Anthony Tucker-Jones concludes his survey of the military aviation

TRAINING

Anthony Tucker-Jones concludes his survey of the military aviation market place with a review of future training needs

N CONCLUDING AFM's global survey of t h e m i l i t a r y a v i a t i o n m a r k e t s , it is necessary to analyse the trainer aircraft market.

Trainers, apart from their very public aerobatic activities, have traditionally been viewed as one o f the l e a s t e x c i t i n g e l e m e n t s o f m i l i t a r y a v i a t i o n . N e v e r t h e l e s s , t r a i n e r s provide a fundamentally vital service in all the world's air forces - they enable fast jet and multi-engine pilots to cut their teeth before being let loose on multi-million dollar front-line machines.

Defence m a n u f a c t u r e r s have always known that trainers, be they prop or jet engine, form an intrinsic part of military aviation. The turbinep o w e r e d t r a i n e r m a r k e t a l o n e has been estimated to be worth between $1 billion and 2 billion per annum. Now a new generation of prop (including the PC-21, ALX, KT-1A) and jet aircraft (including the AMX-AT, MiG-AT, Yak-130,

Mako and T-50) are coming on stream.

In an ever-changing market, this survey briefly reviews some of the lesser-known, as well as the better-known, programmes. Many countries obtained new and surplus turboprop and jet trainer aircraft during the late 1980s and mid-

1990s, with aircraft such as the Aermacchi MB-

326E, Aero L-29/59, BAE Systems Hawk, Embraer

EMB-312 Tucano, Enaer T-35B Pillan and

Nanchang K-8 Karakorum dominating the market.

However, the good news for trainer aircraft manufacturers is that the future replacement market is p o t e n t i a l l y huge. W o r l d w i d e requirements from at least 53 countries total approximately 3,000 aircraft. Furthermore, a challenge to the export success of the BAE Hawk is emerging. There is now a new pretender to the jet trainer/light attack throne - the EADS Mako is looming on the horizon.

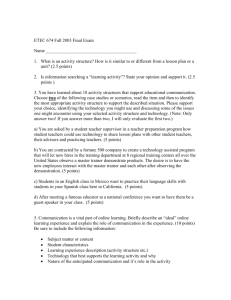

GLOBAL TRAINER AIRCRAFT REQUIREMENTS

2000-2015

Region

Africa

Americas

Asia-Pacific

Europe

Middle East

Total:

No of Countries

06

12

12

13

09

52

No of Trainers

88

1,201

898

614

248

3,049

With global t r a i n e r a i r c r a f t r e q u i r e m e n t s standing at over 3,000, this figure compares favourably with the previous market reviews.

GLOBAL MILITARY AVIATION MARKETS

REQUIREMENTS 2000-2015

Type No Countries

Trainers 51

Combat aircraft 42

Combat helicopters 33

F/W transport 53

R/W transport 53

No Aircraft

2,912

5,256

2,871

1,194

2,123

Europe

Europe has the third largest trainer market potential after the Americas and the A s i a - P a c i f i c region, with r e t i r e m e n t s f r o m at l e a s t 13 countries totalling over 600 aircraft.

The most n o t a b l e E u r o p e a n p r o g r a m m e is the E u r o p e a n

A e r o n a u t i c D e f e n c e and S p a c e

Company's (EADS - formerly DASA) Mako (shark)

Advanced Jet Trainer/Light Attack Jet. The fullscale mock-up first appeared at Paris Air Show in 1999, followed by Dubai, where it generated further press interest. Originally aimed at the

Republic o f K o r e a ( R o K ) and South A f r i c a , potential target customers now include Greece,

Spain and the UAE. C u r r e n t l y t h e r e is no anticipated domestic German market. The first of three prototypes is expected to fly in 2003, with production scheduled from 2007 and first deliveries a year later.

Current variants include the Mako-AT two seat

Advanced Trainer and the Mako-LCA single-seat

Light Combat Aircraft. According to EADS, the programme requires 300-350 orders to break even, with initial sales anticipated in 2008-2012 and a second period of high interest four years later. EADS optimistically predicts total sales of

800 Mako by 2030, of which 30% will be the two-seat version.

The Bulgarian Air Force desperately needs some 20-30 new trainers to replace its old

Aero L-29 Delfin. A turbo-prop type is f a v o u r e d r a t h e r t h a n a j e t , but the requirement is unlikely to be satisfied in the near term b e c a u s e of c h r o n i c funding shortages.

^ Likewise the Czech Republic was procuring 72 indigenous Aero L-59A worth $818.7 million for its Air

Force. Then, in 2001, it a n n o u n c e d t h a t half the fleet would have to be

THE WORLD

Europe's entry into the supersonic trainer market, the EADS Mako has had a protracted development history, but is being offered in both single and two seat versions. At the present time no one has ordered the aircraft, but interest has been expressed by several countries. The lack of a

domestic (German) order is not helping the programme. EADS offered for export due to the poor exchange rate

(which was pushing up the original contract price).

The Czech Defence Minister has since committed the government to the full order. The first L-159A was delivered to the ACR Tactical Air Force Base,

Caslav, Czech Republic, in A p r i l 2000. Final deliveries are expected in 2003. Additionally the

Czech Army is to purchase between six and 12 l_-

159B two-seater prototype light combat trainer aircraft for training its aviation units for combat missions. Production is scheduled to commence in mid-2002. Sale prospects for the L-159 include other East European countries - in particular

Poland, to whom a Maverick-armed version was offered in late 2000, and the Baltic States.

Estonia is seeking two primary trainers and is said to favour the Russian Yak (Aerostar) Yak-52.

H o w e v e r , its 2002 d e f e n c e budget stood at just $121 million and priority purchases are antia i r c r a f t , a n t i - t a n k , c o m m u n i c a t i o n and air surveillance equipment. Neighbouring Latvia w o u l d l i k e s i x light a t t a c k / t r a i n e r a i r c r a f t , though Sweden was offering up to 30-upgraded

Saab Sk 60s. Nonetheless, financial constraints mean that no procurement is anticipated before

2010. Lithuania has a similar requirement for light attack aircraft, the Czech Aero L-159 being the most likely option to supplement its existing six L-39C and L-39ZA Albatrosses.

The Poles have a sizeable requirement for up

EUROPEAN TRAINER AIRCRAFT REQUIREMENTS

Customer

Bulgaria

Czech Republic

Estonia

Latvia

Lithuania

Greece

Ireland

No Req'd Customer

30

84

02

06

06

100

08

Poland

Romania

Russia

Slovakia

Spain

UK

Total:

No Req'd

40

20

250

18

20

30

614

to 40 trainer/light attack aircraft to replace their

TS-11 Iskra: candidates include the indigenous

Iryda (no longer in production), Aero L-159, Mako and Hawk. Romania has largely opted for the more e c o n o m i c a l u p g r a d e o p t i o n . The

R o m a n i a n s h a v e 20 I A R - 9 9 indigenous advanced jet trainers built by Avioane. The government signed a $21 million contract in the late 1990s for a 24-aircraft upgrade to the new

IAR-99 standard with Elbit modernised avionics, plus an option for another 16.

The R u s s i a n s , who have Europe's biggest requirement, need at least 200-300 jet trainers to r e p l a c e their L-29/39 fleet. Indigenous candidates consist of the twin-engine Mikoyan

MiG-AT and Yakovlev Yak-130. SNECMA teamed with MiG to o f f e r its MiG Advanced Trainer utilising Larzac engines and Thales avionics.

The Yakovlev design has Progress turbofans, whilst Italy's Aermacchi has Westernised the

Yak-130 in the shape of the M-346, equipped w i t h a H o n e y w e l l F124 engine and o t h e r components. Significantly, both the MiG-AT and

Yak-130 have failed to find any export customers, whilst at home the MiG-AT remains the favourite.

Mikoyan estimates that foreign markets could bring in up to 500 orders.

Slovakia had shown interest in obtaining 12 Yak-

130, though no contract has been signed. In 2001 the Slovak government unveiled the air force section of its 'Force 2010' military modernisation plan which calls for the procurement of 18 multipurpose fighters in either supersonic or subsonic configurations. Slovakia is examining three

Korean Aerospace Industries and Lockheed

Martin have moved quickly to produce the T-50

Golden Eagle, which completed its first flight on

August 20, 2002. The aircraft's maiden flight marks the renewed market interest in high

(supersonic) performance advanced trainers, for several decades the sole domain of the longout-of-production T-38 Talon.

KAI/LOCKHEED MARTIN

Based on the PA-28 Saratoga, the Pillan is back in production to meet small orders from South

American countries. ENAER sees a good future for the T.35DT

turbo-powered version of the

aircraft (illustrated here by 191). KEY - MALCOLM ENGLISH options; modernising its existing fleet of MiG-29, leasing F-16 fighters from Belgium, or procuring new build subsonic (L-159, Hawk 200, MB-339 or

A M X ) aircraft. The proposal also calls for a limited number of jet trainer a i r c r a f t to be procured, such as the L-39 series or Hawk aircraft.

The Slovak Defence Minister has stated that these procurements should commence in 2005.

Greece's Hellenic Military Aviation wants 40-50 aircraft to replace its 34 remaining T-2E Buckeye as a f i g h t e r l e a d - i n trainer. T y p e s under consideration include Hawk 100, MB-339, MiG-AT,

Yak-130, L-139/159 and AMX-T. In addition, the

Greek Air Force ordered 45 American T-6A

Texan II in 1998 to be delivered between 2000-

2003, with an option for a further five. The Irish

Air Corps needs up to eight trainer/light strike a i r c r a f t to replace its A e r m a c c h i 5F.260WE

Warrior. Italy plans to procure another 15 MB-

339CDs jet trainers whilst Spain may require up to 20 lead-in jet trainers.

In the UK, BAE Systems has been trying to persuade the British Government to procure 30 additional Hawk as part of the outsourcing of military pilot training. This would form part of the proposed UK Military Flying Training System (UK

MFTS) due to be in place by 2007. Currently the intention is that 80 Hawks will receive a fuselage replacement programme, though by 2007 aircraft availability is expected to fall below flying training requirement for 115 aircraft. Similarly, Tucano availability is anticipated to fall below the level required by 2004-11. The out-of-service date for the RAF and RN Jetstream used for multi-engine pilot and observer training is anticipated to be

2007. Although the Dominie could last until 2015 it will require costly upgrades.

Conflict-stricken Yugoslavia has opted for an upgrade option with the G-4M Super Caleb

(Super Sea Gull), which it intends to implement w i t h its 25 r e m a i n i n g s t a n d a r d G-4. The p r o g r a m m e w i l l i n c l u d e e n h a n c e d combat c a p a b i l i t i e s , c o c k p i t m o d i f i c a t i o n s and powerpack upgrade, as engine replacement has been deemed too expensive.

assembled in-country. Brunei, which is seeking around ten armed trainers, has also selected the

BAE Hawk Mk 100/200, though a firm order is still awaited. In sharp contrast, India is looking for approximately 200 basic jet trainer and 70 advanced jet trainers. The former is for the Kiran replacement (design work on HJT-36 having commenced in the late 1990s), whilst for the latter the Hawk remains the favoured aircraft.

The Indians have been s e e k i n g to p r o c u r e advanced trainer jets since the mid-1980s. India requested pricing in 1999 for 92 Hawks (later reduced to 66), of w h i c h eight kits and 42 complete aircraft would be assembled by HAL at

Bangalore. Negotiations continue, hampered by

Indian-Pakistani tensions over Kashmir. At some stage India also needs a turboprop trainer.

To date, Pakistan has only procured six Chinese

K-8, though it is considering up to 100 to replace its Cessna T-37. However, a decision is not expected before 2005. Pakistan is marketing its

Super Mushshak basic trainer (the Saab Safri derivative) manufactured by AMF (the Pakistan

Aeronautical Complex, which is also involved in the K-8 programme). The company has been bidding to sell both aircraft to a number of potential customers in the Middle East. The only

Gulf client for Mushshak is Oman, which already has half a dozen, although the aircraft has also been sold to Iran and Syria in the past. The

Pakistani Air Force is currently taking delivery of ten Super Mushshak: its student pilots undergo their first 50 hours of training on the Mushshak.

To the east, Japan wishes to replacement its

Fuji T-3 (the Fuji T-7 was selected, but suspended, after complaints by the Swiss Pilatus Aircraft Ltd company over the bidding process) and the intention is to procure a total of 50 aircraft. The

RoK is a l s o s e e k i n g up to 100 a d v a n c e d trainer/light combat aircraft. An indigenous supersonic trainer is being developed jointly by

K o r e a n A e r o s p a c e I n d u s t r i e s ( K A I ) and

Lockheed Martin to replace older model BAe

Hawk 67s, Northrop T-38s and F-5Bs.

Korea's Samsung designed the T-50 (formerly the KTX-2) and manufacturing is to commence around 2005. One unusual aspect of the T-50's development is its pace. Full-scale development

(FSD) of the aircraft began in 1997, the first FSD aircraft was turned out on September 14, 2001, and the official rollout for the programme took place on October 31, 2001. The T-50 is capable of supersonic flight - of the other trainers either existing or in development, only the Mako is planned as a fully supersonic platform. The initial RoK Air Force (RoKAF) requirement is for

94 T-50s (50 T-50 trainer version plus 44 A-50 light combat variant), with options for up to 100 more. The T-50 is a l s o a i m e d at t h e international F-5 r e p l a c e m e n t market, and exports are estimated at 600-800 units. RoK was also considering up to 100 Hawks including lead-in trainers for F-16.

The RoKAF's new KT-1A Woong Bee turboprop trainer (designed to replace its Cessna T-41) made its most recent overseas debut at Singapore's Asia

The first export customer for the South Korean KAI KT-1 Woong Bee is the Indonesian Air Force.

The Republic of Korea Air Force will use the aircraft to replace its T-41s. KAI

Asia-Pacific

Asia-Pacific accounts for the second largest share of global demand for trainer aircraft after the Americas, with a regional total of almost

900. India, Pakistan and the RoK are the main market leaders.

Australia ordered 33 BAE Hawk in 1997, 12 of which are being built in the UK and the rest

ASIA-PACIFIC TRAINER AIRCRAFT REQUIREMENTS

Customer

Australia

Brunei

India

Indonesia

Japan

Malaysia

No Req'd

33

10

270

37

50

21

Pakistan

Philippines

Sri Lanka

Taiwan

Total:

100

12

Republic of Korea 279

Singapore 24

12

50

898

The West's most successful advanced trainer is the BAE Systems Hawk. Designed in the late

1960s/early 1970s, the type is still in production, but the advent of a new generation of advanced trainer that includes the Aermacchi M-346 and EADS Mako may have an impact on the type's world-

wide popularity. XX289 is in the colours of No 100 Squadron, based at RAF Leeming. KEY - DAVE WILLIS

60 January 2003

A e r o s p a c e 2002, where two a i r c r a f t w e r e showcased. RoK has 85 on order with 32 delivered by mid-2002. Final deliveries are due in

2003.

Indonesia still awaits delivery of a final six (out of a second order for 16) Hawk Mk 209, which were subject to a UK embargo. The Indonesian

Air Force (TNI-AU) acquired 20 two-seat Hawk Mk

53 advanced and eight Mk 109 lead-in fighter trainers from 1980 onwards. This sale courted controversy after some of them were reported to have been operated in the East Timor area. Two ex-US Navy two-seat TA-4J Skyhawk combat trainers were delivered in September 2001 after r e f u r b i s h m e n t by New Z e a l a n d ' s S a f e A i r company. Also in July 2002, the TNI-AU started to take delivery of 19 ex-Republic of Singapore

Air Force (RSAF) SF-260 trainer aircraft at Halim

Air Base, Jakarta. An initial six were handed over, and the rest are due by the end of the year.

The RSAF and TNI-AU are to work together to restore the aircraft to airworthiness. Indonesia also has ten KAI KT-1B basic trainers on order.

Neighbouring Malaysia would like 12 Hawk Mk

208 to join those purchased in the mid-1990s. In

2001 the Royal Malaysian Air Force ordered nine

Pilatus PC-7 Mk II Turbo Trainers. Although the

Philippines would like 12 light attack aircraft

(candidates include Hawk and the AMX), funding remains scarce.

The Royal Singapore Air Force decommissioned its SF 260 fleet in November 1999 after moving its pilot training to Australia and onto a different type of aircraft. The RSAF has been evaluating

RFIs for up to 24 new turboprop trainer aircraft.

Singapore is said to be planning to evaluate

A r g e n t i n a ' s AT-63 Pampa in 2003. The Sri

Lankan Air Force would like up to 12 additional K-

8s to supplement its previous batch of s i x , especially after three were lost to Tamil Tiger terrorist activity in mid-2001.

At some stage Taiwan will have to replace its i n d i g e n o u s AT-3 Tzu-Chung and A m e r i c a n supplied T-34. The island wants some 40-50 lead-in fighter trainers for its Ching-Kuo combat aircraft. Although Taiwan's Aerospace Industrial

Development Corporation's (AIDC) has completed production of the AT-3, an upgrade programme was started in 1997 and AIDC plans to produce the AT-3A/B variant. The AT-3 has been available, unsuccessfully, for export since 1985.

Middle East

Although the Middle East has traditionally been a significant fighter market, its trainer aircraft requirements are modest in comparison to

Europe and Asia-Pacific, accounting for only around 8% of total requirements. Only Egypt,

Israel and Saudi Arabia have any sizeable plans.

Bahrain has purchased three Firefly to be employed in primary and basic training roles.

There are also hopes that Bahrain may acquire the Hawk as an advanced trainer, something it currently lacks.

The Egyptian Air Force ordered 80 Chinese K-

8E to replace its Aero L-29 under a $345 million contract in 1999. The first ten are to be Chinese-

MIDDLE EAST TRAINER AIRCRAFT REQUIREMENTS

Customer

Bahrain

Egypt

Israel

Jordan

Kuwait

No Req'd

03

70

50

16

06

Customer No Req'd

Lebanon 05

UAE 20

Saudi Arabia 60

Qatar 18

Total: 248

Aermacchi had considerable success with its MB-326 and MB-339 families of trainers and light strike aircraft, and it hopes to repeat this with its new M-346 development of the Yak-130. MB-339

MM55062 of the RSV represents one of the latest MB-339CD ('completely digital') versions of the aircraft to join the Italian Air Force.

Pilatus has developed trainers for the Swiss Air Force (starting with the P.2) since the end of World

War Two, and has sold the PC-7 and PC-9 widewide - the latter type being developed by Beechcraft

(later Raytheon) for the US forces as the T-6A Texan II. The Royal Thai Air Force replaced its RFB

Fantrainers with the PC-9 from the early 1990s. KEY - CHRIS PENNY built, and the rest a s s e m b l e d by the A r a b

Organisation for Industrialisation. The first of these aircraft flew in mid-2000. Egypt has a longer-term requirement for an advanced jet trainer/light combat aircraft, although the RFP is still awaited. Potential candidates include Hawk and the L-139. Whilst the numbers are to be confirmed, simply replacing Egypt's Aero L-29 and Delfin L-59E Albatros would require about

70 aircraft alone.

I s r a e l r e q u i r e s 40-50 a d v a n c e d s c r e e n i n g / p r i m a r y trainer a i r c r a f t . The

Aermacchi SF-260, Enaer T-35 Pillan, Grob G-120A,

PAC CT-4E Airtrainer and Zlin Z 242L were shortlisted. The finalists were the G-120A and CT-4E, the former winning. The aircraft is expected to enter service in 2003 and will replace existing PA-

18 and Zukit trainers. The PZL M-26 Iskierka was also short-listed by the Israel Defence Force as the Piper Super Cub replacement. Kuwait has for some t i m e been e x p e c t e d to p u r c h a s e s i x additional Hawk Mk 64 as attrition replacements to supplement its existing 12.

The Royal Jordanian Air Force has ordered 16

Slingsby Firefly primary trainers to replace its

British A e r o s p a c e B u l l d o g s . Delivery was scheduled for the second half of 2002. Although the Lebanon could do with up to five trainers to r e p l a c e a i r c r a f t dating f r o m the 1960s, it remains largely reliant on gifted equipment.

One of the other major regional marketing opportunities is offered by the UAE. The K-8,

Mako, H a w k and s u r p l u s D a s s a u l t -

Breguet/Dornier Alpha jets have all been under consideration to meet its jet trainer requirement for an estimated 10-20 aircraft. At Dubai Air

Show in 1999, it was announced that the UAE was to buy 32 refurbished German Alpha jets rather than seven new British Hawk Mk 63s, though nothing came of this.

The Germans are also trying to interest the

Emirates in the Mako two-seater light combat aircraft/high performance trainer, successor to the Alpha jet. An initial MoU was signed with

UAE in November 1999 (teaming the UAE Air

Force and Air Defence with EADS) followed by additional MOUs at Dubai Air Show 2001. At the latter a full-scale twin-seater Mako mock-up and fully functional Mako Cockpit Demonstrator were displayed. The UAE University at Al Ain, t h e G u l f A i r c r a f t M a i n t e n a n c e C o m p a n y

(GAMCO), and the Higher College of Technology

(CERT) are reported to have joined forces with the Mako team. The prototype is not expected until 2003, which means it will not go into production until the end of the decade. The

Brazilian aerospace company Embraer has also been marketing its Super Tucano (ALX) turbo prop trainer and AMX jet fighter to the Emirates.

Saudi Arabia has signed a MoU for a second batch of 60 Hawks, reported to include the Mk

205 with APG-66H radar, although a contract has yet to be agreed. S i m i l a r l y Q a t a r was seeking 18 Hawk Mk 100s in the mid-1990s, though no deal was finalised.

The Americas

Because of the requirements of the US Joint

Primary Aircraft Training System (JPATS), the

Americas have the largest global demand with almost 1,200 trainers, representing some 40% of market needs.

Notably in Latin America, Argentina and Chile have revived indigenous trainer programmes. In

June 2000, Argentina recommenced production of the IA 63 Pampa, with a new batch of 12

Pampas (with options for a second batch) in the

AT-63 configuration, deliveries due in 2003. It has a modern Elbit avionics suite, a Honeywell turbofan, and enhanced weapons capability. The

$230 million contract includes upgrades to 14 existing Argentine Air Force IA 63 Pampas. The

Argentine Navy has also shown interest in acquiring a batch of eight a i r c r a f t . A 'newwww.airforcesmontMy.com 61

The Northrop Grumman 7-38 Talon is one of the few supersonic trainers to enter widespread service. The US Air Force has opted to upgrade its vast Talon fleet for further years of service via a number of airframe and avionics modifications. Seen about to land, this Talon serves with the

Turkish Air Force, the only current operator outside North America. KEY - ALAN WARNES

Military versions of the SF260 have been marketed since the late 1960s, and the type is still selling in

small numbers to air forces worldwide. This example is a SF 260WE of the Irish Air Corps. KEY - ALAN WARNES

THE AMERICAS TRAINER AIRCRAFT REQUIREMENTS

Customer

Argentina

Brazil

No Req'd

32

Chile

Cuba

Dominican Republic 04

Ecuador 02

50

25

20

El Salvador

Mexico

NATO

Panama

Venezuela

US

Total:

02

39

20

02

36

969

1,201 generation' Pampa NG appeared in 1997, but no orders were reported and it is now believed to have been subsumed by the AT-63 variant. Two prototypes of the latter were due to start flying by the end of 2002. C o l o m b i a may be a potential export customer for the AT-63.

Chile is seeking a replacement for its Cessna

A/T-37 with a requirement for 16-25 aircraft and a letter of intent was signed for the Raytheon

Beech T-6A Texan II in 1996. I n t e r n a t i o n a l promotion of the indigenous Chilean Enaer

Pillan resumed at Paris in 2001. Although work had s t o p p e d on E n a e r ' s A-35 P i l l a n piston trainer, the company is seeking further export orders and has several countries interested in the new T-35DT Turbo-Pillan. This is being offered with hardpoints to increase its utility, especially in the counter insurgency role.

Indeed, Chile announced the restart of Pillan production in 2000 with an initial batch of four, out of a total build of 12, for the Dominican

Republic. The latter took delivery of the last eight production models in 1999-2000 and wants the second batch for offshore patrol. El

S a l v a d o r , w h i c h is in need of a t t r i t i o n replacements, may account for some of the others being built. Regional interest in the

Pillan, and even the more expensive Turbo-Pillan

(still less than $1 million a copy), remains strong considering that a Tucano, Pilatus PC-7 or PC-9 trainer are at least several million dollars more apiece. In 1997-98 there were proposals for

R u s s i a n - a i d e d development of an upgraded

Pillan 2000 with a redesigned and lighter wing, but these seem to have come to nothing.

Cuba has some 40 Zlin 326 and Aero L-39C

Albatros which need to be replaced but, as ever, it lacks the necessary funds. In the meantime,

Brazil is in the process of procuring 50 Embraer

AT-29 (EMB-314) Super Tucano ALX, with 30 of these replacing the AT-26 Xavante with 2°/5°

Grupo of Training Command at Natal AFB. The remainder w i l l be c o n f i g u r e d for the night intruder role and will serve with 1°/3° Grupo at

Boa V i s t a and 2°/3° Grupo at Porto Velho.

EMBRAER's EMB-312 will enjoy at least another decade of production, with Brazil procuring the

ALX light combat version. The Ecuadorian Navy is buying four new-build Enaer ECH-51B Pillans.

A l t h o u g h M e x i c o ' s A i r Force a c q u i r e d 30

A e r m a c c h i SF.260E trainers in 2000, it s t i l l needs 39 AT-33A replacements: Hawk, Aviojet,

A l p h a a n d A M X a r e p o s s i b l e c a n d i d a t e s .

Panama, bereft of funds, has taken delivery of two r e f u r b i s h e d T-35 P i l l a n s f r o m E N A E R to supplement ten delivered in the late 1980s.

The trainer/ground attack aircraft programme is the most prominent project currently being u n d e r t a k e n b y t h e V e n e z u e l a n m i l i t a r y .

V e n e z u e l a has been negotiating to buy the

Italian MB-339FD and the Brazilian A M X - A T A

(Advanced Trainer & Attack) trainers. The initial planned order was for eight MB-339FD, with a follow-up batch of eight AMX-ATA. Embraer was anticipating that Venezuela would order two further batches of AMX-ATA: however, economic uncertainty has put a question mark over the total number of a i r c r a f t which will now be purchased.

In 2001, Venezuela bought just eight AMX-ATA however, the total order could be for up to 24 aircraft. Three years before that, Venezuela had ordered the Aermacchi SF260E piston engine t r a i n e r ( h a v i n g a l s o c o n s i d e r e d Czech and

Russian aircraft) to replace its ageing Beech T-34

Mentor, with 12 aircraft due to be delivered from

1999 onwards. Further options could include an additional 18, although funding remains an issue.

Venezuela took delivery of two M-26 01 from

Melex USA Inc for the National Guard Training

Centre at Porlamar, Isla Margarita, in 1998.

In North America, the Canadian-based NATO flying school has been acquiring 20 Raytheon T-

6A Texan II and Hawk Mk 115,17 aircraft having been delivered by 2001. The USAF/USN Joint

P r i m a r y A i r c r a f t T r a i n i n g S y s t e m ( J P A T S ) requirement, worth $4.7 billion, was won by the

B e e c h T - 6 A T e x a n II in 1995. The t o t a l requirement is for 782 aircraft (454 USAF, 328

US Navy) by 2017. Deliveries started in 2000 and are continuing. The T-6A Texan II now has the security of US military commitment, making it viable even without exports. In contrast, its cousin, the Pilatus PC-7/PC-9 series, has enjoyed a slow stream of international demand.

To meet requirements for fast jet training, the

US Air Force (USAF) is upgrading approximately

500 N o r t h r o p T-38A/AT-38B Talon to the C standard. The US Navy (USN) has an ongoing procurement programme for 187 Boeing BAE T-

45A/C Goshawk carrier-capable jet trainers.

These aircraft are replacing the T-2C Buckeye and T A - 4 J S k y h a w k , a n d f i n a l d e l i v e r y i s expected in 2005. They will sustain the naval trainer fleet until 2020, though 40 more aircraft will be required for an out-of-service date of

2035 at the end of the Goshawk's airframe life.

Looking ahead to combat a i r c r a f t training,

Lockheed Martin's F-22 will not have a two-seat

F-22B version. This move away from dedicated trainer models could increase Lead-in Fighter

Trainer (LIFT) demand.

Africa

In A f r i c a , the paucity of procurement funding means trainer aircraft acquisition remains a low priority, despite the f a c t that many e x i s t i n g holdings are no longer airworthy. For example,

Zimbabwe's Hawk Mk 60s face a constant battle for spares and are regularly grounded.

Angola recently acquired six ex-Peruvian Air

Force EMB-312 Tucanos for training purposes.

Aero Vodochody has developed its L-39 Albatros family into the L-159 Advanced Light Combat Aircraft,

which can also undertake - in its L-159B incarnation - the advanced training role. JAN KOUBA/AERO VODOCHODY

62 lanuary 2003

AFRICAN TRAINER AIRCRAFT REQUIREMENTS

Customer

Angola

Cote d'lvoire

DRC

No Req'd

06

20

25

Uganda

South Africa

Zambia

Total:

05

24

08

88

The Democratic Republic of Congo will, at some stage, need to update its elderly fleet of 25

Reims Cessna FRA 150M and Aermacchi MB-

326GB. Similarly the Cote d'lvoire has four 20y e a r - o l d Beech F33C B o n a n z a . U g a n d a desperately needs five trainer aircraft as few of its existing fleet are airworthy.

The Zambian Air Force (ZAF) acquired eight

Chinese K-8 in 1999 and is expected to obtain a s e c o n d b a t c h a s MB-326GB r e p l a c e m e n t s .

However, the K-8 has not met with universal approval from the ZAF. Additionally, CATIC

(China National A e r o - T e c h n o l o g y Import &

Export Corporation) and Pakistani officials have remained under contract to the ZAF to provide v i t a l support. Three of Z A F ' s K-8s from 43

Squadron were successfully deployed to South

Africa's Africa Aerospace and Defence 2000.

The Air Force of Zimbabwe (AFZ) needs Hawk attrition loss replacements, having lost four in the Democratic Republic of Congo (DRC). Three of the l a t t e r w e r e l a r g e l y due to pilot i n e x p e r i e n c e or i n c o m p e t e n c e w i t h o v e r e x t e n s i o n of their s t r i k e range rather than o p p o s i t i o n a c t i o n . The m e l t d o w n o f the

Zimbabwe economy has impacted significantly on the AFZ with a lack of serviceable aircraft and trained pilots. During the spring of 2001 none of its H a w k s (Hunters or other strike aircraft) were serviceable, due in part to a lack of foreign exchange to purchase vital spares. In

January 2000, Zimbabwe sought Hawk parts from the UK, but the following May the British g o v e r n m e n t b l o c k e d a l l new Z i m b a b w e a n applications for arms and military equipment, including vital spares for the AZF's Hawk.

South Africa needs 24 lead-in fighter trainers by 2005 to replace its old Impala. The BAE

Systems Hawk has been selected: an initial tranche will comprise 12 aircraft, with an option f o r the s e c o n d b a t c h . S o u t h A f r i c a a l s o considered the EADS Mako before opting for the

Gripen as its fighter replacement. The SAAF has about 50 Impala II, of which 50% are in storage, and 35 Impala I. In the late 1990s, South Africa supplied six surplus Impala to Cameroon.

The Future

In total, global demand for turbo-prop and jet trainer aircraft amounts to at least 3,000 over the next ten to 15 years, with prospects the most promising in Europe and Asia-Pacific. EADS optimistically forecasts a world market for 2,500-

3,000 light combat aircraft between 2007-2027.

However, things do not look as good for the smaller indigenous programmes in countries such as Argentina, Chile and Taiwan, which will be forced to seek international partners or sink.

The way ahead may possibly have been shown by Aermacchi with its M-346, the Westernised

Yak-130 derivative.

Furthermore, overall trainer fleets are not vital to, or for, national security - indeed outsourcing is seen as a way of achieving value for money when it comes to pilot training. Shared trainer fleets may be the way ahead, as in the Euro-

NATO Joint Jet Pilot Training (ENJPT), NATO

Flying in C a n a d a (NFTC) and the A d v a n c e d

European Jet Pilot Training (AEJPT). These have better usage rates than national holdings. Joint training facilities, using common trainer fleets in countries with space to spare and considerable aviation experience, will become more popular.

Indeed, BAE Systems is currently considering similar operations based in Australia for the

Asian market and Bahrain for the Middle East.

One of the most notable trends is that the

E A D S Mako and L o c k h e e d M a r t i n / K o r e a n

Aerospace A-50/T-50 herald a return to the supersonic F-5/T-38 approach to training. Some air forces are modifying their supersonic F-5s to a LIFT configuration (Turkey and Spain, and

Taiwan may f o l l o w suit). Another f a c t o r in favour of advanced jet trainers is a potential return to the high-low mix. Supersonic trainers can be utilised as light fighters or attack aircraft.

Rather than acquiring expensive middleweight fighters, countries may opt for a number of lighter and less expensive aircraft to supplement their heavier fleets, in which case there may be an emerging market for combined trainer/light combat aircraft.

In a market which has always been fiercely competitive, it seems likely that the little guy will be 'muscled' out by the bigger European and

Asian players. Certainly EADS is trying to steal a lead on f u t u r e s u p e r s o n i c jet trainer/light combat aircraft requirements with the aptlynamed Mako, or Shark. In the turboprop field,

Pilatus r e c e n t l y r o l l e d out i t s new PC-21 b a s i c / a d v a n c e d t r a i n e r , w h i c h is bound to maintain the tradition of the PC-7/9.

Global Military Aviation Markets

The aggregate total for the current and future

Trainer/Combat aircraft markets (see table 2), covering a 15 year period, stands at 8,168 units.

However, in comparison to other market analytical groups' figures these are optimistic and include some duplication.

To take an example, Forecast International/DMS, in its 'World Market for Fighter/Attack/Jet Trainer

Aircraft -1997-2006', predicted that "overall trend within this market is unquestionably one of continuing force downsizing...", adding that "The declining threat to US and Western European security from their former nemesis, the latter's chaotic economy, and an overall re-emphasis on diverting funds into non-defence sectors are combining to result in a shrinking market for new fighter/attack/trainer aircraft." Nevertheless, with the increasing age of many trainer fleets, it may be that this trend is due for reversal.

Forecast International/DMS predicts that over the next ten y e a r s , a t o t a l of 3,369 fighter/attack/jet trainer aircraft valued at $100.8

billion will be produced worldwide, and that annual output will rise during the second five-year period. The Teal Group forecasts that some 2,949 combat a i r c r a f t valued at $114.4 billion are expected to be built in the 1997-2006 period.

Teal's forecast shows a significant increase over the 2,700 combat aircraft for the 1995-2004 period. In the light of these predictions, the competition for upcoming Fighter/Attack/Jet

Trainer contracts can only intensify.

Large numbers of Yak-52s are in use with the ROSAAF sports flying organisation in Russia for basic training. This example is based at Kaluga outside Moscow.

KEY - STEVE BRIDGEWATER

Slingsby's T67M Firefly has won a pair of important military orders lately, with both Bahrain and

Jordan having decided to use the type for the basic training role. To celebrate the Jordanian order for 16 T67M260s, Slingsby painted this aircraft in Jordanian colours. SLINGSBY www.alrtorcesmonmiy.com 63