handling redundancies - Voluntary Action Sheffield

advertisement

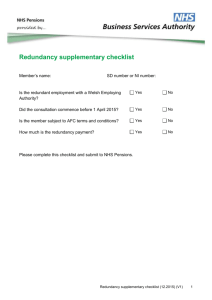

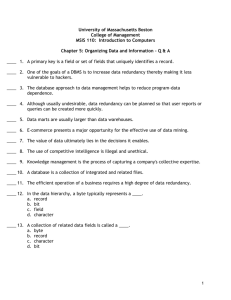

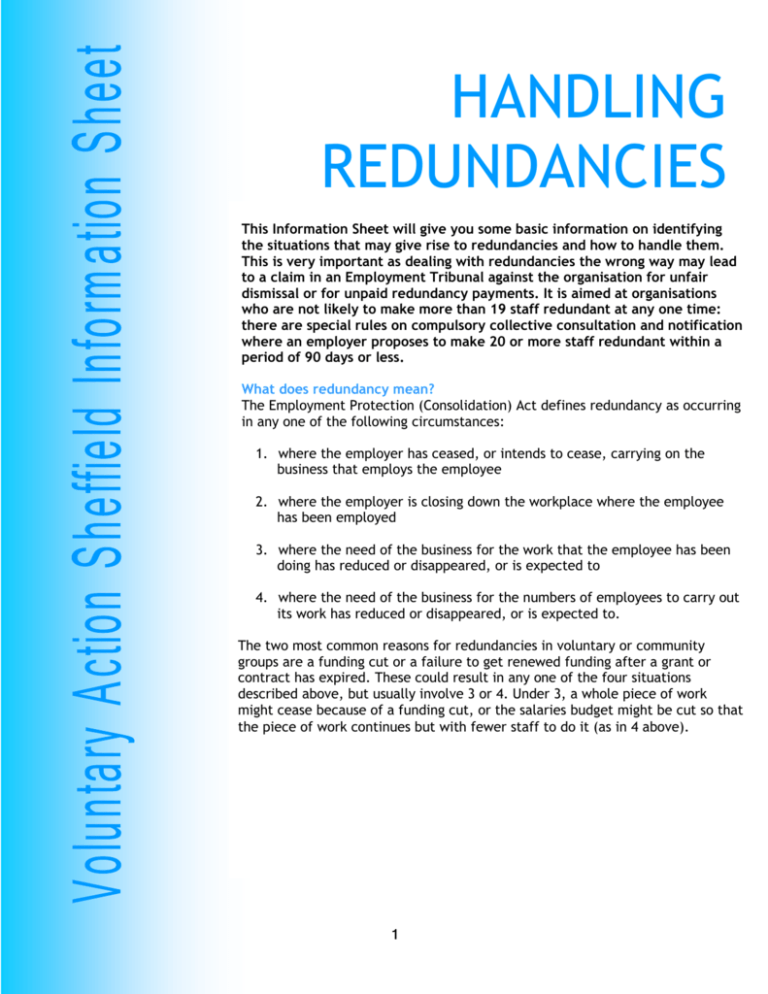

HANDLING REDUNDANCIES CHARITABLE LIMITED COMPANIES There are three This Information Sheet will give you some basic information on identifying the situations that may give rise to redundancies and how to handle them. This is very important as dealing with redundancies the wrong way may lead to a claim in an Employment Tribunal against the organisation for unfair dismissal or for unpaid redundancy payments. It is aimed at organisations who are not likely to make more than 19 staff redundant at any one time: there are special rules on compulsory collective consultation and notification where an employer proposes to make 20 or more staff redundant within a period of 90 days or less. What does redundancy mean? The Employment Protection (Consolidation) Act defines redundancy as occurring in any one of the following circumstances: 1. where the employer has ceased, or intends to cease, carrying on the business that employs the employee 2. where the employer is closing down the workplace where the employee has been employed 3. where the need of the business for the work that the employee has been doing has reduced or disappeared, or is expected to 4. where the need of the business for the numbers of employees to carry out its work has reduced or disappeared, or is expected to. The two most common reasons for redundancies in voluntary or community groups are a funding cut or a failure to get renewed funding after a grant or contract has expired. These could result in any one of the four situations described above, but usually involve 3 or 4. Under 3, a whole piece of work might cease because of a funding cut, or the salaries budget might be cut so that the piece of work continues but with fewer staff to do it (as in 4 above). 1 Is a fixed term contract the answer? Unfortunately no. If a fixed term contract expires without being renewed, the law treats this as a dismissal of the employee. If the reasons for the expiry and the procedures followed are not ‘fair’ within the definitions of the Employment Rights Act, then the dismissal may be’ unfair’ and an employee with full employment rights could claim compensation for unfair dismissal in an Employment Tribunal. The Fixed Term Employees Regulations 2002 prevents employers from putting any waivers into contracts entered into or renewed after July 2002 or from discriminating against fixed term employees in other ways without objective justification. The Regulations will also enable employees to claim permanent status after four years on fixed term contracts, with the four-year period beginning on 10 July 2002. Basic rights of employees facing redundancy Employees are entitled to: reasonable periods of time off with pay to look for other work during the redundancy notice period. It is good practice to extend this right to all staff. be offered suitable alternative posts if available within the organisation. A dismissal for redundancy can be avoided if the employer offers the employee such a post during the redundancy notice period. The employee must accept the offer before the date when her/his contract is due to end and start work in the new post within 4 weeks after her/his contract ends. An employee who accepts the offer is also entitled to a 4 week ‘trial period’ in the new post. However an employee will lose her/his right to a redundancy payment if s/he unreasonably refuses an offer of a suitable alternative post or unreasonably terminates the new post during the trial period. The redundancy policy and procedure One of the reasons for a potential ‘fair’ dismissal under the Employment Rights Act is redundancy. As funding cuts or unsuccessful bids to continue funding are often likely to involve redundancies, good employers should plan in advance how they will handle having to make staff redundant in these situations. There are basically three ways to handle redundancies: Ad hoc and informal arrangement varying with each situation (not recommended) Formal policy agreed with trade unions Formal agreement on procedure negotiated with the unions and workforce. The advantages of a formal policy and procedure It avoids the likelihood of unfair dismissal claims It demonstrates the employer’s commitment to welfare of the organisation’s staff It reduces stress and fear in the workforce It promotes stability and security of employment 2 The redundancy policy covers: A commitment to early consultation A commitment to minimising or avoiding compulsory redundancies A commitment to assisting employees to find retraining or alternative employment A commitment to fairness in developing criteria and procedures for selection for redundancies A reference to the ‘procedure’ document. The redundancy procedure covers: Statement of policy Consultation arrangements with individual employees both individually and collectively (see section below on consultation) Measures for minimising or avoiding compulsory redundancies: – natural wastage – retraining and/or assistance with relocation to another agency – restrictions on recruitment – reductions of hours – seeking applicants for early retirement/voluntary redundancy – non-renewal of temporary or fixed term contracts General guidance on the criteria to be used for selection in the event of redundancies Severance terms – in practice it must be the statutory minimum redundancy notice and payments for staff who qualify for these The principles informing the procedure The employer should balance the skills and experience of the workforce with the organisation’s future needs The employer should consult on any change or departure from the procedure and notify workforce immediately it is agreed The employer should negotiate changes to individual contracts separately with each employee (eg. if offering her/him a suitable alternative post) The employer should comply with the following disclosure requirements - reasons for proposals - numbers of staff affected - descriptions of posts affected - criteria for selection - method of implementation - method of calculation of redundancy pay The employer should clarify whether employees may leave during the redundancy period or postpone notice period without losing entitlement to redundancy pay The employer should allow employees time off to look for other work or training and provision of counselling and advice The employer should recognise employees’ union representatives’ rights of access to union members. Guidance on consultation When consulting with staff about who should be considered at risk of redundancy and about what selection criteria should apply, employers should: have an open mind hear employees‚ views both individually and collectively and discuss particular implications with individual employees try to provide as much information as possible and in an accessible form give staff reasonable time to consider the proposals and put forward alternatives give proper consideration to any proposals from staff both individually and collectively. 3 Redundancy notice All employees are entitled to a statutory minimum redundancy notice. For employees with: less than 2 years’ service 2 years but less than 3 3 years but less than 4 4 years but less than 5 and so on up to a maximum of 12 weeks 1 2 3 4 week weeks weeks weeks You may decide in your contract of employment to give longer periods of notice than the statutory minimum but you cannot give shorter periods. Redundancy payments Employers of staff who have completed 2 years or more continuous employment are entitled to statutory redundancy payments. These are calculated with reference to a week’s pay and cannot exceed 30 times the maximum. These rates depend on age and are: For employees aged 18-21 one half week’s pay for each completed year of service For employees aged 22-40 one week’s pay for each completed year of service For employees aged 41 + one and a half week’s pay for each completed year of service You may decide to give more generous payments in your redundancy policy, but you cannot provide for less generous than the statutory amounts. Statutory redundancy payments are paid free of income tax and National Insurance contributions. Additional payments made under a policy or contract and as long as the total amount does not exceed £30,000 it MAY be free of tax and NI. Financial planning and redundancies Organisations should build in minimum redundancy payments into their funding applications – especially for projects likely to extend beyond two years. Where an organisation has ongoing ‘core’ funding, it should estimate its current liability to make statutory minimum redundancy payments and create a contingency reserve to cover them. This obviously needs to be reviewed regularly as employees gain longer service. Generally accepted redundancy selection criteria Automatically unfair selections Automatically unfair selections will arise if the reason for selection is because, for example, an employee: engages in trade union membership or activities makes a health and safety complaint asserts a statutory employment right e.g. the taking of paternity leave is pregnant or on maternity leave Voluntary redundancies should be considered first. Then the employer can fairly proceed to apply the compulsory redundancy criteria which include: Present Capability 4 Work performance, adaptability and aptitude based on current and existing appraisals: Advantages In theory, it could be relevant and easier to assess Disadvantages It ignores future needs of the organisation. Be careful to avoid sex or disability discrimination in relation to adaptability Conclusion It may be useful in conjunction with ‘Future Needs’, but requires some careful thought. Conduct Attendance, timekeeping, sickness and disciplinary records. Advantages It is reasonably easy to calculate and apply Disadvantages The employer’s records must be accurate, and demonstrate reasons for absences. It requires consistency of approach, taking into account patterns of absences and having clear rules about standards are essential. It may give rise to disability discrimination claims if sickness or time-keeping is affected by a disability. Conclusion May be useful if employer has kept careful and consistent records and has good supervision Future Needs Skills, qualifications and other aptitudes needed by employer to meet future needs of the organisation: Advantages More relevant in a small organisation with professionally qualified staff Disadvantages May be difficult to assess these things objectively; employees selected on this basis may feel insulted and devalued, even if they do not contest their selection Conclusion Most logically useful, but can also be used in conjunction with ‘Present Capability’ 5 Organisations that can advise and help Voluntary Action Sheffield HR Advice Service (for employers) The Circle 33 Rockingham Lane Sheffield S1 4FW Tel: 0114 2536633 Website: http://www.vas.org.uk/ ACAS (Yorkshire and Humber) The Cube, 123 Albion Street, Leeds, LS2 8ER. Tel: 0113 205 3800 Website: http://www.acas.org.uk/ If you are an employee wanting advice, you can consult your Trade Union or if you are not in a trade union: Sheffield Law Centre Waverley House 10 Joiner Street Sheffield S3 8GW Tel: 0114 273 1888 http://www.slc.org.uk Useful publications BIS and ACAS produce a series of booklets with guidance and information for employers on all aspects of employment law. ACAS: Telephone: 08702 42 90 90 Fax: 01375 484 556 Email: acas@ecgroup.co.uk BIS: http://www.bis.gov.uk/policies/employmentmatters/rights/employers-charter Tele: 020 7215 5000 Email: Redundancy Handling – Booklet published by ACAS Reader http://www.acas.org.uk/media/pdf/4/7/B08_1.pdf 6 INFORMATION SHEETS available from VAS: Accessible Organisations Acquiring and Managing Premises Action Planning Business Planning Charitable Incorporated Organisations Closing Down Community Interest Companies Constitutions Contracts and Procurement Data Protection Disciplinary and Grievance Procedures Due Diligence Employing a Worker Equality and Diversity Guarantee Companies Handling Redundancies Health and Safety Incorporated Charities Insuring your Organisation Involving Volunteers Legal Structures Management Committees Monitoring and Evaluation Parents and Carers at Work Quality Assurance Safeguarding Vulnerable People Sickness Absence Management Starting Up Trading and Fund-raising The Circle 33 Rockingham Lane Sheffield S1 4FW Tel: 0114 253 6600 Fax: 0114 253 6601 Email: info@vas.org.uk Website: www.vas.org.uk Registered charity no: 223007 Company limited by guarantee no: 215695 Company limited by guarantee no: 215695 7