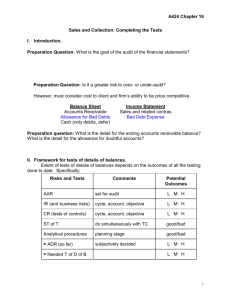

A424 Chapter 14 Sales and Collection Cycle I. Introduction: Review

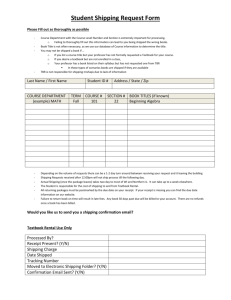

advertisement

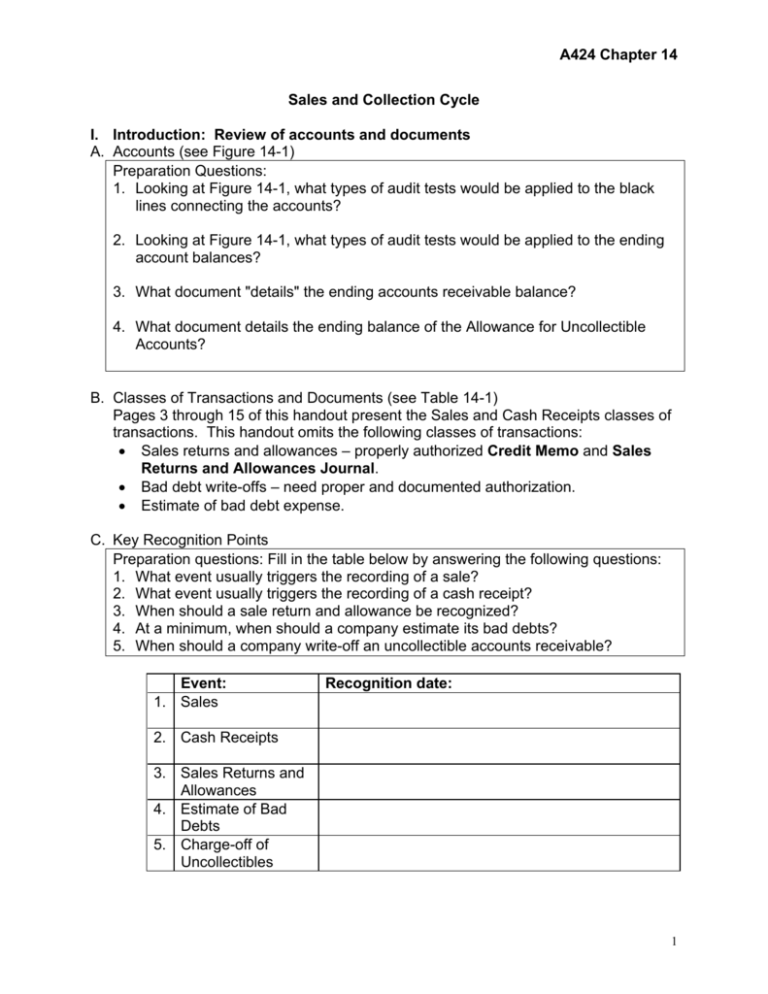

A424 Chapter 14 Sales and Collection Cycle I. Introduction: Review of accounts and documents A. Accounts (see Figure 14-1) Preparation Questions: 1. Looking at Figure 14-1, what types of audit tests would be applied to the black lines connecting the accounts? 2. Looking at Figure 14-1, what types of audit tests would be applied to the ending account balances? 3. What document "details" the ending accounts receivable balance? 4. What document details the ending balance of the Allowance for Uncollectible Accounts? B. Classes of Transactions and Documents (see Table 14-1) Pages 3 through 15 of this handout present the Sales and Cash Receipts classes of transactions. This handout omits the following classes of transactions: Sales returns and allowances – properly authorized Credit Memo and Sales Returns and Allowances Journal. Bad debt write-offs – need proper and documented authorization. Estimate of bad debt expense. C. Key Recognition Points Preparation questions: Fill in the table below by answering the following questions: 1. What event usually triggers the recording of a sale? 2. What event usually triggers the recording of a cash receipt? 3. When should a sale return and allowance be recognized? 4. At a minimum, when should a company estimate its bad debts? 5. When should a company write-off an uncollectible accounts receivable? Event: 1. Sales Recognition date: 2. Cash Receipts 3. Sales Returns and Allowances 4. Estimate of Bad Debts 5. Charge-off of Uncollectibles 1 A424 Chapter 14 II. Examine Internal Controls and Transactions - Satisfy TRAOs by looking for control activities or performing other tests that assure: Specific Objectives TRAO Sales Collections Occurrence Recorded sales are for Recorded cash receipts are shipments actually made to for funds actually received customers. by the company. Completeness Existing sales transactions Cash received is recorded are recorded. in the cash receipts journal. Accuracy Recorded sales are for the Cash receipts are amount of goods shipped deposited and recorded at and are correctly bill and the amounts received. recorded. Classification Sales transactions are Cash receipts transactions properly classified. are properly classified. Timing Sales are recorded on the Cash receipts are recorded correct dates. on the correct dates. Posting and Summarization Sales transactions are Cash receipts are properly properly included in the included in the accounts accounts receivable master receivable master file and file and are correctly are correctly summarized. summarized. A. Occurrence – greatest concern is fictitious customers; for example, for TC look for authorization of credit, valid customer number, shipping documents, sending of monthly statements. For STofT add verification of monetary values, tracing to perpetual inventory records. B. Occurrence – greatest concern is the diversion of cash receipts – do STofT, such as a proof of cash, tests for lapping of accounts receivable. III. Types of Tests and Evidence A. Tests of Controls (documentation, inquiries, reperformance, and observation) B. Substantive Tests of Transactions (documentation, inquiries, recalculation) IV. Audit Procedures Many possibilities, some may satisfy more than one objective V. Example See documents of sales and collection system. 2 A424 Chapter 14 Sales Processing System Basic Accounting Document Flow Diagram Customer (Customer Order) Financial Statements 3 A424 Chapter 14 Exhibit 1: Sample Sales Order ABC Seller Corp. 1234 W. Main Street Fort Wayne, IN 46802 CHARGE SALE ORDER SOLD TO: FIRM NAME __XYZ Buyer Co.__ ATTENTION OF _Bill Harden___ ADDRESS __4357 North Wells_ CITY _____Fort Wayne_______ STATE _IN_ ZIP __46805_____ INVOICE NUMBER __12-28602 INVOICE DATE __9-12-12__ PREPARED BY ____KSP__ CREDIT AUTHORIZED __LH__ FOB ___Shipping Point_______ CREDIT TERMS __2/10, n/30__ CUSTOMER PURCHASE ORDER: NUMBER __156443____ DATE ___Sept. 8, 2012____ SIGNED BY _Bill Harden___ QUANTITY ORDERED 130 50 100 PRODUCT NUMBER XL2000 L2000 XL5000 DESCRIPTION Acctg. Society T-shirt Acctg. Society T-shirt Acctg. Society sweat shirt SHIPMENT DATE ____9/12/12_ SHIPPED VIA __NAVL_______ B.O.L. NO. __12-10279_______ QUANTITY SHIPPED 130 5 100 UNIT PRICE 5.00 5.00 12.50 TOTAL 650.00 25.00 1,250.00 TOTAL SALE CUSTOMER ACCT. NO. VERIFICATION 1,925.00 1037 George sales department enters customer order information. credit department enters credit terms. warehouse department fills-in quantity shipped. shipping department fills-in shipping date, shipped via, and bill of lading number. billing department extends, prepares sales invoices. 4 A424 Chapter 14 A Customer Order is a request (an offer) to buy merchandise from the client company. There is no particular format for the information or mode of communication (e.g., written, phone, e-mail, web, linked computer systems, sales representatives, or customer purchase order). A Sales Order (see Exhibit 1) has a set format (as company specified) and is prepared from information on the customer order by the ___________________. The number of copies produced varies depending on the client’s internal control system, in this example the system requires ten (10) copies. One Copy (Copy 1) initially goes to the __________________ for a credit check and verified approval. The other nine copies are kept in a temporary file. After approval by the Credit Department, copy 1, plus the other nine copies, simultaneously go to: Copy 1 customer open order file along with the customer order Copy 2 warehouse as a stock release Copy 3 warehouse as a file copy Copy 4 billing as an invoice Copy 5 billing as a ledger copy Copy 6 billing as a file copy Copy 7 shipping as a shipping notice Copy 8 shipping as a packing slip Copy 9 shipping as a file copy After the goods are shipped and billed the Sales department receives the shipping notice copy of the sales order. This triggers the paperwork to be moved from the open file to a closed file. If any items are backordered the company should have a system to finish filling the order. 5 A424 Chapter 14 Exhibit 2: Sample Shipping Document (or Bill of Lading) Uniform Bill of Lading – Domestic Document No. 12-10279________ Shipper No. ______________ Carrier No. _______________ Date ___9/12/12____________ ABC Seller Corp. 1234 W. Main Street Fort Wayne, IN 46802 (219) 444-1234 TO: Consignee __XYZ Buyer Co._______ Street ___4357 North Wells________ City/State _Fort Wayne, IN__ Zip _46805_ Route: Number of Shipping Units 1 _____NAVL_____________ (Name of Carrier) Vehicle Kind of packaging, description of articles, special marks and exceptions corrugated 48 X 48 clothing Weight 50# Rate .50 TOTAL Charges 25.00 $ 25.00 The agreed or declared value of the property is hereby specifically stated by the shipper to be not exceeding: IF WITHOUT RECOURSE: the carrier shall not make delivery of this shipment without payment of freight ________________________________ $ ____________ per __________________ (Signature of Consignor) FREIGHT CHARGES Signature below signifies that the goods Check appropriate box: described above are in apparent good order, [ ] Freight prepaid except as noted. Shipper hereby certifies that [ X ] Collect he is familiar with all the bill of lading terms and [ ] Bill to shipper agrees with them. SHIPPER ABC Seller Corp. CARRIER NAVL PER Mike Shipping-Clerk PER Dave Driver DATE 9/12/12 (This bill of lading is to be signed by the shipper and agent of the carrier issuing same.) CONSIGNEE Original document prepared by _____________________________________ when goods and stock release are received from the warehouse & reconciled with the shipping notice. Original document (#1) goes to shipping log or file One Copy (#2) goes to carrier One Copy (#3) goes to carrier for customer (with merchandise) 6 A424 Chapter 14 Exhibit 3: Sample Sales Invoice INVOICE NUMBER: 12-28602 INVOICE DATE: September 12, 2012 CUSTOMER NUMBER: 1037 ABC Seller Corp. 1234 W. Main Street Fort Wayne, IN 46802 SOLD TO: FIRM NAME __XYZ Buyer Co.__ ATTENTION OF _Bill Harden___ ADDRESS __4357 North Wells_ CITY _____Fort Wayne_______ STATE _IN_ ZIP __46805_____ Customer Order No. 156443 QUANTITY ORDERED 130 50 100 Our Sales Order # 12-28602 PRODUCT NUMBER XL2000 L2000 XL5000 Date Shipped 9/12/12 Shipped Via NAVL DESCRIPTION Acctg. Society T-shirt Acctg. Society T-shirt Acctg. Society sweat shirt F. O. B. Shipping Point Terms 2/10, n/30 QUANTITY SHIPPED 130 5 100 UNIT PRICE 5.00 5.00 12.50 Pay This Amount Salesperson Sam TOTAL 650.00 25.00 1,250.00 $ 1,925.00 Thank You! Document prepared by the ___________________________ when it (he/she) receives stock release and shipping notice from shipping. Original (#1) and one copy (#2) are sent to the customer. The copy is a remittance advice and is marked Return with Payment. One copy (#3) called the ledger copy goes to accounts receivable. One copy (#4) called the file copy goes to file. Stock release is sent to inventory control. Shipping notice is sent to sales department. 7 A424 Chapter 14 Exhibit 4: Sample Sales Journal ABC Seller Corp. Sales Journal Date 2012 Sept. 1 2 3 3 3 3 4 etc. 12 12 etc. Account Debited Invoice No. Ref. S250 Accts. Rec. Dr. Sales Cr. Abbot Sisters Babson Co. Carson Bros. Deli Co. XYZ Buyer Co. Hooper and Kids Yahoo, Inc. 12-28576 12-28577 12-28578 12-28579 12-28580 12-28581 12-28582 10,600 11,350 7,800 9,300 2,450 5,400 3,414 Deli Co. XYZ Buyer Co. 12-28601 12-28602 45,900 1,925 205,000 Total for September Document prepared by _________________________. Periodically total information is sent to the general ledger clerk. Exhibit 5: Sample Accounts Receivable Subsidiary Ledger (or Master File) Name: XYZ Buyer Co. Address: 4357 North Wells Fort Wayne, IN 46805 Date Sept. 1, 2012 Sept. 3 Sept. 5 Sept. 12 Explanation Beg. Balance Invoice No. Account Number: 1037 Sale (DR) 12-28580 2,450 12-28602 1,925 Payment (CR) 8,000 Account Balance 12,500 12,950 4,500 6,425 Document prepared by __________________________ after it (he/she) receives ledger copy. Summary information (such as an accounts receivable aging) is periodically sent to general ledger clerk for the purpose of reconciling the control account to the aging. 8 A424 Chapter 14 Exhibit 6: Sample Monthly Statement Monthly Statement ABC Seller Corp. 1234 W. Main Street Fort Wayne, IN 46802 Customer: Invoice Number 12-28327 12-28580 12-28602 XYZ Buyer Co. 4357 North Wells Fort Wayne, IN 46805 Date Aug. 5, 2012 Sep. 3, 2012 Sep. 12, 2012 Totals No. 1037 Date: Sept. 30, 2012 Current Past Due 1-30 2,050 Past Due 31-60 Past Due Over 60 2,450 1,925 4,375 2,050 0 Total Amount Due 0 6,425 Exhibit 7: Sample Aging of Accounts Receivable Customer Invoice Name & Number Number Abbot Sisters 1257 12-28576 Date 9/1/12 ABC Seller Corp. Aging of Accounts Receivable September 30, 2012 Past Past Current Due Due 1-30 31-60 10,600 10,600 0 Past Due Over 60 Total 0 0 10,600 etc., etc. XYZ Buyer Co. 1037 12-28327 12-28580 12-28602 Grand Totals 8/5/12 9/3/12 9/12/12 2,050 2,450 1,925 4,375 2,050 0 0 6,425 127,890 45,687 13,098 4,660 191,335 Original documents (exhibit 6 and 7) prepared by Accounts Receivable. 9 A424 Chapter 14 Cash Collections Processing System Basic Accounting Document Flow Diagram Incoming Mail: Customer checks and Remittance advices Financial Statements 10 A424 Chapter 14 A remittance advice is a turnaround document. Imagine paying your utility and phone bills. The top portion of the bill is removed and returned with your check to the utility or phone company. The top portion of the bill is a remittance advice. In this situation, the _____________ of the sales invoices sent to XYZ Buyer Co. serve as remittance advices. The company receiving payment could also use the bottom half of the check received from the customer as a remittance advice (see check below). Exhibit 8: Sample Customer Check 20-5/740 715023451876 Check No. 56,793 Date: September 3, 2012 XYZ Buyer Co. 4357 North Wells Fort Wayne, IN 46805 Pay to the Order of ________ABC Seller Corp.__________ $ 8,000.00 Eight thousand dollars and no cents__________________________________ Big National Bank Indiana Central Region Indianapolis, Indiana 46266 ____Bill Harden___________ 074000052 715023451876 XYZ Buyer Company For invoice number 12-27301 12-27445 September 3, 2012 $3,500.00 $4,500.00 Document prepared by the ____________________. Cash receipt entry should be dated: ______________. 11 A424 Chapter 14 Exhibit 9: Sample Remittance Advices INVOICE NUMBER: 12-28267 INVOICE DATE: August 3, 2012 CUSTOMER NUMBER: 1037 ABC Seller Corp. 1234 W. Main Street Fort Wayne, IN 46802 SOLD TO: FIRM NAME __XYZ Buyer Co.__ ATTENTION OF _Bill Harden___ ADDRESS __4357 North Wells_ CITY _____Fort Wayne_______ ZIP __46805_____ STATE _IN_ Customer Order No. 156297 QUANTITY ORDERED 250 250 350 Our Sales Order # 12-14341 PRODUCT NUMBER XL1543 XL1809 XL3897 Date Shipped Aug. 3, 2012 Shipped Via Rutgers DESCRIPTION Plain T-shirt – blue Plain T-shirt – red ND T-shirt – the best F. O. B. Shipping point QUANTITY SHIPPED 250 250 300 Terms 2/10, net/30 Salesperson Sam UNIT PRICE 4.00 4.00 5.00 Pay This Amount TOTAL 1,000.00 1,000.00 1,500.00 3,500.00 Thank You! Copy 2 – return with payment INVOICE NUMBER: 12-28444 INVOICE DATE: August 23, 2012 CUSTOMER NUMBER: 1037 ABC Seller Corp. 1234 W. Main Street Fort Wayne, IN 46802 SOLD TO: FIRM NAME __XYZ Buyer Co.__ ATTENTION OF _Bill Harden___ ADDRESS __4357 North Wells_ CITY _____Fort Wayne_______ ZIP __46805_____ STATE _IN_ Customer Order No. QUANTITY ORDERED 500 250 350 Our Sales Order # 07-15677 PRODUCT NUMBER XL1700 XL1600 XL3899 Date Shipped Aug. 22, 2012 Shipped Via NAVL DESCRIPTION Plain T-shirt – green Plain T-shirt – yellow IU T-shirt F. O. B. Shipping point QUANTITY SHIPPED 500 250 300 Terms 2/10,net/30 Salesperson Sam UNIT PRICE 4.00 4.00 5.00 Pay This Amount TOTAL 2,000.00 1,000.00 1,500.00 4,500.00 Thank You! Copy 2 – return with payment 12 A424 Chapter 14 Incoming mail is opened by the __________________. The _______________ compares the checks and remittance advices, then three (3) copies of a prelisting are prepared. One copy (#1) goes to Accounts Receivable Clerk, along with the remittance advices. One copy (#2) goes to cashier, along with the checks. One copy (#3) goes to the controller, who will at a later point in time, compare the prelisting to the validated copy of the deposit slip from the bank and the batch totals for both accounts receivable and cash receipts for the same date. Exhibit 10: Sample Prelisting September 5, 2012 1154 15,687.00 1289 3,000.00 1037 8,000.00 2055 2,543.00 3478 5,634.00 ***** 34,864.00 Ima Goodstudent 13 A424 Chapter 14 Exhibit 11: Sample Cash Receipts Journal ABC Seller Corp. Cash Receipts Journal Date 2012 Sept. 5 5 5 5 5 Account Credited Ref Abbot Sisters Carson Bros. Deli Co. XYZ Buyer Co. Hooper and Kids Total for Sept. 5, 2012 Total for September Cash Dr. Disc Dr. Misc. Cr. CR300 Accts. Rec. Cr. 15,687.00 5,634.00 2,543.00 8,000.00 3,000.00 34,864.00 15,687.00 5,634.00 2,543.00 8,000.00 3,000.00 34,864.00 354,000.00 354,000.00 Exhibit 12: Sample Deposit Slip Date: September 5, 2012_ Account number: _707011123889__ Name: _ABC Seller Corp._____ Address: 1234 W. Main Street___ Fort Wayne, IN 46802_ Description Cash Coin XYZ Buyer Co. Abbot Sisters Carson Bros. Hooper and Kids Deli Co. Total deposit Amount 8,000.00 15,687.00 5,634.00 3,000.00 2,543.00 34,864.00 Cash Receipts records entry in the Cash Receipts Journal, prepares 3 copies of deposit slip and sends journal voucher to General Ledger clerk. Copy of prelist and copy 3 of deposit list filed. Cashier takes deposit to bank Accounts Receivable clerk updates Accounts Receivable subsidiary ledger and sends account summary information to General Ledger clerk. File prelist and remit advices. G/L clerk reconciles information and updates General Ledger periodically. 14 A424 Chapter 14 Exhibit 13: General Ledger 100 Cash Date Jan. 1, 2012 January 2012 February 2012 March 2012 April 2012 May 2012 June 2012 July 2012 August 2012 Sept. 2012 Reference CR50 CD56 CR75 CD63 CR105 CD78 CR167 CD96 CR199 CD100 CR205 CD150 CR245 CD200 CR276 CD257 CR300 CD302 Debit Credit 100,000 100,000 100,000 100,000 100,000 100,000 100,000 100,000 100,000 100,000 100,000 100,000 100,000 100,000 100,000 100,000 354,000 100,000 Balance 103,000 203,000 103,000 203,000 103,000 203,000 103,000 203,000 103,000 203,000 103,000 203,000 103,000 203,000 103,000 203,000 103,000 457,000 357,000 Oct. 2012, etc. 110 Accounts Receivable Date Reference Jan. 1, 2012 January 2012 S100 CR150 February 2012 S120 CR170 March 2012 S140 CR194 April 2012 S180 CR203 May 2012 S200 CR215 June 2012 S210 CR231 July 2012 S220 CR245 August 2012 S230 CR276 Sept. 2012 S250 CR300 Debit Credit 204,000 200,000 201,000 205,000 185,000 184,000 176,000 177,000 189,000 188,000 256,000 175,000 247,000 235,000 234,000 236,000 205,000 354,000 Balance 103,000 307,000 107,000 308,000 103,000 193,000 104,000 280,000 103,000 192,000 104,000 360,000 185,000 432,000 197,000 431,000 340,335 545,335 191,335 15