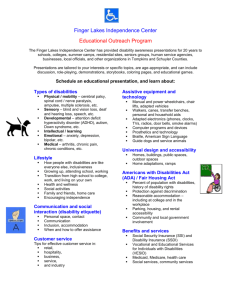

d financial aid for persons with disabilities in

advertisement