$100.00

applicable

marketvalue

Equalto or greaterthan$73.50

t4

I .JOUJ

KELLOGG SCHOOL OF MANAGEMENT

KEL345

FREEPORT.MCMORAN

Exhibit 5 (continued)

Optionalconversion

At any time prior to May 1, 2010,you may electto

converteachofyour sharesofour mandatory

convertiblepreferredstockat the minimum conversion

rateof 1.3605sharesof commonstockfor eachshareof

mandatoryconvertiblepreferredstock.This conversion

rateis subjectto certainadjustmentsas describedunder

"Descriptionof mandatoryconvertiblepreferredstock"

Anti-dilution adjusfinents.

Ranking

The mandatoryconvertiblepreferredstockwill rank

with respectto dividendrights andrights uponour

liquidation,winding up, or dissolution:seniorto all of

our commonstockandto all of our othercapitalstock

issuedin the futureunlessthe termsof that stock

expresslyprovidethat it ranksseniorto, or on a parity

with, the mandatoryconvertibleprefenedstock;

Useofproceeds

We intendto usethe net proceedsfrom the offeringto

repayoutstandingindebtedness

underour TrancheA

term loan facility andTrancheB term loan facility.

Listing

The mandatoryconvertibleprefenedstockhasbeen

approvedfor listing on the New York StockExchange.

KELLOGGSCHooL oF MANAGEMENT

l5

KEL345

FREBPORT-MCMORAN

Exhibit7: Convertible

Preferred

Mechanics

o

;

1.6327

> 1.3505

o

s73.s0

Applicable

MarketValue

Lessthanor equalto $61.25

Between$61.25and$73.50

Equalto or greaterthan$73.50

Rate

Conversion

1.6327

$100.00 divided by the

applicablemarket value

1.3605

As ofthe mandatoryconversiondate,for each$100 mandatoryconvertiblepreferredsharepurchasedby

investors,they will receive1.6327FCX sharesif FCX shareprice is lessthan or equalto $61.25on that

date. If FCX sharepriceis between$61.25and$73.50,investorswill receivebetween1.6527and 1.3605

FCX shares.If FCX shareprice is equalto or greaterthan $73.50,investorswill receive1.3605FCX

shares.

t6

KELLoGG

ScHoor-or MauacplanNr

KEL345

FREEPORT-MCMORAN

Exhibit8: FCXStockPrice,March16,2007-March23, 2007

F C XU S$

T 1O4 - 55 +.64N --x-EquityGP0

DELAY

08:46 Vol 4.392,748 0p 104.98N Hi 105.38P Lo 103.37N

riP0 - B;rr-,lhart

IrTide-l

P;rgeLl!

-@'upper

Rarige@@

eeri,rdlflfiil]

JqFs 81 3 sml

Agn

ffiEil

LowerillFlor,,

StngrcFora 65 6212 !{nO

htov..:';gsflf

i:.,g I5

u.s. I 2t2 3ls

nf,ru

furrencl,,

tffic

L.P,

29-{,.c-?oo7 09,29,8

Source.' Bloomberg

KELLoGG ScHooL

oF MANAGEMENT

t7

KEL345

FREEPORT-MCMORAN

Exhibit9: FCXEquity,March1,29l7-December28,2007

FCXUS$

EquityGP

1 LO4 - 55 +.64 N --x-0ELAY

08:46 Vol 4,392,7480p 104.98N Hi 105.38P Lo 103.37N

paset/6

iip-LineCtrart

mlffil

-3frHiltil Uprr*r[EElt[llill

F.arrseSffi@

.i:!.,!l-s:ff

]rlo,,r,

{urrenci' tlfl{

r.r.,gfp

Periocllffi[]l

L,rwerllElilillllor.i,

JcFEn el 3 3ml

Sgm

Sing{iotre

65 6el2

l0fll

u.s. t 212 318 2000

Caplriqht rtr* Blea{baig Finscr L.P.

8397-6D6-O 2g-Dcg-am7 09, 48, 4l

Source.' Bloomberg

KELLoGG ScHooL oF MANAGEMENT

KEL345

F'RDEPORT-MCMoRAN

Exhibit 10: FCX ConvertiblePreferred.March23,2097-December14,2OO7

pfd Gp

F C X6 3 + e o

EXCH

$

I 3-53 - OOO +.660 N --x-and Settings\plr610\Desktop\preferred.bmp

Screensavedas D:\Documents

ffiEE

iip-Lineitrart

Page l.16

-Wupp*''

IFjTI

.r.'.'s:r

Rarrge@

l"to'".

crrrrenc;r

ffiffi]

fff

peric,dllil$Jl

..r'rr IF

Lrwer [illFl,r'u.

.tqpqn 91 3 3201 S900

Singdpre

65 6212 lo00

u.s. I 212 318 2000

Copgright *rrr

Bloofrb€,rg Finsnce L.P.

8597-606-0

29-Dec-2O07 09'27' 44

Source: Bloomberg

KELLoCG ScHooL oF MANAGEMENT

l9