160

Values-Based Investing

Values and performance: no contradiction

120

80

40

0

Mar Sep Mar Sep Mar Sep Mar Sep Mar Sep Mar Sep Mar Sep Mar

06 06 07 07 08 08 09 09 10 10 11 11 12 12 13

Behaving in a socially and environmentally

responsible way makes business sense

The business case for companies to behave in a socially

and environmentally responsible way – often called

corporate social responsibility (CSR) – appears quite

clear. Prudent management of the environmental and

social aspects of running a company helps increase efficiency and reduce operational costs. It can contribute

to attracting and retaining employees, enhancing the

company’s reputation and reducing its exposure to risk.

It can also help uncover the commercial opportunities

inherent in today’s environmental and social challenges.

But is there any evidence that such virtuous behavior is rewarded by the stock market? The tricky issue

with CSR is that there is often no clearcut correlation

between effort and effect. The benefits are not always

easy to quantify and often become evident only over

the long term. Many CSR-related activities require longterm investments, and these are not always easy to

reconcile with the short-term nature of certain shareholders’ demands.

Opposing theories – who is right?

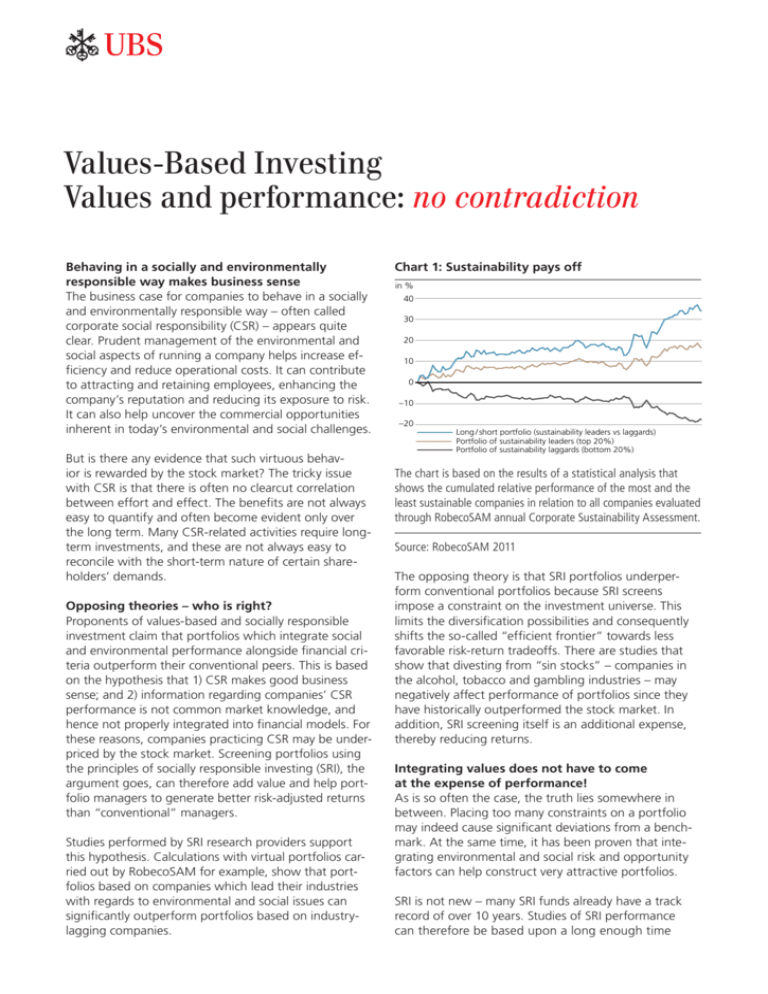

Proponents of values-based and socially responsible

investment claim that portfolios which integrate social

and environmental performance alongside financial criteria outperform their conventional peers. This is based

on the hypothesis that 1) CSR makes good business

sense; and 2) information regarding companies’ CSR

performance is not common market knowledge, and

hence not properly integrated into financial models. For

these reasons, companies practicing CSR may be underpriced by the stock market. Screening portfolios using

the principles of socially responsible investing (SRI), the

argument goes, can therefore add value and help portfolio managers to generate better risk-adjusted returns

than “conventional” managers.

Studies performed by SRI research providers support

this hypothesis. Calculations with virtual portfolios carried out by RobecoSAM for example, show that portfolios based on companies which lead their industries

with regards to environmental and social issues can

significantly outperform portfolios based on industrylagging companies.

Fund 1 (Total Return EUR)

Fund 2 (Total Return EUR)

ChartFund

1: 3Sustainability

pays

off CLEAN ENERGY (Total Return EUR)

(Total Return EUR)

S&P GLOBAL

in %

40

30

20

10

0

160

–10

120

–20

80

40

Long / short portfolio (sustainability leaders vs laggards)

Portfolio of sustainability leaders (top 20%)

Portfolio of sustainability laggards (bottom 20%)

The

0 chart is based on the results of a statistical analysis that

Mar Sep

Mar Sep Marrelative

Sep Mar

Sep Mar SepofMar

shows

the cumulated

performance

the Sep

mostMarandSeptheMar

06 06 07 07 08 08 09 09 10 10 11 11 12 12 13

least sustainable companies in relation to all companies evaluated

Fund 1 (Total Return EUR)

Fund 2 (Total Return EUR)

throughFund

RobecoSAM

Corporate

Assessment.

3 (Total Returnannual

EUR)

S&P GLOBALSustainability

CLEAN ENERGY (Total

Return EUR)

Source: RobecoSAM 2011

The opposing theory is that SRI portfolios underperform conventional portfolios because SRI screens

impose a constraint on the investment universe. This

limits the diversification possibilities and consequently

shifts the so-called “efficient frontier” towards less

favorable risk-return tradeoffs. There are studies that

show that divesting from “sin stocks” – companies in

the alcohol, tobacco and gambling industries – may

negatively affect performance of portfolios since they

have historically outperformed the stock market. In

addition, SRI screening itself is an additional expense,

thereby reducing returns.

Integrating values does not have to come

at the expense of performance!

As is so often the case, the truth lies somewhere in

between. Placing too many constraints on a portfolio

may indeed cause significant deviations from a benchmark. At the same time, it has been proven that integrating environmental and social risk and opportunity

factors can help construct very attractive portfolios.

SRI is not new – many SRI funds already have a track

record of over 10 years. Studies of SRI performance

can therefore be based upon a long enough time

horizon and a large enough number of funds to allow

for meaningful conclusions. It is, however, important

not to compare apples with oranges. When talking

about performance, it is useful to distinguish between

broadly diversified products and thematic products.

The majority of studies on funds conclude that broadly

diversified SRI funds which are managed against a

broad market benchmark and are predominantly invested in large companies (best-inclass funds and funds

with a negative screen) appear to have similar riskadjusted returns as their conventional peers.

Chart 2:Conventional vs. SRI global funds:

similar performance

Annualized performance in %

14.0

12.0

10.0

8.0

6.0

160 4.0

2.0

120 0.0

–2.0

80 –4.0

40

Chart 4:Global clean energy related funds:

big differences

–1Y

–3Y

–5Y

Global Equity Funds (EUR)

–7Y

–10Y

Global Equity SRI Funds (EUR)

Sep Mar Sepdata

Mar isSep

Mar on

Sepglobal

Mar Sep

Mar funds

Sep Mar

Sep Mar

TheMarperformance

based

equity

available

06 06 07 07 08 08 09 09 10 10 11 11 12 12 13

in Europe with benchmark MSCI World and a correlation to the

Fund 1 (Total Return EUR)

Fund 2 (Total Return EUR)

benchmark

of higher than 0.9 over

all time periods.

Fund 3 (Total Return EUR)

S&P GLOBAL CLEAN ENERGY (Total Return EUR)

This is also confirmed by the performance of various

SRI indices, such as the MSCI World SRI Index or FTSE4Good Index, both of which perform roughly in line

with their “conventional” peers. Another illustration of

this similar performance is a comparison between the

MSCI Europe and MSCI SRI Europe indices, see chart

below.

Chart 3:MSCI SRI World vs MSCI World

115

110

105

100

95

90

85

Oct

11

Nov

11

Jan

12

Mar

12

Apr

12

MSCI World SRI (Total Return USD)

Jun

12

Jul

12

80

40

0

Mar Sep Mar Sep Mar Sep Mar Sep Mar Sep Mar Sep Mar Sep Mar

06 06 07 07 08 08 09 09 10 10 11 11 12 12 13

Source: Morningstar / UBS, as of 31.12.2012

Aug

11

160

120

0

80

Jul

11

Products which focus on specific themes seek to invest

in companies whose products and services address

environmental or social issues, for example companies

active in clean energy, energy efficiency, or water treatment. This usually leads to investment in predominantly

small and mid-sized companies with attractive growth

potential. They are usually young and operate in markets that are new and very dynamic. Stock performance

is correspondingly volatile. Such companies often perform very well in times of strong growth and booming

stock markets but may suffer in times of credit constraints and fear of deflation. General statements about

performance of thematic products are difficult due to

the variety of themes and the lack of comparability.

Even within a theme, as illustrated by the chart below,

there are significant differences in terms of performance and volatility. The selected funds all aim to play

clean energy opportunities but have different allocation

of investments to sub-themes (e.g. solar power vs. wind

power or energy efficiency).

Sep

12

Nov

12

Dec

12

MSCI World (Total Return USD)

Source: Datastream, as of 01. 03.2013

Feb

13

Fund 1 (Total Return EUR)

Fund 3 (Total Return EUR)

Fund 2 (Total Return EUR)

S&P GLOBAL CLEAN ENERGY (Total Return EUR)

Source: Datastream, as of 01.03.2013

Challenge: find the best managers

It should come as no surprise that, as with any investment product, SRI products are only as good as their

portfolio managers and the underlying financial analysis. The challenge is to find the best managers for the

respective products.

UBS offers knowledge, advisory and investment

solutions

Having offered SRI solutions for over fifteen years

and gained know-how in impact investing through its

philanthropy services, UBS has a great deal of ValuesBased Investing experience. We can offer a range of

solutions for clients wishing to integrate their values

into their portfolios while taking into consideration

their risk profile and their individual views of ethics

and sustainability.

For further information on UBS Values-Based

Investing solutions please contact us at

sh-vbi@ubs.com or ask your client advisor.

UBS Values-Based Investing, March 2013

© UBS 2013. All rights reserved.