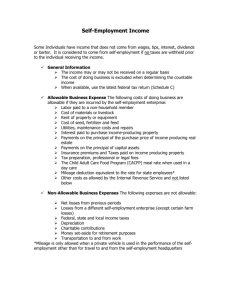

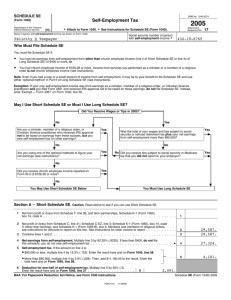

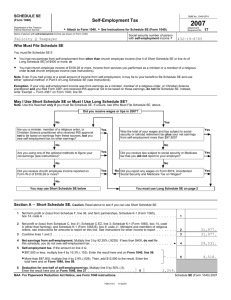

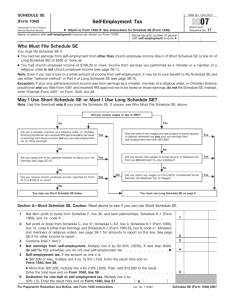

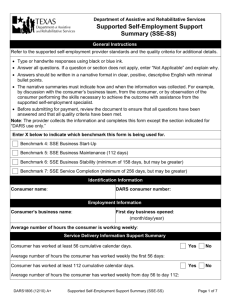

Self Employment Instructor Guide - Minnesota Department of Human

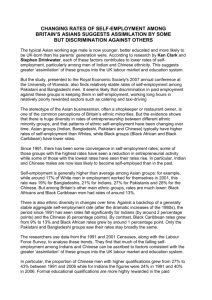

advertisement