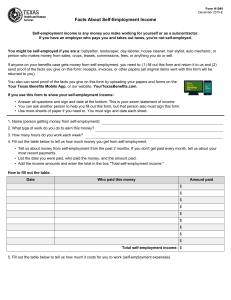

Self-Employment Income

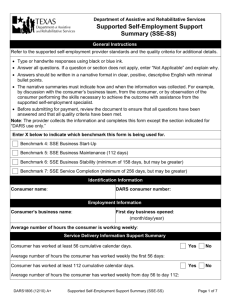

advertisement

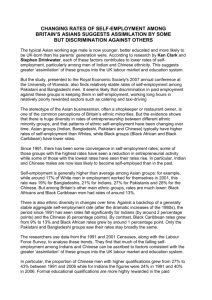

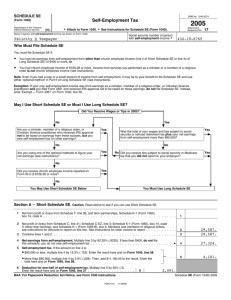

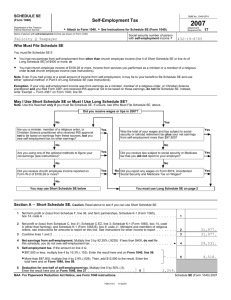

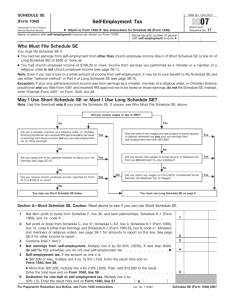

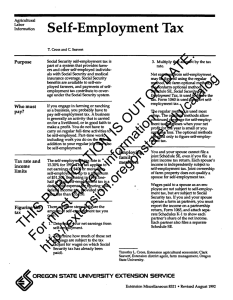

Self-Employment Income Some Individuals have income that does not come from wages, tips, interest, dividends or barter. It is considered to come from self-employment if no taxes are withheld prior to the individual receiving the income. General Information The income may or may not be received on a regular basis The cost of doing business is excluded when determining the countable income When available, use the latest federal tax return (Schedule C) Allowable Business Expense The following costs of doing business are allowable if they are incurred by the self-employment enterprise: Labor paid to a non-household member Cost of materials or livestock Rent of property or equipment Cost of seed, fertilizer and feed Utilities, maintenance costs and repairs Interest paid to purchase income-producing property Payments on the principal of the purchase price of income producing real estate Payments on the principal of capital assets Insurance premiums and Taxes paid on income producing property Tax preparation, professional or legal fees The Child Adult Care Food Program (CACFP) meal rate when used in a day care Mileage deduction equivalent to the rate for state employees* Other costs as allowed by the Internal Revenue Service and not listed below Non-Allowable Business Expenses The following expenses are not allowable: Net losses from previous periods Losses from a different self-employment enterprise (except certain farm losses) Federal, state and local income taxes Depreciation Charitable contributions Money set-aside for retirement purposes Transportation to and from work *Mileage is only allowed when a private vehicle is used in the performance of the selfemployment other than for travel to and from the self-employment headquarters Self-Employment in Home If the household operates a self-employment enterprise from the home, they have the option of counting the entire shelter expense as either a business or a shelter deduction. If the household chooses to have the cost considered as a business deduction, allow the entire deduction. If the household chooses to have the expenses considered as a shelter deduction, the expense MUST cover both the client’s home and business. If given as a shelter deduction, a business deduction CANNOT be given. Budgeting Self Employment Non-Farm Income If the self-employment activity has been in operation for at least 12 months, use the client’s latest federal tax return (provided it was filed and is representative of anticipated income). Otherwise use the client’s business records. If the business has been in operation less than 12 months, use the client’s records. Have the client sign and date a summary and advise the client to keep records of income and expenses so a more accurate estimate can be made at the next recertification. Recalculate the self-employment income at the next recertification by combining prior and new self-employment information. If the self-employment is seasonal, prorate the income over the months the income is intended to cover. Explore how the household meets living expenses throughout the entire certification period. Farm income is treated the same as other self-employment income except that losses may be subtracted from other earned income. If the farm loss exceeds the other earned income, the remainder may be subtracted from any unearned income. Note: When subtracting farm loss from earned income makes sure you allow the 20% work expense. Manual References Vol. II, Sections 5320, 5330, 5340, 5470