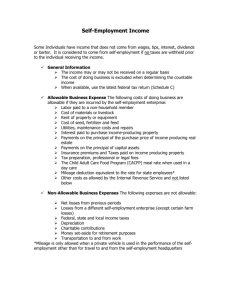

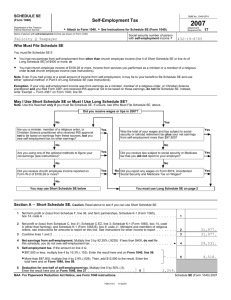

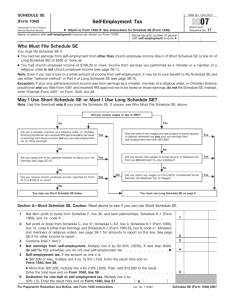

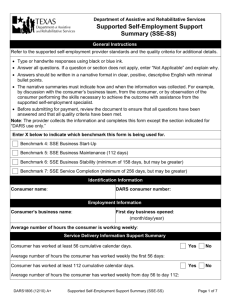

Self Employment Instructor Guide - Minnesota Department of Human

advertisement