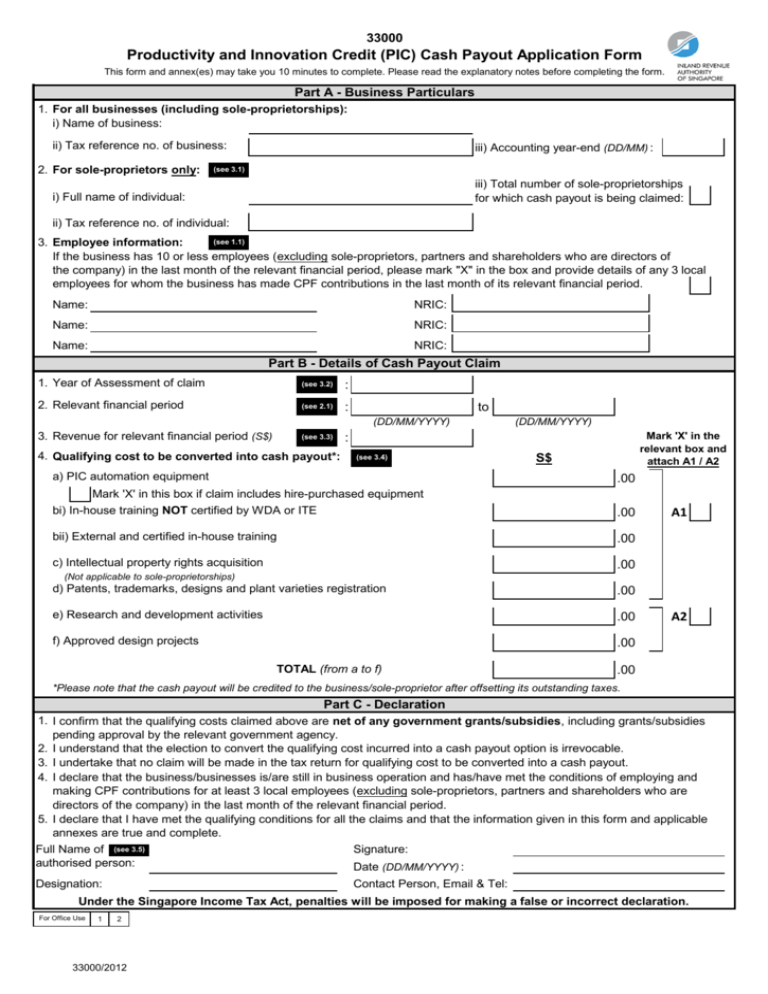

Productivity and Innovation Credit (PIC) Cash Payout Application Form

advertisement

33000 Productivity and Innovation Credit (PIC) Cash Payout Application Form This form and annex(es) may take you 10 minutes to complete. Please read the explanatory notes before completing the form. Part A - Business Particulars 1. For all businesses (including sole-proprietorships): i) Name of business: ii) Tax reference no. of business: 2. For sole-proprietors only: iii) Accounting year-end (DD/MM) : (see 3.1) iii) Total number of sole-proprietorships for which cash payout is being claimed: i) Full name of individual: ii) Tax reference no. of individual: (see 1.1) 3. Employee information: If the business has 10 or less employees (excluding sole-proprietors, partners and shareholders who are directors of the company) in the last month of the relevant financial period, please mark "X" in the box and provide details of any 3 local employees for whom the business has made CPF contributions in the last month of its relevant financial period. Name: NRIC: Name: NRIC: Name: NRIC: Part B - Details of Cash Payout Claim 1. Year of Assessment of claim (see 3.2) : 2. Relevant financial period (see 2.1) : to (DD/MM/YYYY) 3. Revenue for relevant financial period (S$) (see 3.3) 4. Qualifying cost to be converted into cash payout*: (DD/MM/YYYY) Mark 'X' in the relevant box and attach A1 / A2 : (see 3.4) a) PIC automation equipment S$ .00 Mark 'X' in this box if claim includes hire-purchased equipment bi) In-house training NOT certified by WDA or ITE .00 bii) External and certified in-house training .00 c) Intellectual property rights acquisition .00 A1 (Not applicable to sole-proprietorships) d) Patents, trademarks, designs and plant varieties registration .00 e) Research and development activities .00 f) Approved design projects .00 TOTAL (from a to f) A2 .00 *Please note that the cash payout will be credited to the business/sole-proprietor after offsetting its outstanding taxes. Part C - Declaration 1. I confirm that the qualifying costs claimed above are net of any government grants/subsidies, including grants/subsidies pending approval by the relevant government agency. 2. I understand that the election to convert the qualifying cost incurred into a cash payout option is irrevocable. 3. I undertake that no claim will be made in the tax return for qualifying cost to be converted into a cash payout. 4. I declare that the business/businesses is/are still in business operation and has/have met the conditions of employing and making CPF contributions for at least 3 local employees (excluding sole-proprietors, partners and shareholders who are directors of the company) in the last month of the relevant financial period. 5. I declare that I have met the qualifying conditions for all the claims and that the information given in this form and applicable annexes are true and complete. Full Name of (see 3.5) Signature: authorised person: Date (DD/MM/YYYY) : Designation: Contact Person, Email & Tel: Under the Singapore Income Tax Act, penalties will be imposed for making a false or incorrect declaration. For Office Use 1 2 33000/2012 33000/1 Productivity and Innovation Credit Cash Payout Application Form ANNEX A1 (PIC Automation Equipment/Training/Intellectual Property Rights Acquisition/ Patents, Trademarks, Designs and Plant Varieties Registration) BUSINESS PARTICULARS For all businesses (including sole-proprietorships): (ii) Business tax reference no. : (i) Year of Assessment of claim: (iii) Name of business: DETAILS OF QUALIFYING PIC EXPENDITURE Please refer to the qualifying conditions for each activity at www.iras.gov.sg (Businesses > For Companies > Productivity and Innovation Credit) before completing this annex. (Please attach a separate sheet if you need more space. For sole-proprietors making a claim for more than 1 business, please use a separate sheet for each business.) 1 No. Date incurred (DD/MM/YYYY) PIC Activity2 (please select from drop-down list) Description of equipment3/training course/ intellectual property rights Qualifying cost incurred (in S$) 1 2 3 4 5 6 7 8 9 10 TOTAL 1 $ Refers to date of purchase/HP instalment payment/period of lease; date of training; date of intellectual property rights acquisition; date of filing for registration of patents, trademarks, designs and plant varieties 2 1. Cash purchase of PIC automation equipment; 2. Hire purchase of PIC automation equipment; 3. Lease of PIC automation equipment; 4. Inhouse training not certified by WDA or ITE; 5. In-house training (WDA certified and ITE approved); 6. External training; 7. Intellectual Property Rights acquisition; 8. Patents, trademarks, designs and plant varieties registration) 3 Please indicate the serial number of the category for equipment that falls within category 5 to 34 of the PIC Automation Equipment List. For equipment acquired on hire purchase (HP) , please provide the date and duration of HP agreement, cost of equipment and principal amount paid (excluding HP interest) in the relevant financial period.Qualifying cost is computed based on the principal amount paid subject to the expenditure cap. 33000/1/2012 33000/2 Productivity and Innovation Credit Cash Payout Application Form ANNEX A2 (Research & Development Activities/Approved Design Projects) BUSINESS PARTICULARS For all businesses (including sole-proprietorships): (i) Year of Assessment of claim: (ii) Business tax reference no.: (iii) Name of business: Please refer to the qualifying conditions for each activity at www.iras.gov.sg (Businesses > For Companies > Productivity and Innovation Credit) before completing this annex. (Please attach a separate sheet if you need more space. For sole-proprietors making a claim for more than 1 business, please use a separate sheet for each business.) RESEARCH AND DEVELOPMENT ACTIVITIES (exclude R&D activities conducted on behalf of others by an R&D organisation) Description of R&D project (Please provide details, including: (i) objective of the project Date (ii) unique/innovative elements of the intended incurred product(s)/process(es) (DD/MM/YYYY) (iii) description of activities/study undertaken and any technical risks involved) Qualifying in-house R&D cost incurred (in S$) Qualifying outsourced R&D cost incurred (in S$) [A] [B] Qualifying cost Total under R&D qualifying cost-sharing cost arrangement incurred (in S$) (in S$) [C] [A+B+C] Qualifying out-sourced design cost incurred (in S$) Total qualifying cost incurred (in S$) [B] [A+B] APPROVED DESIGN PROJECTS Date of approval (DD/MM/YYYY) Description of design project Qualifying in-house Application design cost no. incurred (in S$) [A] 33000/2/2012 Explanatory Notes on completing the Productivity and Innovation Credit (PIC) Cash Payout Application Form Important: The original PIC Cash Payout Application Form must be endorsed by the authorised person and sent to 55 Newton Road, Revenue House, Singapore 307987. Facsimile or photocopy of the application form will NOT be accepted. Businesses eligible for PIC Cash Payout 1 1.1 Sole-proprietors, partnerships, companies (including registered business trusts) in business that have employed and made Central Provident Fund (CPF) contributions for at least 3 employees who are Singapore Citizens or Permanent Residents in the last month of the relevant financial period (see 2.1) of cash payout claim. These employees must not be sole-proprietor or partners of the business or shareholders who are directors of the company. Companies servicing related companies and derive arm's length fees qualify for PIC. Such companies must prepare their tax computation under the normal tax rules. 2 Relevant financial period of cash payout claim 2.1 Businesses are allowed to submit quarterly applications or accumulate claims for consecutive quarters within the same financial year. The relevant financial period for which the claim is made should consist of 3 months, 6 months, 9 months or 12 months. Completing the PIC Cash Payout Application Form 3 Part A – Business Particulars 3.1 Sole-proprietors making claims for more than 1 business should add all claims and submit 1 application form, after the end of the relevant financial period of all the businesses. Please submit separate annexes for each business indicating the relevant financial period (see 2.1) and Revenue for relevant financial period (see 3.3) in a separate sheet. Part B – Details of Cash Payout Claim 3.2 Qualifying cost refer to cost incurred in the financial year preceding the Year of Assessment (YA) (e.g. Qualifying cost incurred during the financial year 1 Apr 2010 to 31 Mar 2011 will be eligible for YA 2012 cash payments). Also, separate applications should be submitted for each YA. 3.3 Please fill in the revenue for the relevant financial period for which you are claiming the cash payout. Revenue refers to the main income source(s) of a business as reflected in its profit and loss account. For sole-proprietorships/partnerships, this would refer to its gross sales. 3.4 For each activity, please fill in the total qualifying cost to be converted into cash payout and complete the relevant annex. (E.g. If you wish to convert a total of $10,000 incurred on external training into a cash payout, please fill in “10,000” in Part B, item 4(bii), and provide details of the external training in Annex A1.) See Section 4 for details on how to compute the cash payout. Part C – Declaration 3.5 Authorised person(s) who can endorse the form are: - for companies: company director, principal officer, or a person authorised by the company; - for partnerships: precedent partner; - for sole-proprietorships: sole-proprietor. Important Information on Computing the Cash Payout 4 4.1 Businesses must claim a minimum qualifying cost of $400 for each application submitted. 4.2 The cap on total qualifying expenditure for all activities is $100,000 per YA for YA 2013 to YA 2015. A combined cap of $200,000 applies to claims made in YA 2011 and YA 2012. 4.3 The conversion rate for the cash payout is 30% for YA 2011 and YA 2012, and 60% from YA 2013 to YA 2015. 4.4 The maximum amount of cash payout that a business can receive is $60,000 per YA from YA 2013 to YA 2015, and a total of $60,000 for YA 2011 and YA 2012 combined. For sole-proprietors with multiple businesses, this cap is applied on the total claim for all their businesses. 4.5 The combined cap for YA 2011 and YA 2012 does not apply to newly incorporated companies or newly registered sole-proprietorships and partnerships whose first YA is YA 2012. For these companies/businesses, the cap on qualifying expenditure is $100,000 and the maximum amount of cash payout is $30,000 for YA 2012. 4.6 Expenditure on in-house training not accredited by Workforce Development Authority (WDA) or approved/certified by Institute of Technical Education (ITE) are eligible for PIC with effect from YA 2012, subject to a cap of $10,000 per YA. Supporting Documents 5 5.1 All sole-proprietorships and partnerships (including those with revenue <$500,000) that have applied for cash payout must submit their certified statement of accounts together with their income tax returns by the filing due date. Otherwise, IRAS may recover the cash payout. 5.2 Supporting documents such as invoices, agency approval letters and CPF Records of Payment do not need to be submitted with this application form. Businesses should retain these documents and submit to IRAS upon request. 5.3 All supporting documents submitted will be retained by IRAS. Businesses are advised to retain a copy for their own reference. When to submit the PIC Cash Payout Application 6 6.1 The application form and relevant annexes can be submitted anytime after the end of the relevant financial period, but no later than the filing due date of the income tax return (i.e. 15 Apr for sole-proprietorships/partnerships, and 30 Nov for companies). Application Outcome and Payment of Cash Payout 7 7.1 IRAS will generally disburse the approved cash payout within 3 months of receipt of this application form and relevant annexes. The cash payout will be credited into the business’/sole-proprietor’s GIRO account after offsetting its outstanding taxes. A cheque will be issued if the business does not have a GIRO arrangements with IRAS. We encourage businesses to join GIRO to facilitate future payments. Please download the GIRO application form from our website and send us the completed form. Disposal of Assets 8 8.1 The assets on which the PIC cash payout has been claimed must be held for at least 1 year. If assets are leased to another party/disposed within 1 year, the business must submit a Disposal of Qualifying Assets Form (available at IRAS' website) within 30 days from the date of lease/disposal. IRAS may issue a recovery notice informing the business to repay the cash payout. If you require further clarification, please call our helpline at 1800-356 8622 (for companies)/ (65) 6351 3534 (for sole-proprietorships/partnerships) or send an email to picredit@iras.gov.sg. Visit www.iras.gov.sg (Businesses > For Companies > Productivity and Innovation Credit) for more information on PIC.